HIGHLIGHTS AND THEMES

- The Bloomberg Commodity Index moved higher for the second week in a row after recent DeMark buy Countdown 13’s. There is near term resistance and sell Setup 9’s due which will be a big test.

- Energy improvement with WTI Crude and even Natural Gas which also has resistance near but might just push higher.

- Gold remains the most resiliant commodity and has some more sell Countdown 13’s – a Combo but a secondary Sequential remains in progress. It’s not a buy here but continues to be a buy the dip idea unless the 60% level on sentiment breaks.

- Copper also has seen improvement and will be tested to see if this can continue this week.

- Grains remain mixed lacking upside momentum

- Softs are mixed with Sugar having a big move that should consolidate overbought conditions

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily continued higher after the recent DeMark buy Countdown 13’s with 200 day resistance. Sell Setup 9 expected on Tuesday will be a big test.

Bloomberg Commodity Index Weekly up for the second week in a row and above 110 would be a huge statement for the commodity index.

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY

Bloomberg Energy Index is improving on the upside, yet needs more after a likely Setup 9 possible on Tuesday.

The weekly moved lower in 5 waves and with the recent buy Setup 9 let’s watch for a price flip up.

WTI Crude futures daily has had a nice move off the lows, but there’s been a pattern of lower highs and lower lows that needs to be resolved, and I am a little concerned sentiment is a little elevated. Middle East tensions could send this higher.

WTI Crude futures bullish sentiment moving back near extreme zone.

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

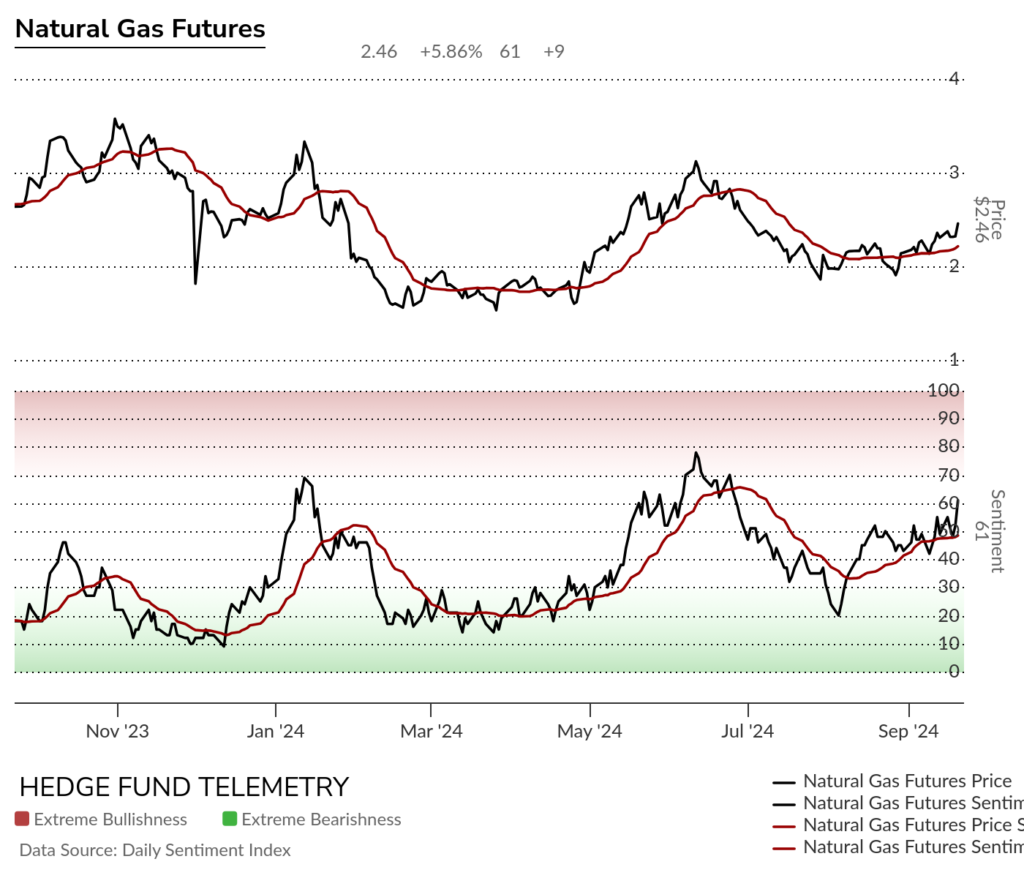

Natural Gas futures daily could continue higher and clearing recent resistance is a positive.

