HIGHLIGHTS AND THEMES

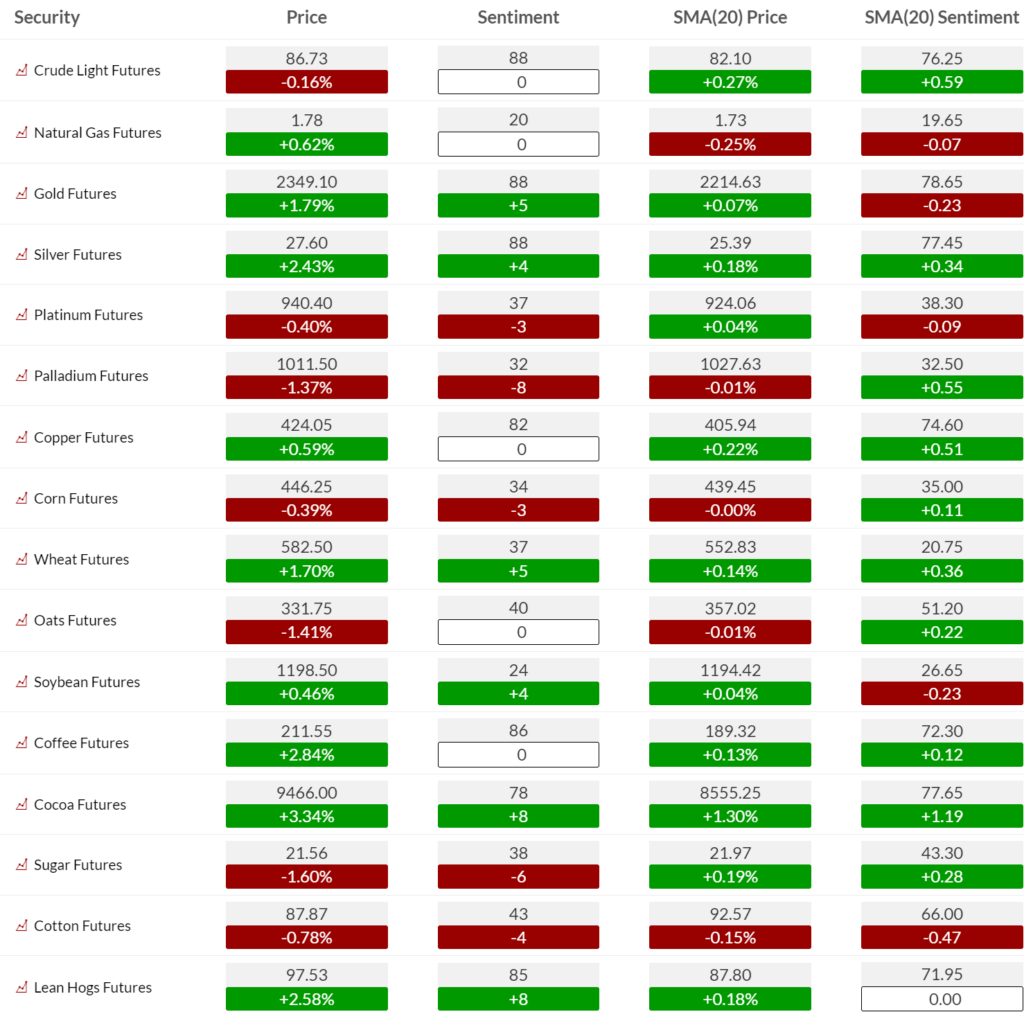

- I’ve had a positive bias on commodities for the last six weeks and now generalists are starting to catch on to the positive action. The Bloomberg Commodity index has some exhaustion signals developing in upside wave 3 of 5. A higher low pullback would be welcome buying opportunity. I have expressed the concerns about commodity inflation showing up with the CPI and PPI and we’ll know more if that is true with this week’s data.

- Several commodity markets have sentiment at extreme levels which is a short term limiting factor.

- Crude had another weak Friday and Natural Gas just can’t find any upside momentum.

- Gold is one that has extreme sentiment and developing upside daily DeMark sell Countdown 13’s. Silver sentiment is also in the extreme zone. Both have DeMark Setup counts on day 7 of 9. Copper is extended as well but might have a little more upside even with some

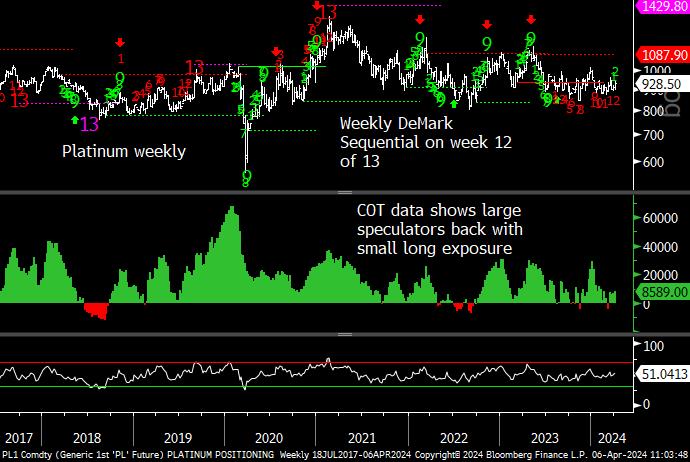

- Both Platinum and Palladium could possibly join the metals upside.

- Grains still look constructive with Soybeans, Corn and now Wheat starting to show signs of upside.

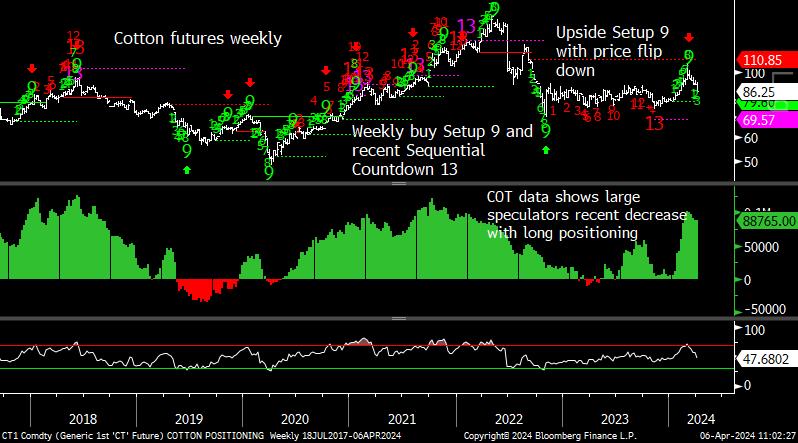

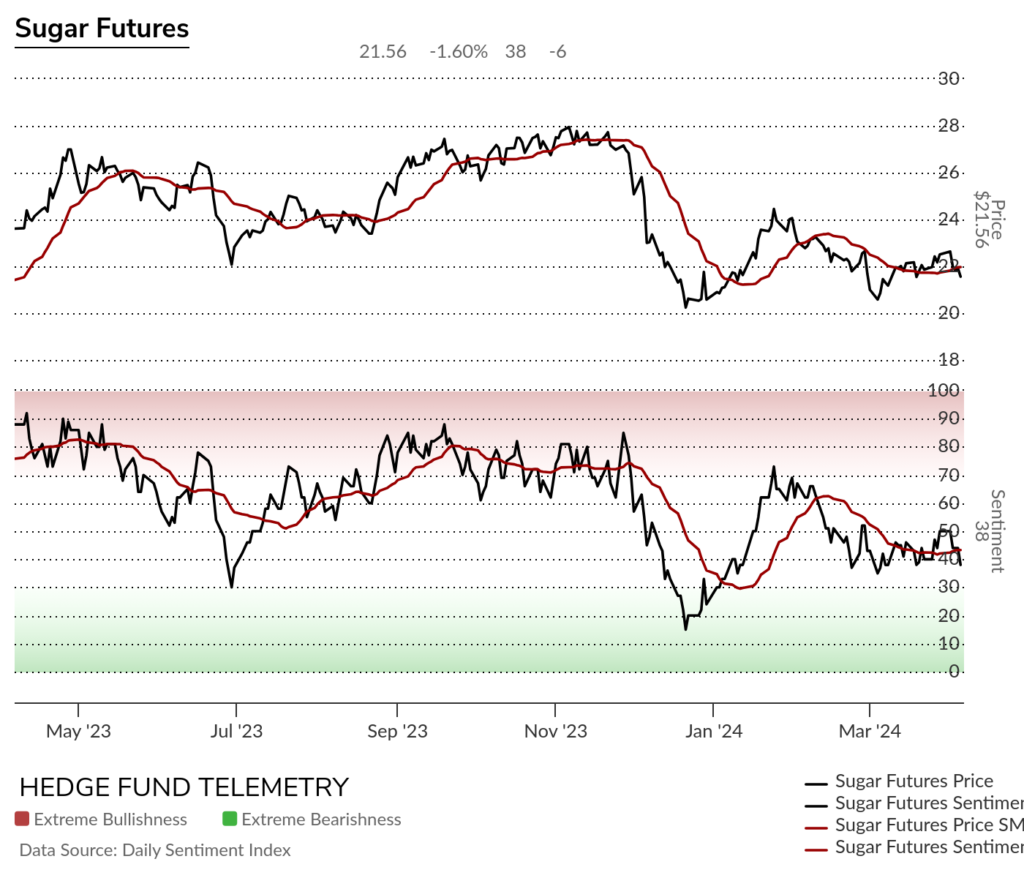

- Cotton and Sugar have been weak which is how I still see the charts.

