New Hedge Fund Telemetry video series

As mentioned recently we have launched a new video series with interviews with friends in the business. These videos will be archived on the site soon and will be available on our YouTube channel. We hope to have at a minimum two per month. Not only will these be educational but timely as our guests will have different backgrounds and market focus. If you have suggestions of who you would like us to interview, please send us an email.

Here are the replays to our Short Interest webinar and the interview we did with macro specialist Julian Brigden earlier in the week. On late Friday I spoke with my friend Jim Bianco about inflation staying sticky as well the risk of inflation rising in the coming months. This interview blew me away with Jim’s clear and concise explanation of the dynamics of what comprises the CPI and PCE. I promise this will help you understand how to interpret this data and more importantly what to expect this year. Jim and I also had some views on the current equity markets late in the video. This is well worth an hour of your time.

TOP EVENTS AND CATALYSTS

The week ahead has only two major macro events on the calendar starting with the FOMC meeting minutes on Wednesday afternoon (expect a ha and the flash PMIs for February onThursday morning. The US markets are closed on Monday in observance of President’s day holiday. I will be working tomorrow and will return emails that are backed up.

The big earnings event will be on Wednesday postmarket with Nvdia which everyone will be watching with expectations very high for another beat and raise. The last two earnings reports that were focused on the AI opportunity were blow outs yet the stock faded with profit taking. The stock is up 40%+ YTD so profit taking would not surprise (especially after SMCI’s 25% drop on Friday from highs) as well there are daily and weekly DeMark upside exhaustion signals in play. The overall risk to the major indexes is high if NVDA does fade since it has attributed to over 30% of the YTD gains. NVDA’s market cap is now $1.8 billion and the implied move is very high at 11% which means this could have a nearly $200 billion market cap move after earnings.

The important US earnings reports include: Tuesday premarket: HD, MDT, WMT; Tuesday postmarket: IFF, KEYS, PANW, SEDG, TOL; Wednesday premarket: ADI; Wednesday postmarket: ETSY, LCID, NTR, NVDA, RIVN; Thursday premarket: KDP, PLNT, POOL, W; Thursday postmarket: BKNG, CVNA, INTU, LYV, PODD, SQ; and Friday premarket: WBD.

The important EU earnings earnings reports include: Tuesday: Barclays, InterContinental Hotels; Wednesday: Glencore, HSBC; Thursday: Anglo American, AXA, Danone, Lloyds Banking Group, Mercedes Benz, Nestle, Rolls-Royce, WPP; and Friday: Allianz, BASF.

A few conferences will take place, including the Bank America Financial Services Conf., the Barclays Industrials Select Conf., CAGNY, and the Citigroup Industrial Tech & Mobility Conf.

weekend news

- Ukraine has ordered the complete withdrawal from Avdiivka, handing Russia one of its biggest victories in months (NYT);

- US economy receives a major boost from all the aid money flowing to Ukraine – of the ~$61B earmarked for Ukraine in the $95B supplemental bill, about 65% would flow right back to the American defense industrial base (WSJ); Germany warns that failure to approve additional aid in the US Congress could harm the American economy (Bloomberg)

- Netanyahu vows not to succumb to int’l pressure and call off a planned invasion of Rafah (NYT); Qatar said Gaza ceasefire negotiations haven’t progressed as hoped (Bloomberg);

- Chinese stocks are set to rally after reopening following the holiday closure as data signals strong consumption during the Lunar New Year (Bloomberg)

- Apple to be hit with a EU500M fine by the EU over allegedly favoring its own music streaming service over competitors (FT); Seems like this is another shakedown.

- Barclays will provide investors with a much-anticipated strategy update alongside its earnings report Tues morning with mgmt. facing pressure to boost the beleaguered stock price (FT);

- Intel is in talks for ~$10B+ in grants and loans as part of the US government’s Chips Act

- The next major Fed events will be: 1) FOMC meeting minutes (Wed 2/21); 2) PCE for Jan (Thurs 2/29); 3) Powell’s semi-annual testimony (Wed 3/6 and Thurs 3/7); 4) jobs report for Feb (Fri 3/8); 5) NY Fed inflation expectations for Feb (Mon 3/11); 6) CPI for Feb (Tues 3/12); 7) Michigan inflation expectations for Mar (Fri 3/15); and 8) FOMC decision (Wed 3/20).

