Remember, we are hosting our bi-monthly new short interest webinar today at 10:30 a.m. ET. Here is the link to register.

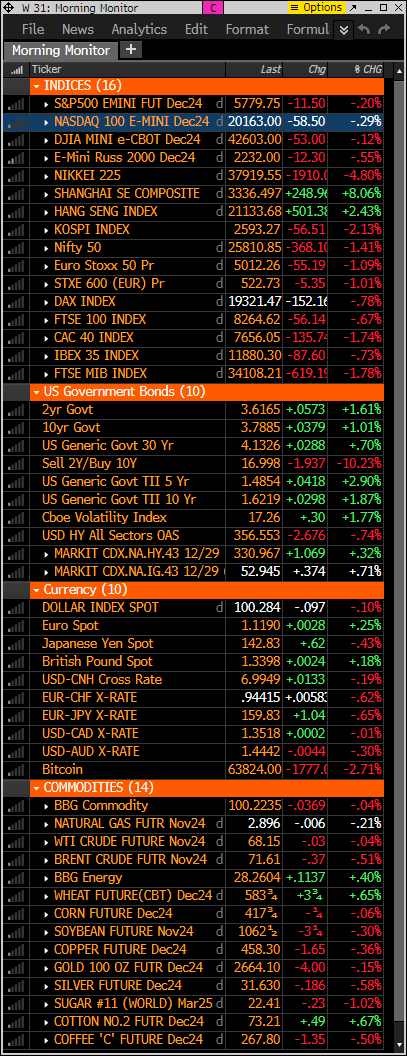

- S&P futures down 0.25% and Nasdaq futures down 0.35% in Monday premarket trading, off worst levels. Shanghai was up 8% and Hong Kong up 2.4% while Japan was down 4.8%. This is lifting out China tech longs again in the premarket. European markets are down 1%+ with some recent DeMark sell Countdown 13’s (see charts at bottom) Treasuries weaker with some curve flattening. Dollar index down 0.1%, mixed on the major crosses. Yen slightly weaker after a a big strong day on Friday. Gold down 0.2%. Bitcoin down 3%, though off worst levels. WTI crude down 0.3% despite continued Mideast uncertainties.

- Fed Chair Powell is set to speak today (1:00 ET). This comes after last week’s Fedspeak leaned dovish, with a number of officials continuing to argue the Fed needs to get ahead of the curve given recent labor market cooling. The JPM collared fund will print new option strikes midday and could see some volatility. End of the month price marking expected at the end of the day.

- US east coast port strike threat remains unresolved with no talks scheduled. In addition to Powell, Fedspeak today include Fed Governor Bowman (8:50 ET). Tuesday’s VP debate the next big election item, though some press pieces noted investors so far playing down political uncertainty into Q4. China continued to offer policy support updates, cutting mortgage rates and easing homebuying restrictions in latest effort to prop up real estate market. China September PMI also mixed while Caixin PMIs also mixed including manufacturing back into contraction territory.

- AAPL pulled out of latest investment round in OpenAI, but MSFT expected to follow through with additional $1B investment. Reports said OpenAI expected to see $5B in losses on $3.7B in revenue this year, though revenue growing sharply. Reports said Apple also expected to shift headset strategy, exploring potentially cheaper Vision Pro 2, smart glasses. T to sell remaining DirecTV stake to TPG for over $7B, while latest reports said DirecTV in advanced stages of acquiring Dish. Union representing BA workers said talks with company broke off following latest negotiations. Glenview Capital expected to meet with CVS leadership today in what could be start of activist push. STLA cut annual guidance, citing weaker global industry dynamics, rising China EV competition. – another European automaker warning.

- Key Upgrades/Downgrades: Barclays upgrades BF.B; downgrades PG. Permian Resources initiated buy at Goldman Sachs. Morgan Stanley upgrades CADE, USB, ZION; downgrades CBSH, JPM. Freeport-McMoRan downgraded to sector perform from sector outperform at Scotiabank GBM. Walt Disney upgraded to buy from neutral at Seaport Research Partners. Accenture upgraded to buy from hold at TD Cowen. Hess Corporation upgraded to outperform from peer perform at Wolfe Research

market snapshot

economic reports today

premarket trading

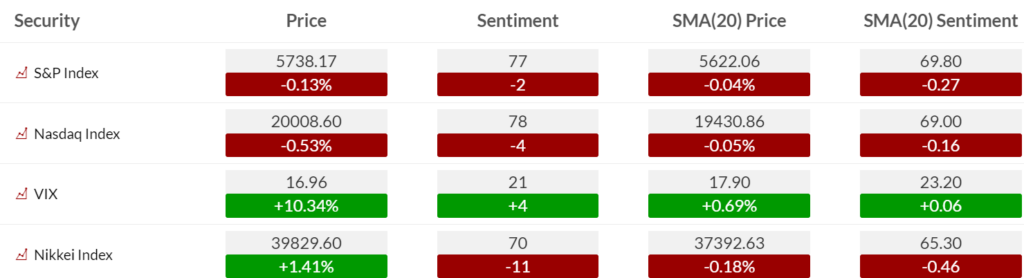

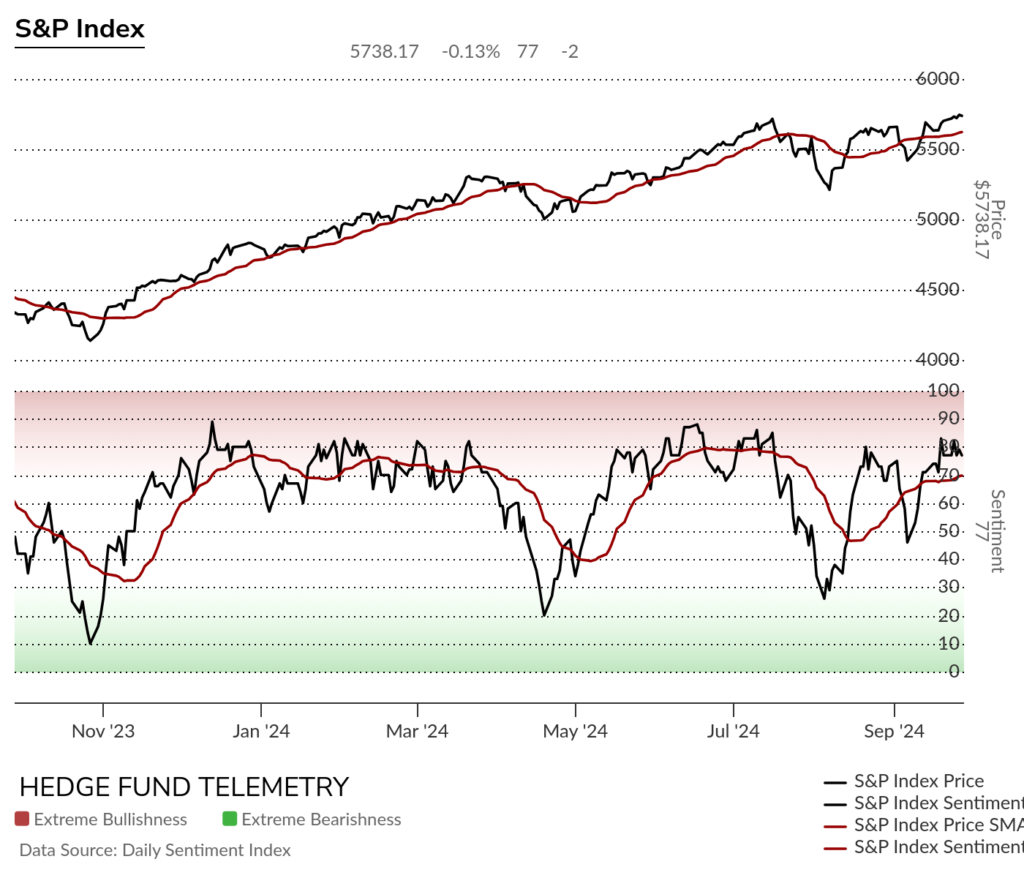

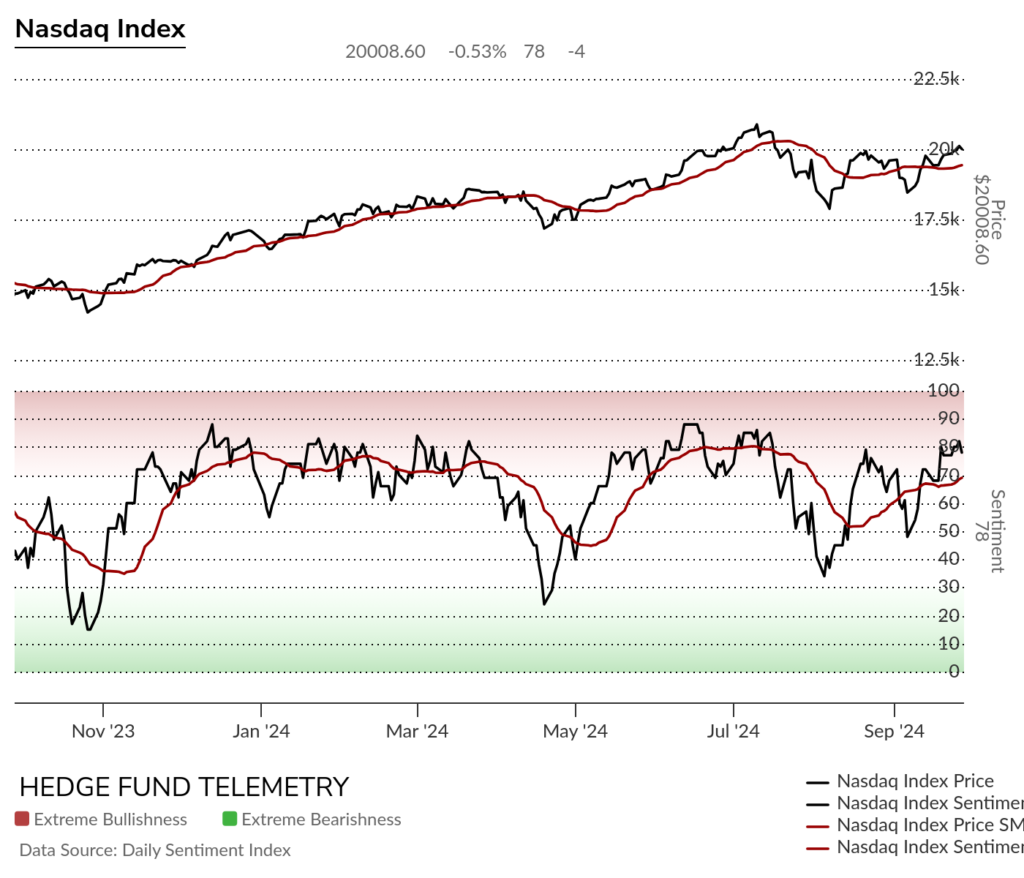

US MARKET SENTIMENT

S&P and Nasdaq bullish sentiment with small drop on Friday at the upper end of the elevated zone >70% but back below the extreme zone >80%.

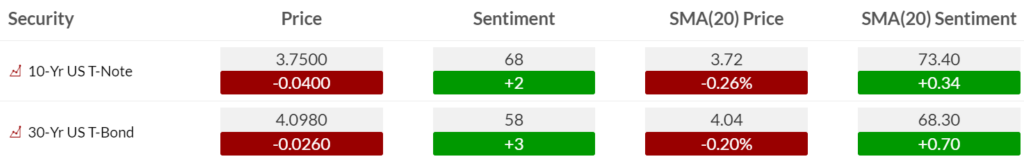

Bond bullish sentiment ticked higher after falling all week

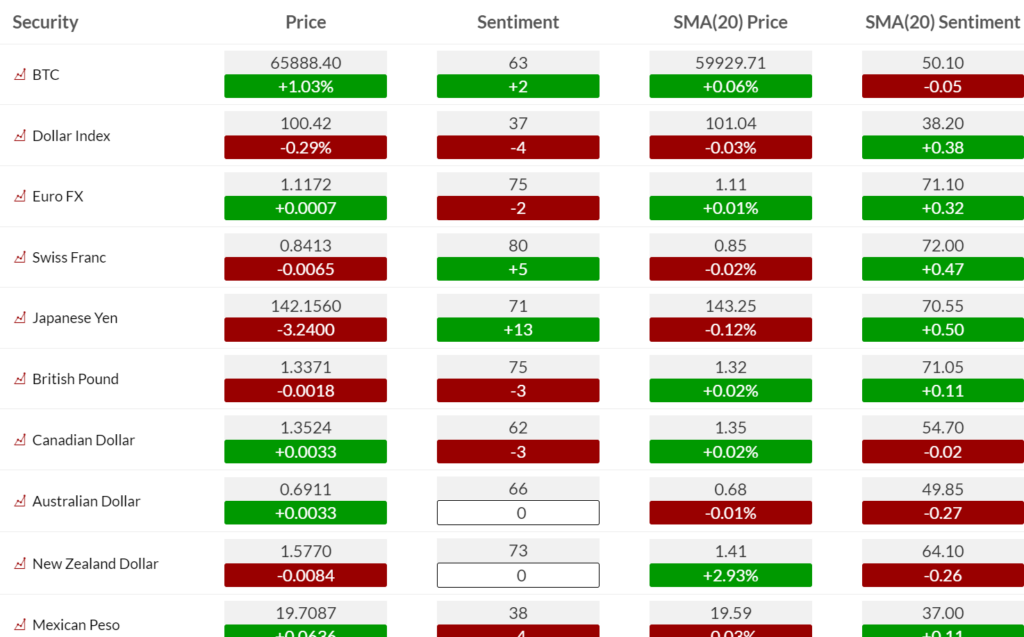

Currency bullish sentiment saw the US Dollar sentiment drop while a big bounce for Yen sentiment.

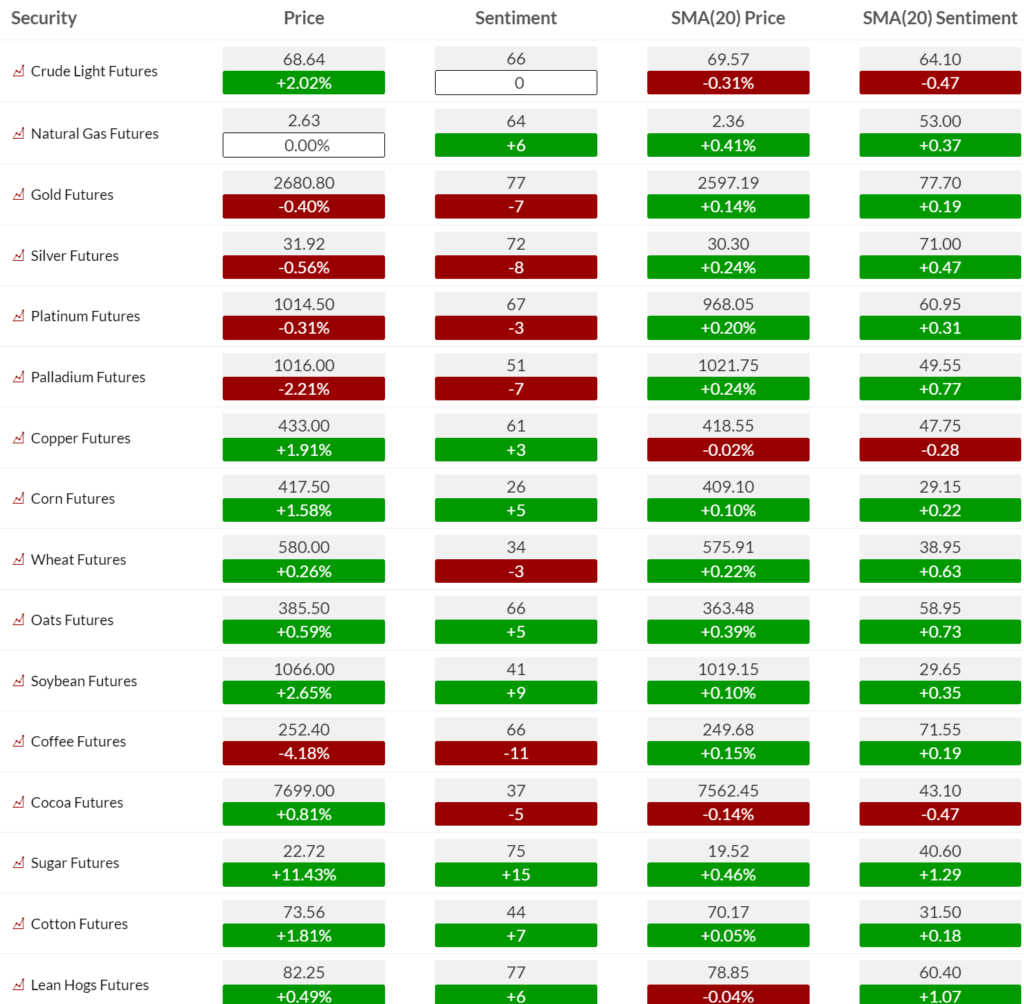

Commodity bullish sentiment saw metals sentiment decline from extreme zone >80%

US MARKETS

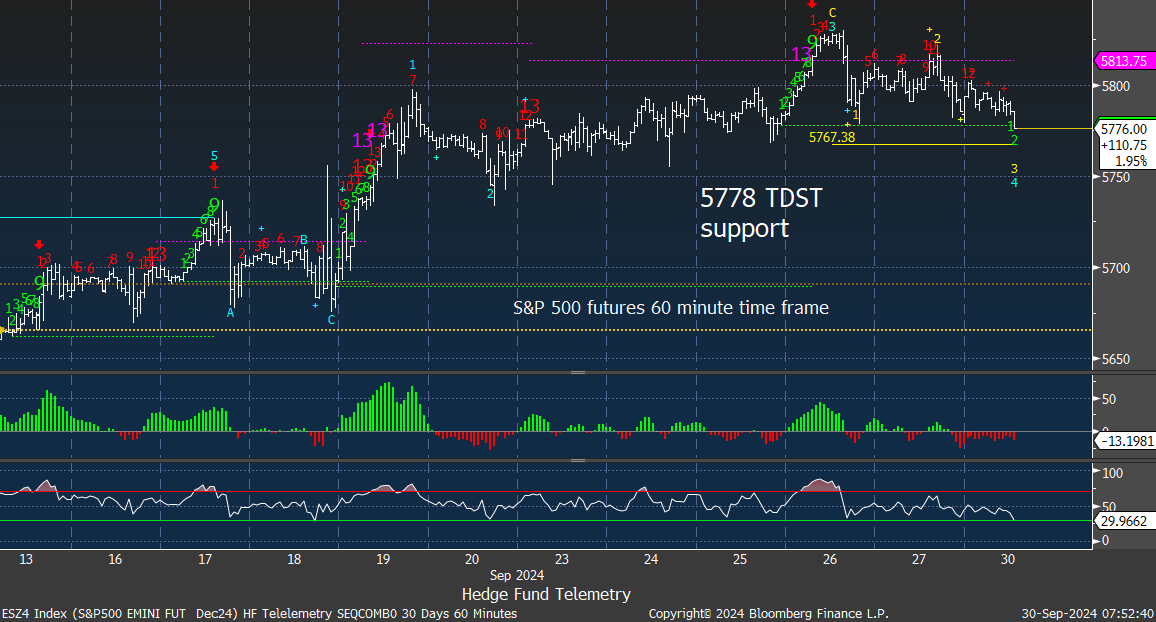

S&P futures 60-minute tactical time frame had a DeMark Cobom near the recent high with a Sequential left pending on hour bar 12 of 13. Near term support at 5750

S&P futures 240-minute with recent DeMark Sequential at the high. 5700 is support

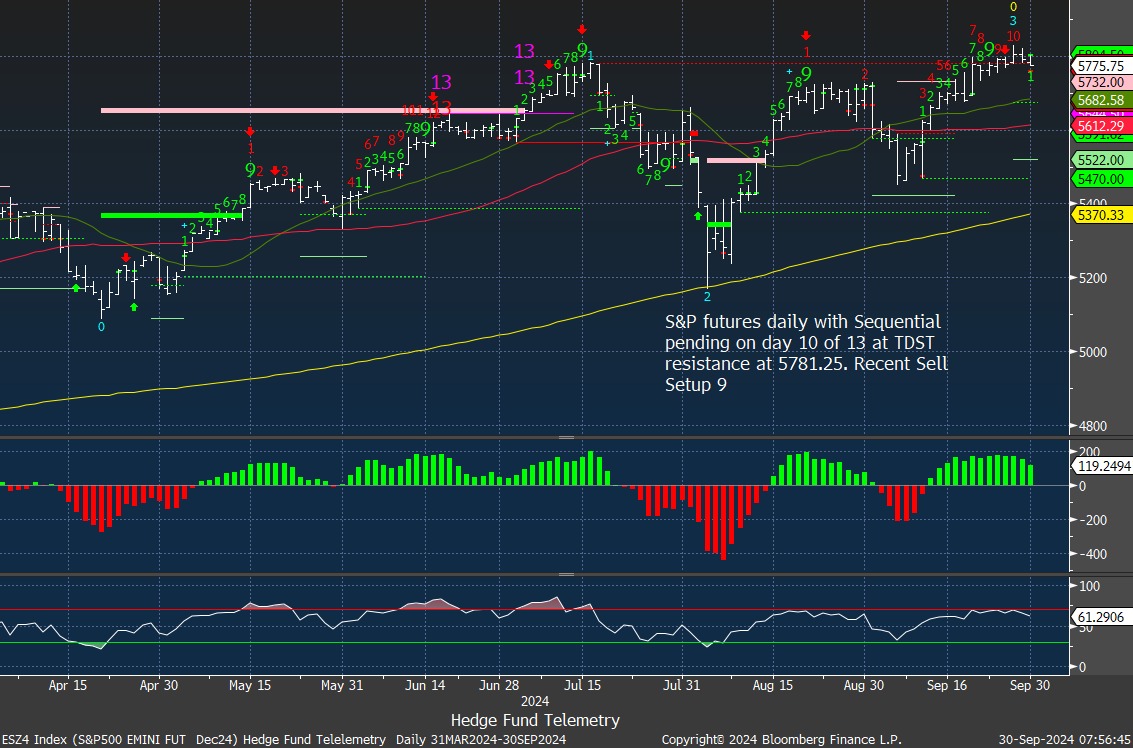

S&P futures daily still has the Sequential pending on day 10 of 13 with price flip down today. A Sequential can go silent and sideways in the process.

S&P bullish sentiment dipped on Friday and remains in the elevated zone >70%

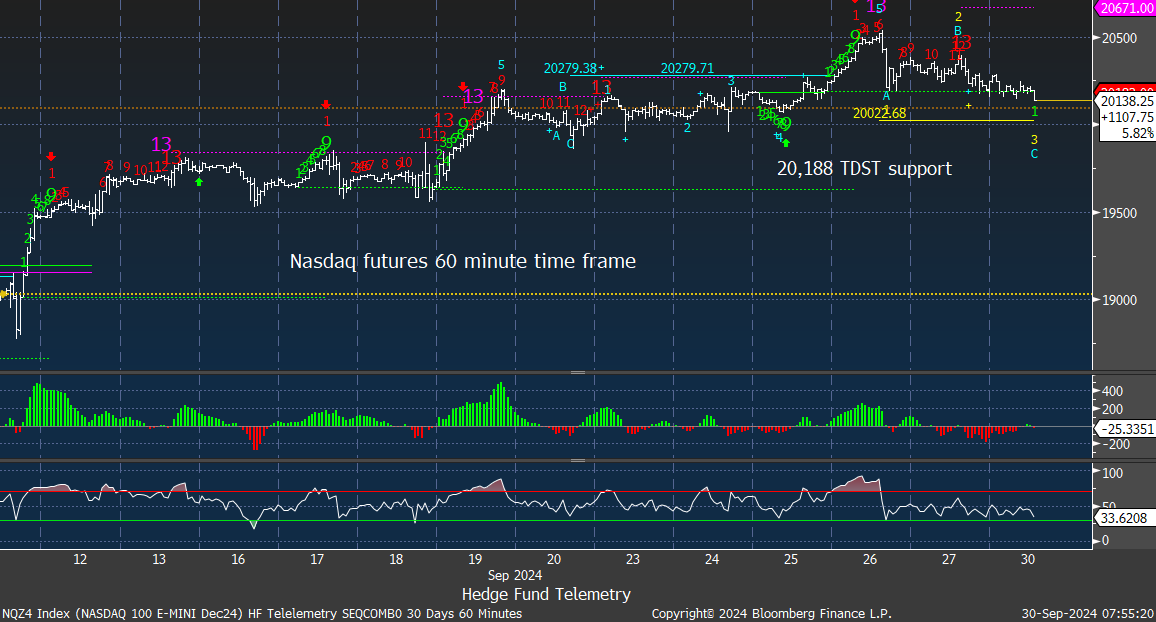

Nasdaq 100 60-minute tactical time frame with recent DeMark Combo and Sequential sell Countdown 13’s breaking TDST support with bigger round number 20k support

Nasdaq 100 240-minute had recent Sequential and Combo sell Countdown 13’s

Nasdaq 100 futures daily still has the Sequential in progress

Nasdaq sentiment dipped on Friday and remains elevated

Extra charts we’re watching

US Dollar Index daily still has the Sequential in progress on day 10 of 13

Yen strength came back on Friday after the election results. Today’s action is muted and not much of a reversal. Risk of breaking recent support which would qualify into wave 5 of 5

US 10-Year Yield with Setup 9. Watching to see if upside continuation starts a new Sequential Countdown in coming days.

Bitcoin Daily is down 3% today, with pending Sequential now on day 12 of 13. To qualify for the 13, a move lower is required.

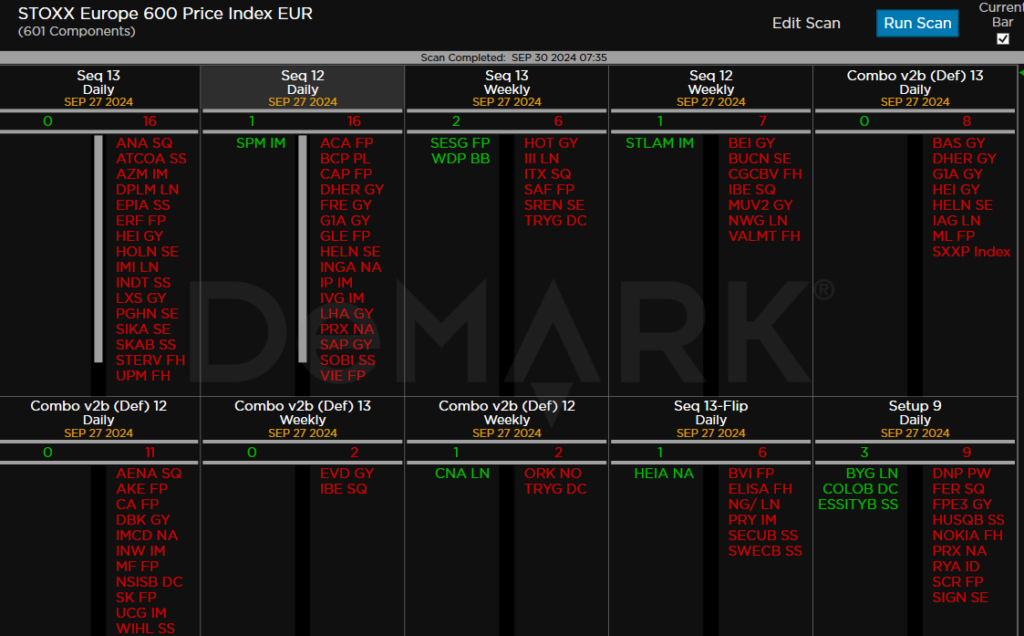

DeMark Observations – Euro Stoxx 600

Euro Stoxx 600 with new DeMark Sequential and Combo sell Countdown 13’s

Germany, France, Italy with DeMark sell Countdown 13’s

Continued high number of sell Countdown 13’s developing