Commitment of Traders – The Basics

The Commitments of Traders (CoT) is a weekly report released by the Commodity Futures Trading Commission (CFTC). The CoT report outlines how different traders are positioned in the futures markets. There are two main types of traders in a CoT report: commercials and money managers.

Commercials are the producers and users of a commodity that use the futures markets to hedge. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Commercial traders are considered the “smart money” since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, comprises hedge funds, mutual funds, and commodity trading advisors. These speculative traders have no interest in the underlying physical commodity business.

CoT data is most meaningful at extremes when either commercial traders or speculators are super net long or net short. The charts below are mostly self-explanatory by looking at the color-coded type of traders. For a more detailed explanation, please see the bottom of this note.

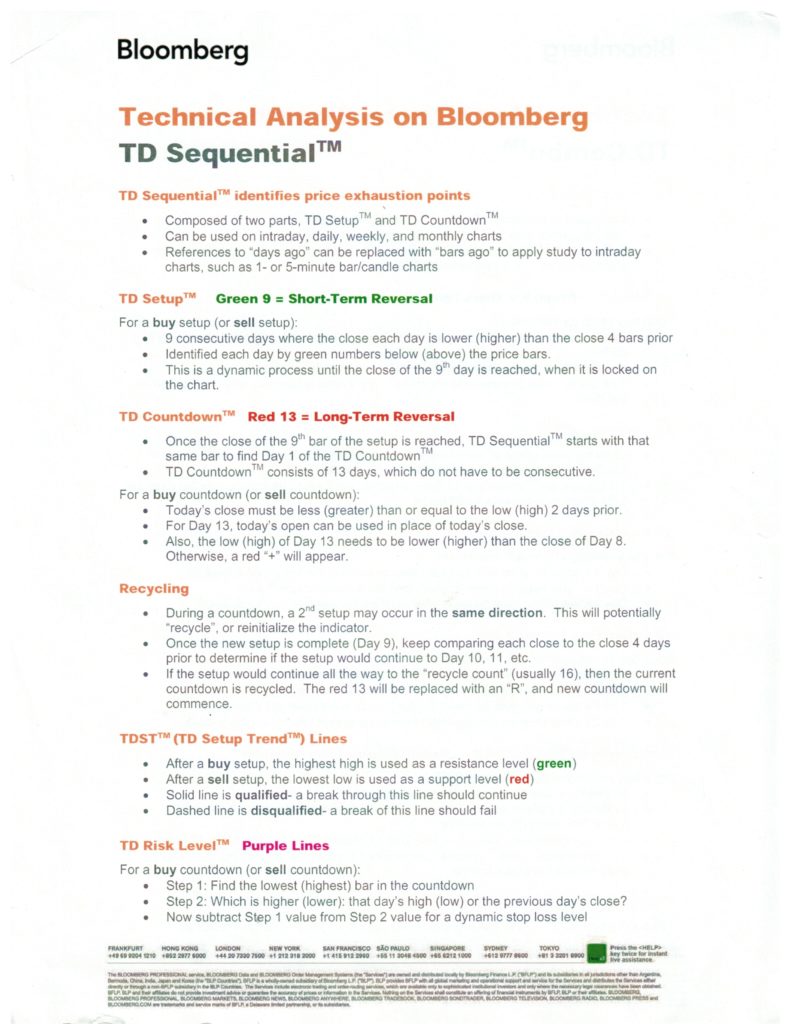

DeMark Indicators basics at the bottom of this note

HIGHLIGHTS AND THEMES

The Bloomberg Commodity Index daily shows potential for more upside, while the weekly makes me a little cautious. I would stay long crude and try Natural Gas on the long side. Gold and silver have the potential for a little more, but it might get choppy and consolidate the highs before the DeMark exhaustion signals. Copper remains in a range. Platinum should stall here, while Palladium has the potential for an upside move. Corn, wheat, and hogs can be bought. Soybeans, cattle, coffee, and sugar can be sold.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily, as I mentioned in the last few weeks, has upside potential and now, with the Sequential in progress, I continue to see this moving higher. This might be the first of five waves higher on the daily time frame.

Bloomberg Commodity Index Weekly doesn’t make the above chart a strong buy since there is a Sequential in progress but a bounce off the wave 3 of 5 price objective could see a bounce perhaps to 115-120

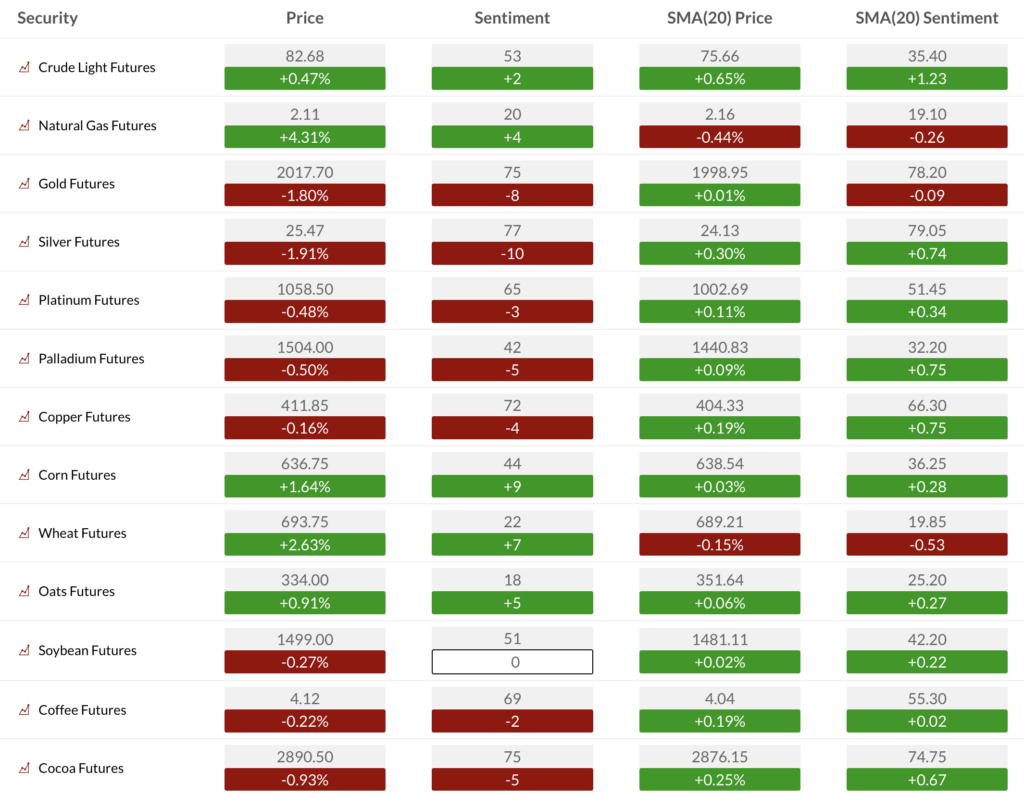

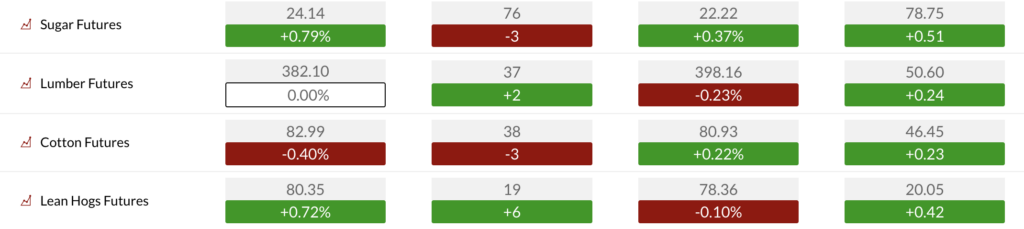

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY

The Bloomberg Energy Subindex has a similar chart for the daily and weekly time frames as the Bloomberg Commodity index charts.

