There were several stories about the US Secretary of the Treasury eating psychedelic mushrooms at a restaurant in China. The restaurant has since seen huge bookings. It can’t be confirmed, but don’t you wish she would take some mushrooms? Perhaps some clairvoyance would follow rather than the typical blather.

Today’s note has a few sections that are worth checking out. US sector ETF charts and internals are now clearly overbought. Then I look at a huge disconnect between earnings estimates and price action in the last quarter. A simple earnings beat might not be enough to justify the current P/E valuations after the surge. Guidance for Q3 will be important and if they continue this move into Q3 I could see a major market event (lower) in the Fall.

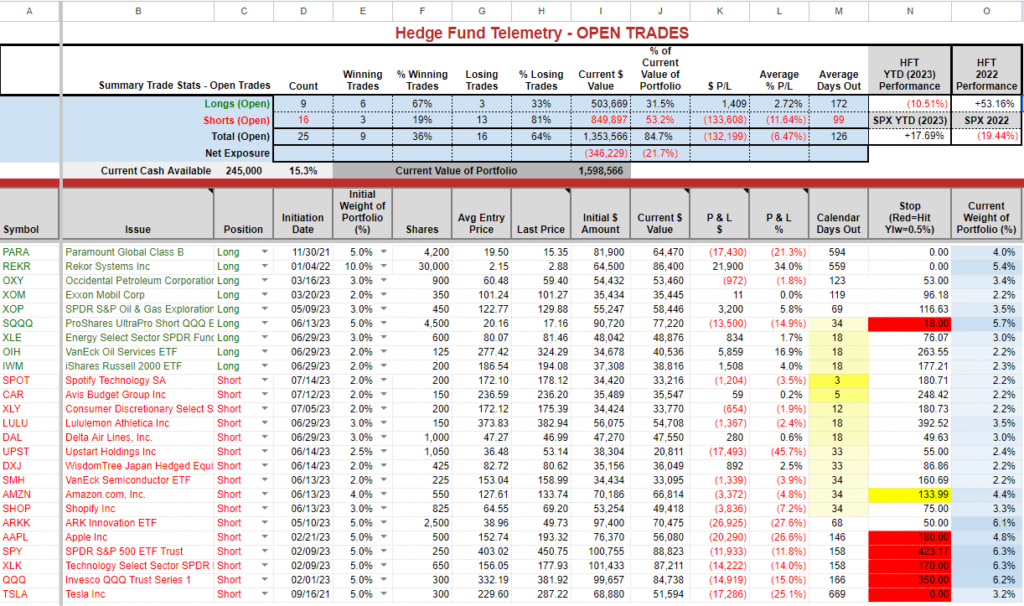

TRADE IDEAS

With market sentiment and positioning now extreme combined with some important DeMark Sequential and pending Combo sell Countdown 13’s, I will stick with some of the underperforming shorts as a 5%-10% pullback is more likely that up that amount. 15% in cash. If you don’t want to short – raising cash is advised.

US MARKETS

Here is a primer on the DeMark Setup and Sequential indicators basics.

S&P 500 futures 60-minute time frame still is below Friday’s high. If Friday’s high is surpassed which won’t surprise me then the downside wave pattern will cancel and will revert back to upside wave 5. The wave 5 price objective of 4548 was achieved last week.

SPY daily has DeMark Sequential 13 in play now with the Combo on day 12 of 13. This could qualify tomorrow too. RSI at 75 is overbought too.

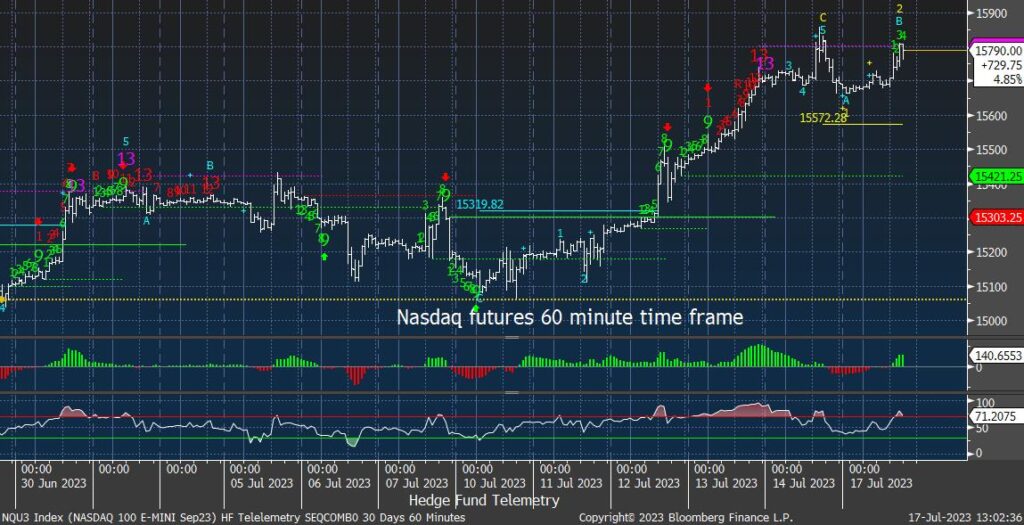

Nasdaq 100 futures 60 minute. If the the Friday high is surpassed then the downside pattern will cancel and revert back to upside wave 5. Not a buy signal by any means as RSI is overbought

QQQ daily with residual momentum after the recent Sequential and Combo sell Countdown 13’s. This could be setting up a 9-13-9 on the daily while the QQQ weekly has a Combo 13 qualified this week.

