Commitment of Traders – The Basics

The Commitments of Traders (CoT) is a weekly report released by the Commodity Futures Trading Commission (CFTC). The CoT report outlines how different traders are positioned in the futures markets. There are two main types of traders in a CoT report: commercials and money managers.

Commercials are the producers and users of a commodity that use the futures markets to hedge. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Commercial traders are considered the “smart money” since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, comprises hedge funds, mutual funds, and commodity trading advisors. These speculative traders have no interest in the underlying physical commodity business.

CoT data is most meaningful at extremes when either commercial traders or speculators are super net long or net short. The charts below are mostly self-explanatory by looking at the color-coded type of traders. For a more detailed explanation, please see the bottom of this note.

DeMark Indicators basics at bottom of this note

HIGHLIGHTS AND THEMES

- Commodities still have wide dispersion.

- Crude bounced last week and will see some DeMark Sell Setup 9’s with make or break moment.

- Natural Gas will be a buy this week – perhaps Tuesday or Wednesday

- Gold, Silver, and Copper have DeMark sell Countdown 13’s still in play

- Softs continue sideways

- Livestock reversal lower should continue

- Coffee bounced after a recent DeMark buy Setup 9

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily bounced after the recent DeMark Combo buy Countdown 13. There is potential for a new sell Setup 9 on Monday; however, it will be close as the 9th bar needs to close over the 5th bar close. I will put an update on tomorrow’s notes.

Bloomberg Commodity Index Weekly also has potential with buy Setup 9 this week.

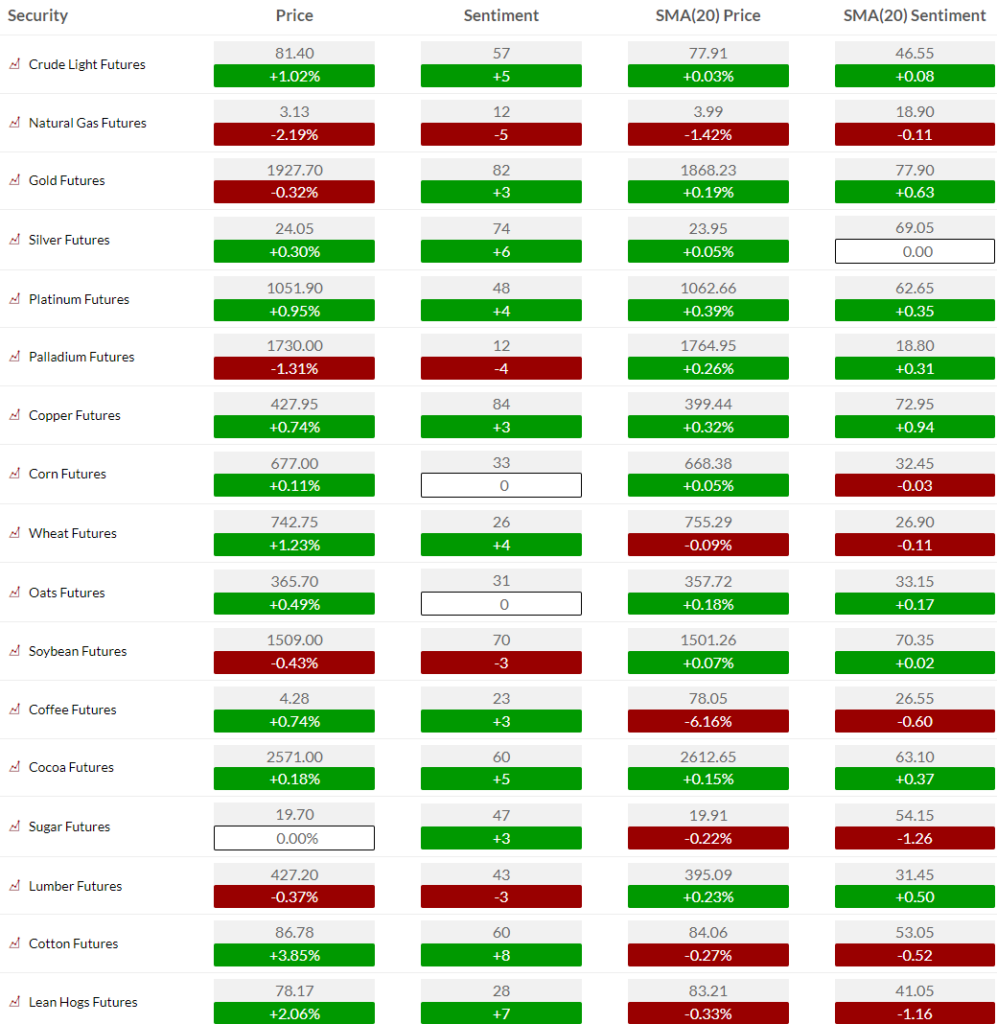

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY

Bloomberg Energy Subindex Daily also has potential for a sell Setup 9 this week.

Bloomberg Energy Subindex Weekly should get the buy Setup 9 this week unless this makes a decent upside move.

WTI Crude futures daily also might get the sell Setup 9 tomorrow. The last two sell Setup 9’s saw reversals.

Brent Crude futures daily has been a little ahead of WTI and has a sell Setup 9.

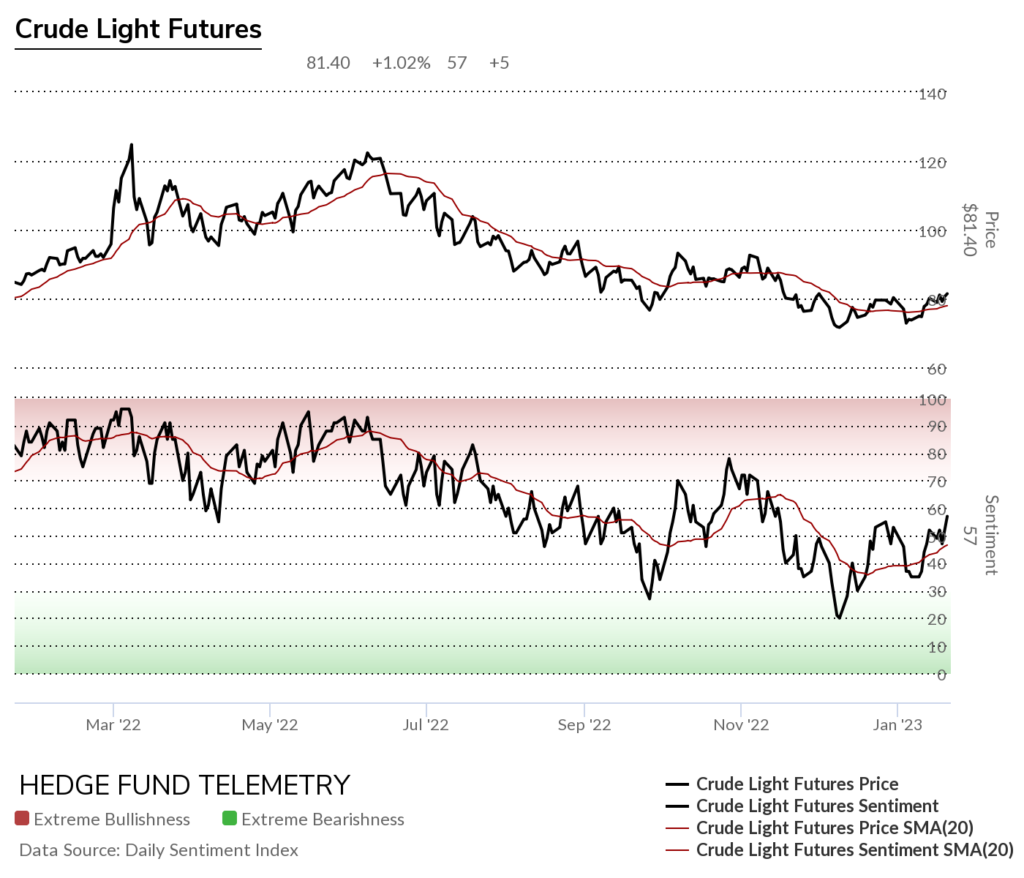

WTI Crude futures bullish sentiment, as mentioned recently looks like sentiment made a higher low. If this continues we should expect the Sequential to start after the Setup 9