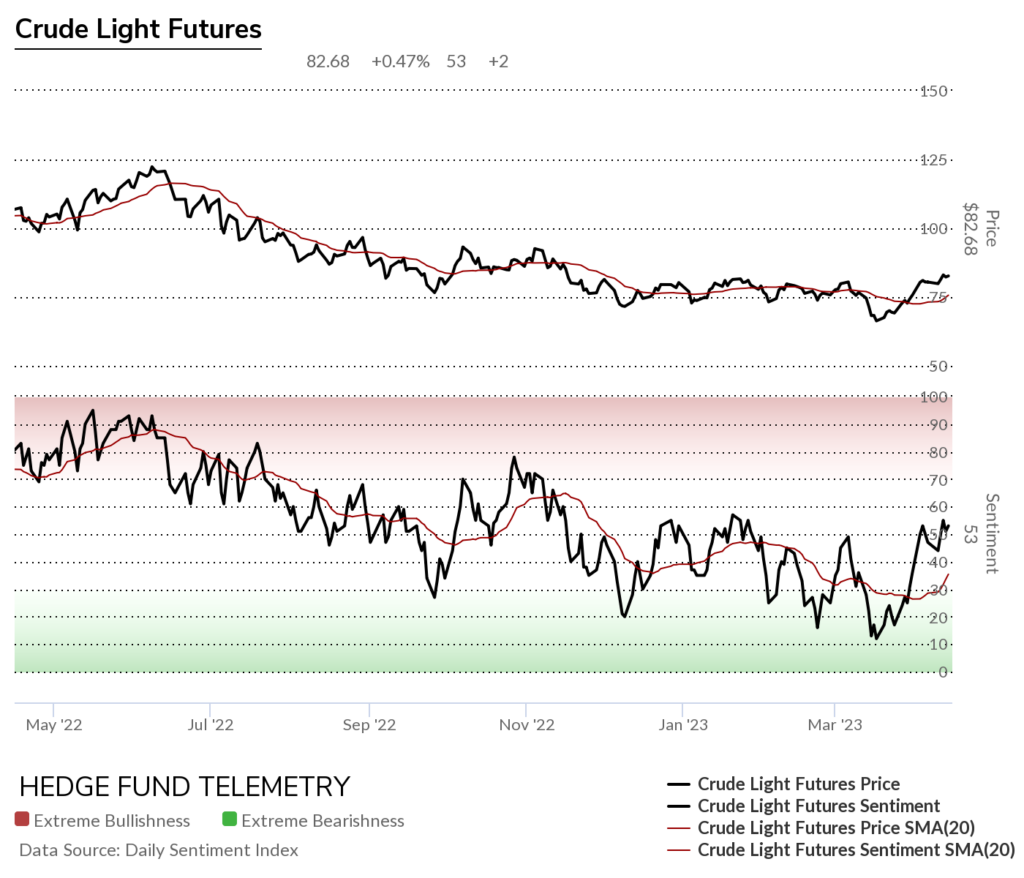

WTI Crude futures daily needs to clear 85

Brent Crude futures daily needs to clear 90

WTI Crude futures bullish sentiment at resistance at 50% midpoint majority level.

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. The Sequential on week 11 of 13 is nearing exhaustion too

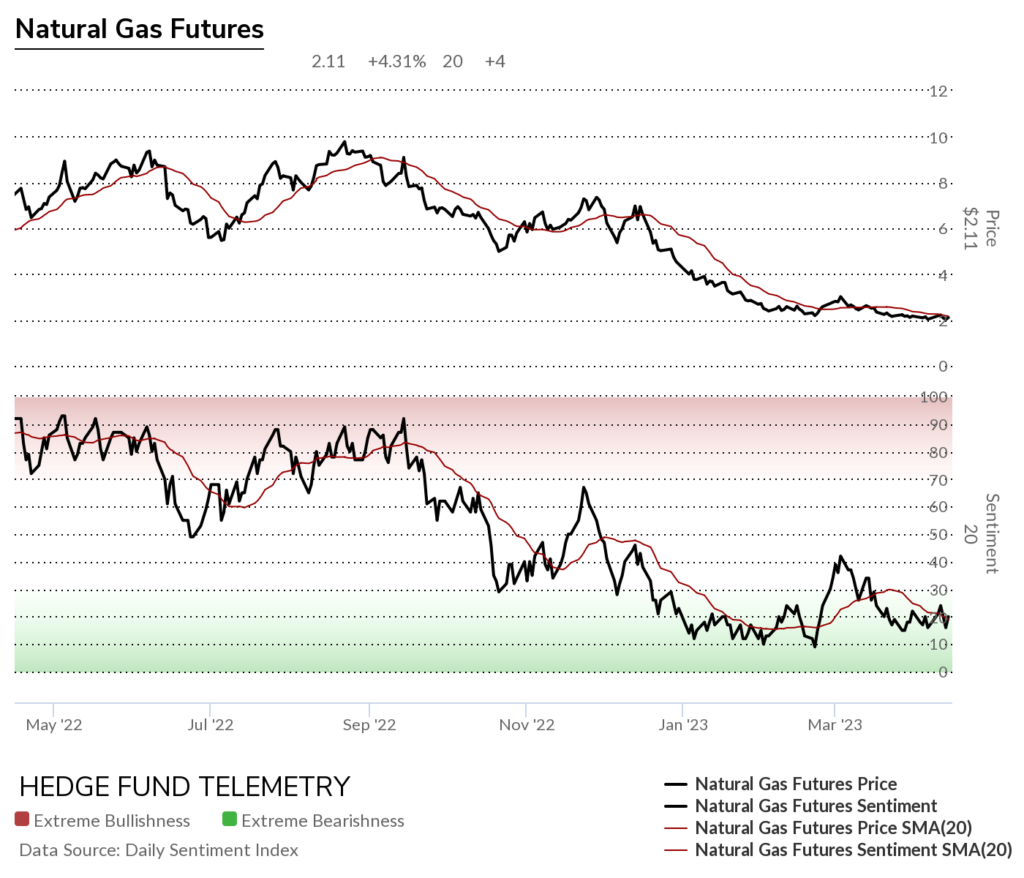

Natural Gas futures daily still has the potential to turn higher from here but honestly it’s a struggle

Natural Gas futures bullish sentiment remains under pressure

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. There is a weekly Sequential buy Countdown 13 that adds to my conviction this can lift from here. Plenty of shorts are still involved and complacent.

Metals

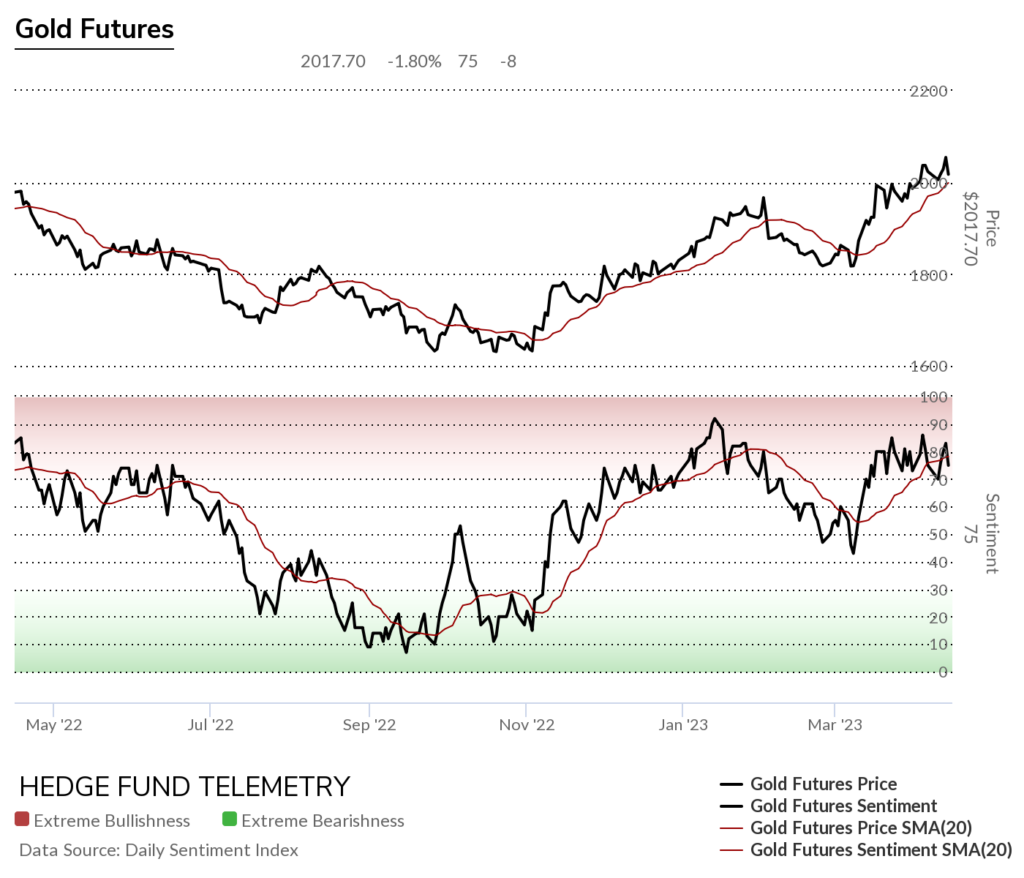

Gold still has a Sequential in progress and could continue higher to complete the 13 however I wouldn’t doubt a choppy top starting

Gold futures bullish sentiment backed of from the extreme zone over 80% and remains elevated

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators.

