TOP EVENTS AND CATALYSTS

The week ahead will focus primarily on Tuesday’s US election, which should dominate the news headlines and market action all week. The other big macro events this week include the China NPC meeting, the US services ISM for October Tuesday, Japan’s wage numbers for September, China’s import/export numbers for October both on Wednesday night, central bank decisions (the Riksbank, Norges Bank, BOE, and FOMC all have policy decisions on Thursday, and China’s CPI/PPI for October on Friday night. I can’t recall a week when the Fed decision was not the most important market-moving catalyst.

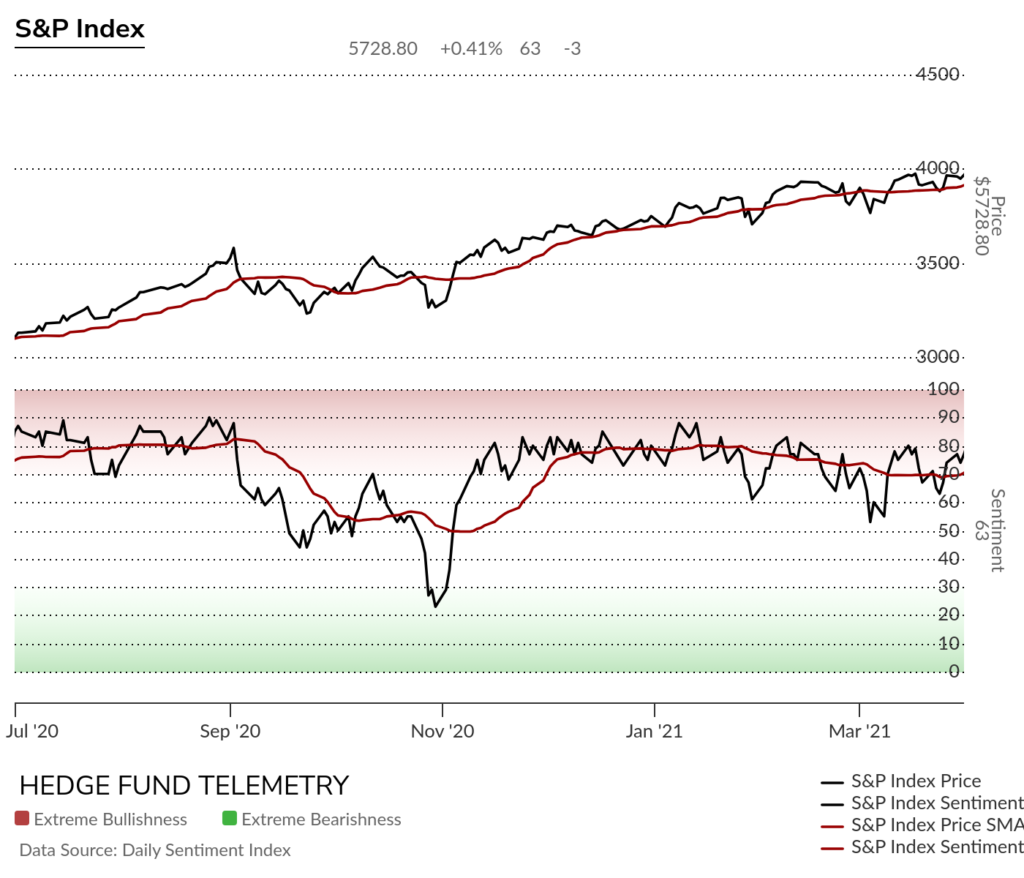

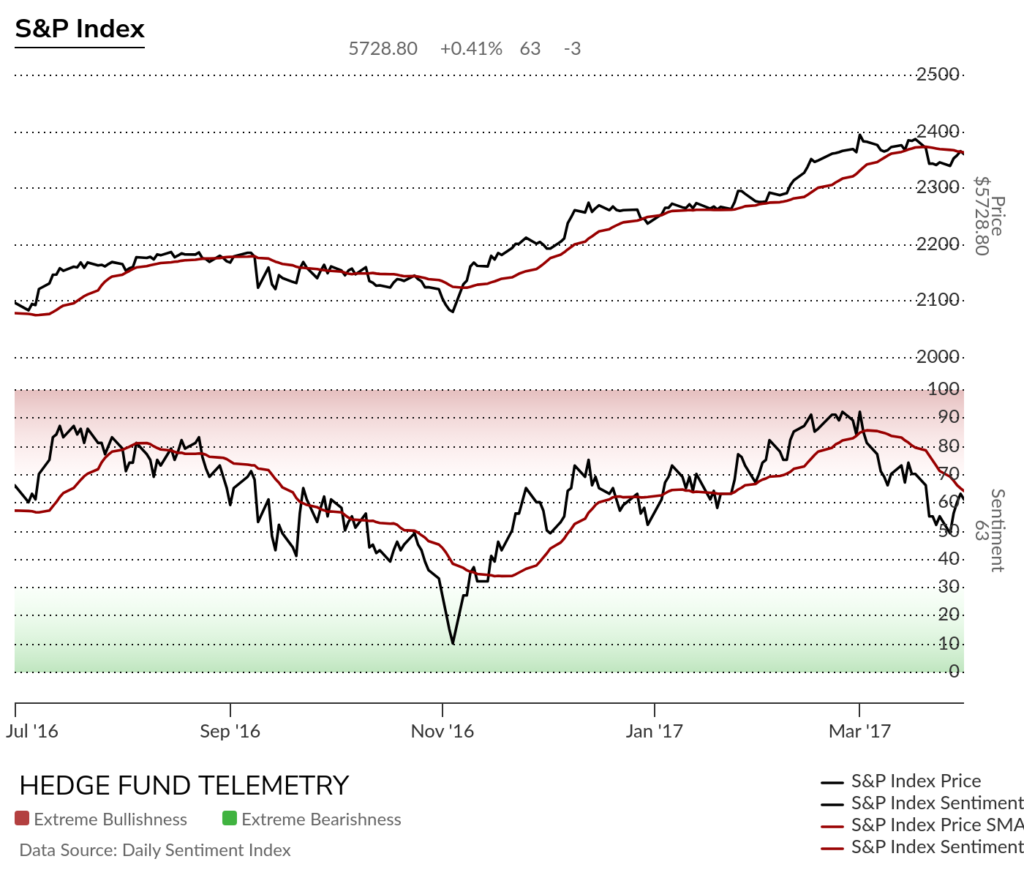

I added many extra charts to this note, including S&P and Nasdaq multi-time frames, some internals, and sentiment from 2016 ahead of the election and today. There are 2, 10, and 30-year yield charts with interesting moves on Friday. Lastly, I added some charts with the tightening election.

For Q3 US earnings, the major reports include: Monday premarket: BEN, CEG, FIS, FOX, MAR, YUMC; Monday postmarket: AIG, AVB, NXPI, PLTR, WYNN; Tuesday premarket: APO, CMI, DD, EMR, GFS, MPC, YUM; Tuesday postmarket: LUMN, MCHP, SMCI; Wednesday premarket: CVS, HWM, JCI; Wednesday postmarket: ARM, BMBL, BROS, GILD, HUBS, LYFT, MTCH, NTR, QCOM, TTWO; Thursday premarket: APD, CG, DDOG, HAL, KVUE, RL, ROK, TAP, TPR, UAA, USFD, VST, WBD; Thursday postmarket: ABNB, AFRM, AKAM, ANET, CPRI, DKNG, EXPE, FTNT, PINS, SOLV, SQ, TTD; and Friday premarket: BAX, FLR, NRG, PARA.