Charts we are watching

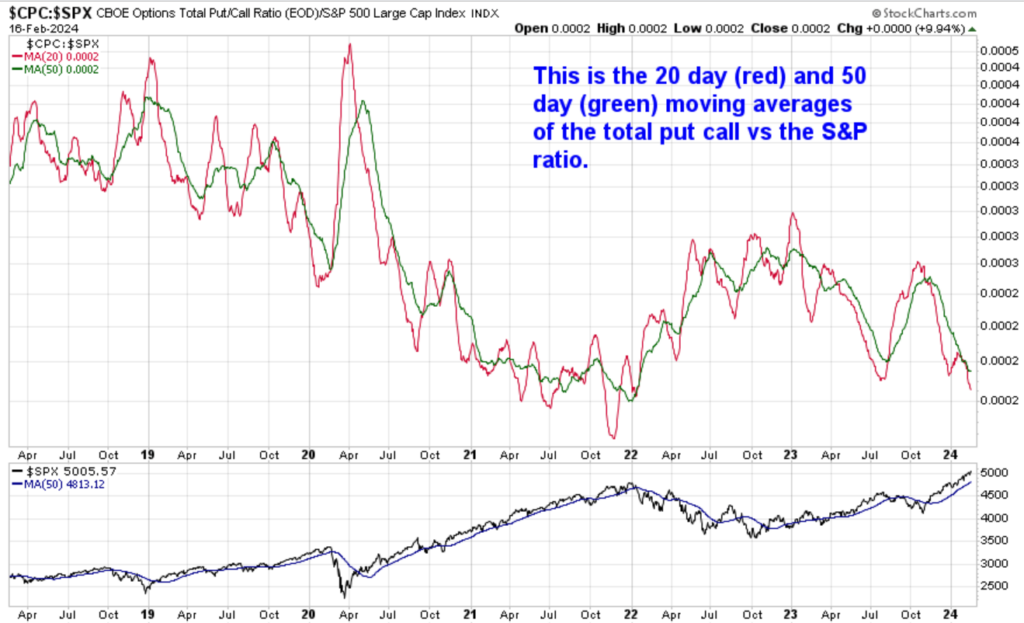

Jeff DeGraaf one of the all time best technical analysts, taught me to watch the 20 day moving average of the Put Call Ratio vs the S&P index as a ratio. I show the 5 day moving average all the time but I thought I would show this chart which illustrates the high speculation with heavy call buying and overbought nature of the market. This has both the 20 day and 50 day lines that have been sloping down. When these turned up after the July earnings season the S&P had a 10% correction. I will post updates to this chart more often on our notes.

I have shown several times this past week several charts from a few sell side derivitive desks the continued HEAVY call buying and the 5 day moving average of equity put call ratio declined hard this past week and is at levels again that are oversold. I woud toss out the 2021 period of heavy call buying and look at previous years as more normal as 2021 was a one off year as it had never been as low in history.

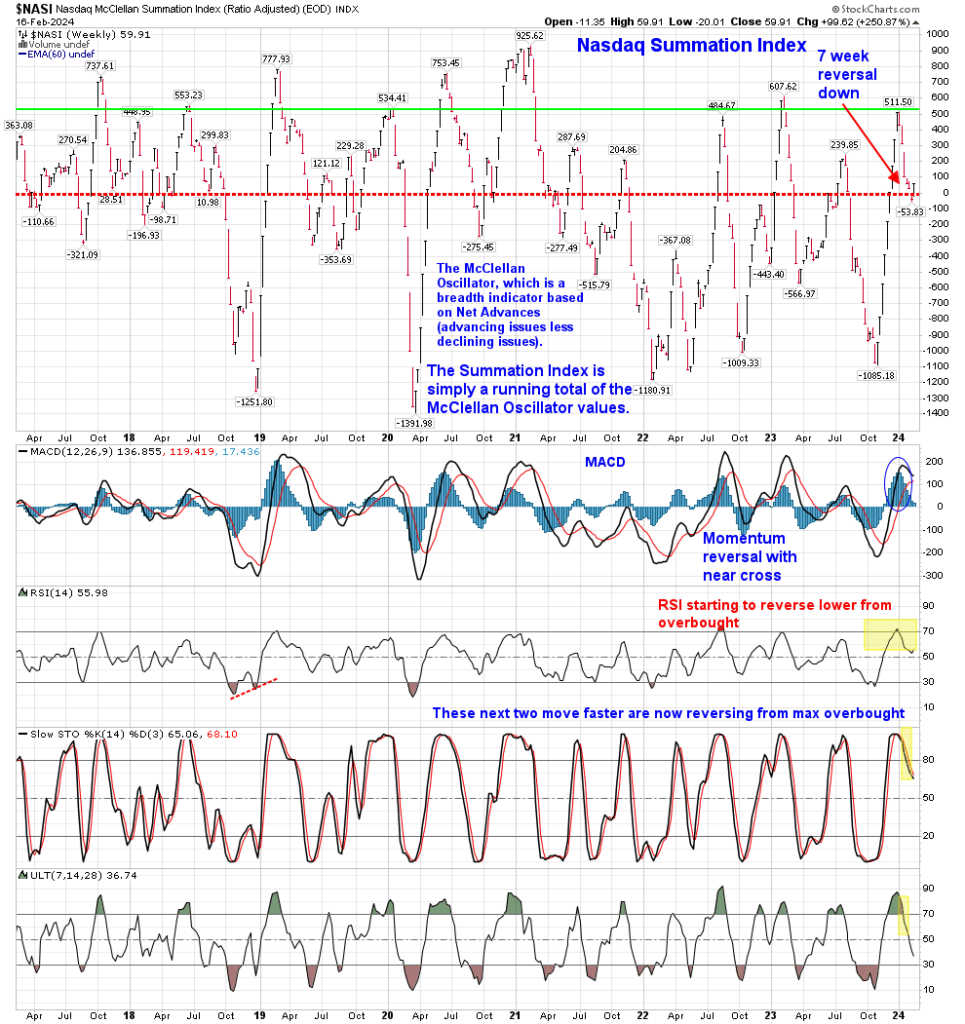

The Nasdaq Summation Index weekly has been declining for 7 weeks after a spike in Q4. Last week bounced however the momentum indicators have been reversing lower and tend to move from overbought to oversold (and vice versa). I still expect this index to fall more to get the momentum indicators back to oversold levels.