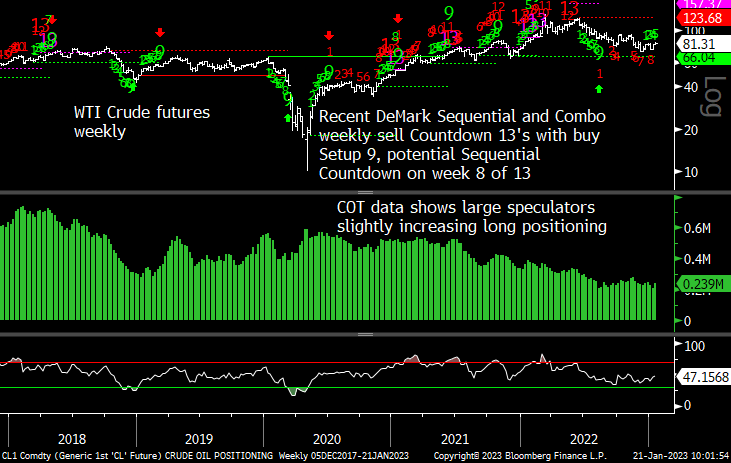

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

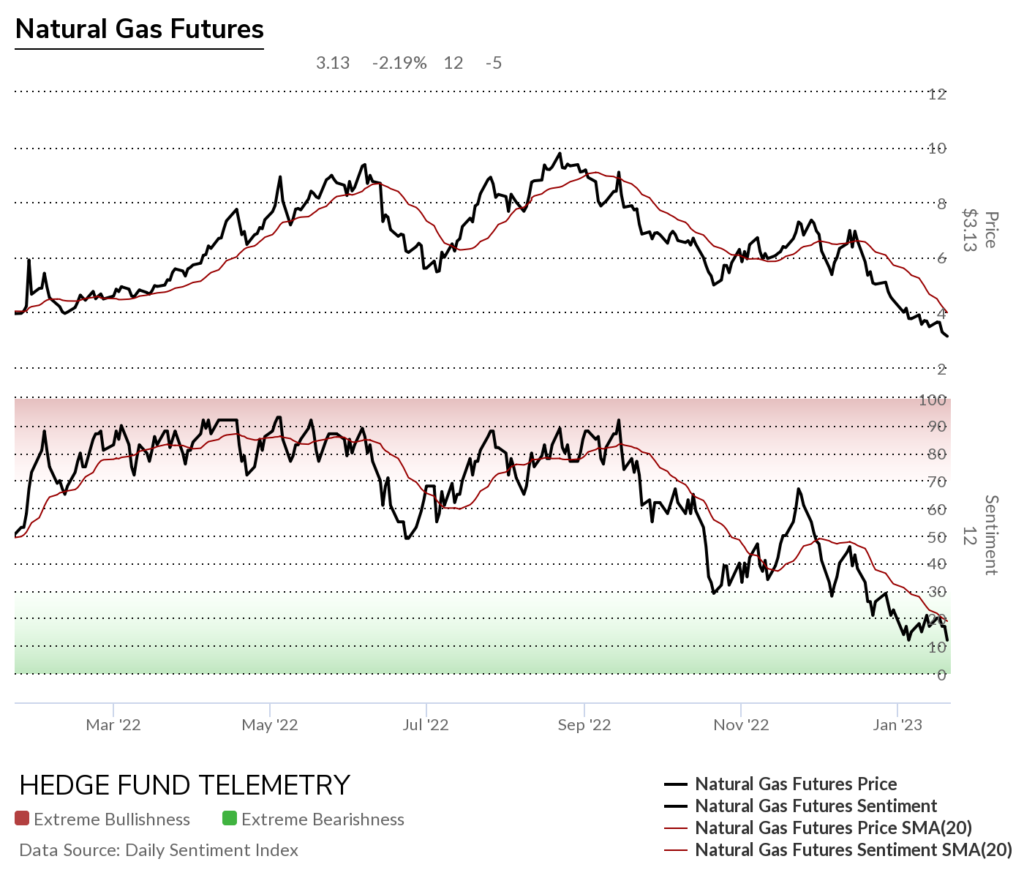

Natural Gas futures daily has been so banged up and is VERY close to the pending DeMark buy Countdown 13’s. I will make a call to buy Natural Gas this week.

Natural Gas futures bullish sentiment has been very oversold.

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Gasoline Daily has had a big move that will have implications for January’s CPI inflation report

Gasoline Commitment of Traders shows speculators remain set up long

Metals

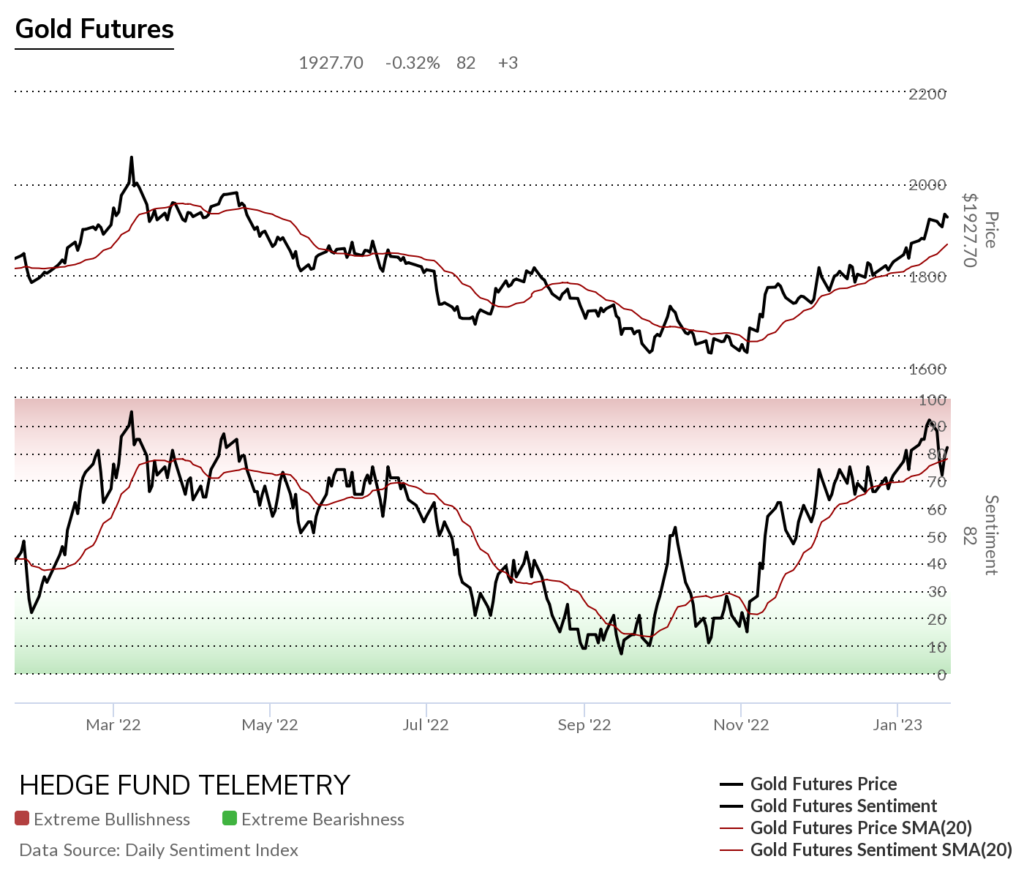

Gold futures daily has not seen a price reversal as expected, yet the exhaustion signals are still in play.