For EU earnings, the major reports include Ryanair on Monday, Adecco, Hugo Boss, Vestas Wind on Tuesday, Ahold, BMW, Novo Nordisk, Unicredit on Wednesday, ArcelorMittal, BT Group, Munich Re on Thursday, and Richemont on Friday.

weekend news

- Berkshire Hathaway reported a shortfall on EPS due to weak insurance underwriting earnings (storm-linked losses and other factors weighed down results) and an FX headwind while GEICO, BNSF, and BH Energy all performed well Berkshire sold another ~100M shares in Apple and the company’s cash balance ballooned to $325B now over 30% of the market cap.

- As you would expect, the news over the weekend has been focused on the election ahead of Tuesday, with polls tightening between Harris and Trump.

- The prominent Des Moines Register poll, shows Harris up a few points in Iowa (47-44%) thanks to an advantage among women, suggests an important shift occurring in her direction. Politico

- Harris’s team shifts its view on the race and no longer considers themselves to be the underdog (Trump’s team pushed back at such a change, and notes that strong early voting numbers from Republicans bodes well for them) Washington Post

- Iran’s rhetoric towards Israel turns increasingly hostile (the country’s supreme leader vowed a “tooth-breaking response”) while a senior official said Tehran can produce nuclear weapons NBC News

- The Fed is widely expected to cut rates by 25bps at this week’s meeting, although there remain questions about the pace of easing beyond November WSJ

We are hosting our bi-monthly new Short Interest data webinar on Monday at 10:30 a.m. ET. Geoff and I will focus on the 2016 election and today’s short interest setup. To register for this webinar, please use this link. We will send a replay link to subscribers later. The Currency and Commodity weekly notes will be sent early this evening, as I want to get some markets after the Sunday opening.

Charts we are watching

The S&P 500 futures 60 minute chart was cropped to highlight the risk of a lower move. If this bounce was a corrective lower high wave 4 of 5 bounce and the recent lows break (wave 3 in yellow) then it will qualify into downside wave 5 with a potential wave 5 price objective if 5643.

The S&P 500 Index gapped down hard on Thursday, closing on the lows at the 50 day. Friday’s action gave back most of the bounce. The 5695 is the TDST Setup Trend green dotted line support that I believe has to be watched this week.

The S&P 500 Index weekly shows a large drop in the last week after the recent DeMark Combo sell Countdown 13 and Setup 9. I created the levels of fear the market and Fed will be watching a while ago and believe these will still apply going forward.

I did the same thing as above with the Nasdaq 100 futures 60 minute time frame that shows the potential lower high corrective wave 2 of 5. Breaking the recent low (wave 1 in yellow) would qualify downside wave 3 with a potential wave 3 price objective of 19,535.

Nasdaq 100 Index daily shows the drop after the recent Sequential and Combo 13’s (albeit sideways action. The 50 day at 19,800 is the support level to watch this week.

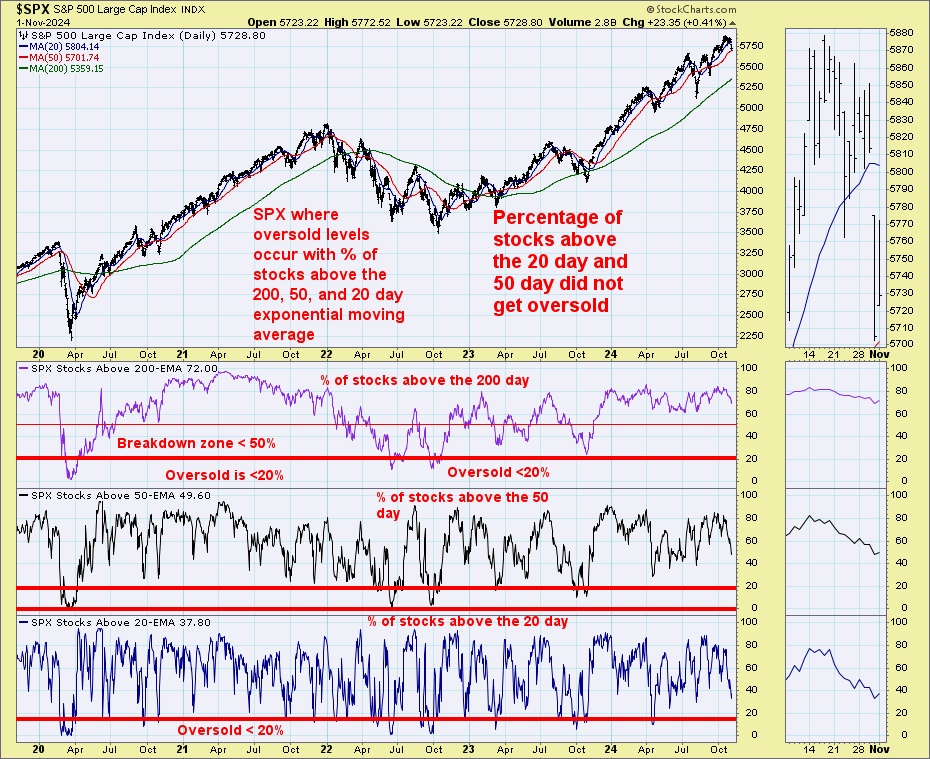

The percentage of S&P 500 stocks above the 20 and 50 day have been dropping in the last two weeks and are not oversold. Readings at or near 20% are oversold where better buying opportunities have higher probabilities.

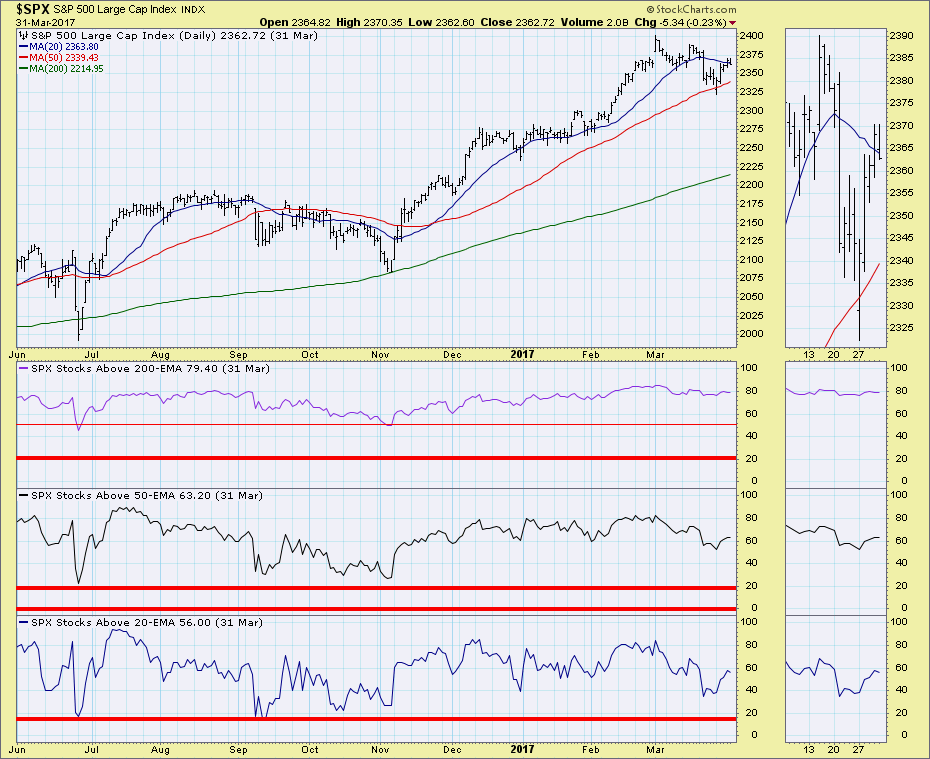

Here’s the same chart from 2016 ahead of the election that had the percentage of stocks above the 20 day and 50 day much lower vs today.

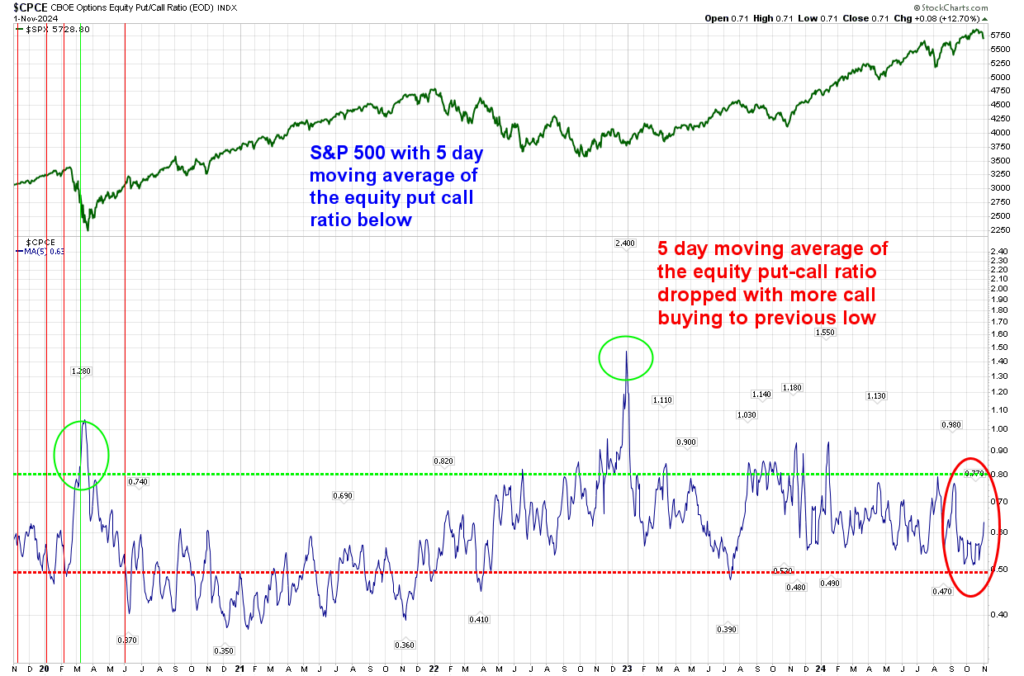

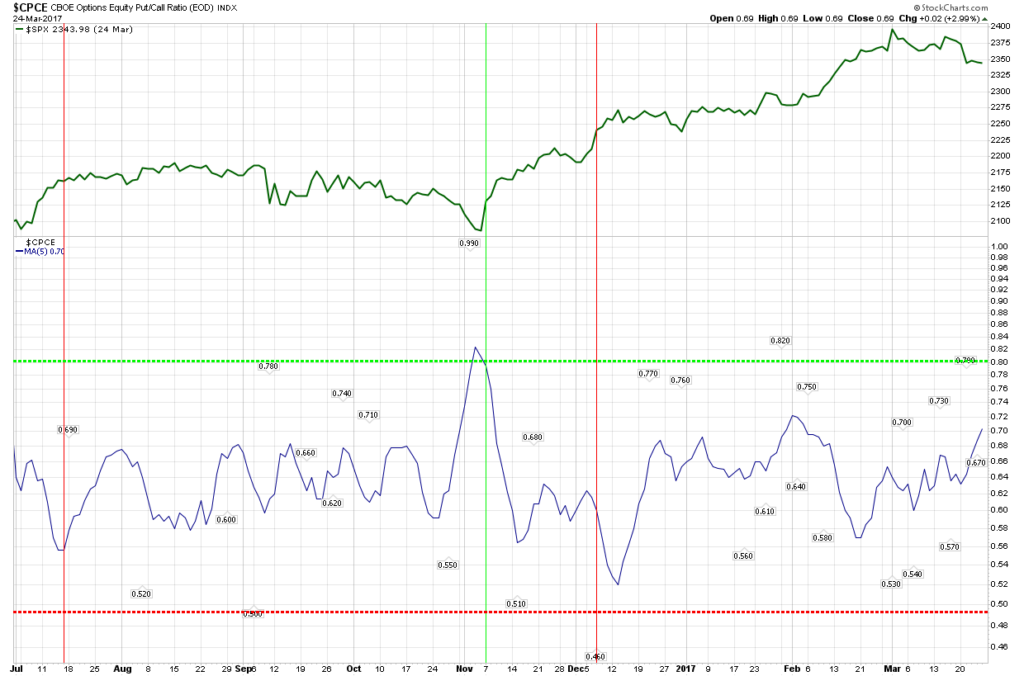

The 5 day moving average of the equity put call ratio moved a little higher last week after a period of heavy call buying. Traders are set up long still ahead of the election.

Here’s the same chart from 2016 ahead of the election. There was heavy put buying ahead of the election which quickly turned into a squeeze higher.

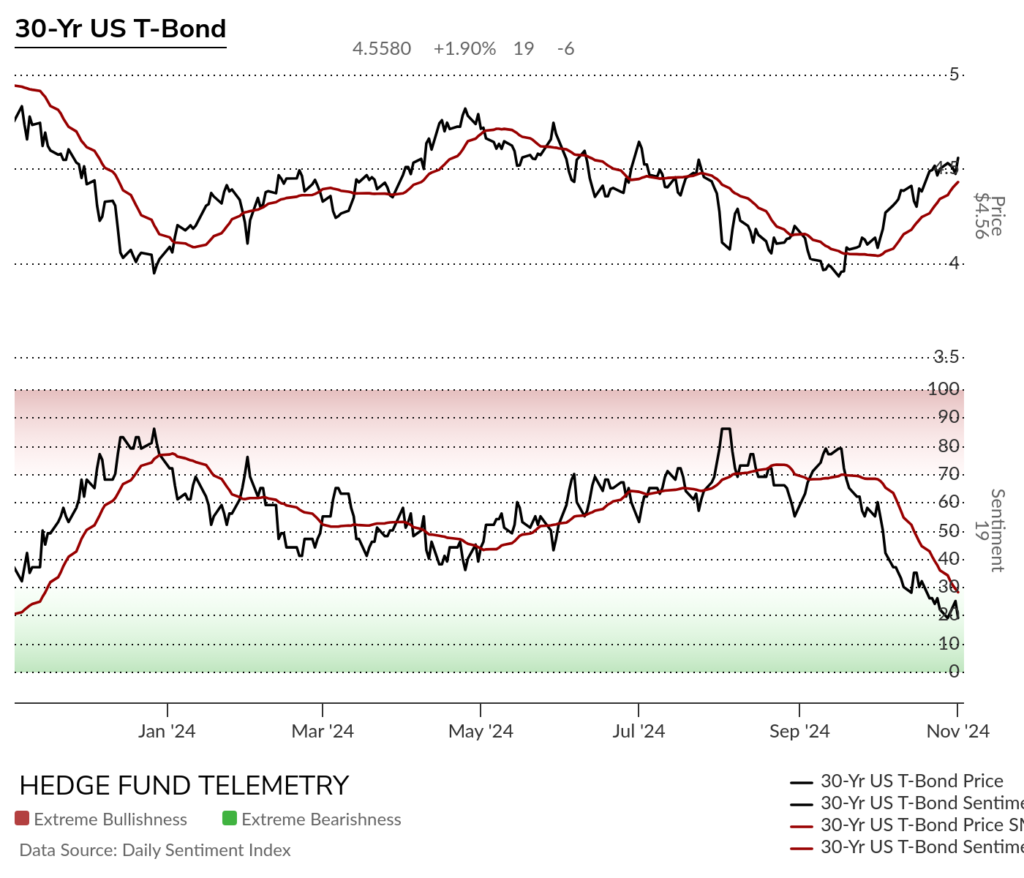

The bond market has been selling off, with rates increasing right after the Fed cut 50bps. Friday saw rates move lower and then closed on the highs. The 2 year has a DeMark Sequential still in progress on day 9 of 13 with a second Setup 9. The 10 year did qualify the Sequential 13 that started after the first Setup 9 and now a second Setup 9 could have a secondary Sequential start – with it on day 1 of 13. 30 year had only one Setup 9 and has a qualified Sequential 13.

Presidential election – Tight down to the wire

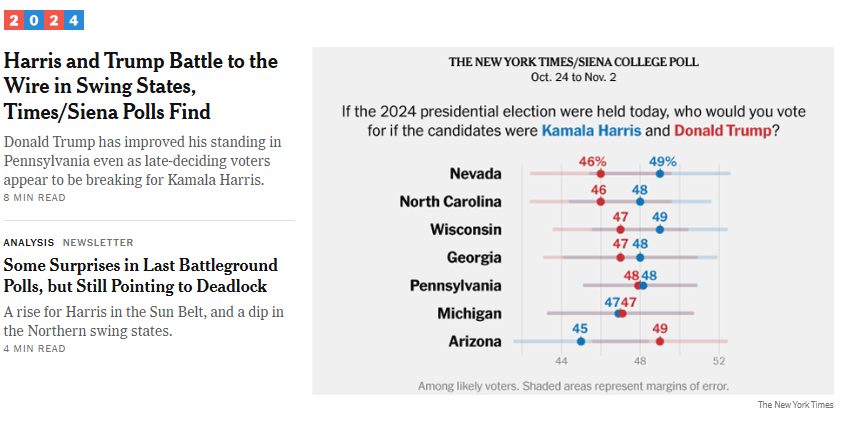

Polls and prediction data show a close and tightening race in the presidential election three days before Tuesday’s election day. Real Clear Politics average polls have Trump at 48.4 vs. Harris at 48.1. In 2016, Trump trailed Clinton on Real Clear Politics, and some believe Trump’s support is underrepresented in polling. With it this close, the true result probably won’t be settled on Wednesday, with both sides expected to be challenged. That could put the markets at risk.

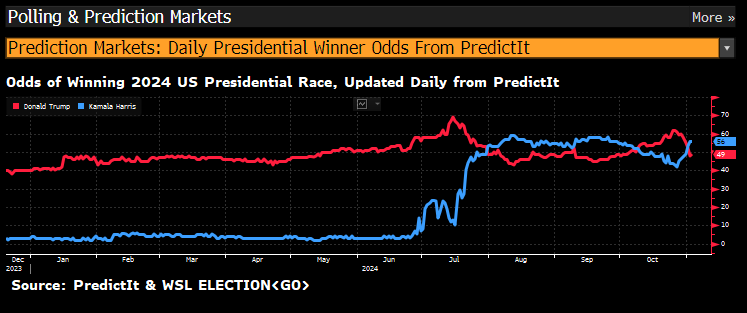

Predictit is a betting site and the recent wide Trump lead over Harris has flipped with Harris at 56 vs Trump at 49. These can move fairly easily being manipulated with large bets.

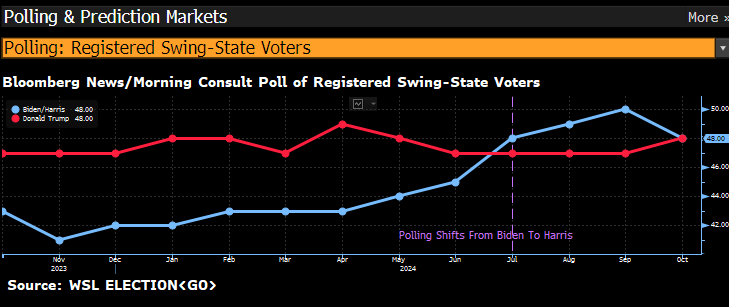

It’s no surprise that the swing state voters would be the battleground, and it’s tied at 48

The NY Times has a poll out this morning with the swing states polls.

Goldman Sachs has both Trump and Harris baskets of stocks that would benefit from either winning. The markets have been increasing in October, with the Trump-winning basket notably outperforming the Harris-winning basket. In the last week, there have been slight turns in both.

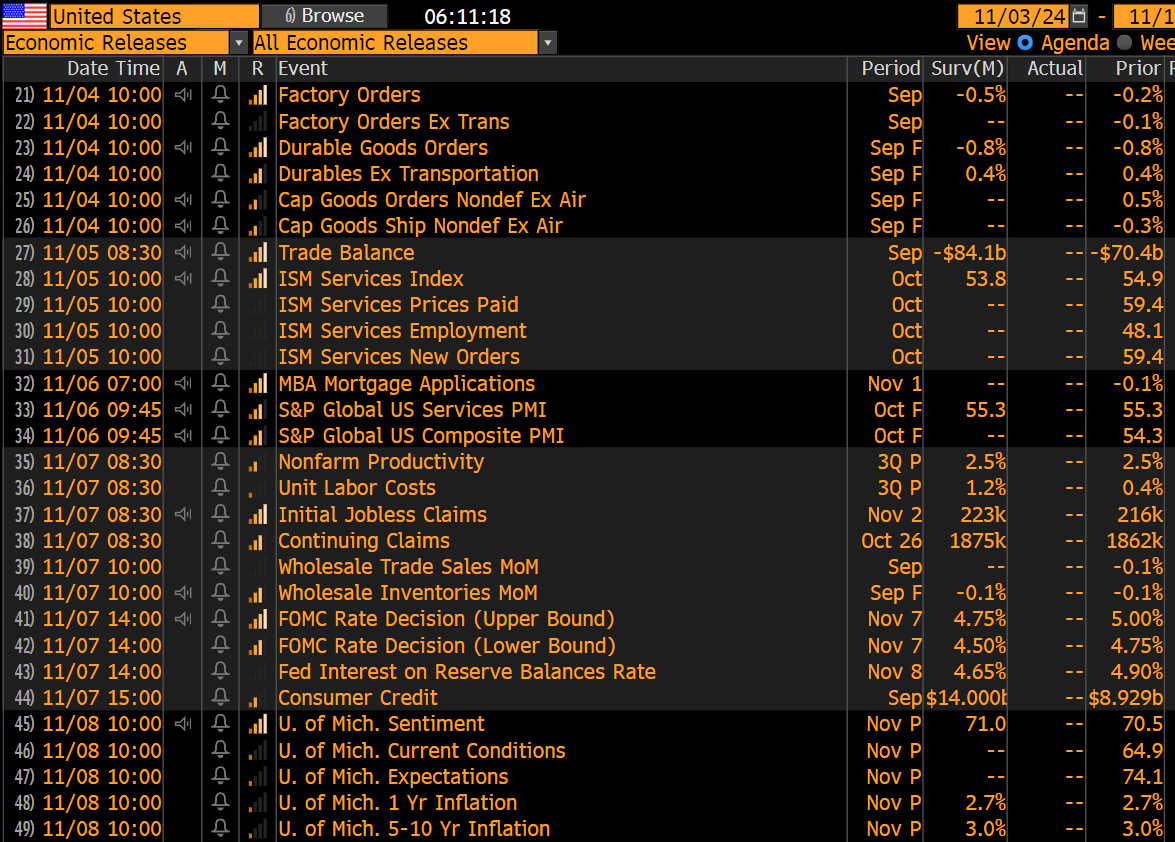

US economic data for the week

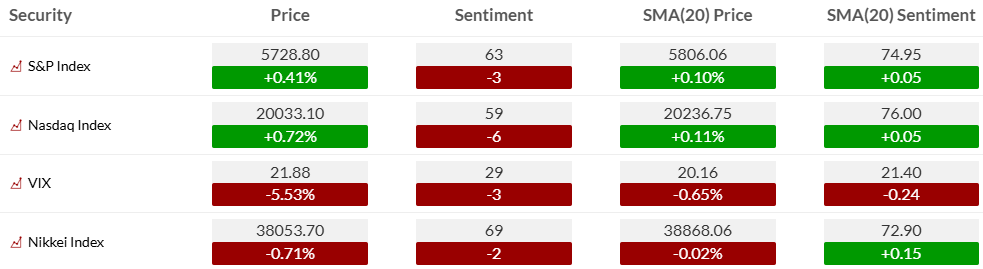

KEY MARKET SENTIMENT

Equity bullish sentiment dropped on Friday despite the increase with the indexes.

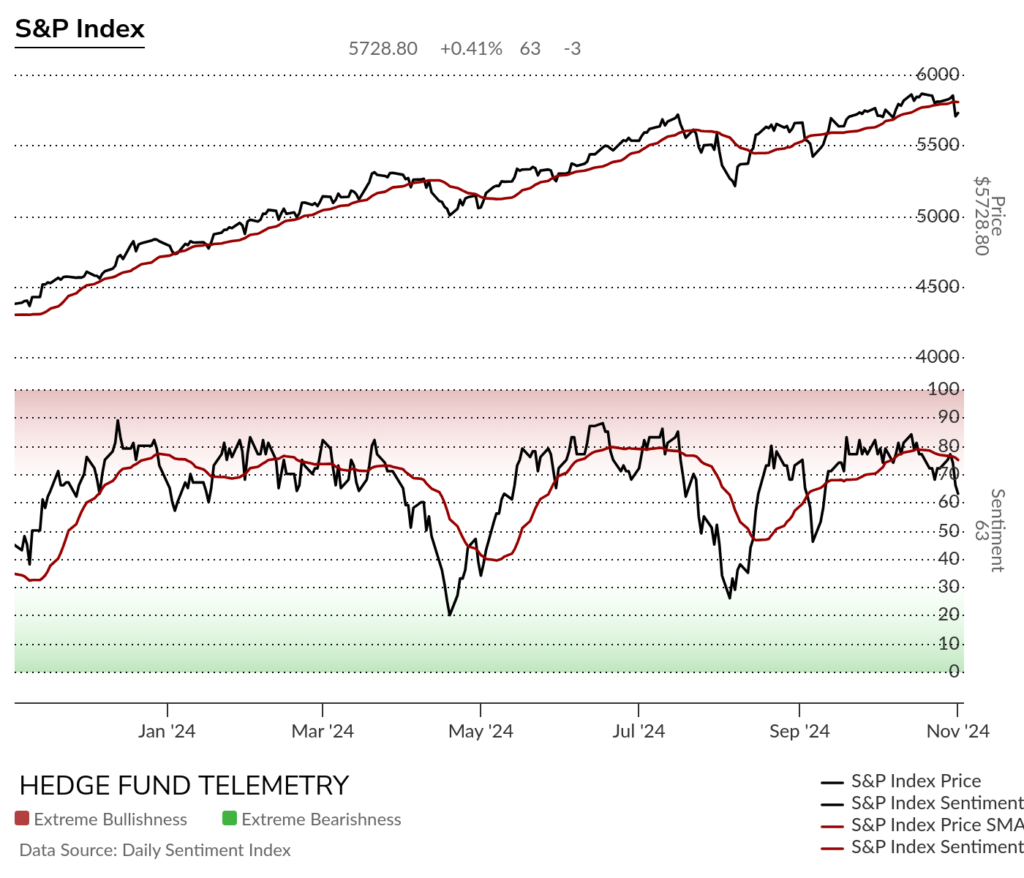

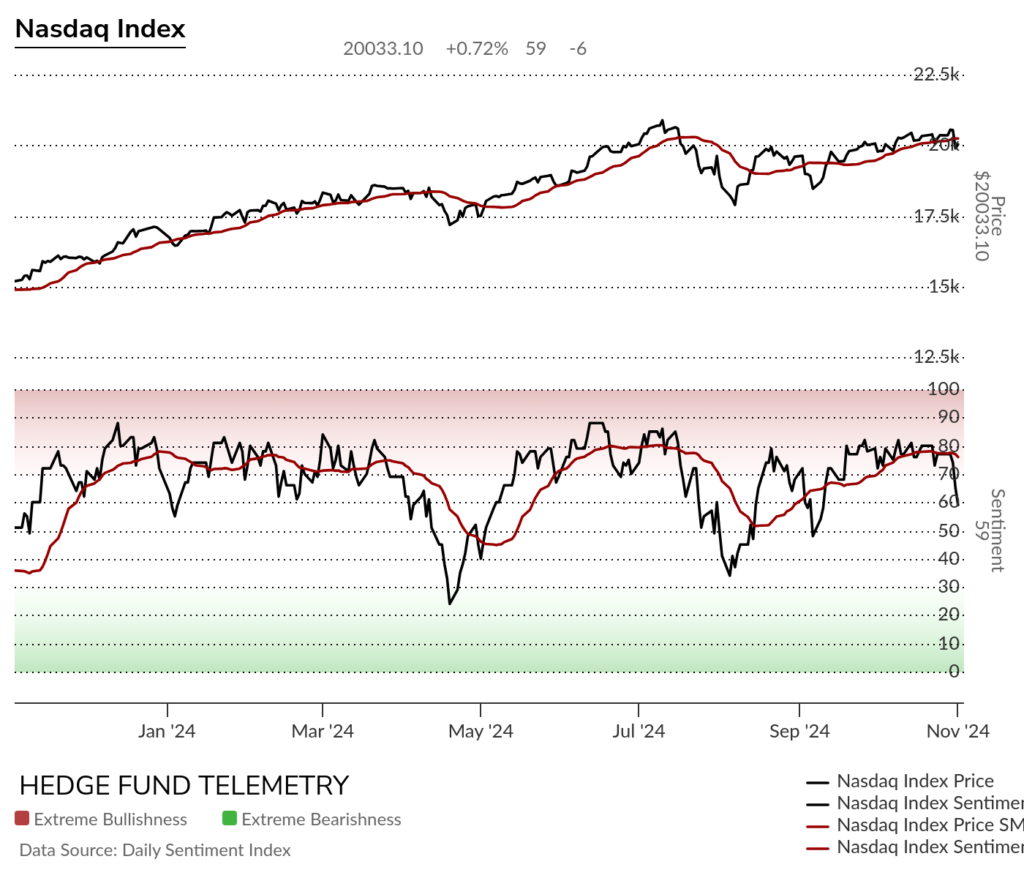

Bullish sentiment in the S&P and Nasdaq made recent lower highs and broke lower on Friday. This is a different setup from the last two elections.

The following two charts are the S&P sentiment charts ahead of the 2020 and 2016 elections. Both saw large declines into oversold territory ahead of the election, which, once the election was over, saw strong reversals. Will this time be different, with sentiment set up in overbought territory ahead of the election? Here’s 2020 ahead of the election, with sentiment bottoming at 25% bulls.

Here’s 2016 ahead of the election, bottoming at 10% bulls

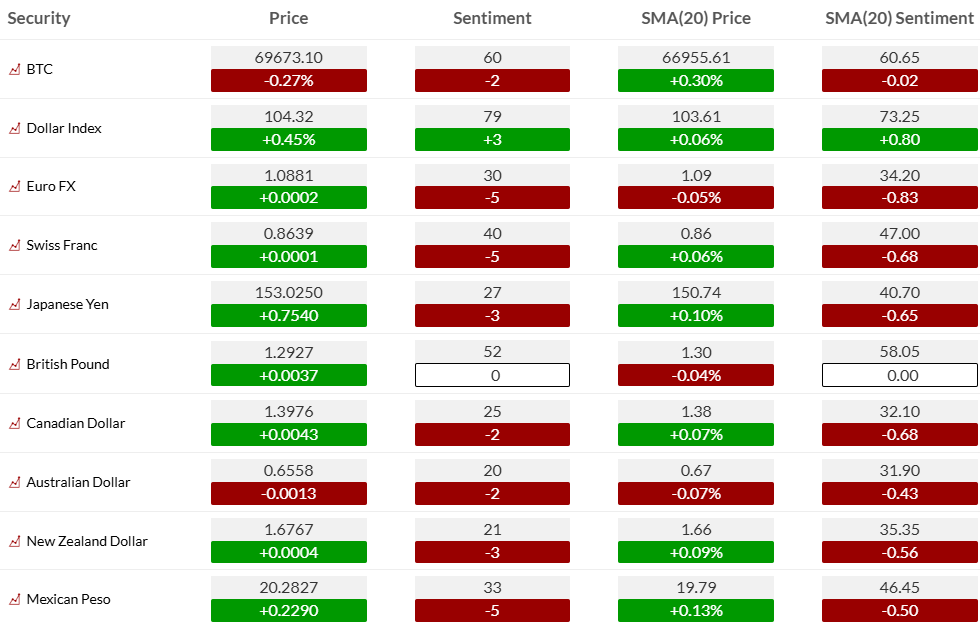

Currency bullish sentiment with US Dollar bullish sentiment nearly in the extreme zone.

Dollar Sentiment has moved from deeply oversold at 13% to now 79%

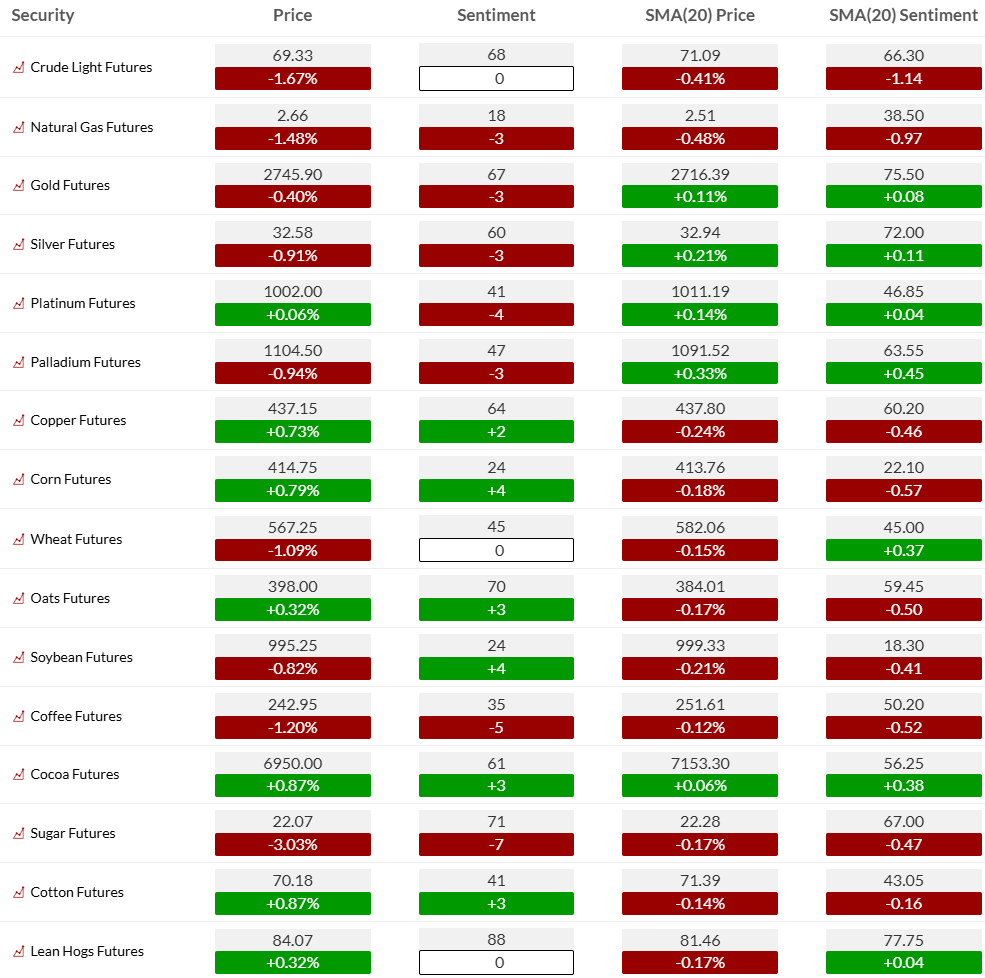

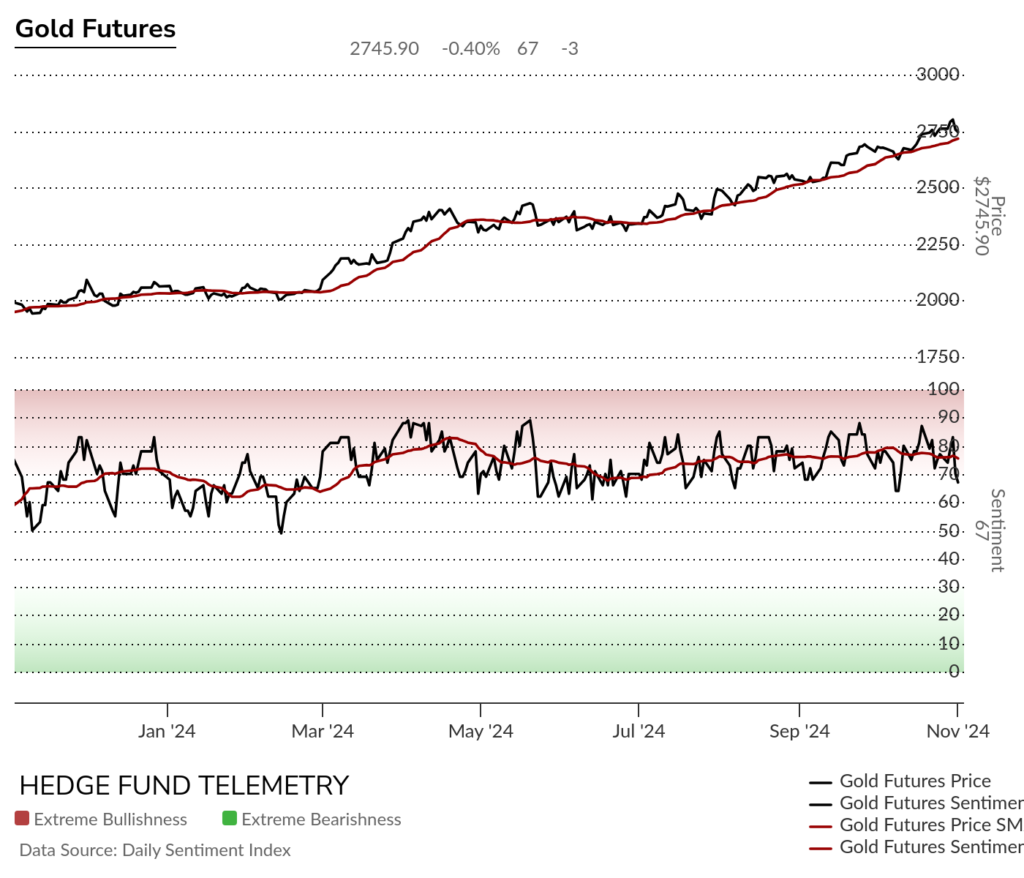

Commodity bullish sentiment declined, with the most important heavyweights in the Commodity Index. Crude sentiment has remained relatively strong vs. weak price action, and I would attribute that to the continued headlines coming out of the Middle East. Gold bullish sentiment is at 67% and has remained over ~60% for the past year. A clear breakdown under that level would signal a trend change.

Gold bullish sentiment has remained above the ~60% level in the past year, with one trip down to the 50% level. Breaking down under 60% and 50% would signal a trend change, with the nominal dips turning into someone more significant.

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 04-Nov:

- Corporate:

- Earnings:

- Pre-open: AGM, ALX, AMG, BAM, BCRX, BEN, BNTX, CC, CEG, CHH, CNTY, DOCN, ENFN, ENTG, EVEX, FIS, FOXA, FRPT, FTDR, GTE, IART, KNF, KOS, KRYS, LSEA, MAR, NSSC, NYT, OMI, PEG, RVTY, SLQT, SSP, TGI, TRS, VRNA, WLFC, YUMC, ZTS

- Post-close: ABCL, ADUS, AHH, AIG, ALAB, ANDE, AOSL, APLE, AQST, ARIS, ATUS, AVB, AZPN, BCC, BCOV, BFAM, BOOM, BOWL, BRCC, BSM, BWIN, BWXT, CBT, CDNA, CE, CENX, CLF, CLW, CRBG, CRD.B, CRGY, CRUS, CSTL, CVGI, CWK, DEI, DHC, EGHT, ELME, EQH, ES, EVER, FANG, FBRT, FN, FTK, FWRD, GAIA, GKOS, GLRE, GOOD, GROY, GT, GXO, HCKT, HDSN, HHH, HIMS, HMN, HOLX, HPK, HSII, HUN, ICHR, ILMN, INN, INSP, INTA, IPI, ITUB, JELD, KE, LSCC, MED, METC, MQ, MTG, MYE, MYPS, NTST, NVTS, NXPI, O, OGS, OPAD, OTTR, PARR, PLMR, PLTR, PRAA, PRIM, PRPL, PSTL, QNST, REAL, RHP, RRX, SANM, SEI, SLAB, SMLR, ST, STRT, SUPN, TBI, TCMD, TDC, TDUP, TGS, UTL, VMEO, VNO, VNOM, VOYA, VRTX, VTS, VVX, WOW, WTRG, WYNN

- Brokerage Conference:

- J.P. Morgan Global Energy Conference

- Gabelli Funds Automotive Symposium

- BIO Europe Conference

- PDUFA: 500124.IN (DFD-29)

- Earnings:

- Economic

- US: Durable/Factory Orders

- Europe: Sentix Economic Index

- Asia: CPI y/y

- Corporate:

- Tuesday 05-Nov: Election Day

- Corporate:

- Earnings:

- Pre-open: ACDC, ADM, AGCO, AHCO, APLS, APO, ARCH, BEAM, BLD, BLDP, BLDR, BOW, BR, BRKR, BVS, CEIX, CIGI, CMI, CMT, DD, DEA, EMR, FUFU, GBTG, GFS, GLDD, HLMN, HSIC, HY, INGR, IT, KPTI, LGIH, LIND, LPX, MITT, MLCO, MPC, MPLN, MPLX, NDOI, NEO, NMRK, NOVT, NPO, NRP, OGE, ONIT, OXSQ, PAX, PAYO, PINC, PMTS, PSBD, PTLO, QSR, RACE, SHC, SHIP, SNDL, SOPH, SQNS, STVN, TKR, TRGP, ULS, USAC, VPG, WLK, WLKP, XMTR

- Post-close: AFG, AHT, AIP, AIZ, BCSF, BGS, CBDBY, CGBD, CPNG, CRC, CRCT, CTKB, DVN, EML, EOSE, EXAS, FORR, GIFI, GMED, GO, GPOR, HLIO, IFF, IGIC, INNV, IOSP, IRBT, IVR, KGC, KTCC, LDI, LMB, LUMN, MASI, MBC, MCHP, MEC, MGNX, MRC, MRCY, NCMI, NE, NHI, NOG, OUT, PAAS, PAYS, QLYS, RARE, RVLV, RYAM, RYTM, SMCI, SNDX, SWIM, TMCI, TRVG, TSLX, TX, UFCS, USPH, VIV, VSEC, VTEX, VTOL, WEYS, WTTR