Nasdaq Composite Index with new Sequential sell Countdown 13 with Combo on day 12 of 13

Russell 2000 daily is getting late in the upside Sequential Countdown. I will hold this longer

US SECTOR ETF FOCUS

Comments on charts

XLK Technology with potential 9-13-9 DeMark pattern with the residual momentum after the Countdown 13’s.

XLY Consumer Discretionary

XLI Industrials

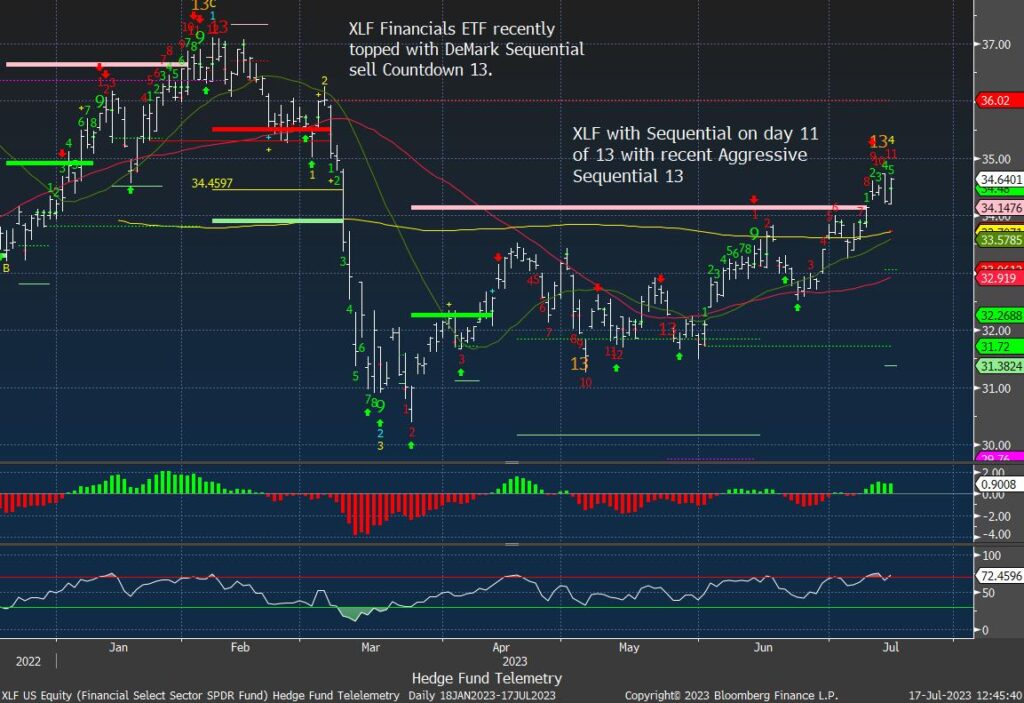

XLF Financials

KRE Regional Banks at resistance

XLE Energy nearly hit the upside wave 3 price objective. Expect this pullback to be a higher low wave 4 of 5

XOP doesn’t have the same wave pattern but is also trading between the 200 day and 50 day.

OIH Oil Service is overbought with a Sequential buy Countdown in progress.

XLV Healthcare with resistance near ~133 with more important resistance at 135

XLP Consumer Staples tightly wound

XLC Communications Services at upside wave 5 price objective with residual momentum

XLB Materials with new DeMark Sequential sell Countdown 13.

XLRE Real Estate

XLU Utilities to qualify the 13 it will have to see one more downside move

IYT Transports has been a focus recently with the cluster of DeMark sell Countdown 13’s

ITB Housing has been relentless with several DeMark sell Countdown 13’s with brief pauses of sideways action. Very overbought at upside wave 5 price objective

GDX Gold Miners was a good recent short idea sold at the highs and covered at the lows with DeMark Countdown 13s. I believe this will be a corrective lower high wave 4 bounce that will fail and a move lower below the recent lows.

URA Uranium ETF has been choppy with upside potential if 20 can hold.

