TOP EVENTS AND CATALYSTS

- The week ahead does not include any significant macro events, although investors will watch the G20 Leader’s Summit in Brazil and the flash PMIs for November on Friday.

- The main newsworthy headlines will be focused on details of Trump’s cabinet decisions. Secretary of Treasury remains unfilled with Scott Bessent and Howard Lutnick the two who have been discussed the most likely. Someone else may emerge as Elon Musk has voiced his displeasure of Bessent and Lutnick as his choice. Scott Bessent would be my choice and probably the market’s choice as he would be the most global market-savvy Treasury secretary in decades.

- For earnings, the major reports include: Tuesday preamarket: AS, LOW, MDT, WMT; Tuesday postmarket: KEYS; Wednesday premarket: TGT, TJX, WSM; Wednesday postmarket: NVDA, PANW, SNOW; Thursday premarket: BIDU, DE; and Thursday postmarket: GAP, INTU, NTAP, ROST. Microsoft CEO Satya Nadella will deliver the keynote at the company’s Ignite conf. on Tuesday at 9amET.

- Conferences during the week include Barclays Auto/Mobility; JPMorgan global TMT; Stifel Healthcare; and RBC Tech/Internet/Media/Telecom.

I mentioned on our Slack channel that I woke up today not feeling great as Lee Ann returned home from her CA girl’s trip with a virus, and I seemed to have caught whatever she had. It’s our 29th wedding anniversary tomorrow, and it’s a gift I really didn’t have on my list. I have the Currency and Commodity notes about halfway done and will likely postpone them until tomorrow as I need to rest. And if you want to be in our Slack room, use this link as it has been working to get more people in. I have a bunch of emails and back-office stuff to finish up, too. Please be patient on return emails.

I posted a lot on this note to review.

market views

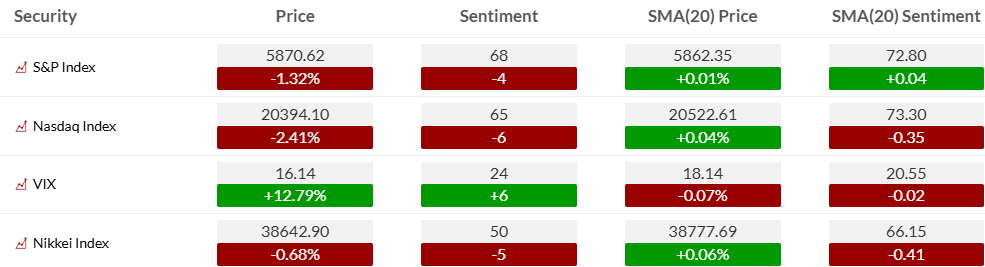

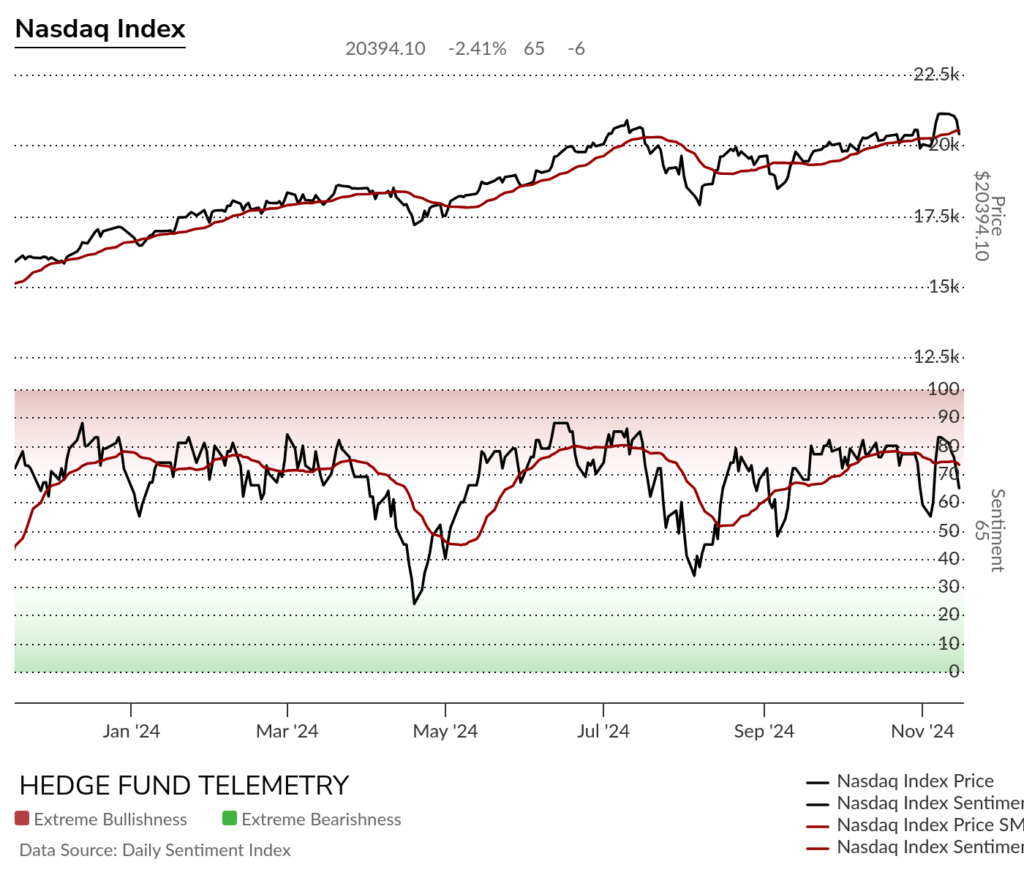

- Market sentiment started lower ahead of the election and bounced back into the extreme zone. It started moving back down and we should watch the recent lows if they hold.

- S&P and a few other indexes with the spike higher triggered the in progress sell exhaustion sell Countdown 13’s and reversed down.

- VWAP levels calculated from the reopening after the election have broken to the downside and considering the inflows after the election were huge, it should be watched as there could be a lot of trapped capital higher. Further downside would only motivate more those who chased higher.

- There are a lot of negative divergences within the internals that make confirming more upside difficult (see below)

- I am hopeful more volatility will move indexes and stocks lower for decent buying opportunities. Having a higher level of cash on the Trade Ideas sheet has been a tell of my concerns for a deeper pullback.

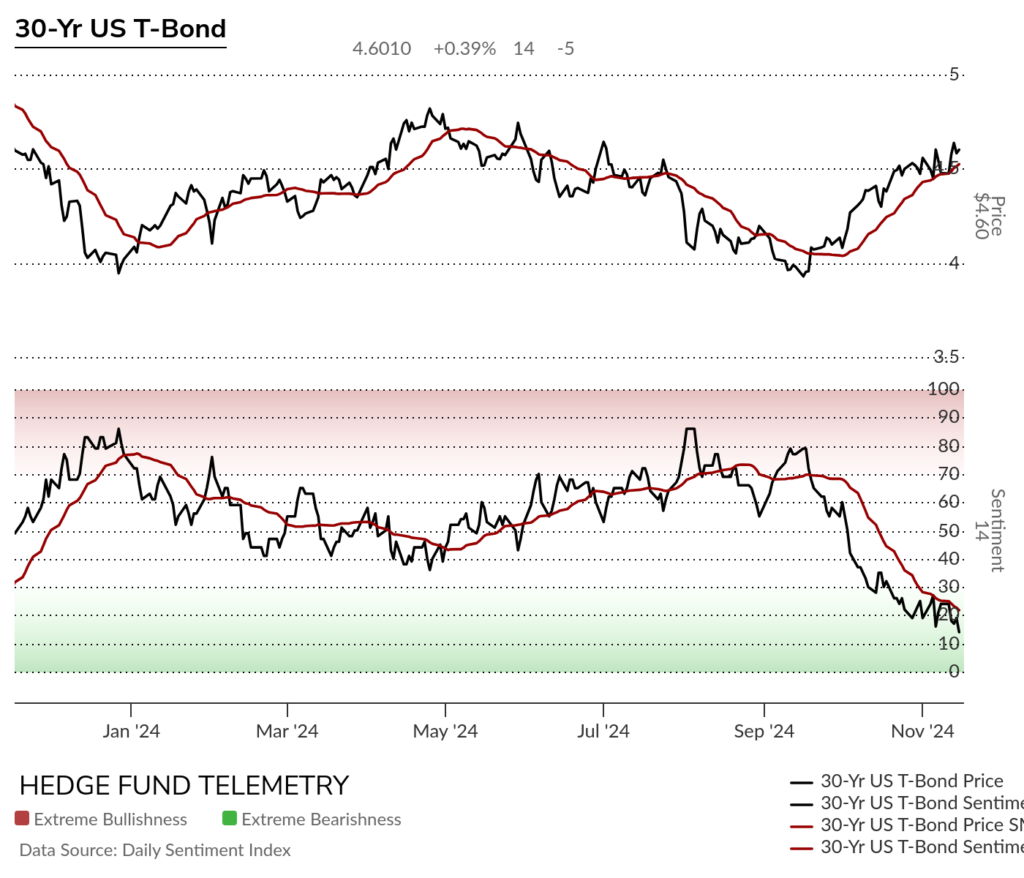

- Bonds might find a bid this week and that could be due to equities selling off harder.

- Nvidia, the largest market cap reports on Wednesday and with the weakness seen in the semi sector, a lot is riding on another strong beat and raise.

Weekend News

- The majority of news this weekend has been centered around Trump appointees

- US equities at risk as analysts cut earnings estimates Bloomberg

- European leaders are increasingly pushing for a diplomatic settlement to the Ukraine war as they increasingly worry time isn’t on Kyiv’s side WSJ

- Russia hit Ukraine over the weekend with one of the largest missile and drone barrages of the entire war WSJ

- Russia is waging a fierce battle to dislodge Ukraine from Kursk before it enters into negotiations over the war w/the incoming Trump administration Washington Post

- China’s Xi expresses a desire to achieve a stable and healthy relationship with the incoming Trump administration WSJ

- Netflix’s boxing Friday drew in a lot of viewers but had problems with the live broadcast

Charts we are watching

The WSJ’s Gunjan Banerji (I love reading her stories on the markets) posted a story about the huge inflows into the equity markets in the last week. I focus on VWAP levels (volume-weighted average price) when significant volume events or catalysts exist. The election was a huge catalyst, and markets gapped higher. I’ve been showing the VWAP levels on SPY, QQQ, and IWM almost daily, and these levels have broken down to the downside. This matters as those that chased higher could now be second-guessing their decision as prices turn red. Nothing motivates sellers more than seeing red.

Gunjan’s chart shows the huge volume that has flowed into US equities. It’s going to take more to keep this going on the upside.

It’s a little tough to see, but these are charts of SPY, QQQ, and IWM in a 60-minute time frame, with the orange line as the anchored VWAP after the markets opened on Wednesday after the election. SPY VWAP is 593.88 vs 585.75 last, QQQ VWAP is 508.15 vs 496.57 last, and IWM VWAP is 236.09 vs 228.48 last.

SPY S&P 500 reversed down to the 20 day moving average again after recent DeMark Sequential and Combo sell Countdown’s which I knew were developing with two days remaining after the election. Watch the DeMark Trend Factor downside targets. If this this gets sloppy, perhaps due to Nvidia reaction after earnings a move below the 50 day is very possible and perhaps to the 200 day at 540. This would definitely have a lot of capital trapped higher.

QQQ Nasdaq 100 did not have any new signal although Nasdaq 100 futures did have a new Combo 13 at the recent high. Keep an eye on the Trend Factor levels.

IWM Russell 2000 with Sequential sell Countdown 13 at the highs and when we added it short.

Back in September when the Fed starting cutting rates there were DeMark sell Countdown 13’s on TLT and other bond proxies that lined up for bonds to sell off and rates to turn higher. I mentioned it several times and have shown rates moving higher on First Call each day. Now there is potential for a second Sequential on Monday following a new Combo 13. I’ve said it’s possible a bond bounce could happen as a result of weaker equity markets. A risk-off type of move to the ‘safety’ of bonds.

More on the internals below but this shows the percentage of S&P 500 stocks above the 50 day divergent with a downside Sequential in progress on day 9 of 13. One of my frustrations in this market has been the lack of good oversold conditions. 55% of the index remain over the 50 day and a good oversold condition would be at or below 20%. When that occurs, you’ll probably think I’m as crazy wanting to buy as I’ve been wanting to short the markets today.

internals update

There are a lot of negative divergences with the internals and this with the advance decline data has been developing for a while. I’d like to see these break down more well under 30% (the red line)

More divergences with price action as the percentage of S&P stocks above the 20 day and 50 day bounced but remain well off highs and also reversed down late in the week. If we can see these get into the low 20’s or even lower a decent buying opportunity would present itself.

The 5 day moving average of the equity only put call ratio has been low, a sign of heavy call buying which is NOT when one should be adding significant money on the long side. If we can get the heavy put buyers to come back it would be a sign for a lower risk buying opportunity as heavy put buying is like buying insurance when the house is already fully engulfed in flames.

The S&P and Nasdaq 100 indexes with McClellan indicators have been massively divergent from price action and reversed down last week after barely moving after the big upside gap higher.

Nasdaq summation index weekly was down on the week and has been hanging around the zero level completely divergent from index price action. I would like to see this drop (with the market) and the momentum indicators on this get fully oversold.

nvidia and semiconductors thoughts

Nvidia has the largest market cap in the US. It has had quite an amazing year as it has contributed 25% of the S&P gains by itself and even more with the Nasdaq 100. They are reporting on Wednesday and will be the most important event for the week. I’ll post some more thoughts ahead of the report. There is a recent new DeMark Combo 13 (strict version) It’s under the 20 day with momentum not quite in reversal confirmation and will be important to see the magnitude of the guidance raise. They have been guiding higher by a few billion more than consensus, and if that moderates, they could join others in the semiconductor space fading. It’s a great company that I missed on the upside, so hopefully, this can get a pullback that we might want to buy.

I created this YTD chart of various semiconductors a while back showing the gains and now losses starting to show up. The red line is SMCI which had the biggest gains of 300%+ and now it’s down YTD 31% and could be possibly delisted due to accounting irregularities. NVDA remains the leader up 186%

Out of this group only two remain positive from the start of Q2 July 1st while the S&P is up 8%. I have said when the semiconductor capital equipment start to fade it could be a significant top in the sector. AMAT was the lastest semi-cap to fall hard after earnings this past week.

This is the YTD SOX Index attribution with just 12 up and 22 down. It’s still up 15%, but if NVDA and TSM give way, then it could get ugly.

This is the quarter-to-date attribution, with NVDA actually not the biggest attribute on the upside as MRVL has overtaken them. And breadth is bad, too, with only 7 up and 23 down.

US economic data for the week

KEY MARKET SENTIMENT

Equity bullish sentiment fell again on Friday with both below the 20 day moving average of bullish sentiment.

S&P and Nasdaq bullish sentiment started lower ahead of the election and bounced right back to the extreme zone >80%. Here’s the S&P with two years of data and the Nasdaq with just one year to show a bit closer up. Breaking the recent lows would likely signal a deeper correction ahead.

Bond bullish sentiment made another lower low into the deep oversold territory which I have said was entirely possible with rates moving higher. A bounce possibility. Yes there is and it might be due to the equity markets falling and a risk off move to bonds.

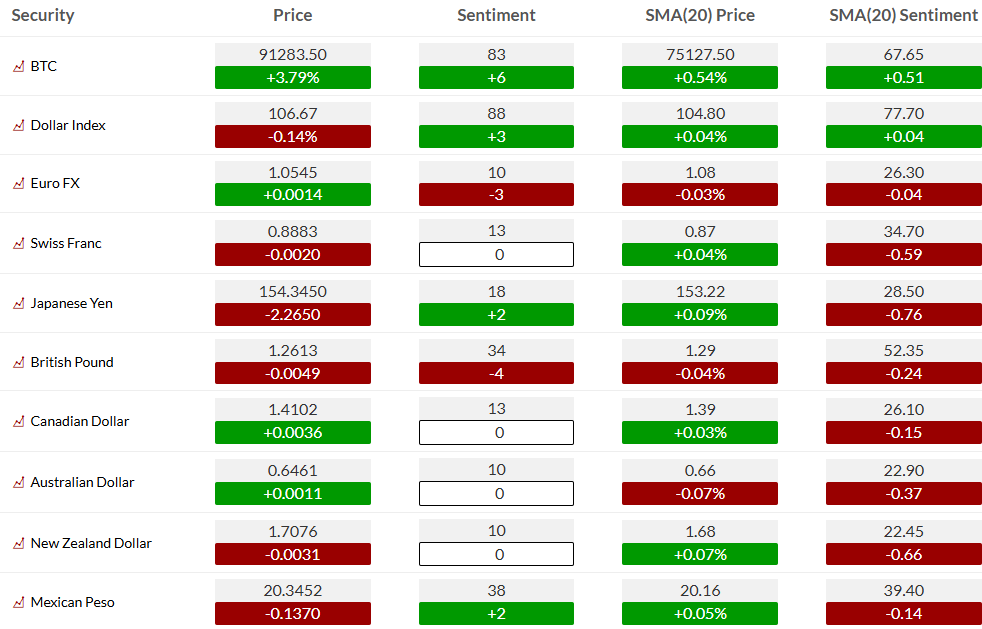

Currency bullish sentiment with US Dollar and Bitcoin bullish sentiment both in the extreme zone.

Commodity bullish sentiment was highlighted with gold hitting another new low.

I stressed for months how gold sentiment remained steady above the low end of bullish sentiment at 60% and that if sentiment broke combined with the recent DeMark sell Countdown 13’s a deeper move was possible. This is why we combined both indicators in our analysis.

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 18-Nov:

- Corporate:

- Earnings:

- Pre-open: BRC, BTBT, BTDR, CLRB, EH, MGIC, MOND, NIU, TWST

- Post-close: ACM, BRBR, FINV, IIIV, SYM, TATT, TUYA, ZENV, ZEPP

- Analyst/Investor Events: DNUT, ERII, FTNT, HHH, PFG, VRT

- Brokerage Conference:

- UN COP29

- American College of Rheumatology Meeting

- American Association for the Study of Liver Disease Meeting

- American Heart Association Scientific Meeting

- Anand Rathi Flagship G-200 Conference

- Seaport Virtual Digital Media and Advertising Conference

- LSX Investival Showcase

- ICR Consilium Healthcare Conference

- J.P. Morgan Global TMT Conference

- Stifel Healthcare Conference

- American Society For Mass Spectrometry Fall Workshop

- CITIC CLSA India Forum

- ICICI Securities India Financials Conference

- Citi Korea Corporate Day

- BNP Exane MidCap CEO Conference

- Wolfe Research Healthcare Conference

- NAREIT REITworld

- JM Financial India Conference

- Earnings:

- Economic

- US: NAHB Housing Market Index, TIC Flows

- Canada: Housing Starts

- Europe: Trade Balance

- Corporate:

- Tuesday 19-Nov:

- Corporate:

- Earnings:

- Pre-open: ALLT, AS, ATAT, ELTK, ENR, ESLT, FUTU, J, KC, LOW, MDT, MYTE, NESR, NTIC, OCSL, STRR, VIK, VIPS, VVV, WKHS, WMT

- Post-close: AUNA, AZEK, DLB, GBDC, KEYS, KORE, LZB, POWL, RNW, SBLK, VREX

- Analyst/Investor Events: AEIS, BL, CTVA, LMND, QCOM, TRP

- Brokerage Conference:

- UN COP29

- American College of Rheumatology Meeting

- American Association for the Study of Liver Disease Meeting

- Anand Rathi Flagship G-200 Conference

- J.P. Morgan Global TMT Conference

- Stifel Healthcare Conference

- American Society For Mass Spectrometry Fall Workshop

- CITIC CLSA India Forum

- ICICI Securities India Financials Conference

- Citi Korea Corporate Day

- BNP Exane MidCap CEO Conference

- Wolfe Research Healthcare Conference

- NAREIT REITworld

- JM Financial India Conference

- Craig Hallum Alpha Select Conference

- TD Securities Energy Conference

- Jefferies Miami Consumer Conference

- J.P. Morgan UK Leaders Conference

- DZ BANK Equity Conference

- SEB Healthcare Seminar

- RBC Technology, Internet, Media and Telecommunications Conference

- ABGSC Nordic Opportunities Seminar

- 121 Mining Investment Conference

- Bradesco BBI CEO Conference

- NYSE Industrials Day Conference

- Raymond James Meetings at REITworld

- Jefferies London Healthcare Conference

- Deutsche Bank dbAccess Business Services, Leisure, Transport & Retail Conference

- Earnings:

- Economic

- US: Building Permits, Housing Starts, Redbook Chain Store, API Crude Inventories

- Canada: Core Inflation (m/m), CPI (m/m)

- Europe: CPI y/y

- Asia: Trade Balance

- Corporate:

- Wednesday 20-Nov:

- Corporate:

- Earnings:

- Pre-open: BERY, DOYU, DY, GLBE, JFIN, NAAS, RERE, SR, SY, TGT, TJX, WIX, WSM, YMM, YSG, ZIM

- Post-close: CLIR, CPA, DUOT, JACK, KLC, MMS, NVDA, PANW, SNOW, SQM, UTI, VNET, WALD

- Analyst/Investor Events: ACST, AIOT, ASIX, DAL, NESR, NVAX, PYXS, LSPD, QSI, QUAD, ROK, SHC, SWK

- Brokerage Conference:

- UN COP29

- BNP Exane MidCap CEO Conference

- Wolfe Research Healthcare Conference

- NAREIT REITworld

- JM Financial India Conference

- Jefferies Miami Consumer Conference

- J.P. Morgan UK Leaders Conference

- DZ BANK Equity Conference

- SEB Healthcare Seminar

- RBC Technology, Internet, Media and Telecommunications Conference

- ABGSC Nordic Opportunities Seminar

- 121 Mining Investment Conference

- Bradesco BBI CEO Conference

- NYSE Industrials Day Conference

- Raymond James Meetings at REITworld

- Jefferies London Healthcare Conference

- Deutsche Bank dbAccess Business Services, Leisure, Transport & Retail Conference

- CIC Market Solutions Forum

- Needham Virtual Infrastructure, Data Analytics Software & Cloud Communications Conference

- Roth Technology Conference

- Van Lanschot Kempen London Conference

- Goldman Sachs CEEMEA Conference

- Deutsche Bank Global Space Summit

- Three Part Advisors Southwest Ideas Conference

- Swiss Mining Institute Conference

- Morgan Stanley Asia Pacific Summit

- Wolfe Research Inaugural Oil & Gas Conference

- Barclays Global Automotive and Mobility Tech Conference

- J.P. Morgan European Financials Conference

- Morgan Stanley European Technology Media & Telecoms Conference

- New Orleans Investment Conference

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, DOE Crude Inventories

- Europe: CPI y/y, PPI y/y, Output PPI y/y

- Corporate:

- Thursday 21-Nov:

- Corporate:

- Earnings:

- Pre-open: ATKR, BIDU, BJ, BZUN, CRNC, DE, EVGN, IQ, ITRN, LOT, NNOX, SCVL, VSTS, WMG

- Post-close: CPRT, ESTC, GAP, GEOS, INTU, LGTY, MATW, NGVC, ROST, UGI

- Analyst/Investor Events: BTBT, GEHC, ICUI, KD, LFCR, NLY, NMIH, PCOR, PG, PYCR, RVTY

- Brokerage Conference:

- UN COP29

- NAREIT REITworld

- JM Financial India Conference

- Raymond James Meetings at REITworld

- Jefferies London Healthcare Conference

- Deutsche Bank dbAccess Business Services, Leisure, Transport & Retail Conference

- Three Part Advisors Southwest Ideas Conference

- Swiss Mining Institute Conference

- Morgan Stanley Asia Pacific Summit

- Wolfe Research Inaugural Oil & Gas Conference

- Barclays Global Automotive and Mobility Tech Conference

- J.P. Morgan European Financials Conference

- Morgan Stanley European Technology Media & Telecoms Conference

- New Orleans Investment Conference

- OpenAI DevDay

- Canaccord Genuity Medtech, Diagnostics and Digital Health & Services Forum

- Jefferies New Nuclear Conference

- Kotak Midcap Conference

- Society for Neuro Oncology Conference

- Earnings:

- Economic

- US: Weekly Jobless Claims, Philadelphia Fed Index, Existing Home Sales, Leading Indicators, EIA Nat Gas Inventories, KC Fed Manufacturing Index

- Europe: Unemployment Rate, GDP q/q, Manufacturing Business Climate, Business Survey, Flash Consumer Confidence

- Asia: CPI Core National y/y, CPI ex-Fresh Food and Energy, CPI National y/y

- Corporate:

- Friday 22-Nov:

- Corporate:

- Earnings:

- Pre-open: BKE, DXLG, GB, STG, ZKH

- Analyst/Investor Events: BTBT

- Brokerage Conference:

- UN COP29

- J.P. Morgan European Financials Conference

- Morgan Stanley European Technology Media & Telecoms Conference

- New Orleans Investment Conference

- Kotak Midcap Conference

- Society for Neuro Oncology Conference

- Stephens Investment Conference

- Mega Securities Investor Conference

- CEM Florida Capital Conference

- Earnings:

- Economic

- US: PMI Manufacturing Preliminary, PMI Services Preliminary, Michigan Consumer Sentiment (Final)

- Canada: Retail sales (m/m), Retail Sales ex-Autos,

- Europe: GDP y/y, Retail Sales y/y

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.