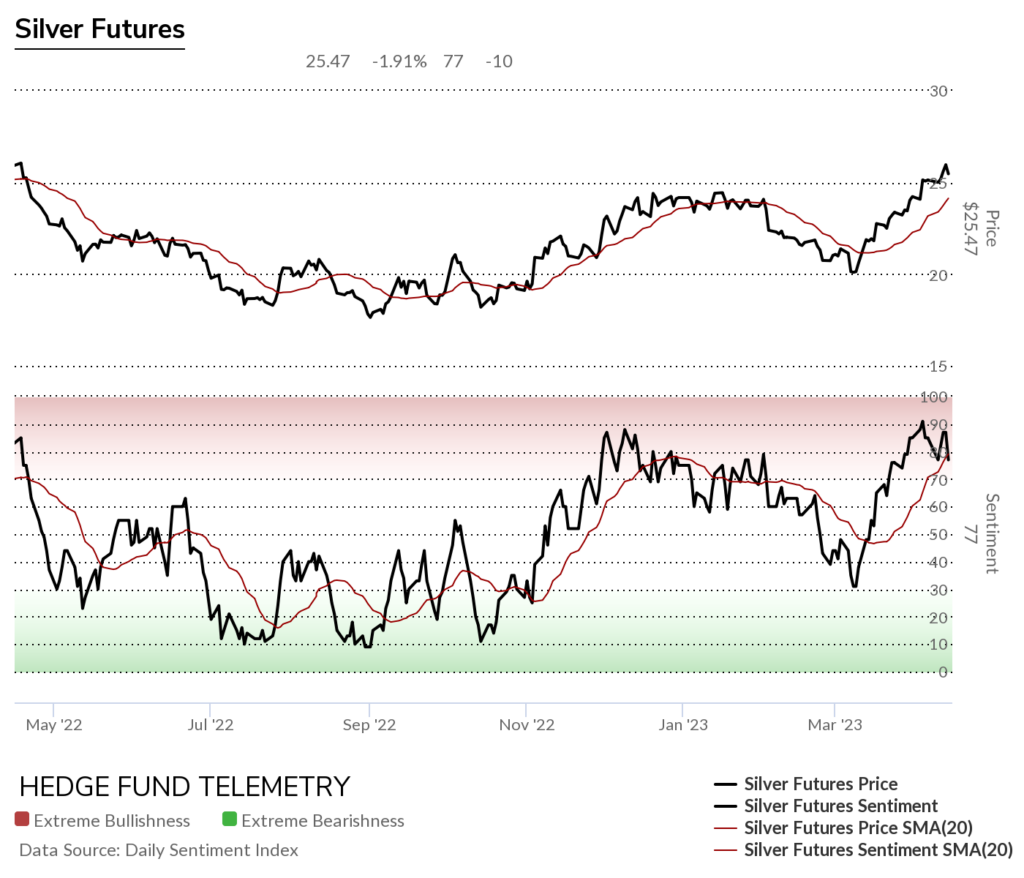

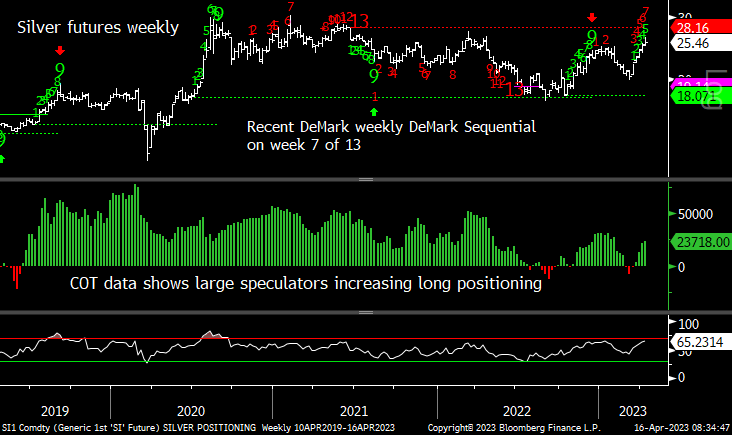

Silver futures daily is closer to getting the Sequential sell Countdown 13

Silver futures bullish sentiment backed off from moving briefly over 90%

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

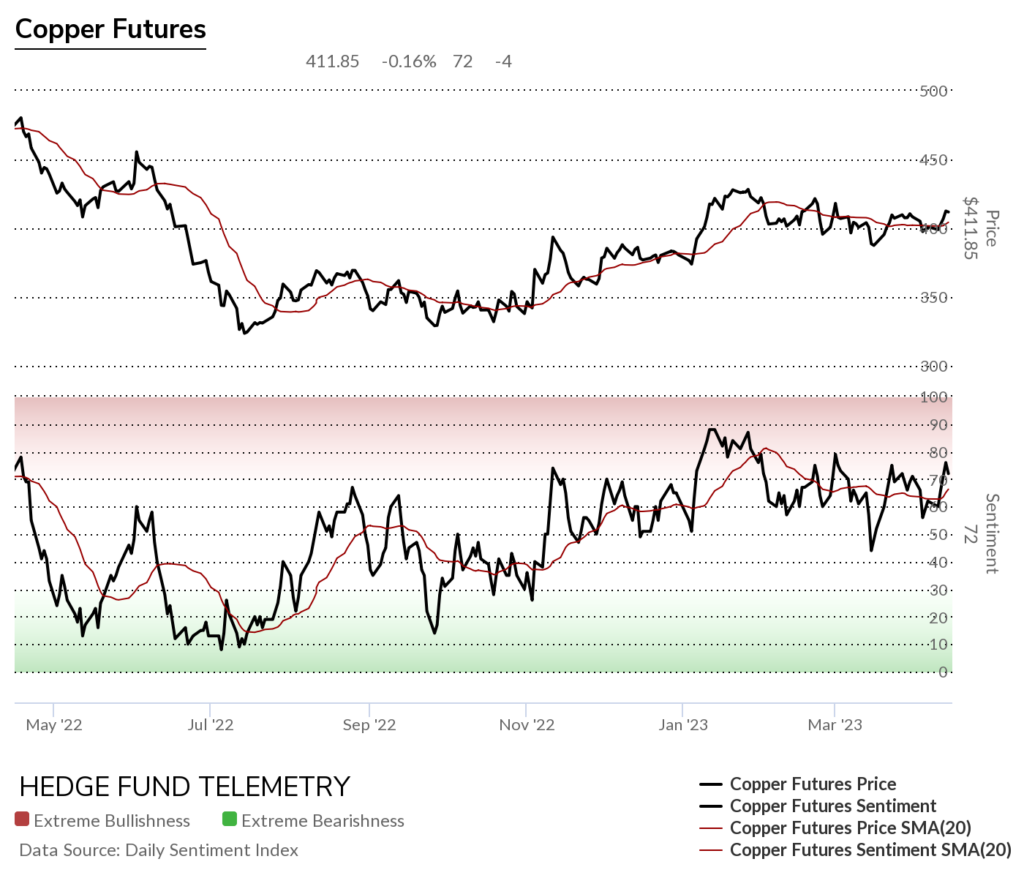

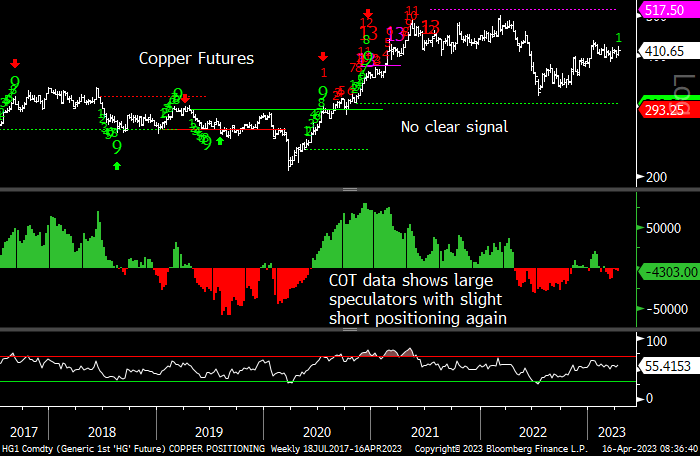

Copper futures daily range bound

Copper futures bullish sentiment holding over 50% is the only thing going for Copper right now