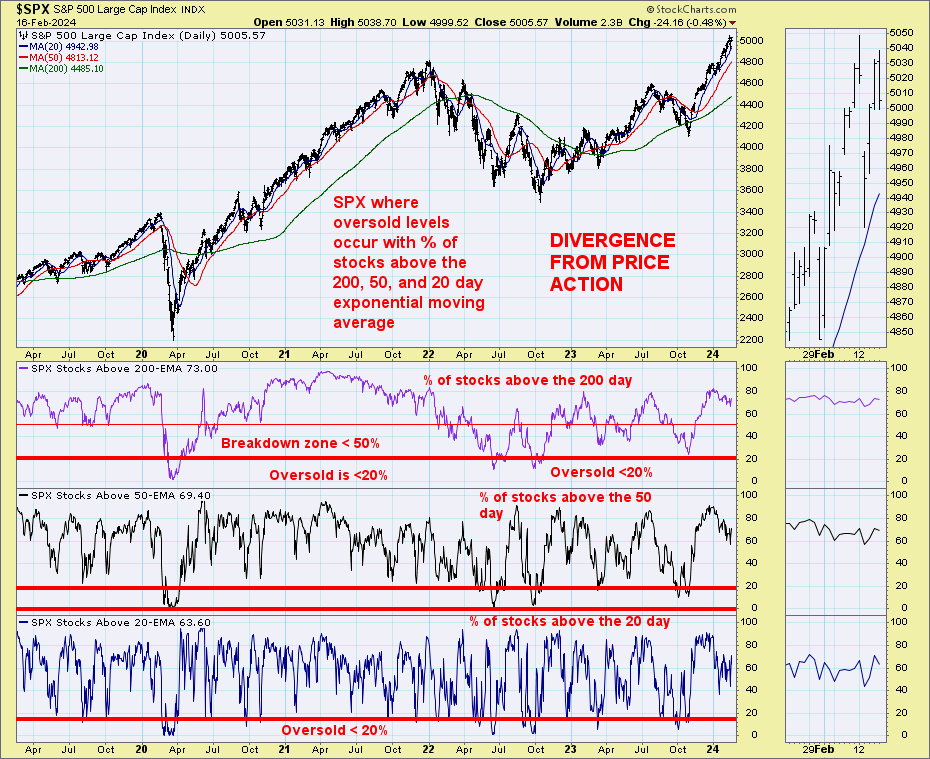

The S&P shows divergences with the percentage of stocks above the 20, 50, and 200 day moving averages starting to decline while the index made a new high.

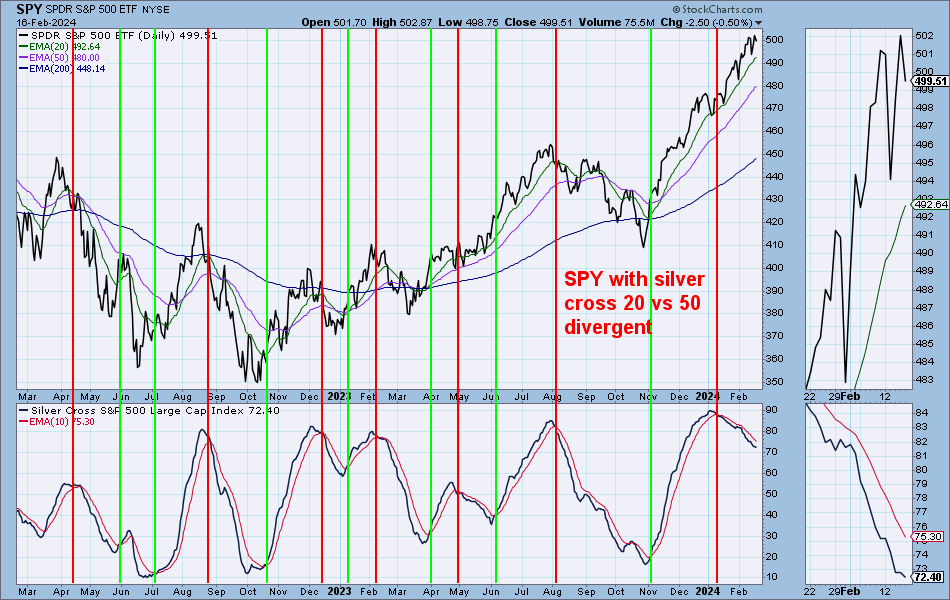

This chart still has me baffled. This is the SPY with the percentage of stocks within the index with positive silver crosses – those that have the 20 day higher than the 50 day. I recently move up to over 90% which is one of the highest readings in a long time and has started to decline now at 72%. It is still a high number and might matter more breaking 60% or 50%. In the past when it has started to decline the index had already started to decline. The simple explanation is that the gains have been very narrow with just a few of the mega-cap stocks attributing unusually more to lift the indexes. As mentioned above NVDA has attributed the most YTD over 30% of the total gain so the pressure on NVDA’s earnings and response is huge.

US economic data for the week

KEY MARKET SENTIMENT

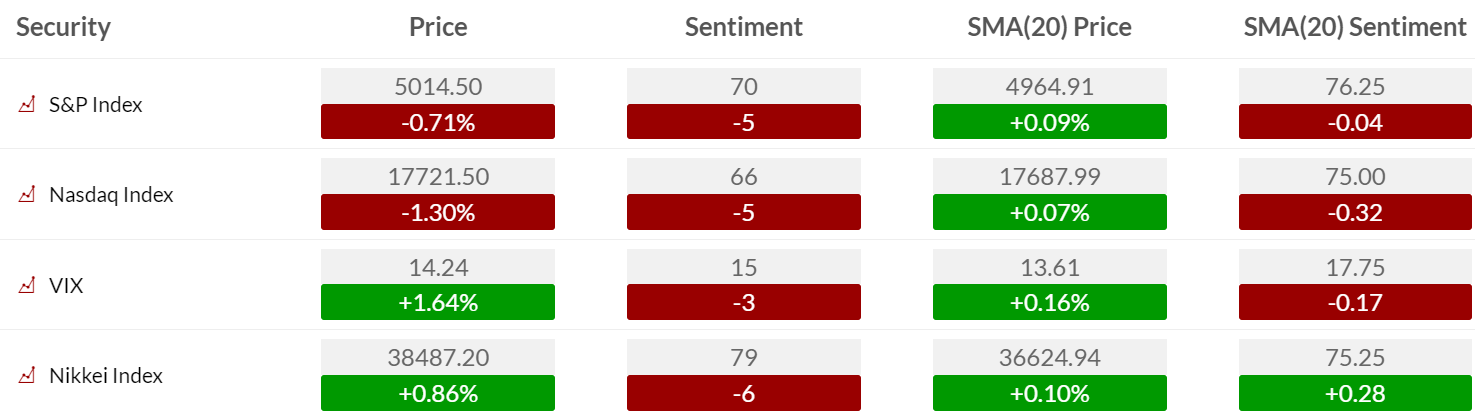

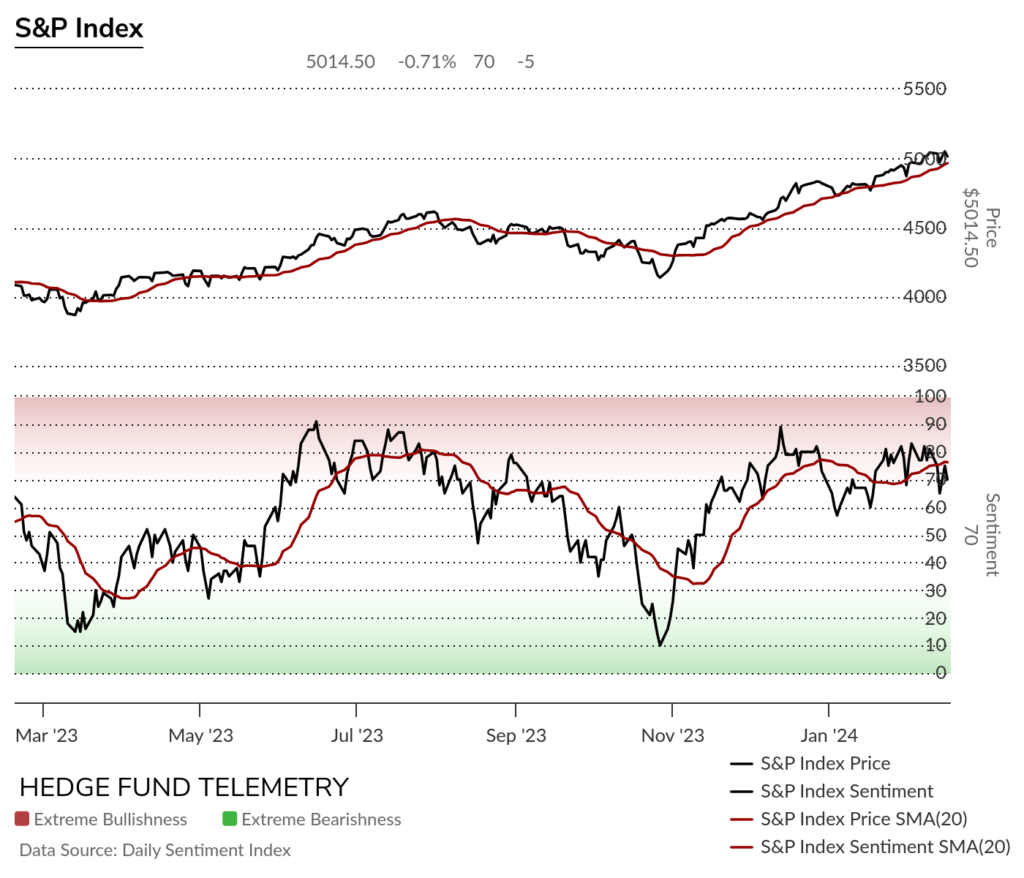

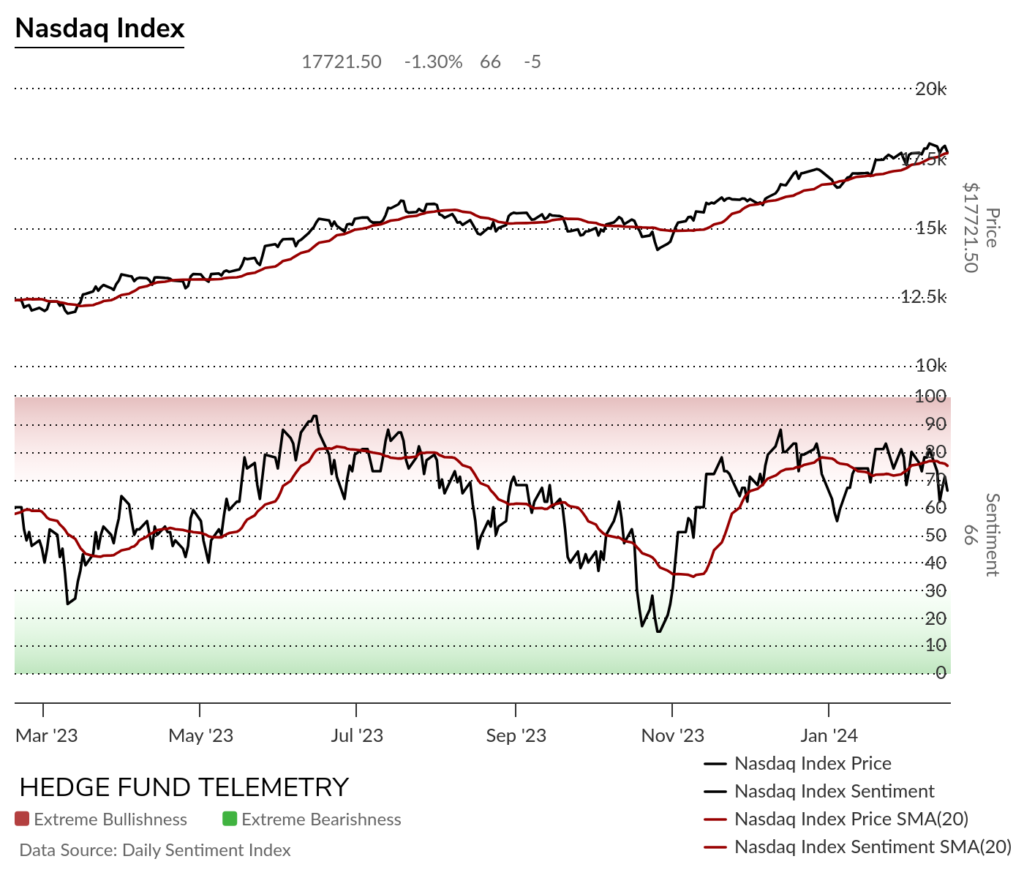

Equity bullish sentiment had a volatile week and settled with the S&P at 70% and the Nasdaq lower at 65%.

S&P and Nasdaq bullish sentiment dropped hard on the CPI data bounced for two days nearly recaputuring the entire drop then fading on Friday. I continute to watch the recent lows around 60% and then if things give way to the downside the 50% midpoint majority line.

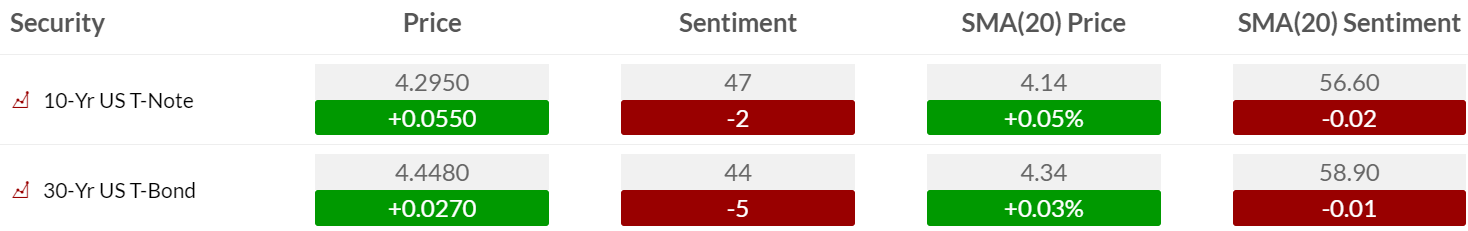

Bond bullish sentiment remains under the 50% level. Risk to higher rates continues.

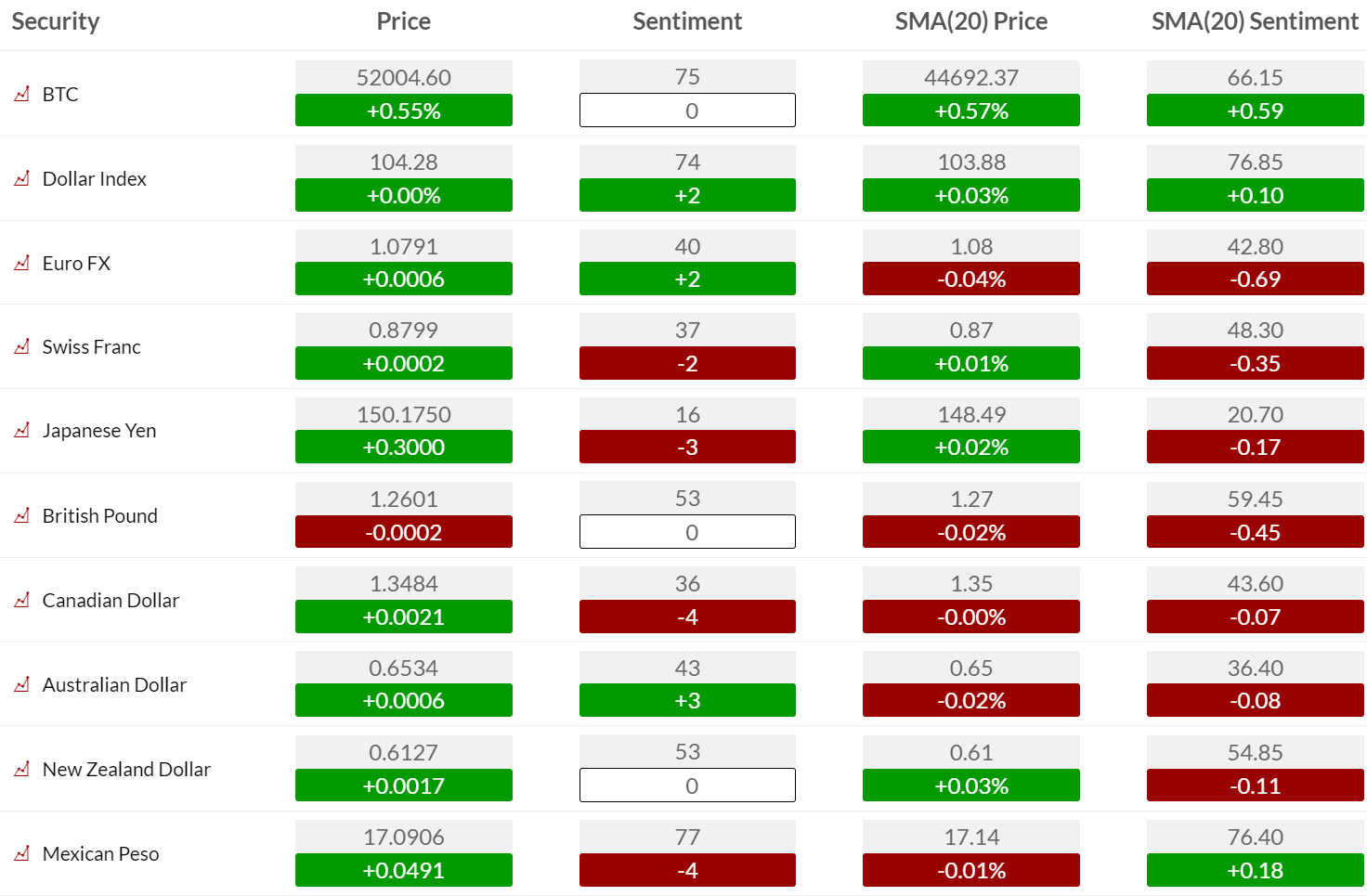

Currency bullish sentiment with US Dollar bullish sentiment holding in the elevated zone which is bullish after dropping out of the extreme zone.

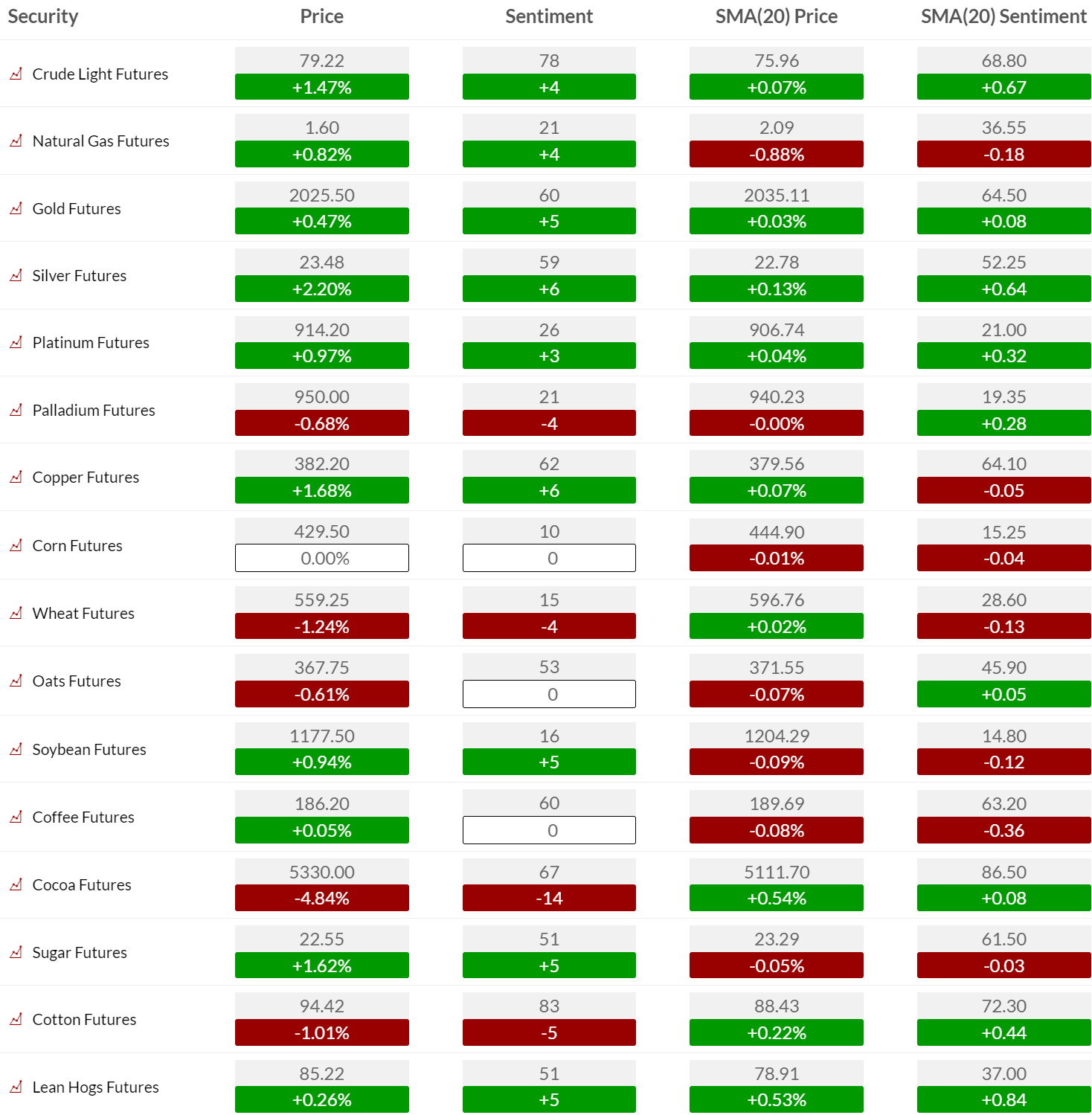

Commodity bullish sentiment shows crude remaining elevated at 78%. Crude has been in a bullish position for weeks and has breakout potential. Natural Gas has mean reversion bounce potential. Even the metals could see a bounce albeit these have been in ranges and lack upside momentum. Cocoa had a big drop on Friday and considering this has been the strongest commodity in the last two year it’s notable.

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 19-Feb: US Markets Closed for President’s Day

- Corporate:

- Earnings:

- Post-close: BSM, DOOR, FET, HSTM, JELD, RIG

- Brokerage Conference:

- Antique Build India New India Conference

- Kotak Chasing Growth Conference

- Earnings:

- Economic

- Europe: CPI y/y, Trade Balance, PPI y/y

- Corporate:

- Tuesday 20-Feb:

- Corporate:

- Earnings:

- Pre-open: ALE, ALLE, AVNS, AWI, AXSM, CAMT, CHH, CNP, CRNT, DAN, DBRG, DFIN, ETRN, FLR, GTE, HD, KBR, LGIH, MD, MDT, MIDD, NPO, NXRT, OIS, OMI, PSA, RIG, RNW, SCL, SMMT, SPNS, TCMD, TPH, UFPI, VC, WLK, WLKP, WMT

- Post-close: ABCL, ADEA, AIP, AMPL, ANDE, AROC, BCC, BKD, BXC, BYON, CE, CHK, CIB, CMTG, CSGP, CSR, CVI, CWK, CYH, CZR, ENLC, ENVX, ESI, ESRT, FANG, FLS, GFL, GMED, HALO, HCKT, IFF, ILPT, INST, JBT, KAR, KEYS, LAND, LZB, MATX, MAX, MED, MFIN, MTDR, MTTR, NEO, NHI, O, PANW, QUAD, RNG, RWT, SEDG, SKWD, SPNT, SPT, SUI, TDOC, TOL, TRTX, TRUE, TX, UAN, VIV, VNOM, WGS, WK, WSC, WTTR

- Analyst/Investor Events:

- Brokerage Conference:

- Antique Build India New India Conference

- Kotak Chasing Growth Conference

- Consumer Analyst Group of New York Conference

- Responsible Investment Forum: New York

- Citi Global Industrial Tech and Mobility Conference

- Bank of America Securities Securities Financial Services Conference

- Autonomous Vehicles Silicon Valley

- Earnings:

- Economic

- US: Leading Indicators, Redbook Chain Store, API Crude Inventories

- Canada: Core Inflation (m/m), CPI (m/m)

- Asia: Trade Balance

- Corporate:

- Wednesday 21-Feb:

- Corporate:

- Earnings:

- Pre-open: ADI, ALIT, AVA, BLCO, BRSP, CLH, CSTE, CSTM, DINO, EXC, GLBE, GRMN, IONS, KRP, LANV, LIVN, MPW, NI, OGE, PGY, PHIN, PLAB, PRG, PUMP, RGEN, ROCK, SHEN, SSTK, THRM, TNL, UIS, UTHR, VRSK, VRT, WING, WIX, WKME, WWW, XPRO

- Post-close: ACVA, AGR, AMK, AMSF, APA, ATNI, AWR, BALY, BELFB, BNL, BRDG, BROS, CAKE, CBD, CCAP, CCRN, CCSI, CDE, CENX, CHDN, CHRD, CLW, CNNE, CPK, CSV, CWH, DOCN, ECPG, ERII, ETSY, EXAS, FG, FIVN, FNF, FWRD, GKOS, GNW, GOOD, GSHD, GSM, HST, HUN, ICCC, ICLR, JACK, JOBY, JXN, KALU, KW, LCID, LUNG, MATV, MCW, MGRC, MOS, MRO, NDSN, NEXA, NGVT, NOVA, NR, NVDA, NVRO, NYMT, OBDC, OGS, OLO, OM, ORA, OUT, PAAS, PEB, PNST, PRDO, QTWO, RCUS, RELY, RGR, RIVN, ROG, ROOT, RRC, RUN, SJW, SM, SNPS, SPOK, TBI, TNDM, TPL, TS, UCTT, VAC, VMEO, VMI, VRE, VTLE, WEAV, WES, ZD

- Analyst/Investor Events:

- Brokerage Conference:

- Kotak Chasing Growth Conference

- Responsible Investment Forum: New York

- Citi Global Industrial Tech and Mobility Conference

- Bank of America Securities Securities Financial Services Conference

- Autonomous Vehicles Silicon Valley

- Barclays Industrial Select Conference

- Goldman Sachs European Technology Conference

- Citi Oncology Leadership Summit

- American Bankers Association Wealth Management and Trust Conference

- American Society for Transplantation and Cellular Therapy and CIBMTR Meeting

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, DOE Crude Inventories, FOMC Minutes

- Europe: Flash Consumer Confidence

- Corporate:

- Thursday 22-Feb:

- Corporate:

- Earnings:

- Pre-open: ACRE, AHH, AMBP, BHC, BIGC, BLDR, BRC, CARS, CIO, CWEN, D, DRVN, ENOV, ETR, FCN, FTI, FVRR, GCI, GLT, GNK, GRAB, GVA, HLMN, HNI, HOV, HRMY, IMUX, INSM, IRM, ITCI, KDP, KLTR, KOF, LAUR, LKQ, LNG, LNTH, MFA, MGPI, MRNA, NABL, NEM, NKLA, NMRK, NTLA, NVCR, OPCH, PCG, PLNT, PLYM, POOL, PRM, PRMW, PWR, RYI, RYTM, SHYF, STWD, TALK, TFX, THRY, TNC, TNK, TRN, UPBD, VAL, W, XPEL

- Post-close: AAOI, ACA, ACCO, AEE, ALRM, ALTR, AMH, AMSWA, APLE, ARDX, AXTI, BCOV, BKNG, BLX, BMRN, BOOM, BWMX, CABO, CHUY, COLD, COLL, CPRT, CTO, CTRA, CVNA, DAIO, DRH, DVAX, EGO, EIX, ENV, EOG, ERF, EVH, EXFY, EXPI, FND, FOXF, FTAI, GDYN, GH, GHI, HCAT, INDI, INTU, IRTC, LASR, LAW, LYV, LZ, MAIN, MELI, MODV, MP, MRVI, NE, NOG, NU, NVEE, OII, OLED, ONTF, PEN, PKST, PLYA, PODD, RCEL, RHP, RKT, RMAX, SEM, SFM, SNBR, SPXC, SQ, TPIC, TV, UPLD, UVE, VALE, VCYT, VICI, VICR, VIR, WKC, WTRG, ZEUS, ZIP

- Analyst/Investor Events:

- Brokerage Conference:

- Kotak Chasing Growth Conference

- Citi Global Industrial Tech and Mobility Conference

- Bank of America Securities Securities Financial Services Conference

- Autonomous Vehicles Silicon Valley

- Barclays Industrial Select Conference

- Goldman Sachs European Technology Conference

- Citi Oncology Leadership Summit

- American Bankers Association Wealth Management and Trust Conference

- American Society for Transplantation and Cellular Therapy and CIBMTR Meeting

- IFRS Sustainability Symposium 2024

- Gabelli Funds Pump Valve & Water Symposium

- Mines and Money Miami Conference

- JP Morgan Korea Conference

- Earnings:

- Economic

- US: Existing Home Sales, Weekly Jobless Claims, EIA Natural Gas Inventories, Manufacturing/Services PMI

- Canada: Retail Sales

- Europe: Manufacturing Business Climate, Business Survey, CPI y/y, PPI m/m

- Asia: GDP NSA Y/Y (Final)

- Corporate:

- Friday 23-Feb:

- Corporate:

- Earnings:

- Pre-open: AER, AGM, BLMN, CLMT, DSX, FYBR, GTN, HBM, LAMR, NWN, SHO, SSP, WBD

- Analyst/Investor Events:

- Brokerage Conference:

- Autonomous Vehicles Silicon Valley

- American Bankers Association Wealth Management and Trust Conference

- American Society for Transplantation and Cellular Therapy and CIBMTR Meeting

- Mines and Money Miami Conference

- JP Morgan Korea Conference

- American Academy of Allergy, Asthma & Immunology Meeting

- Earnings:

- Economic

- Europe: GDP y/y, IFO Business Climate

- Asia: CPI NSA Y/Y

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.