Highlights and themes

- Dollar strength has continued overall although the DXY Index and Bloomberg Dollar index failed to hold above the near term resistance levels.

- Dollar bullish sentiment remains in a favorable position.

- Euro and Pound charts are tightly wound holding clear support again.

- Yen weakness continues to be a concern with USDJPY 152 as the alarm bell level

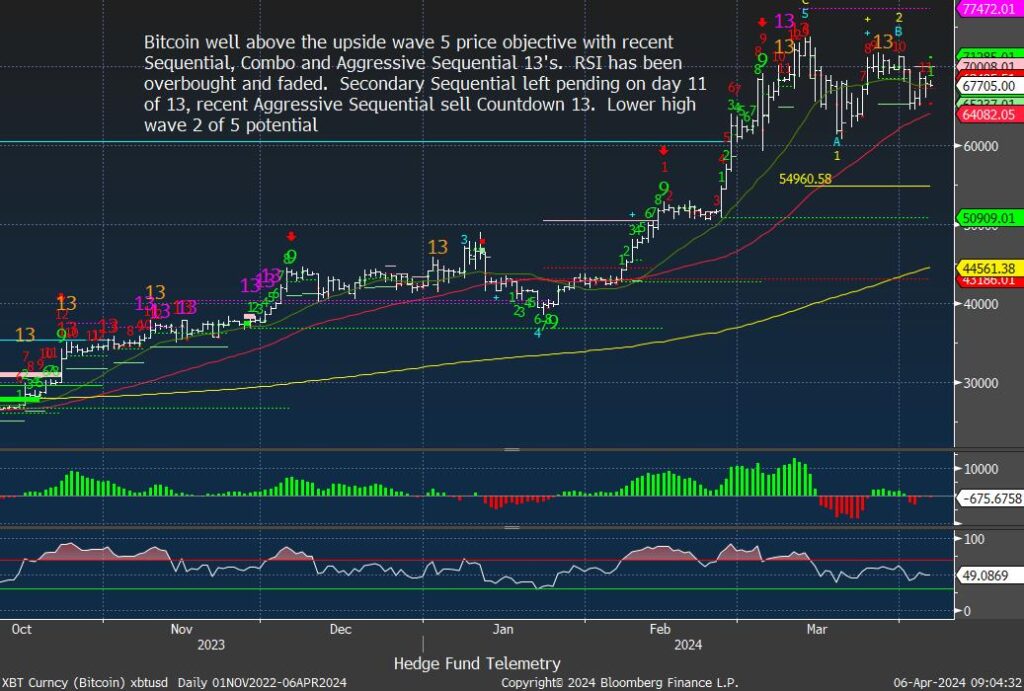

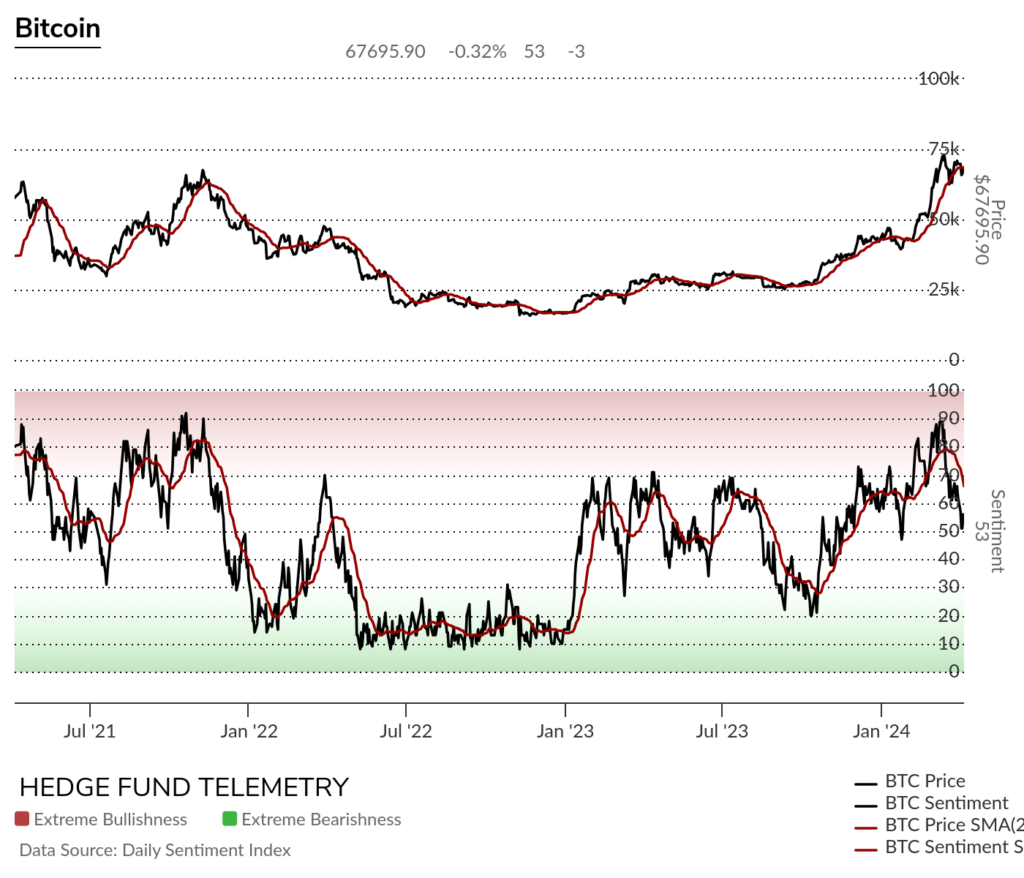

- Bitcoin bullish sentiment peaked at 89% recently and fell down to the 50% level.

