Commitment of Traders – The Basics

The Commitments of Traders (CoT) is a weekly report released by the Commodity Futures Trading Commission (CFTC). The CoT report outlines how different traders are positioned in the futures markets. There are two main types of traders in a CoT report: commercials and money managers.

Commercials are the producers and users of a commodity that use the futures markets to hedge. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Commercial traders are considered the “smart money” since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, comprises hedge funds, mutual funds, and commodity trading advisors. These speculative traders have no interest in the underlying physical commodity business.

CoT data is most meaningful at extremes when either commercial traders or speculators are super net long or net short. The charts below are mostly self-explanatory by looking at the color-coded type of traders. For a more detailed explanation, please see the bottom of this note.

DeMark Indicators basics at the bottom of this note

HIGHLIGHTS AND THEMES

Wide dispersion within the commodity markets continues

Energy remains under pressure making new lows

Metals are nearing upside exhaustion – specifically gold and silver. Copper fails to breakout while platinum breaks out and palladium breaks down.

Grains are basing with softs stalling with livestock reversing lower off recent highs.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily broke lower yesterday hard and is nearing support levels from July, Sept, Oct, and Dec.

Bloomberg Commodity Index Weekly with a downside Propulsion and downside wave 3 price targets in play IF support here breaks

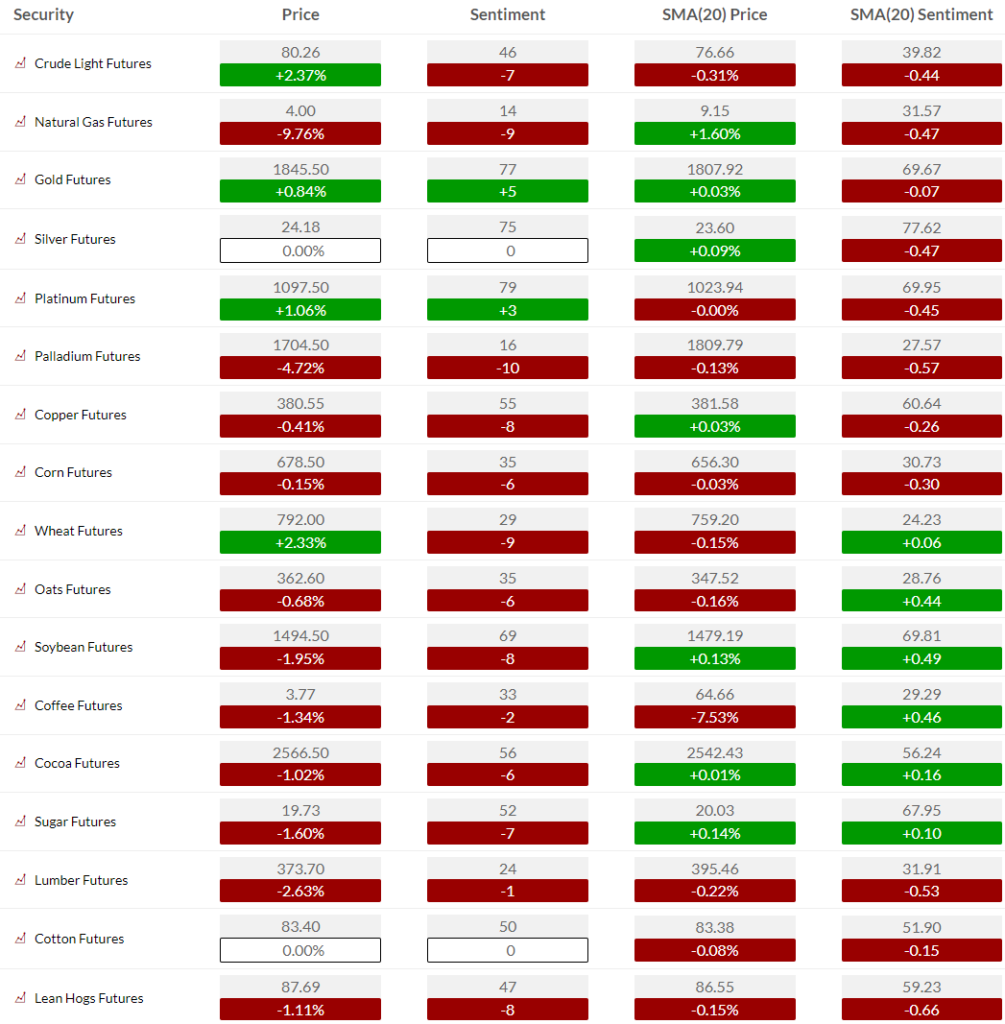

COMMODITY SENTIMENT OVERVIEW

Wide commodity sentiment dispersion continues

OIL AND ENERGY

Bloomberg Energy Subindex Daily has made lower highs and now again lower lows. There is a downside DeMark Sequential and Combo in progress nearing the downside wave 3 price objective of 3.59

Bloomberg Energy Subindex Weekly shows the steady decline. A buy Setup 9 is possible in late January and would also sync up with the traditional seasonal strength with energy markets.

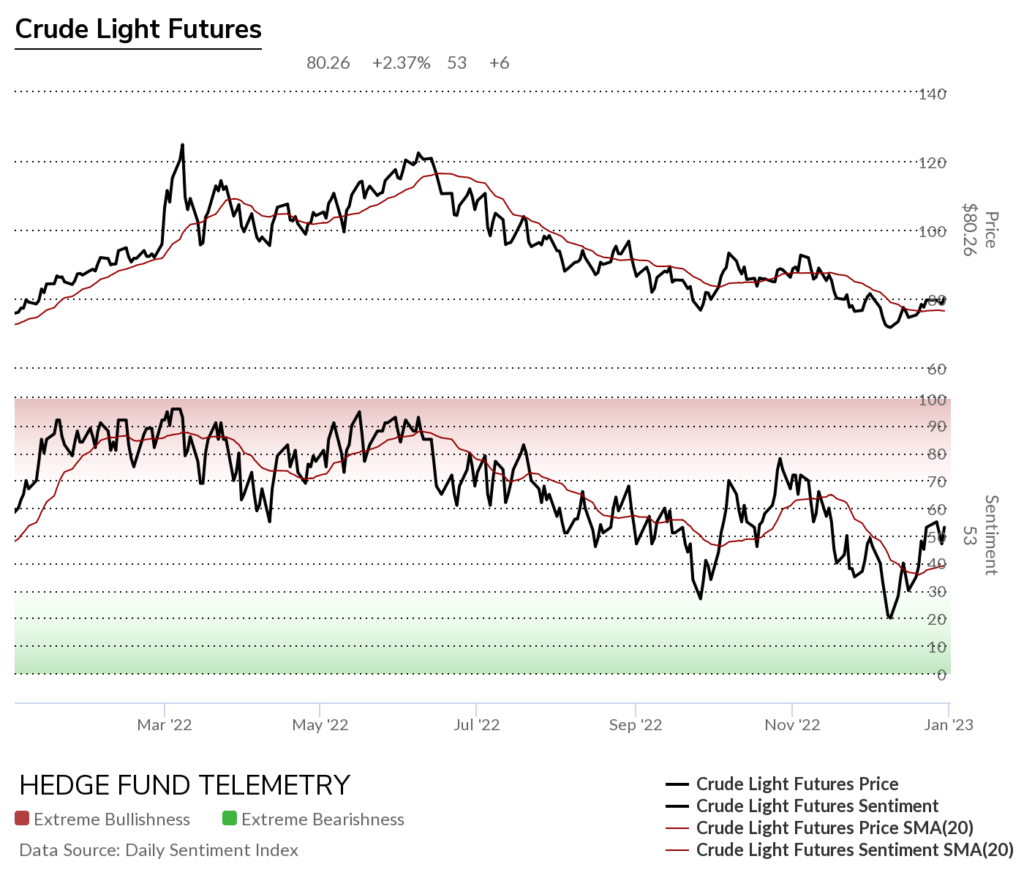

WTI Crude futures daily has risk lower still with the DeMark Sequential in progress

WTI Crude futures bullish sentiment did bounce recently and might be another lower high