Natural Gas futures bullish sentiment made a decent move on Friday after consolidating near 50%

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Metals

Gold daily continues to grind higher despite the recent sell Countdown 13’s. RSI is getting overbought again so a pullback would not surprise but pullbacks have been nominal all year.

Gold bullish sentiment has been the most resilient commodity all year with nominal pullbacks, with sentiment holding the 60% level, which, if it breaks, would be a major change.

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

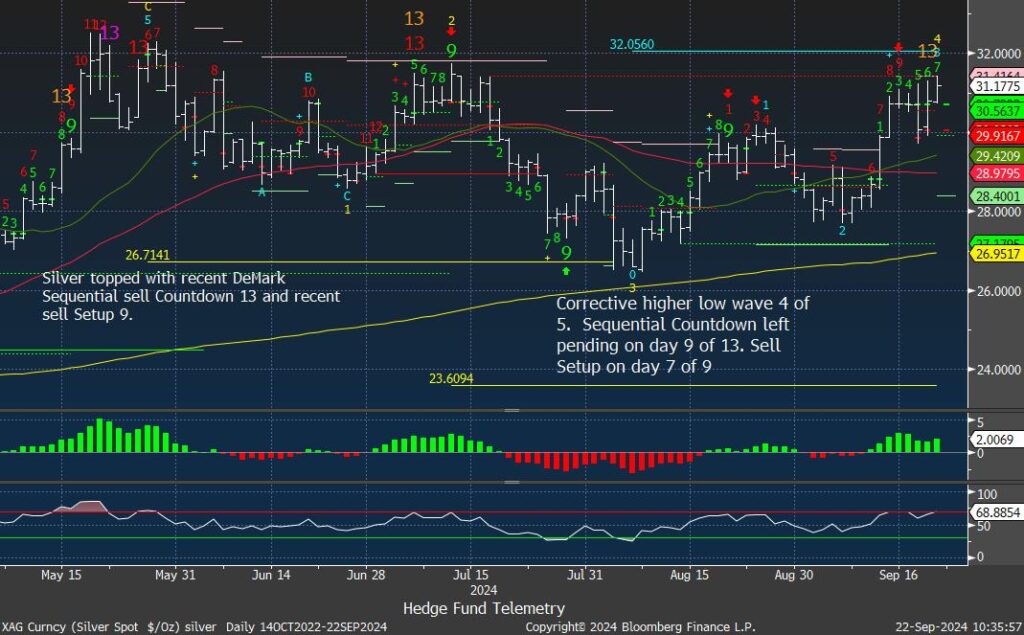

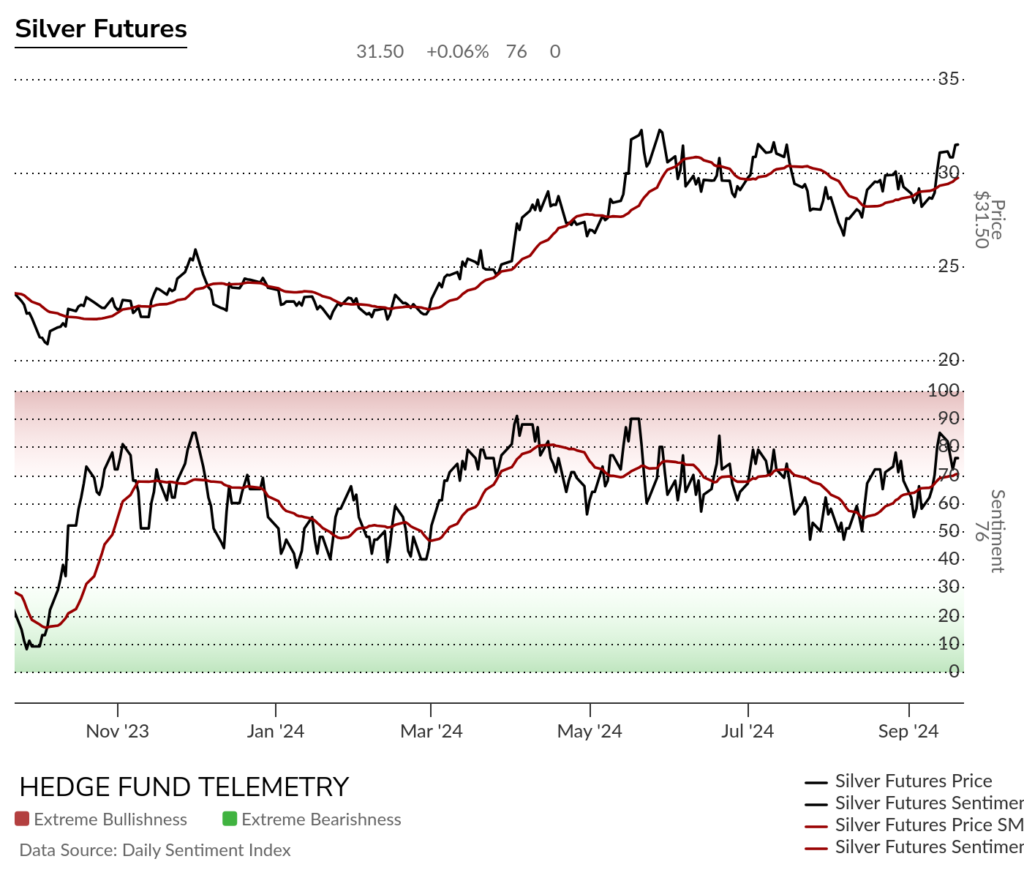

Silver daily has a sell Setup on day 7 of 9. Sell Setup 9’s have been decent at spotting inflection points in the past.

Silver bullish sentiment moved into the extreme zone and has seen stalling when above 80% this year.

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Copper futures daily has a Sequential in progress, a new Aggressive Sequential (amber 13) and sell Setup 9. Pattern looks decent for a continuation.

Copper futures bullish sentiment made a higher low and could continue higher.

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Platinum daily with nice upside bounce that stalled.

Platinum bullish sentiment nearly hit the extreme zone but backed off.

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Palladium daily with sell Setup 9 and pausing or could make a higher low wave 4 but that would need a 13 day closing low to qualify.

Palladium bullish sentiment paused and is consolidating the recent strength.

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

Corn futures daily if thinking bullish, this needs to make a higher low wave 2 of 5 then move higher.

Corn futures bullish sentiment reversed and remains under pressure.

