Highlights and themes

- Despite the stronger inflation data and rates spiking higher the US Dollar backed off from the CPI report to the end of the week. It could be due to the Yen weakness had the BoJ jawbone or perhaps do a little intervention to strengthen it as it has been moving lower for weeks. It’s hard to tell if the BoJ actually does some intervention unlike times in the past.

- The US Dollar did break higher and backed off and remains in a pattern that could see further gains. Both Euro and Pound held the recent support lows although if those break then the Dollar will be moving at more rapid pace.

- Yen weakness continues to be a macro risk reflected with US rates.

- Crypto spiked higher with some of the speculative action in the equity markets but both Bitcoin and Ethereum have DeMark sell Setup 9’s in play and could see pullbacks. Both are in upside wave 5 with Bitcoin sentiment hitting a multi year high and pulling back so I’m not sure if that is all there is going to be with crypto for now.

Comments on charts. If you have questions or would like more context, please email.

Currency Sentiment Overview

Currency sentiment highlights

US Dollar Indexes

DXY US Dollar Index daily

Bloomberg US Dollar Index daily

Bloomberg US Dollar Index weekly

US Dollar bullish sentiment

US Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Major USD Crosses

EURUSD Euro / US Dollar

Euro bullish sentiment

Euro Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

GBPUSD British Pound Sterling / US Dollar

British Pound Sterling bullish sentiment

British Pound Sterling Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

AUDUSD Australian Dollar / US Dollar

Australian Dollar bullish sentiment

Australian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDCAD US Dollar / Canadian Dollar

Canadian Dollar bullish sentiment

Canadian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDCHF US Dollar / Swiss Franc

Swiss Franc bullish sentiment

Swiss Franc Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDJPY Japanese Yen daily still has risk if 151-152 breaks.

Japanese Yen bullish sentiment

Yen Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Crypto

Bitcoin daily could pullback after DeMark sell Setup 9. It’s extended while in upside wave 5 of 5.

Bitcoin bullish sentiment pulled back late in the week

Ethereum also could stall with recent sell Setup 9.

Three major Yen crosses

With Yen weakness these three crosses still have breakout potential.

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

USDBRL US Dollar / Brazilian Real

USDMXN US Dollar / Mexican Peso

Mexican Peso bullish sentiment

Mexican Peso Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDZAR US Dollar / South African Rand

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan)