Gold futures bullish sentiment hit an extreme reading and backed off. I could see a negative divergence with sentiment making a lower high vs price

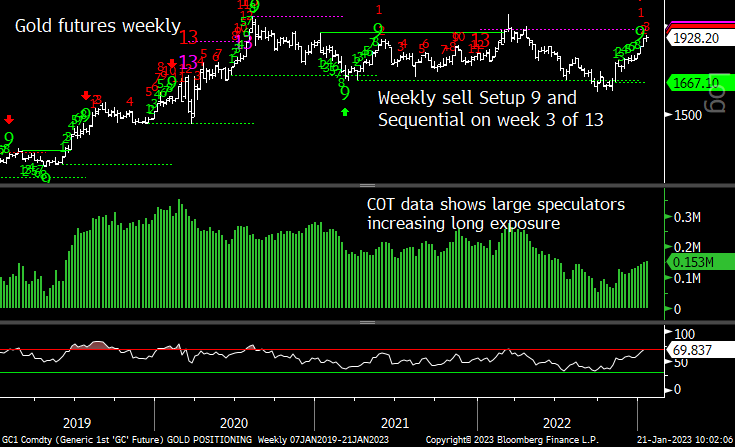

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

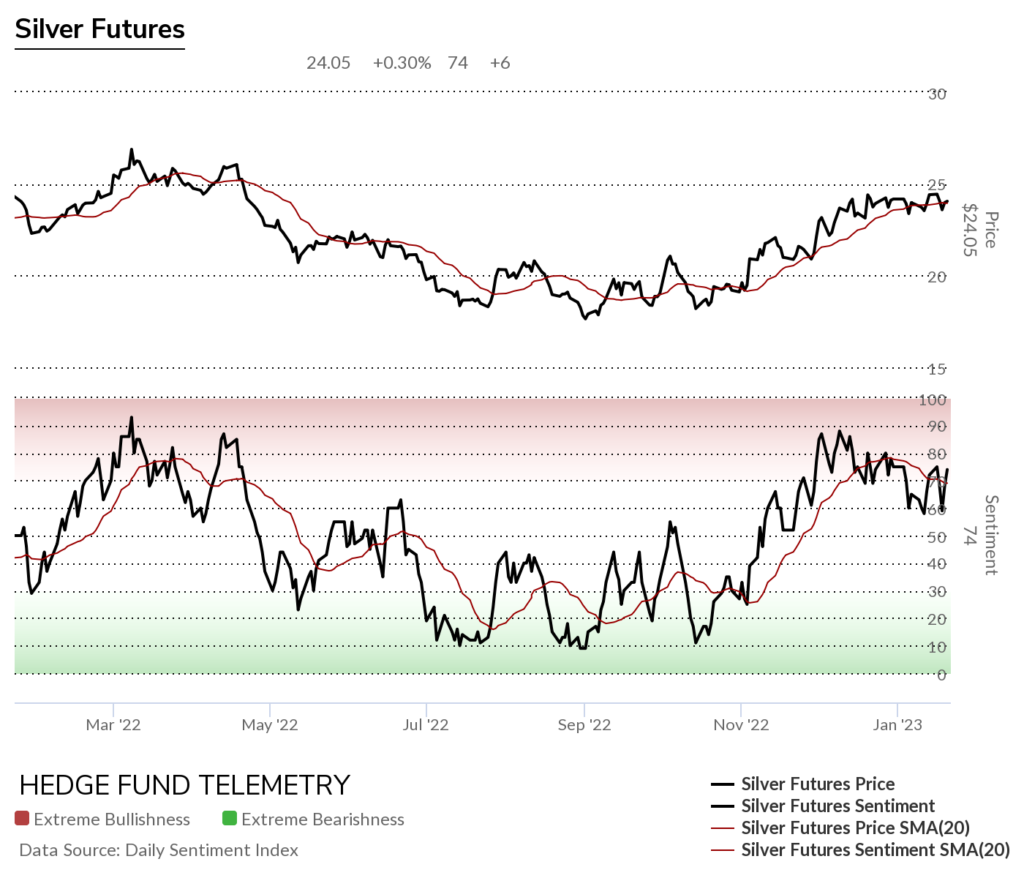

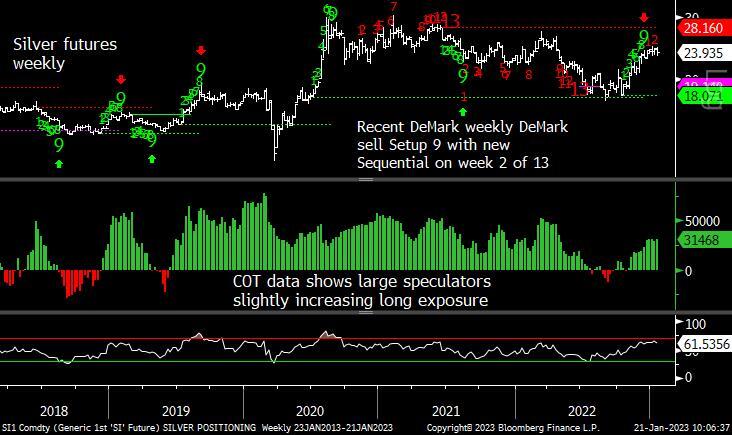

Silver futures daily is toppy

Silver Futures Bullish Sentiment stopped going up in December

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

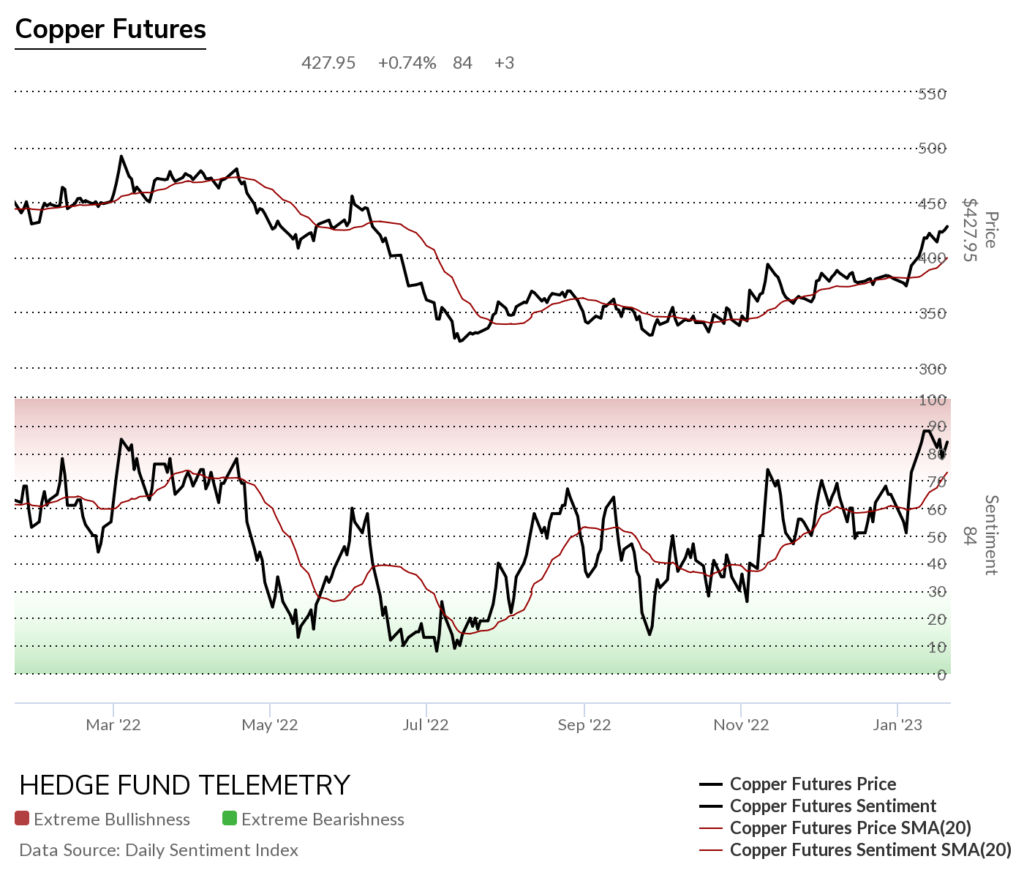

Copper futures daily with DeMark exhaustion sell signals in play