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

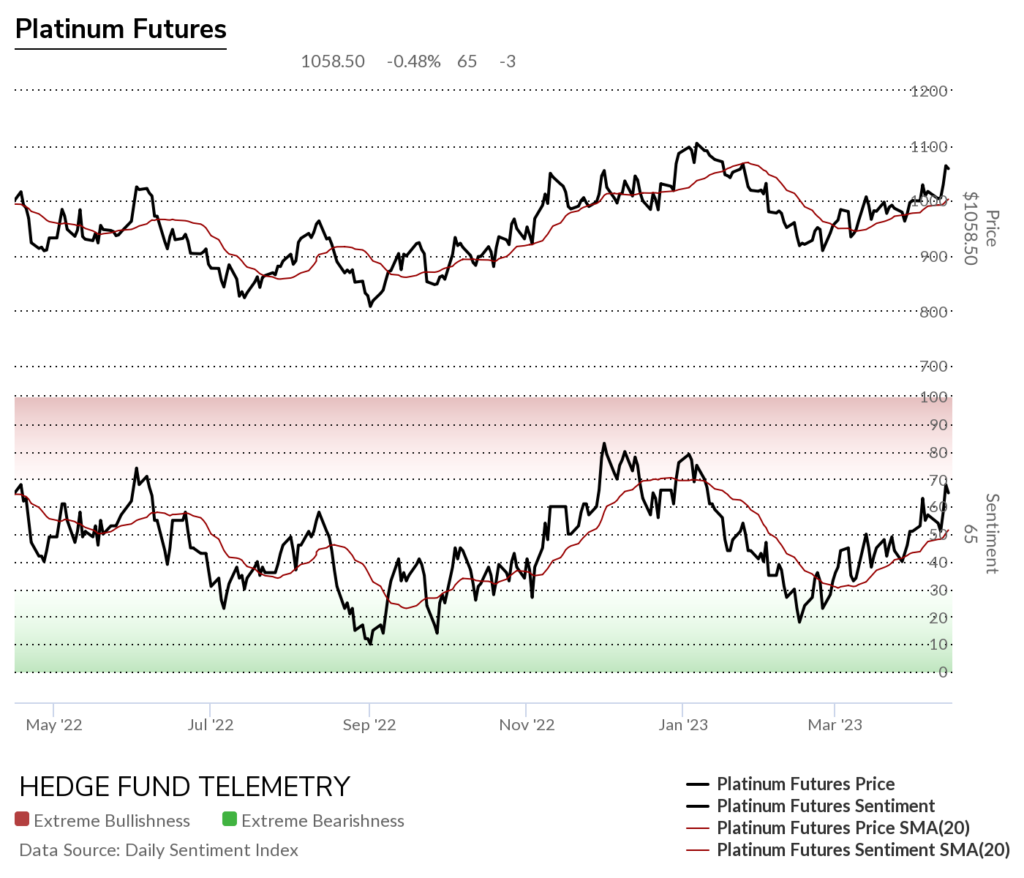

Platinum daily

Platinum bullish sentiment has been quietly working higher

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

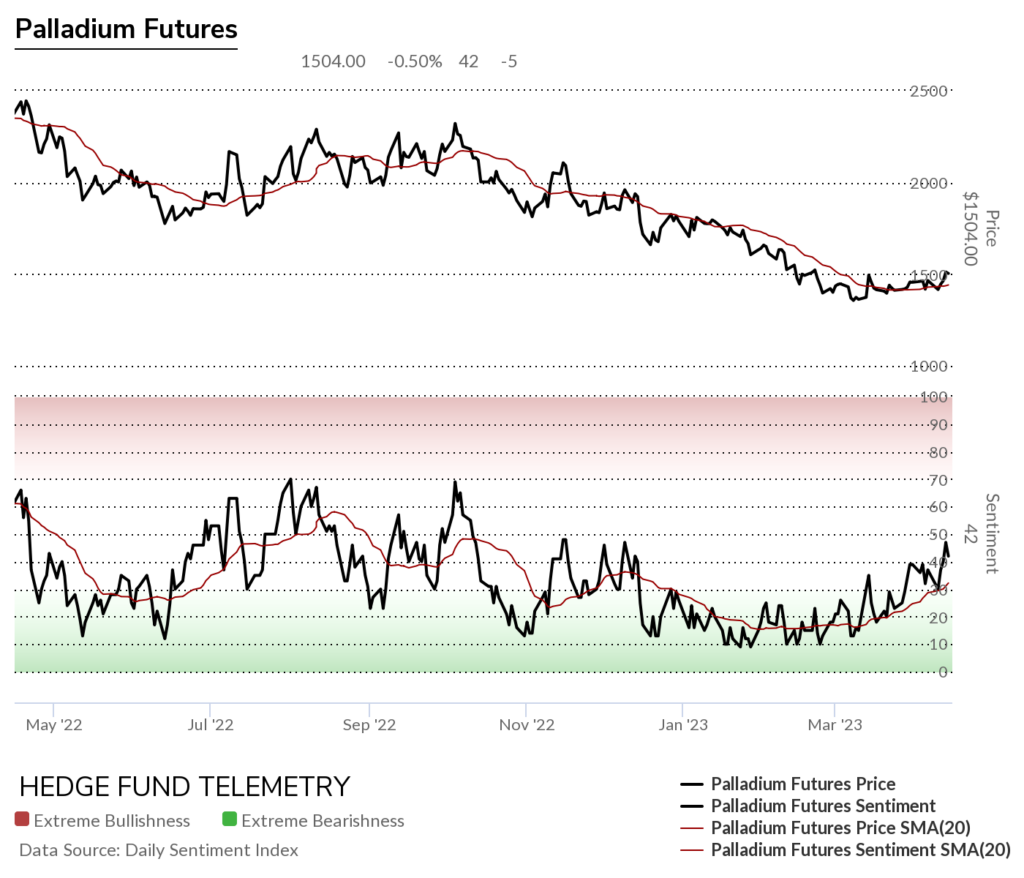

Palladium daily

Palladium bullish sentiment looks better than the price action which often is a good sign for continuation

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

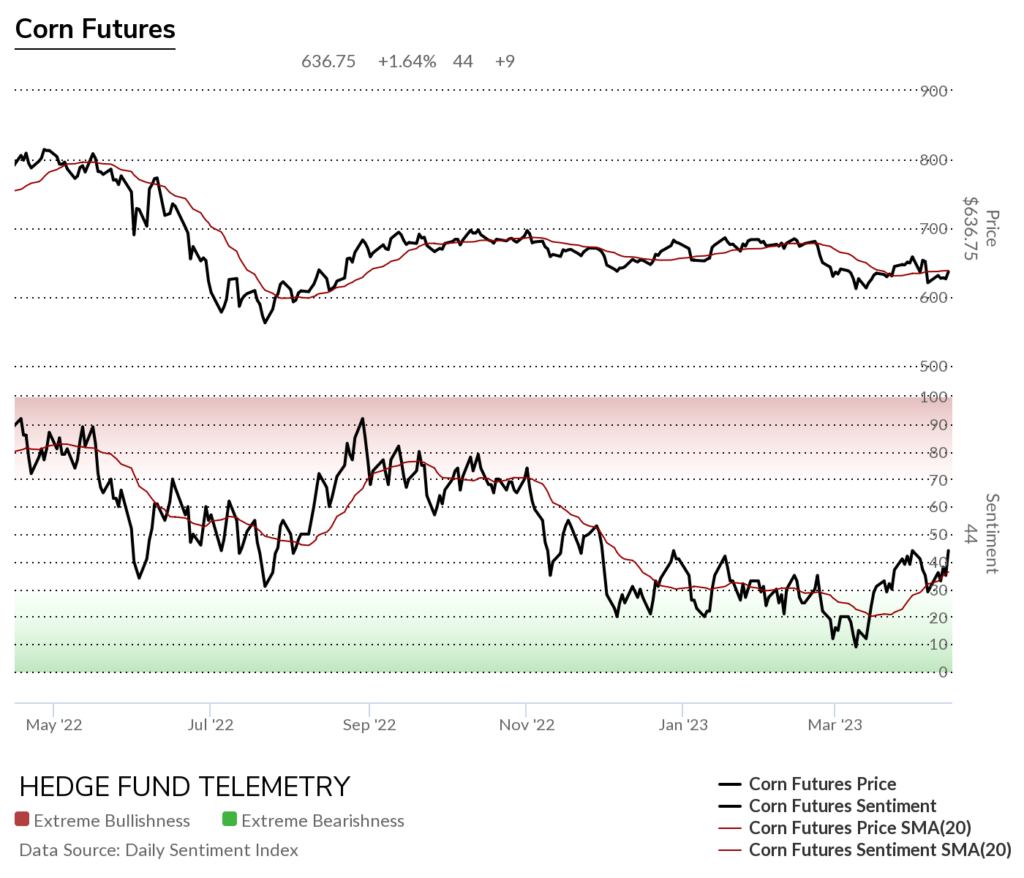

Corn futures daily has been moving higher running into resistance from late last year