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

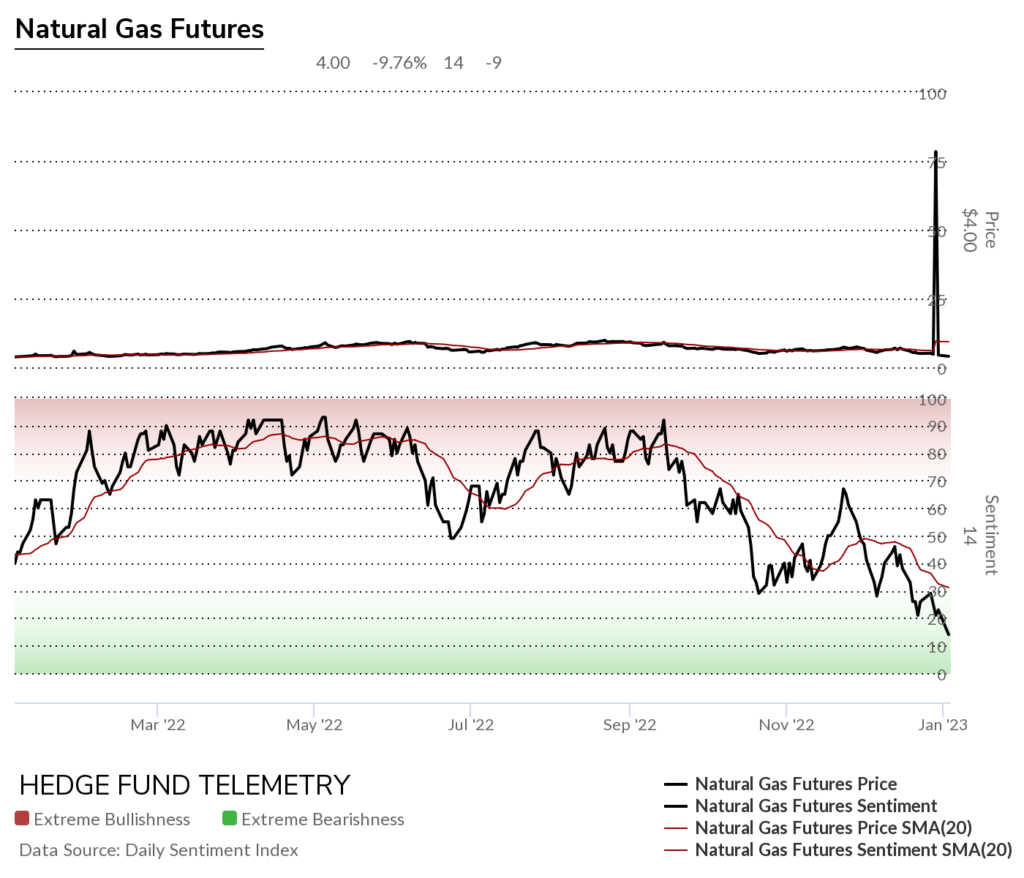

Natural Gas futures daily could continue lower, although it’s very oversold.

Natural Gas futures bullish sentiment has a data feed issue, but sentiment is correct and its’ getting very oversold at 14% bulls

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators has a weekly downside Sequential and that’s a negative

Gasoline Futures Daily has bounced off the December lows. The December CPI could reflect the decline in gasoline prices yet those declines that helped the CPI could end in Q1

Gasoline Commitment of Traders

Metals

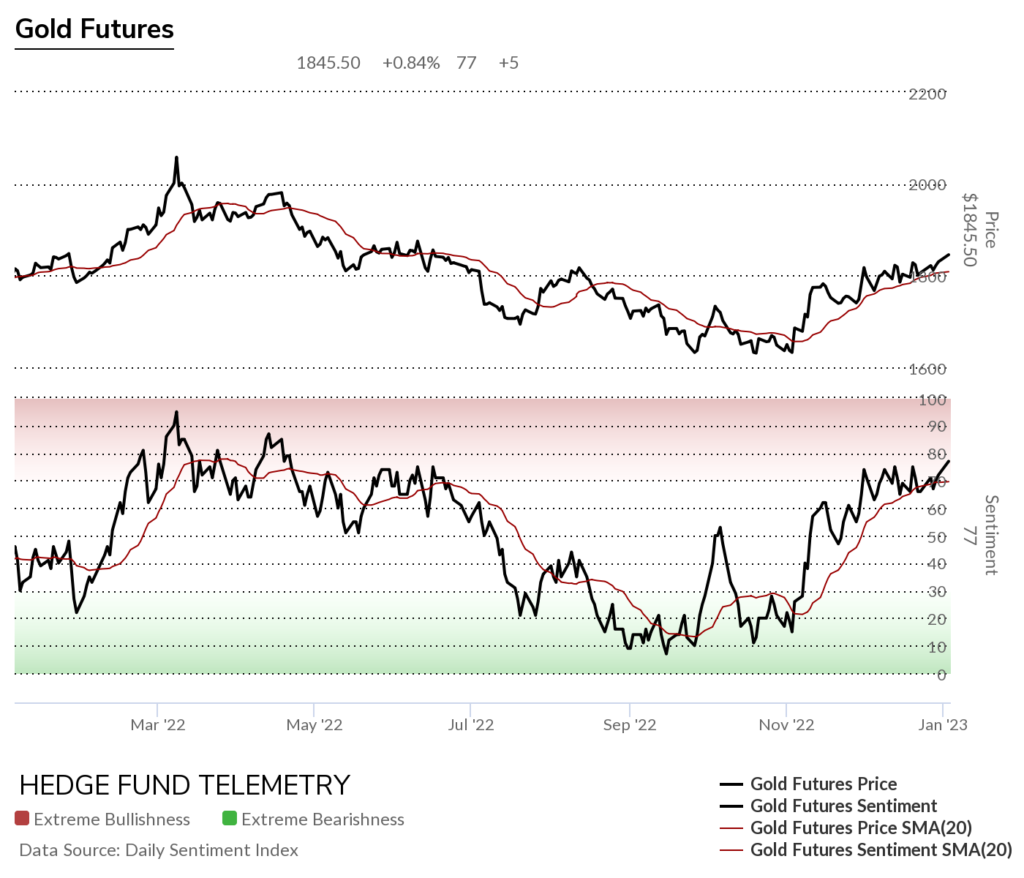

Gold futures daily with some upside exhaustion signals in play with the Combo needing a couple more upside days to qualify the sell Countdown 13

Gold futures bullish sentiment is nearing the extreme zone over 80%

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Weekly sell Setup 9 and the Daily Sequential 13 syncs up for a pullback