Copper futures bullish sentiment remains extreme over 80%

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

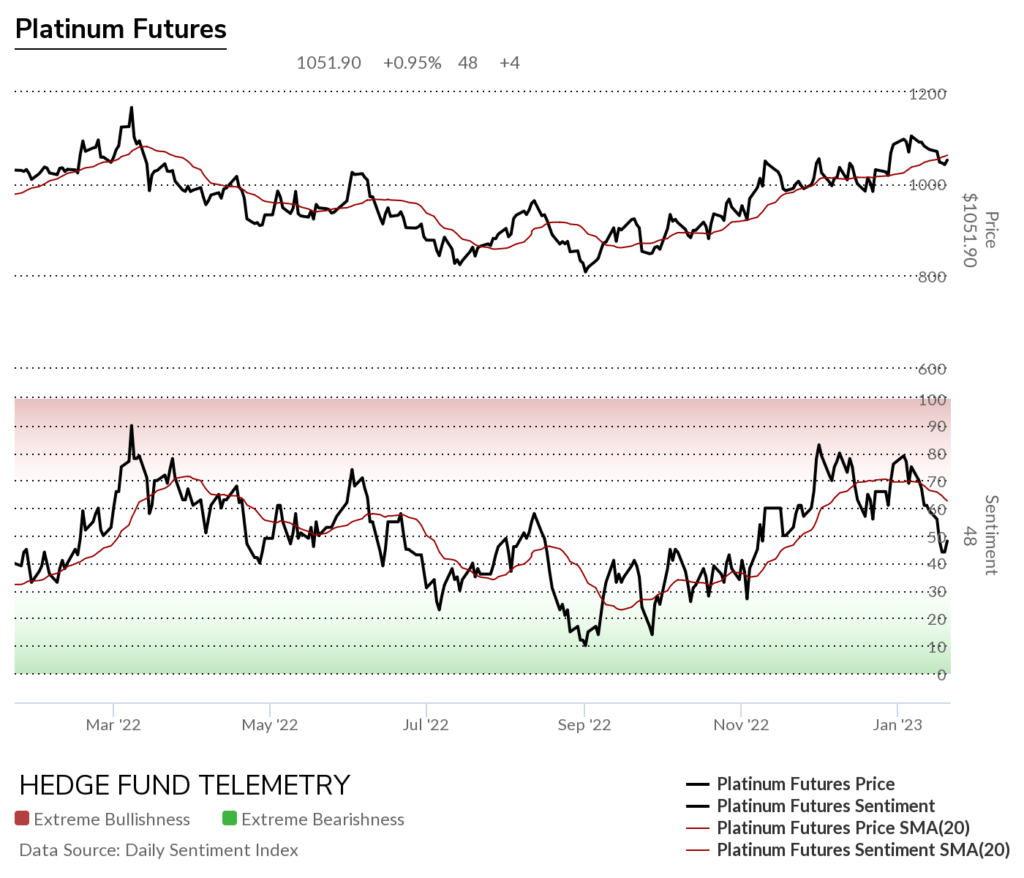

Platinum daily

Platinum bullish sentiment

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

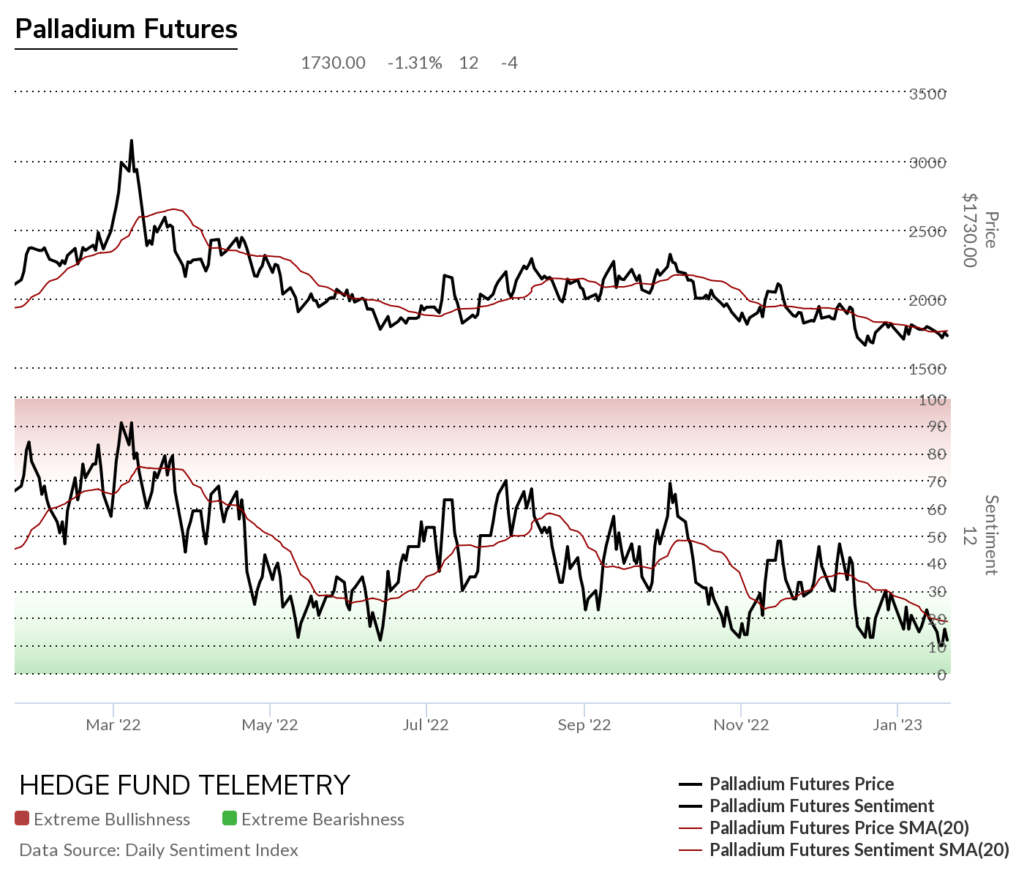

Palladium daily

Palladium bullish sentiment

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

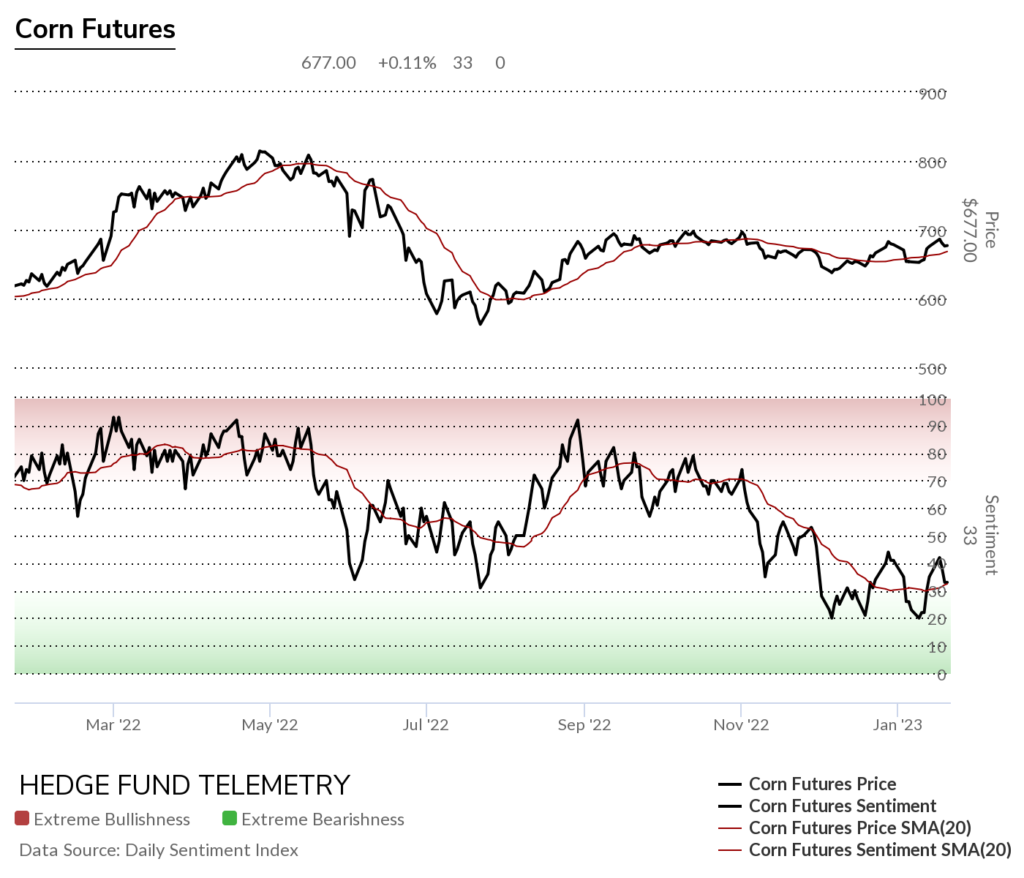

Corn futures daily remains under the resistance level. I doubt the sell Setup 9 will complete tomorrow and will cancel

