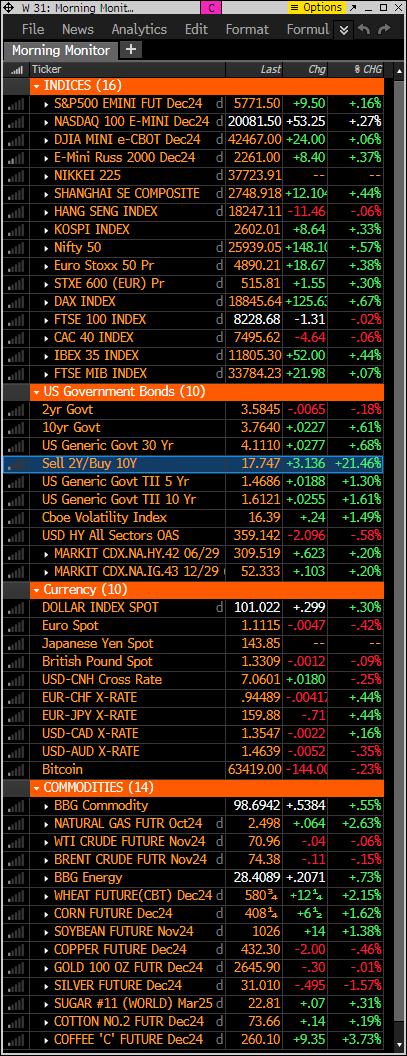

- S&P and Nasdaq futures up 0.1% – 0.25% in quiet Monday morning trading. Treasuries narrowly mixed with the curve further steepening after 2/10 spread ended last week at steepest level since June 2022 – today +17bps (see below as I see this continuing). Dollar index up 0.3%. Gold flat. Bitcoin down 0.25%. WTI crude up 0.1% after gaining nearly 3.5% last week.

- No big directional drivers in play to start the week. Headlines have revolved around INTC takeover/investment interest, softer Eurozone flash PMIs, China rate cut (and additional stimulus measures expected to be announced tomorrow) and Middle East tensions. Bullish talking points revolve around favorable combination of Fed easing and economic soft landing, along with broadening earnings growth, near-record buyback authorizations, inflow trends and less stretched positioning (particularly in MCG & Tech). Bearish talking points revolve around negative 2H September seasonality, fading buyback bid as corporate blackouts kick in into earnings season, increasingly demanding valuations, election uncertainty, geopolitical tensions and China global growth drag.

- September flash PMIs on the US economic calendar this morning. Manufacturing expected to improve to 48.6 from 47.9. Services expected to slip to 55.3 from 55.7. Data highlight of the week looks to be core PCE inflation on Friday. Street looking for core PCE inflation to increase 0.1% m/m in August, leaving the y/y rate of growth at 2.7% vs 2.6% in July. Minneapolis’ Kashkari said disinflation remains on track with bigger risk around labor market weakening, sees 50 bps more in cuts through year-end. Bostic, Goolsbee also on the schedule for today. Busy week of Fedspeak ahead with Bowman, Kugler, Williams, Barr, Cook and Collins all on tap. While Fed Chair Powell delivers the opening remarks at 10th annual US Treasury Market Conference on Wednesday, his comments will be pre-recorded.

- INTC still the big corporate story. Bloomberg reported QCOM is interested in buying all of Intel (and has been speaking with US regulators about an all-American combination) but has not ruled out buying or selling parts of it in a deal. Subsequent report said APO has offered to make a multibillion-dollar investment in Intel. New NKE CEO expected to focus on repairing relations with retailers to boost sales. BA defense unit head leaving the company. LUV reportedly warned employees of tough decisions coming amid plan to restore profits.

- Key Upgrades/Downgrades: General Motors downgraded to market perform from outperform at Bernstein. BofA upgrades ONON; downgrades ZGN. Microsoft downgraded to neutral from buy at DA Davidson. Bank of New York Mellon upgraded to buy from hold at Deutsche Bank. Trade Desk initiated neutral at MoffettNathanson. Palantir Technologies downgraded to market perform from outperform at Raymond James. Ulta Beauty downgraded to hold from buy at TD Cowen. Truist downgrades ADI, MCHP.

market snapshot

economic reports today

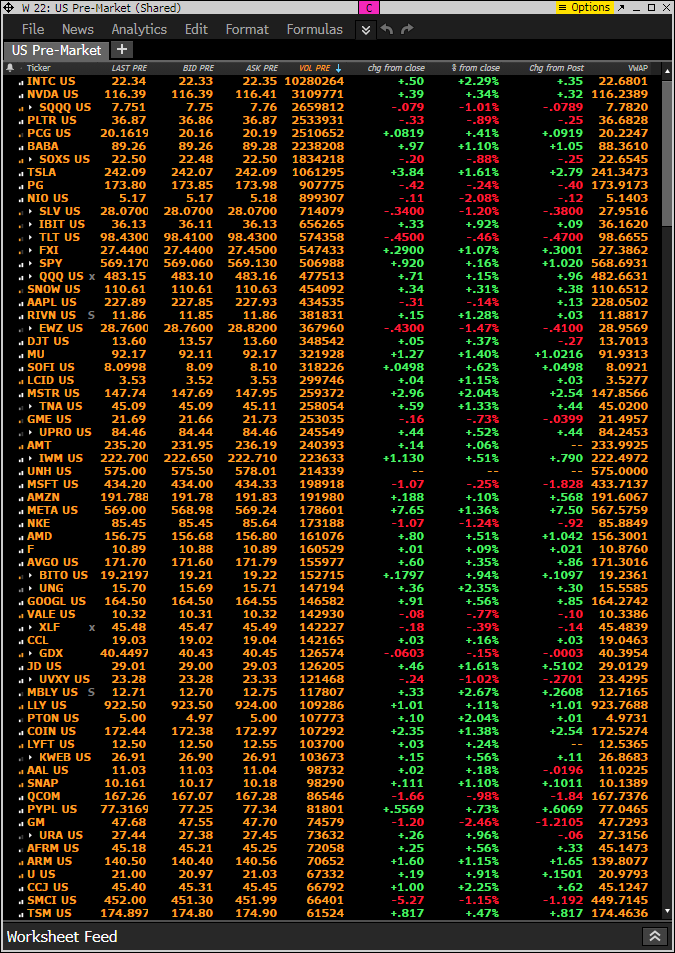

premarket trading

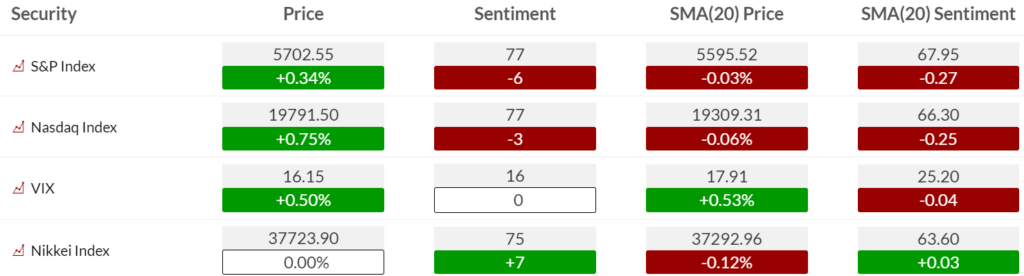

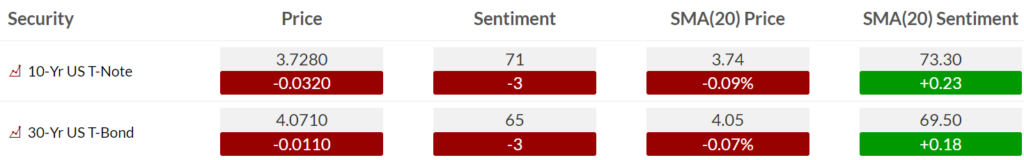

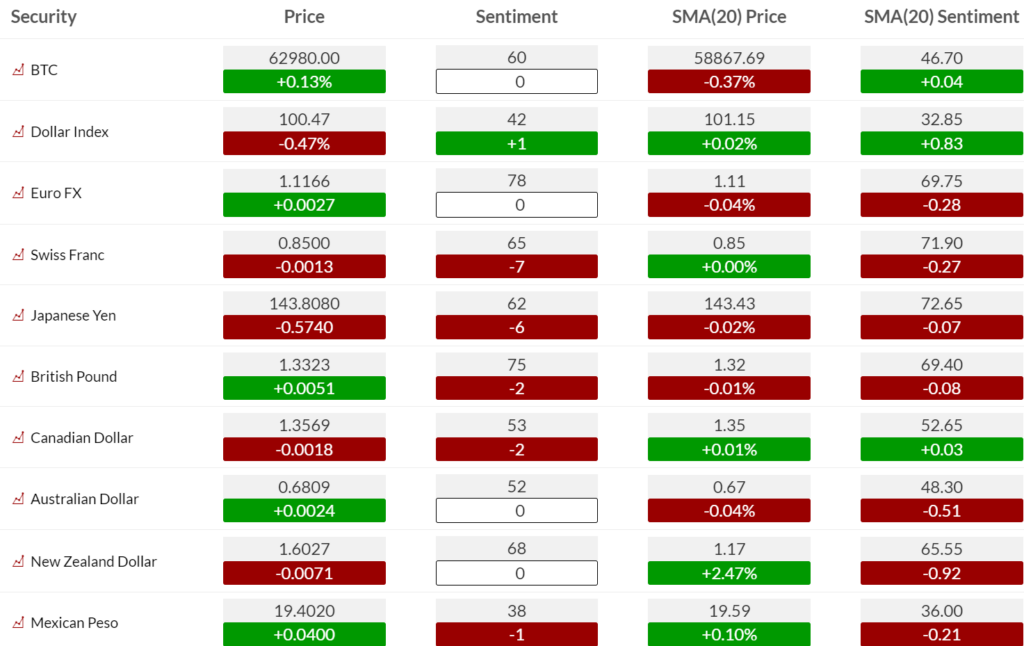

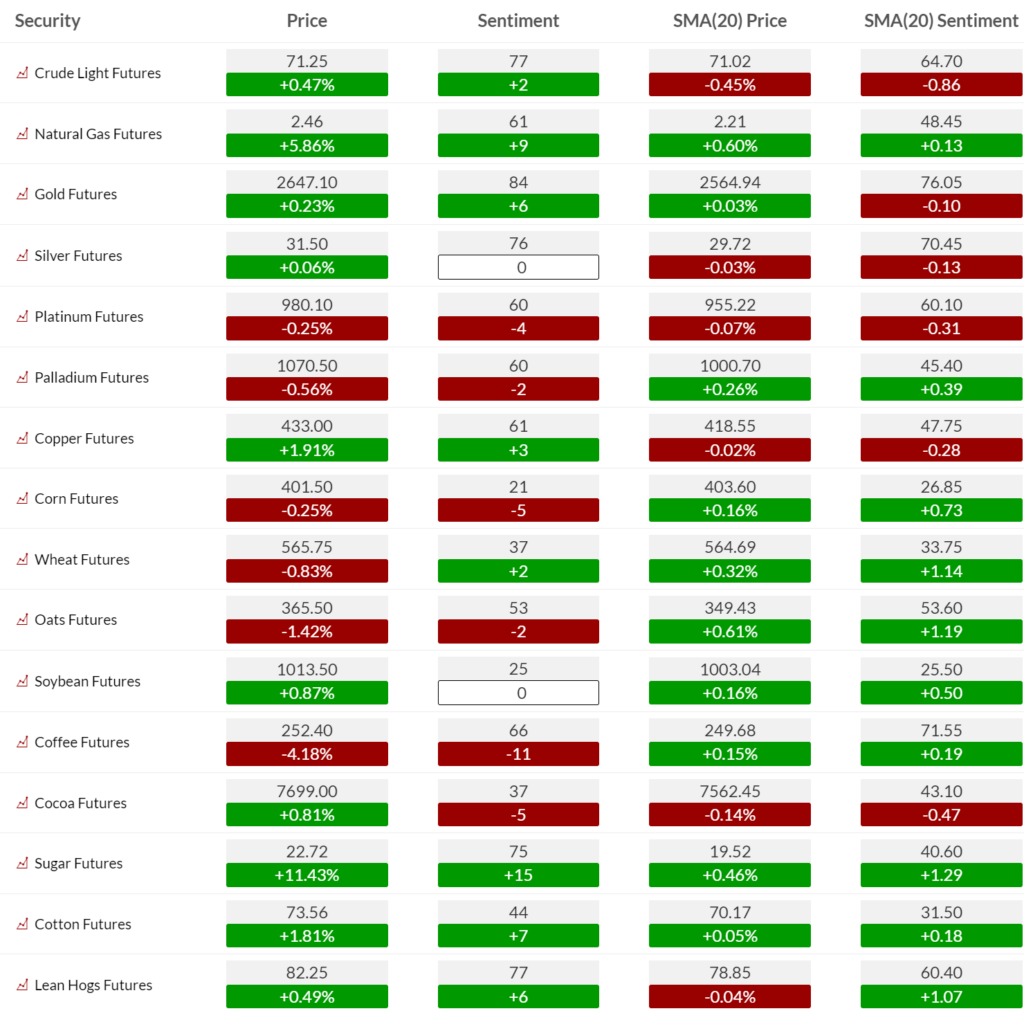

US MARKET SENTIMENT

S&P and Nasdaq bullish sentiment fell back down under the extreme zone into the elevated zone.

Bond bullish sentiment continued to drop after the Fed cut

Currency bullish sentiment little change with US Dollar sentiment still under 50% midpoint majority level. Yen drop was largest weekly drop in quite a while

Commodity bullish sentiment with energy strength on Friday. Notably with Nat Gas. Gold is in the extreme zone at 84% again and might continue to stay elevated. Breaking 60% on Gold sentiment would be the first sign of a trend change.

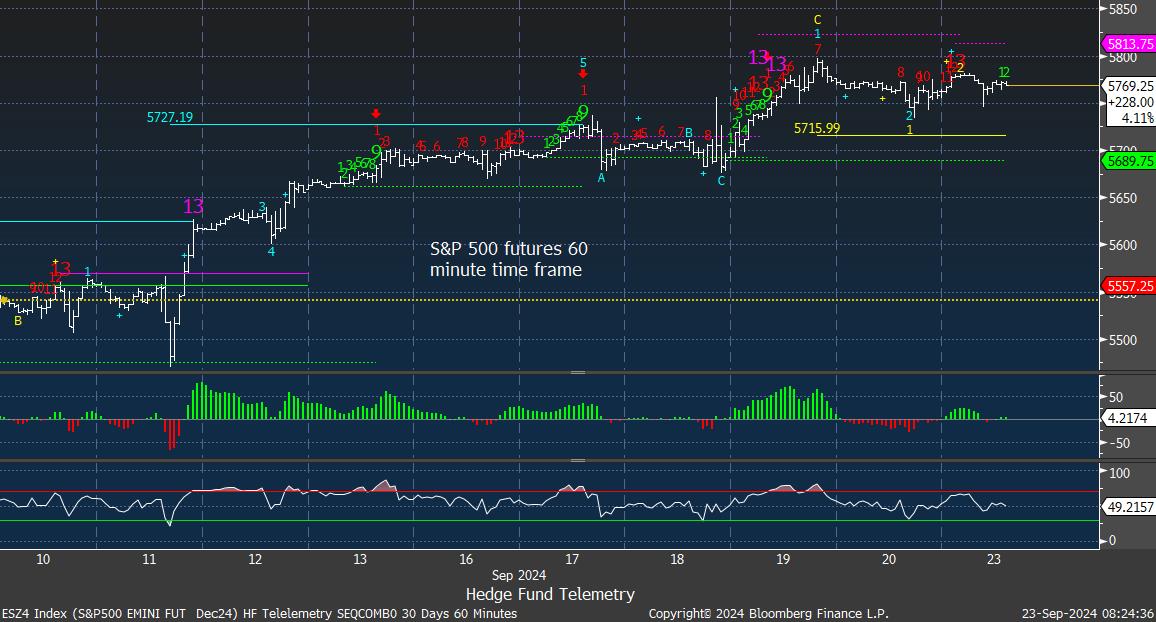

US MARKETS

S&P futures 60-minute tactical time frame sideways action with recent DeMark Sequential sell Countdown 13. Lower high wave 2 of 5 with break of wave 1 (yellow 1) would qualify downside wave 3 of 5 with a potential downside wave 3 price objective of 5715

S&P futures daily with new Sell Setup 9 which has seen stalling and pullbacks in the last 6 months.

Nasdaq 100 60-minute tactical time frame also with recent Sequential sell Countdown 13 with a lower high

Nasdaq 100 futures daily still has the Sequential pending with lower highs

Extra charts we’re watching

US Dollar Index daily continues to consolidate not far from lows.

US 10-Year Yield continues to tick higher

The 2/10 Yield Curve spread continues to steepen.

Bitcoin Daily stalling at the 200 day. If the Setup 9 completes this week, the pending Sequential will cancel. I am unsure this will qualify the 9 as the prices are very tight in the last few days.

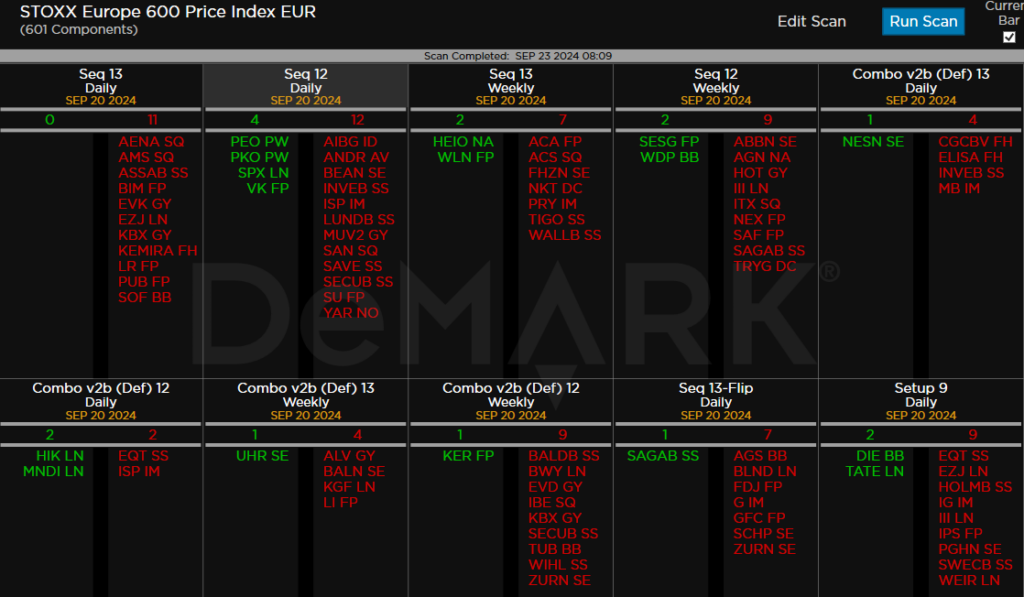

DeMark Observations – Euro Stoxx 600

Continued high number of sell Countdown 13’s on 12/13s