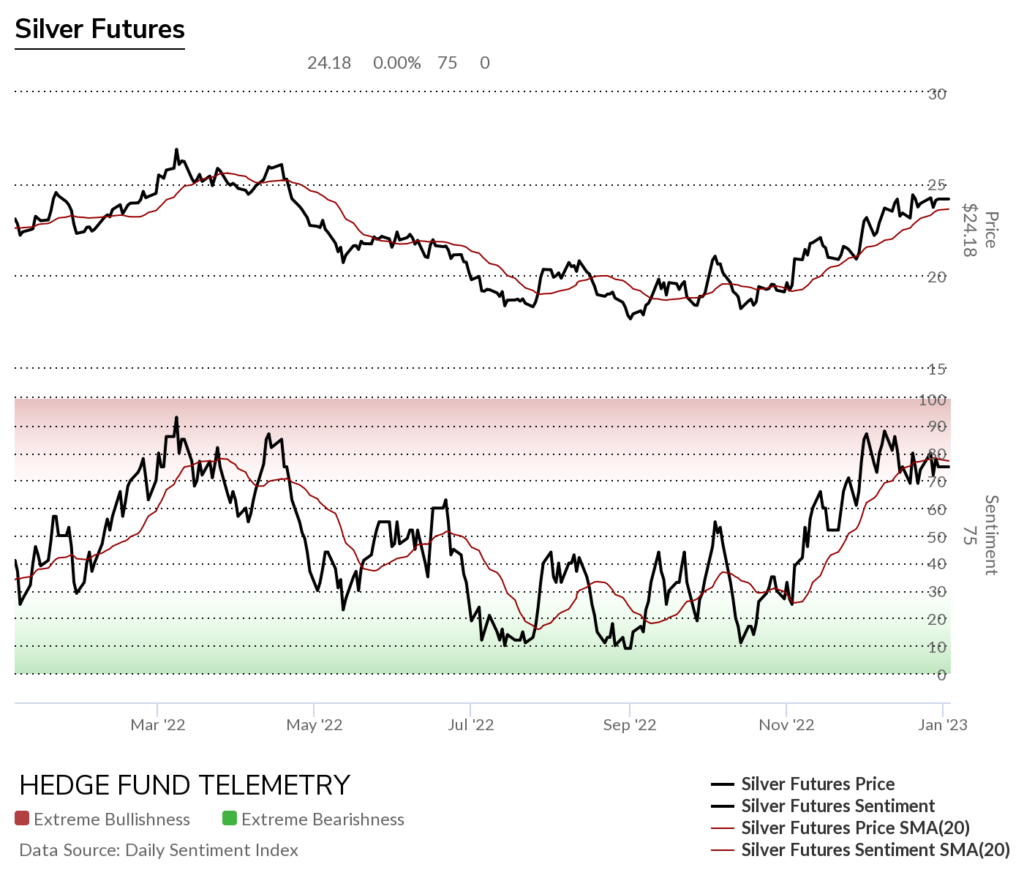

Silver futures daily is also nearing upside exhaustion

Silver Bullish Sentiment has been in the extreme zone for the past month

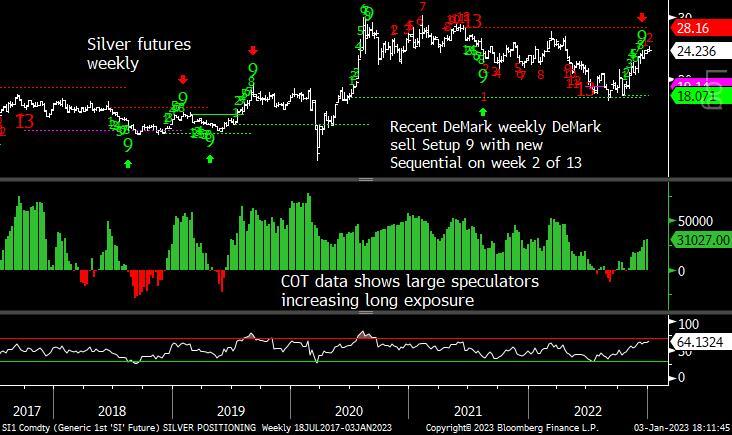

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

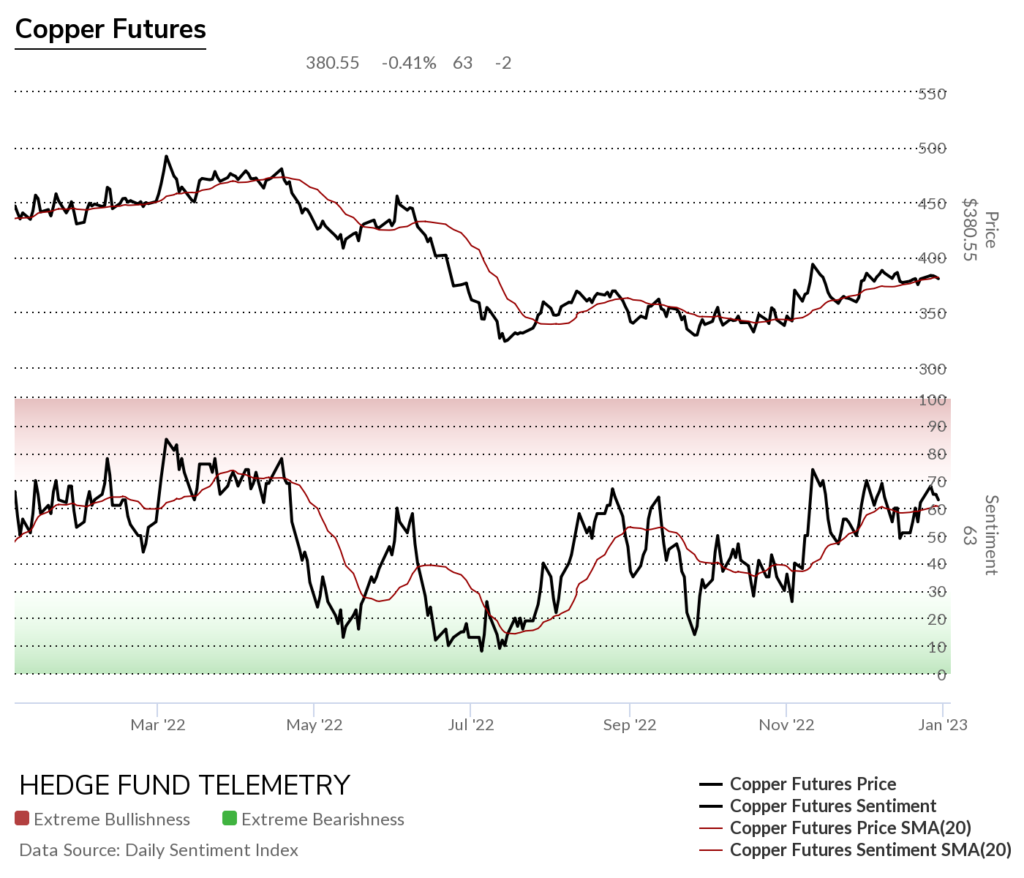

Copper futures daily has been in a range for the last 2 months and needs to breakout over 400