Corn futures bullish sentiment remains under pressure

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

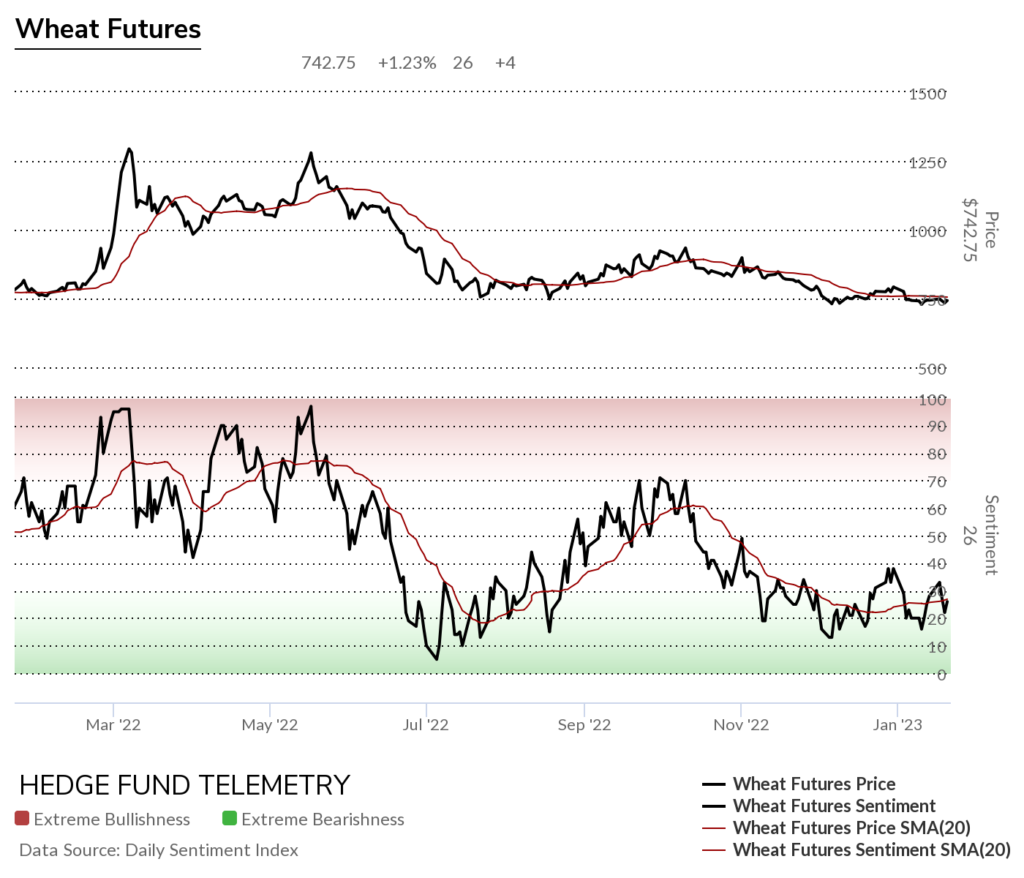

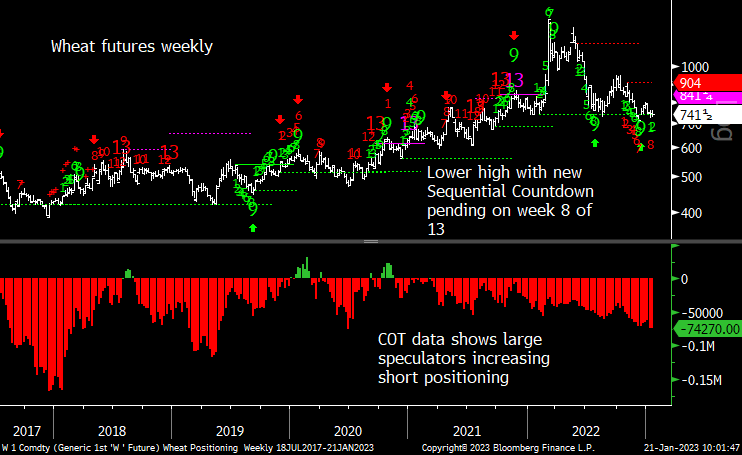

Wheat futures daily lacks any upside momentum holding support

Wheat futures bullish sentiment remains under pressure

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

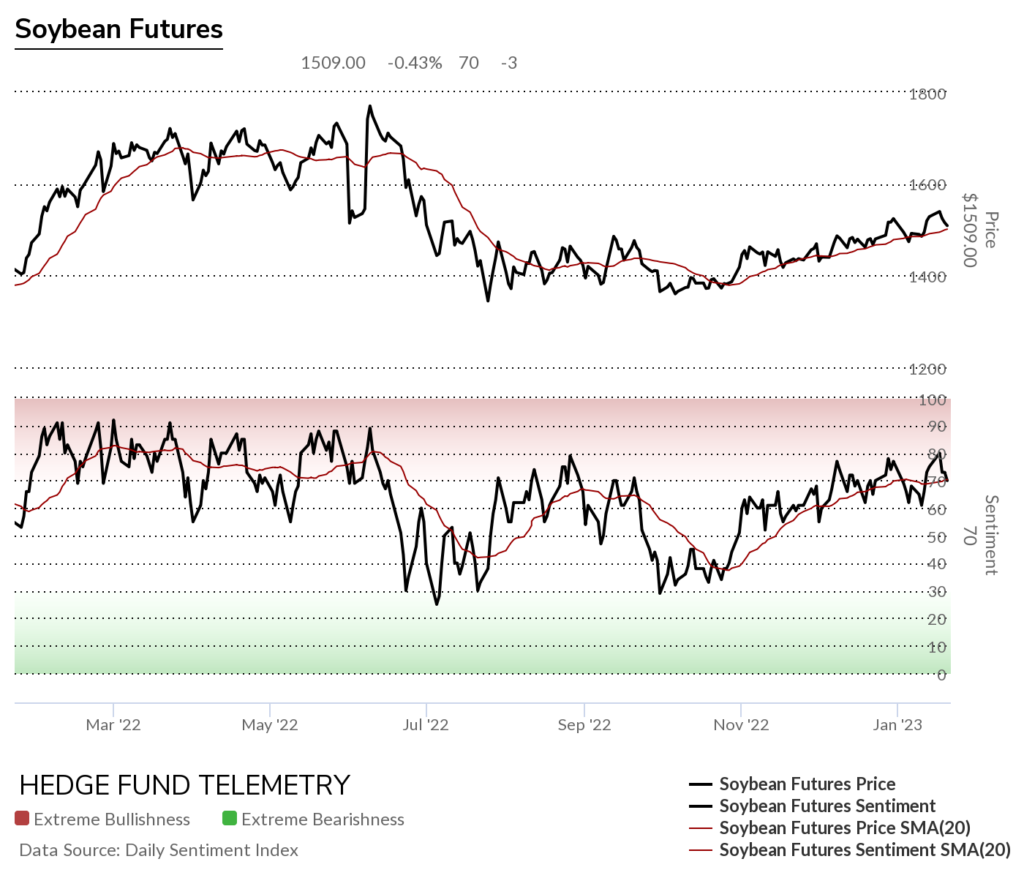

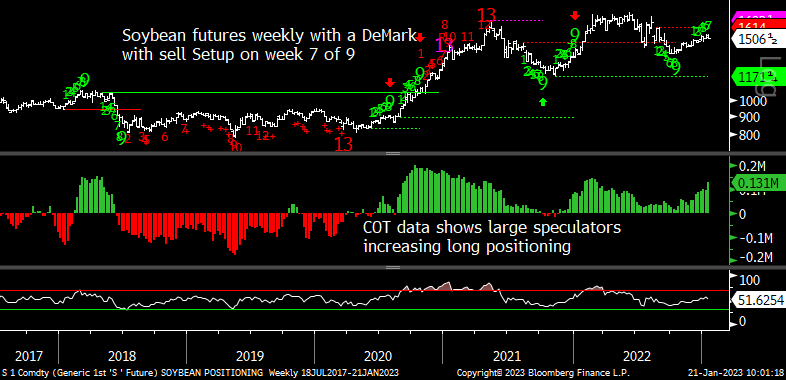

Soybean futures daily

Soybean futures bullish sentiment has been supportive. Breaking 60% and more importantly 50% would change this to a bearish bias

