If you have been waiting for Rolls Royce to open a bespoke showroom in NYC so you can design your next Rolls Royce, it’s your lucky day as they finally opened it. I know there are a few of you to whom this doesn’t apply, but this is great news for the rest of us. In all seriousness, I point this out because it could be a sentiment read or a peak on the highest of the high-end consumer.

I distinctly remember when Lamborghini opened a showroom here in Greenwich in Q3 2007 (right after the Fed cut rates for the first time). It marked a high point, and the showroom closed in March 2009, when the markets bottomed. Rolls-Royce discussed how they hoped the US market would be strong to offset the weakness seen in China. I’m not a Rolls Royce buyer any time soon and am happy driving my 13 year old Range Rover (when it runs properly). Rolls-Royce is a beautiful car with superior engineering, but the snob factor can’t get any higher.

There has been a bifurcated consumer, with the high end starting to show some slowing. Slowing in a way where the Amex bill is still thicker each month in the mail than the average person. The middle class has shown signs of looking for bargains to stretch dollars, and the low end is struggling hard. The S&P may be at a new high, but consumer confidence has declined. This is also seen in the political angst this election. I pride myself on being “aggressively frugal,” which has been my advice to my adult daughters. I expect times to get tougher next year as a recession has a greater than 50% chance.

After seeing my texts about the Rolls NYC showroom, my friend Julian Brigden sent me this chart of the timing of two other big markets for Rolls Royce buyers. Again, I think it’s a sentiment read on the high-end consumer. If the high-end consumer starts to slow spending, then there could be a trickle-down effect.

Another sign is that the art market is under stress. Sotheby’s needs a bailout. I don’t feel too bad for art dealers, as most travel in an opaque market. But if sales are past peak, many leveraged owners of overpriced artworks are out there. Are real estate, classic cars, and other overpriced collectibles next to see sellers emerge?

This leads me to something we’re more involved with—the equity markets. We got a taste of a short-lived panic with the Japanese carry trade unwind, which quickly hit all markets. It was a good read on the potential leveraged positioning that now has investors “all in,” the recent Fed cut gave them the comfort of a soft landing, no landing, or status quo. As I mentioned yesterday, Bank of America saw one of the most significant inflows into the equity markets last week since they tracked the data. I see this as a risk because I’d rather be a buyer of a huge outflow to capture the renewed inflow and take things higher. Any slip-up in economic data, a major earnings warning, or even something outside the markets could cause another sharp drop, with everyone running for the doors together.

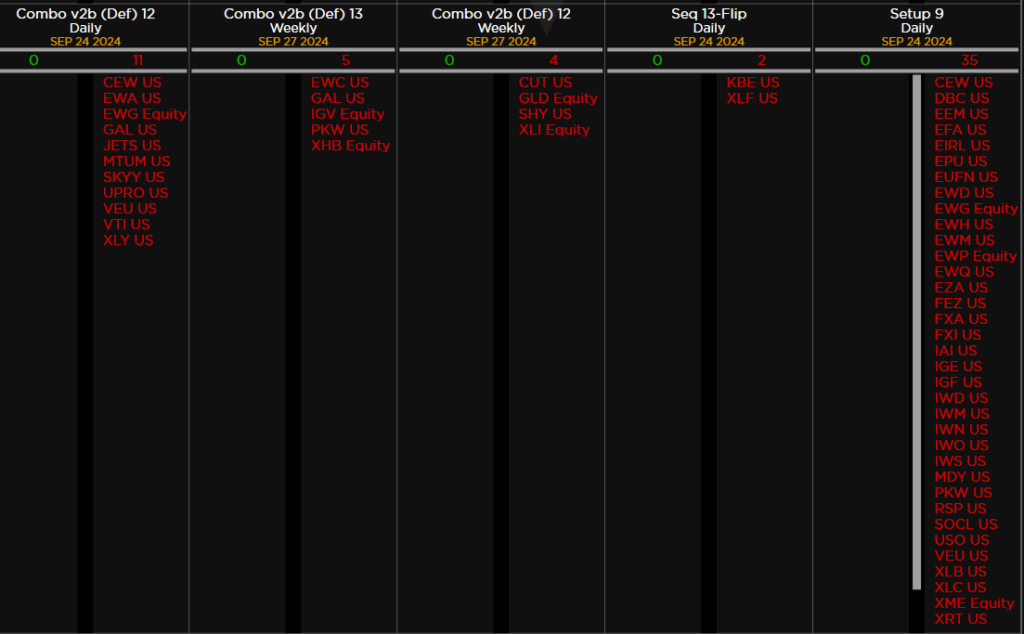

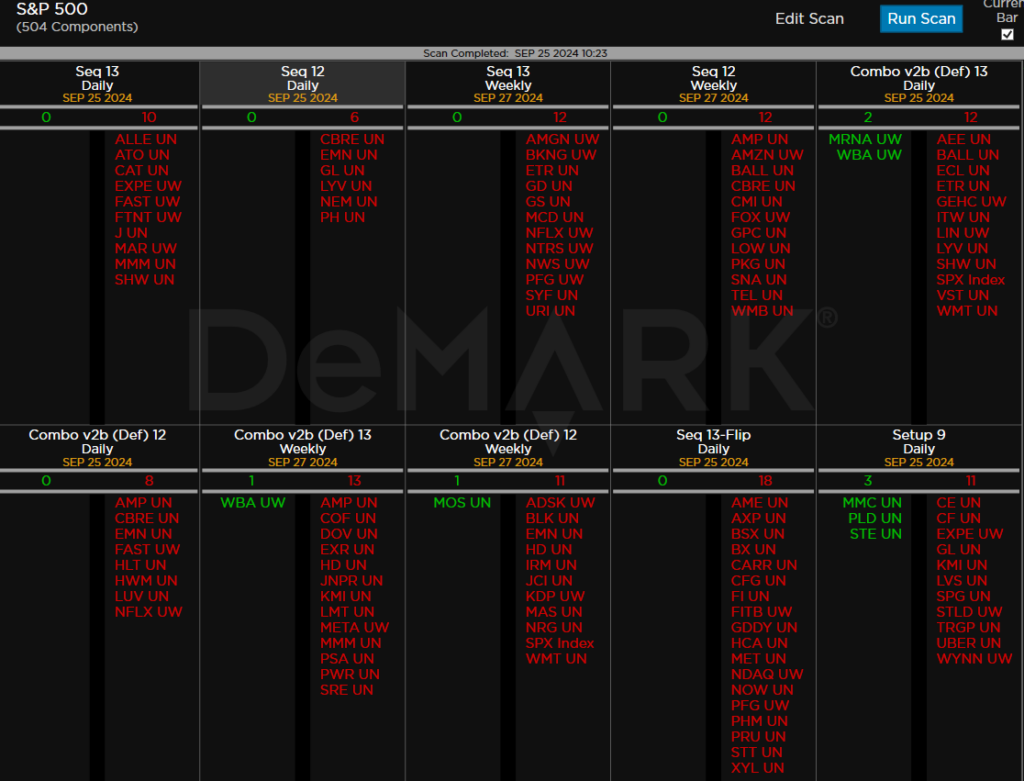

Below, I focused on the major US sector ETFs, of which there are many, with some important DeMark signals developing. The number of sell Countdown 13s and sell Setup 9s that I post each day on the screens is again elevated, and as a power in-numbers person, seeing this many signals is a concern.

Equity markets are off highs and down moderately, masked by Mag 7 strength. Short baskets are down hard, as is the Russell 2000 (~1%). Breadth is negative, with the NYSE down 1350 issues and the Nasdaq down 1200 issues. Rates are higher again up 6 days in a row since the Fed cut. Commodities are mixed with Crude pulling back 2.5%, with metals mostly flat.

TRADE IDEAS

Giving back a PNL little from yesterday’s nice gain. Some longs that were very strong and backing off and I have no issues with them. I will hold off on any changes.

US MARKETS

Here is a primer on the basics of DeMark Setup and Sequential indicators. And this is a good video on DeMark – it’s an old video but pretty good from the late Steven Quimby of DeMark.

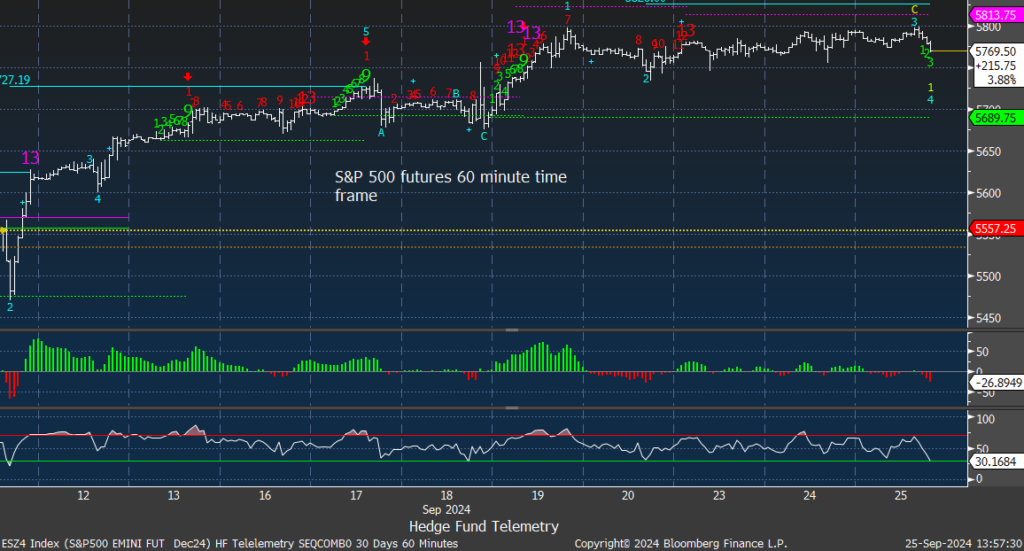

S&P 500 futures 60-minute time frame lacking momentum on the upside and downside. Sideways until 5700 breaks on the downside.

S&P daily has new Combo sell Countdown 13’s with the Sequential getting closer on day 11 of 13.

Nasdaq futures 60 minute sideways with 20k as important support

Nasdaq 100 daily has an uncanny look similar to NVDA (see below).

Russell 2000 daily with new Sell Setup 9 which worked the last few times

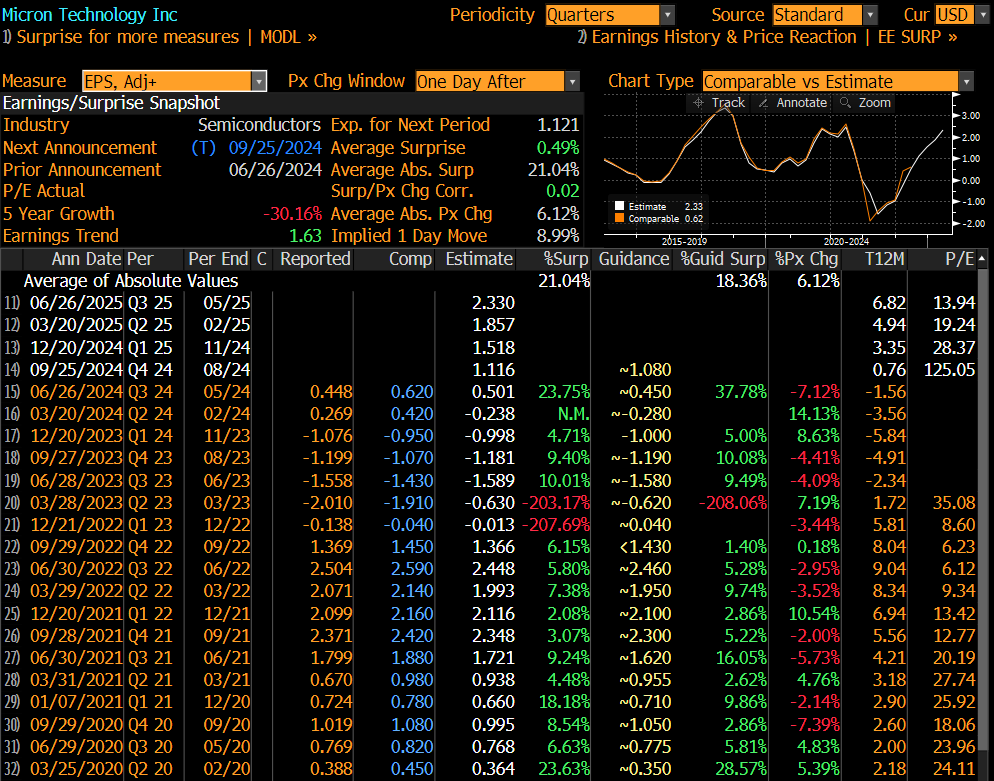

Micron earnings preview

Micron MU reports after the bell and it will be watched closely as another semiconductor read. It’s down about 35% from the last report and It’s made lower highs and lower lows. It’s moved off the lows and I believe sentiment is cautiously optimistic. DRAM pricing (their main business) has been weak and the question is if the AI business can lift this. I’m going to pass on doing anything and I would probably lean slightly long into this.

The implied move is high at 9%.

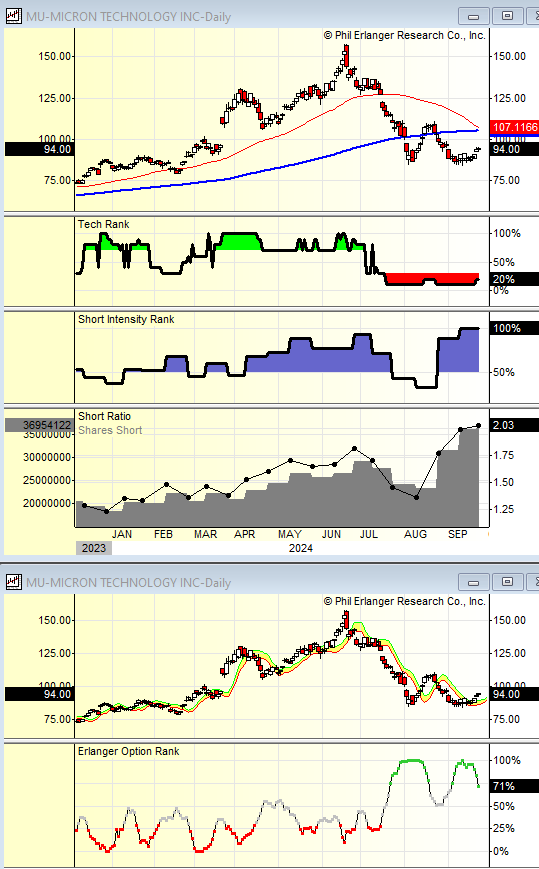

One of the reasons I would lean long is the higher short interest with 2 days to cover. On the Options Rank there has been heavy put buying with the green dots also a contrary signal that could see a bounce. Seasonality isn’t great but the heavy short interest could see a squeeze and in this market people will buy anything that goes green especially a semiconductor!

US SECTOR ETF FOCUS

Comments on charts

XLK Technology still has a Sequential Countdown pending on the downside however if the upside Setup 9 completes – it’s on day 5 of 9 today then the pending Sequential will cancel. This looks like the next few chart in tech.

SMH Semiconductors bounced again off the 200 day with a Sequential in progress on day 8 of 13.

I put NVDA in here as it looks identical to the Nasdaq 100 and SMH.

FDN Internet with new DeMark sell Countdown 13’s. Overbought RSI

XLY Consumer Discretionary has both AMZN and TSLA with ~20% weight each. Sequential on day 12 of 13 and is extended.

XLI Industrials with new Sequential and Combo sell Countdown 13’s. Extended

XLF Financials, KBE and KRE all had recent DeMark sell Countdown 13’s as I highlighted last week and reversed down.

XLE Energy and OIH Oil Service have made lower highs and since I am long, I’m a little concerned about today’s pullback. I will hold both for now as a pullback after the move shouldn’t be a surprise.

XLP Consumer Staples with a Sequential nearing

XLC Communications Services with new Sell Setup 9 that worked the last several times.

XLV Healthcare and IBB Biotech have pulled back

XLB Materials is on day 12 of 13 with the Sequential Countdown

XLRE Real Estate and XHB Homebuilders are extended with some DeMark sell signals. I expect these to pullback – especially if the regional banks continue to weaken.

XLU Utilities is extended with DeMark sell Countdown 13’s still in play. Overbought RSI

IYT Transports getting closer to the Sequential 13

FXI and KWEB China/Hong Kong ETFs have new Sequential Countdowns but I want to see if the gap can hold before adding more.

ARKK is nearing another new Sequential sell Countdown 13

FEZ Euro Stoxx 50 also with a Sequential 13 like the Euro Stoxx 50 index as shown on First Call.

GLD Gold has new Sell Countdown 13’s as does a few other gold proxies.

GDX Gold Miners trades well and does not have a DeMark Signal

SLV Silver with new Combo and Sequential 13 nearing

URA Uranium is a current long idea working well. I still like this however the RSI is a bit overbought

I thought I’d put TLT in here too as I had been highlighting the sell signals within the bond market ETF proxies in the last few weeks.

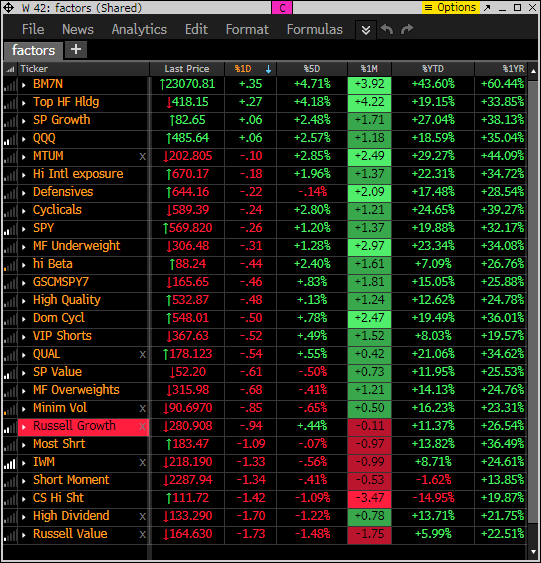

FACTORS, GOLDMAN SACHS SHORT BASKETS AND PPO MONITOR UPDATE

Factor monitor today shows where the money has been and continues to gravitate to – Mag 7, GS VIP top holdings, growth, QQQ and momentum.

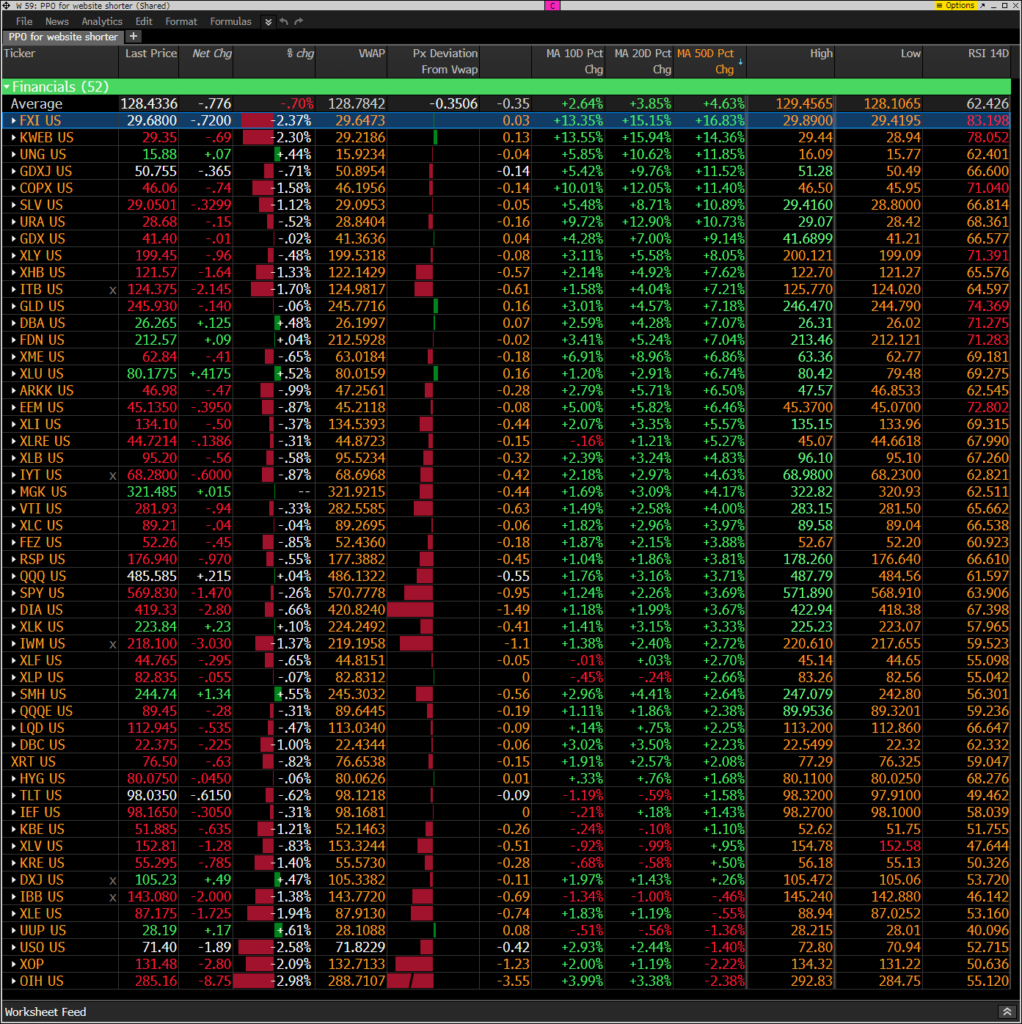

This is similar to the above monitor with various ETFs other indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Today the short baskets are mostly all lower.

The PPO monitor (percentage price oscillator) force ranks ETF’s by percentage above/below the 50 day moving average. For information on this monitor please refer to this primer. This monitor is offered to Hedge Fund Telemetry subscribers who are on Bloomberg. Notable: Most ETFs are down and under today’s VWAP levels.

Demark observations

Continued high number of Sell Countdown 13’s developing with a large number of price flips down

The ETFs also have an unusually large number of sell Countdown 13s and a high number of sell Setup 9s. There are 160 ETFs screened each day.