Copper futures bullish sentiment stalling

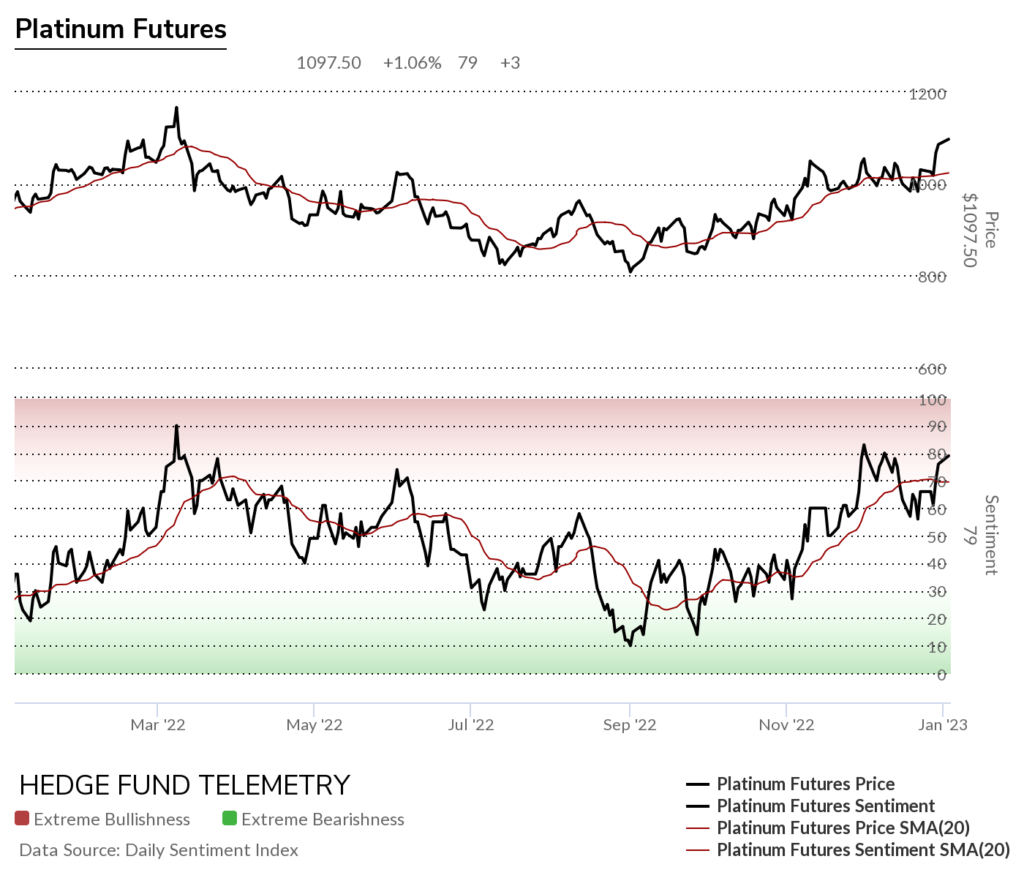

Platinum daily finally broke out

Platinum bullish sentiment with the break-out sentiment is in the extreme zone

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

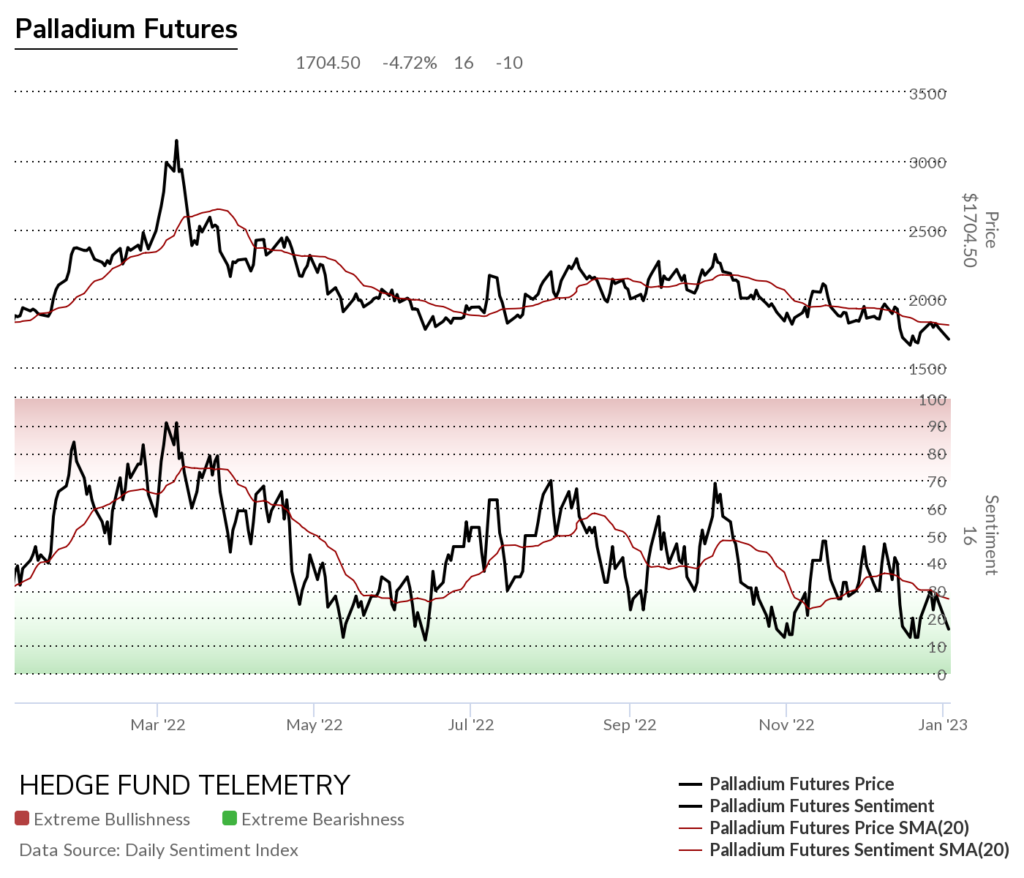

Palladium daily remains under pressure

Palladium bullish sentiment remains under pressure

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Downside weekly Sequential in progress is a negative

Grains

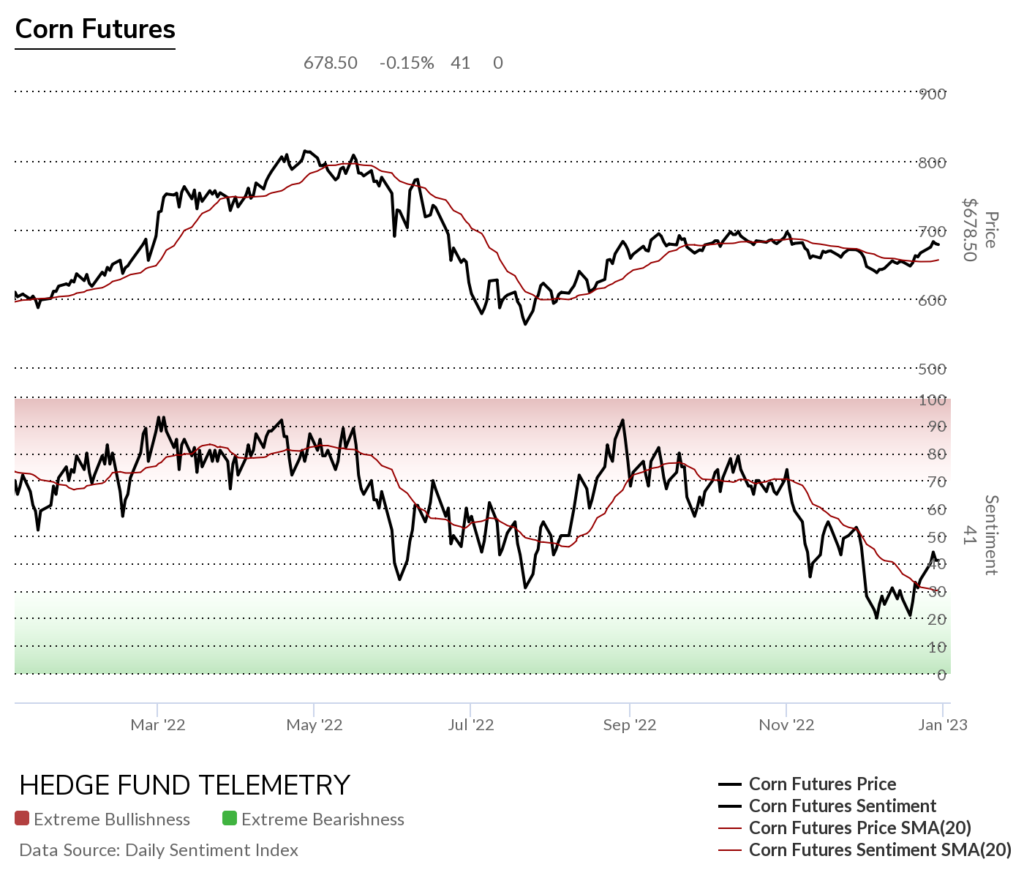

Corn futures daily has been in a wide range with big resistance at 700

Corn futures bullish sentiment improved off oversold lows and now needs to clear 50% the majority line