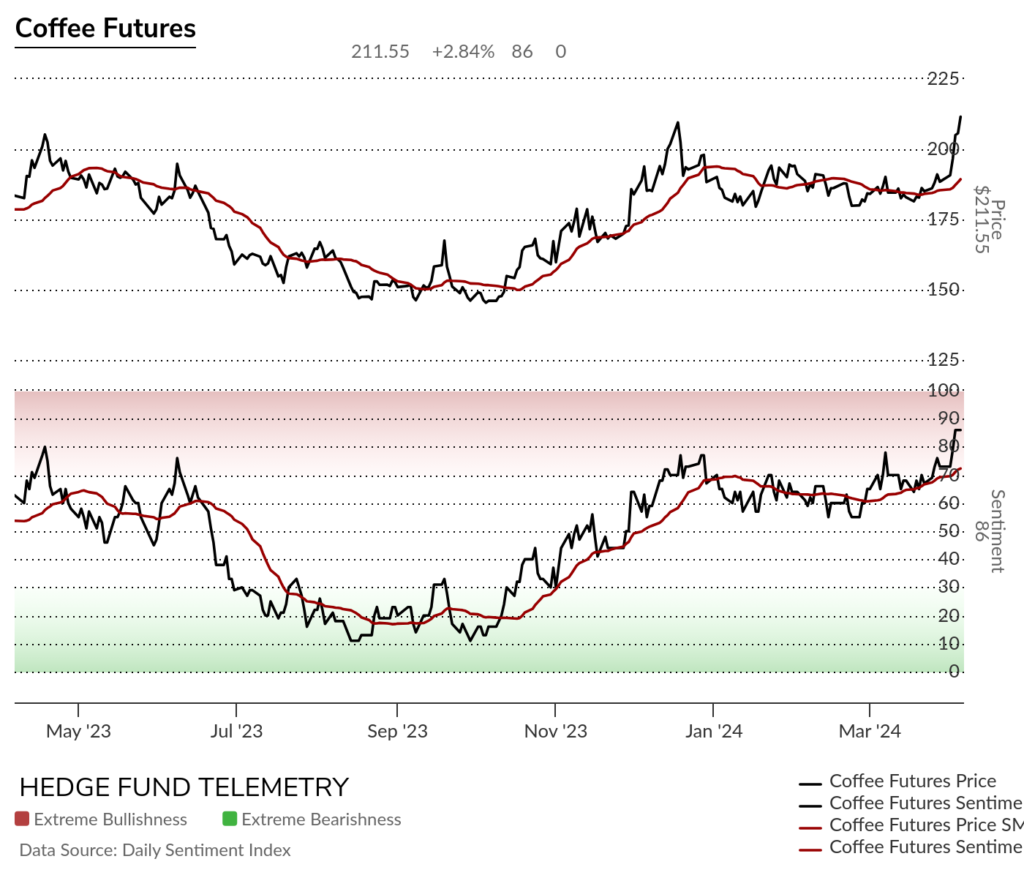

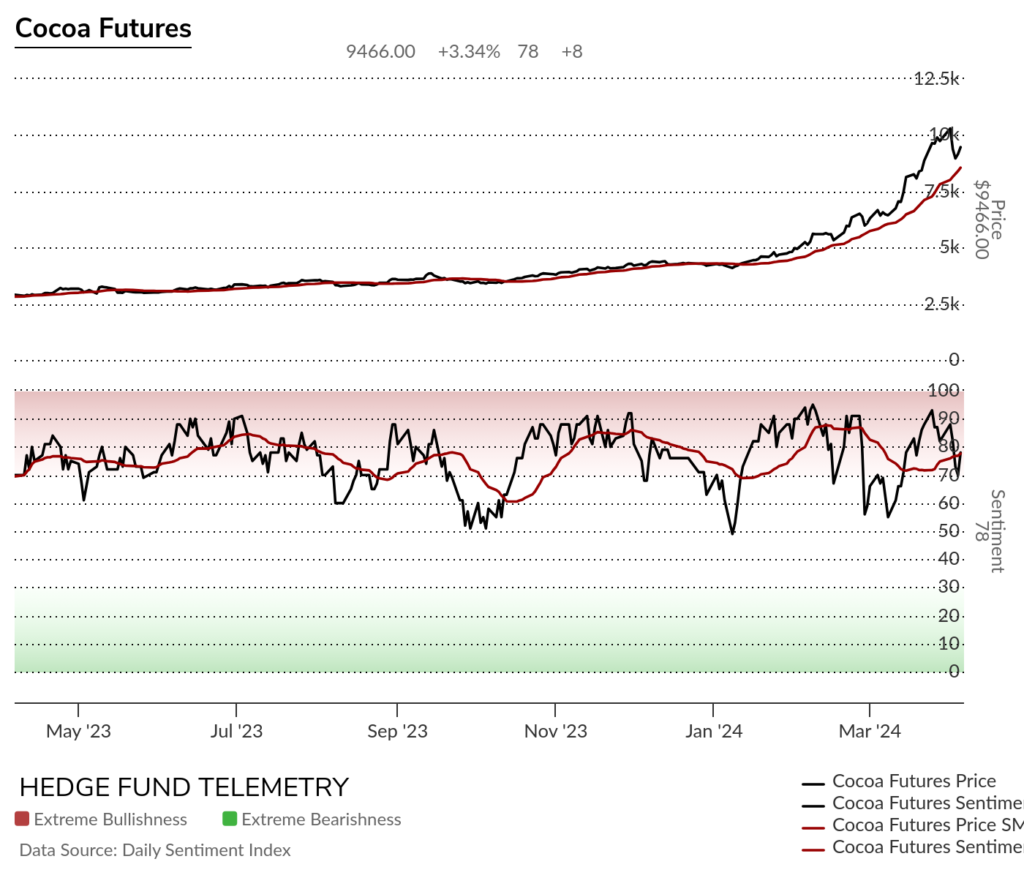

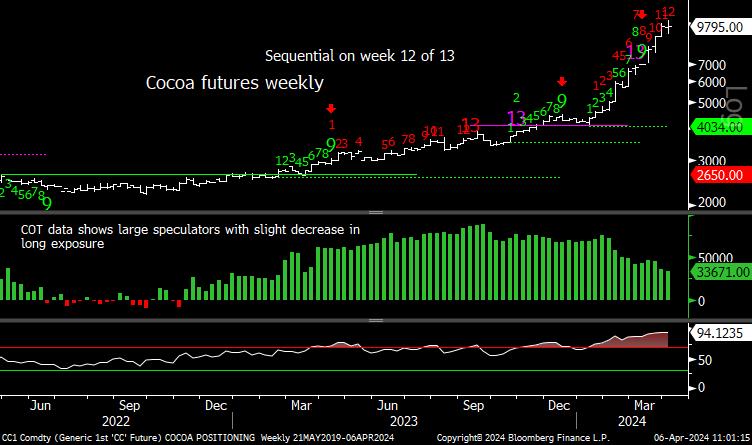

- Coffee did react positively with the recent DeMark Sequential buy Countdown 13 and is a little short term overbought. Cocoa has been the best performing commodity in the last 18 months could be getting closer to topping with weekly exhaustion nearing.

- Livestock has been mixed with Hogs higher with new Sell Countdown 13’s (and should be sold here) while Cattle reversed down after recent DeMark Sell Countdown 13’s.

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily is now overbought in the short term with new DeMark Combo sell Countdown 13’s in play with Sequential still in progress on day 10 of 13. RSI overbought.

Bloomberg Commodity Index Weekly has been working for six weeks with September highs in reach now.

DBC Commodity ETF is a current 4% weighted long position on the Trade Ideas sheet. Despite several upside price targets we’ve had surpassed and RSI overbought the Sequential on day 7 of 13 still remains favorable for continued upside. It’s in upside wave 3 of 5 so a higher low corrective wave 4 is possible. To qualify the wave 4, a 13 day closing low would have to occur and that might take some time with consolidation and not breaking the wave 2 low.

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY

Bloomberg Energy Index daily has been improving and is on day 6 of 9 with Setup. Upside Propulsion target and wave 3 price objective at 33.91 are achievable on this move.

The weekly using the standard setting for Sequential is on week 11 of 13.

Same chart with the 8 vs 5 Sequential setting. Sequential pending on week 6 of 13. The Sequential will continue on the upside when it moves above the 5th red bar close from last September.

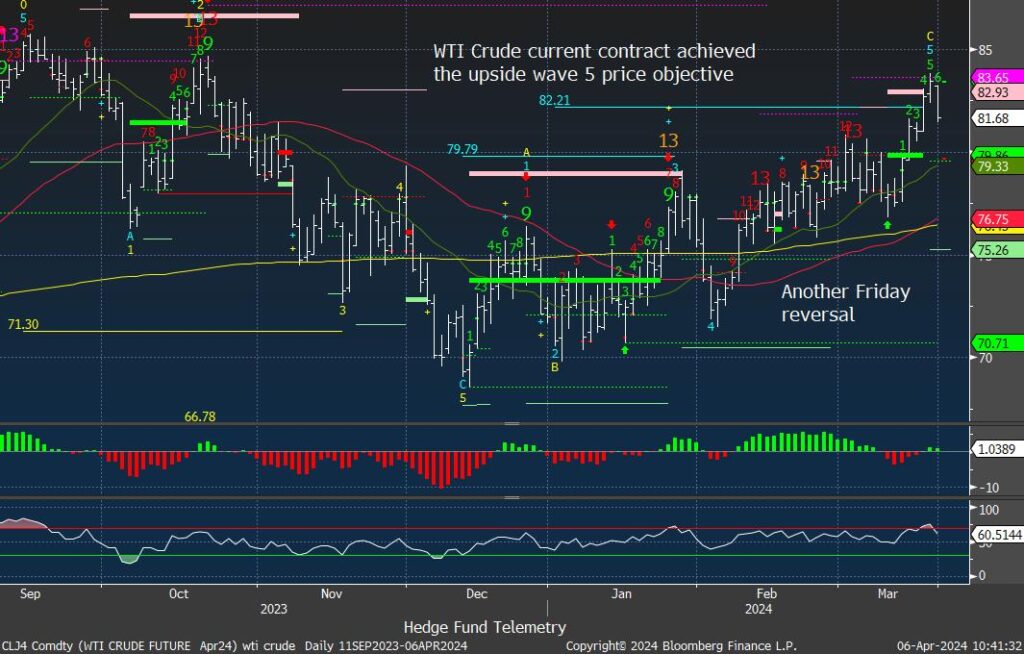

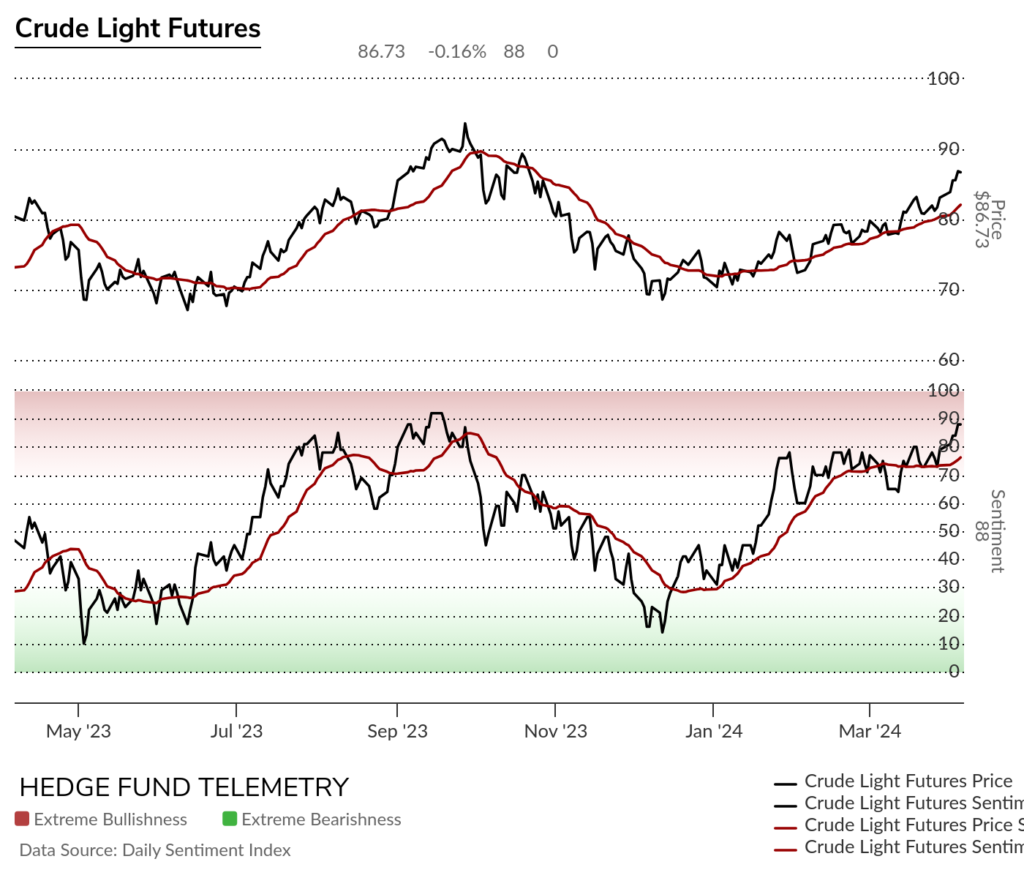

WTI Crude futures daily with another Friday pullback which has happened quite often. Overbought in upside wave 5.

WTI Crude futures bullish sentiment is nearing the peak levels seen last September at 91%.

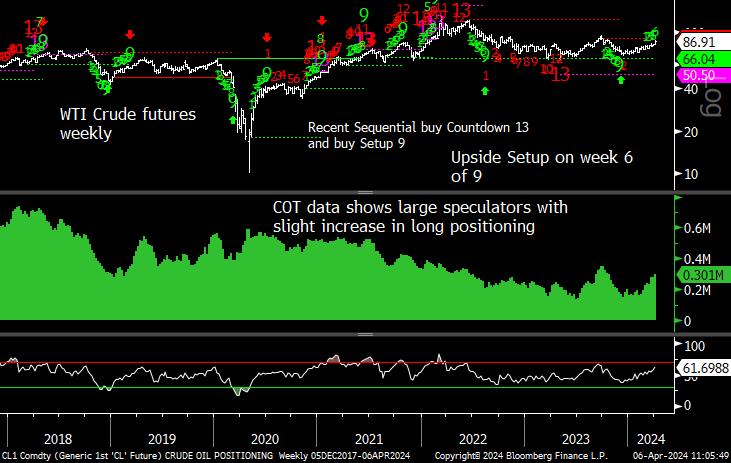

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Natural Gas futures daily lacks any upside momentum after several buy Countdown 13’s.

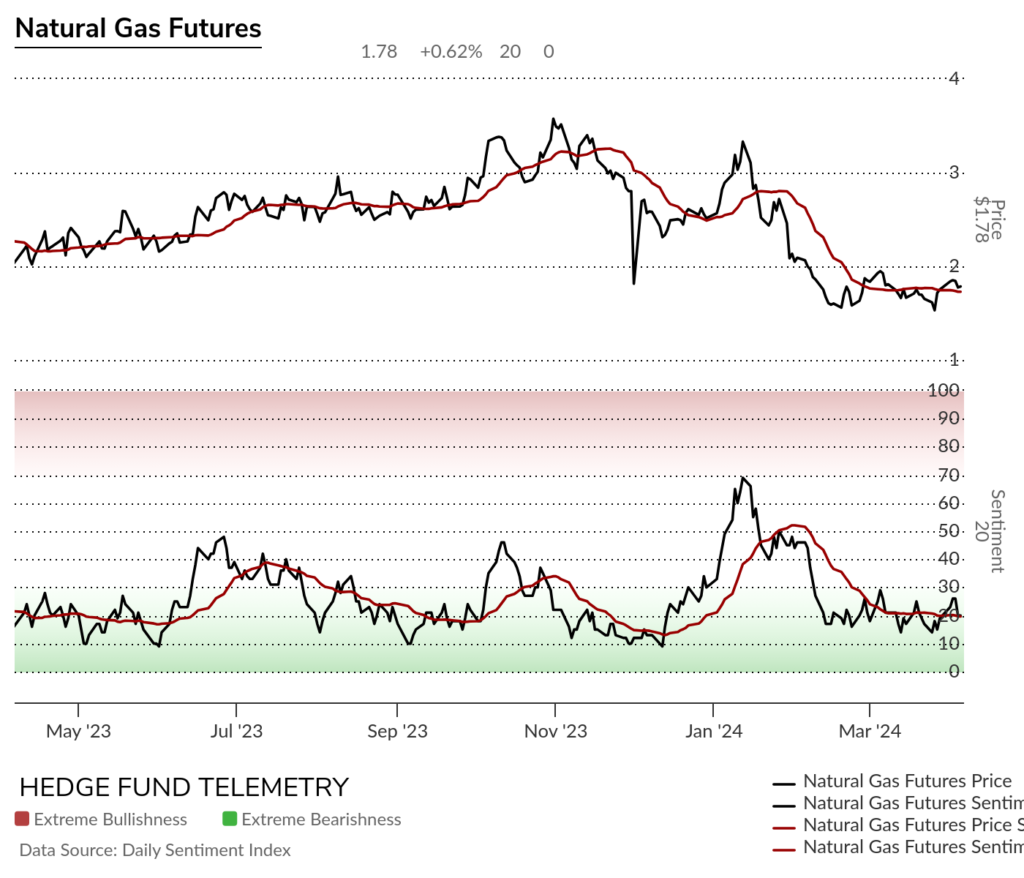

Natural Gas futures bullish sentiment remains under pressure

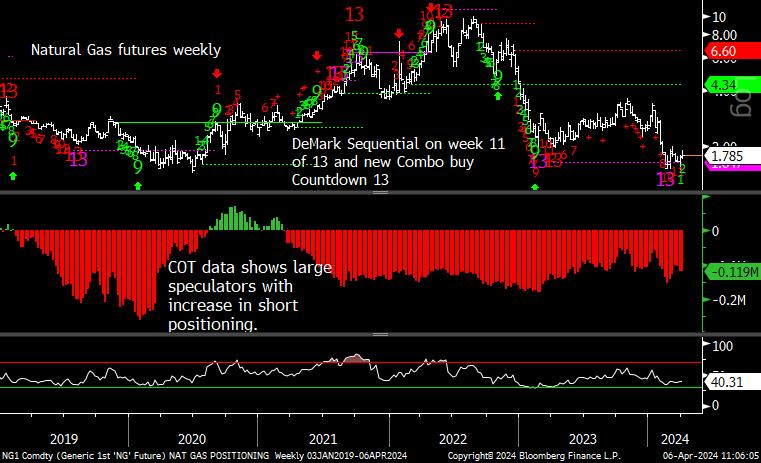

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Metals

Gold daily XAU/USD does have Sequential and Combo sell Countdown 13’s with Sell Setup on day 7 of 9. RSI is overbought at 86.

Gold futures has had a Sequential running behind the other Gold proxies. It’s on day 10 of 13 with other DeMark exhaustion signals.

GLD Gold ETF also with some DeMark exhaustion in play

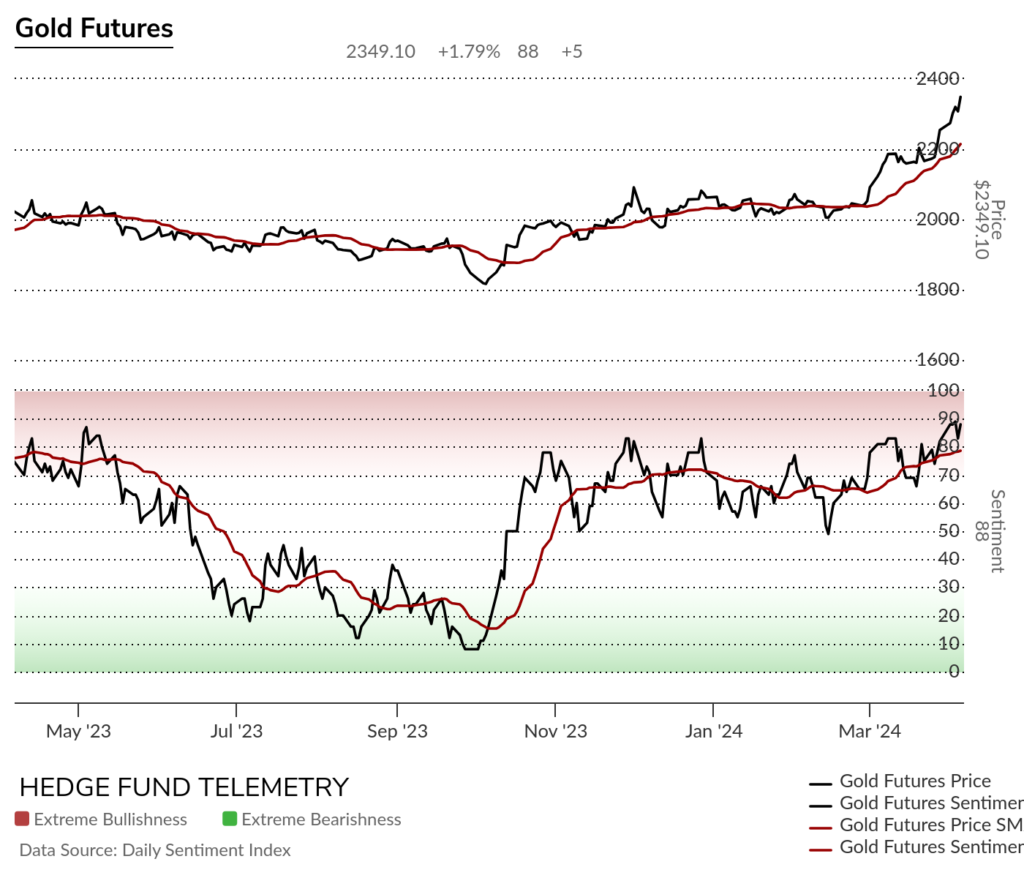

Gold bullish sentiment is at 88% and a move over 90% historically has seen peaks in price.

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Weekly Sell Setup on week 7 of 9 is could see top in next two weeks.

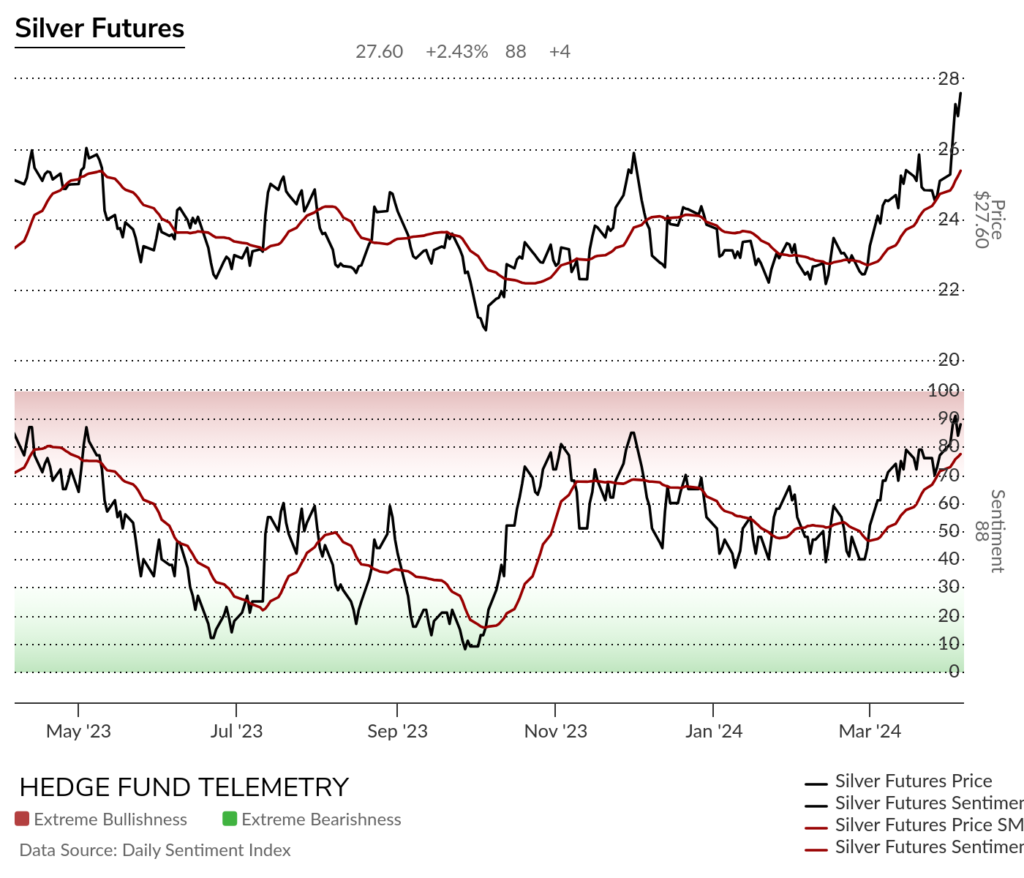

Silver daily has sell Setup on day 6 of 9. It’s overbought and should not be chased especially with extreme sentiment levels.

Silver bullish sentiment is extreme at 88% and a limiting factor.

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators will get a sell Setup 9 this week. And has seen price stall with previous 9’s.

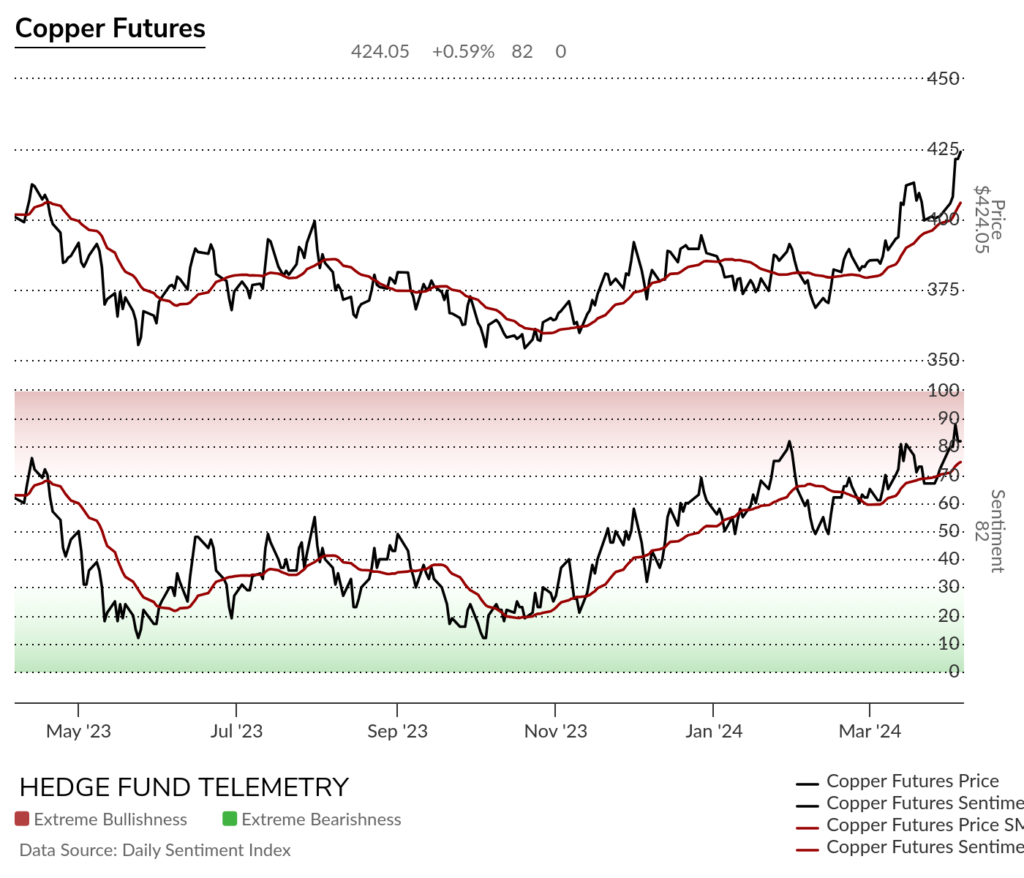

Copper futures daily

Copper futures bullish sentiment peaked near 90% which is a limiting factor.

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators should get weekly sell Setup 9 this week.

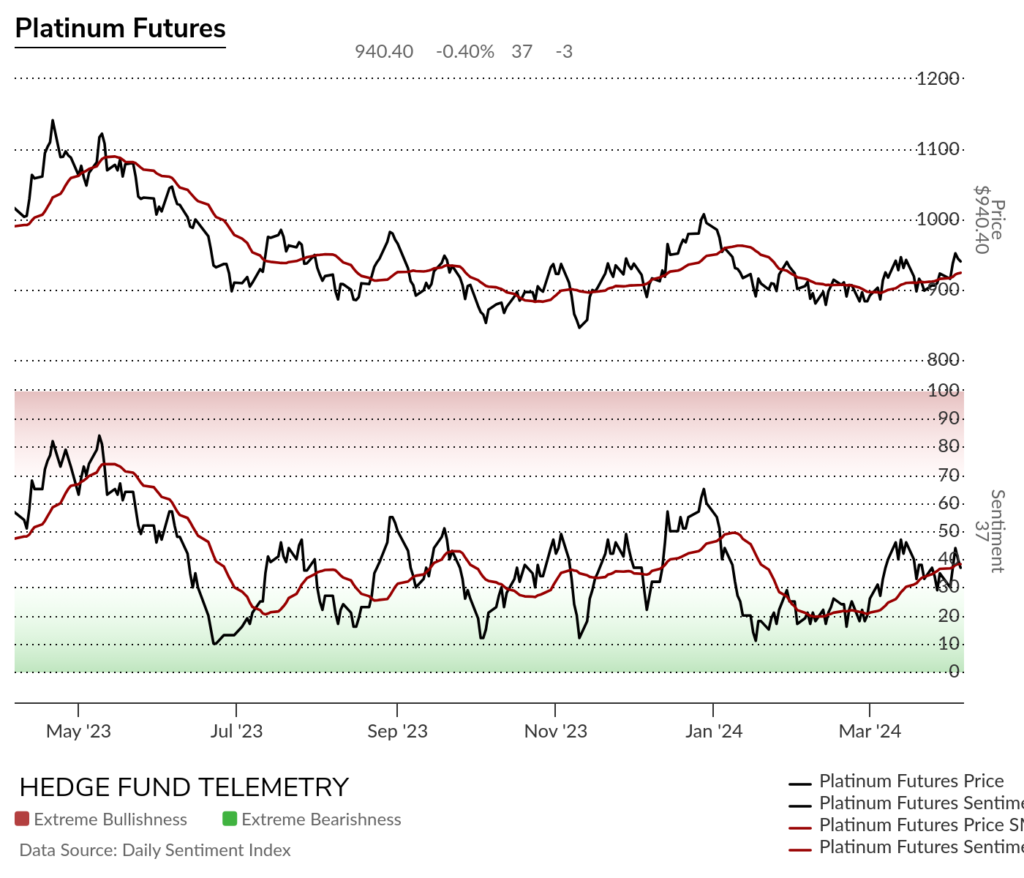

Platinum daily has an upside Sequential pending on day 6 of 13. Breakout level above 950

Platinum bullish sentiment has made higher lows but needs to clear 50% midpoint level.

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

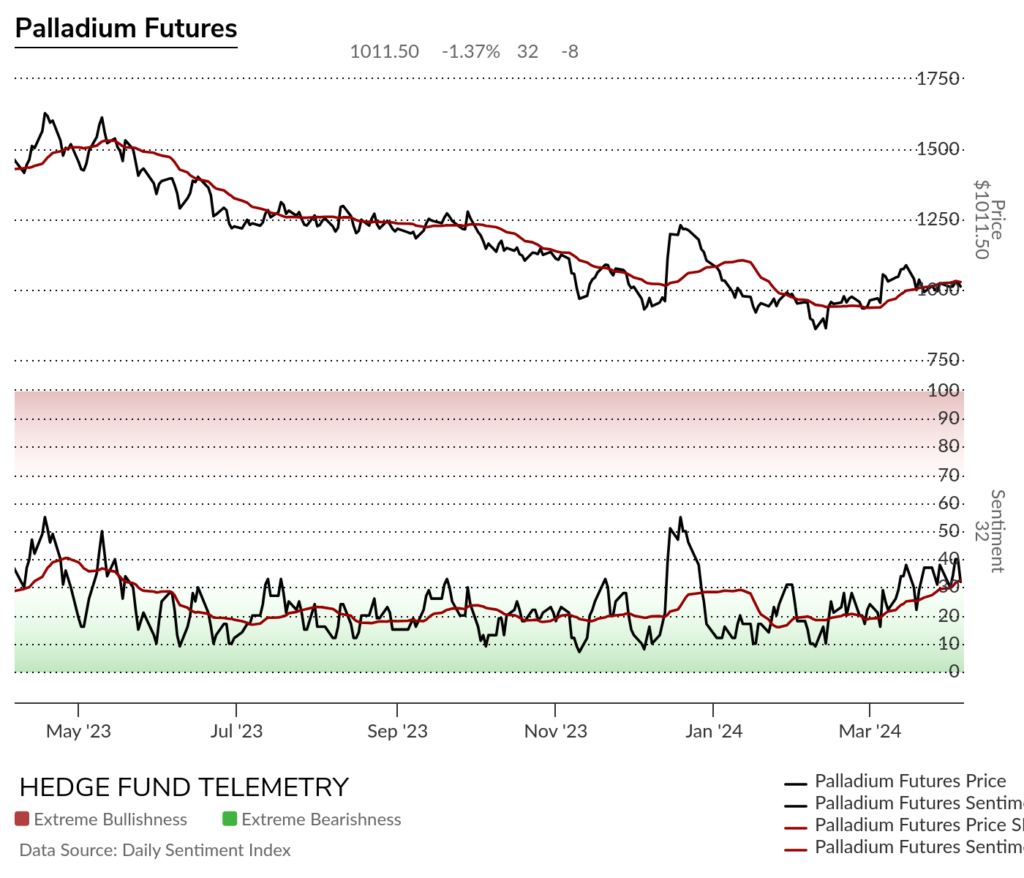

Palladium daily is trying to build a base although the big issue is clearing above the 200 day

Palladium bullish sentiment choppy but trying to move higher

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

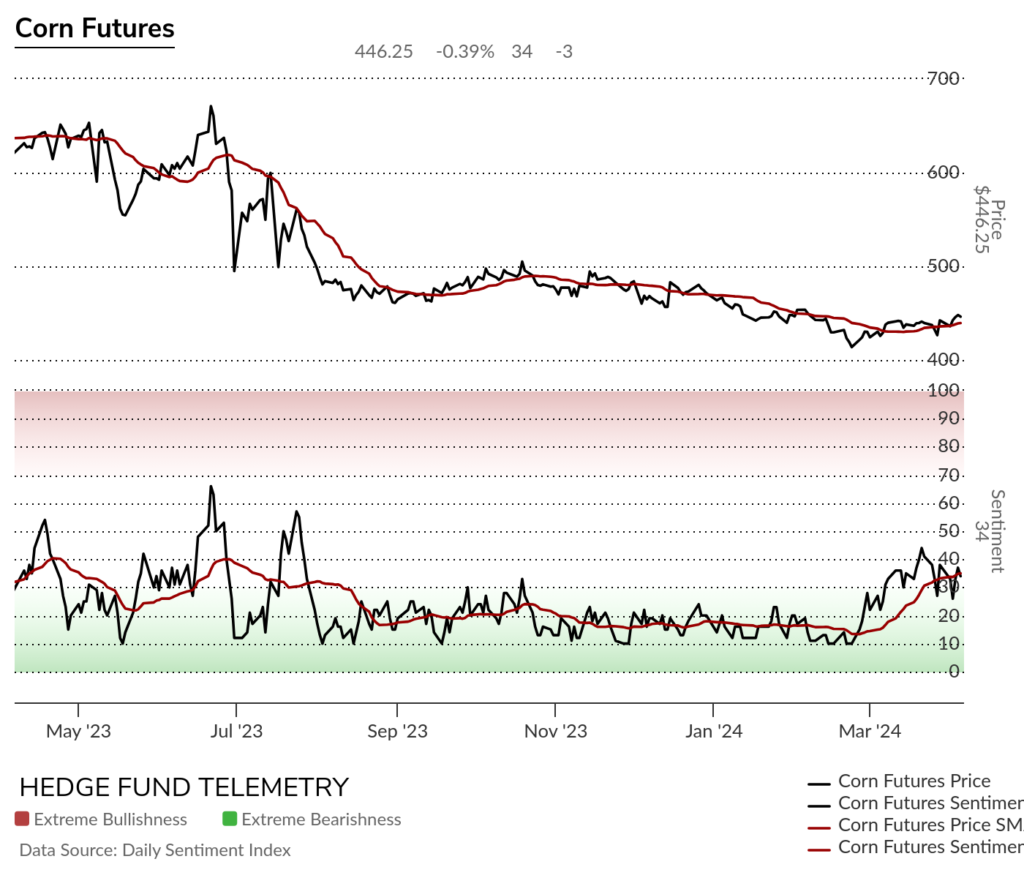

Corn futures daily still looks OK as a buy but the lingering secondary Sequential gives me a little pause. A move above 450 would be a convincing breakout.

Corn futures bullish sentiment stalled

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

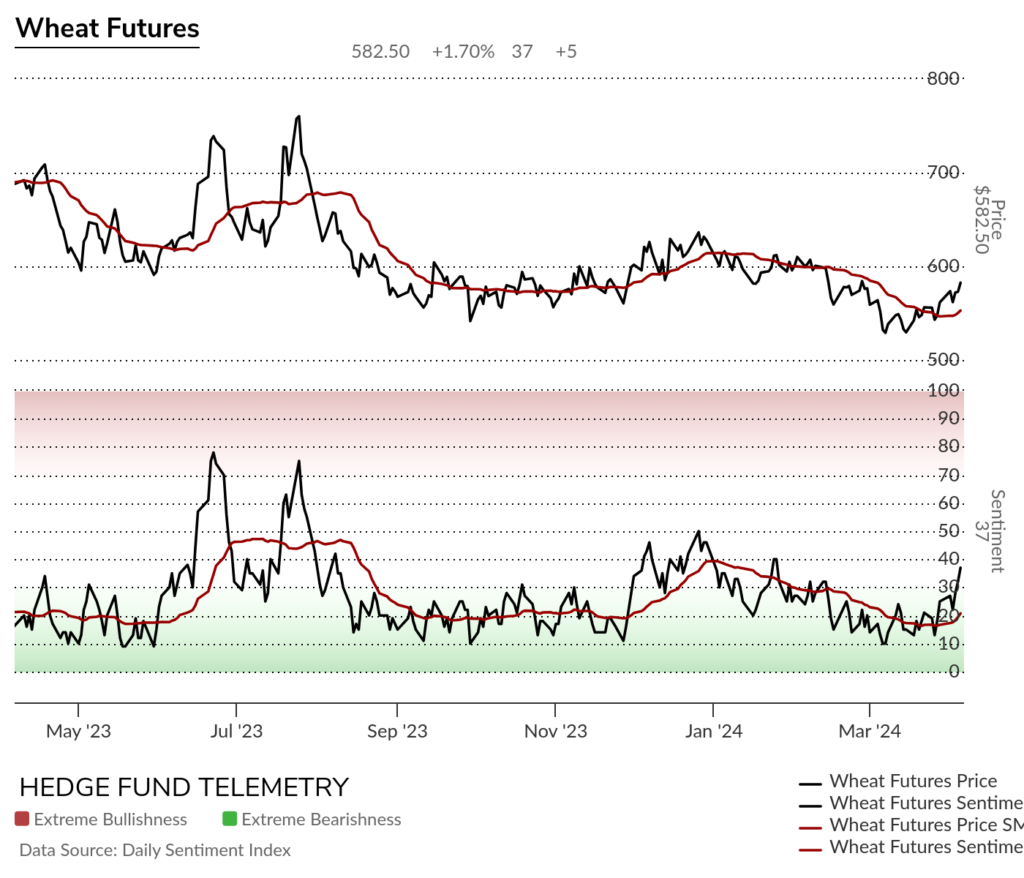

Wheat futures daily has been making progress on the upside. I’m going to say give this a shot on the long side as the benefit of the doubt is the the upside.

Wheat futures bullish sentiment is starting to show signs of life

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

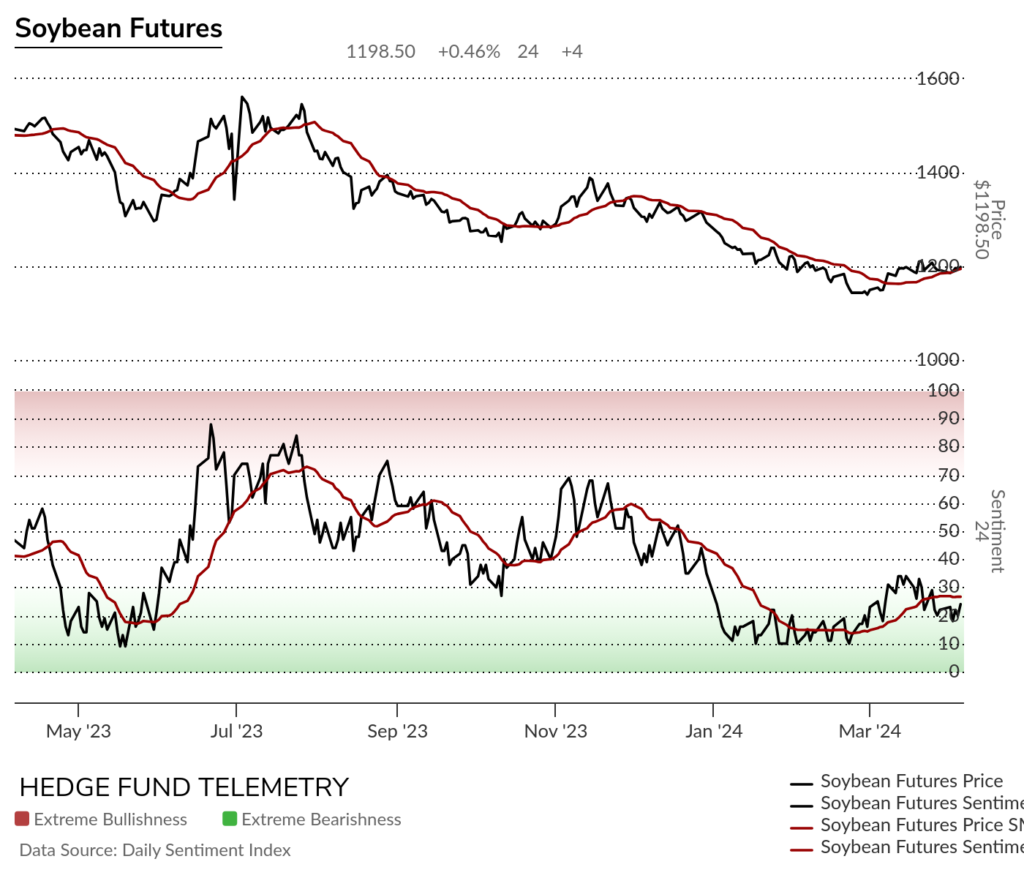

Soybean futures daily lost some of the start of momentum and a buy Setup 9 is possible. I still think this can work higher.

Soybean futures bullish sentiment lost some momentum but might have made a higher low. Now a higher high is needed for upside conviction to increase.

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

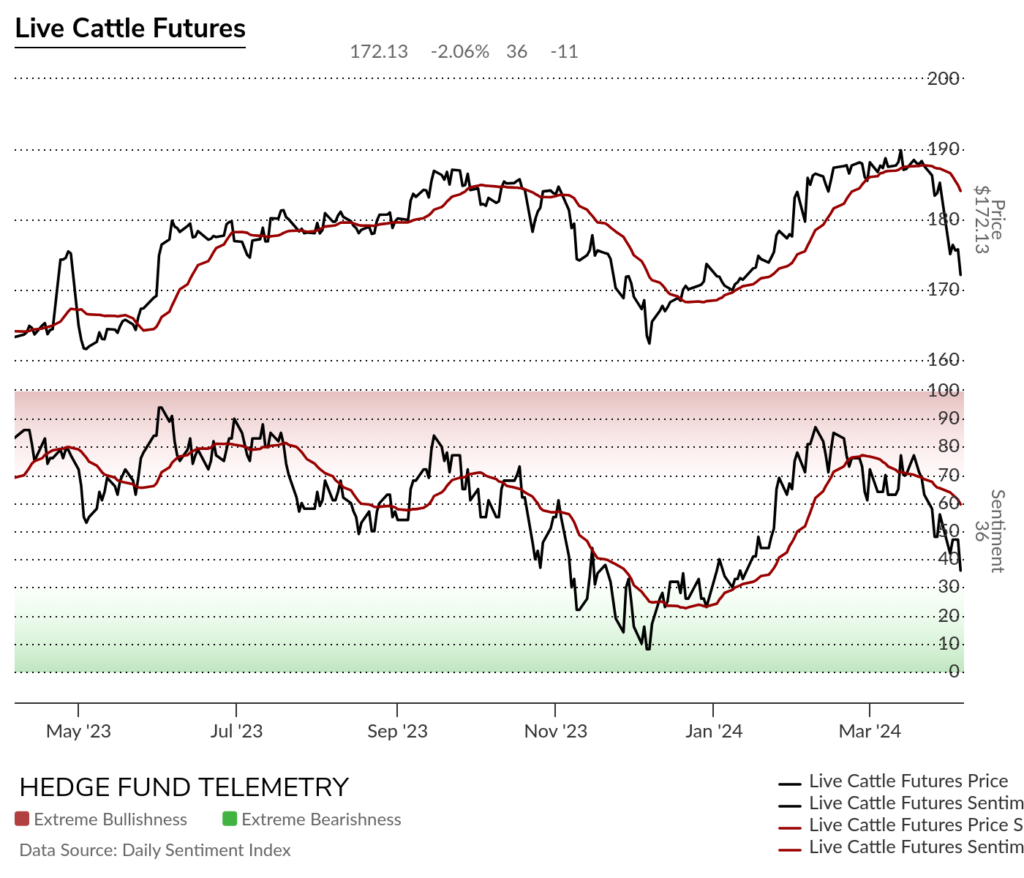

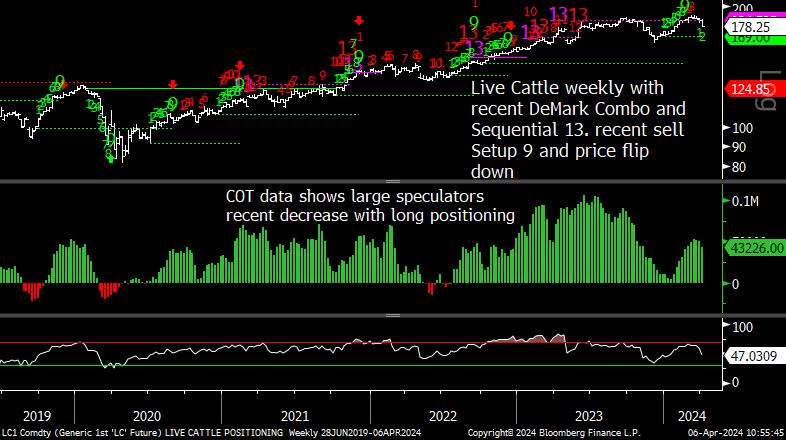

Live Cattle futures daily topped with recent exaustion signals and might continue lower with a new Sequential Countdown starting.

Live Cattle futures bullish sentiment has been weakening and broke lower last week

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

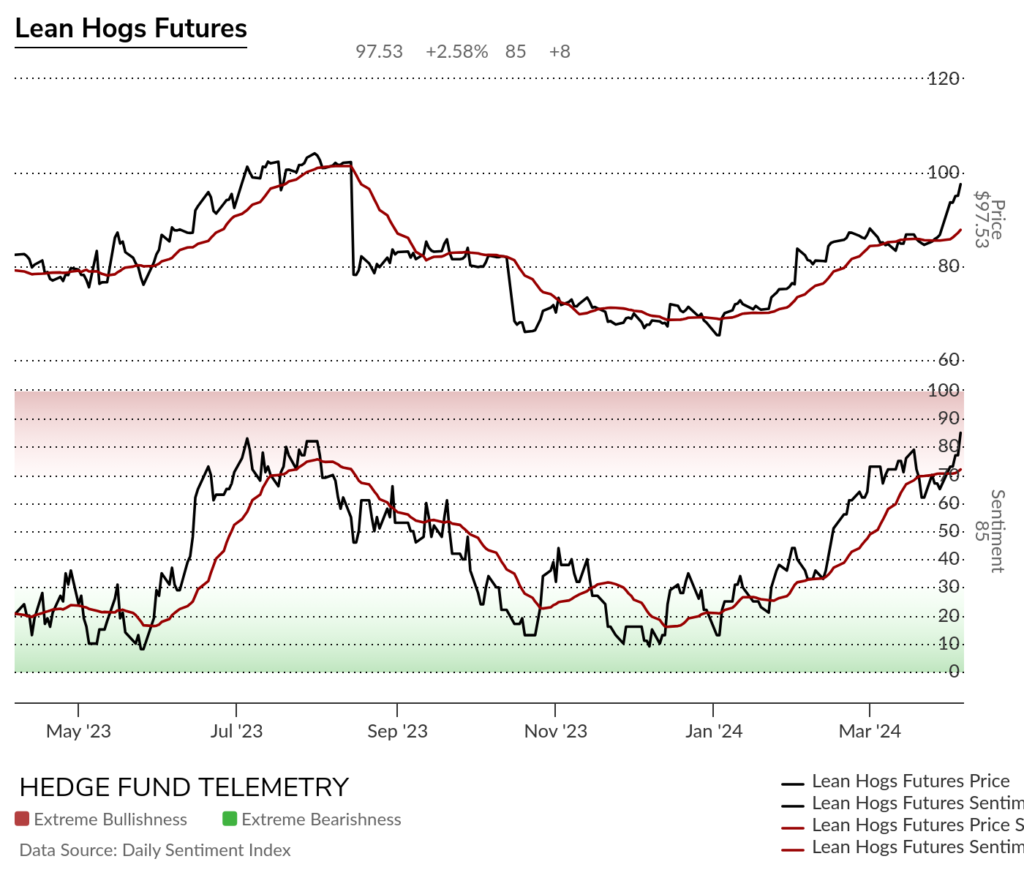

Lean Hogs futures daily is overbought with new Sell Countdown 13’s and sell Setup 9

Lean Hogs bullish sentiment made a one year high in the extreme zone

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

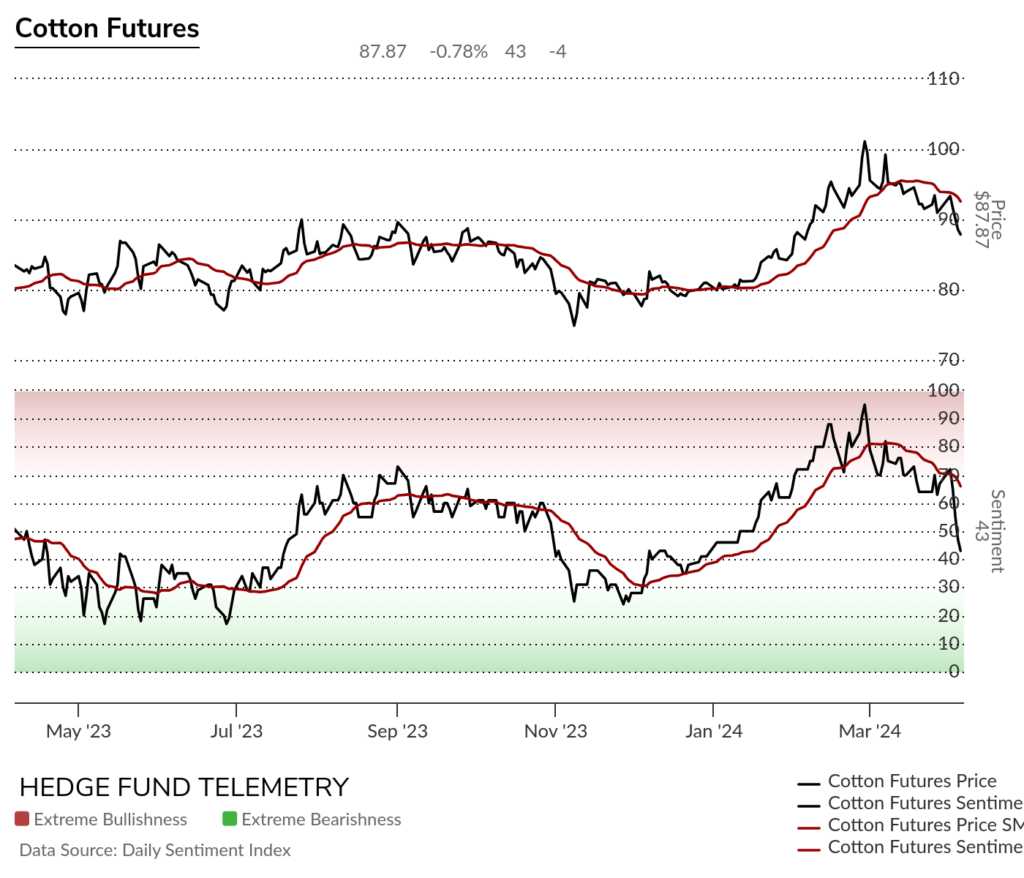

Cotton futures daily has been on my list of those that should reverse and it continues lower.

Cotton futures bullish sentiment has been declining and broke 50% convincingly after recent peak over 90%

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Coffee futures daily did have the Sequential 13 work with a spike into wave 5 of 5.

Coffee futures bullish sentiment in the extreme zone again.

Sugar futures daily has a lower high wave 2 of 5 still awaiting a new low but that might not happen if the Sequential pending on day 10 of 13 qualifies the 13.

Sugar futures bullish sentiment has made lower highs at near term support again.

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Cocoa futures daily with possible Combo 13 top but let’s see if the Sequential sell Countdown 13 can qualify soon.

Cocoa futures bullish sentiment is starting to chop with support at 70% then 60%.

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. With weekly Sequential on week 12 of 13 a top is possible soon.

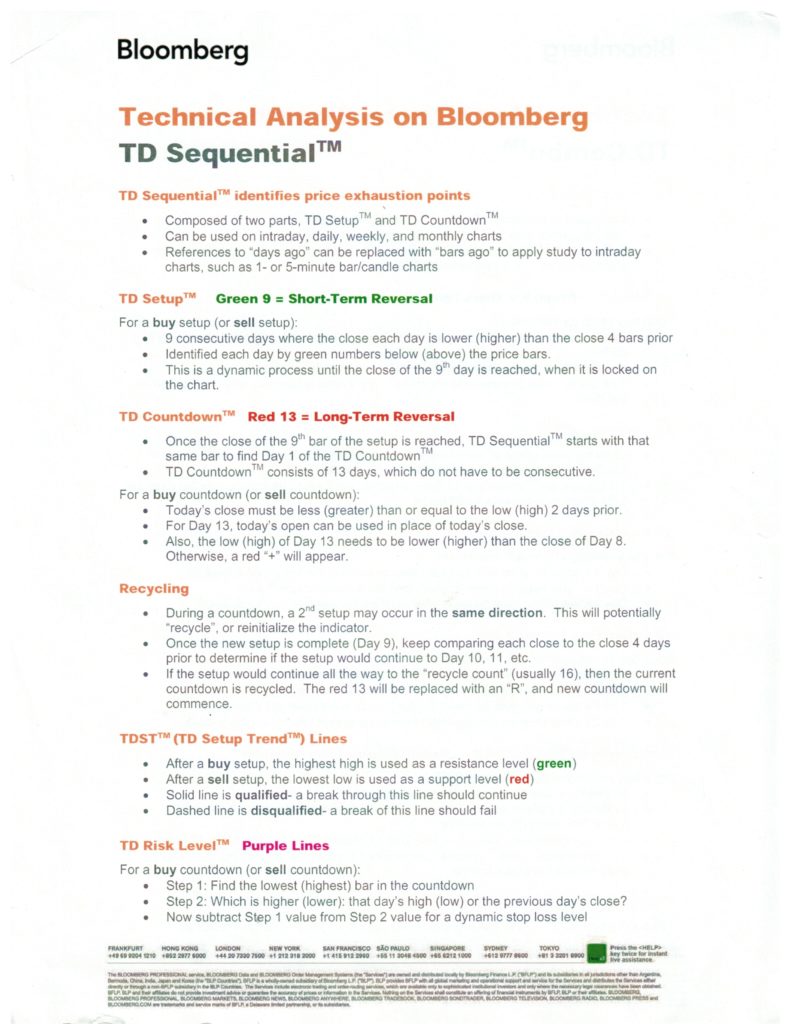

DeMark Sequential Basics

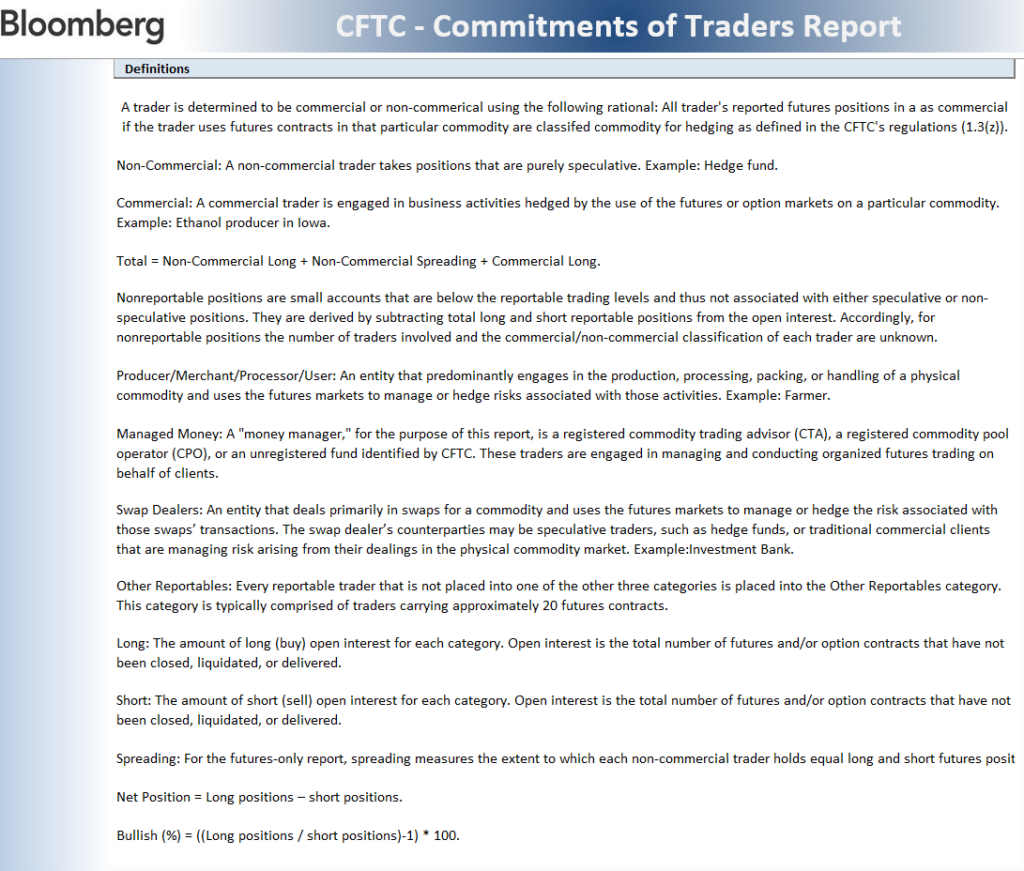

DETAILED COMMITMENT OF TRADERS DEFINITIONS