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

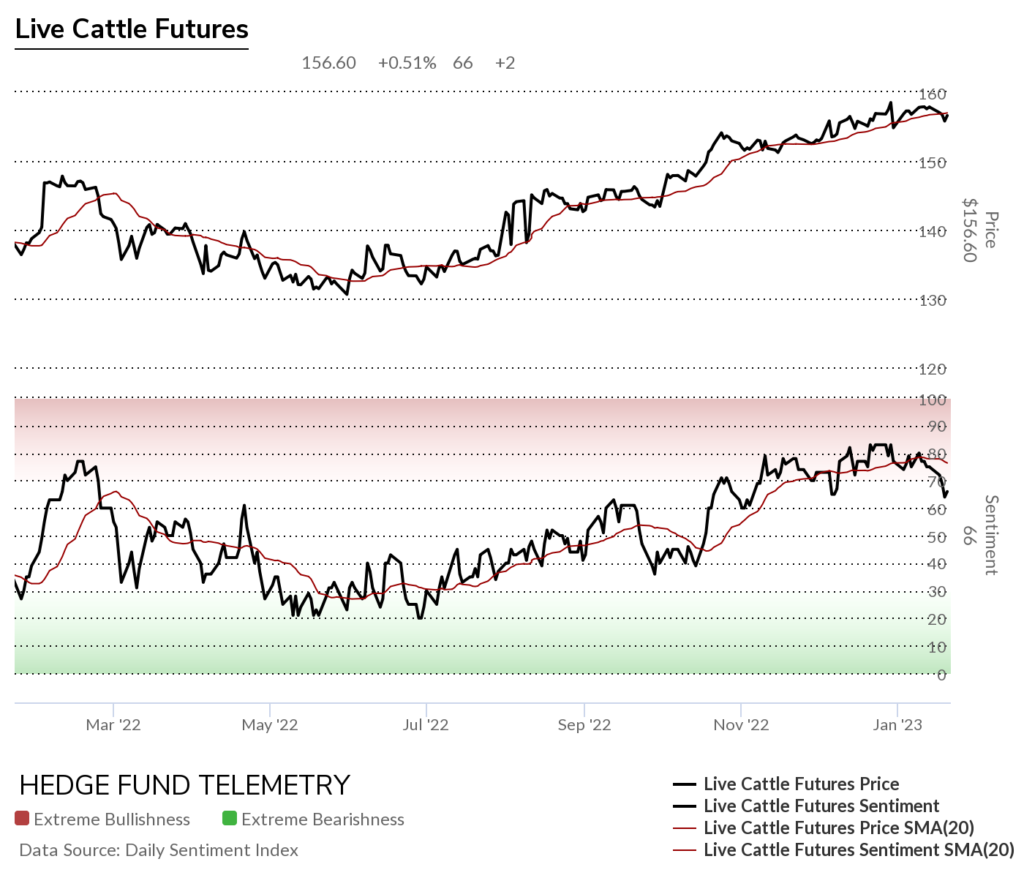

Cattle futures daily reversal and might make a higher low as that’s what it’s been doing.

Cattle futures bullish sentiment reversing from extreme levels

Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

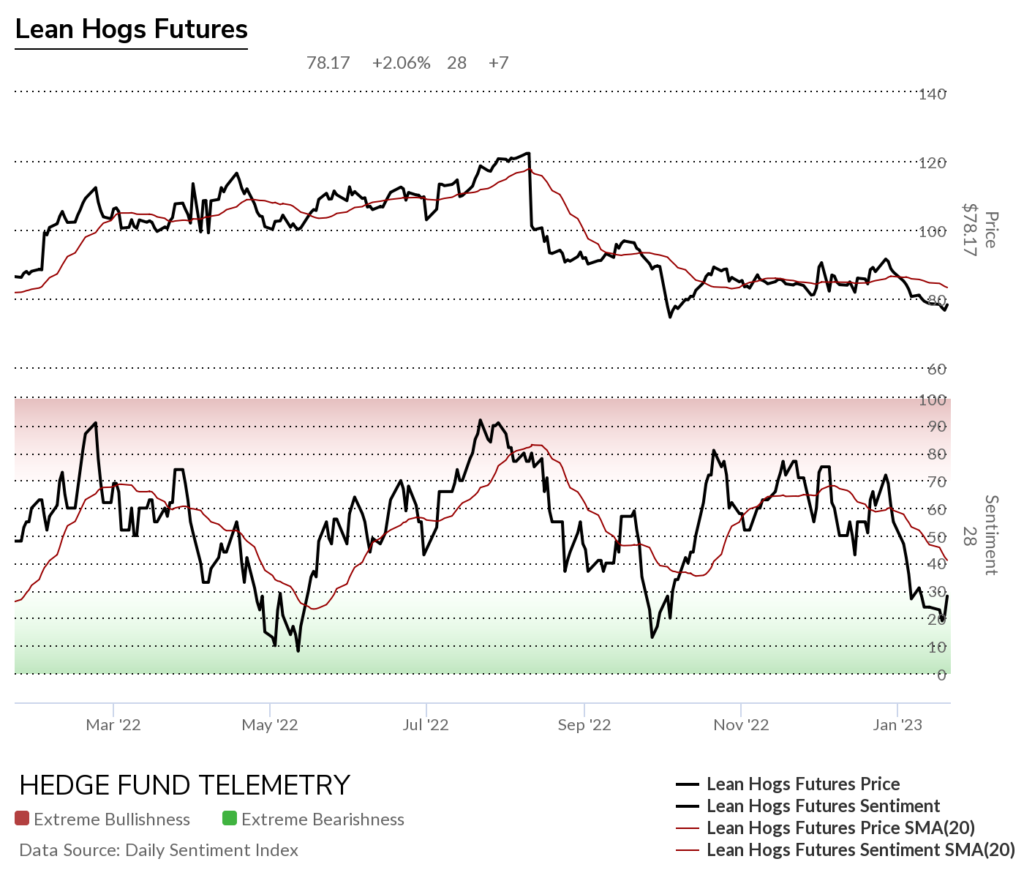

Lean Hogs futures daily continues lower

Lean Hogs bullish sentiment remains under pressure

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

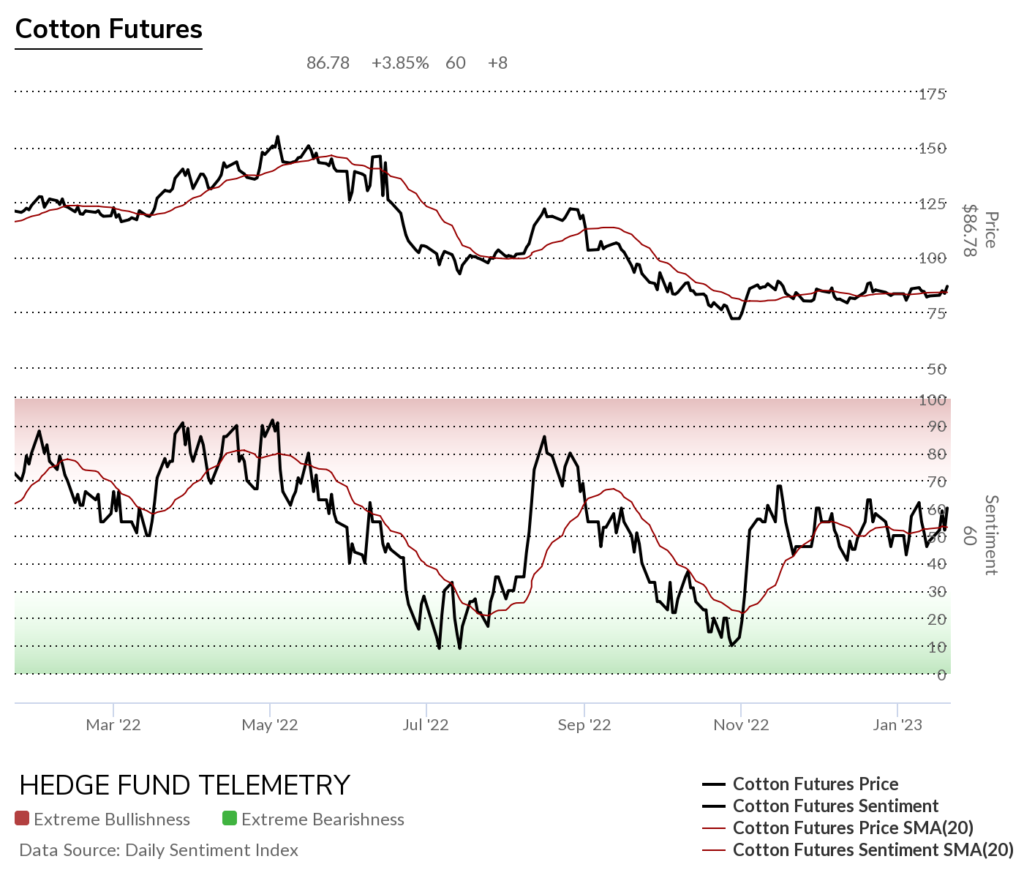

Cotton futures daily continues sideways with upside and downside wave patterns that breakout or breakdown will determine which wave is dominant.