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

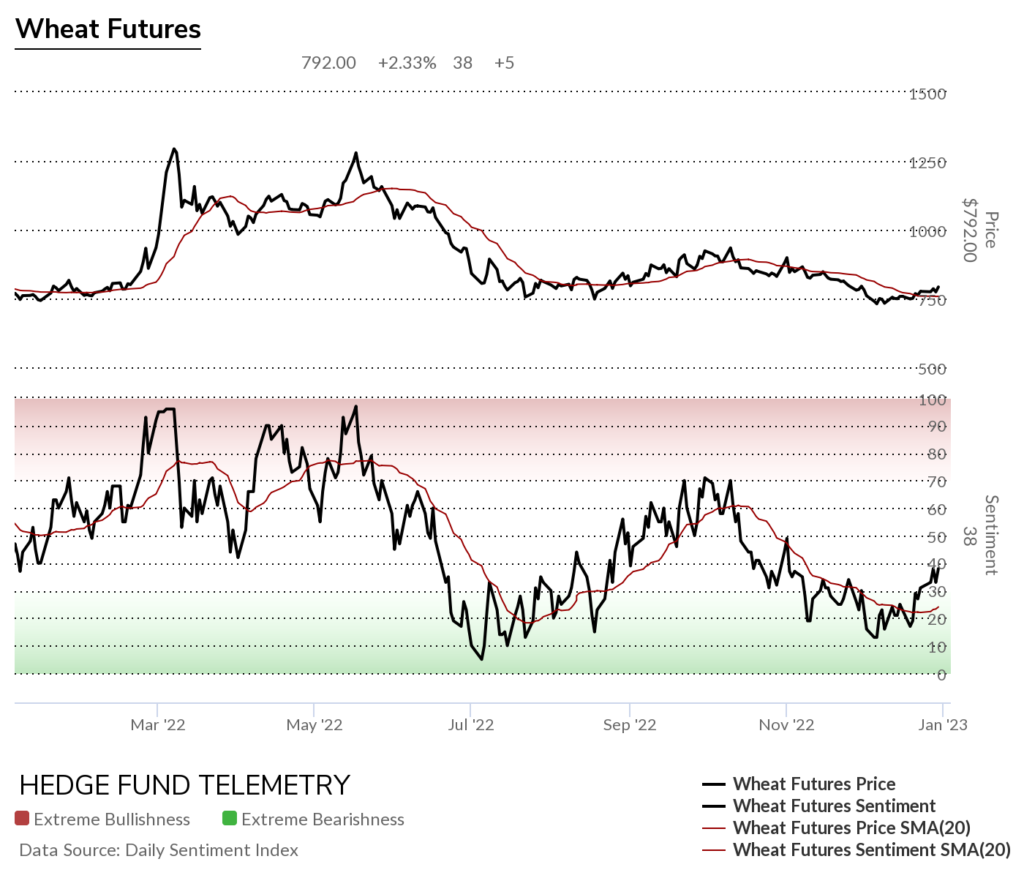

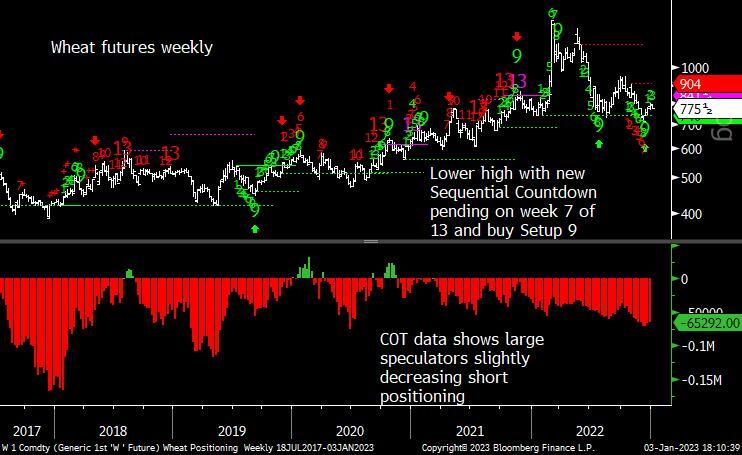

Wheat futures daily has been trying to build a base. Short-term stall after sell Setup 9. A break out above the recent high will start a new upside Sequential, and you will want to be long.

Wheat futures bullish sentiment improvement and now needs to clear 50%

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

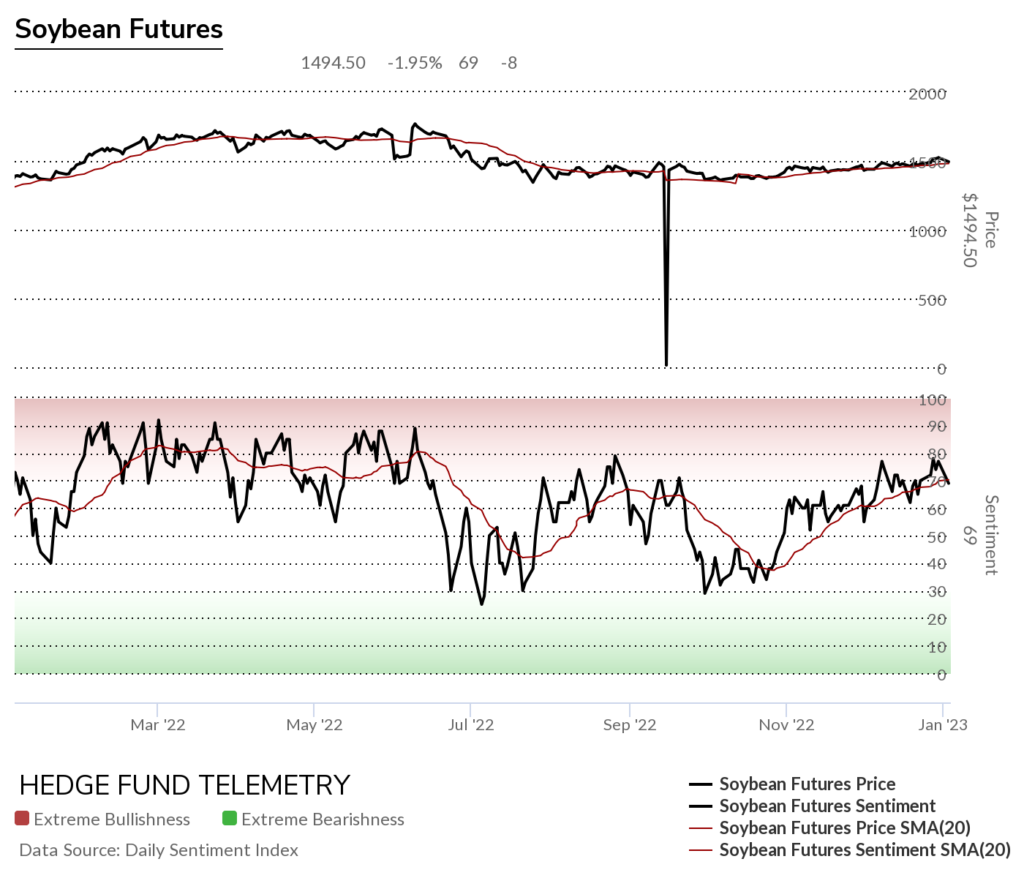

Soybean futures daily choppy drift higher

Soybean futures bullish sentiment has seen sentiment elevated

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

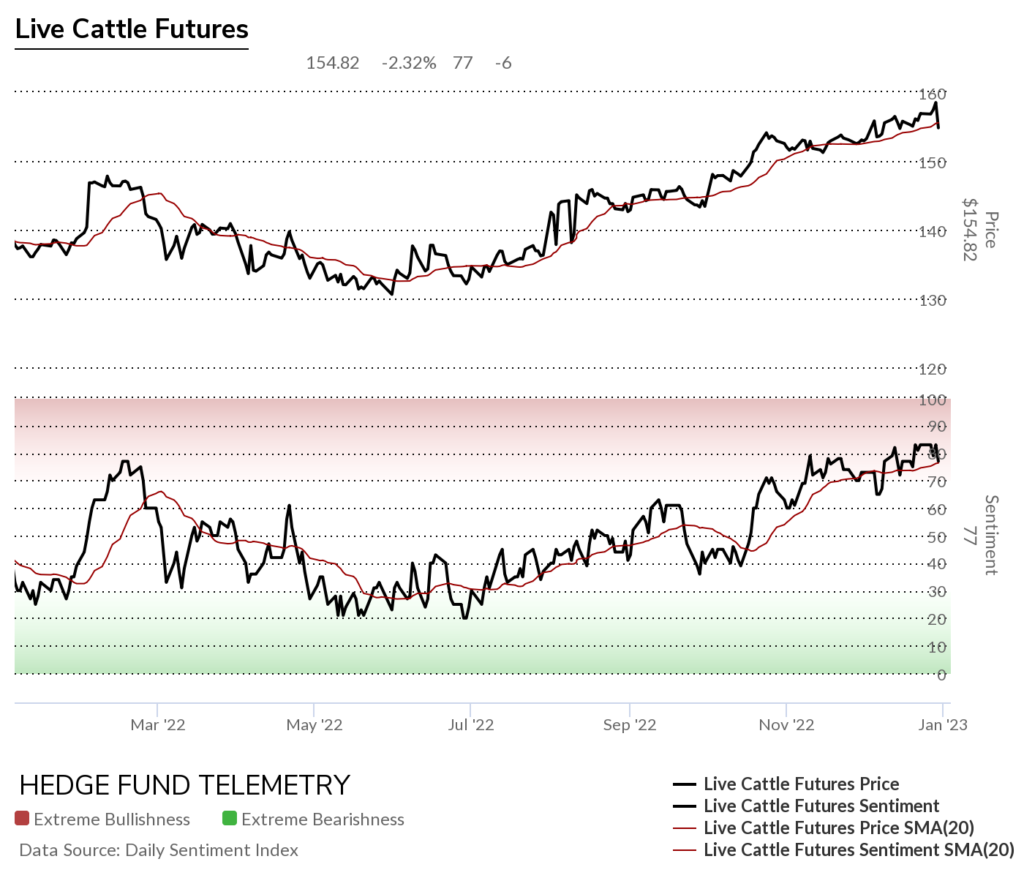

Cattle futures daily broke down after nearly hitting the upside wave5 price objective