Corn futures bullish sentiment improving

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

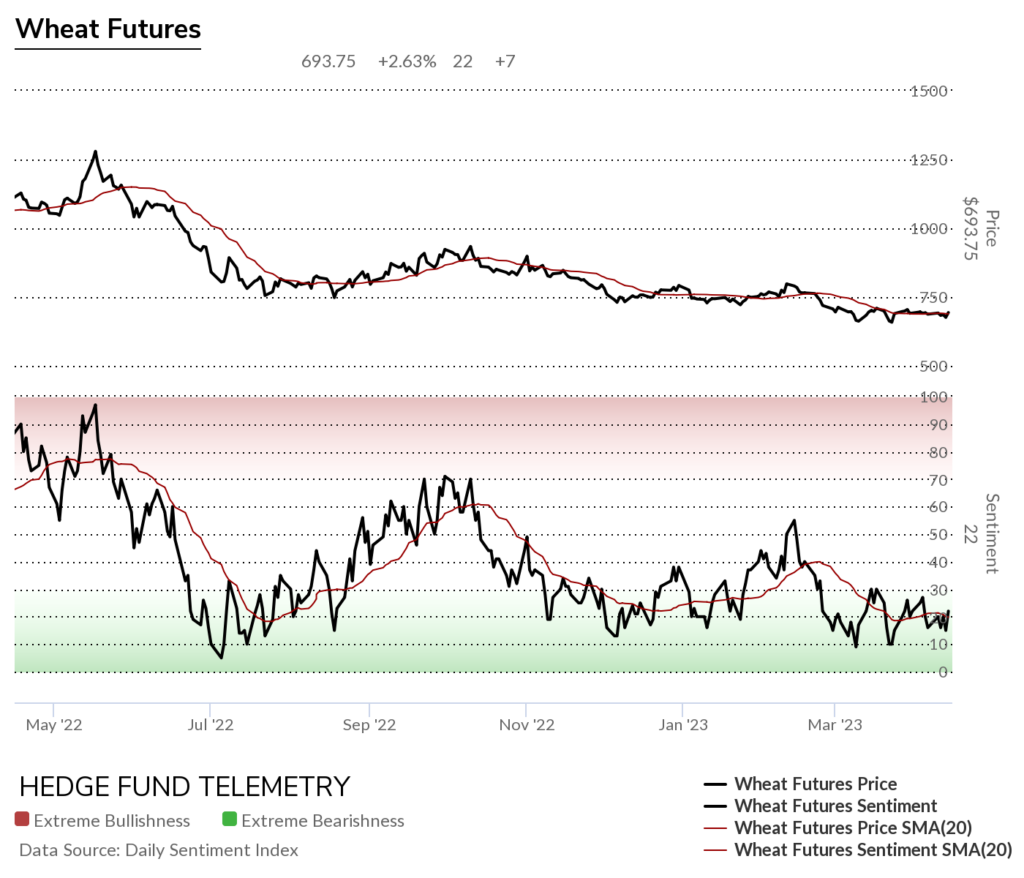

Wheat futures daily with ANOTHER Sequential buy Countdown 13. Brief bounce or more?