Cotton futures bullish sentiment sideways still

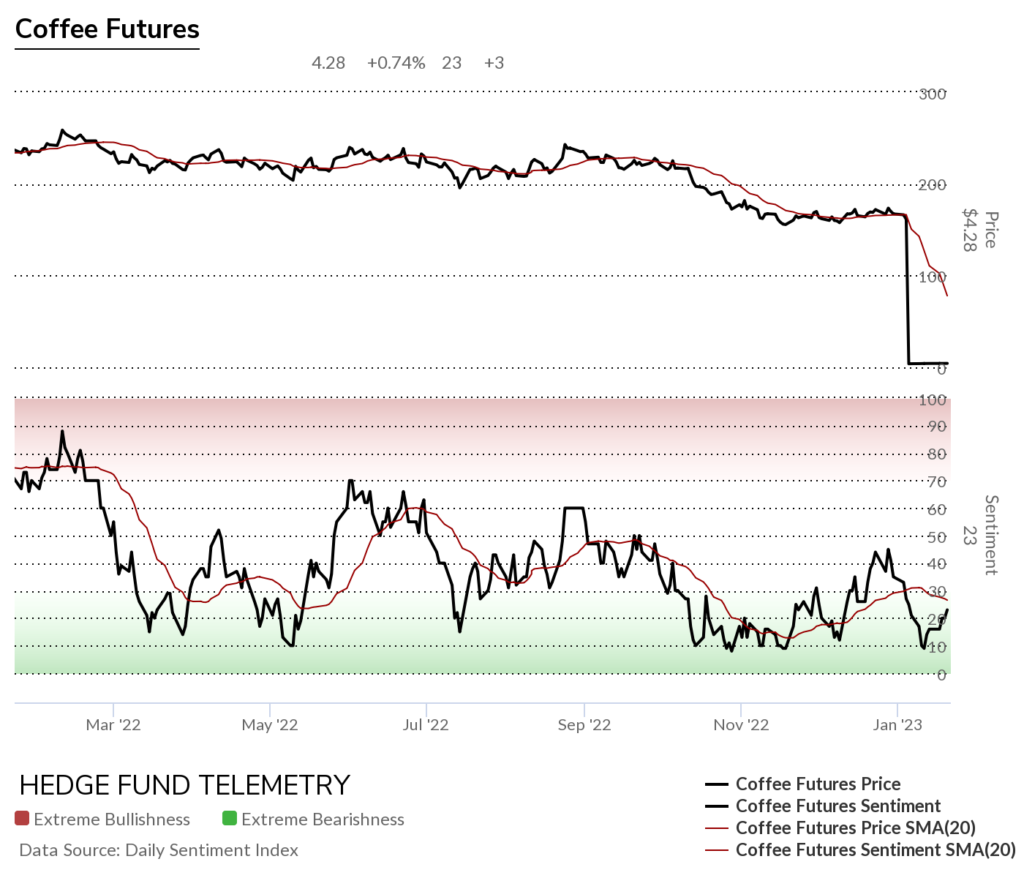

Coffee futures daily bounced after the buy Setup 9 and needs to continue with upside Setup