Cattle futures bullish sentiment has been in the extreme zone and should pullback from here

Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

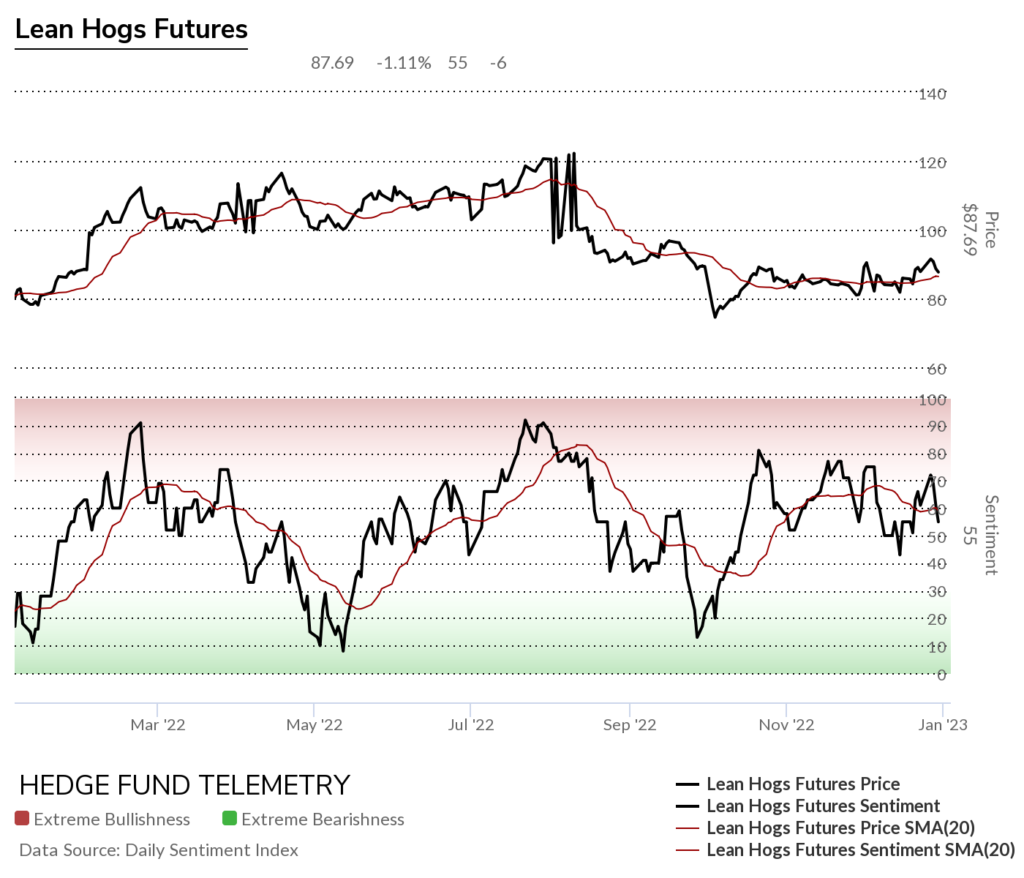

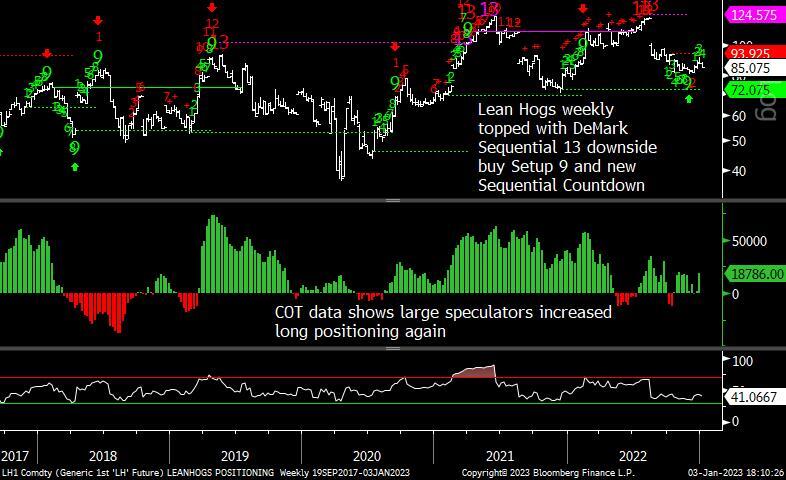

Lean Hogs futures daily reversal down after failing to breakout above the TDST line and with the DeMark Sequential sell Countdown 13

Lean Hogs bullish sentiment is choppy, with slightly lower highs. Breaking 50% to the downside will confirm bearish bias

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

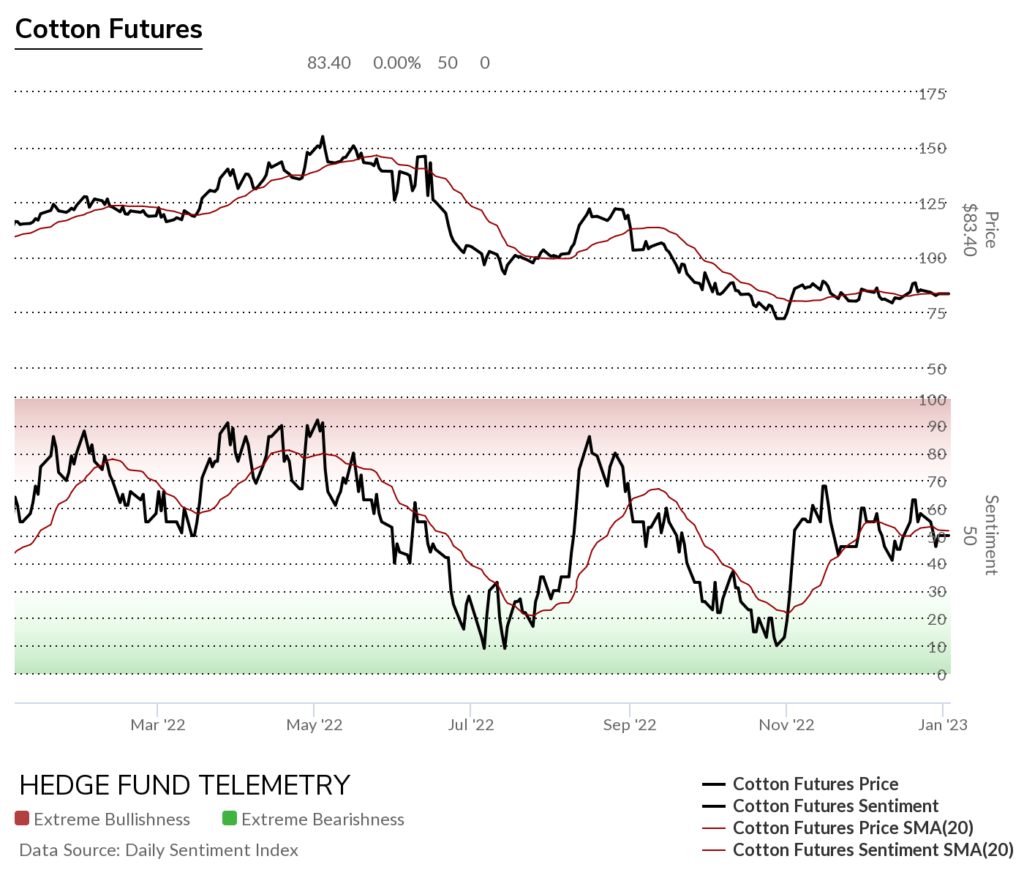

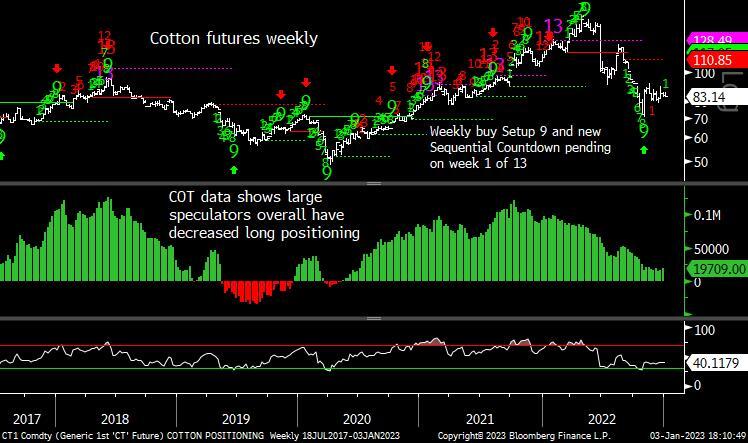

Cotton futures daily sideways

Cotton futures bullish sentiment

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

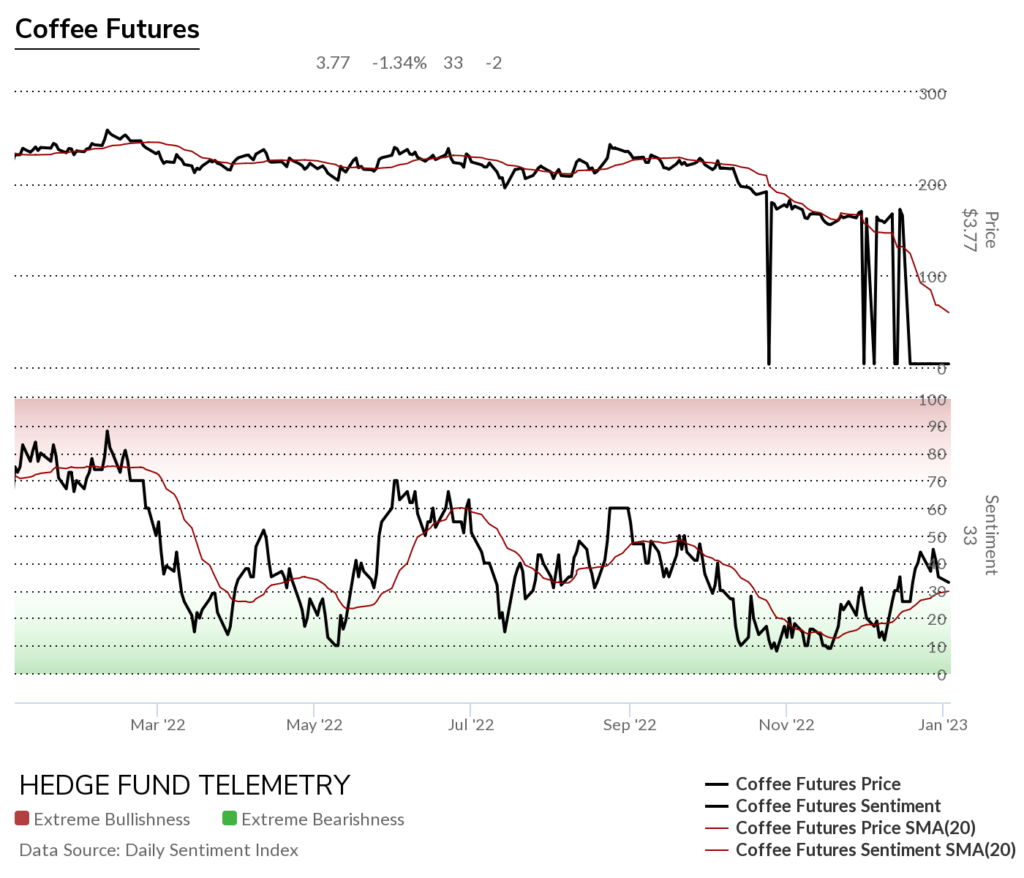

Coffee futures daily just hasn’t been able to break out over the recent highs. I will remain long

Coffee futures bullish sentiment with some data feed issues. Sentiment has struggled to get over 50%