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

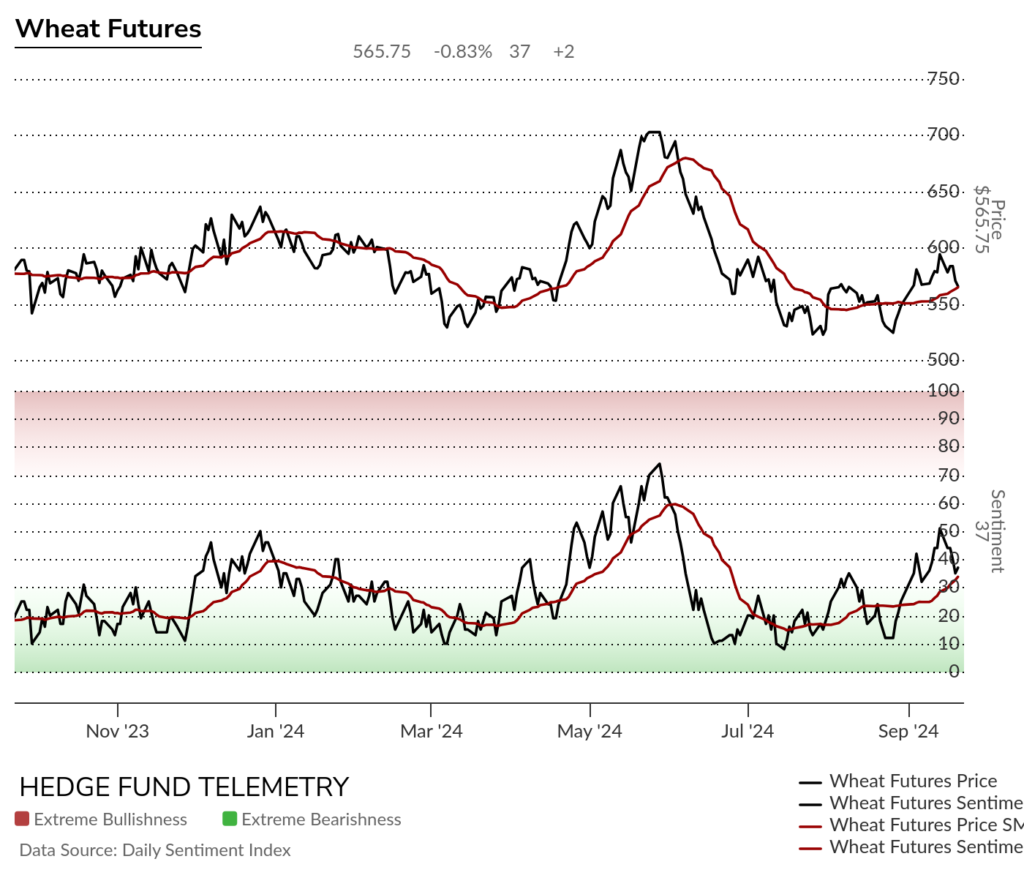

Wheat futures daily might need to complete the Sequential 13 with a new low. The pattern doesn’t look bad, but wheat has been difficult all year, fading after the start of upside moves.

Wheat futures bullish sentiment faded after hitting the 50% midpoint level.

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Soybean futures daily sideways and needs to show some upside momentum

Soybean futures bullish sentiment hasn’t improved much for any conviction

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

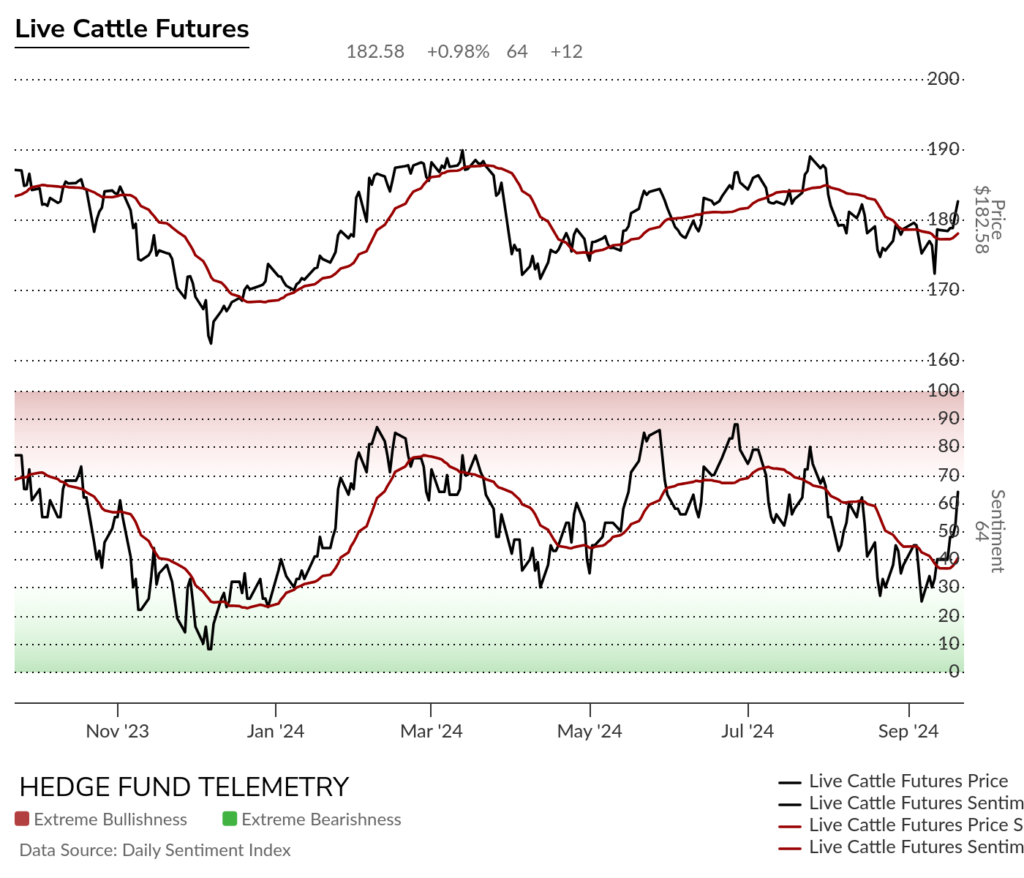

Live Cattle futures daily could see a pause or reversal with new sell Setup 9 on Monday.

Live Cattle futures bullish sentiment with big move higher

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Lean Hogs futures daily could stall out here with sell Setup 9

Lean Hogs bullish sentiment nearing the extreme zone again

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

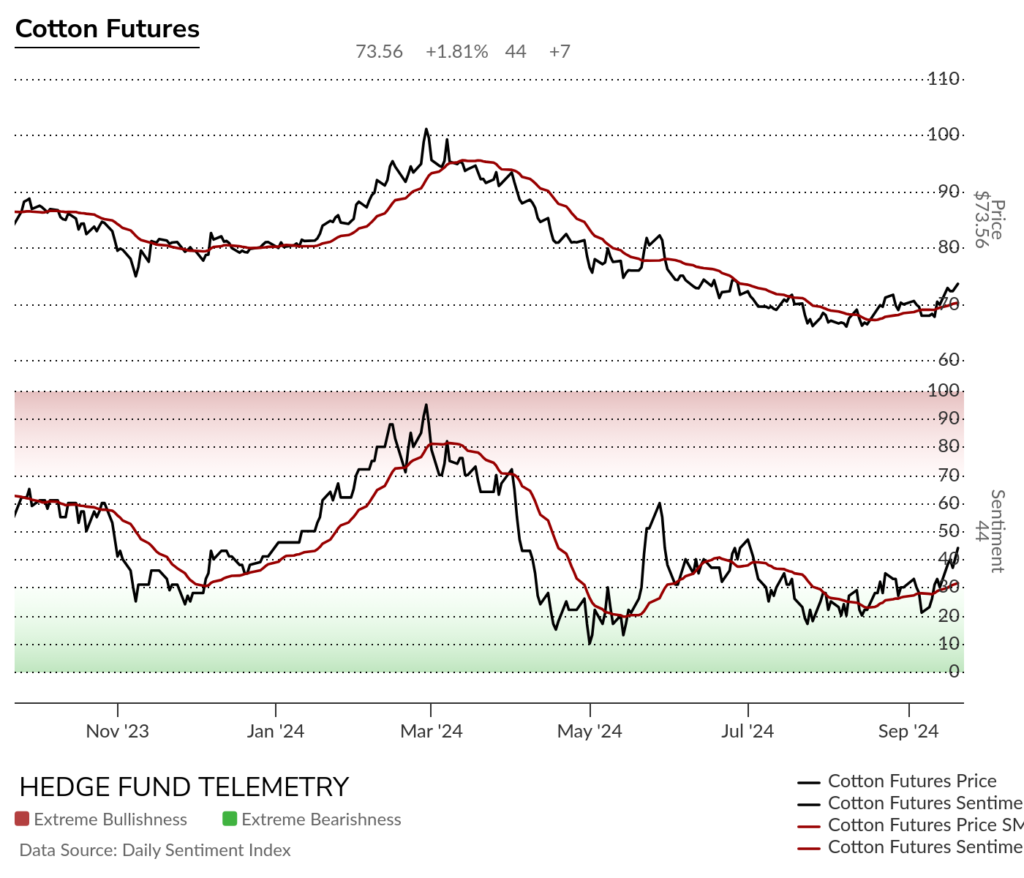

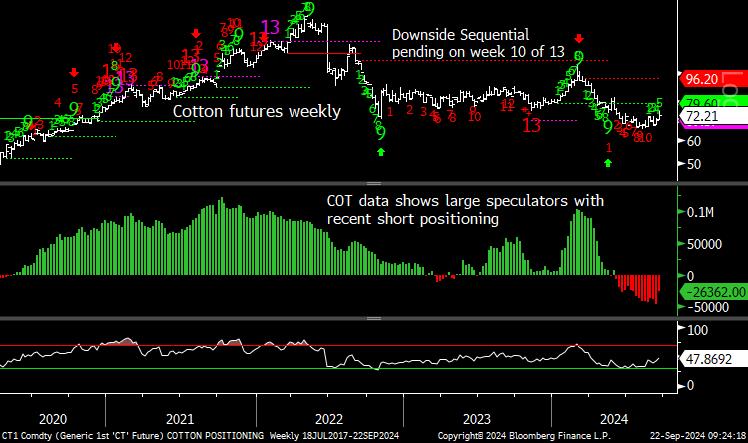

Cotton futures daily with strong week but watch the sell Setup 9 likely on Monday for a stall

Cotton futures bullish sentiment improving

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Coffee futures daily reversed after the sell Setup 9 but 50 day has been support all year.

Coffee futures bullish sentiment sideways

Sugar futures daily spiked this past week but RSI at 86 is overbought and could see sell Setup 9 too

Sugar futures bullish sentiment spiked well above 50% midpoint level that was resistance several times

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators with large spike

Cocoa futures daily sideways failing to break out at least for now

Cocoa futures bullish sentiment lacks upside momentum under the 50% midpoint level.

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

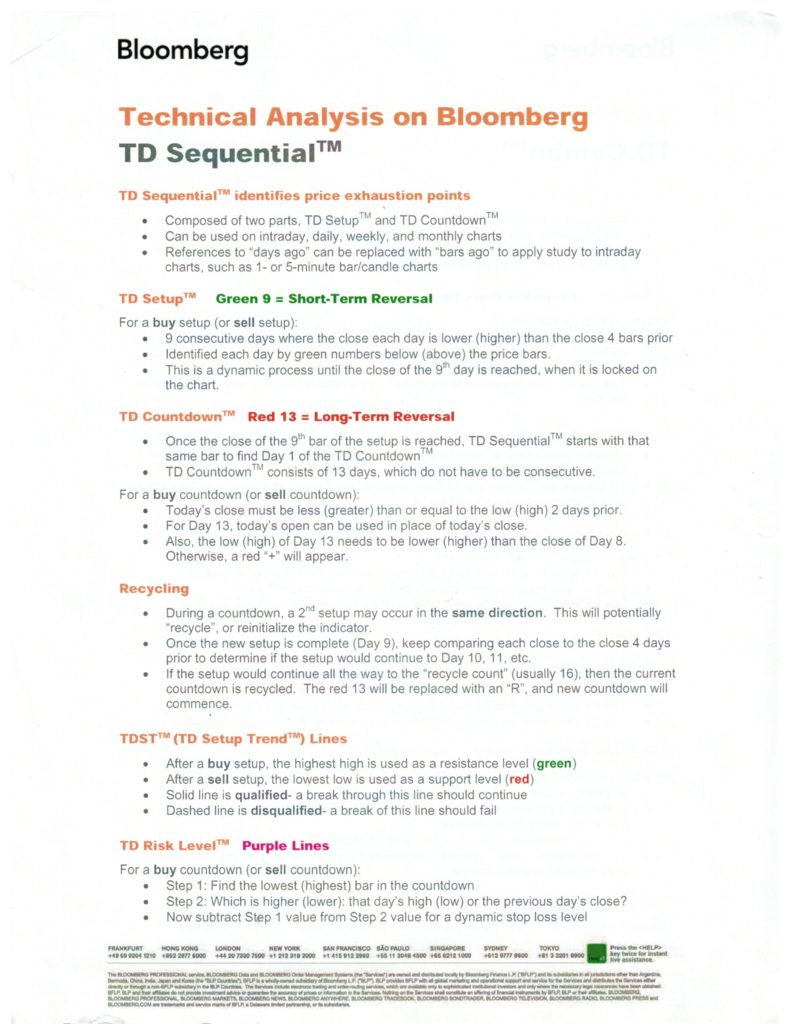

DeMark Sequential Basics

DETAILED COMMITMENT OF TRADERS DEFINITIONS