Please join us at 10:30am ET today for our new short interest data webinar. Here’s the link to register. We will take questions and chart requests as time permits. I will post the replay on Sunday’s week ahead.

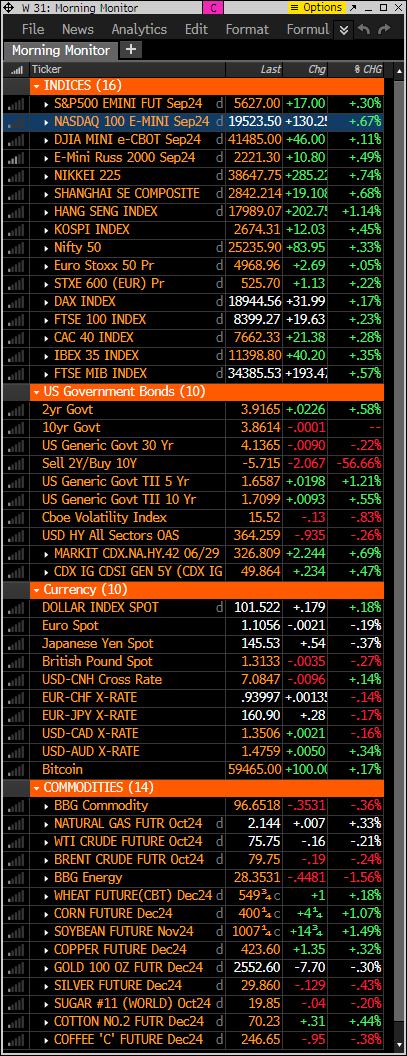

- S&P futures up 0.3% and Nasdaq futures up 0.65% off earlier highs in Friday morning trading. Comes after US equities finished mixed on Thursday with NVDA pullback a drag at the index level. Treasuries mixed with curve flattening. Dollar index up 0.15%. Gold off 0.3%. Bitcoin little changed. WTI crude down 0.15%.

- I will send the next note out later around 2pm ET

- The US economic calendar features personal income, spending, and PCE inflation (both inline), Chicago manufacturing PMI, and final University of Michigan consumer sentiment (and inflation expectation). Core PCE inflation came out as expected, posting a 0.2% m/m increase. The y/y rate was unchanged from the last report at 2.6%.

- China officially ends antitrust review of Alibaba, a big positive with stock up 4.75% – The State Administration for Market Regulation says in a statement that Alibaba has completely stopped its monopolistic behavior after the review. It further says it will continue to guide Alibaba to regulate its operations, accelerate innovation and improve services. This is a big shift as the Chinese government has been moving from stamping out China tech’s power to now supporting them.

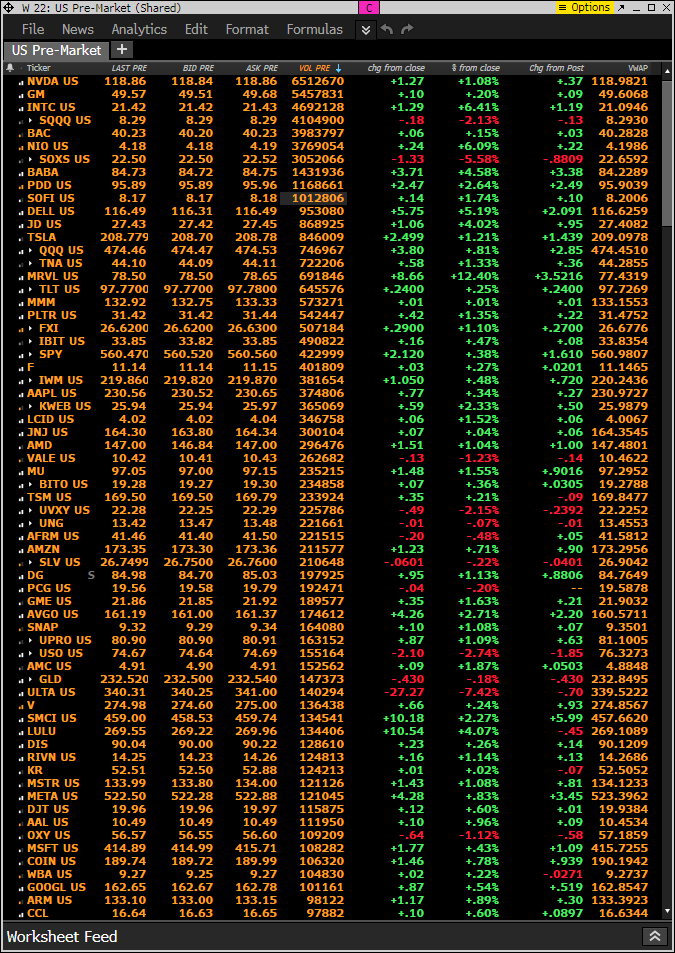

- DELL beat and talked up accelerating AI momentum and backlog/pipeline strength although margins were under pressure. ADSK beat and raised with takeaways focused on better underlying margin guide. MRVL beat and guided above, highlighting strong demand from AI and ramp in custom AI programs. In retail, LULU sales missed and lowered FY guidance, though EPS beat and company talked up healthy traffic trends and strong demand for newness. ULTA missed and lowered FY guidance with takeaways focused on competitive pressures and deleverage. Outside of earnings, INTC is reportedly considering strategic options, including a split of design and manufacturing businesses.

- Key Upgrades/Downgrades: Abercrombie & Fitch upgraded to buy from neutral at Citi. Dollar General downgraded to hold from buy at Gordon Haskett. CrowdStrike upgraded to buy from hold at HSBC. Dollar General downgraded to equal-weight from overweight at Morgan Stanley. Ulta Beauty downgraded to outperform from strong buy at Raymond James. Kohl’s downgraded to hold from buy at TD Cowen. Dollar General downgraded to market perform from outperform at Telsey Advisory Group.

market snapshot

economic reports today

premarket trading

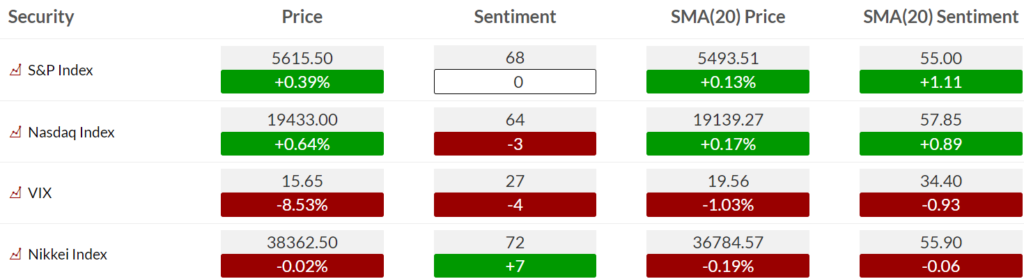

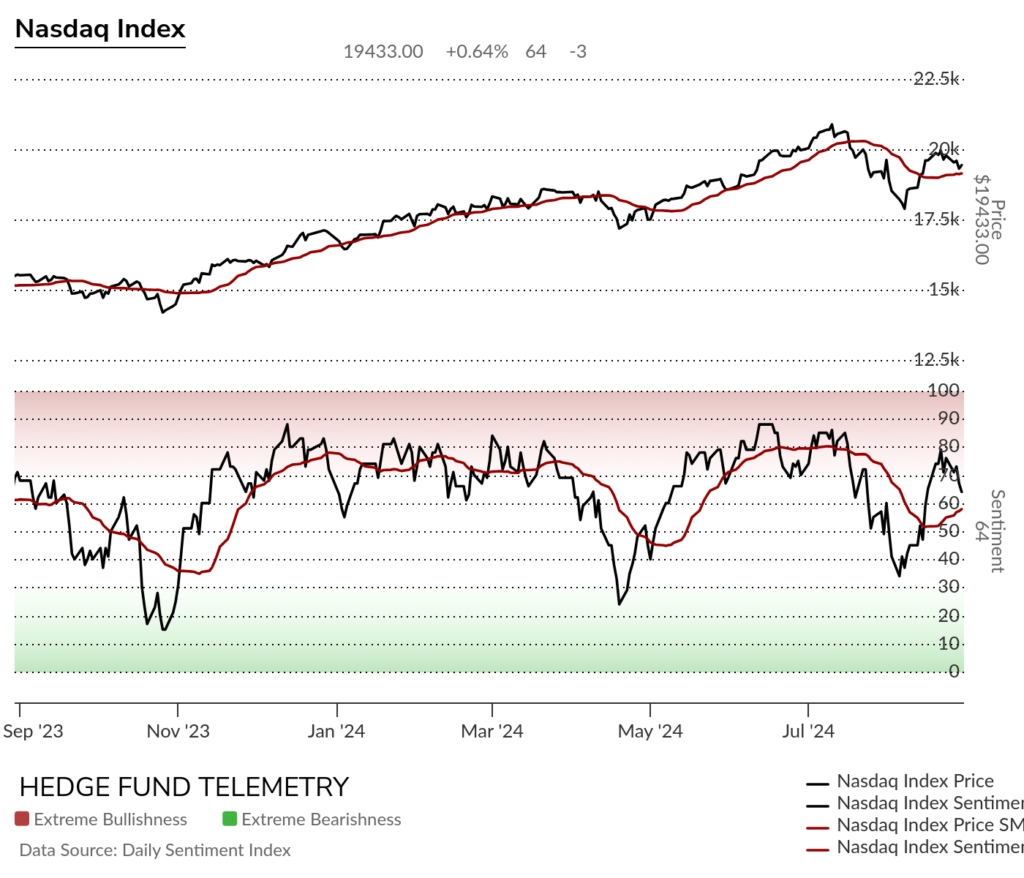

US MARKET SENTIMENT

S&P and Nasdaq bullish sentiment was unchanged to down for the Nasdaq.

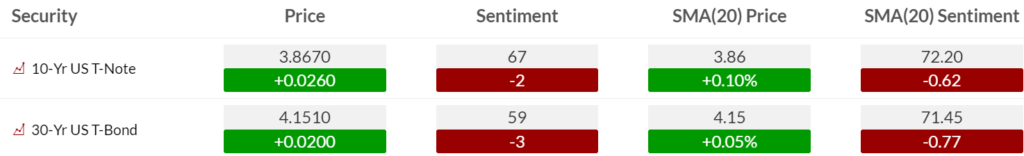

Bond bullish sentiment continued to tick lower

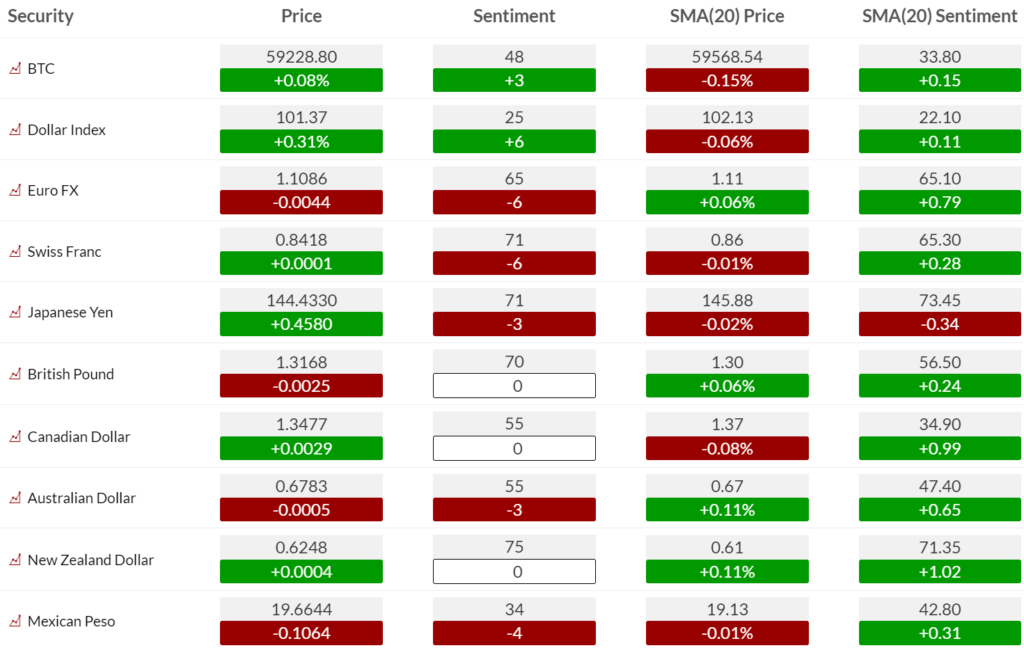

Currency bullish sentiment highlighted with US Dollar up again after hitting 13% earlier this week.

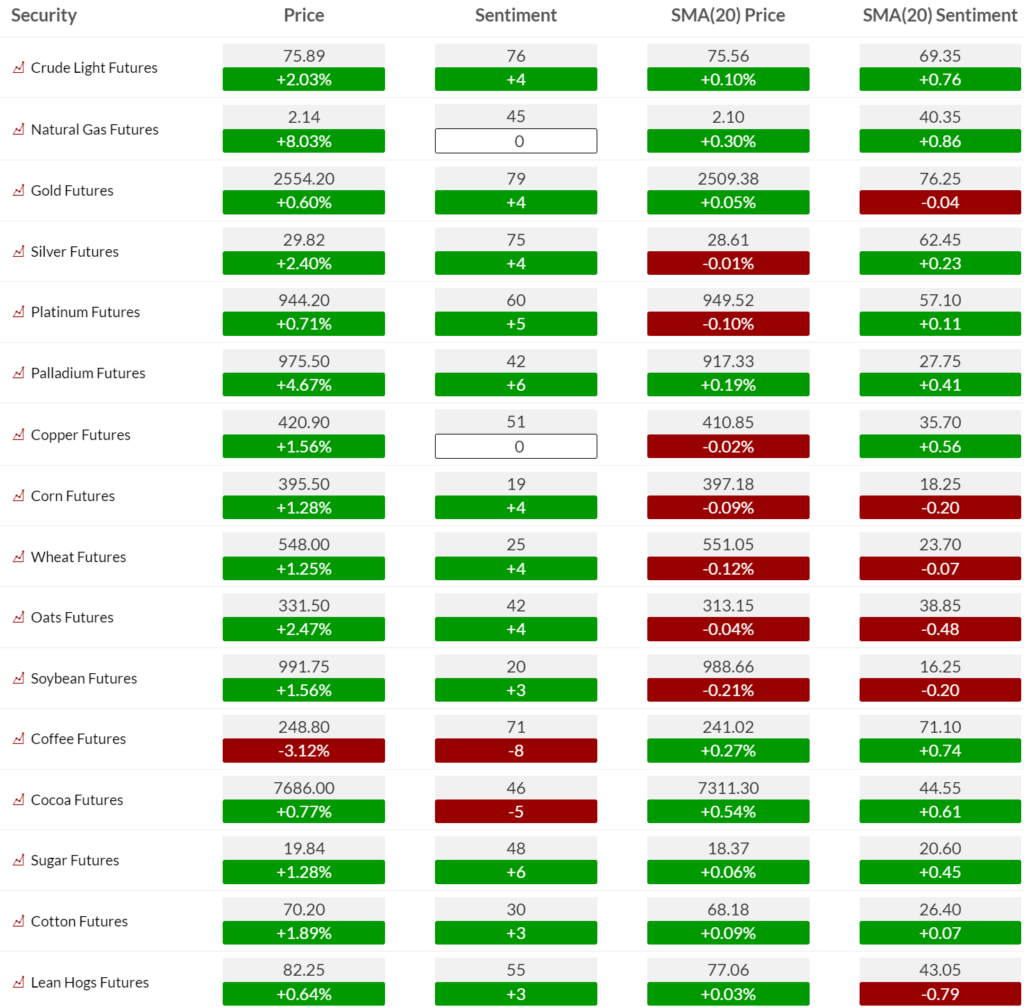

Commodity bullish sentiment had a strong day yesterday with Crude, Gold, Silver in elevated zone.

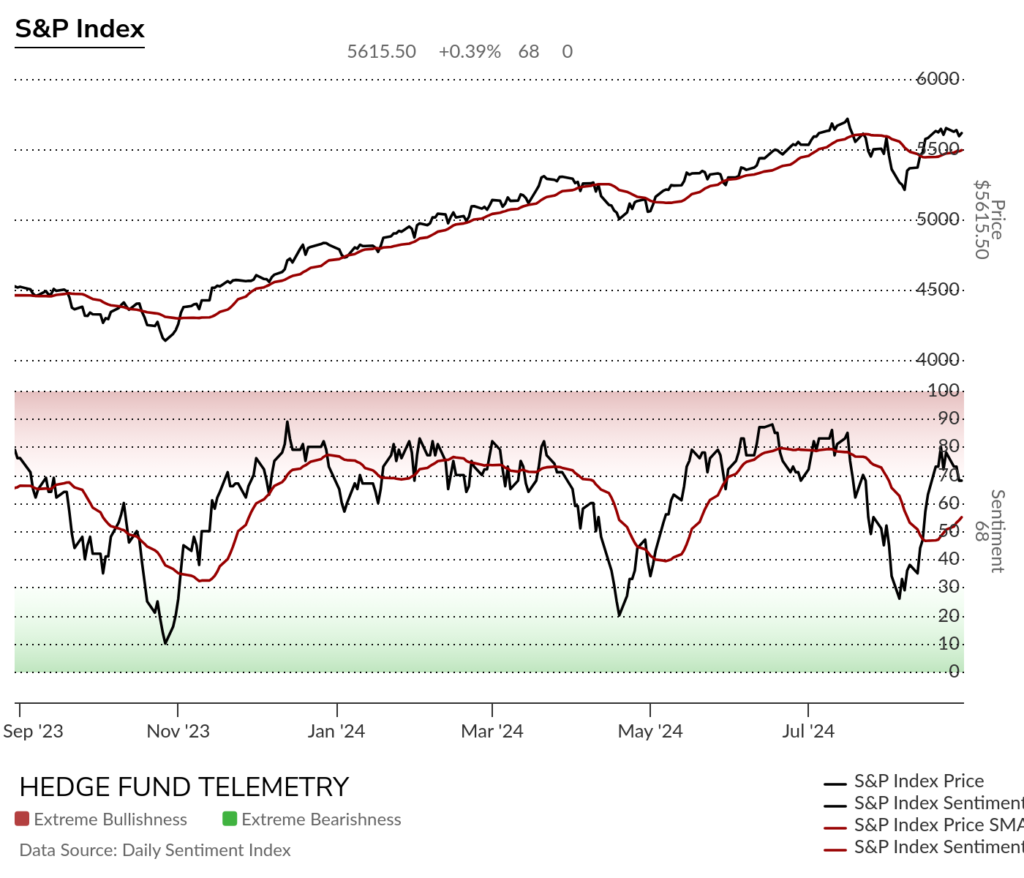

US MARKETS

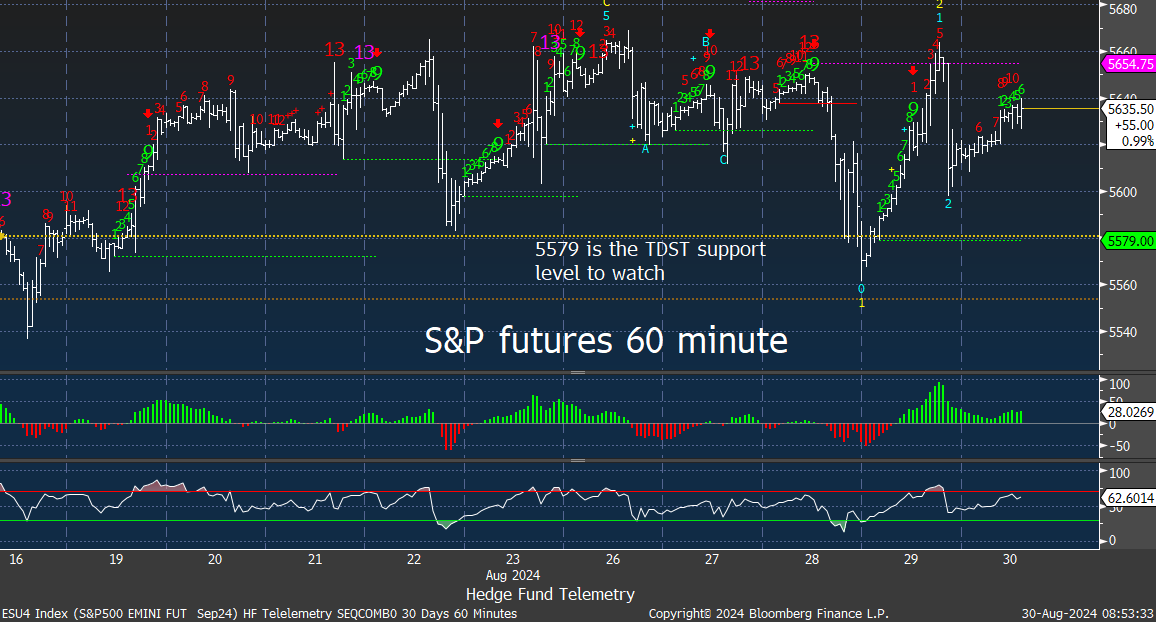

S&P futures 60-minute tactical time frame choppy sideways going nowhere type action partly why I’ve done less trading considering low liquidity and end of summer trading. Pending Sequential on hour bar 10 of 13. 5600 is the level most will be watching to hold.

S&P futures daily sideways to slightly lower after recent Sell Setup 9. 50 day at 5542 is logical level most will be watching.

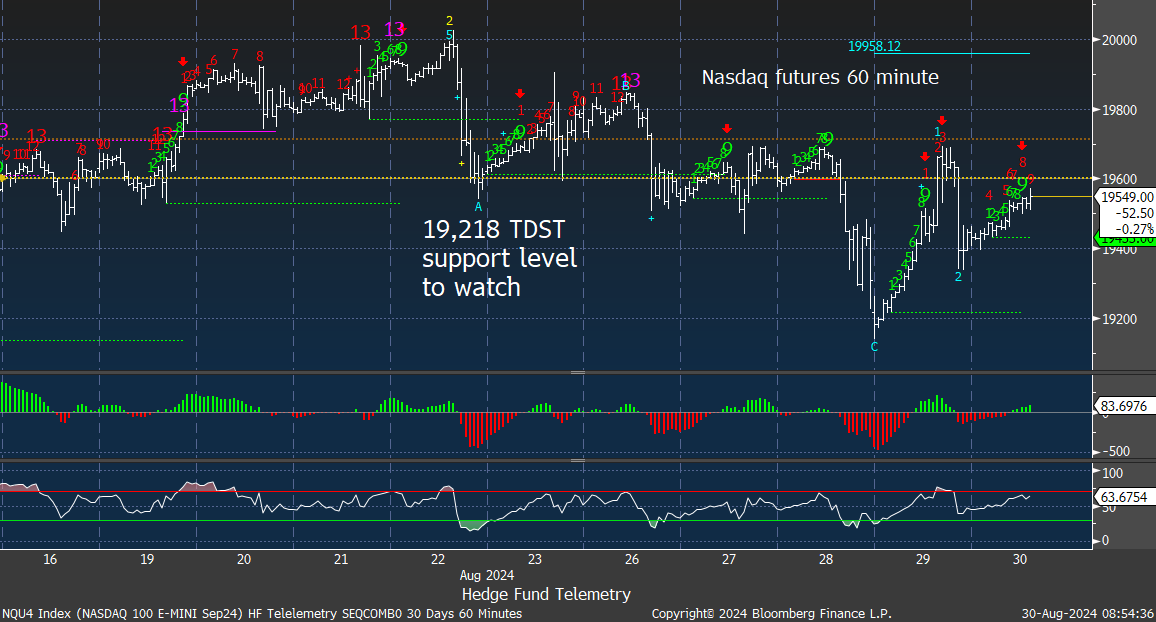

The Nasdaq 100 60-minute tactical time frame has stair-stepped lower. Pending Sequential on hour bar 9 of 13. That TDST support level is the line in the sand.

Nasdaq 100 futures daily still has the downside Setup on day 7 of 9. It is not a given this will complete to 9 since in order to complete the Setup 9 there must be nine consecutive closes higher/lower than the close four price bars earlier. If this pattern is interrupted the Setup will cancel and disappear from the chart.

Extra charts we’re watching

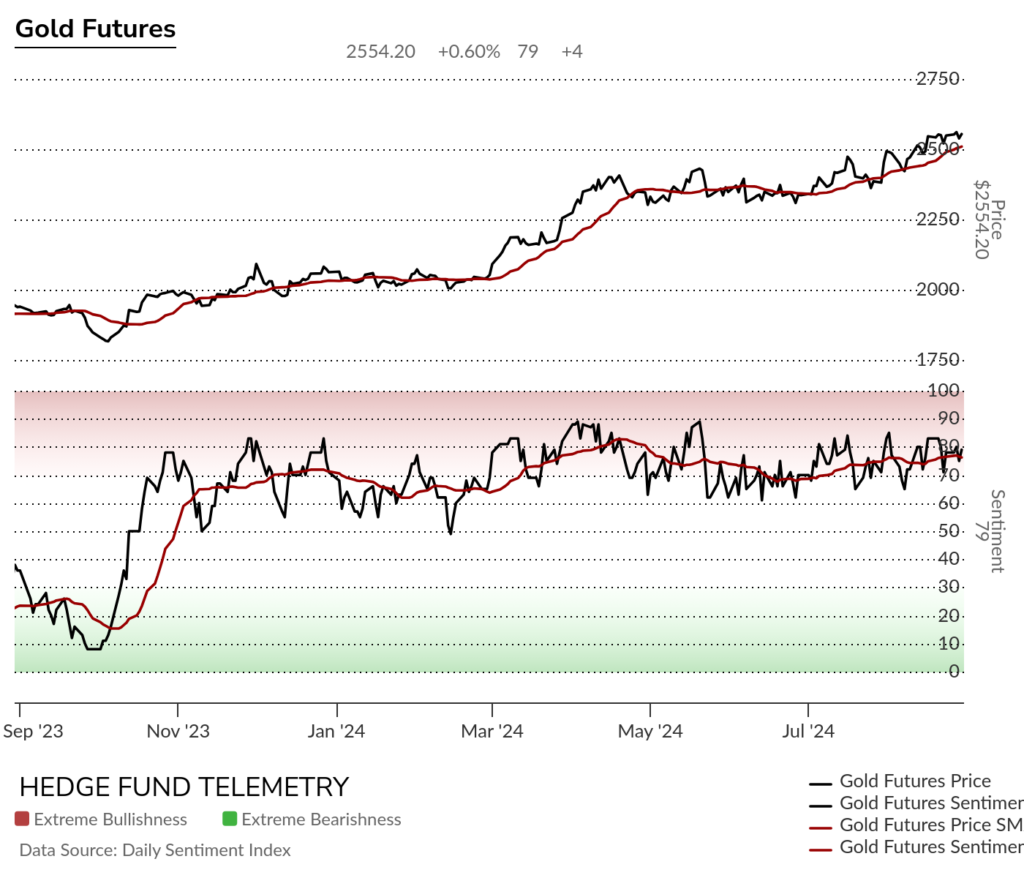

Gold has been the most resilient commodity, absent any significant drawdowns. Recent DeMark Sequential and Combo sell Countdown 13s are in play, and other 13s have exhausted the buyers after positive performance. Stalling with nominal pullbacks has been the situation all year. If there was a larger reversal, a break of sentiment at ~60% and ~2400 would have to occur.

Sentiment has remained steady and the only reversal down would matter if the ~60% support level breaks.

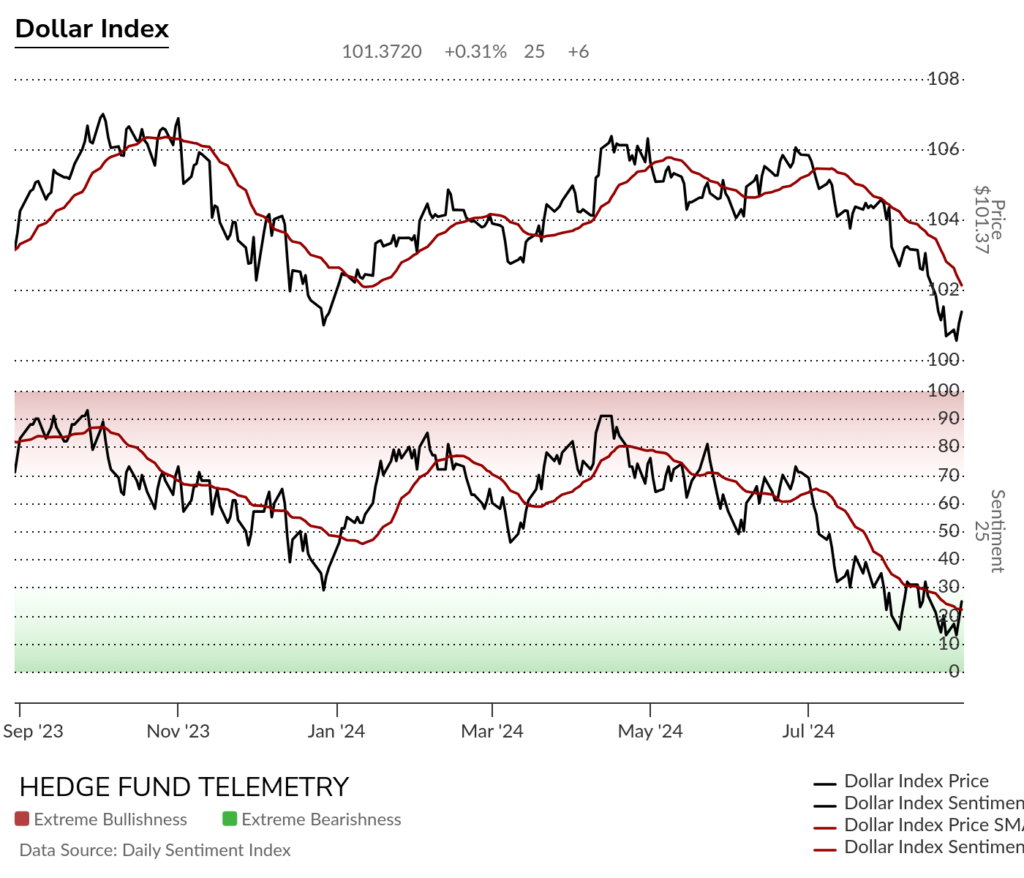

US Dollar Index daily reversal after recent DeMark Sequential and Combo buy Countdown 13’s and buy Setup 9

Dollar sentiment hit multi-year lows this week at 13% and has reversed slightly above the 20 day moving average of bullish sentiment.

US 10-Year Yield with slight increase after recent DeMark Sequential buy Countdown 13

Bitcoin Daily up a little today with pending Sequential and TDST what I’m watching.

DeMark Observations – Euro Stoxx 600

Still a high number of sell Countdown 13’s on daily and weekly time frames.