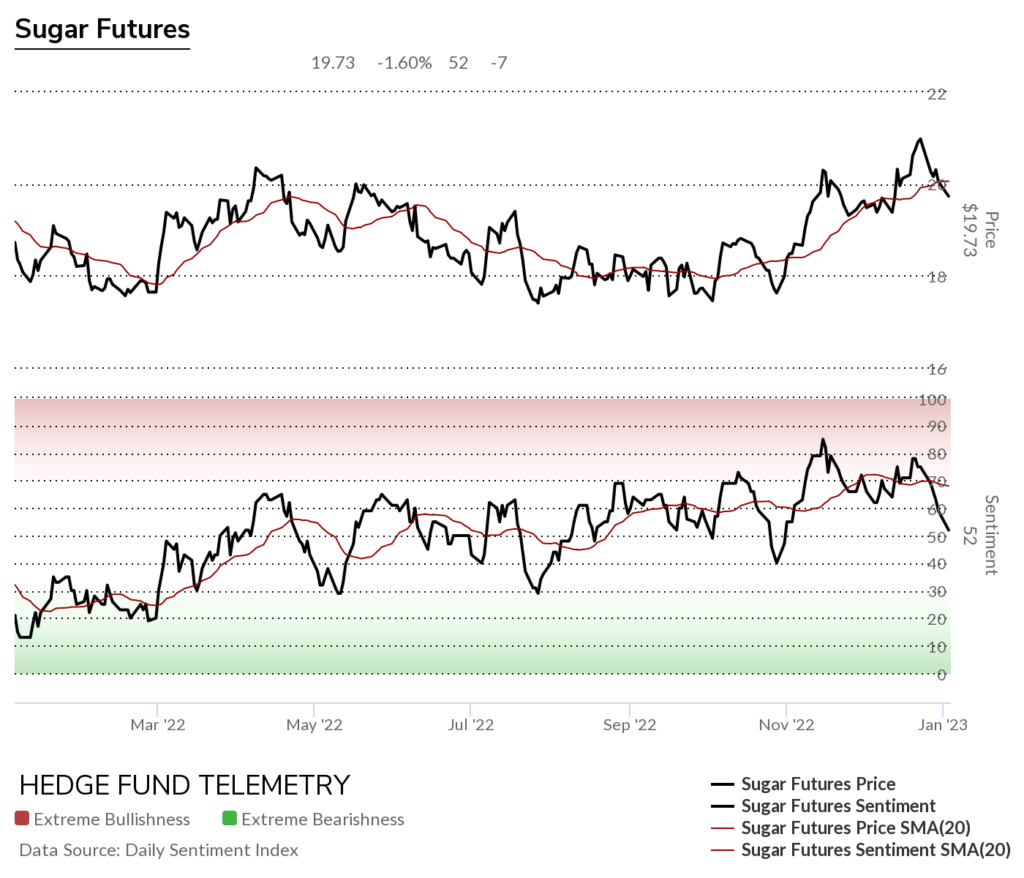

Sugar futures reversed after some overbought conditions and DeMark sell Setup 9

Sugar futures bullish sentiment was in the extreme zone

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

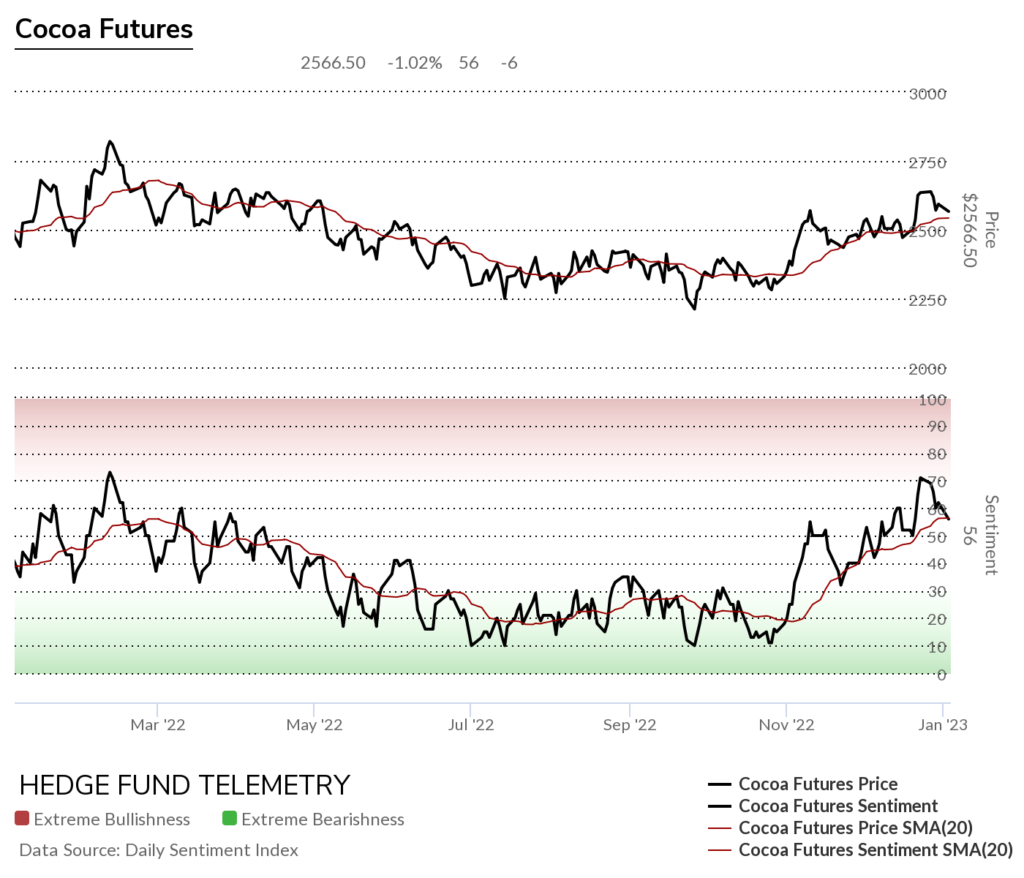

Cocoa futures daily didn’t get the full 13’s. Risk lower if 2500 breaks

Cocoa futures bullish sentiment has made higher highs and higher lows. Will this continue?

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

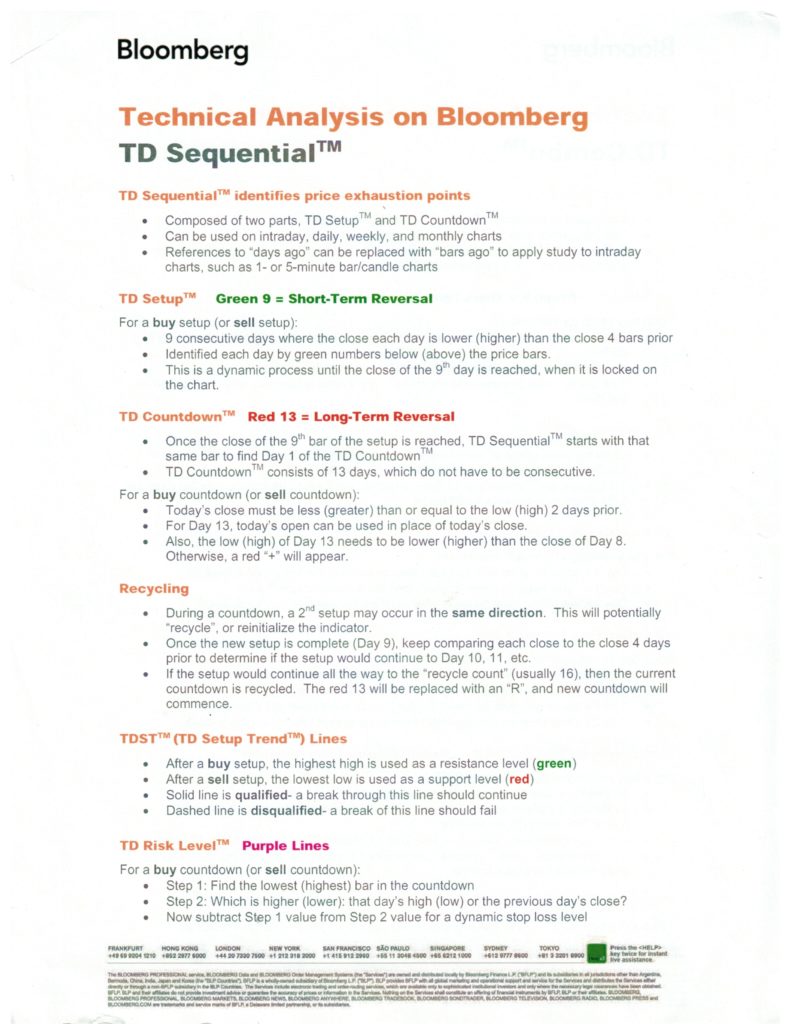

DeMark Sequential Basics

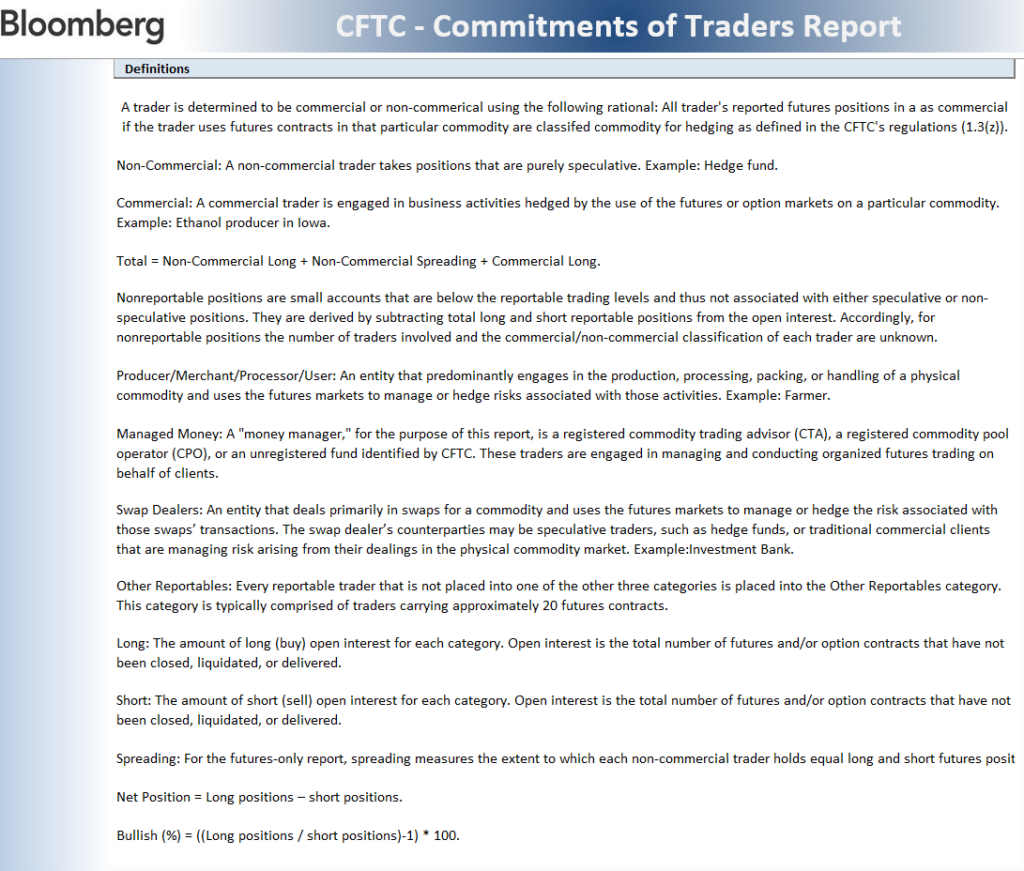

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS