- S&P futures down 0.35% and Nasdaq down 0.3% in Tuesday morning trading. Treasuries rallying across the curve – we bought bonds yesterday. Dollar index little changed despite yen strength. Gold up 1% – we bought GLD yesterday. Bitcoin up 2%. WTI crude down 0.4% after rallying nearly 3.5% on Monday.

- Feeling better and working on getting caught up. Trade Ideas sheet will be updated on the site in a few minutes. I’ll do a NVDA preview on the next note.

- Defensive tilt seems to be a function of continued ramp in geopolitical concerns with Ukraine making first strike on Russian soil with ATCACMS missiles despite Putin’s expanded nuclear doctrine. WMT earnings takeaways positive although this might fade as it’s up huge YTD and crowded. The market still in waiting mode ahead of NVDA results Wednesday, which is expected to show ongoing strength but faces a high bar given performance and positioning dynamics. Big tech regulatory scrutiny in the headlines though fallout cushioned by looming administration change. Still no Treasury Secretary decision from Trump, though Warsh momentum seems to have picked up despite his free-trade leanings.

- Housing starts and building permits for October on the US economic calendar this morning. Canadian inflation rises more than consensus. Kansas City Fed President Schmid scheduled to speak at 13:10. Nothing on the economic calendar for Wednesday. Thursday brings claims, Philly Fed and existing home sales, while Fed’s Hammack and Goolsbee scheduled to speak. Flash PMIs and final University of Michigan consumer sentiment cap off the week on Friday.

- Justice Dept. reportedly may ask judge to consider structural changes to GOOGL business, including divesting Chrome browser or Android operating system. Justice Dept. also reportedly may challenge HPE acquisition of JNPR. WMT beat and raised FY25 guidance, with Sam’s Club outperformance, high-income customer growth among highlights. LOW beat and bumped FY guidance up small though bar was higher following similar from HD last week and it also flagged continued softness in DIY bigger-ticket discretionary demand. MCHP up on news of CEO change. SMCI up on news it has engaged BDO USA as its independent auditor, while it also submitted compliance plan to Nasdaq. ADM in line with preliminary results and noted seeing softer market conditions into next year but taking actions to boost performance and drive value.

- Key Upgrades/Downgrades: Newmont upgraded to overweight from neutral at JPMorgan. Apollo Global Management initiated overweight at Piper Sandler.

Scotiabank GBM initiates software sector. Academy Sports & Outdoors downgraded to hold from buy at Truist.

Here’s the link to join our Slack channel. It seems to be working fine. If you have any issues please let us know.

market snapshot

economic reports today

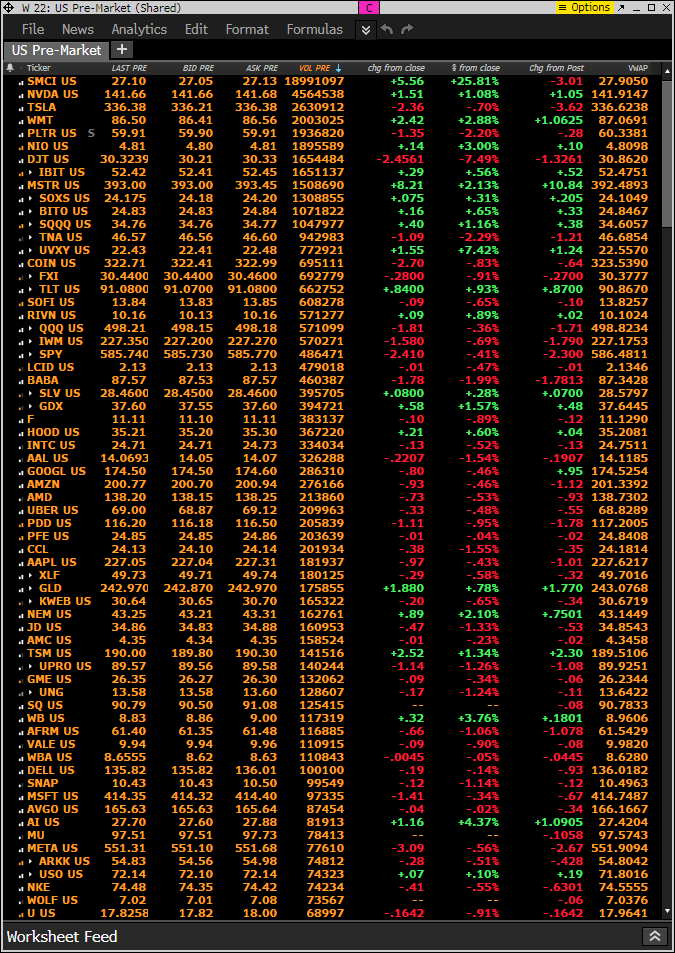

premarket trading

Watch the last price vs premarket VWAP.

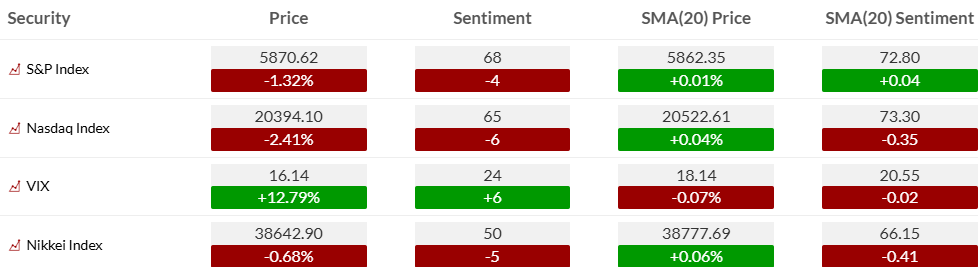

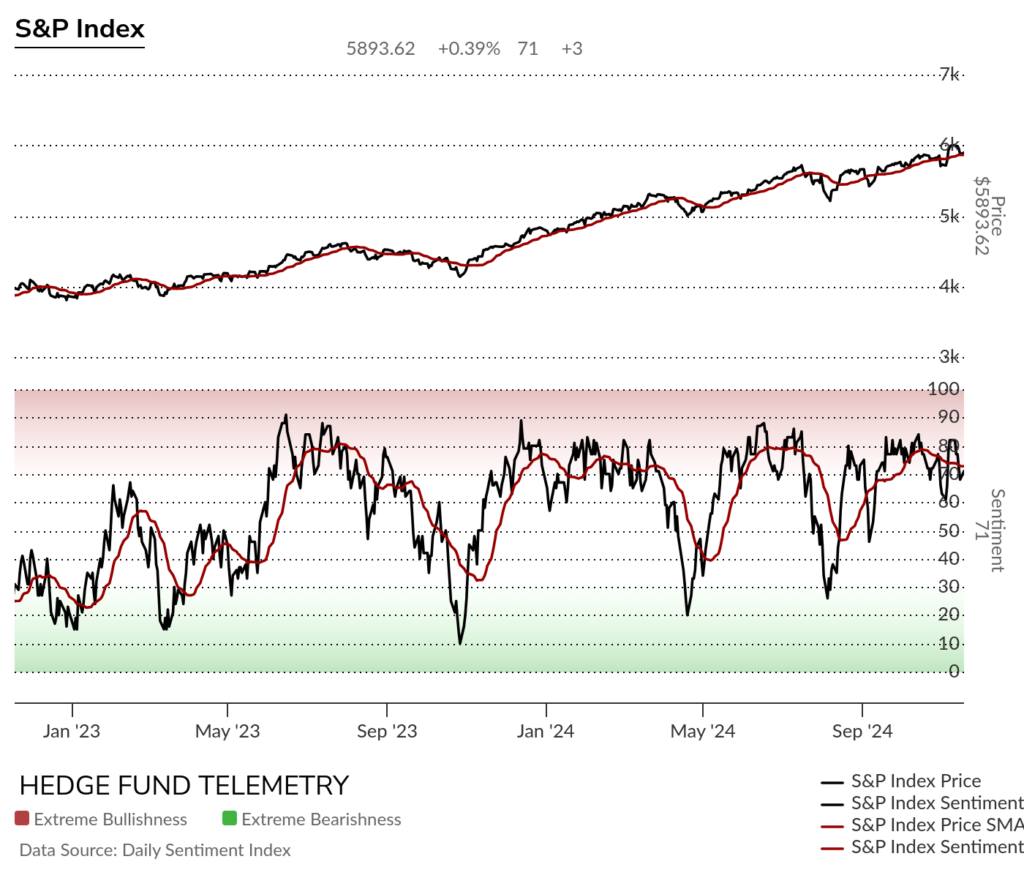

US MARKET SENTIMENT

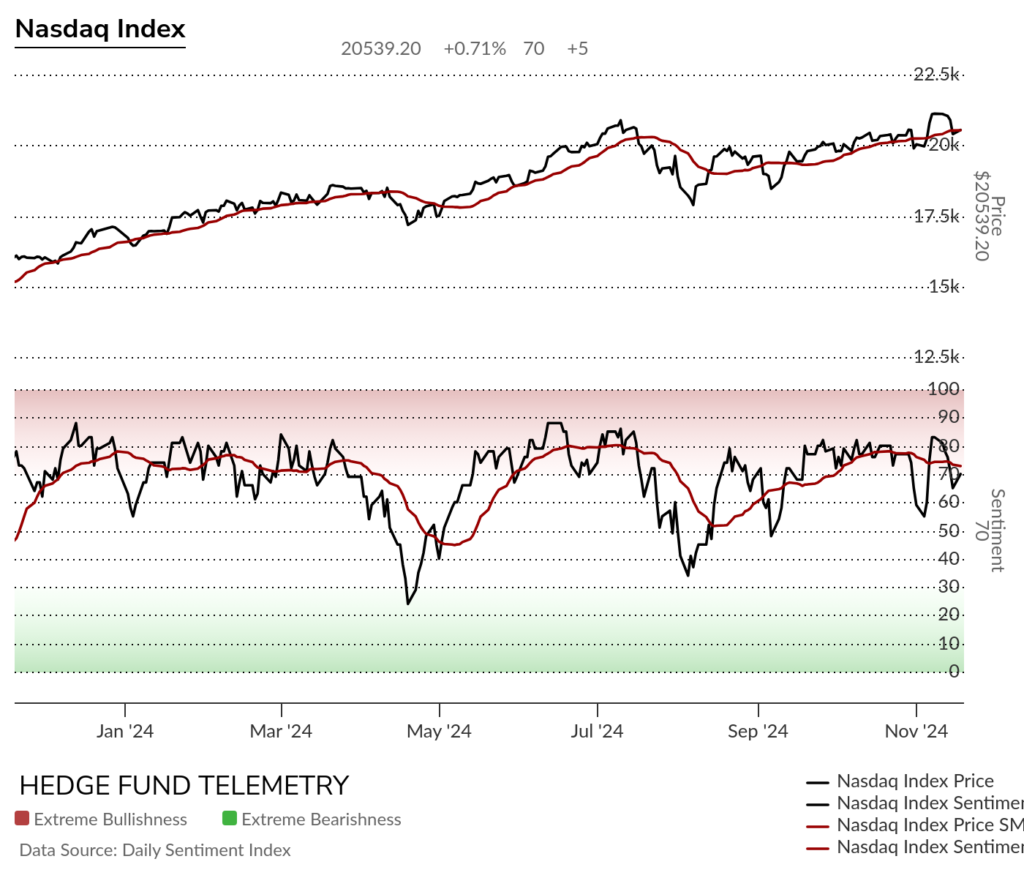

S&P and Nasdaq bullish sentiment dropped again and are still above the recent lows pre-election.

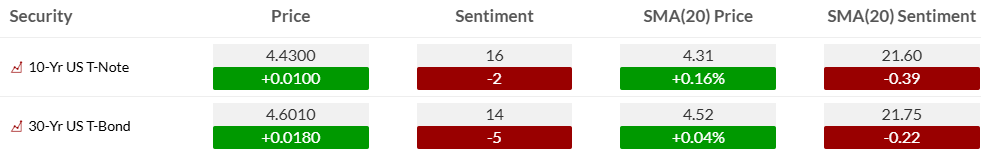

Bond bullish sentiment continue in the deep oversold zone.

Currency bullish sentiment highlighted with Bitcoin and US Dollar extreme.

Commodity bullish sentiment saw mixed action yesterday.

US MARKETS

S&P futures 60-minute tactical time frame has been trying to hold the recent lows from last week with a sideways Sequential pattern and upside Sequential on hour bar 9 of 13. A clean break below the TDST level could cancel the pending Sequential.

The 240 minute time frame is informative as it shows the start of the Trump election victory with TDST support at 5745. This is a very important level to watch for support. Downside Sequential on bar 6 of 13

S&P futures daily had DeMark Sequential and Combo sell Countdown 13’s at the highs with a price reversal to the 20 day. The November low is the most important support to watch.

Nasdaq 100 240-minute tactical time frame clearly shows the start of the election win with a downside Sequential on bar 7 of 13. There are a lot of trapped longs in the last two weeks with risk of breaking the November low.

Nasdaq 100 futures daily is still holding the lows from last week and slightly below the 20 day.

Extra charts we’re watching

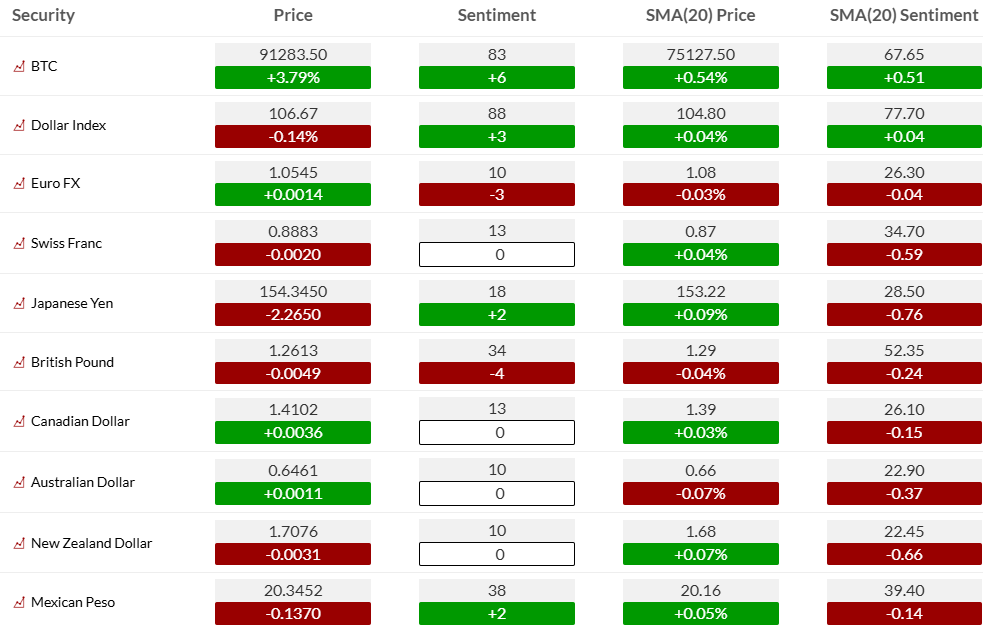

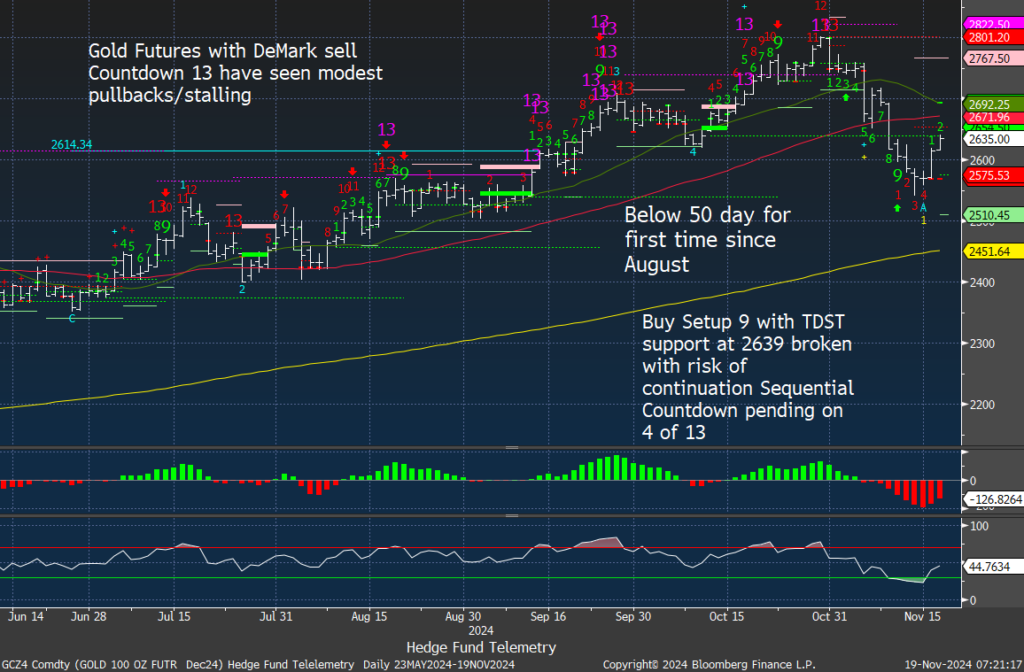

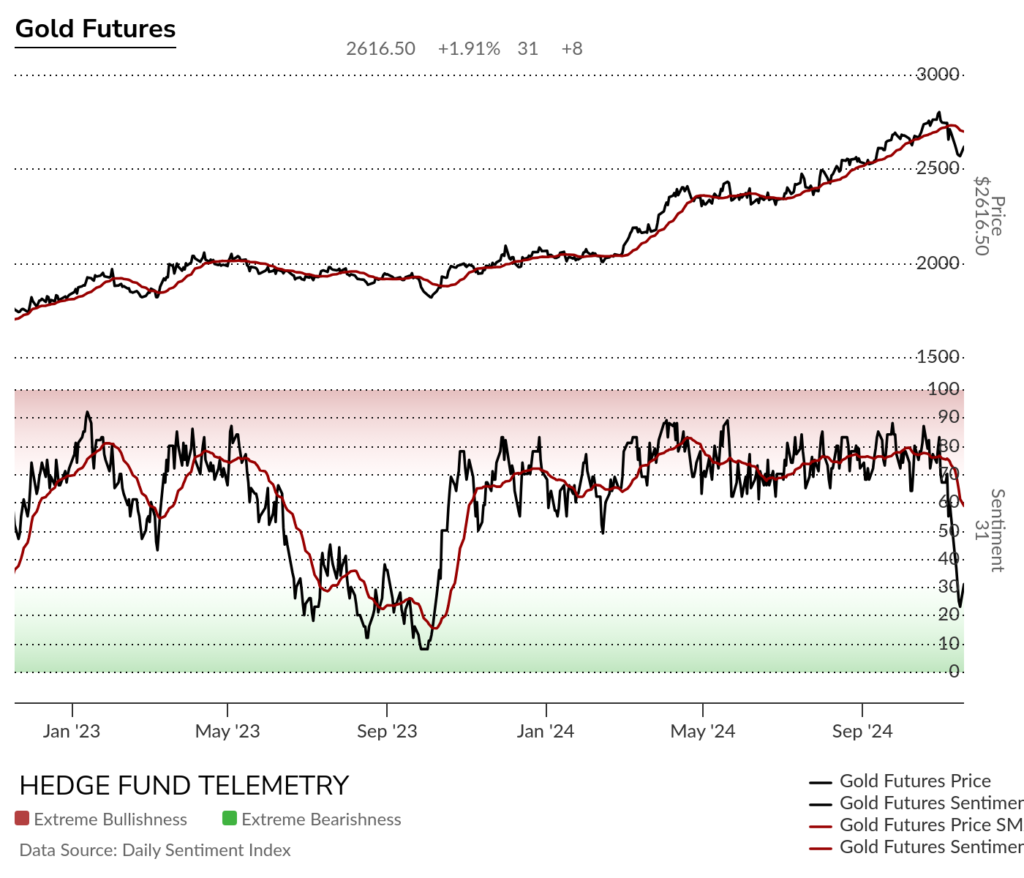

Gold futures bouncing again today. I bought GLD yesterday and expect a lower high bounce so this trade is just that, a trade.

Gold bullish sentiment has been straight down in recent weeks and a reflexive bounce was due. It can and might go lower after the bounce.

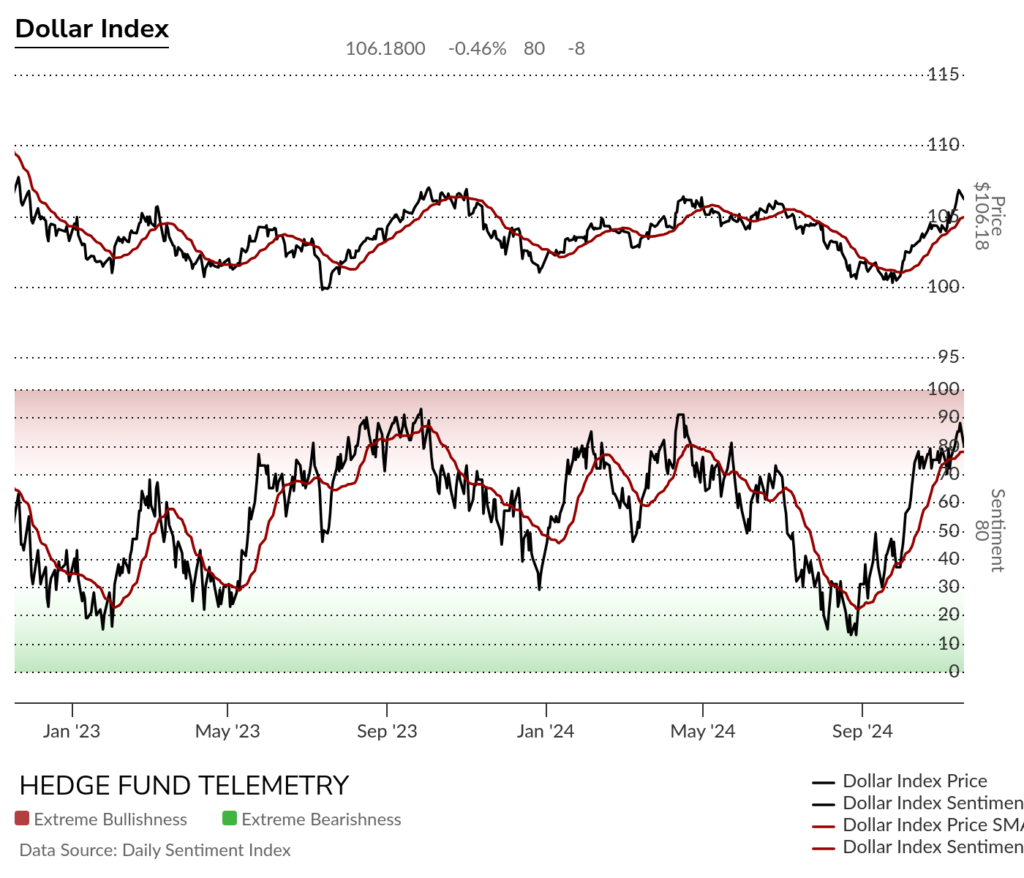

US Dollar Index daily has been very strong and has new Sequential and Combo sell Countdown 13’s and sell Setup 9 in play. Price flip down today but needs to confirm with a close under yesterday’s low.

A two year look at the US Dollar sentiment has seen it move briefly over 90% with a reversal occurring shortly after this extreme signal. It hit 88% and reversed down yesterday.

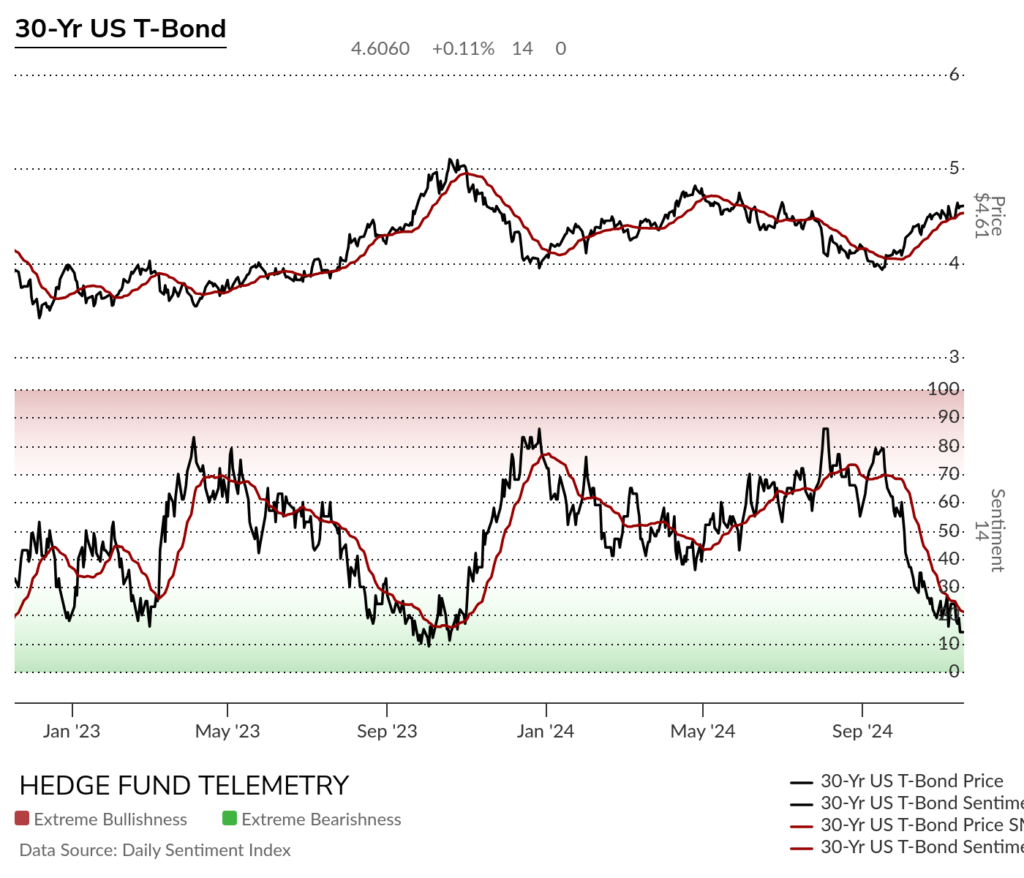

US 10-Year Yield has had recent Sell Countdown 13’s and a possible secondary Sequential. Momentum has been stalling and there is a new price flip down with Setup on day 2 of 9. I bought bonds yesterday.

Bond bullish sentiment was unchanged at 14% in oversold territory. The 2 year low was 10%

Bitcoin Daily still consolidating at highs with RSI overbought. With the Setup 9 could a new Sequential start? Maybe but too early to tell.

Bitcoin bullish sentiment looking back two years shows the peak in sentiment was 90% with it now at 86% remaining extreme.

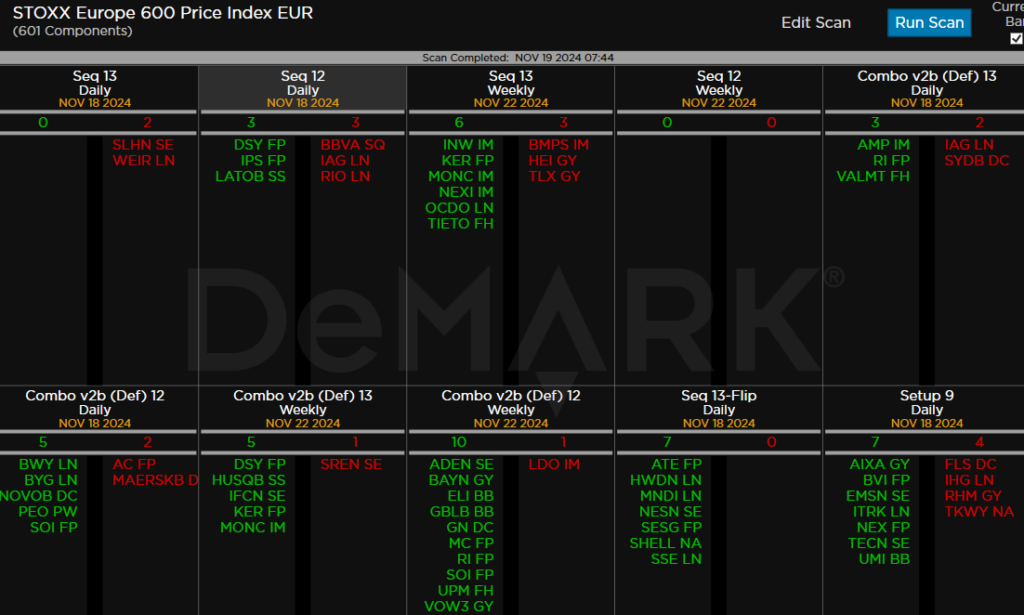

DeMark Observations – European indexes

Recently I have shown some European indexes weakening with potential breakdowns with some downside DeMark Sequential Countdowns in progress after recent Sequential sell Countdown 13’s. Here’s Eurostoxx 50, Germany, Italy, and UK