HIGHLIGHTS AND THEMES

- Commodities over the last six week have risen although there was a pullback late in the week with the Bloomberg Commodity Index . I still see upside potential although the pullback might last a few more days. It could be a higher low corrective wave 2 of 5 which would be followed by an upside wave 3.

- Crude reached the upside wave 5 price objective and has stalled. I remains biased positive.

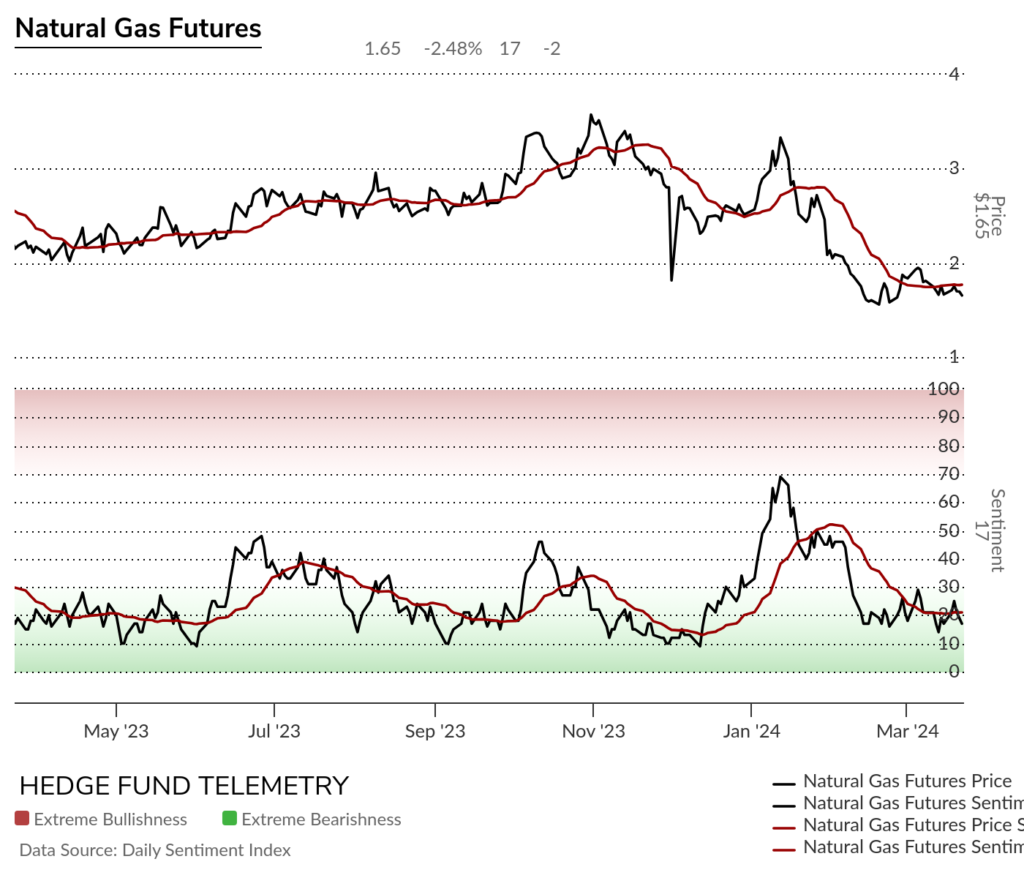

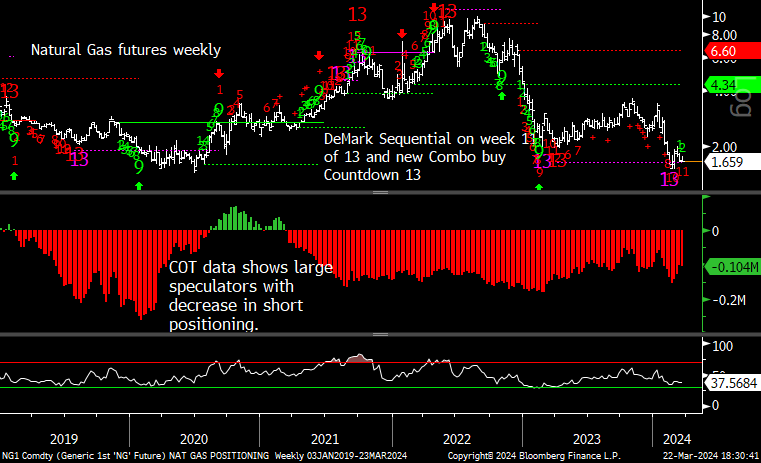

- Natural Gas continues to lack any upside momentum.

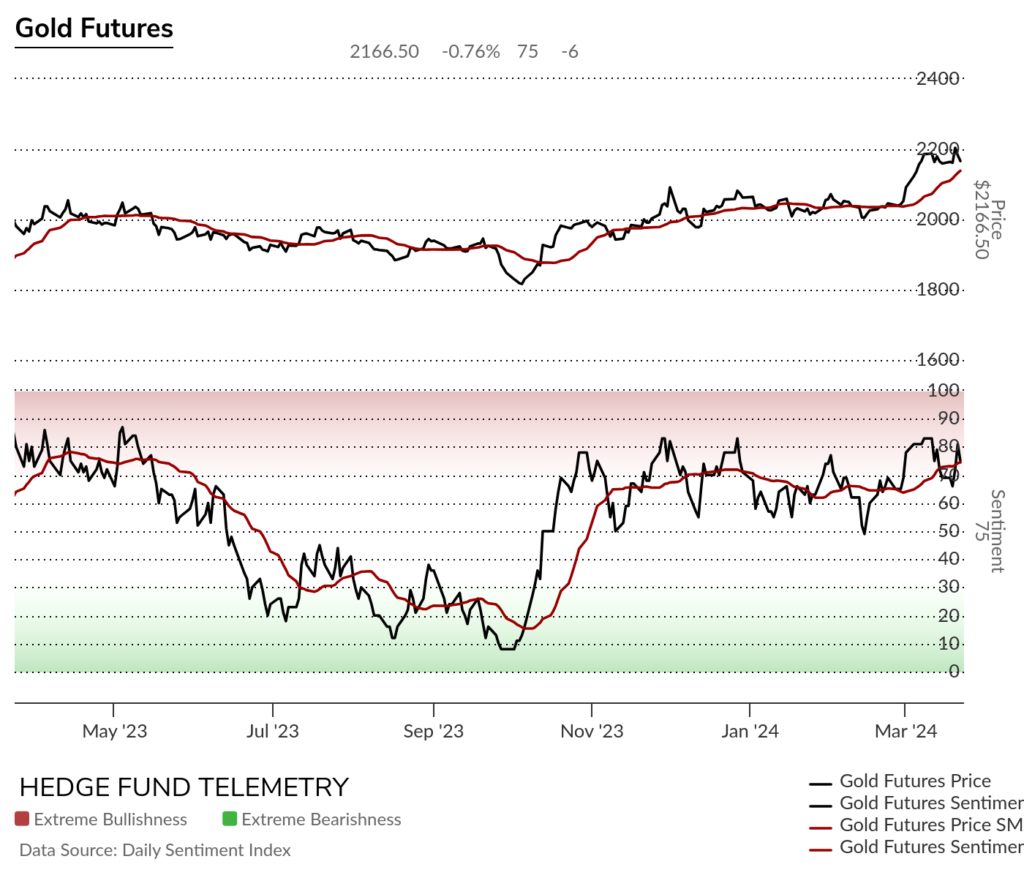

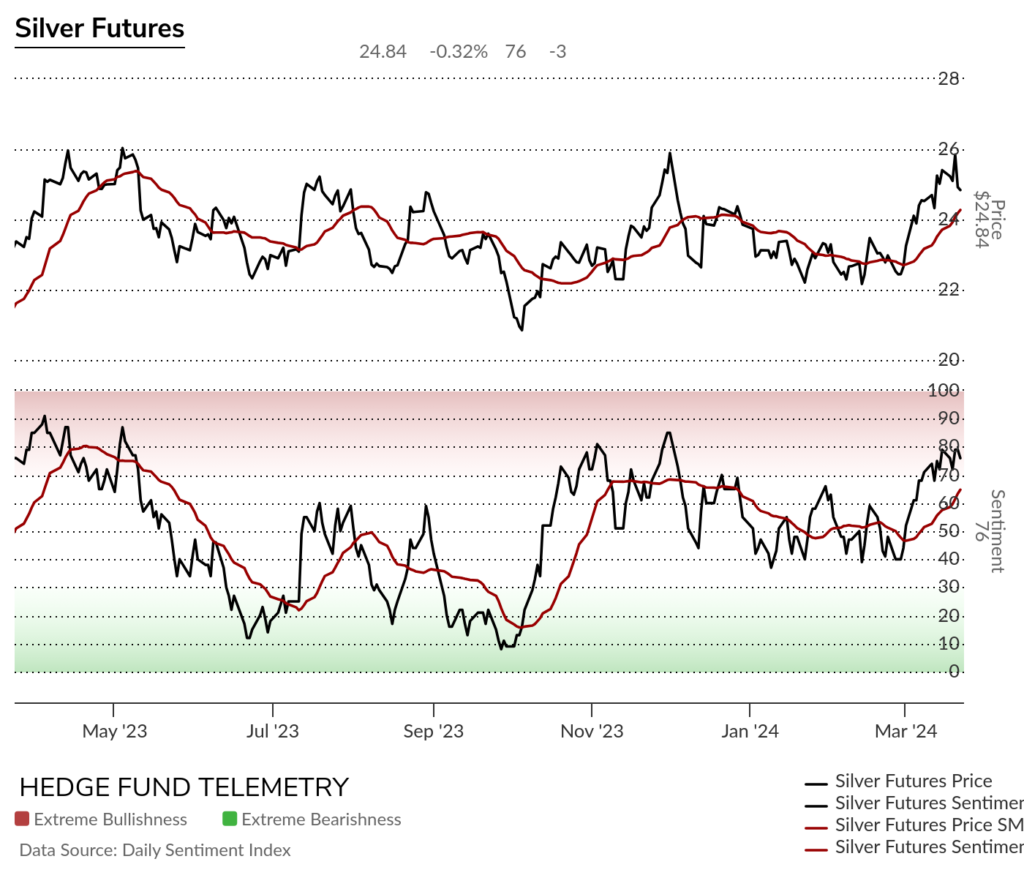

- Metals: Gold reversed off a spike as it’s done in the past. Silver remains range bound. Copper backed off from recent highs after breakout. Platinum and Palladium failed again to get through the 200 day resistance.

- Grains were mixed with Corn and Soybeans which I am biased positively still paused while Wheat bounced but needs a lot more work on the upside to give any conviction of a bottom.

- Livestock: Both Live Cattle and Lean Hogs had DeMark Sell Countdown ‘s in play and have started to back off and reverse lower.

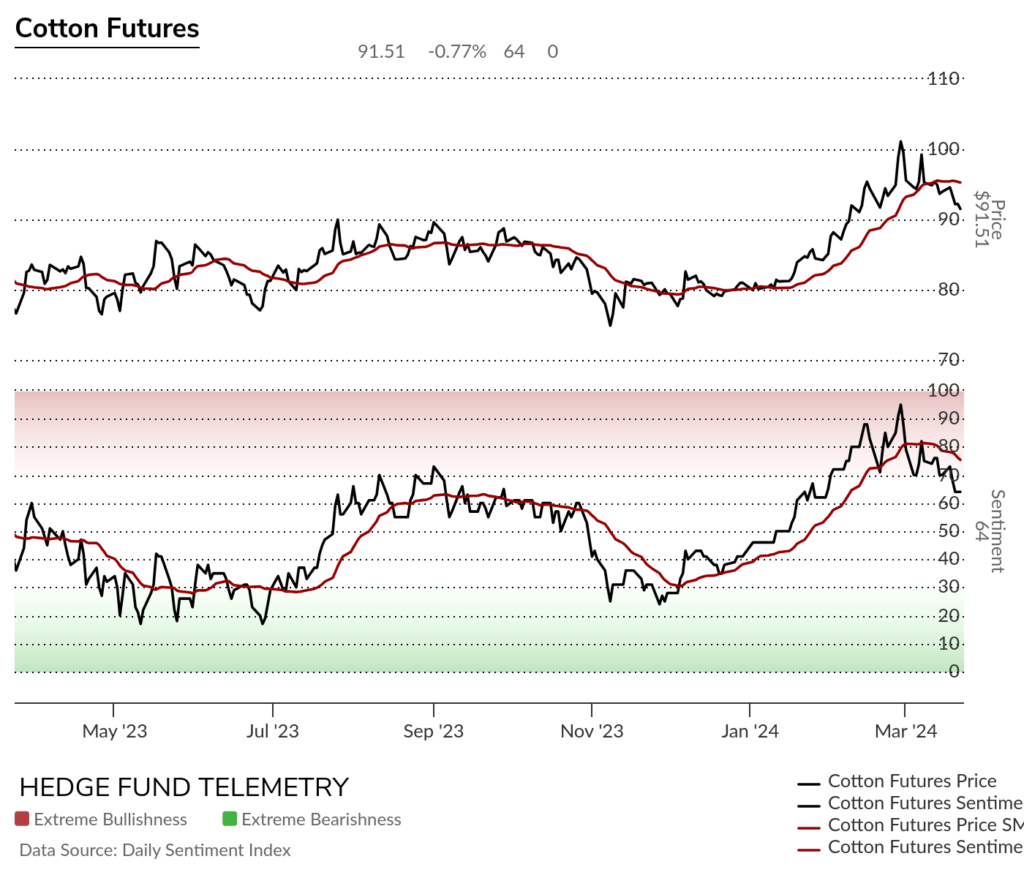

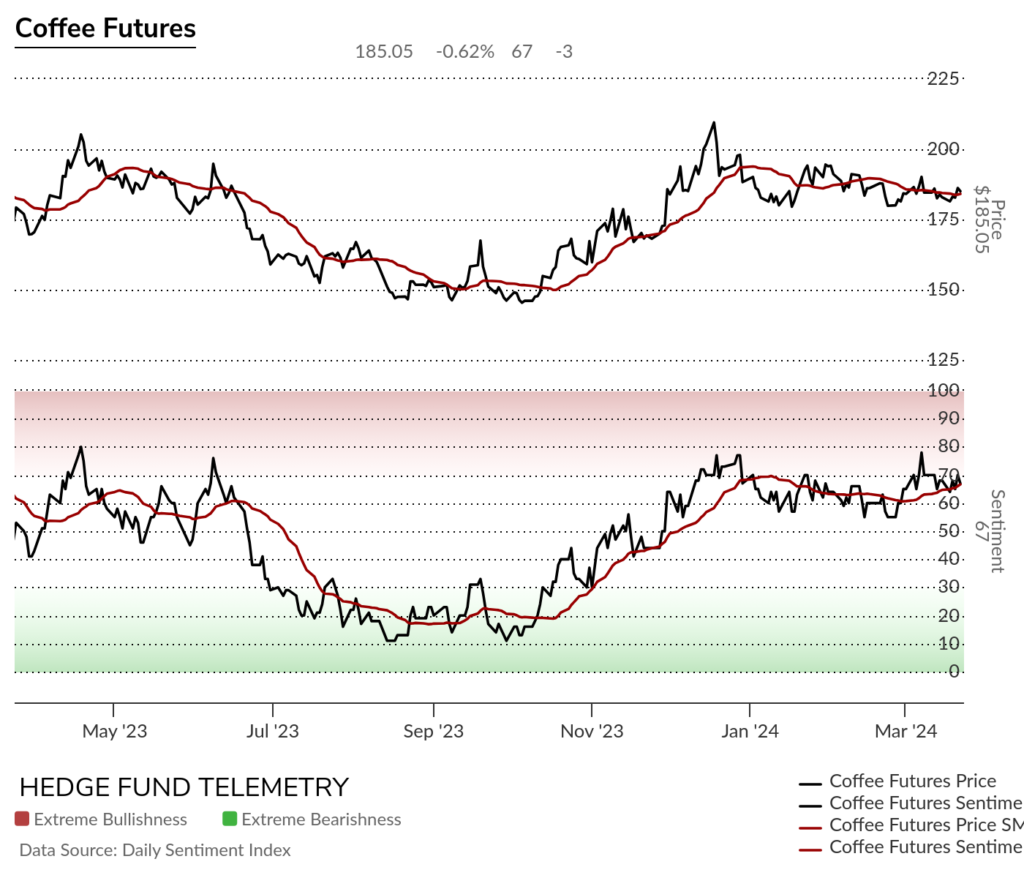

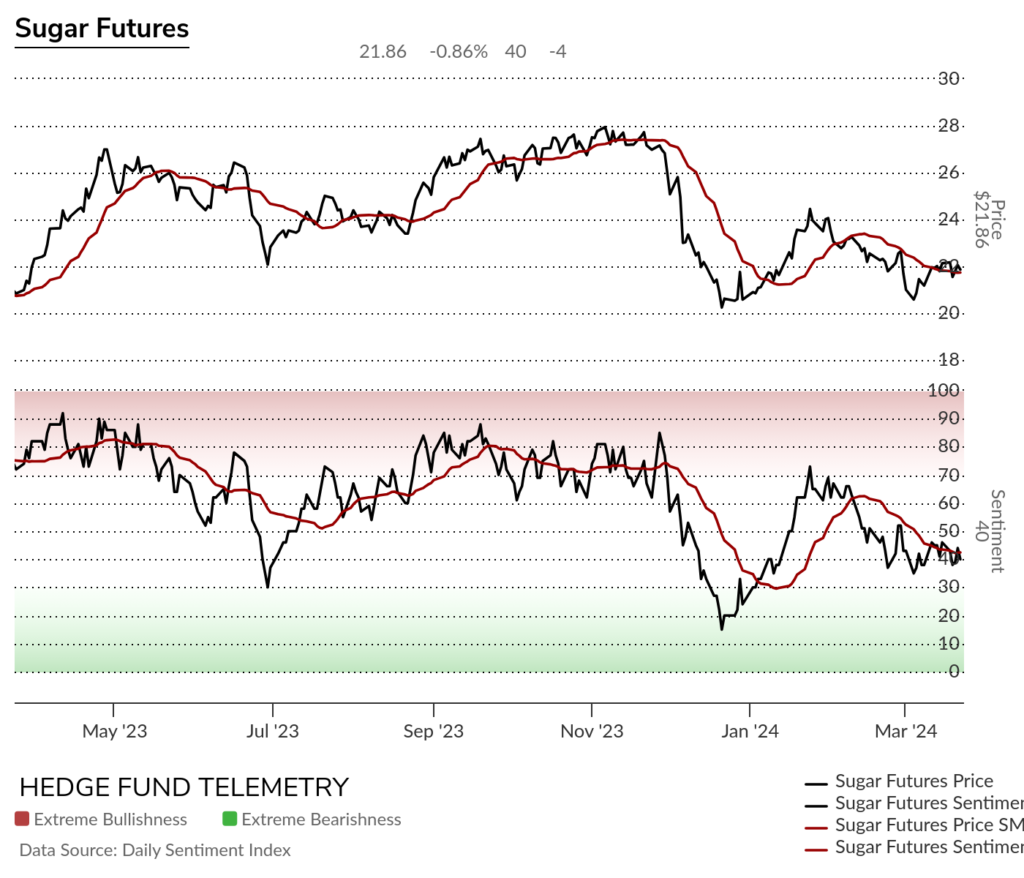

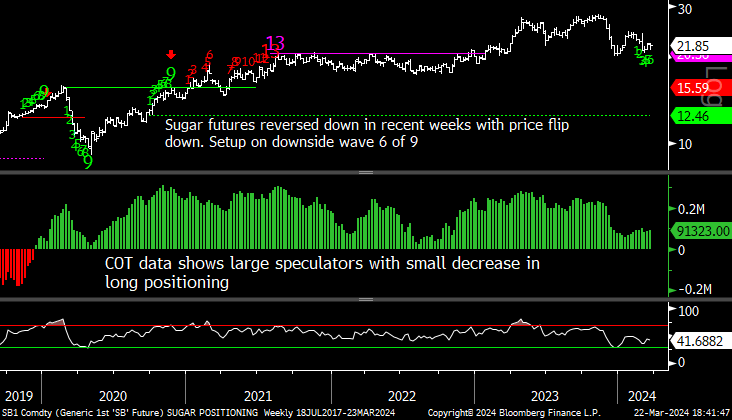

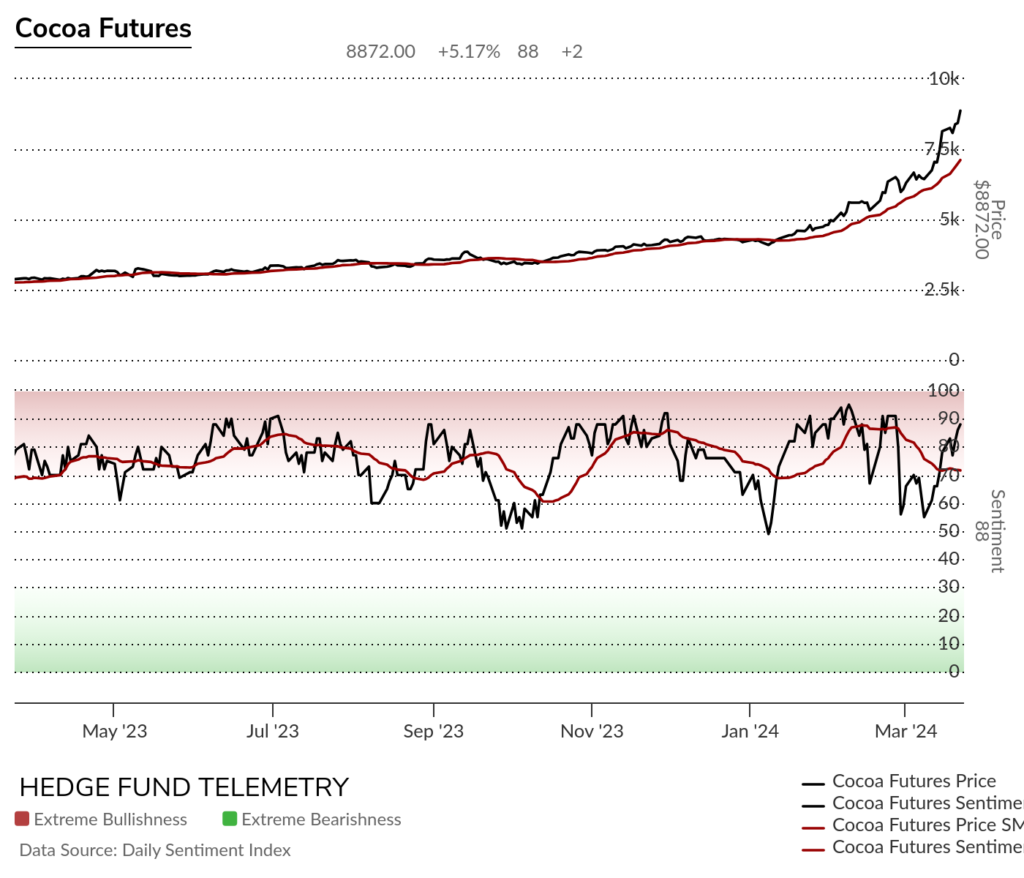

- Softs: Cotton as I have been saying for the last few weeks would fall back down which it did. Coffee has a new DeMark buy Countdown 13 that I don’t trust. Sugar still has downside risk after making a lower high. Cocoa continues higher and has a weekly DeMark Sequential on week 10 of 13 and that might be over 10k.

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily with a late in the week sell off. Could be partly due to US Dollar strength. A higher low corrective wave 2 of 5 pullback will qualify with an 8 day closing low then there will be an upside wave 3 of 5 potential price objective.

Bloomberg Commodity Index Weekly has increased in the last 6 weeks.

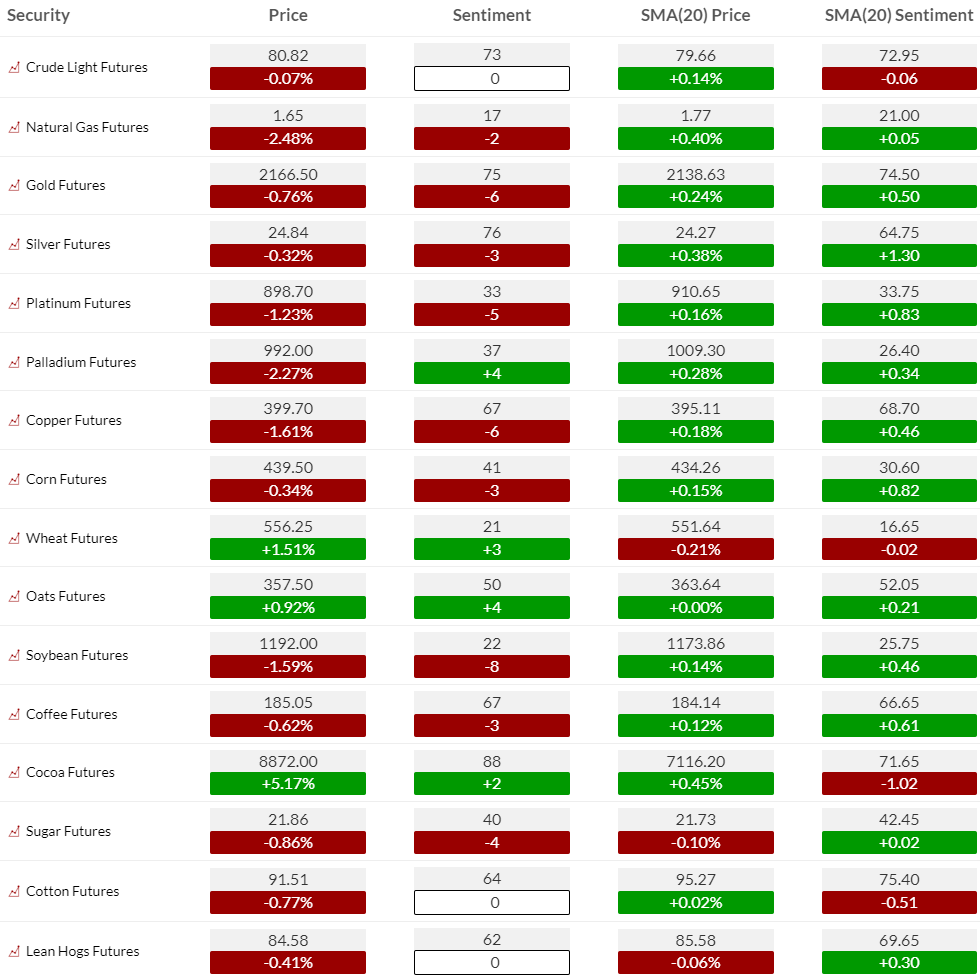

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY

Bloomberg Energy Index daily fell back late in the week and still can’t get above resistance.

The weekly still has an upside Sequential pending on week 9 of 13 but let’s be real, there is no upside momentum which is strange considering crude and gasoline big rise.

WTI Crude futures daily stalling above the upside wave 5 price objective. RSI was short term overbought

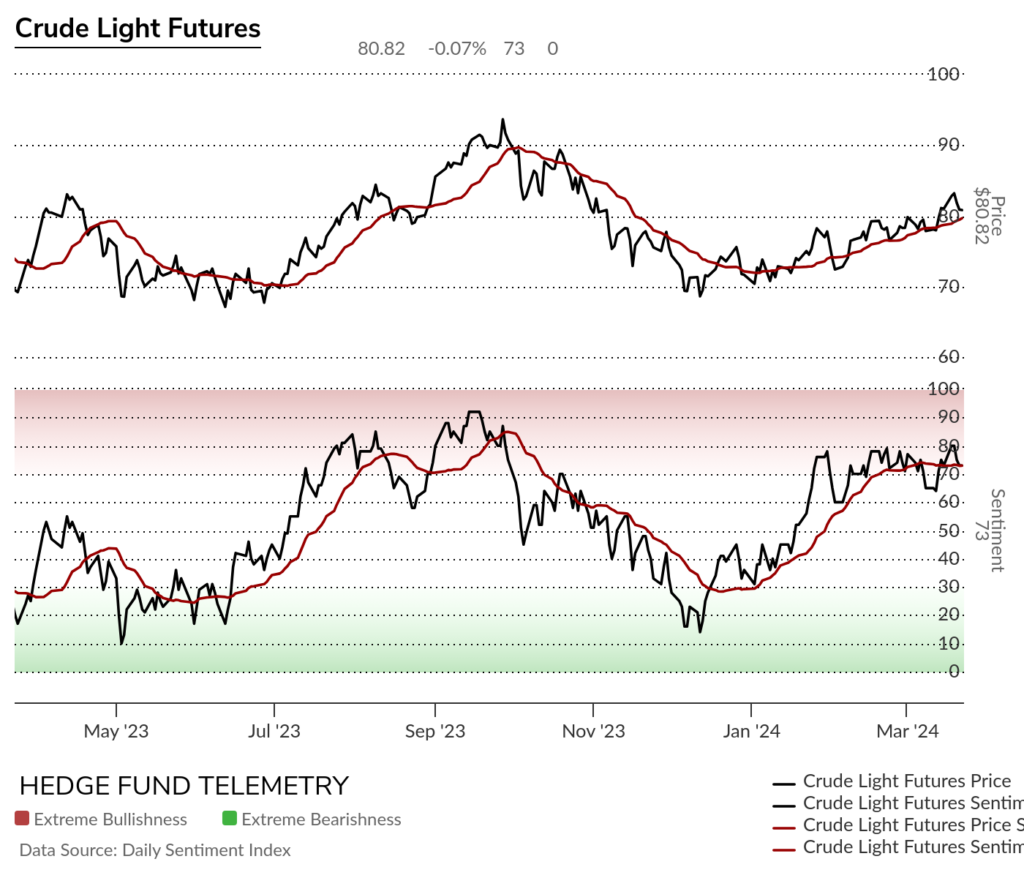

WTI Crude futures bullish sentiment has stalled at 80% a few times but it can and might get up into the 90’s for a peak reading.

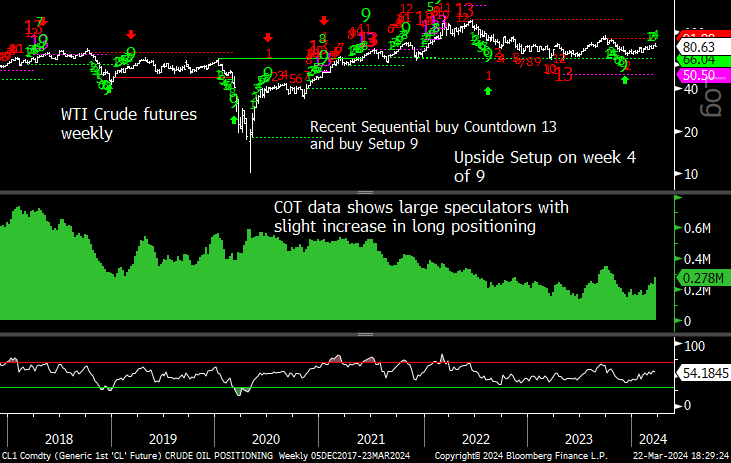

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Natural Gas futures daily hasn’t been able to get any upside momentum. A Combo on day 11 of 13 is pending.

Natural Gas futures bullish sentiment remains under pressure

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Sequential on week 11 of 13. Maybe… if the Sequential buy Countdown 13 qualifies in the next few weeks a true bottom will be in.

Metals

Gold daily spiked and reversed with Sequential pending on day 10 of 13 and topped with Combo sell Countdown 13.

Gold bullish sentiment has seen mid 80’s sentiment peaks in the last year

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Silver daily still range bound

Silver bullish sentiment near recent levels where it reversed in the trend

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

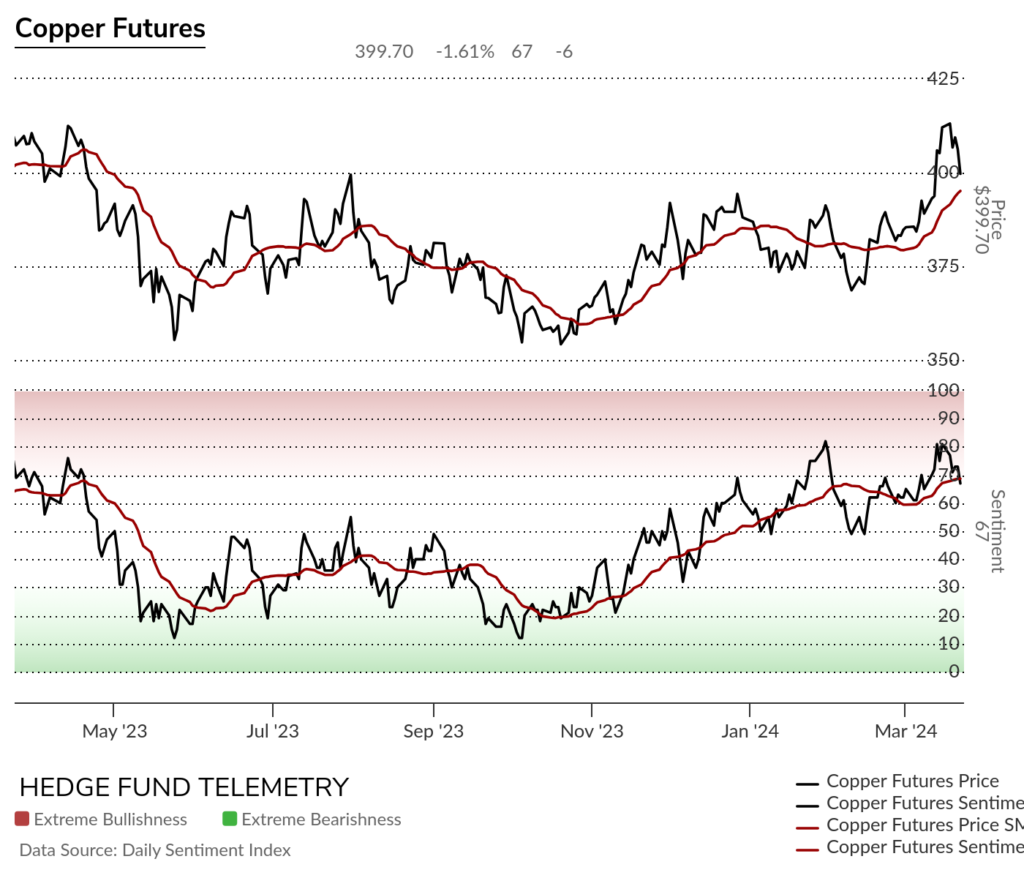

Copper futures daily backed off after spiking which I thought was possible due to overbought RSI and sell Setup 9. There is a pending Sequential on day 4 of 13 so perhaps a little more downside with a higher low then upside. Sentiment also was a limiting factor on the spike as it was in the extreme zone.

Copper futures bullish sentiment

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

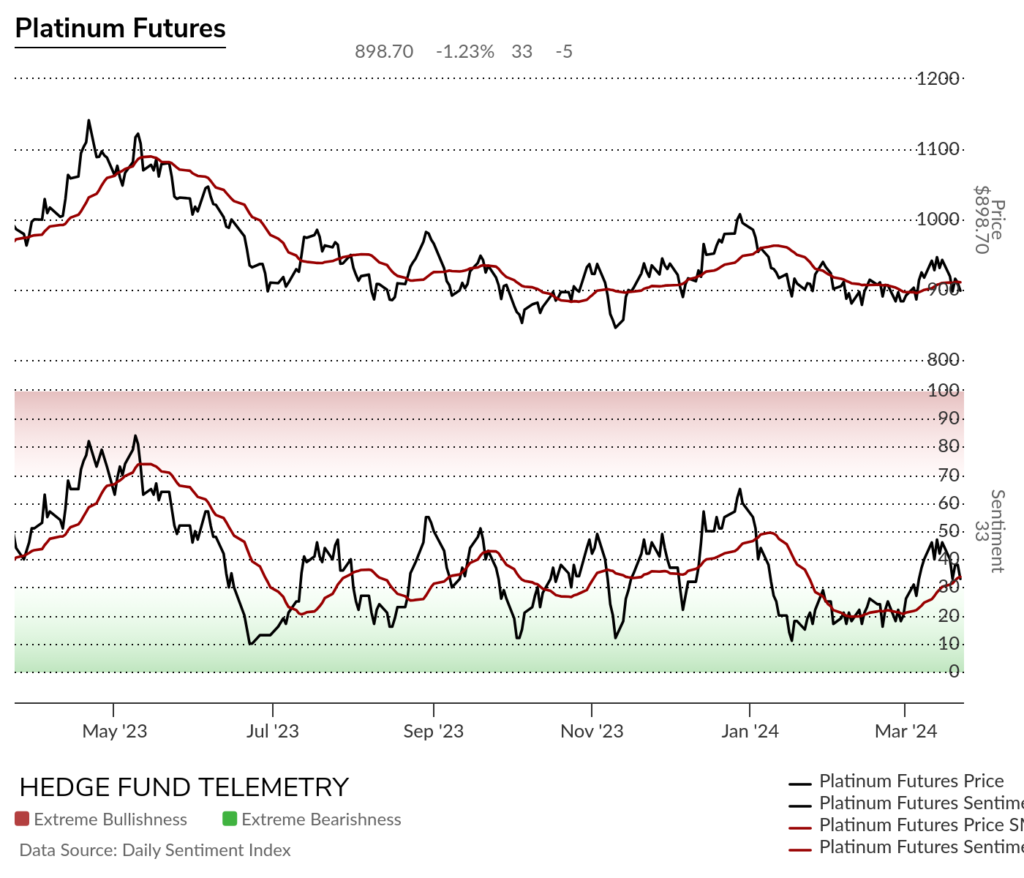

Platinum daily has struggled to keep momentum going and backed off with recent Sell Setup 9.

Platinum bullish sentiment failed to get through 50% again

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

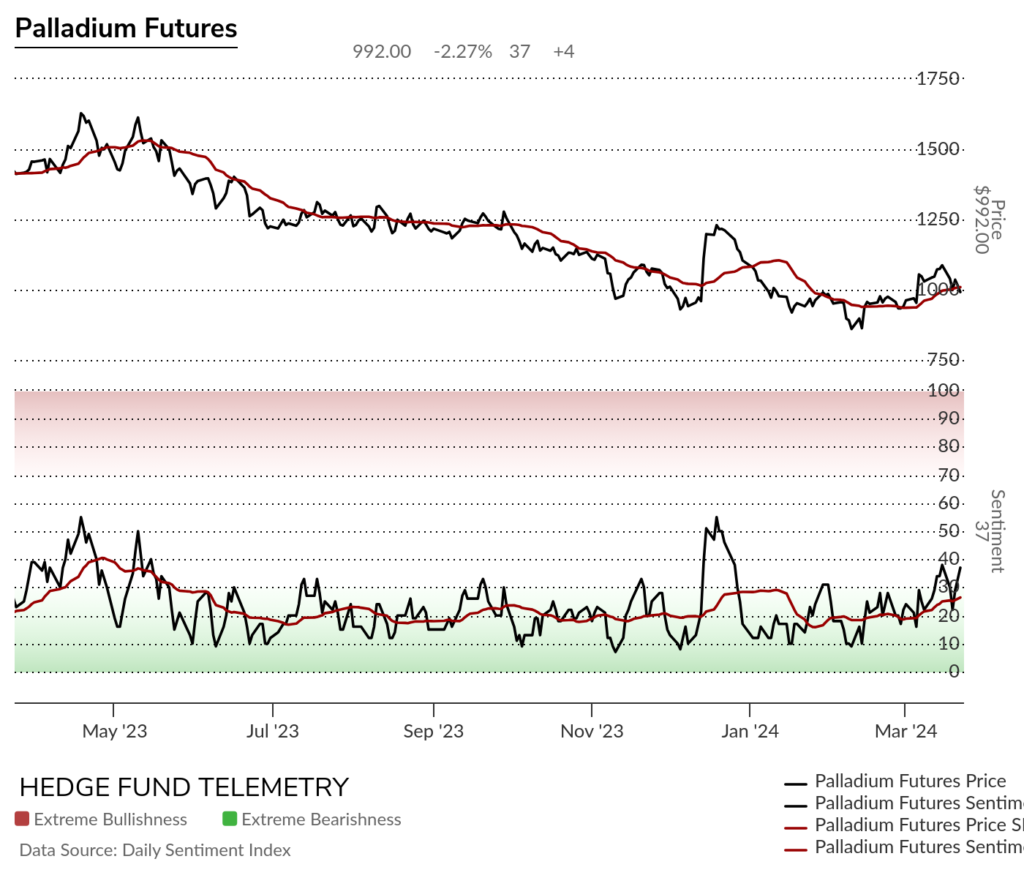

Palladium daily has tried to improve but fell at the 200 day again. That is the hurdle it needs to clear.

Palladium bullish sentiment trying to improve

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

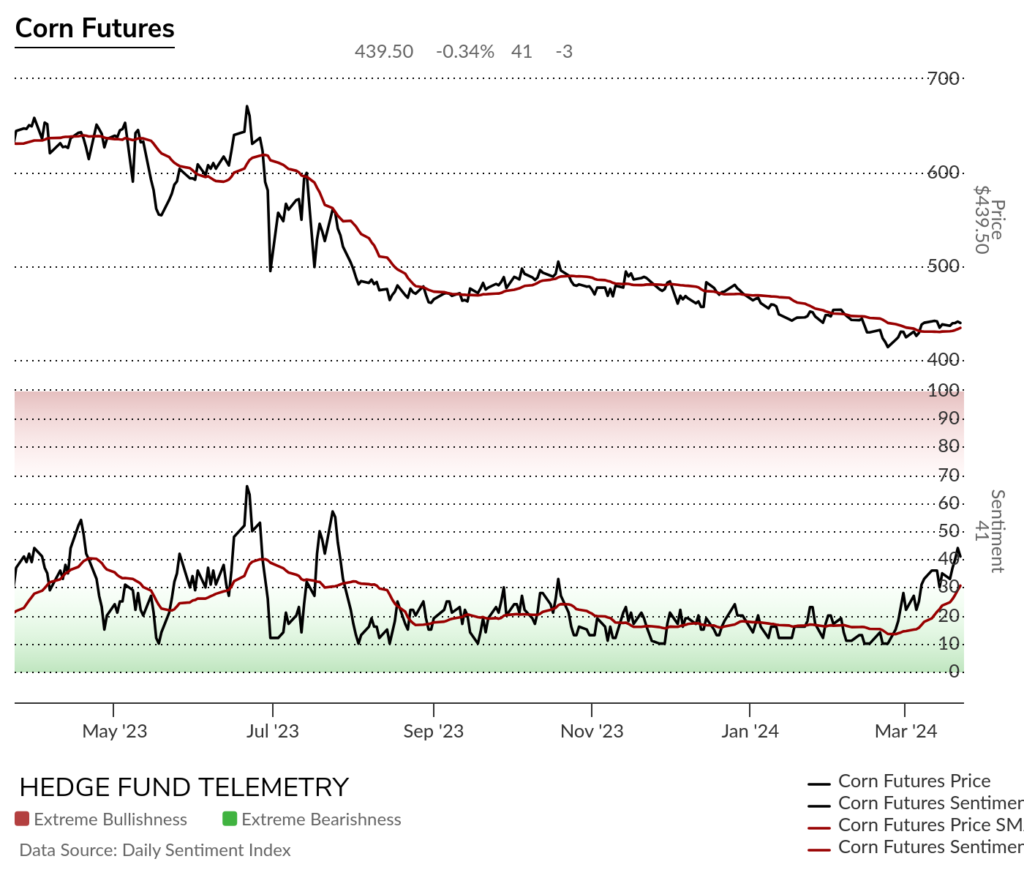

Corn futures daily continues to look good as a long off the lows however the pending secondary Sequential is a bit of a concern. Needs to hold the 50 day and move above 450

Corn futures bullish sentiment has improved but needs to clear 50%

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

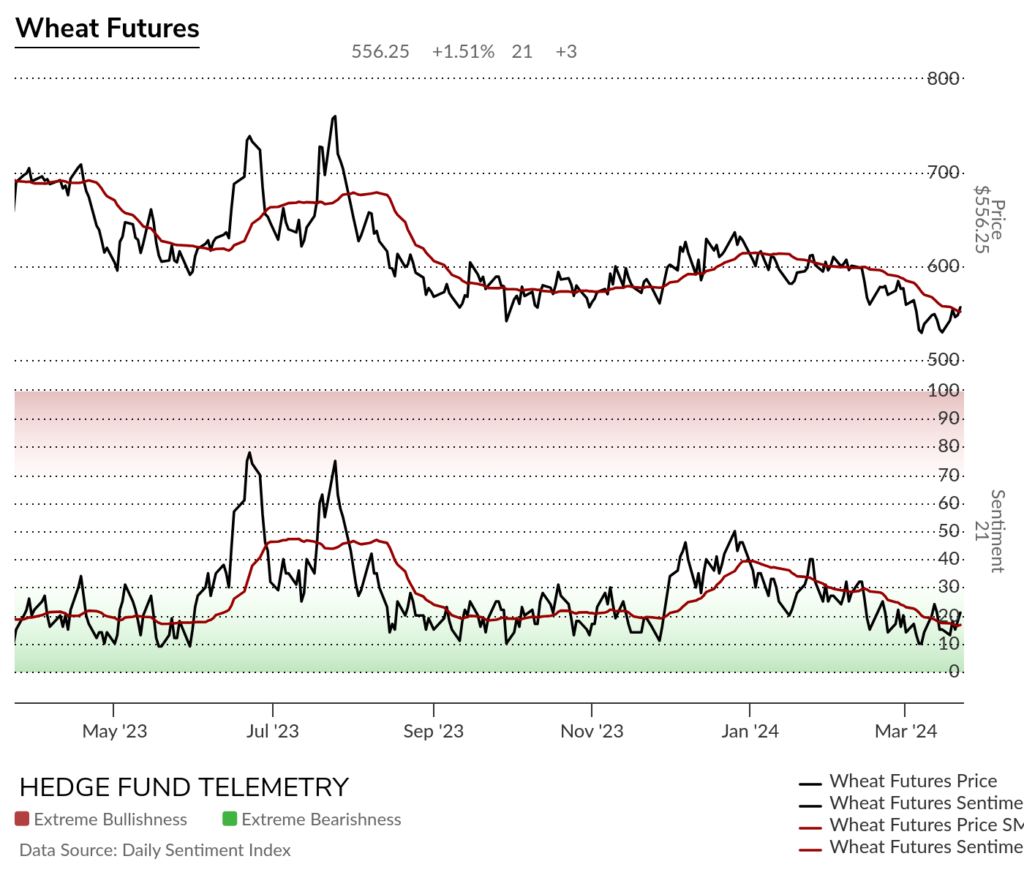

Wheat futures daily remains in a difficult place to make a long bet

Wheat futures bullish sentiment still has work to do if this bounces

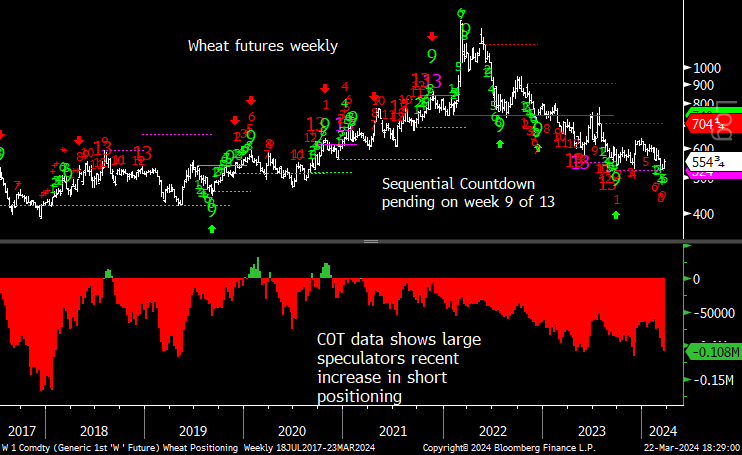

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Downside Sequential on week 9 of 13

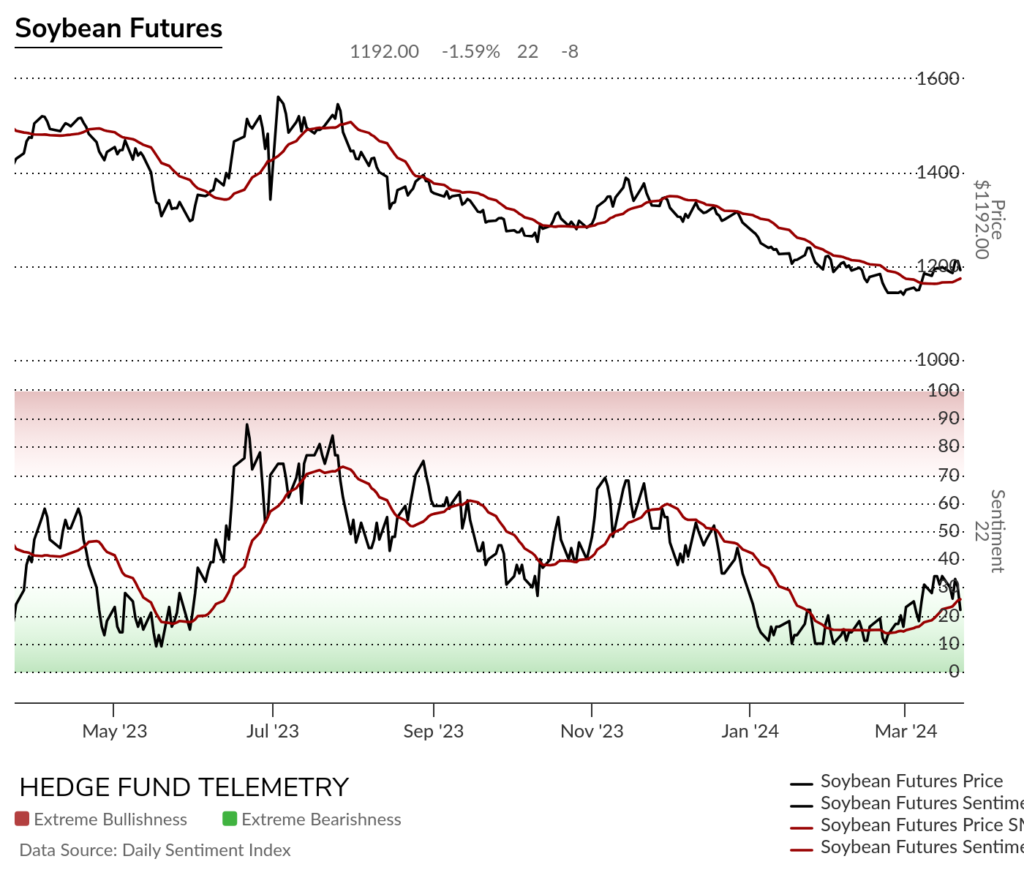

Soybean futures daily still has the upside Sequential pending in progress. Pullback on Friday was a lot so perhaps a higher low wave 2 (8 day closing low needed to qualify the 2)

Soybean futures bullish sentiment

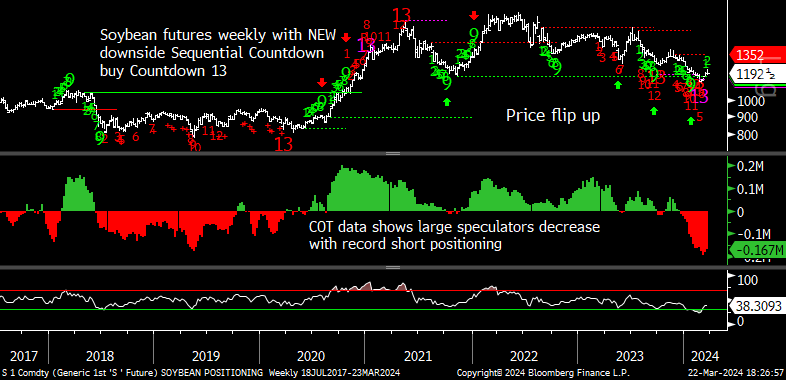

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

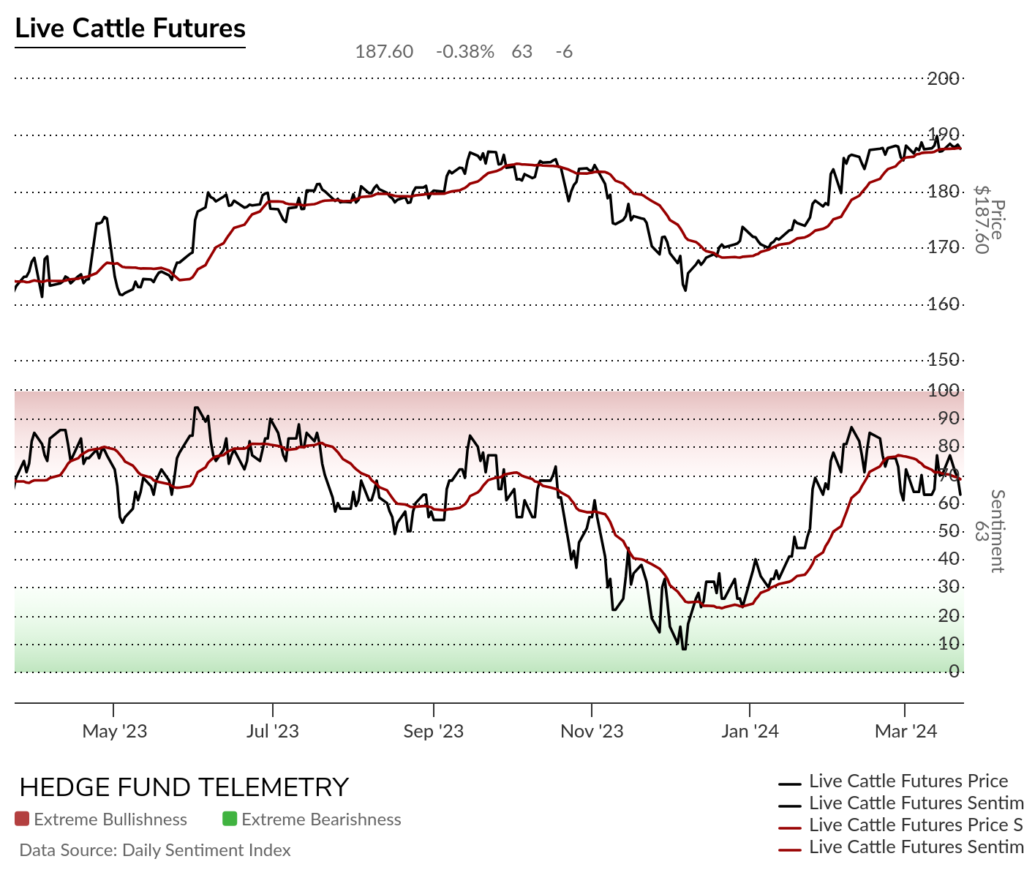

Live Cattle futures daily stalled recently with the DeMark sell Countdown 13’s. Price flip down on Friday could see continuation

Live Cattle futures bullish sentiment made a lower high so will it make a lower low?

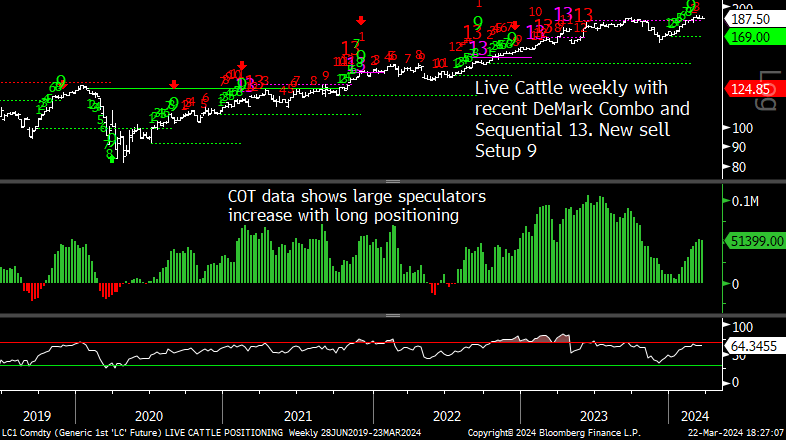

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

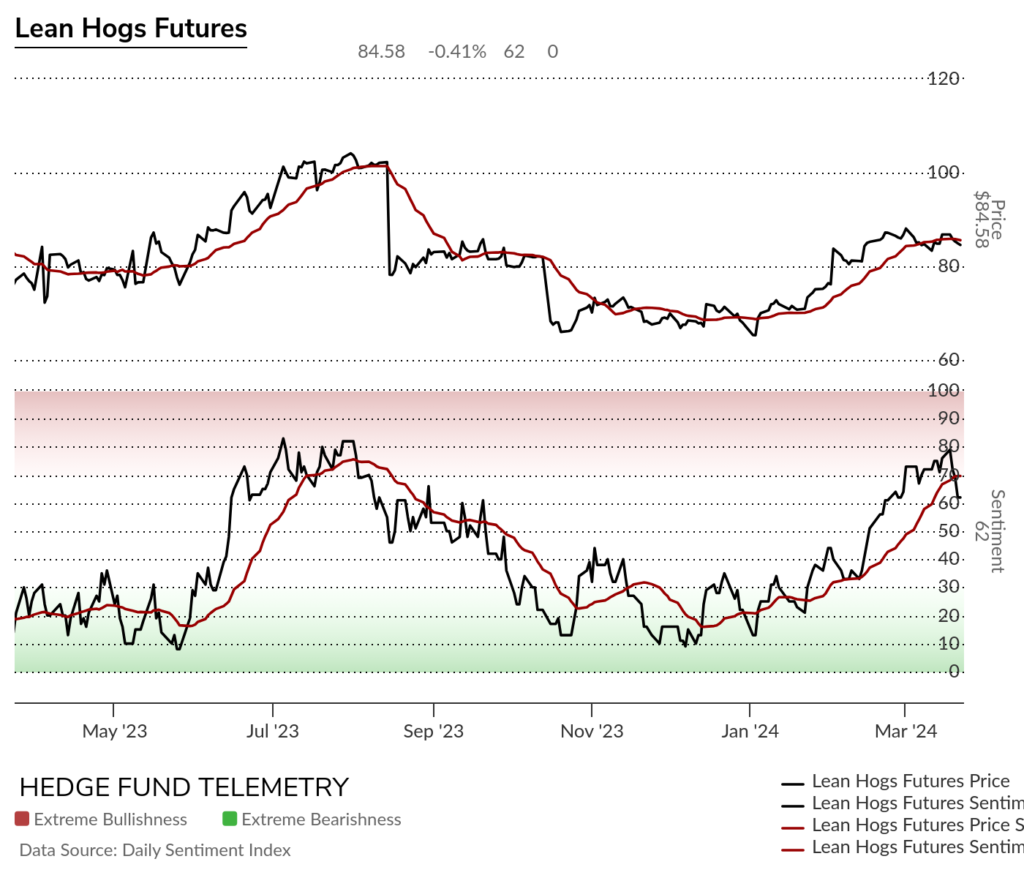

Lean Hogs futures daily reversed after the Combo sell Countdown in upside wave 5.

Lean Hogs bullish sentiment broke the 20 day moving average of bullish sentiment

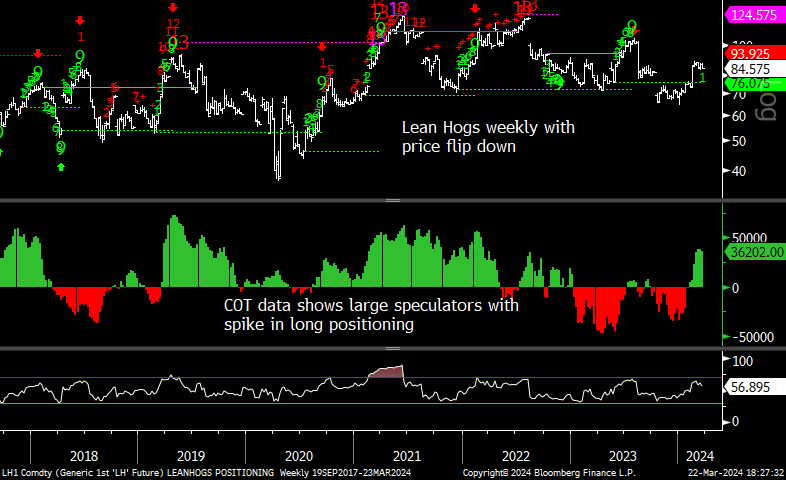

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

Cotton futures daily reversed as I expected in the last few weeks. Now with Setup 9 at the 50 day it’s going to bounce or start a new Sequential. I lean on the bounce scenario.

Cotton futures bullish sentiment fading after reaching the highest level in several years

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Coffee futures daily

Coffee futures bullish sentiment

Sugar futures daily still has the downside Sequential in progress after making a lower high bounce

Sugar futures bullish sentiment remains under some pressure

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Cocoa futures daily could continue higher with the start of a new Sequential and the weekly below is on week 10 of 13. RSI remains very overbought

Cocoa futures bullish sentiment has remained in extreme zone with little pullbacks

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators has a weekly Sequential on week 10 of 13. Hello 10k

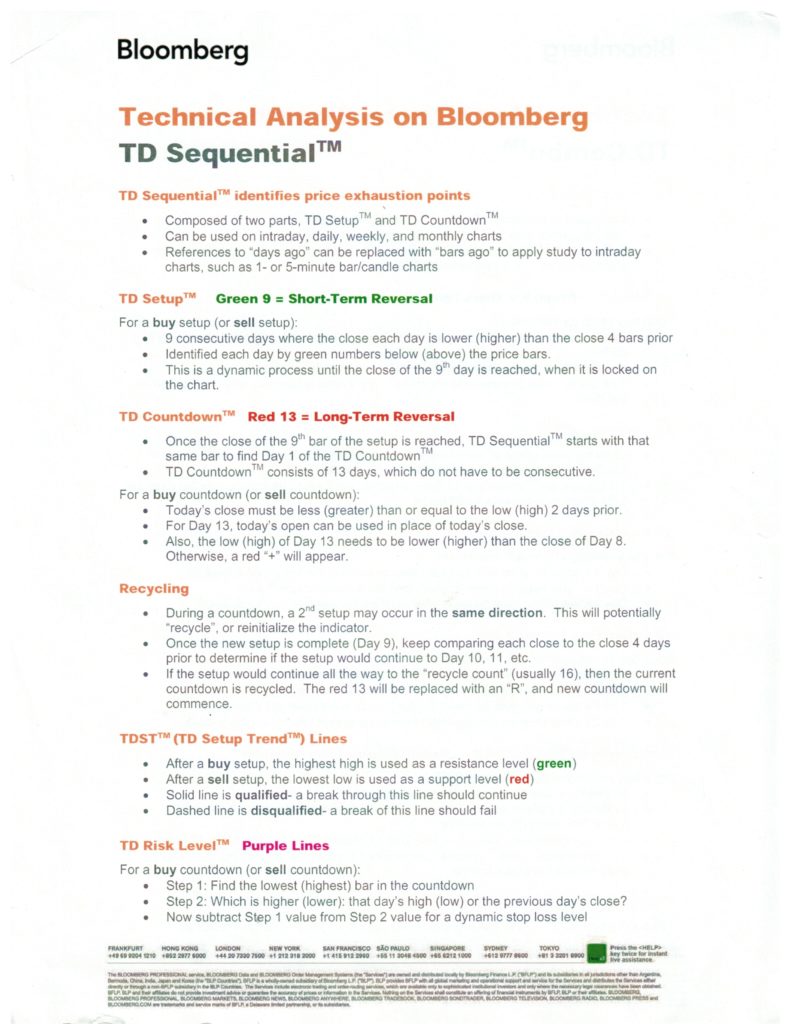

DeMark Sequential Basics

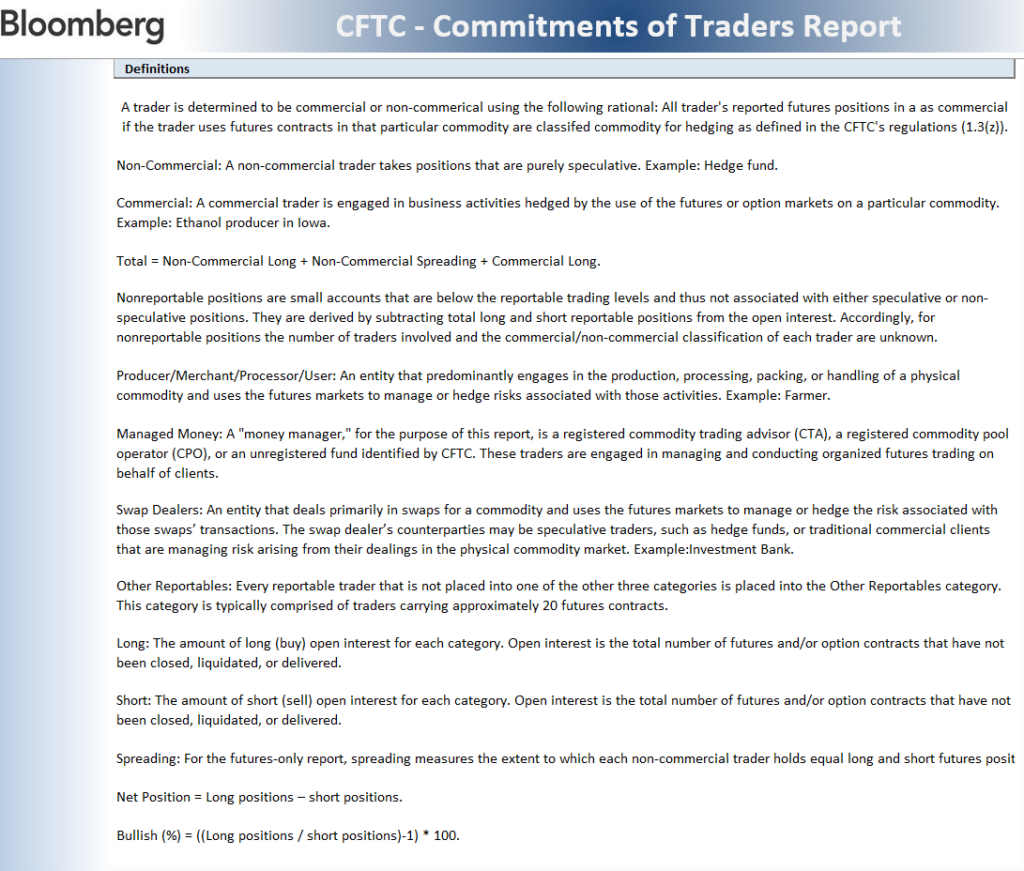

DETAILED COMMITMENT OF TRADERS DEFINITIONS