The disconnect

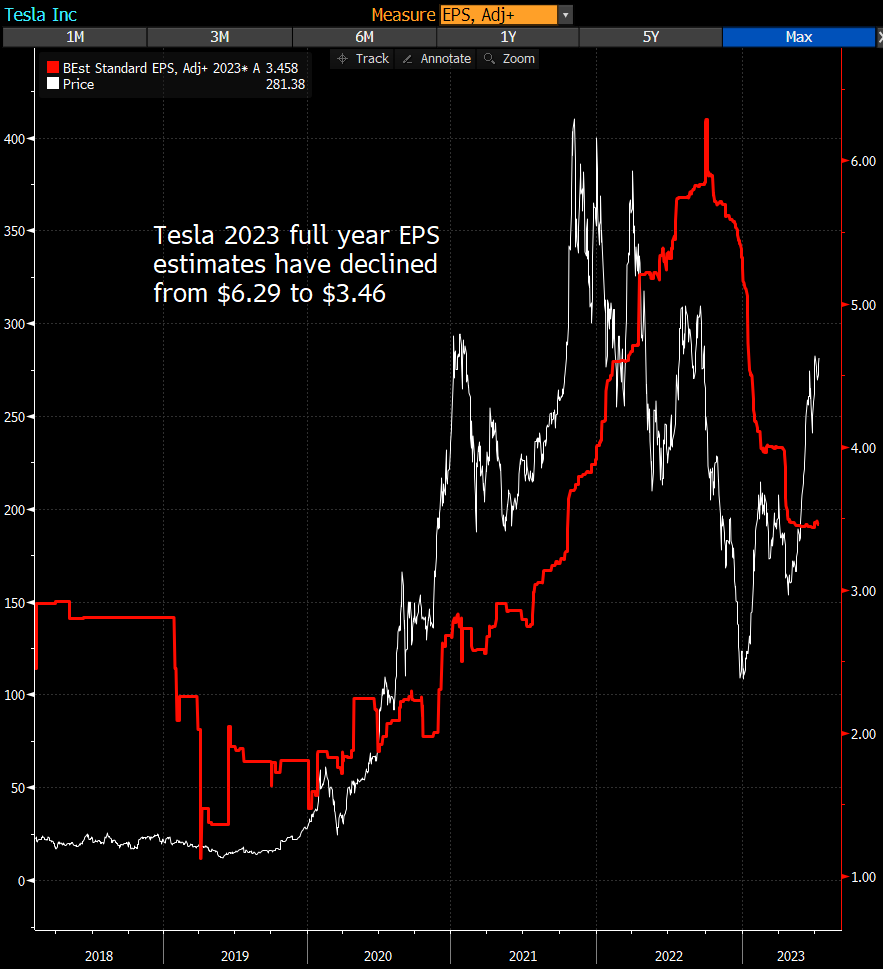

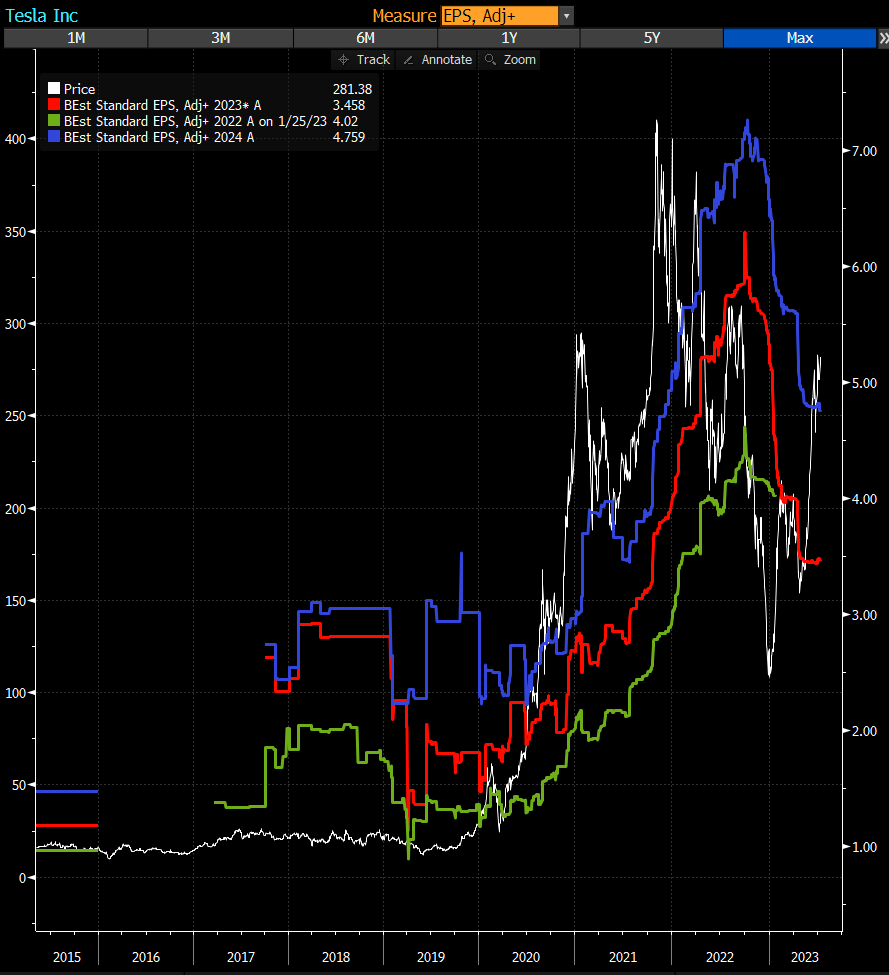

Tesla’s earnings for 2023 have been ratcheted down hard by sell-side analysts after projecting unrealistic upside earnings.

2023 earnings are expected to be LOWER than last year, while hope is eternal for 2024. In 2024, no significant new cars or products will increase earnings expected. If you think the Cybertruck will move the needle, it won’t.