- Bitcoin has a potential lower high bounce still in progress while Ethereum looks weaker.

Comments on charts. If you have questions or would like more context, please email.

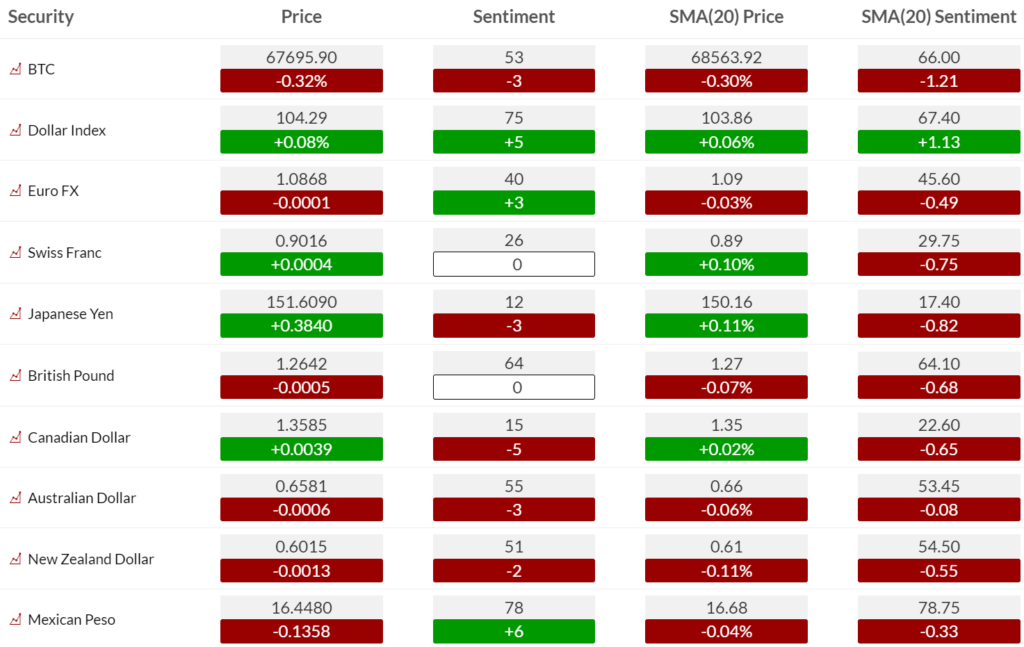

Currency Sentiment Overview

Currency sentiment highlights has seen mixed action with US Dollar strength and some divergence with Bitcoin sentiment vs price action. Yen sentiment remains under pressure which has been something that is nothing new with Yen.

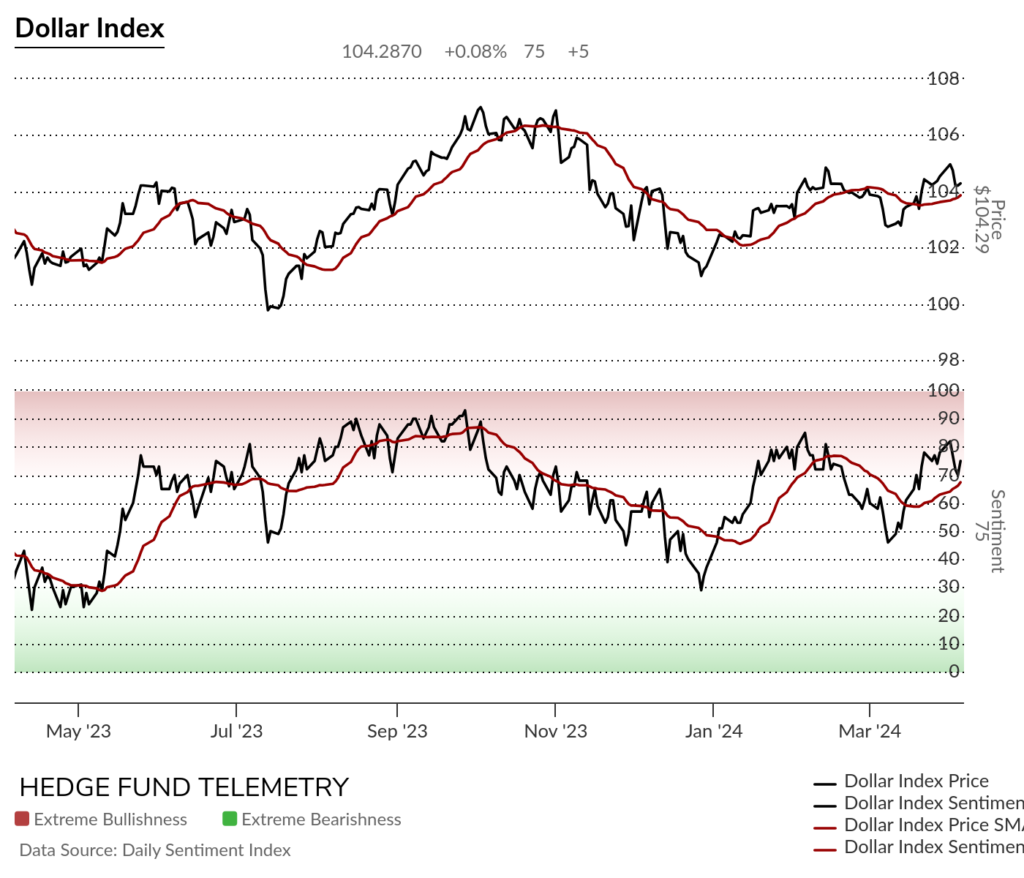

US Dollar Indexes

DXY US Dollar Index daily failed to hold above the 105 breakout levels however an upside Sequential Countdown remains pending.

DXY US Dollar Index weekly has been a bit of mixed picture with a downside Sequential and upside Setup.

Bloomberg US Dollar Index daily backed off late in the week also failing to clear the resistance.

Bloomberg US Dollar Index weekly is similar with a mixed picture to the DXY weekly

US Dollar bullish sentiment bounced off the 50% level and moved back into the extreme zone >80% and backed off but remains with a bullish picture.

US Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

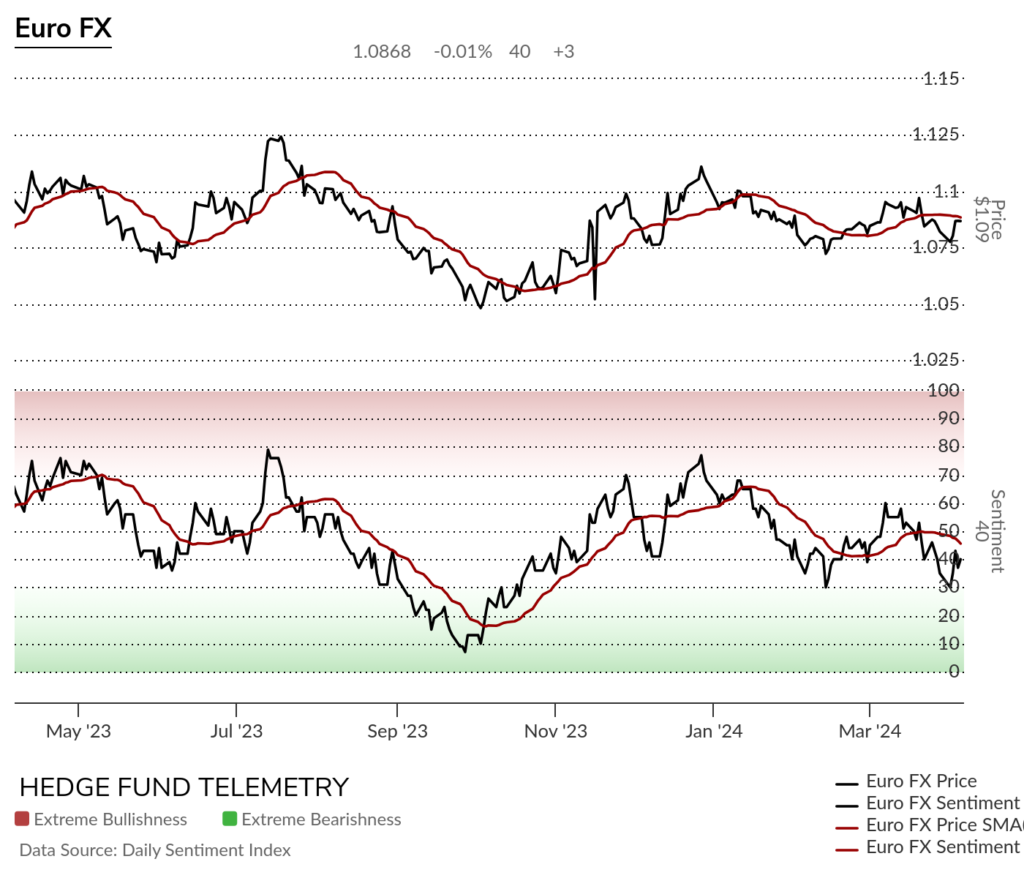

Major USD Crosses

EURUSD Euro / US Dollar bounced last week and remains tightly wound.

Euro bullish sentiment has been under some pressure but not moving to oversold levels.

Euro Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

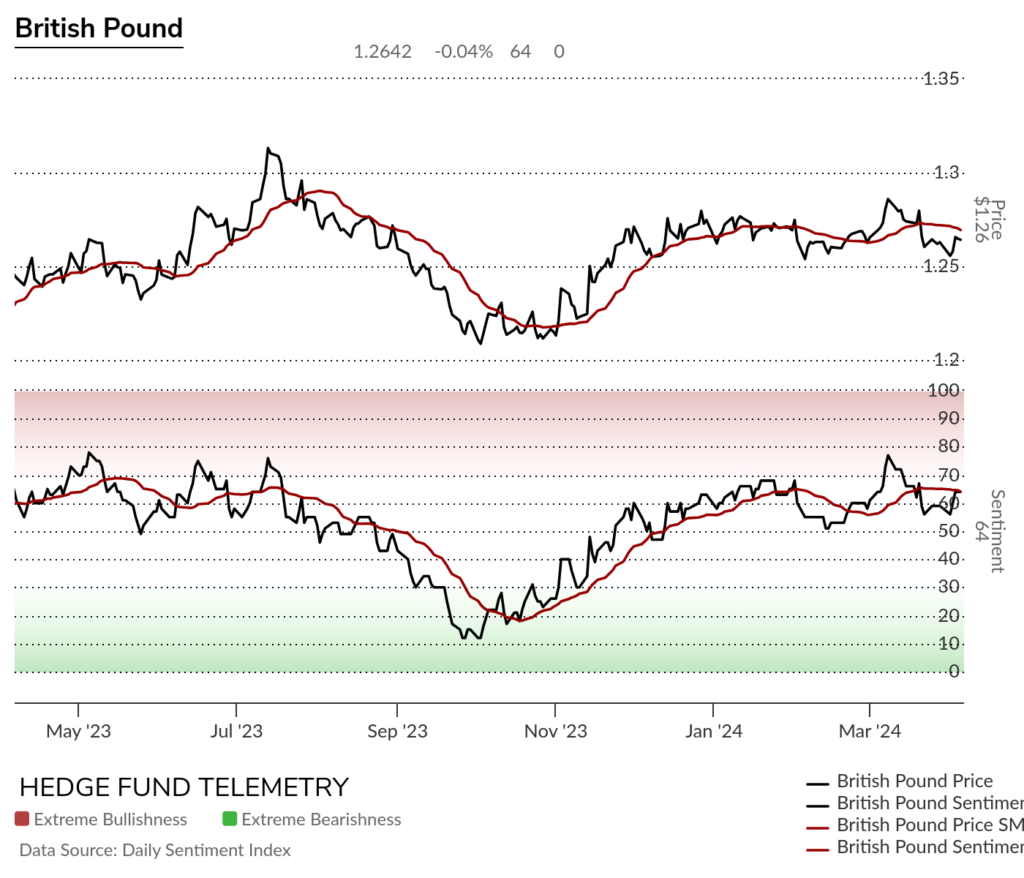

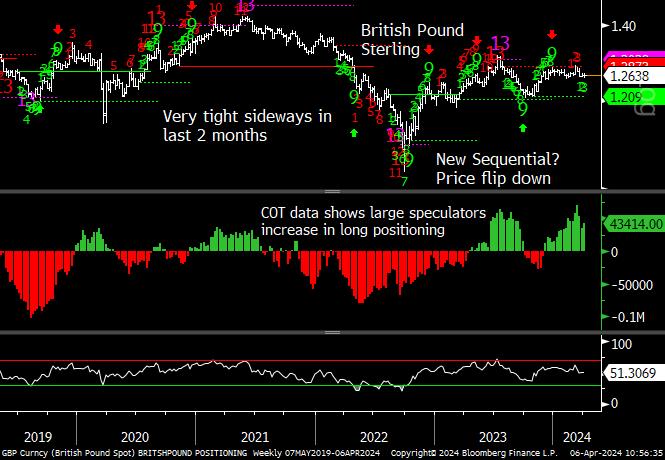

GBPUSD British Pound Sterling / US Dollar is also tightly wound holding recent support

