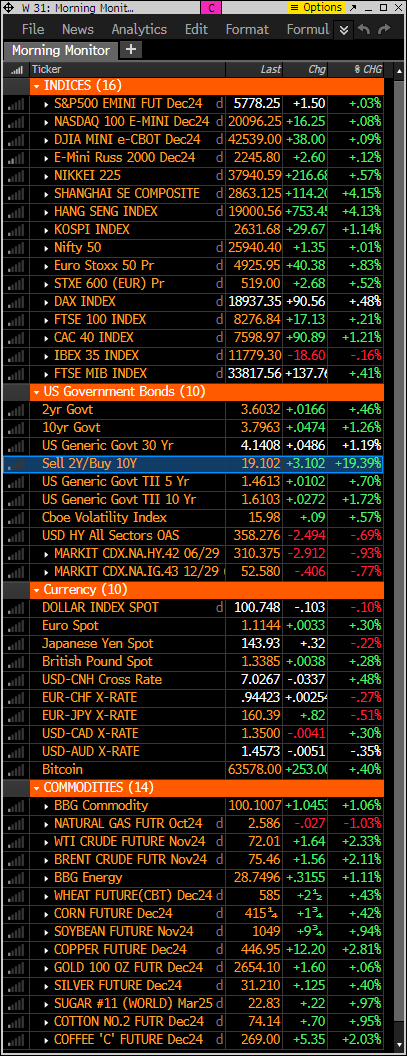

- S&P and Nasdaq futures up 0.1% in Tuesday premarket trading, off best levels. Starting to see some volatility with futures trading with Middle East headlines – an under appreciated risk. Energy was the best performing sector yesterday. Treasuries weaker with more curve steepening; 2/10 spread has expanded for five straight sessions now at +19bps. Dollar index down 0.1% though some yen weakness on dovish leaning Ueda comments. Gold flat. Bitcoin is up 0.2%. WTI crude up 2.2%.

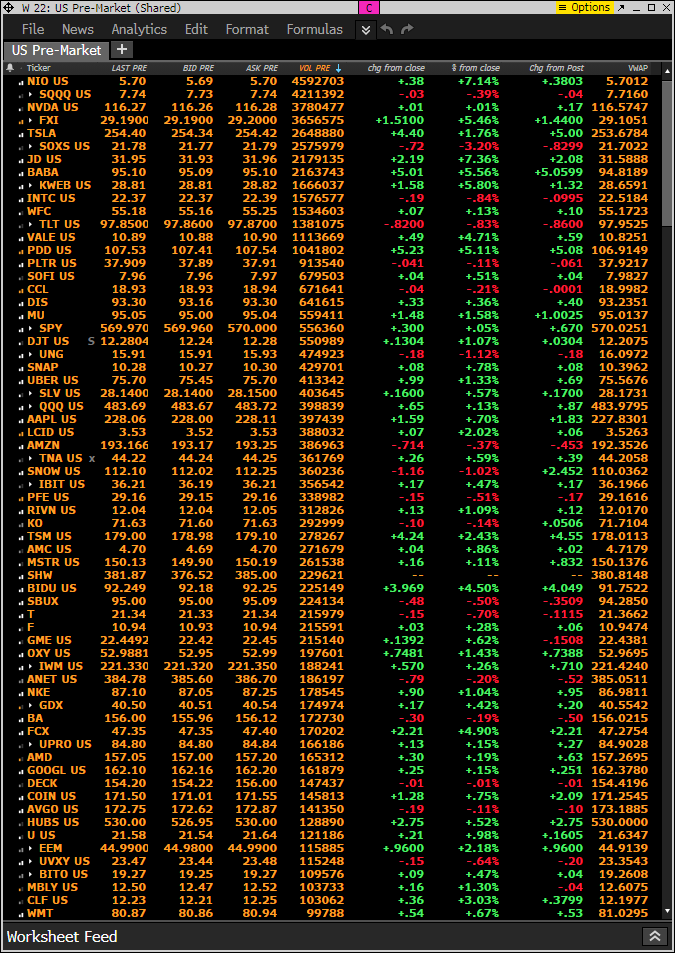

- Trade Ideas Sheet: China finally released some stimulus, which is moving our China long exposure in the premarket: BABA is up nearly 6%, KWEB is +6.25%, and BIDU is +4.5%. I will continue to hold what we have with overall China tech exposure at 7%.

- China policy support measures have received the bulk of the attention today. While somewhat more aggressive than expected, still concerns Beijing needs to deliver more aggressive fiscal stimulus to boost domestic demand and more aggressive destocking and debt restructuring measures to address structural headwinds on the property sector. Deluge of Fedspeak not expected to have much impact on the 25 vs 50 bps debate that has shifted to the November FOMC meeting, particularly with a flurry of data over the next six weeks. Combination of Fed easing and soft landing still the key tailwind for risk sentiment. However, also near-term concerns surrounding negative seasonality and fading buyback bid into earnings.

- US economic calendar brings FHFA house price index and S&P Case-Shiller 20-city home price index for July and Conference Board consumer confidence and Richmond Fed manufacturing index for September. Fed Governor Bowman also speaks today. Following her dissent in favor of a 25 bps rate cut last week, Bowman flagged concern that a 50 bps move could be construed as signaling a “premature declaration of victory” on the inflation mandate. Added that a 25 bps move would have dampened the risk of unnecessarily stoking demand. Treasury will sell $69B of 2-year notes this afternoon, ahead of 5- and 7-year note auctions on Wednesday and Thursday.

- Still pretty quiet in terms of corporate news. Visa reportedly to be hit by DoJ with debit card business monopolization lawsuit. Striking machinists said final offer from BA not good enough and won’t vote on the measure. Trump threatened to hit DE with 200% tariffs if the company moves production to Mexico. AZO missed, flagging deferrals across its discretionary merchandise categories. SNOW lower after announcing $2B convertible note offering. FT reported LEVI again warned of delay in hitting $10B sales goal. LBRDK up big on CHTR combination proposal.

China names—stay long KWEB FXI – from sales trader at MLCO

My assumption is most are going to throw some cold water on this “more of the same not enough” and that very well could happen.. However I think this rally may stay well bid for longer than most believe vs being entirely ephermal.

1) there should be anticipation of more to come which you don’t want to fight (sure its not enough but it’s a good start)

2) there is nobody there and sentiment could not be worse

3) trying to stay long will be very contrarian

4) have seen size positioning in options markets FXI KWEB EEM

5) technicals improving

Key Upgrades/Downgrades: BofA downgrades EQR, ESS, INVH. Starbucks downgraded to underperform from hold at Jefferies. Sirius XM Holdings resumed underweight at Morgan Stanley. Pinterest initiated outperform at Oppenheimer. Lowe’s Companies upgraded to outperform from perform at Oppenheimer. Salesforce upgraded to overweight from neutral at Piper Sandler. Redburn Atlantic downgrades BP.LN, XOM. Truist upgrades WMT; downgrades COST.

market snapshot

economic reports today

premarket trading

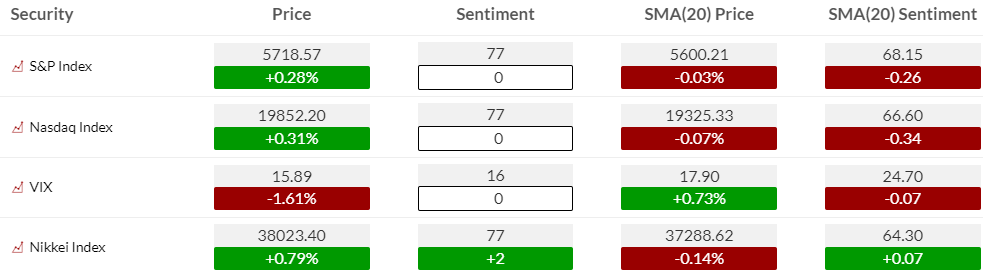

US MARKET SENTIMENT

S&P and Nasdaq bullish sentiment was unchanged at the upper end of the elevated zone >70%

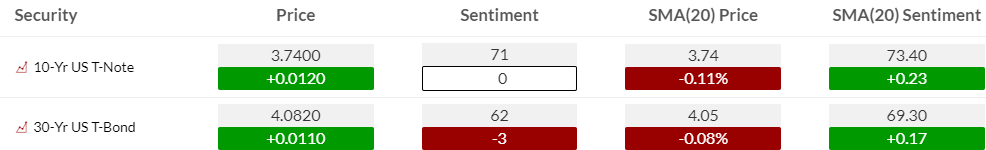

Bond bullish sentiment slipped again after sentiment moved into extreme zone ahead of the Fed

Currency bullish sentiment shows US Dollar sentiment strength. It’s highly divergent with sentiment and price since the recent low in sentiment was 13% and now it’s nearly at 50% with very little upside price movement.

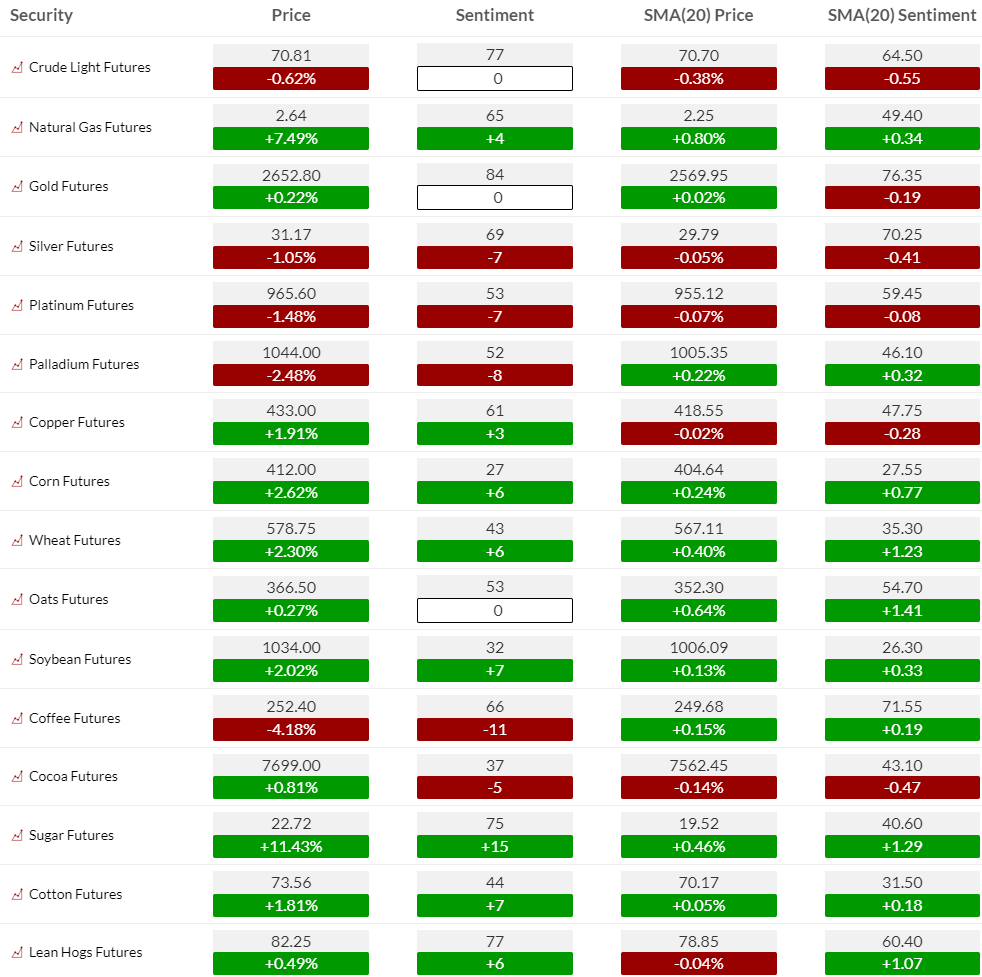

Commodity bullish sentiment with notable weakness in metals ex gold and copper

US MARKETS

S&P futures 60-minute tactical time frame sideways action continues.

S&P futures daily with new sell Setup 9 with current Sequential started from the Setup 9 from back in August is on day 9 of 13

Nasdaq 100 60-minute tactical time frame sideways action continues

Nasdaq 100 futures daily still has the pending Sequential to watch while this remains well off July highs

Extra charts we’re watching

US Dollar Index daily continues to struggle and could very well move lower and complete the pending Sequential Countdown to 13

US 10-Year Yield continues higher with Setup on day 5 of 9. Completion of the current Setup to 9 will cancel the pending Sequential

2/10 yield curve spread continues to steepen

Bitcoin Daily continues to stall at the 200 day with Sell Setup on day 7 of 9. It will need to lift a little more to qualify and continue the Setup count

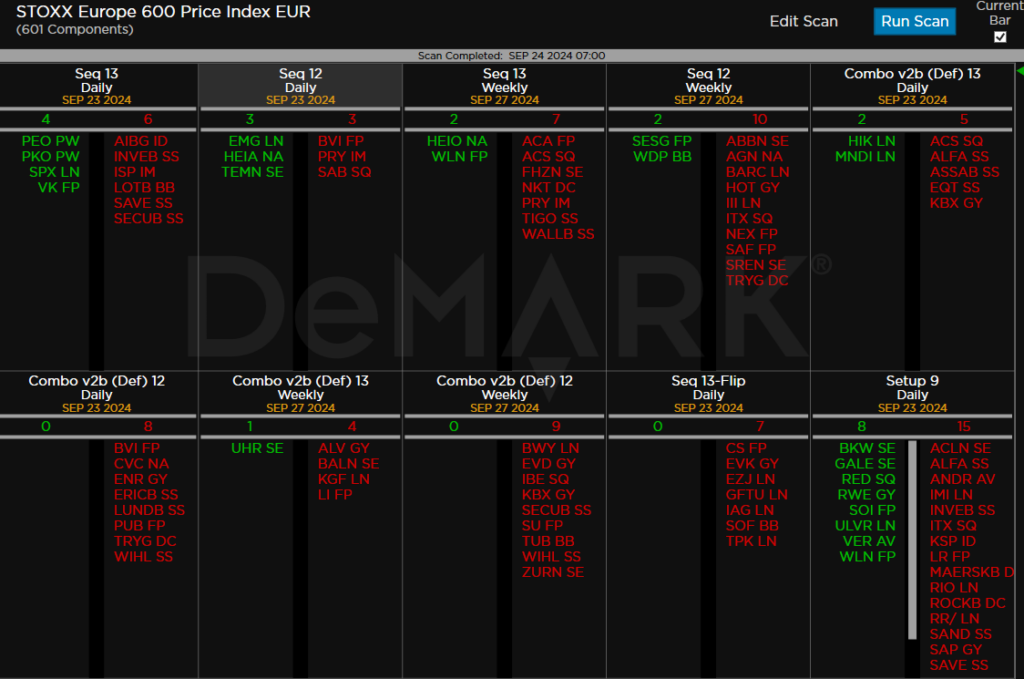

DeMark Observations – Euro Stoxx 600