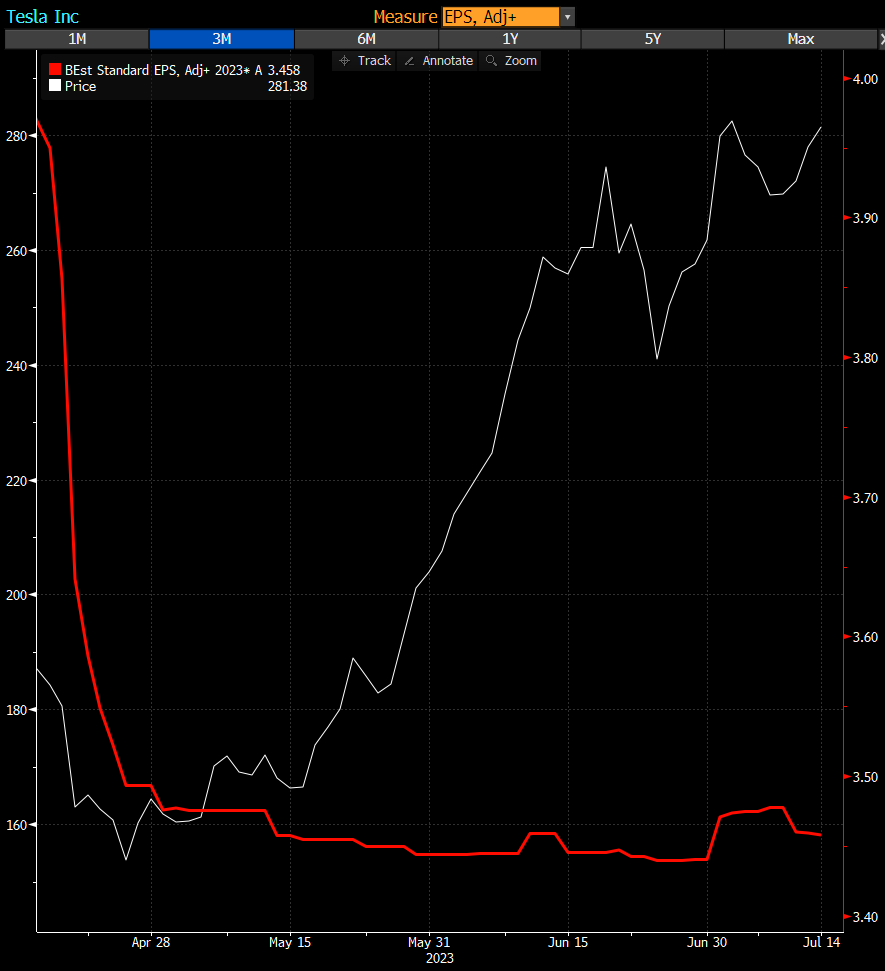

TSLA has increased $200+ billion in market cap since the last earnings report while earnings estimates have decreased. Recall the company announced ‘record’ deliveries with big YoY deliveries in China (vs last year when there were Covid lockdowns). When they “beat consensus” this quarter remind yourself it’s YoY down despite China reopening.

Tesla’s price rise has been all P/E multiple expansion that is unsustainable without MUCH stronger earnings.

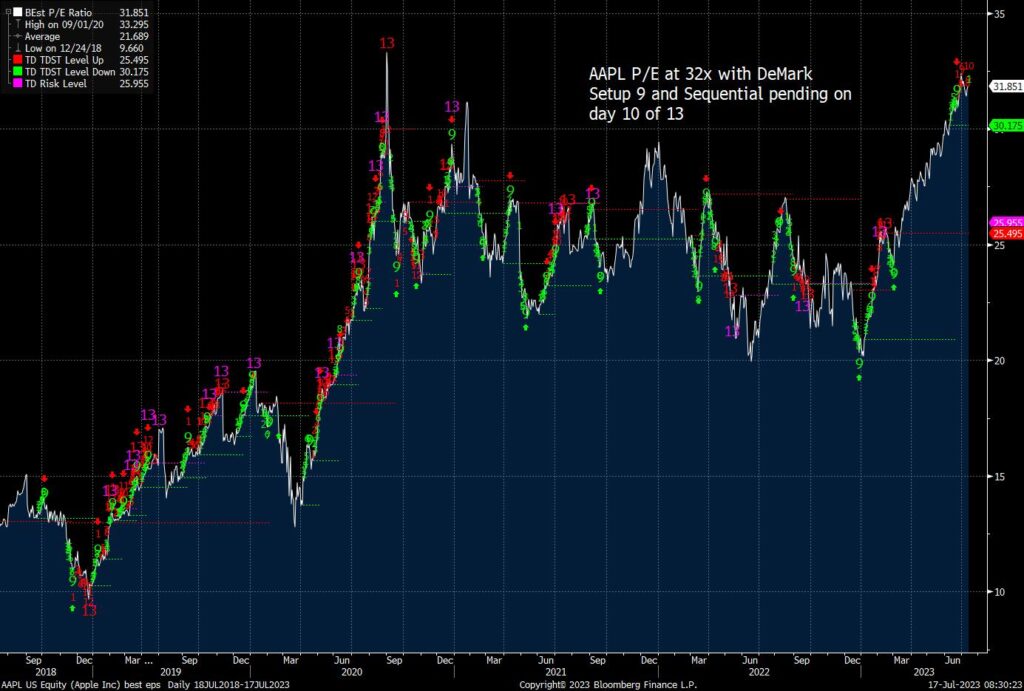

It’s not just Tesla as Apple has seen earnings for 2023 have dropped too while the price action is totally disconnected to a company that has declining growth.

The amount of market cap increase with Apple pushed it over the $3 trillion valuation. Earnings are up 2 cents per share this past quarter.

Apple’s P/E is nearly as high as Covid lock down when they actually had an excuse for earnings weakness. Expect to hear the usual “super cycle refresh” coming for the next iPhone which has been the mantra for the last 4 iPhones which don’t have much new or improved. Oh wait they are 20% more expensive.