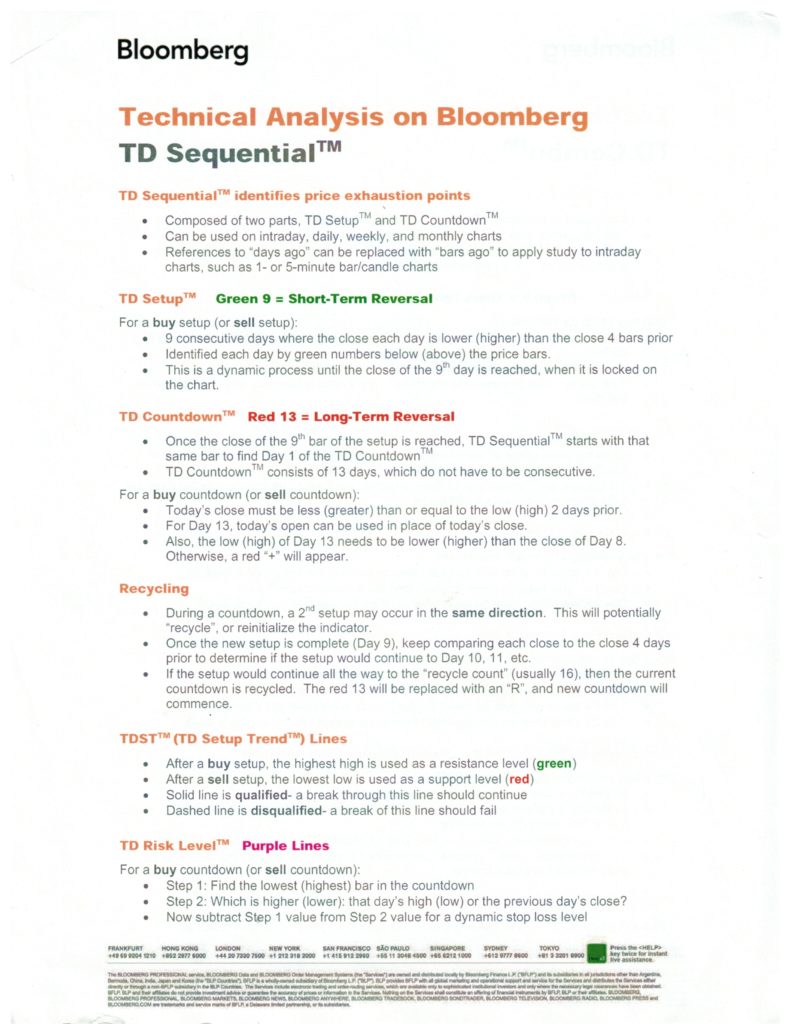

DeMark Sequential Basics from Bloomberg

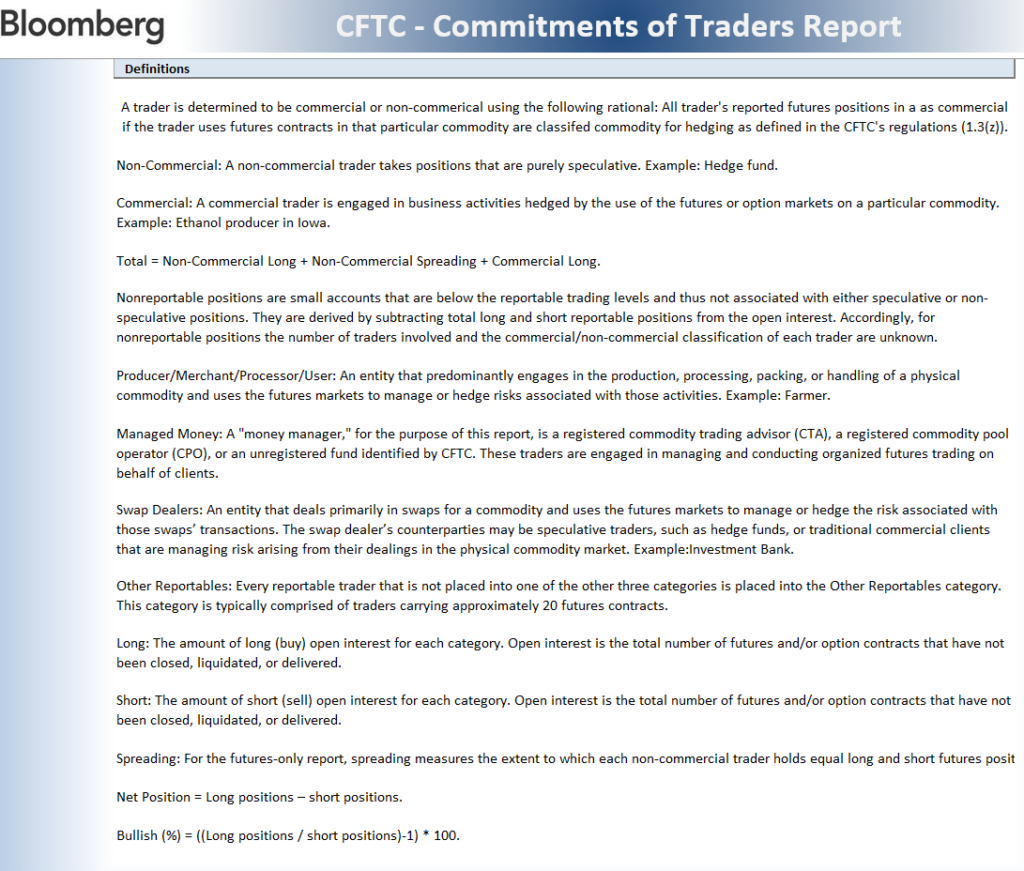

Detailed Commitment of Traders explanation