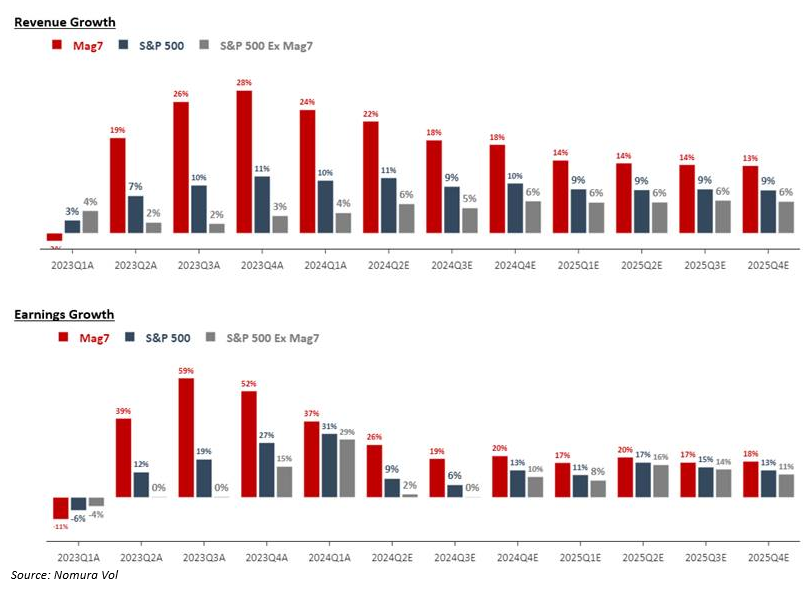

I didn’t have a clear read on a few companies reporting today, but here are some for the rest of the week, including Nvidia – the magnificent one, which will be a binary event for the markets. I grabbed this chart from Nomura with revenue and earnings growth, which is expected to gradually decline through 2025. I believe the risk is greater than earnings growth, slowing a lot more in 2025.

I am going to add today a 2% weight short with BBY. With a few others reporting tomorrow, I will decide whether to do anything after the NVDA and the more important market response. I will have another note out today.

As usual, I have Adam from Vital Knowledge’s take on metrics and expectations. My charts, implied moves with historical earnings data, finished with positioning with Erlanger research short data and Options Rank. The recent short interest was just released, with NYSE and Nasdaq increasing by 2% each as shorting the downside occurred, and the recent bounce squeezed those shorts out, as I have shown with the GS Most Shorted basket. There was heavy put-buying on the lows, possibly contributing to the squeeze on the bounce. Green dots = heavy put buying, and Red dots = heavy call buying. We believe this is a good counter-trend read as traders buy puts/calls usually heavily after the move is complete.

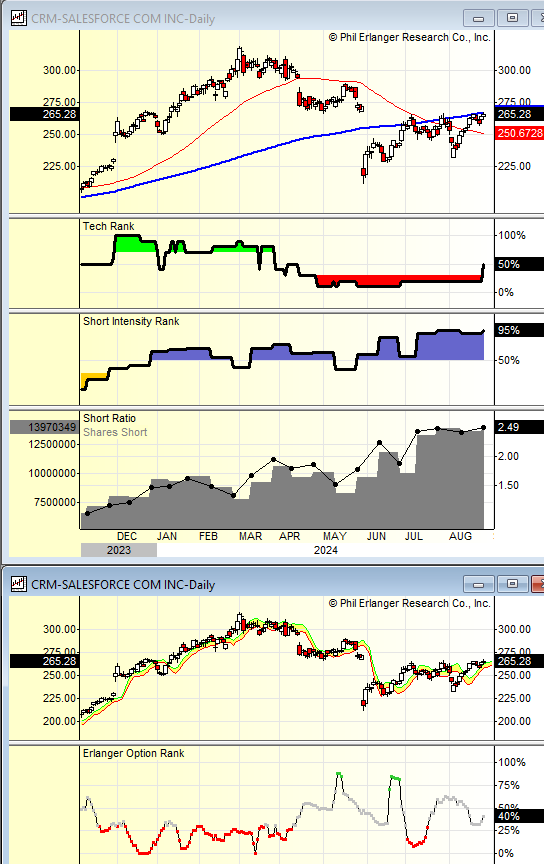

- CRM (Salesforce) FQ2 earnings preview (reports Wed 8/28 after the US close) – the stock was hit following the FQ1 report back in May after mgmt. acknowledged some modest macro headwinds, but sentiment remains bullish on the story, and most feel the company won’t trim its guidance further. For FQ2, the Street is looking for FXN sales growth of ~7.75% w/cRPO FXN growth of ~8.1%, op. margins of 31.95%, and EPS of 2.36.

Last quarter CRM reported a messy quarter and gapped down hard. Recall I was long the smallest weight 1% and was sunburned. The bounce now has another low high with recent DeMark Sequential sell Countdown 13 and sell Setup 9. A lot of people expect the same result to be unlikely as last quarter. I will sit this one out.

The implied move is 7%

Short interest is higher this quarter with 2.5 days to cover. The Options Rank is neutral. The options traders were correct on this one last quarter.

- CRWD (CrowdStrike) FQ2 earnings preview (reports Wed 8/28 after the US close) – sentiment was dealt a blow by the recent IT outage but if mgmt. provides reassurance that the incident isn’t causing more than a near-term financial setback, there will be plenty of people eager to buy the stock given the company’s favorable secular outlook. For FQ2, the Street is looking for EPS of 98c with sales +30.85% to $957.5MM, net new ARR of ~$202MM, and op. margins of 21.8%.

CRWD is oversold due to the software upgrade disaster. It’s bounced and could have made a lower high although it’s still over the 20 day so if you are long 245-250 is a clear stop level. Considering the fallout from the software problem is unknown, this one is hard to call until after hearing from management. Sidelines for me.

The implied move is 8.7% and they have had nearly 4 recent quarters with 10%+ moves

Short interest has dropped with shorts covering the drop. Nearly 2 days to cover. On the Options Rank traders bought puts after the downside move with the green dots. It’s now set up neutral.

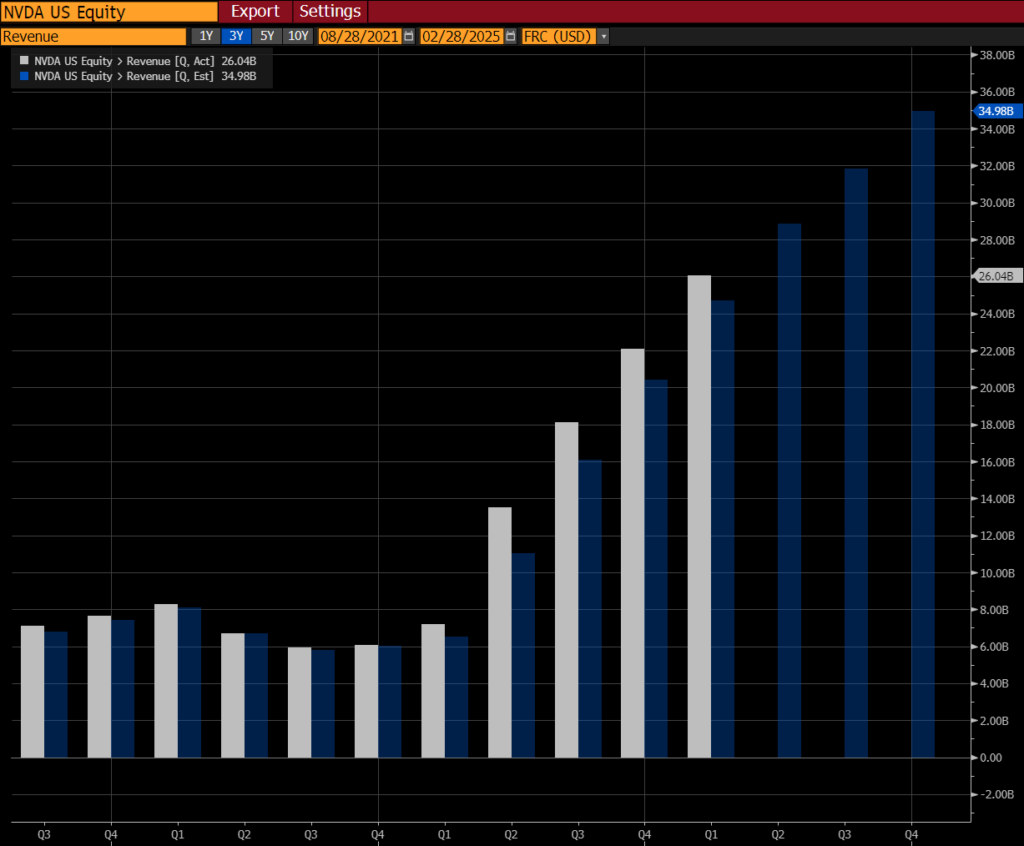

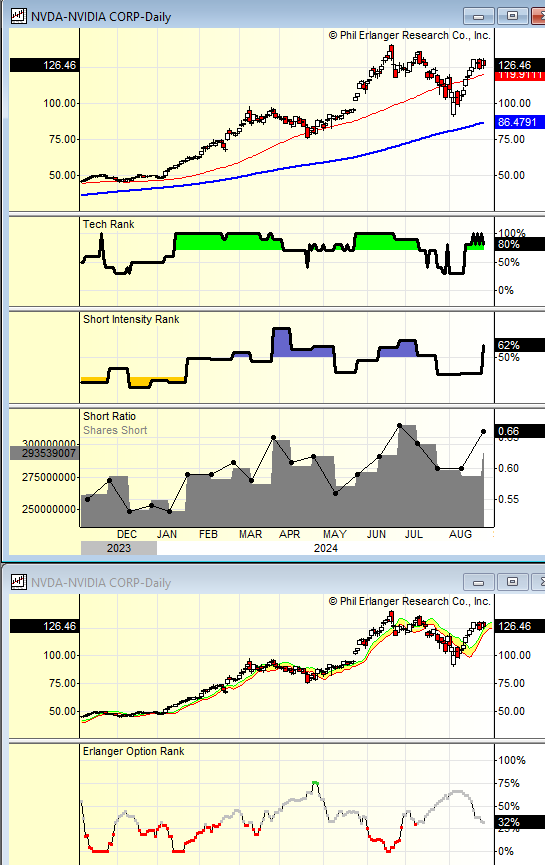

- NVDA (Nvidia) FQ2 earnings preview (reports Wed 8/28 after the US close) – the stock has encountered some volatility over the last couple of months and while Y/Y growth will slow (simply because comparisons are growing increasingly difficult), sentiment remains very bullish on the industry’s overall demand backdrop and Nvidia’s dominance of it. Worries about Blackwell’s possible delay have calmed recently – while the chips may not ship in volume until early C2025, demand for Nvidia’s current generation of products remains extremely robust. For FQ2, the Street is looking for EPS +138% to 64c with sales +112% to $28.7B (including Data Center +141% to $24.9B), GMs of 75.5%, and op. margins of 65.7%.

NVDA is the big one as it’s a huge weight in the indexes and the leading attribute for all index performance in the last 18 months. The expectations are very high yet there has been some positioning moves that shows both bulls and bears are terrified going into this report. Bulls seem to be either very long or wanting to buy any declines. The management should sound very bullish on the call which is typical. Any slight miss on guidance of $32b or comments on push out for the new Blackwell chips will sink this one. It is crowded for many reasons on the long side. It’s been the only one that really has worked in AI mania. It’s made a potential lower high after dropping 32% in July. If I was long I’d rather have this trading down into numbers and I’ll sit on the sidelines and may trade it after earnings. Vols are juiced in the options market so trading the QQQ makes more sense if you’re looking to put on a trade ahead of the report. I am going to sit on the sidelines with NVDA holding my SMH and tech exposure shorts

The implied move is high for NVDA at nearly 10%.

These two charts show the hypergrowth revenues. Expectations for this quarter are nearly 29b, and next quarter guidance is expected to be 32b. One thing that stands out is that the guidance raises have decreased in $ or % terms. Growth is amazing, but growth will start to level off from hyper to great to good to flat. I’m not sure this is that moment, but that is what people are watching.

Short interest is a touch higher in the last report as the downside move lured in some shorts. The days to cover is only 0.66 days which is low yet a reflection this is one of the most actively traded stocks each day.

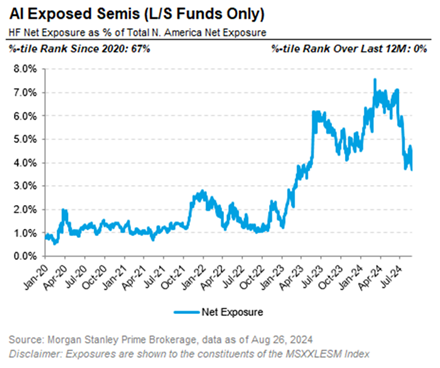

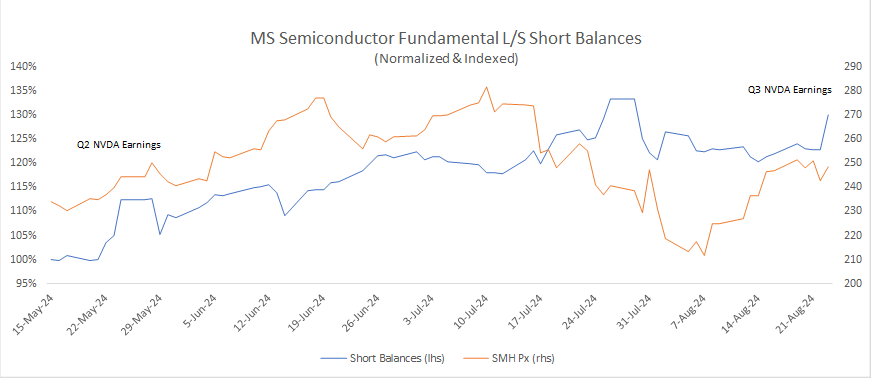

Morgan Stanley’s prime brokerage showed long short funds have dramatically decreased exposure to semiconductor sector in the last quarter.

They also show NVDA has more shorts involved and I’m told they rank those clients that are short as a little better at shorting based on their overall book.

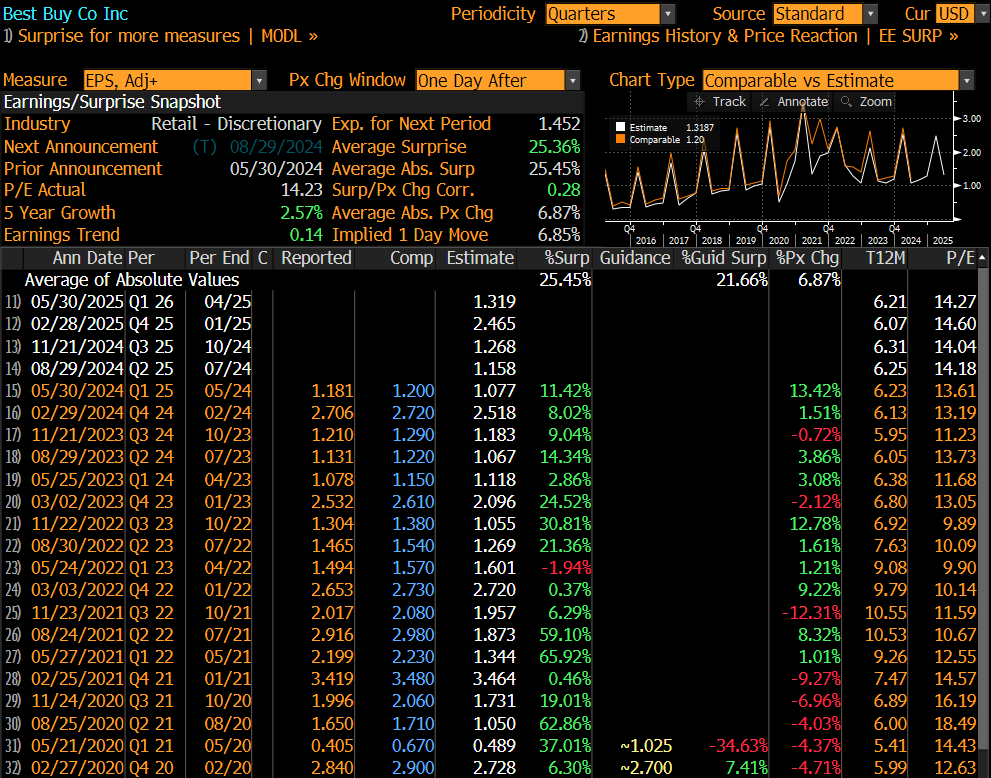

- BBY (Best Buy) FQ2 earnings preview (reports Thurs 8/29 before the US open) – sentiment is fairly neutral on the name, w/bulls focused on new product cycles (iPhone, AI PCs, etc.), a relatively cheap valuation, and a healthy dividend while bears emphasize secular headwinds facing the industry and tepid growth. For FQ2, the Street is looking for EPS of 1.16 with comps -3.1% and GMs of 23.5%.

BBY is back to levels where it has faded and there is a new DeMark sell Setup 9. Last quarter it gapped higher after being down hard so low expectations could be the reason. With it up 10% in the last month it could be overpriced and they sell discretionary items – some big ticket items which several other retailers like HD and LOW saw weaker trends. I am going to short a 2% weight today

The implied move is 6.85%.

Short interest has been dropping with days to cover at 4.62%. This is also a reflection of volume traded. On the Options Rank the move down lured in put buyers but has moderated with a put squeeze type of move.

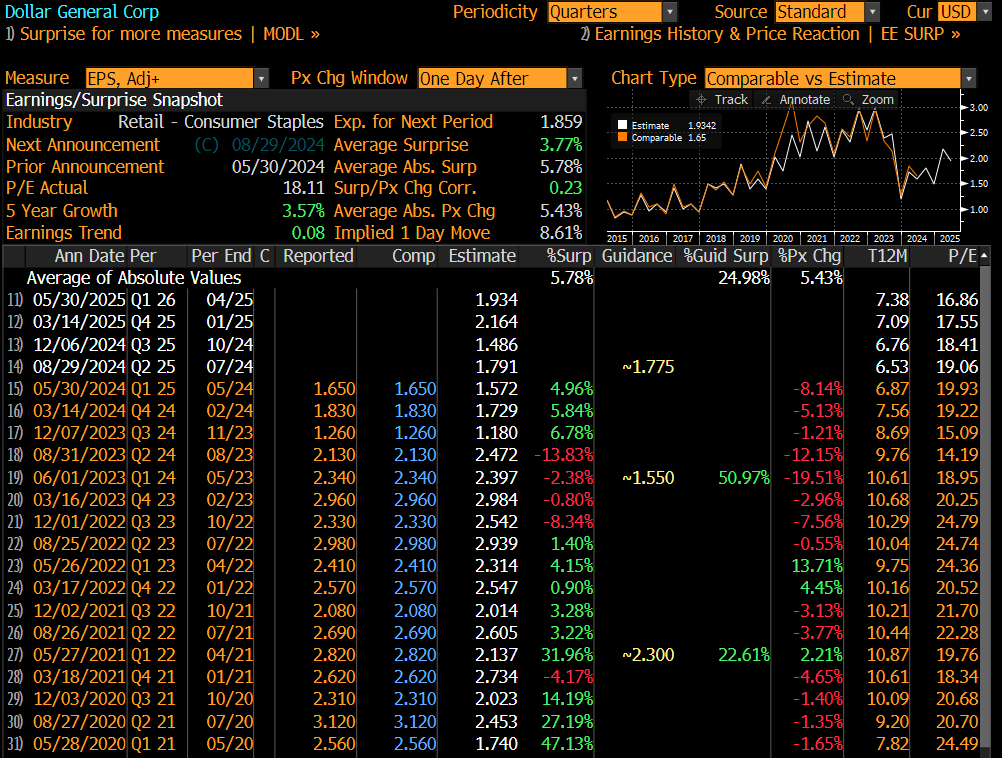

- DG (Dollar General) FQ2 earnings preview (reports Thurs 8/29 before the US open) – despite the solid WMT report, sentiment is fairly downbeat on DG as its core customer base faces intensifying macro headwinds. For FQ2, the Street is looking for EPS of 1.80 with comps +2.2% and GMs of 30.3%.

DG has been trending lower, and recently, it bounced with better WMT and TGT earnings. A downside Sequential is in progress on day 5 of 13 so there is risk lower if the report doesn’t show similar improvement with low end consumer.

The implied move is 8.6% and has seen more downside moves after earnings than up.

Short interest is higher going into this report with 2.35 days to cover. On the Options Rank it’s setup more neutral. Some potential for a squeeze

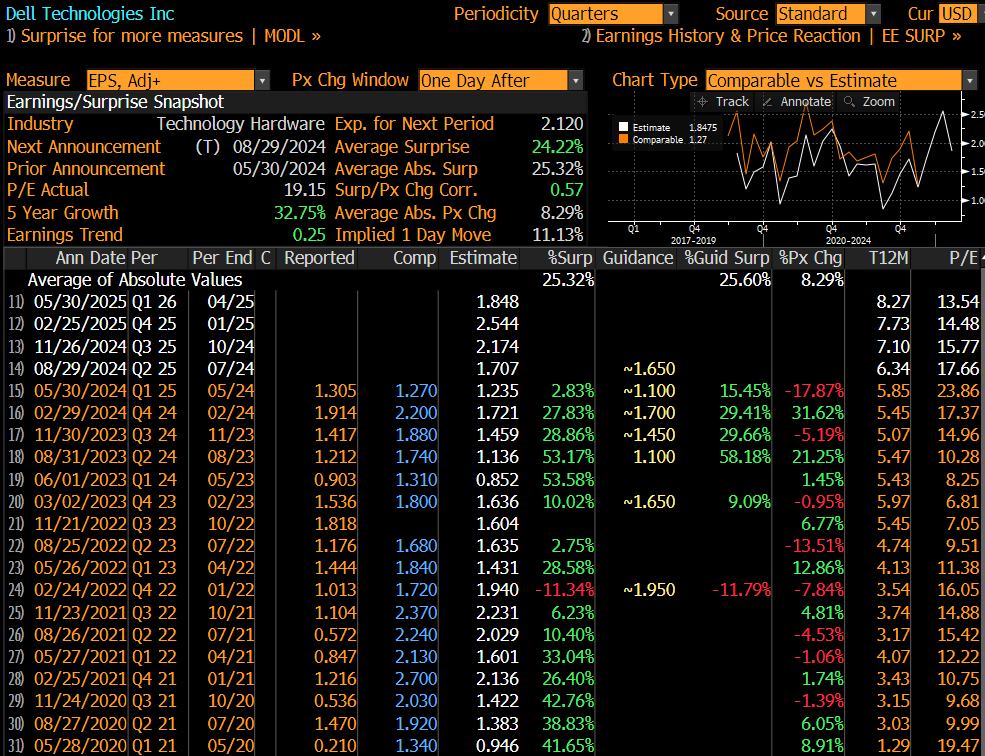

- DELL (Dell) FQ2 earnings preview (reports Thurs 8/29 after the US close) – the stock was hit hard after the last earnings report due to margin concerns, although sentiment has improved since then, with investors focused on AI-related growth tailwinds, not only in servers but PCs too. For FQ2, the Street is looking for EPS of 1.68 with sales +5.3% to $24.1B (including Client -3%/$12.55B and Infrastructure +25%/$10.58B). GMs are seen coming in at ~22% with op. margins of ~7.5%.

With DELL a lot will depend on the NVDA report and more so the price move. This gapped higher earlier this year and backed off and then continued higher into the last earnings and dropped hard. Since then it’s made lower highs and lower lows. I will have this on tomorrow’s note with a better view.

The implied move is 11% after several wild quarters up and down after earnings.

Short interest has been dropping hard and shorts increased after the recent drop and have covered on the way down. Only 1.2 days to cover is low. On the Options Rank there was heavy put buying near the lows and that’s moderated with the bounce which was a put squeeze higher.

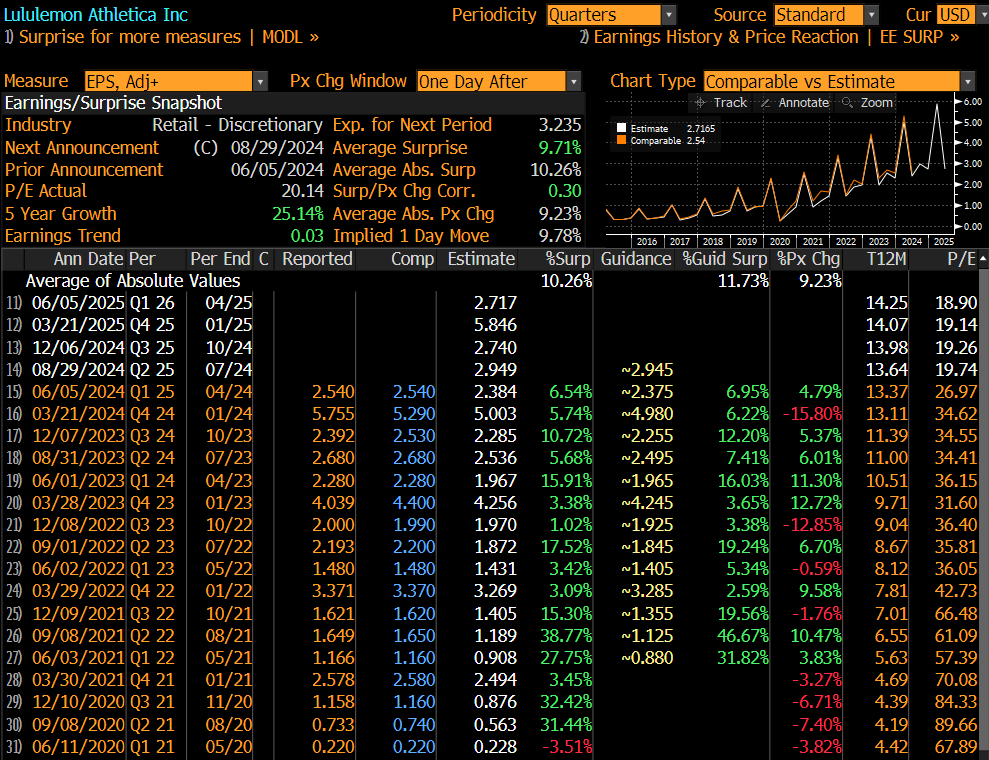

- LULU (Lululemon) FQ2 earnings preview (reports Thurs 8/29 after the US close) – sentiment is fairly cautious due to questions/concerns about the product lineup and innovation abilities along with overall consumer macro headwinds. The Street is looking for FXN sales growth of ~10.2% w/comps +6.15%, GMs of 57.8%, op. margins of 21.2%, and EPS of 2.96.

LULU has seen several gap downs (downward dog pattern) after earnings and recently bounced off the lows. There is a new Sell Setup 9 and down hard today. Let’s see how tomorrow’s market action is before doing anything here.

The implied move is 10% and expectations are high to meet guidance.

Short interest has declined recently with shorts covering. Days to cover is down as well to 2.34. On the Options Rank there has been persistent call buying with the red dots. Traders continue to bet on a rebound.

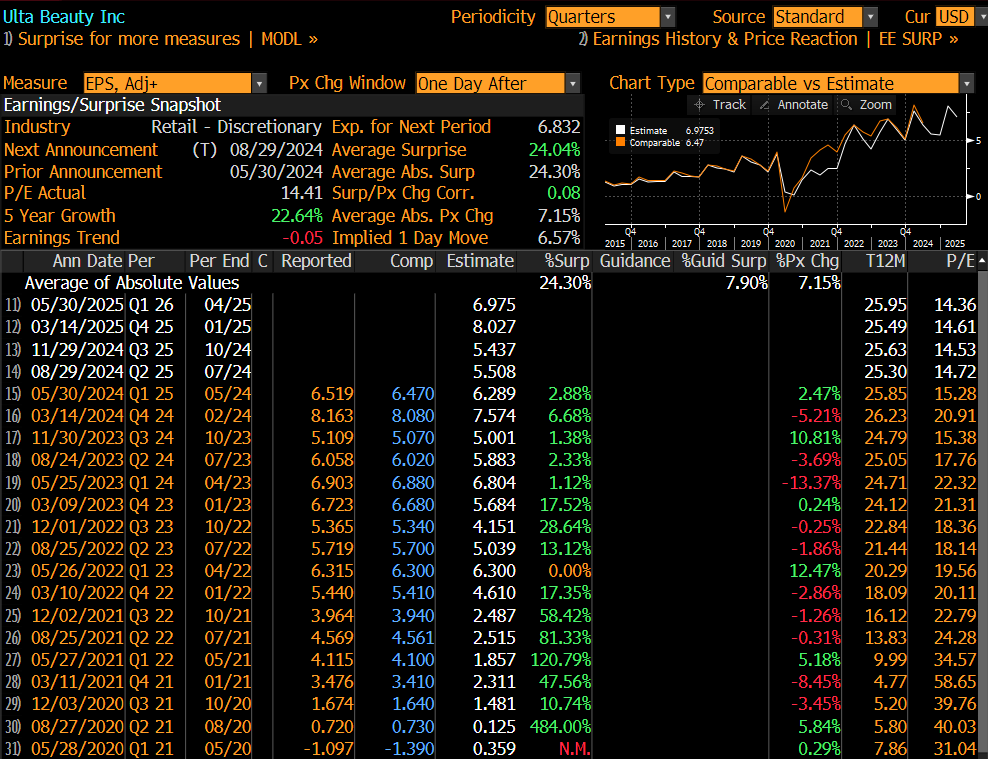

- ULTA (Ulta) FQ2 earnings preview (reports Thurs 8/29 after the US close) – the stock has rebounded off its lows, thanks in large part to the Berkshire stake, although sentiment around fundamentals is still cautious amid signs of cooling demand in the beauty category. For FQ2, the Street is looking for comps of +1.4% with GMs of 38.8%, op. margins of 13.2%, and EPS of 5.53.

ULTA has a similar demographic (and chart) with LULU. It recently bounced big with Berkshire’s new long position. The risk I see being long is if this is light those new buyers that bought after BRK disclosure will puke this one out. Warren and his team have a longer term view when they buy vs the typical trader in today’s market. There remains a downside wave pattern in play (wave 4 of 5) with a downside Sequential in progress.

The implied move is 6.6%.

Short interest has been increasing with days to cover at 3. The Options Rank counters some of the short squeeze potential with the heavy call buying red dots.