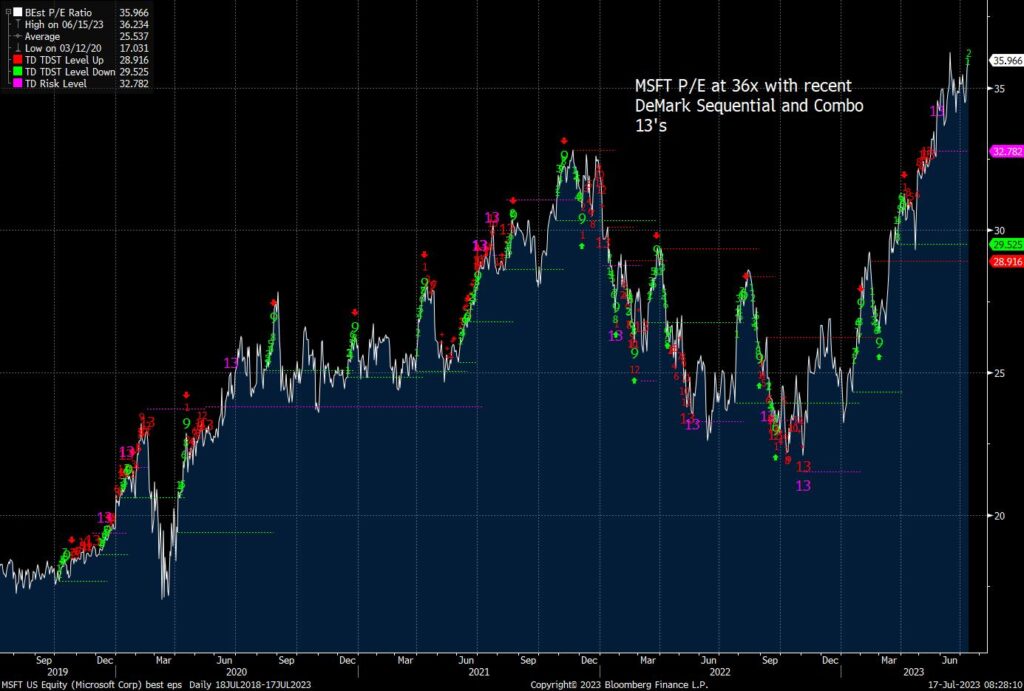

Microsoft is an AI stock now but earnings have barely moved higher despite all of the hype.

Microsoft’s P/E is at multi year highs. Again there needs to be more “E” to justify the “P”

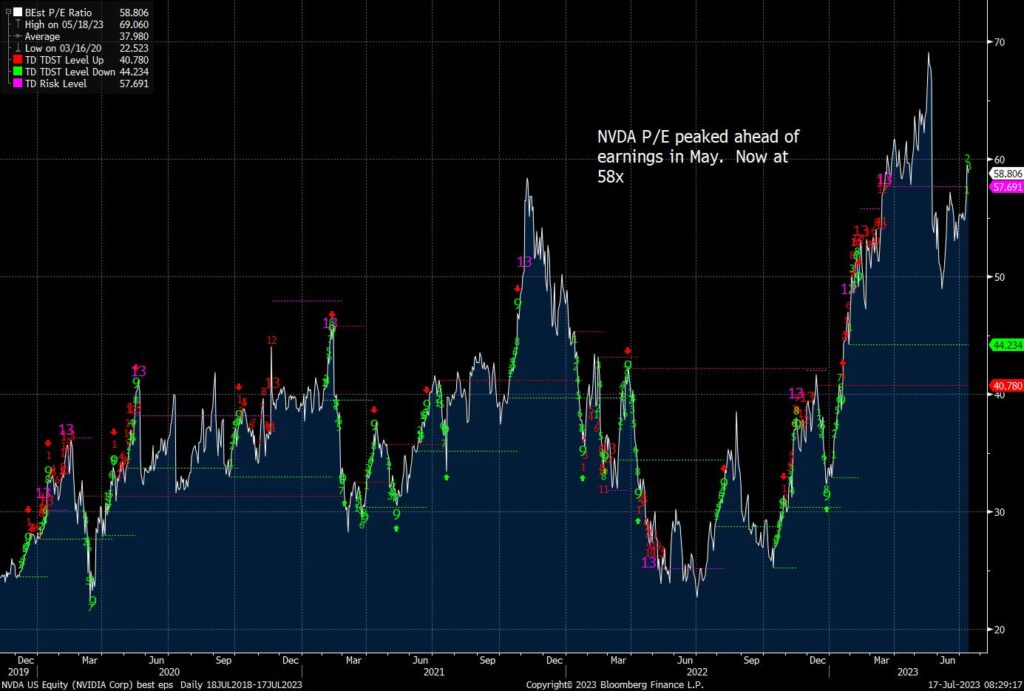

NVDA’s earnings have actually gone up along with price. The bar is still very high with the market cap well over $1b and largest semiconductor company in the world.

NVDA’s P/E is elevated at 58x higher than ever

This is AMD’s Q2 earnings expectations that has moved lower while the price has moved higher. Recall last quarter they missed and guided lower and didn’t mention AI once on the call. It’s an AI company now! I think we’ll hear more about AI which I think is them reclassifying some chips now as AI chips.

AMD’s P/E is elevated as well

AMZN’s earnings expectations haven’t move up in this quarter with hopes AWS growth bottoms this quarter.

AMZN’s P/E is the highest in a decade. Again we need to see more “E” over “P” to justify this valuation.

Internals – overbought

Advance Decline data with slight negative divergence with S&P while mid-cap and small-cap were closer to extreme overbought levels.

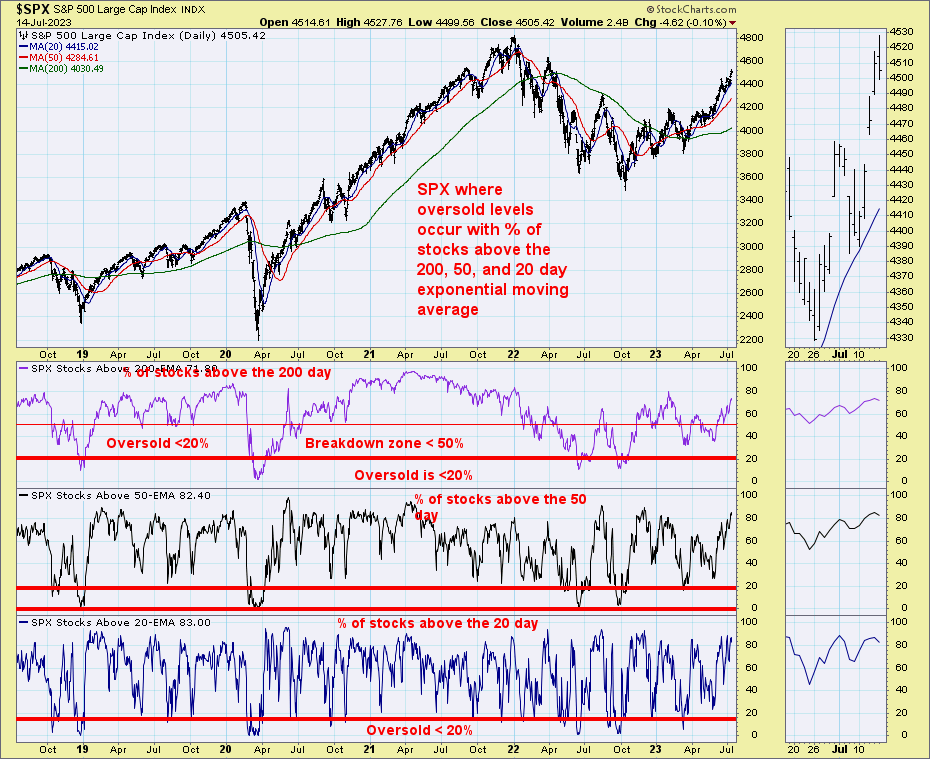

S&P 500 percentage of stocks above the 20, 50, and 200-day moving averages. These are in overbought territory ~80%.

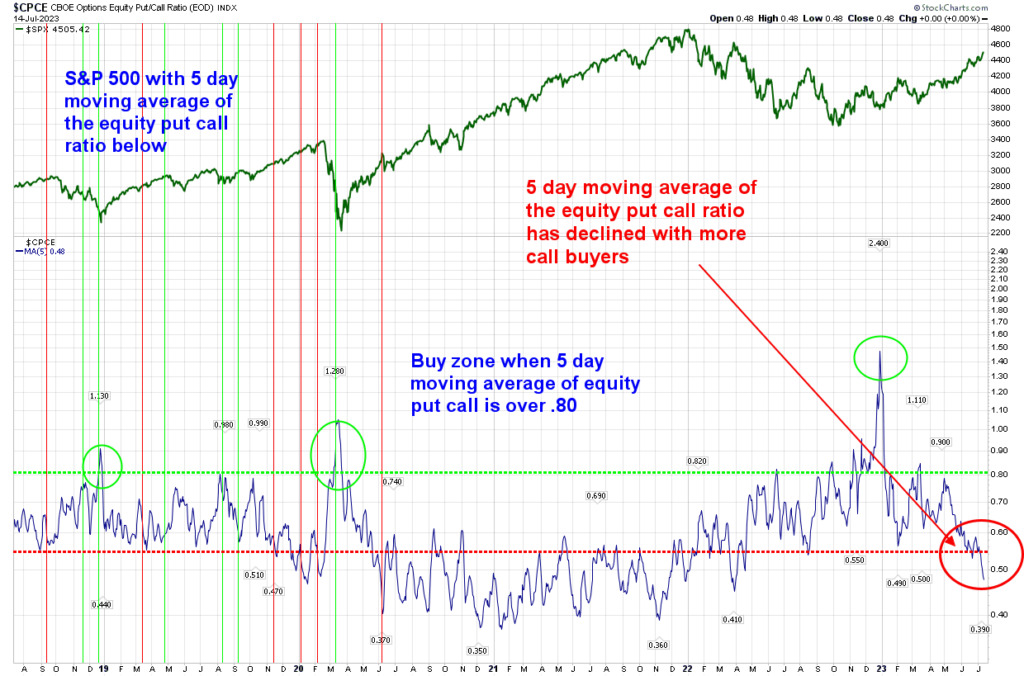

5 Day Moving Average Equity Put/Call Ratio remains at a concerning level of extreme call buying. We want to buy when the opposite is happening with heavy put buying.

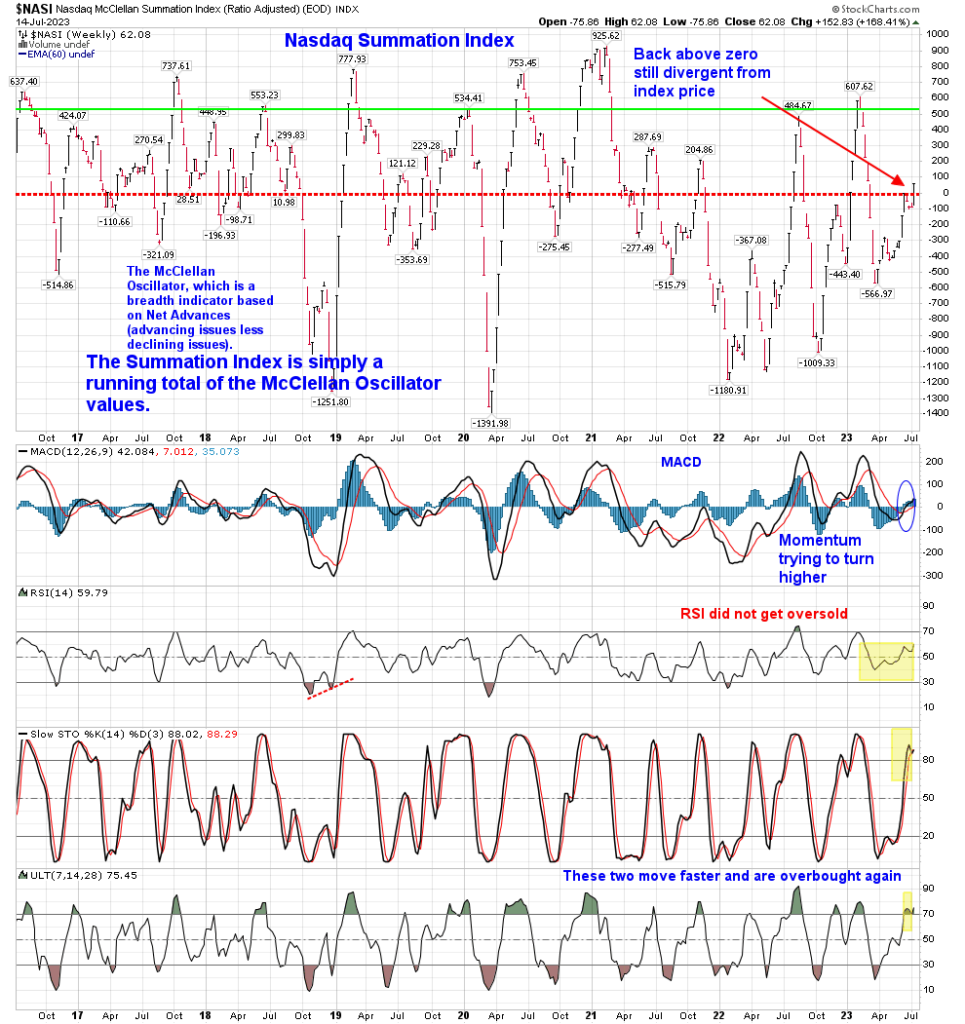

Nasdaq Summation Index weekly moved higher above zero, crediting the broadening breadth.

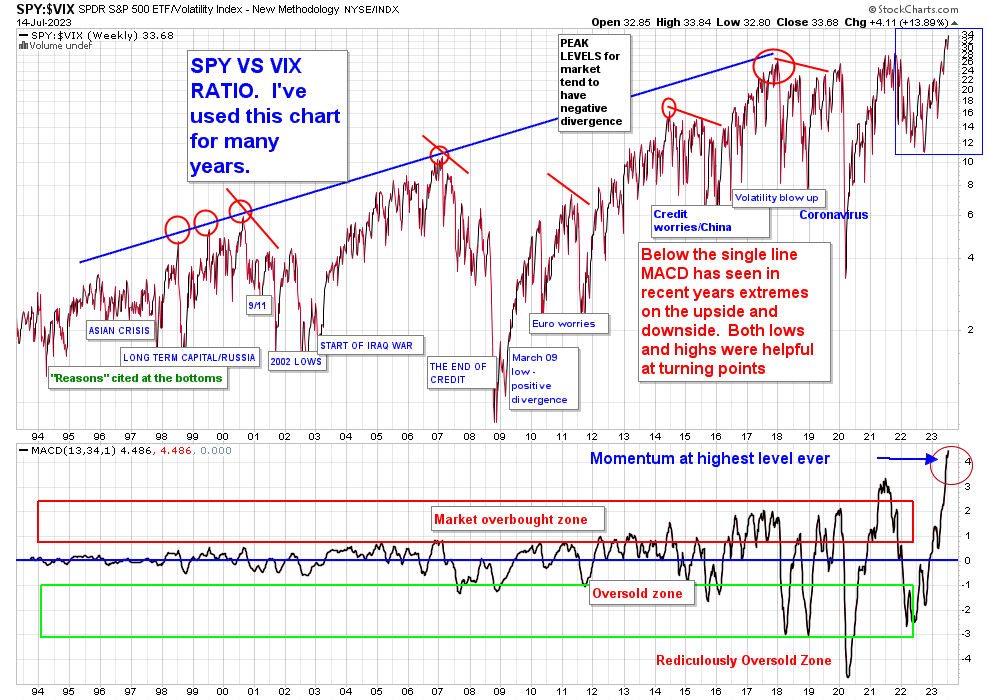

SPY vs VIX index weekly ratio with MACD the highest reading ever.

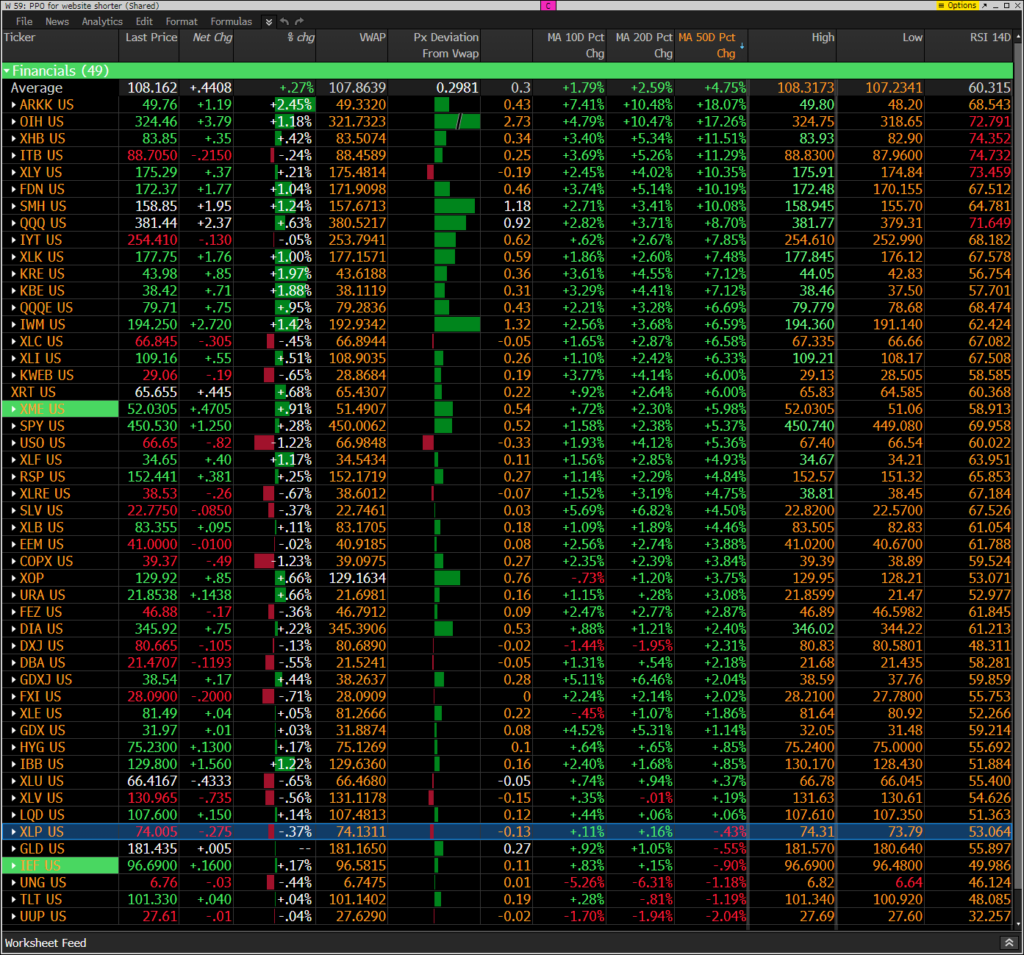

FACTORS, GOLDMAN SACHS SHORT BASKETS AND PPO MONITOR UPDATE

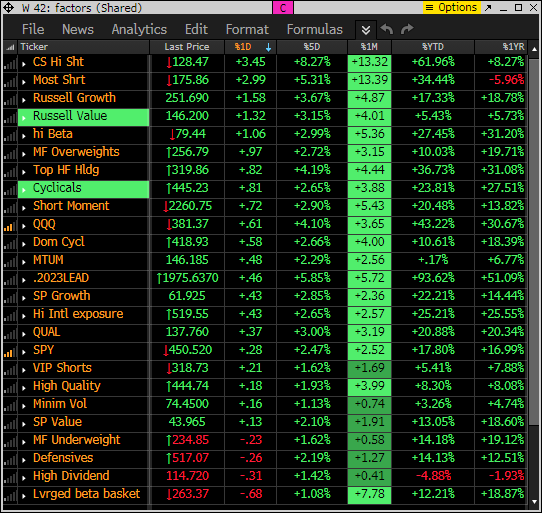

Factor monitor shows Citi’s and GS most shorted baskets getting squeezed hard today.

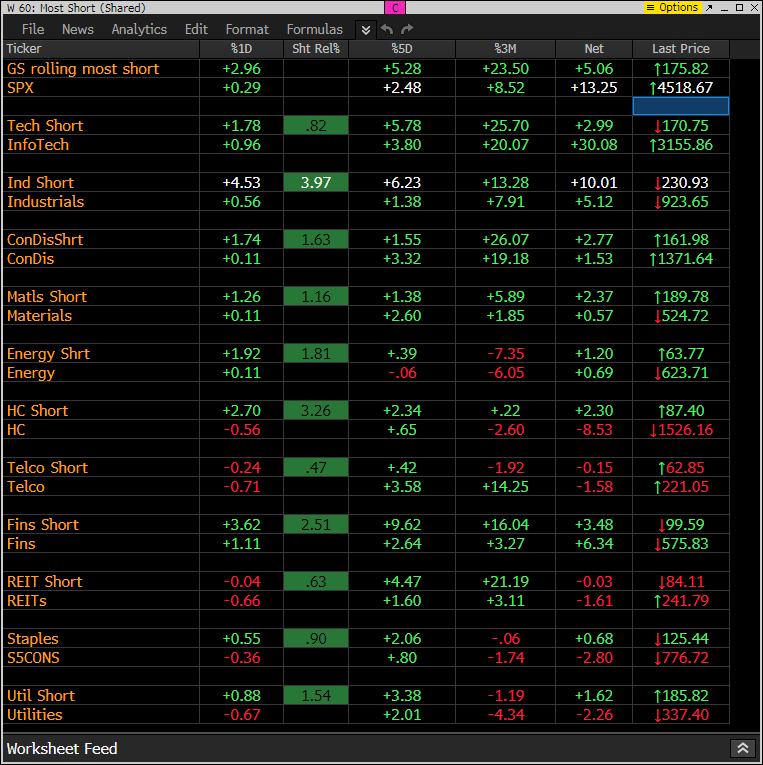

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Today the shorts are getting squeezed harder than in the morning. The Short baskets are up in some sectors over 20% in the last 3 months and as I showed last week the GS most shorted basket has a DeMark Sequential sell Countdown 13 in play.

The PPO monitor (percentage price oscillator) force ranks ETF’s by percentage above/below the 50 day moving average. For information on this monitor please refer to this primer. This monitor is offered to Hedge Fund Telemetry subscribers who are on Bloomberg. Notable: Mixed action with the top 1/3 which have been leading in the last month are seeing the biggest gains.