Coffee futures bullish sentiment

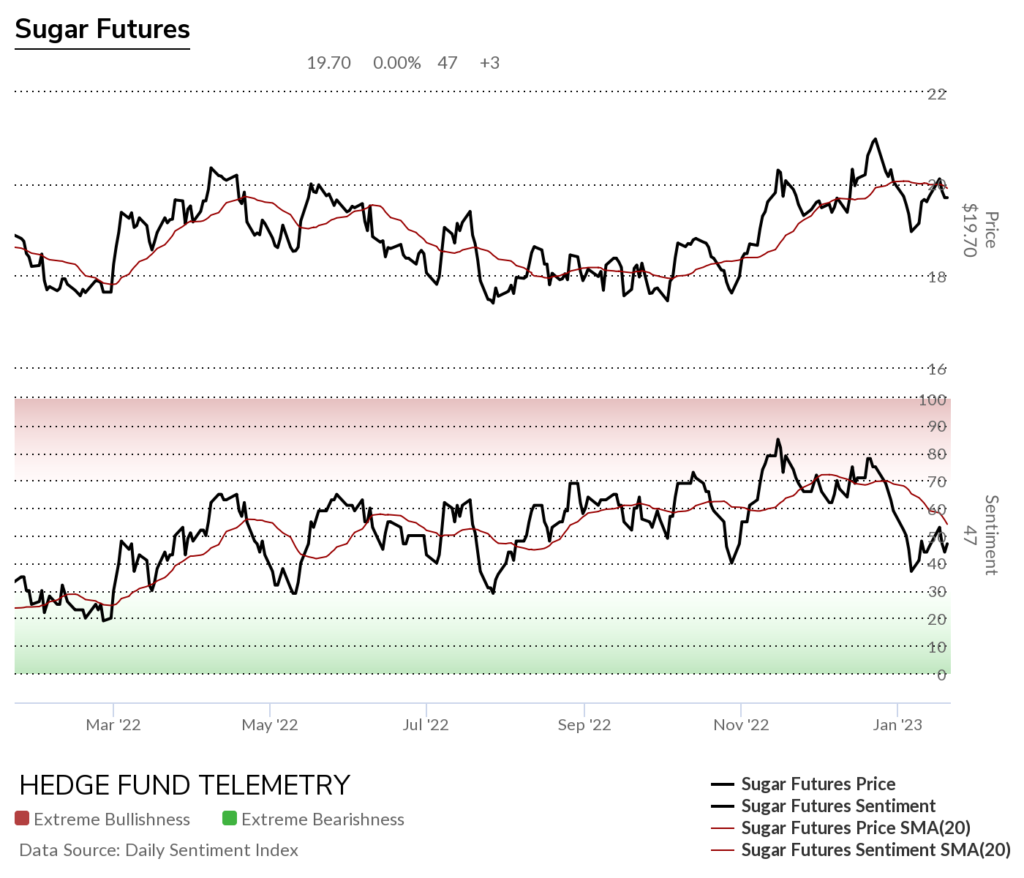

Sugar futures daily made a lower high last week

Sugar futures bullish sentiment struggling

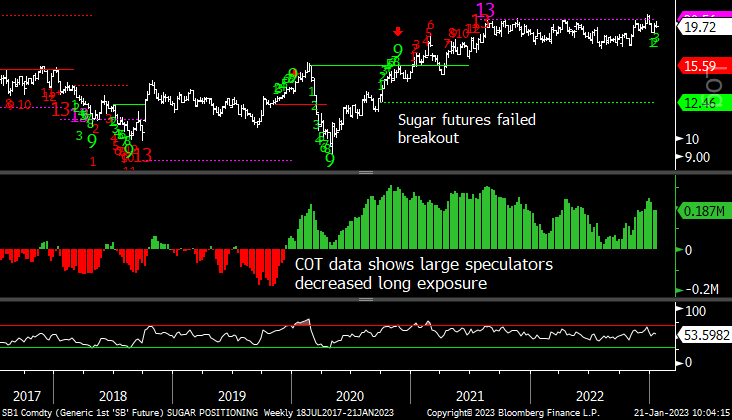

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

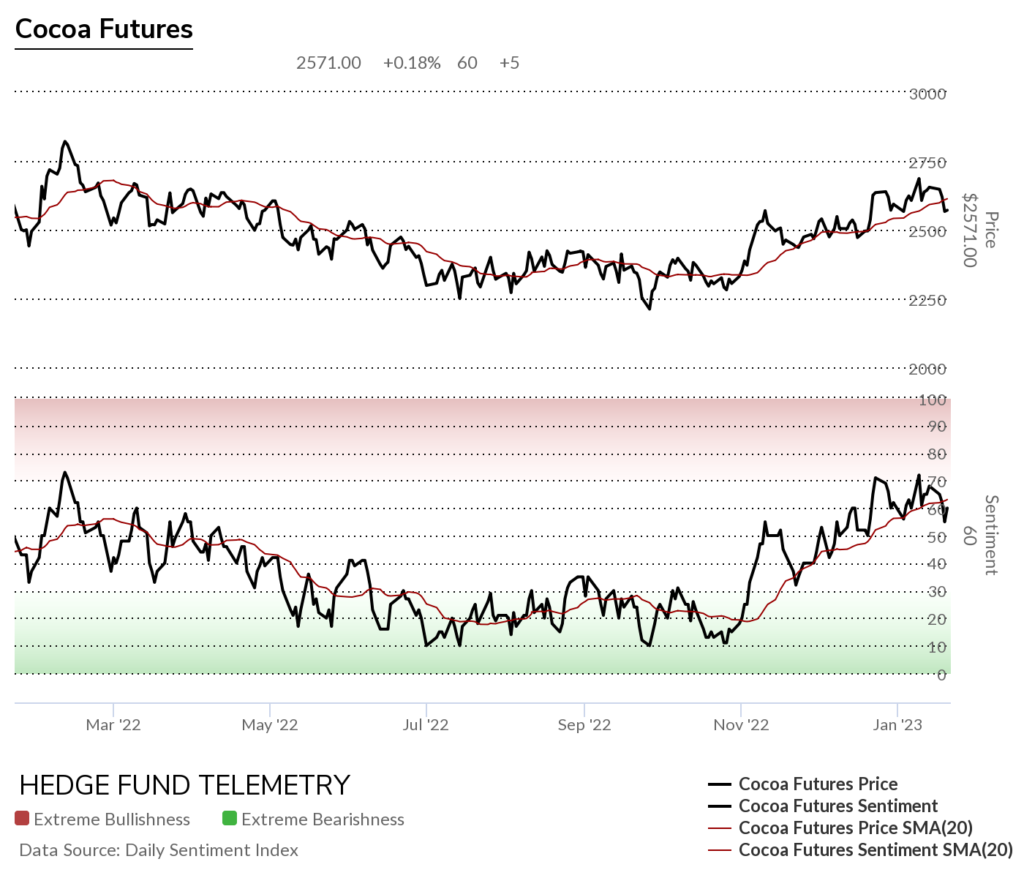

Cocoa futures daily reversal lower, although Friday’s action was strong off lows.

Cocoa futures bullish sentiment fading a little but still above 50% midpoint

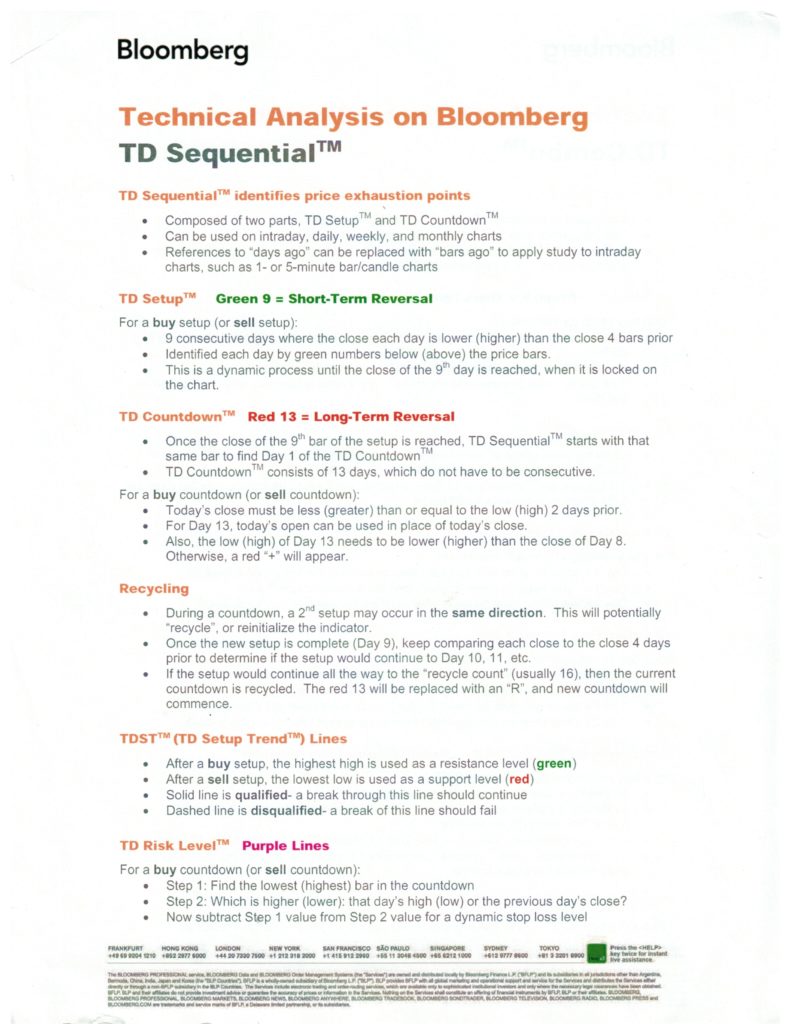

DeMark Sequential Basics

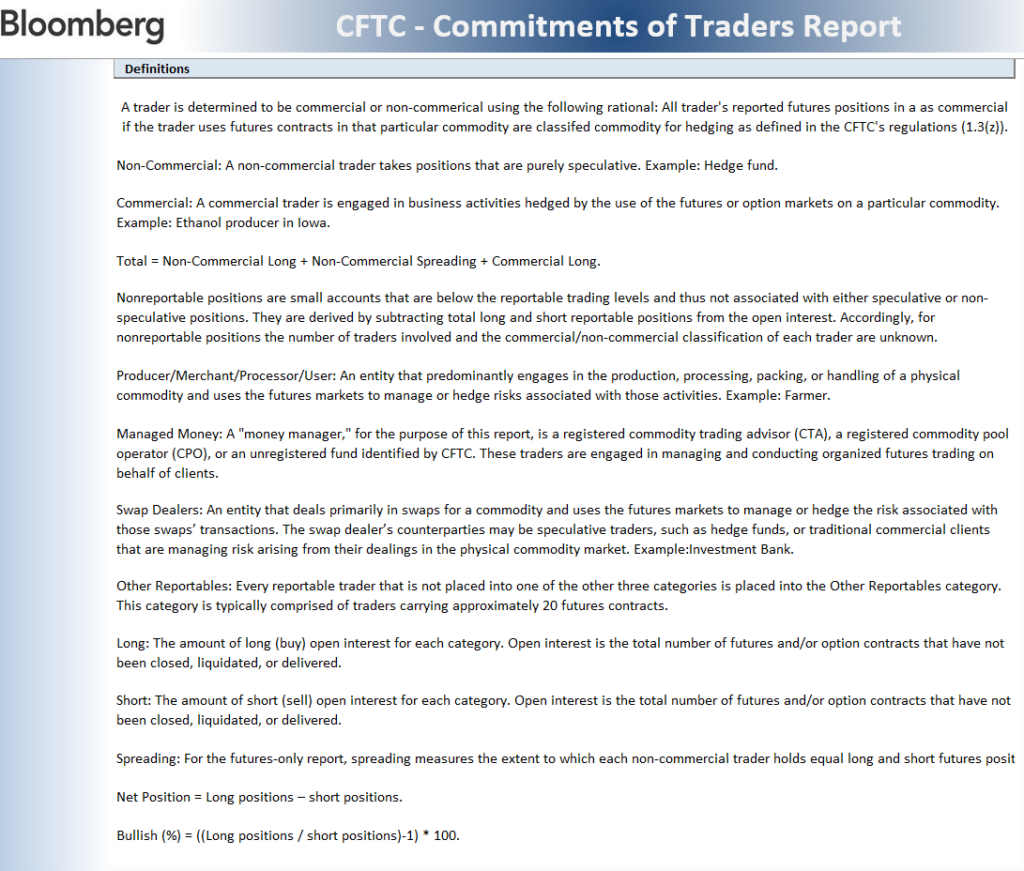

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS