Highlights and themes

- US Dollar strength continued with the US Dollar Index nearing again the 105 resistance level. Dollar sentiment is at 78% which is near the extreme zone and could be a limiting factor.

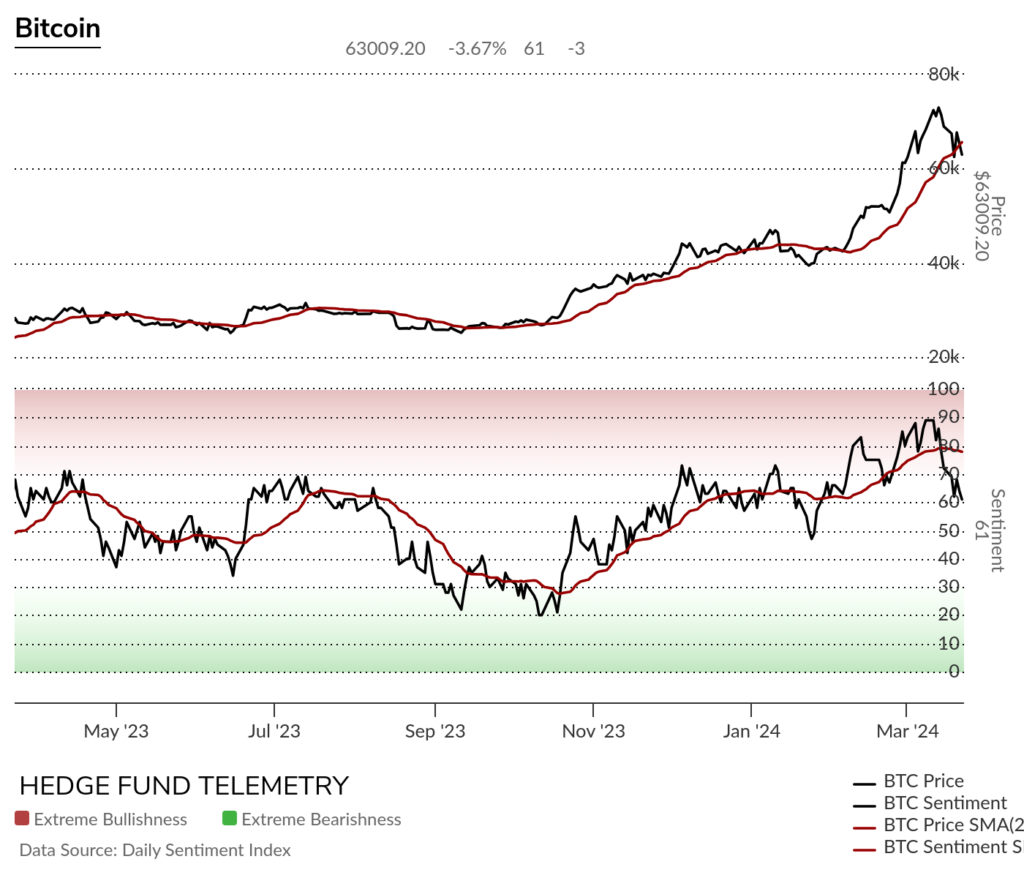

- Bitcoin bullish sentiment two weeks ago peaked at 89% the second highest peak in it’s history and now it’s backed off to 61%.

- Yen weakness was the big story after the BoJ policy changes. Nearly broke down below November levels ~152

- UK Pound Sterling reversed lower after the recent DeMark sell Countdown 13

- Euro also was weaker but both Euro and Pound have not broken support.

- Swiss Franc weakened and still has potential for a little more weakness.

Comments on charts. If you have questions or would like more context, please email.

Currency Sentiment Overview

Currency sentiment highlights shows US Dollar strength all week with Dollar sentiment getting near the extreme zone again. Bitcoin bullish sentiment dropped again this week to 61% after peaking at 89% two weeks ago.

US Dollar Indexes

DXY US Dollar Index daily rebounded after the recent weakness with 105 resistance nearing. Upside Setup on day 7 of 9 and it will be a big tell after the Setup 9 if it qualifies on Tuesday what will happen next. A continuation with a new Sequential Countdown starting or reversal. Sort of amazing how there hasn’t been a completed Setup since early October.

Bloomberg US Dollar Index daily had a strong turn around week with resistance nearing at 1250.

Bloomberg US Dollar Index weekly has nagged me with the downside Sequential with my longer term bullish view however this past week got a price flip and could continue. We’ll see this week.

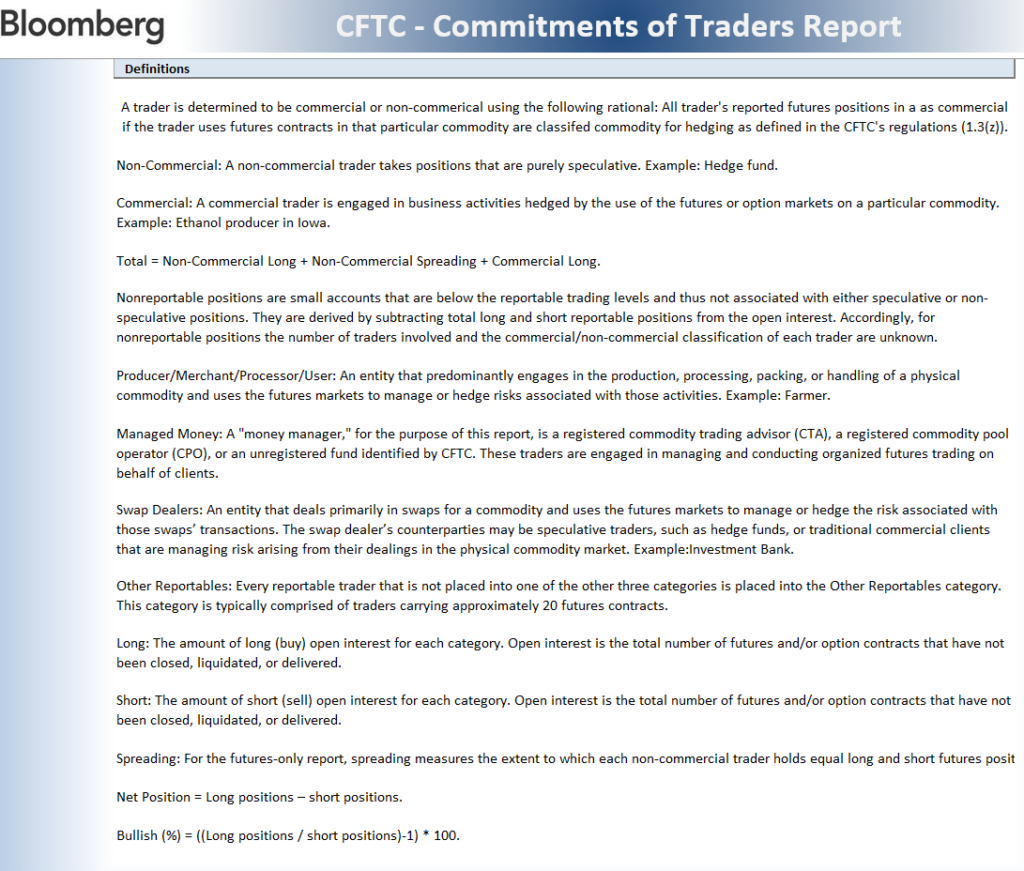

US Dollar bullish sentiment continued to move higher this past week after bouncing off the 50% midpoint level.

US Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. The downside Sequential on weekly time frame has been nagging me with my longer term bullish view

Major USD Crosses

EURUSD Euro / US Dollar fell slightly under the flat 50 day and 200 day. 106.73 TDST is the big level to watch.

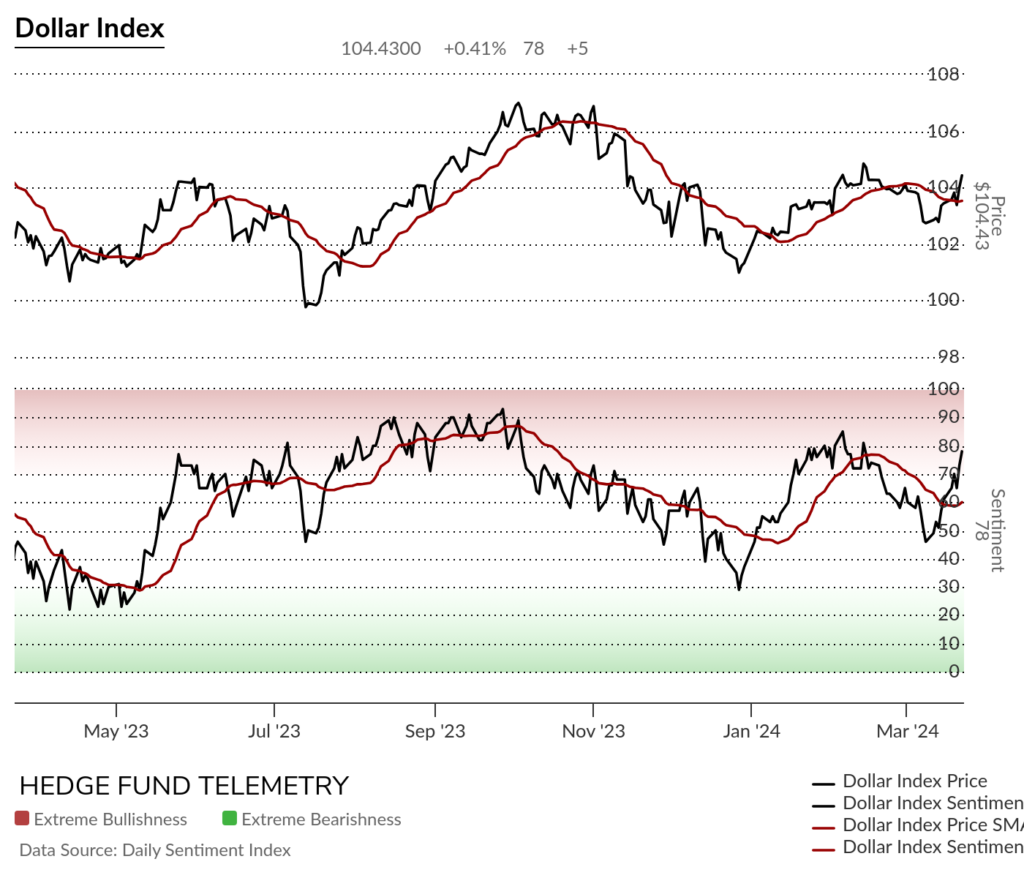

Euro bullish sentiment remains under 50% midpoint level

Euro Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

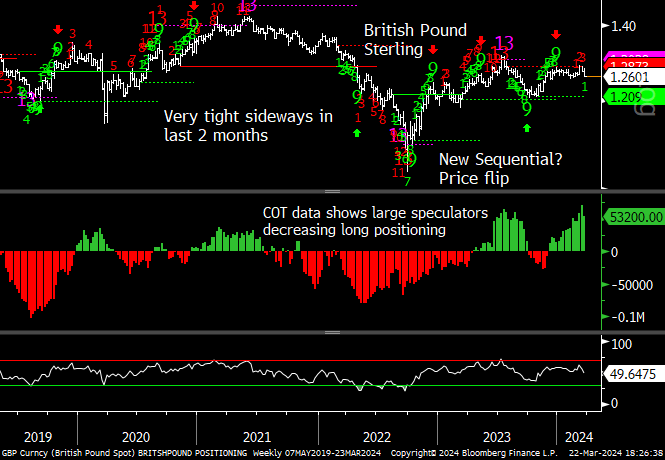

GBPUSD British Pound Sterling / US Dollar reversed lower after the recent DeMark Sequential sell Countdown 13

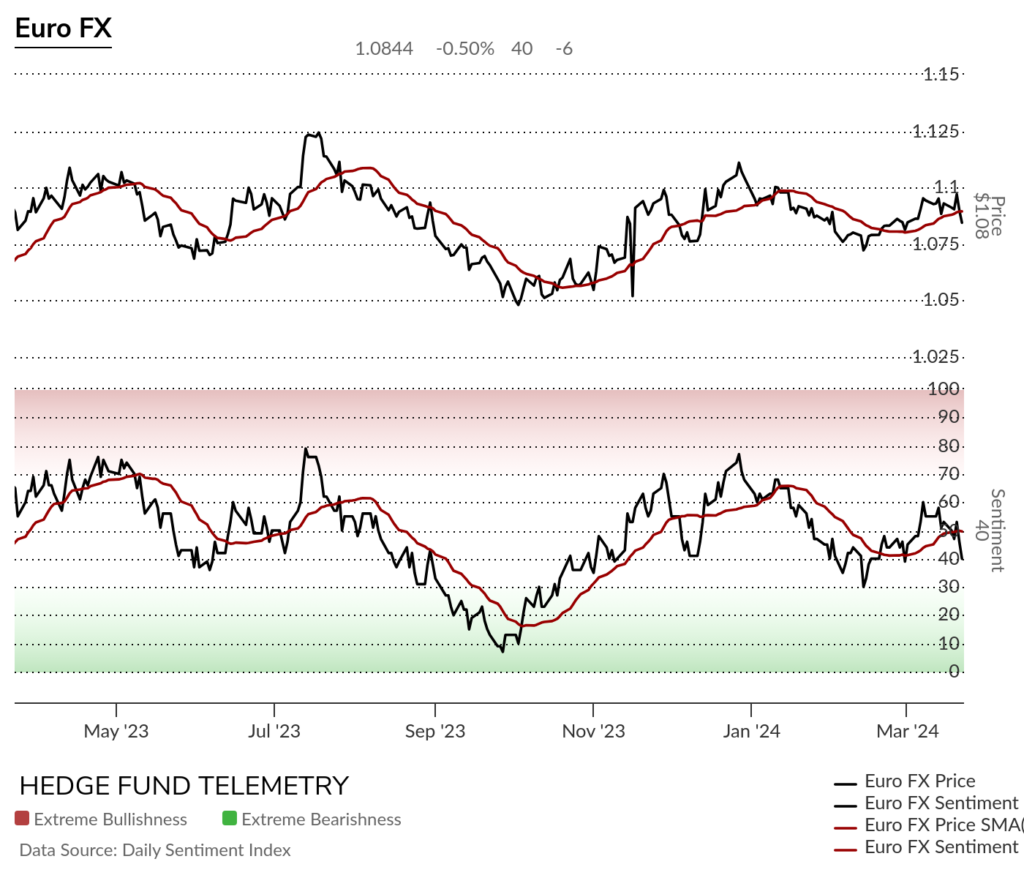

British Pound Sterling bullish sentiment fell last week with 50% midpoint level to watch

British Pound Sterling Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

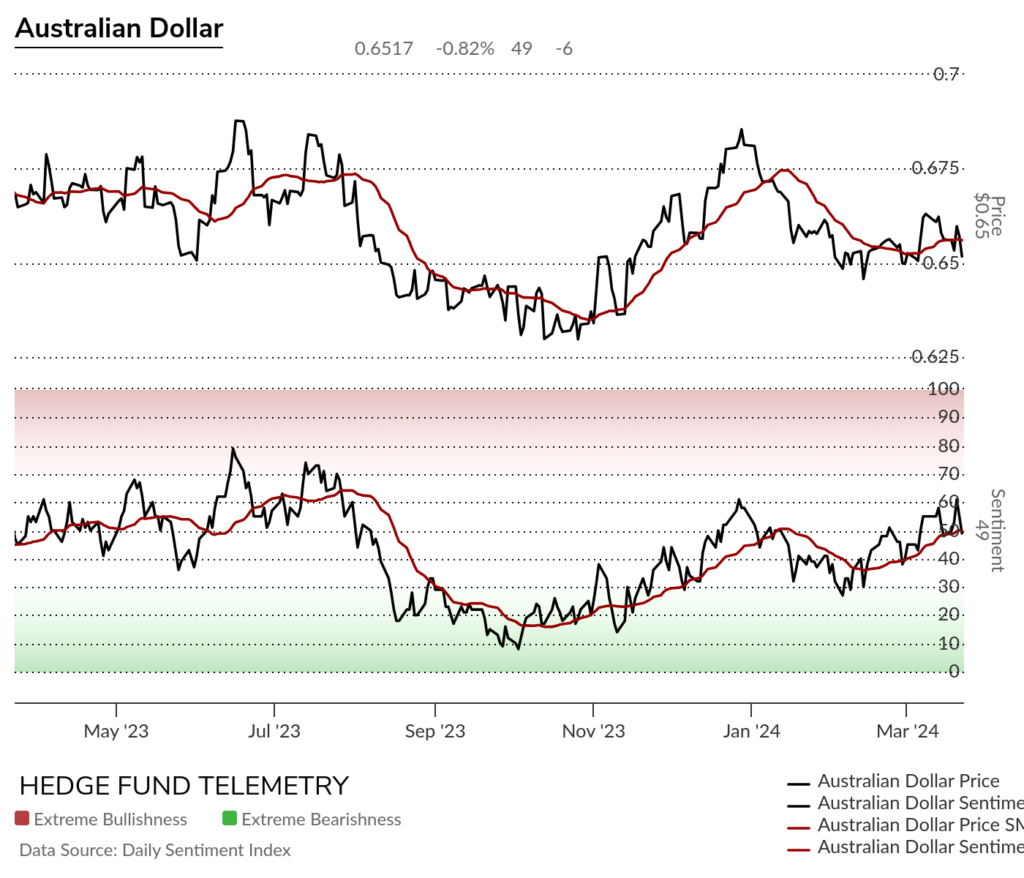

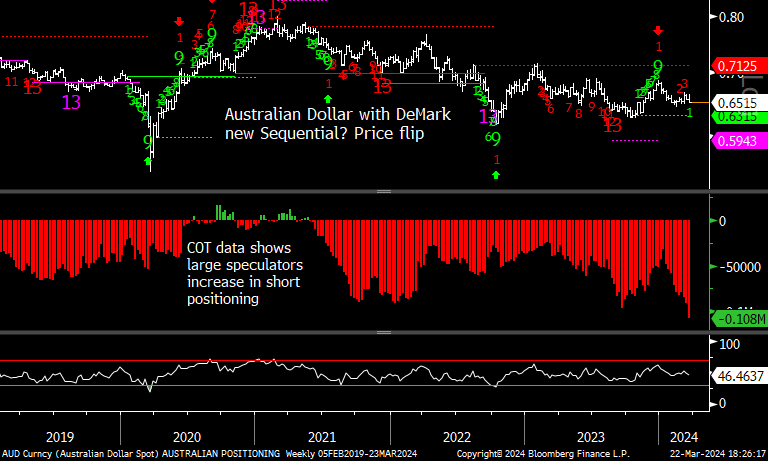

AUDUSD Australian Dollar / US Dollar tightly wound

Australian Dollar bullish sentiment hanging around the midpoint

Australian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators with a new record amount of shorts.

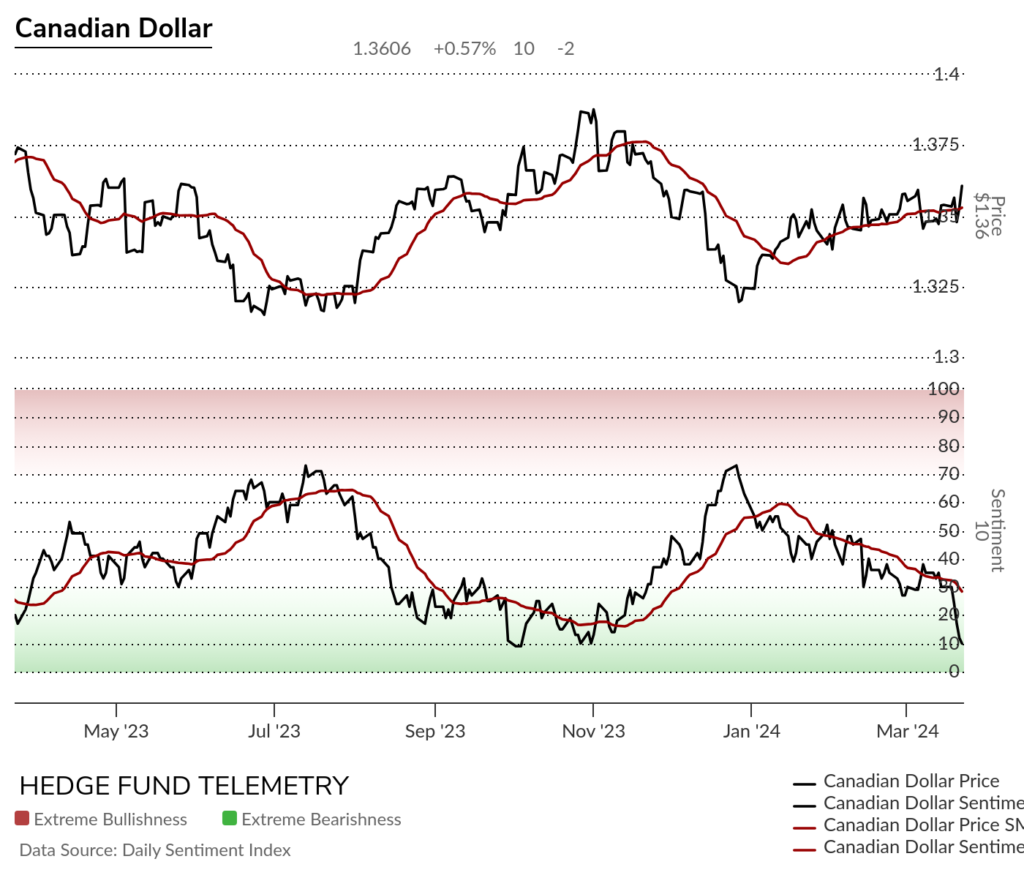

USDCAD US Dollar / Canadian Dollar near a breakout level again

Canadian Dollar bullish sentiment fell very hard this week

Canadian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

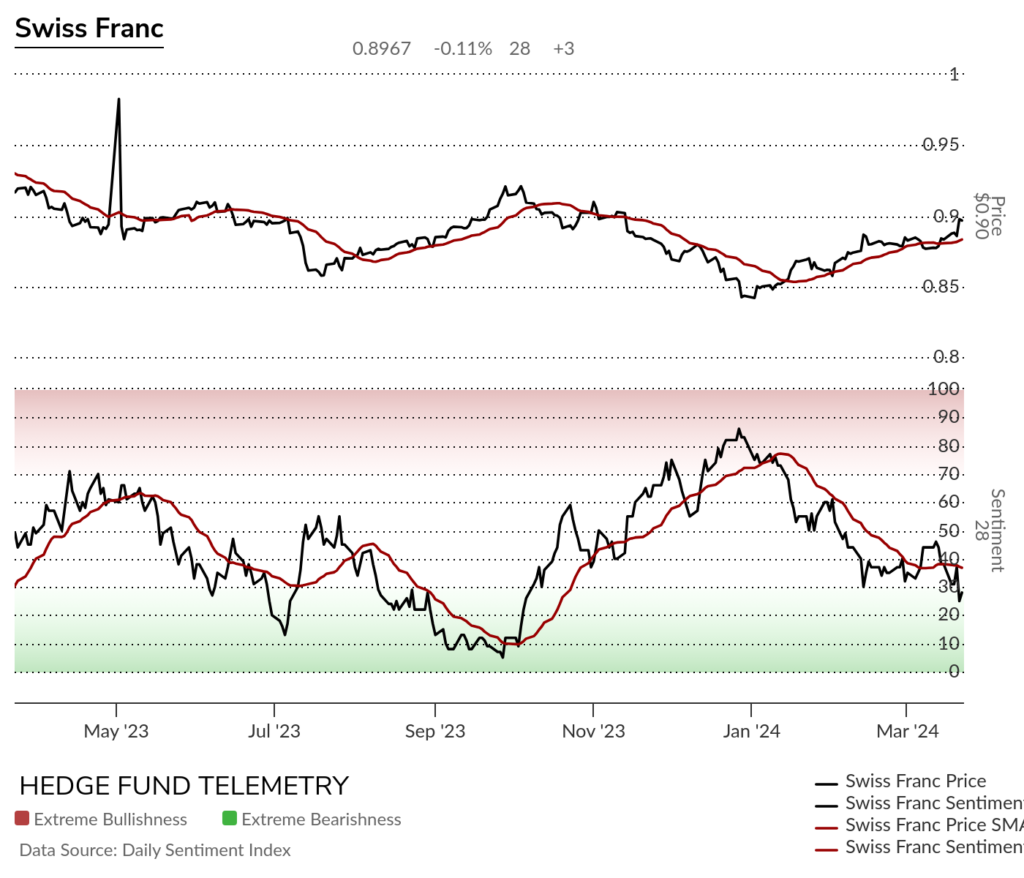

USDCHF US Dollar / Swiss Franc could see a little more weakness for Swiss Franc

Swiss Franc bullish sentiment has been under pressure

Swiss Franc Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDJPY Japanese Yen daily did get the Combo and Aggressive Sequential 13’s (amber 13 is AS) Standard Sequential remains pending on day 12 of 13.

Japanese Yen bullish sentiment back to oversold levels however Yen has had many periods of depressed sentiment.

Yen Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Crypto

Bitcoin daily has support at 60k (big round number) then 57k 50 day, then back to February Setup 9 TDST line at 50k.

Bitcoin bullish sentiment peaked at 89% and feel again ending the week at 61%

Ethereum with Setup 9 could either stall or bounce (likely) but a new downside Sequential is possible and we’ll know more this coming week if there is continuation.

Three major Yen crosses

With Yen weakness the three crosses made new highs vs Yen but that might be limited.

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

USDBRL US Dollar / Brazilian Real

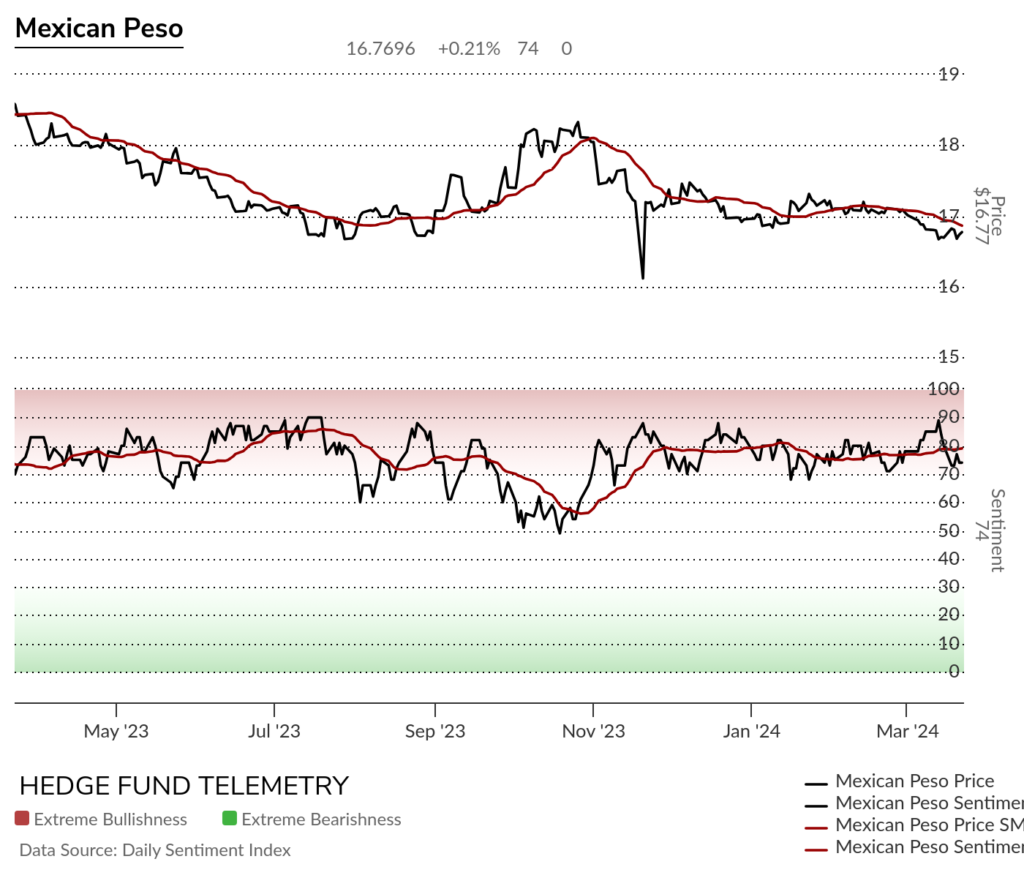

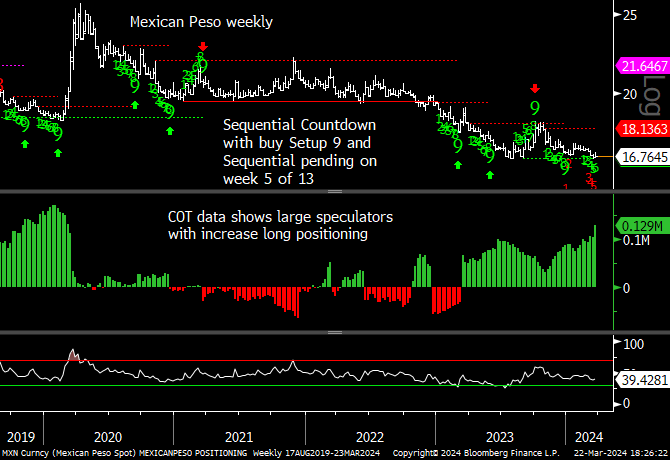

USDMXN US Dollar / Mexican Peso

Mexican Peso bullish sentiment

Mexican Peso Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDZAR US Dollar / South African Rand

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan) saw the Chinese currency weaken enough to qualify the Sequential 13. Could they be setting up for a devaluation?

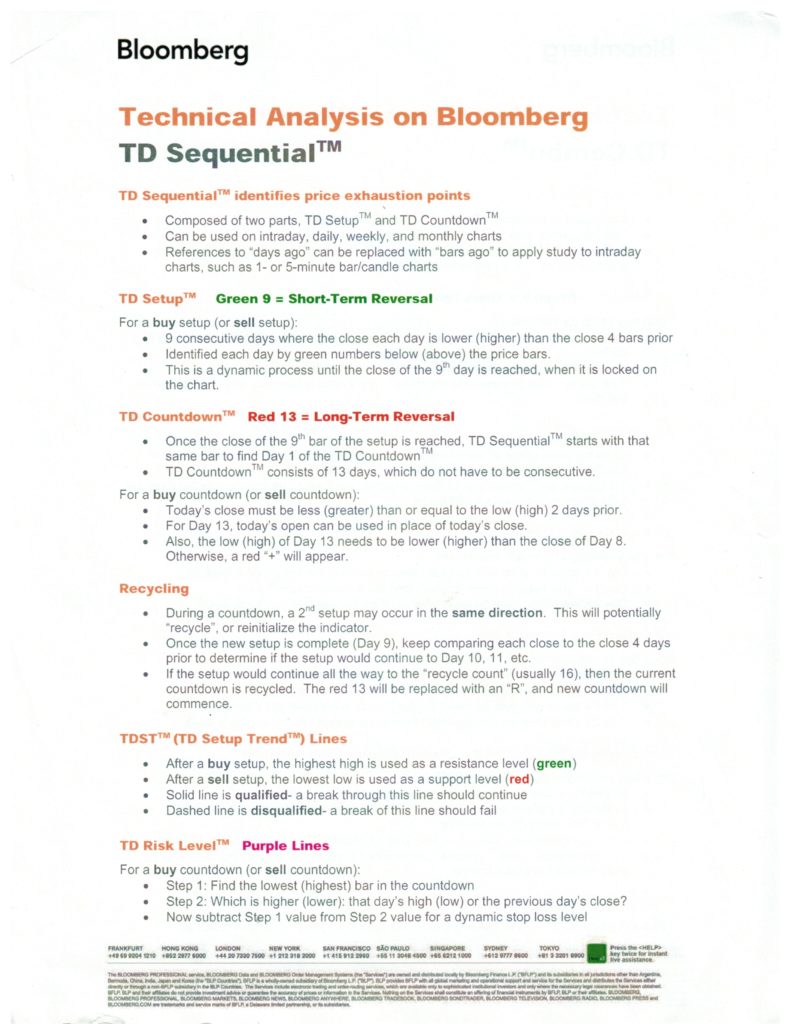

DeMark Sequential Basics from Bloomberg

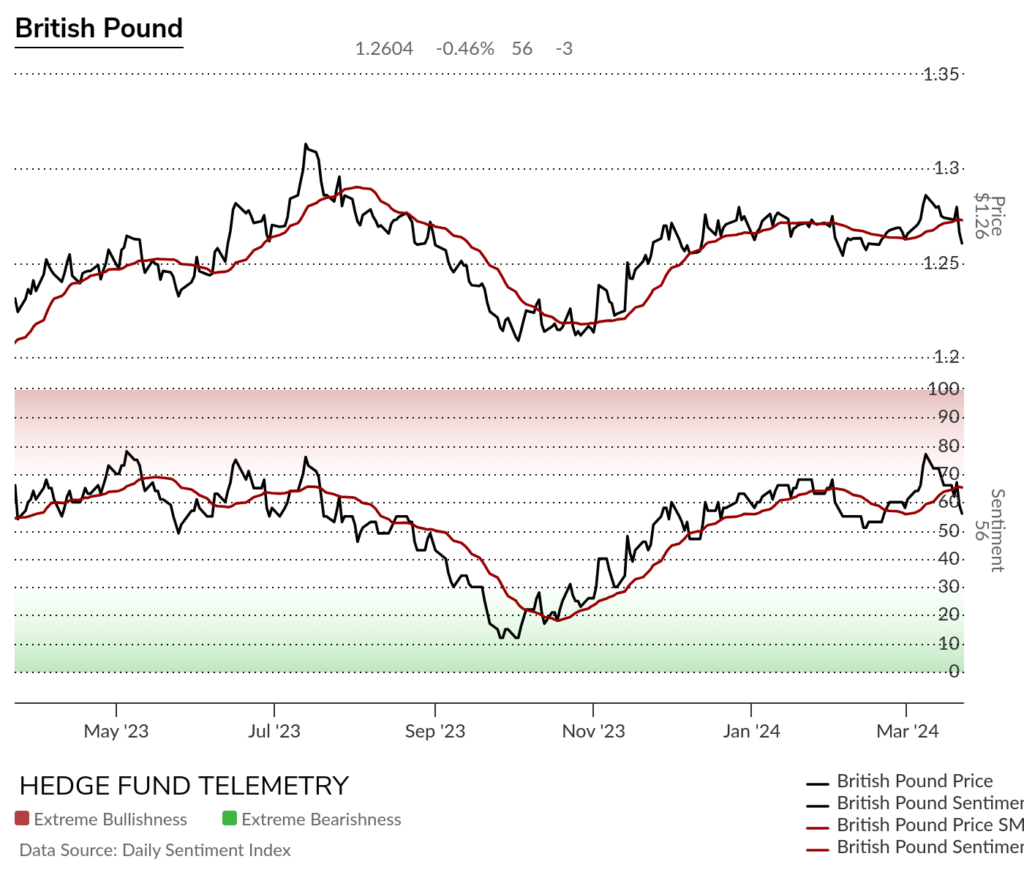

Detailed Commitment of Traders explanation