British Pound Sterling bullish sentiment also has held the 50% support level

British Pound Sterling Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

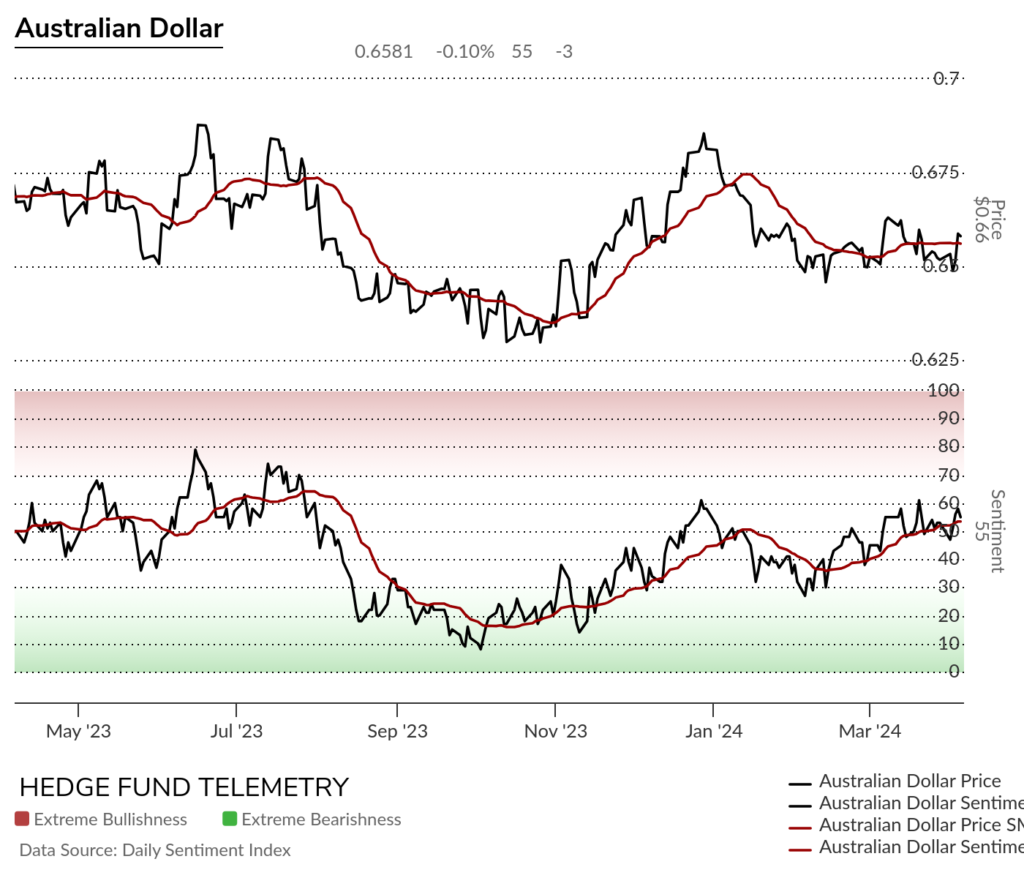

AUDUSD Australian Dollar / US Dollar is getting tightly wound too holding recent support.

Australian Dollar bullish sentiment has made higher lows but failed at 60% again.

Australian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

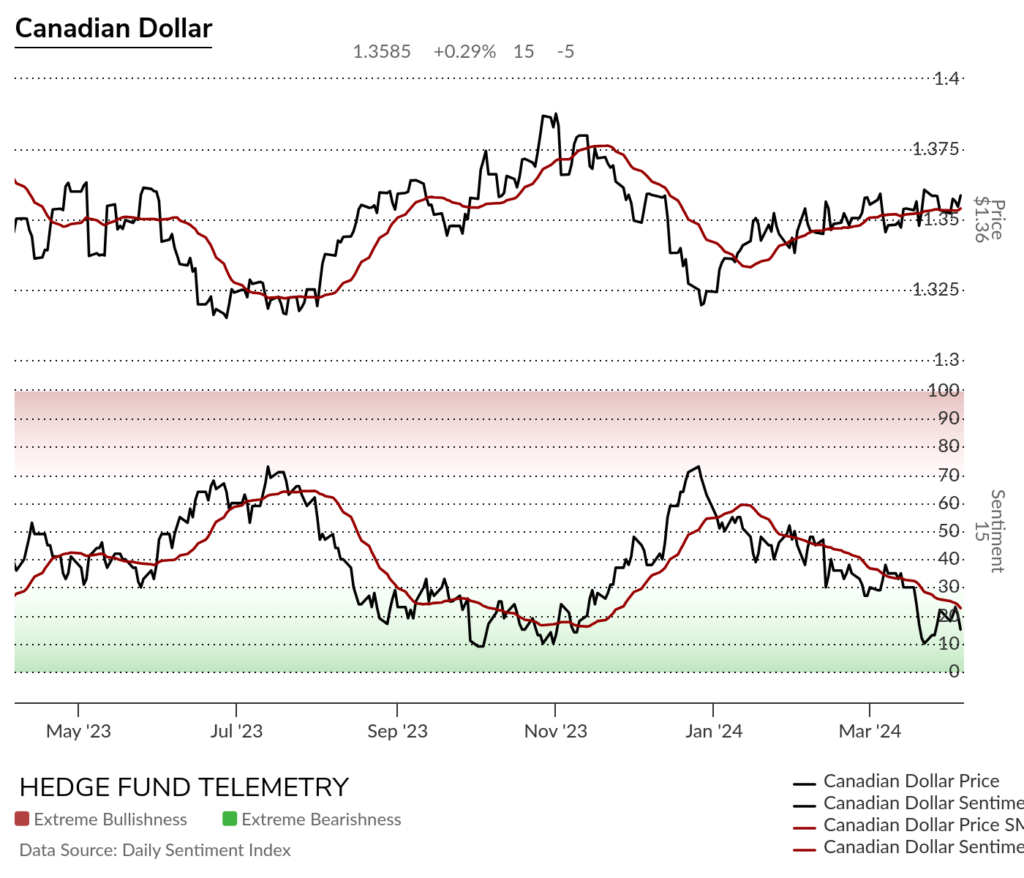

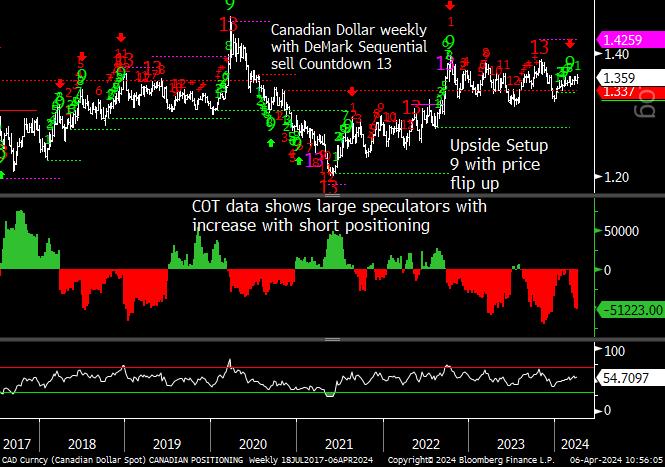

USDCAD US Dollar / Canadian Dollar tried to make a move but gave it back on Friday. Canadian Dollar remains under some pressure vs USD.

Canadian Dollar bullish sentiment has been under pressure

Canadian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

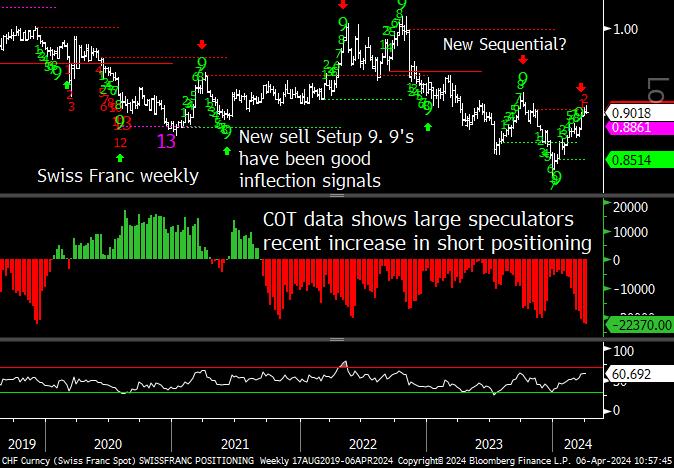

USDCHF US Dollar / Swiss Franc had recent Sequential sell Countdown 13 with price flip down.

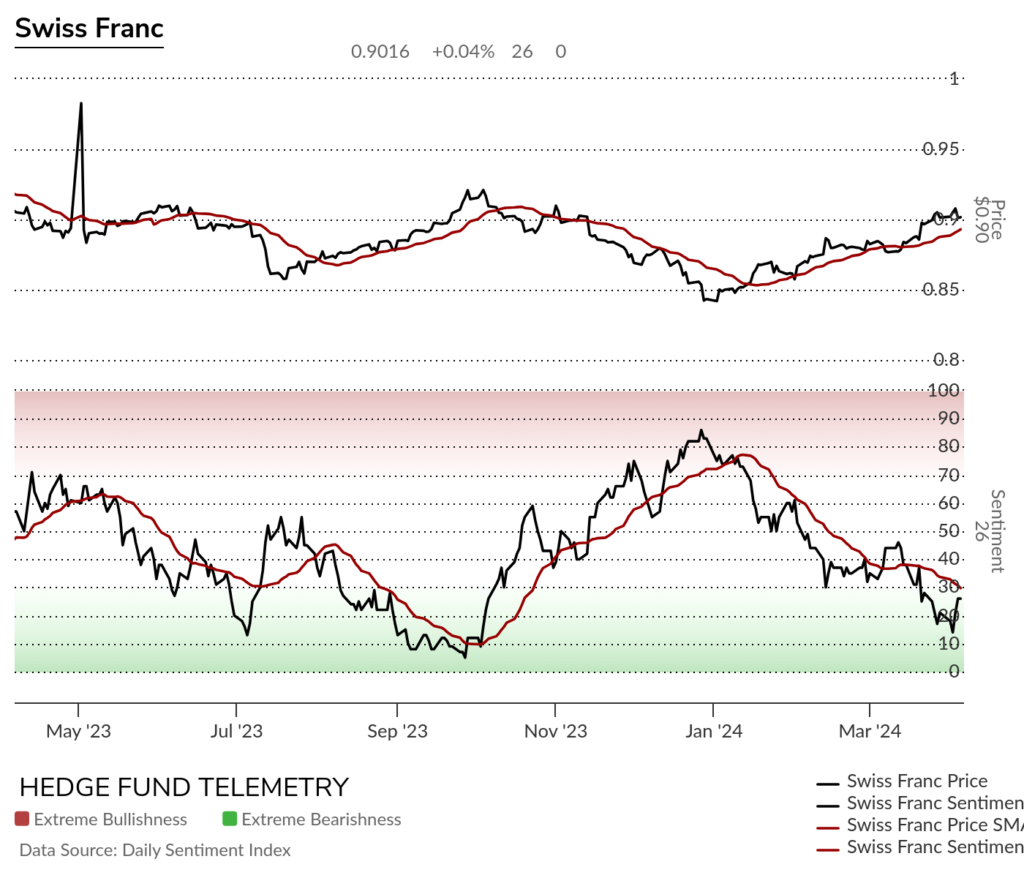

Swiss Franc bullish sentiment has been under pressure and bounced late in the week off oversold levels.

Swiss Franc Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDJPY Japanese Yen daily has recent DeMark Sequential 13 and sell Setup 9. 152 remains the alarm bell level to watch if the Yen weakens more.

Japanese Yen bullish sentiment has been under pressure and has seen periods of pressure on the downside.

Yen Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. A new record amount of short positioning.

Crypto

Bitcoin daily has a potential lower high wave 2 with Sequential pending on day 11 of 13. A move over 71 and the 8th red bar close would qualify the Sequential 13.

Bitcoin bullish sentiment over the past three years shows the peaks in sentiment.

Ethereum looks weaker vs BTC with a downside Sequential pending on day 3 of 13 with downside wave 3 qualified and a potential downside wave 3 price objective of 2812.

Three major Yen crosses

All remain in an upside trend vs Yen

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

USDBRL US Dollar / Brazilian Real

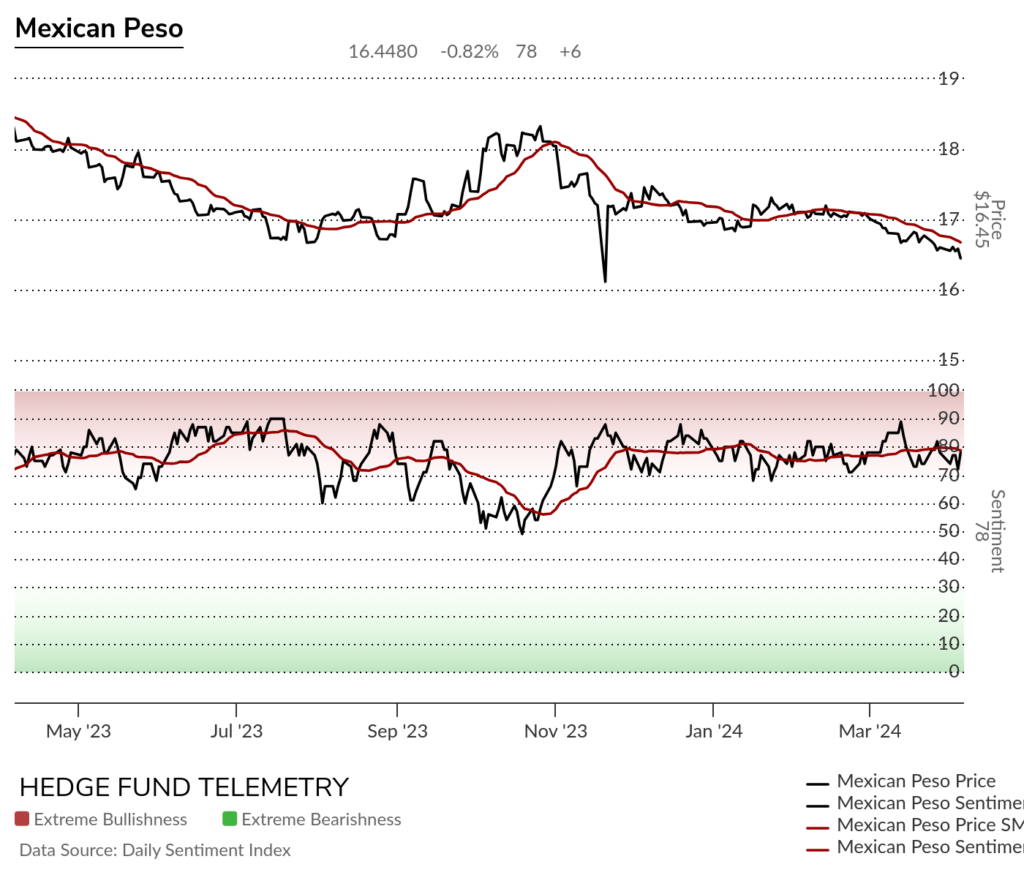

USDMXN US Dollar / Mexican Peso continues to show strength with Peso

Mexican Peso bullish sentiment has remains in the elevated or extreme zone for well over a year.

Mexican Peso Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDZAR US Dollar / South African Rand

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan) did qualify the Sequential 13 over a week ago.

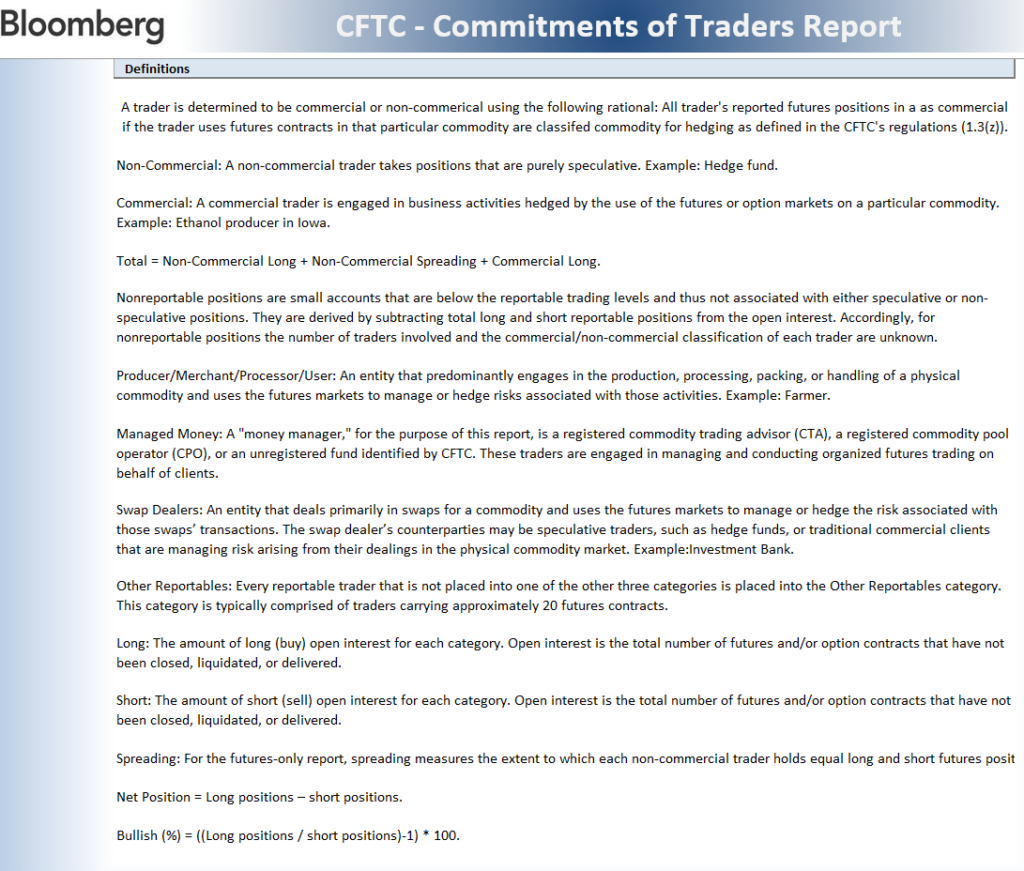

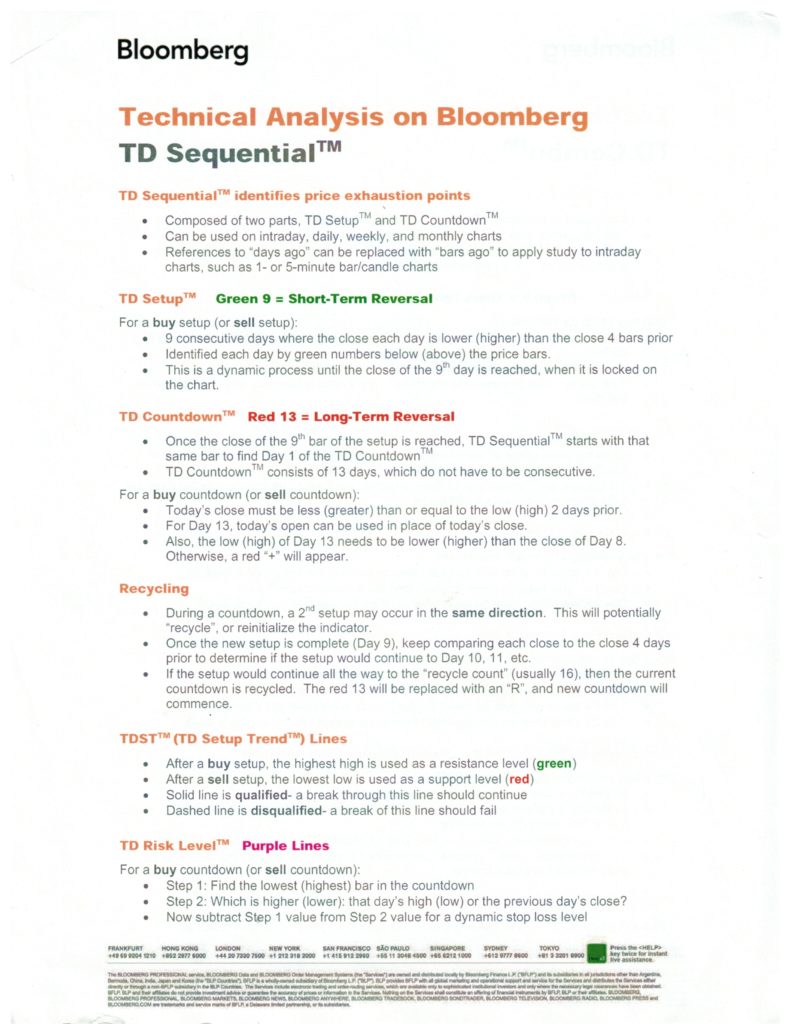

DeMark Sequential Basics from Bloomberg

Detailed Commitment of Traders explanation