Wheat futures bullish sentiment remains under pressure

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

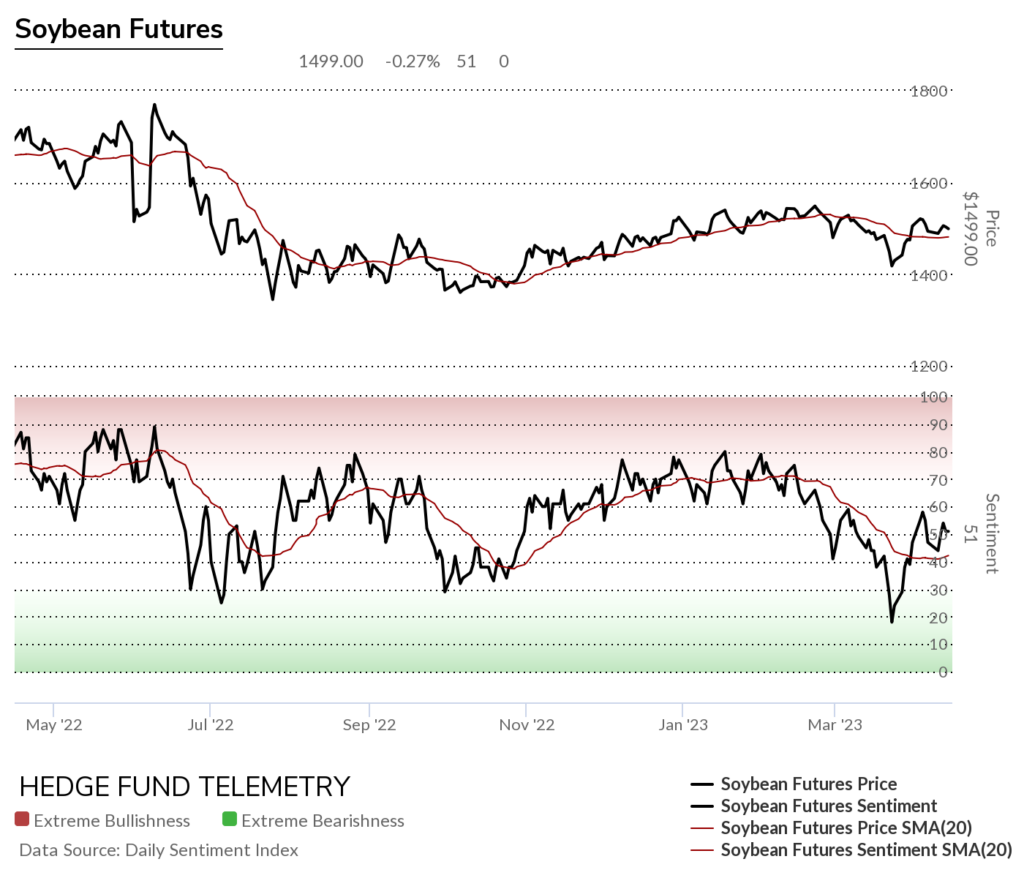

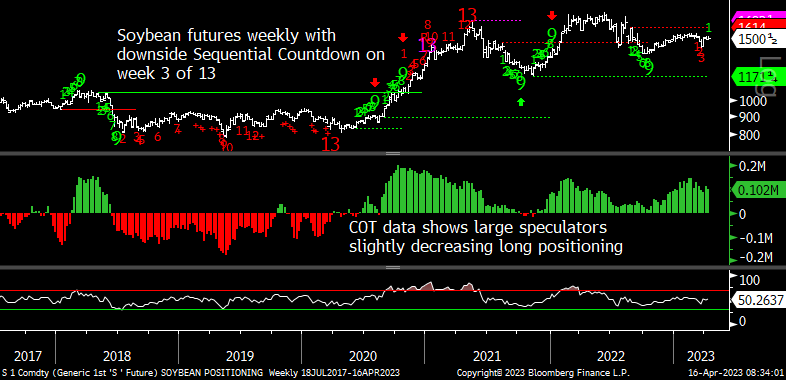

Soybean futures daily

Soybean futures bullish sentiment lower highs too

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

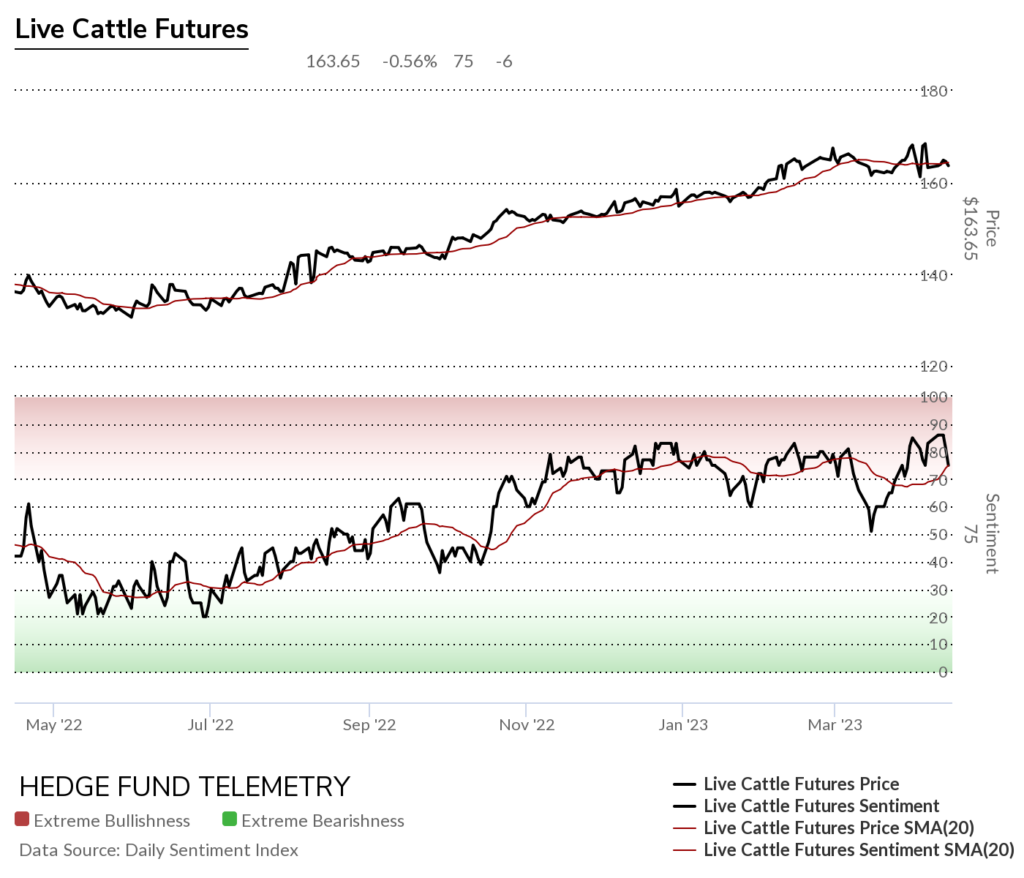

Cattle futures daily looks like a blow off top

Cattle futures bullish sentiment reversal from extreme zone

Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Combo sell Countdown 13 in play

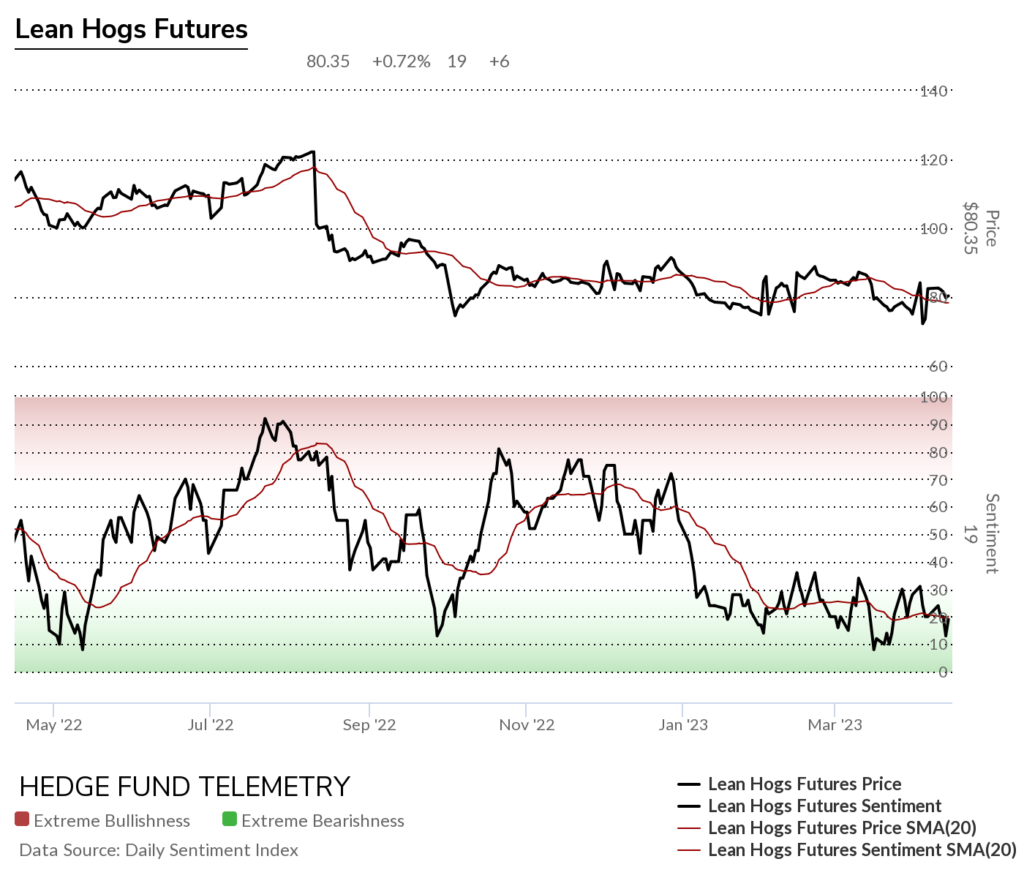

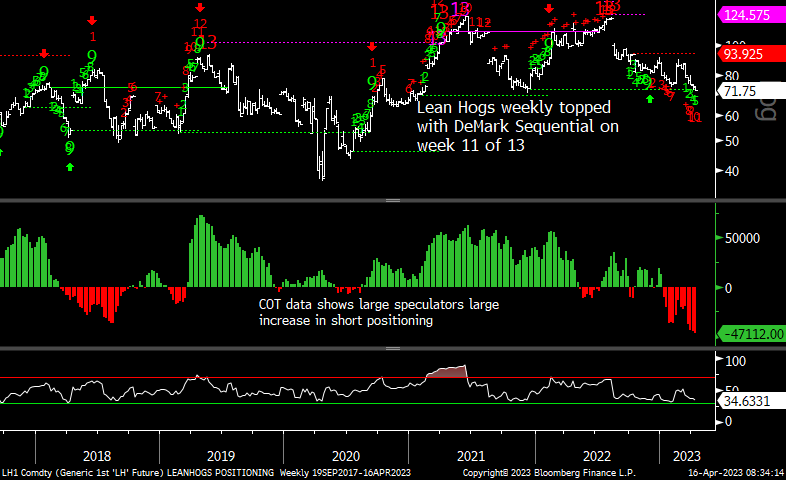

Lean Hogs futures daily could bounce with these signals

Lean Hogs bullish sentiment remains under pressure

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

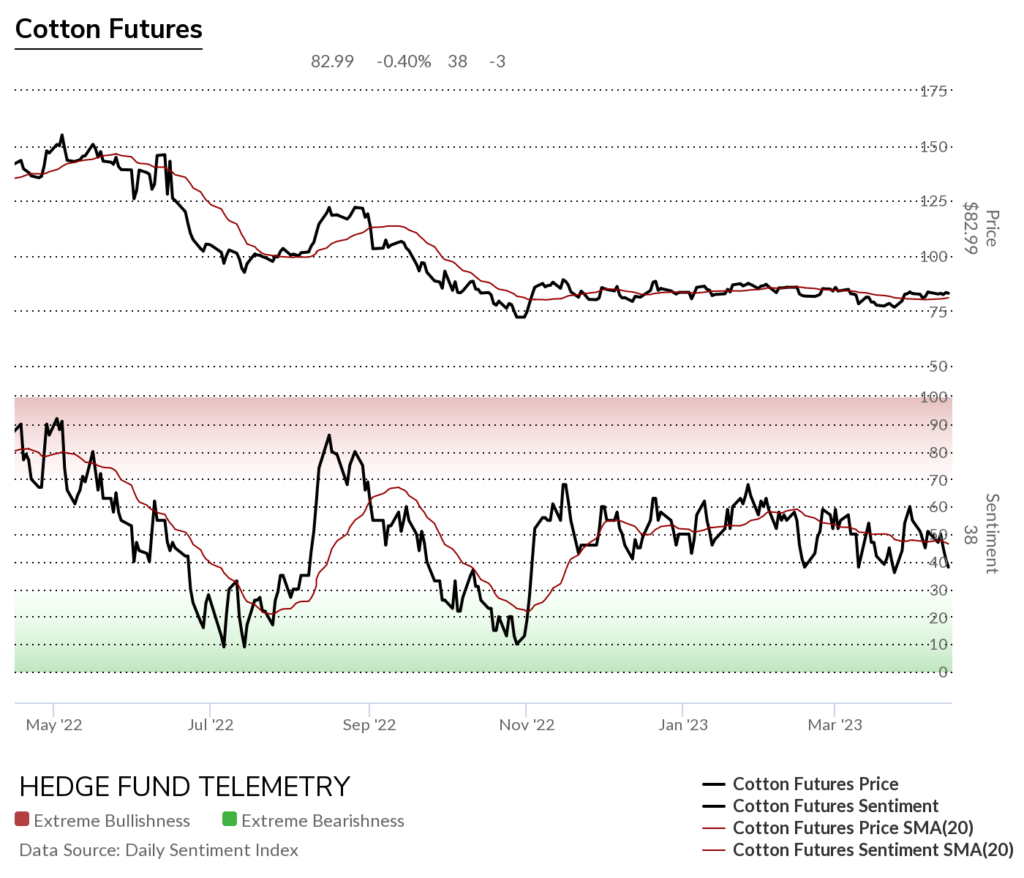

Cotton futures daily in a tight range

Cotton futures bullish sentiment

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

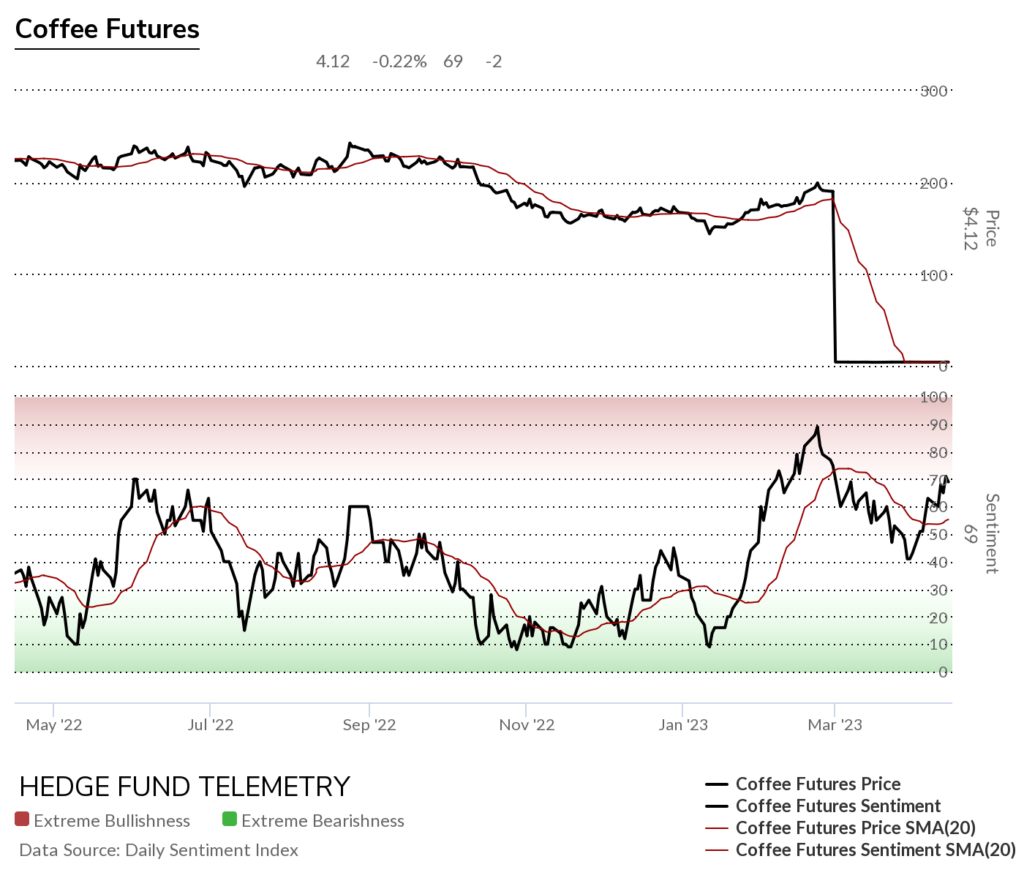

Coffee futures daily with sell Setup 9. I covered this short quickly with small loss because it failed to stay under 170 and the wave was wave 2 of 5 on the upside, which is not ideal for a short position.

Coffee futures bullish sentiment still shows our data feed issue (I am sorry about this; we will try to find a fix). Sentiment improved in the last two weeks.

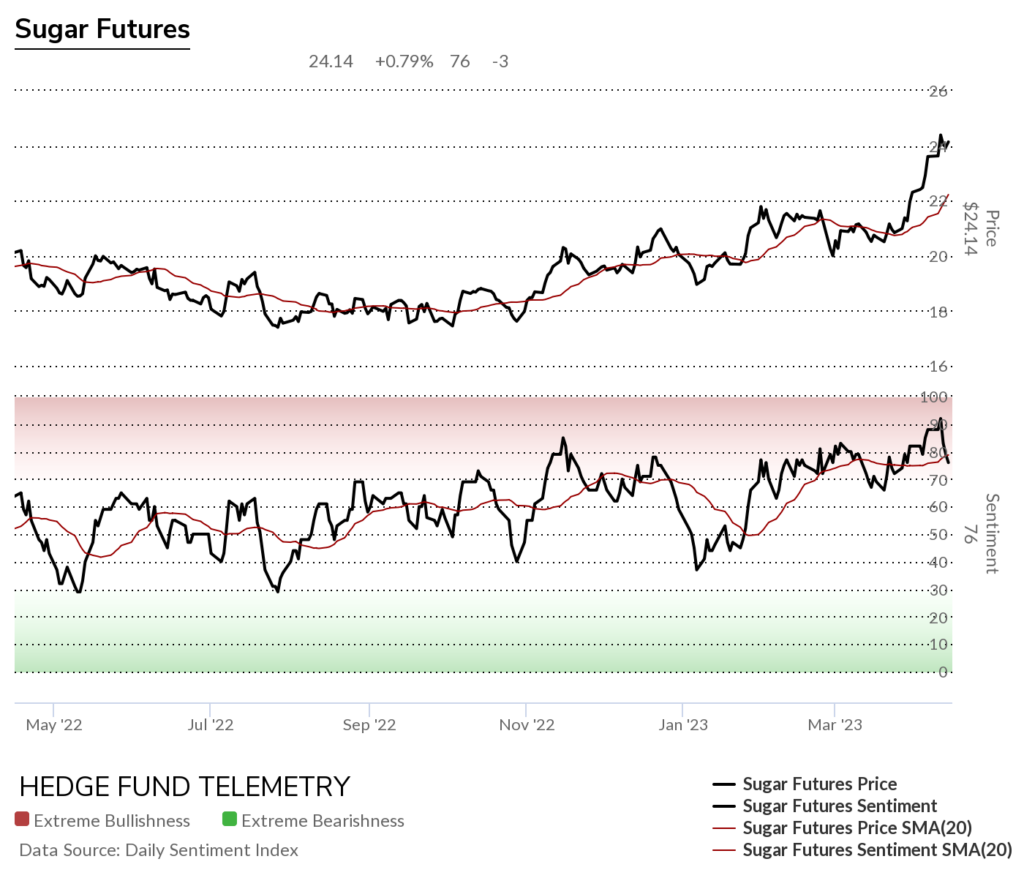

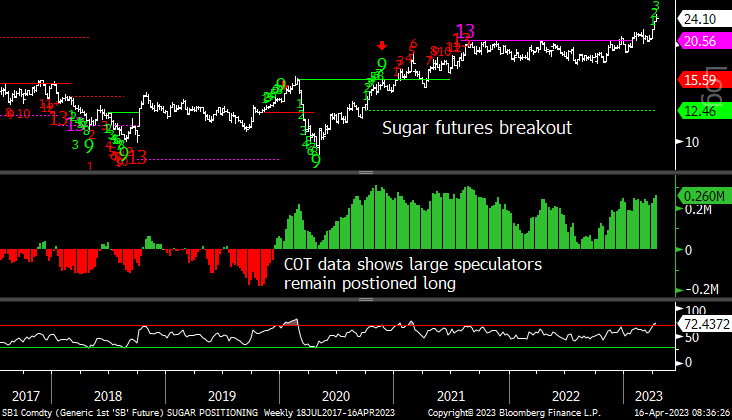

Sugar futures daily stalling here with DeMark Sequential 13’s

Sugar futures bullish sentiment reversed after moving over the extreme of extreme levels 90%

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

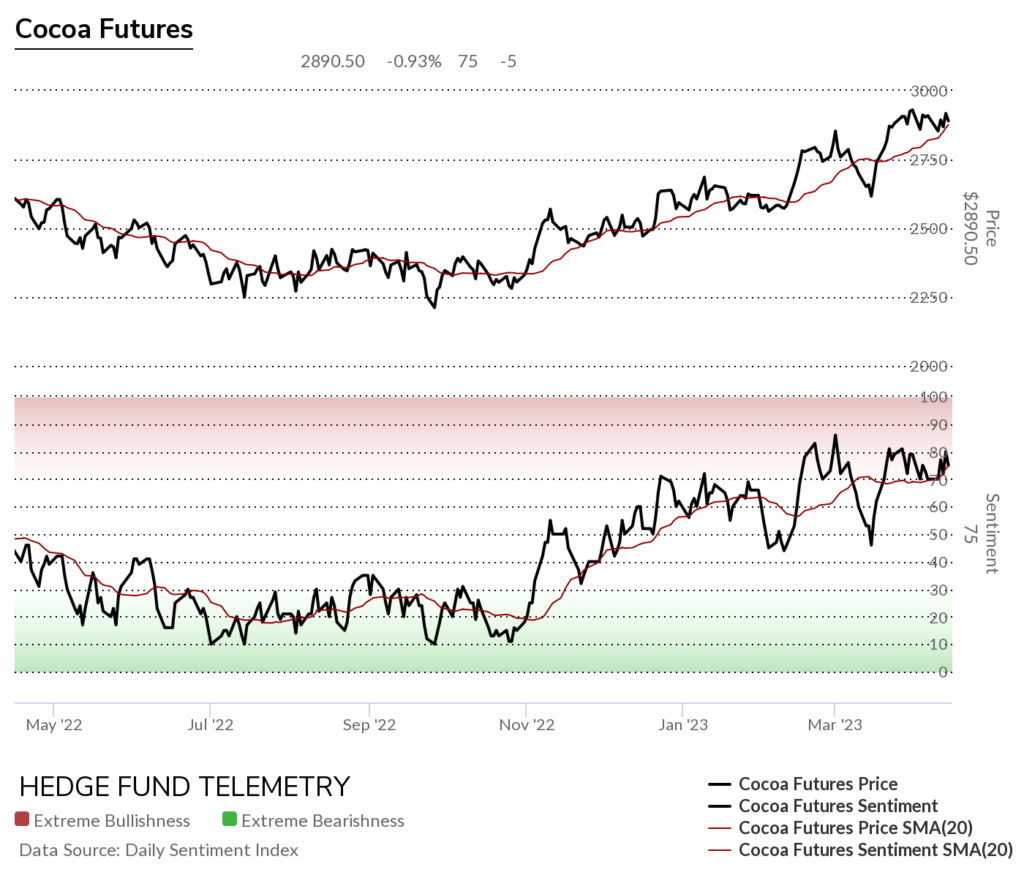

Cocoa futures daily has been a strong

Cocoa futures bullish sentiment remains elevated

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Lumber futures daily has the potential to continue but I’ll want to see a few days of upside to make that call. The sell Setup 9’s have seen brief continuation starting Sequential Countdown’s but failed.

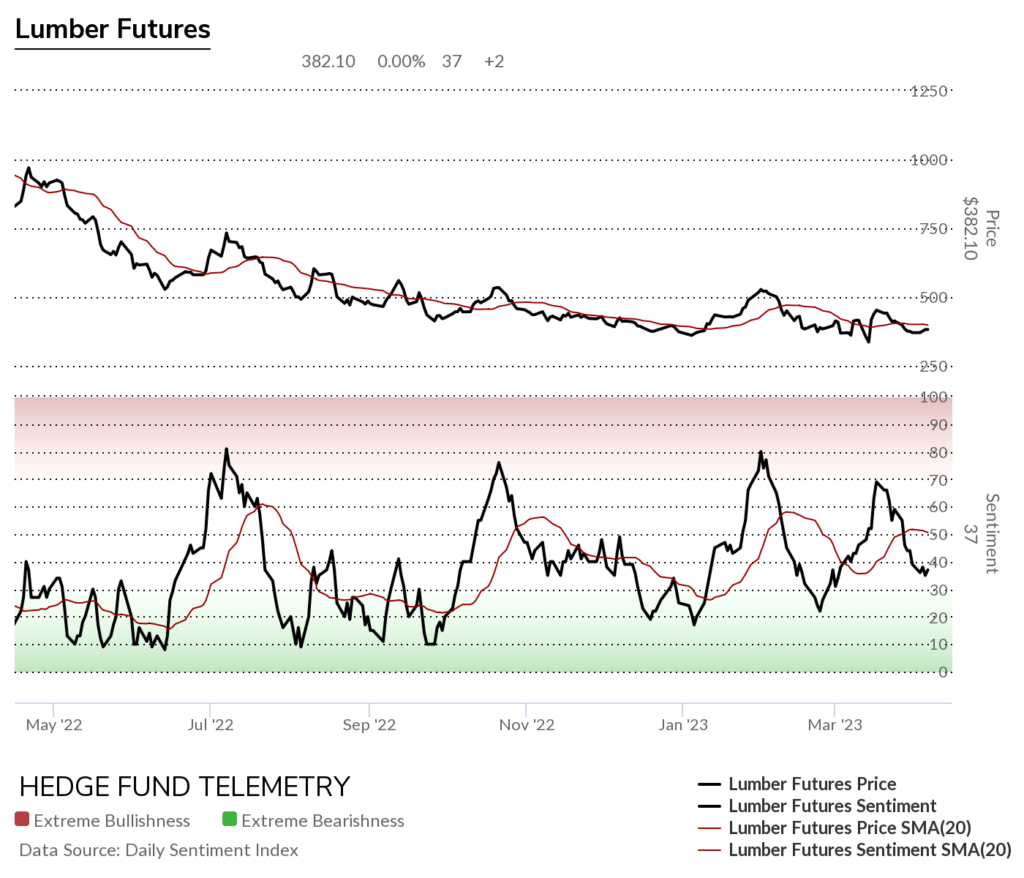

Lumber bullish sentiment

DeMark Sequential Basics

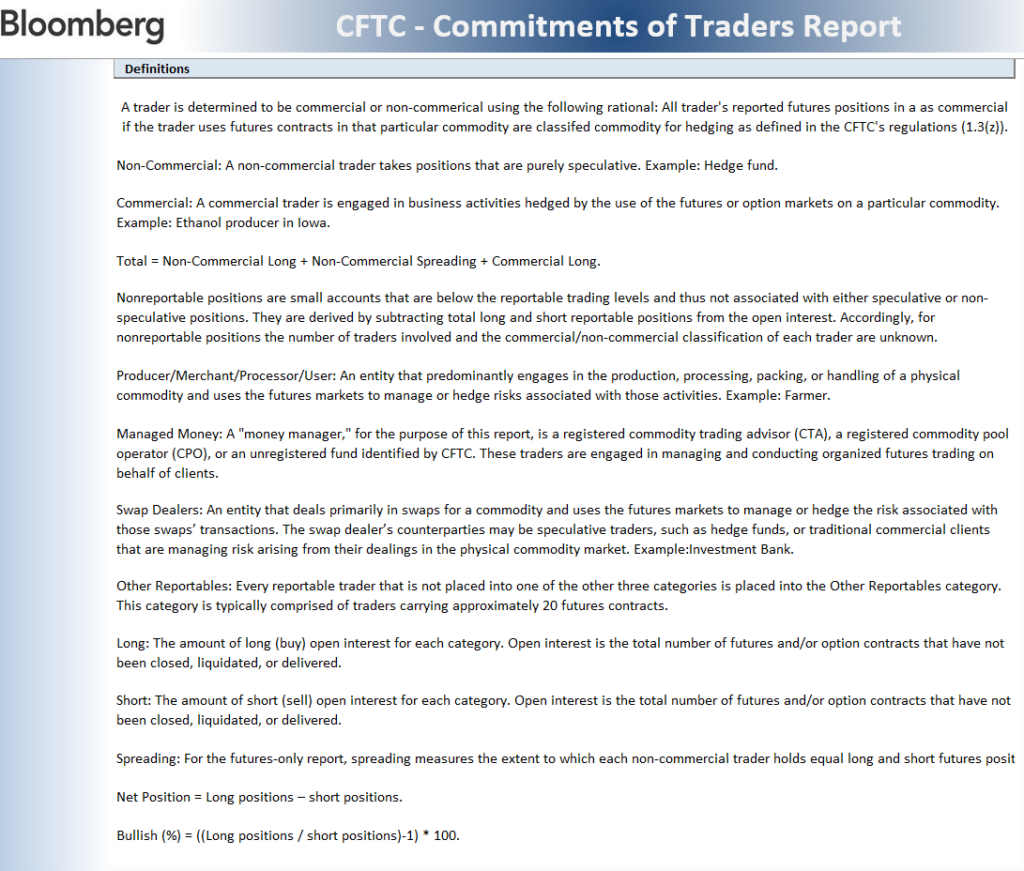

DETAILED COMMITMENT OF TRADERS DEFINITIONS