- Analyst/Investor Events: EPAC, TECK

- Brokerage Conference:

- J.P. Morgan Global Energy Conference

- Gabelli Funds Automotive Symposium

- BIO Europe Conference

- Societe Generale European ESG Conference

- Earnings:

- Economic

- US: Trade Balance, PMI Services Final, ISM Non-Manufacturing Index, API Crude Inventories, Redbook Chain Store

- Canada: Trade Balance

- Europe: Unemployment rate (sa), Industrial Production m/m, Unemployment Change

- Asia: Retail Sales Nominal NSA Y/Y

- Corporate:

- Wednesday 06-Nov:

- Corporate:

- Earnings:

- Pre-open: ABUS, AEP, AOMR, ASC, ASTE, AUDC, AVA, AVDX, BATRA, BCO, BIP, CELH, CHRS, CIM, CLBT, CLVT, CNDT, COR, CRL, CTRI, CVS, CXW, DIN, DK, DKL, DZSI, EHTH, ENOV, EYE, FOLD, FUN, GHI, GNE, GPRK, HLNE, HWM, IONS, IRM, JCI, JLL, KLTR, KMT, KPLT, KRNT, LENZ, LNTH, LXP, MAC, MCFT, MDV, MFA, MHH, MKTX, MODV, MOGO, OC, ODP, OESX, OSS, PERI, PFGC, PNW, POWI, PRGO, RGS, RPRX, SFL, SGHC, SMG, SMRT, SNDR, SRE, STR, STWD, SUN, SWX, TCPC, TEVA, TRMB, TWIN, URGN, VERX, VLN, VSH, WBX, WMB, WW, ZVIA

- Post-close: ACAD, ACIC, ACLS, ACT, ADTN, AEE, AEVA, ALB, ALNT, ALTO, AMC, AMPH, AMPY, AMRK, APA, APP, APPS, ARAY, ARDT, ARM, ARQT, ASH, ASPN, ATO, ATRO, AWR, BALY, BBDC, BBSI, BGSF, BHR, BIRD, BKD, BKH, BLND, BMBL, BRDG, BROS, BWMN, BYND, CAPL, CCRN, CDE, CDLX, CDRE, CERT, CHRD, CLNE, CLOV, COHR, COOK, CORZ, COTY, CPRX, CRSR, CSGS, CTVA, CURI, CWAN, CXDO, CXT, CYTK, DLX, DUOL, DV, EBS, ECPG, EE, EFC, EHAB, ELF, ENS, EOLS, EPSN, ET, EVTC, FARO, FBIN, FC, FG, FICO, FLL, FNF, FOA, FRGE, FRSH, FSK, FSLY, FTEK, GFL, GH, GHLD, GILD, GMRE, GNK, GNL, GNW, GPMT, GSM, GWRS, HCAT, HG, HL, HRTG, HST, HUBS, IIPR, IONQ, IPAR, JAZZ, JOBY, JXN, KAR, KD, KGS, KIDS, KIND, KNTK, KRUS, KVYO, KW, LAND, LAW, LB, LILAK, LOMA, LOPE, LSAK, LSF, LYFT, LZ, MATV, MCK, MDAI, MDXH, MEG, MELI, MKSI, MTCH, MTRX, MWA, MXCT, MYO, NDLS, NEWT, NFG, NMIH, NVGS, OBDC, ODD, OM, ORA, OSUR, PAHC, PCRX, PETS, PFMT, PHX, PKOH, PLYA, PLYM, PNTG, PR, PRI, PSNL, PTC, PYCR, QCOM, QGEN, QTWO, QUBT, RAMP, RCUS, RDN, RDVT, RDW, REI, REPX, RGLD, RGNX, RLJ, RM, RNR, RPD, RRGB, RVMD, RYN, SAAFY, SEDG, SEER, SERA, SGC, SITM, SKT, SLNG, SLRC, SPCE, SRPT, STE, STRL, SUI, SVC, TKO, TNDM, TPC, TPL, TPVG, TRIP, TRUE, TRVI, TS, TTEC, TTWO, TYGO, UHAL, UMH, UPWK, USIO, VAC, VATE, VCYT, VECO, VNDA, VSAT, VTLE, WAY, WES, WK, WOLF, XHR, XPER, ZG, ZIP

- Brokerage Conference:

- BIO Europe Conference

- Societe Generale European ESG Conference

- ZKB Swiss Equities Conference

- Society for Immunotherapy of Cancer Meeting

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, DOE Crude Inventories

- Canada: Ivey PMI

- Europe: Factory Orders m/m, Manufacturing Turnover (sa) m/m, PPI y/y, Unemployment Rate

- Asia: Trade Balance

- Corporate:

- Thursday 07-Nov:

- Corporate:

- Earnings:

- Pre-open: ACIW, ACMR, ACRE, ADV, APD, APPN, ARQ, ASLE, AUPH, AVAH, AXGN, BDX, BIGC, BKSY, BLZE, BRY, BSY, CARS, CCOI, CEVA, CG, CION, CLDT, COLD, COMM, CUTR, DBD, DCO, DDOG, DKNG, DNOW, DNUT, DRIO, DT, DTC, DUK, ECX, EDAP, ELAN, EPAM, EPC, ESPR, EVRG, FWONK, FWRG, GBLI, GDRX, GEO, GERN, GOCO, GOLF, GOOS, HAE, HAIN, HAL, HBI, HBIO, HGTY, HGV, HIMX, HOUS, HSY, HYFM, IBP, IHRT, INSW, IRWD, JMIA, KELYA, KLG, KRP, KVUE, LBRDK, LCII, LFST, LGND, LVO, LYTS, MDU, MFIC, ML, MPW, MRNA, MRX, MTSI, MUR, NABL, NCDL, NEUE, NTLA, NVEE, NVMI, NXST, OB, OFIX, OLPX, OPFI, OSCR, OTLY, PBH, PCG, PCT, PENN, PHAT, PLNT, PLTK, PODC, PRKS, PRMW, PRTH, PRVA, PZZA, QRTEA, REAX, REFI, RL, ROK, RXO, SCSC, SEAT, SEE, SGA, SHEN, SHOO, SPTN, SRAD, STGW, STRA, SUNS, SUP, TAP, TBLA, TDG, TGLS, TGNA, THRY, TLS, TPB, TPR, TPX, TSQ, UAA, UP, USFD, VCEL, VFF, VITL, VST, VTRS, VYX, WBD, WD, WHF, WRBY, WWW, XPEL, XRAY, YETI, YOU

- Post-close: AAOI, AAON, ABL, ABNB, ACHR, ACHV, ACVA, ADEA, ADMA, ADPT, AEYE, AFRM, AGL, AKA, AKAM, AL, ALLO, ALRM, AMN, AMPL, AMPX, AMRC, ANET, AORT, ARKO, ARLO, ARRY, ASTH, ATEN, AUID, AVGR, AVPT, AXDX, AXON, BAP, BARK, BE, BHF, BILL, BL, BLNK, BRLT, CABO, CARG, CBUS, CCSI, CIB, CIVI, CLAR, CLFD, CLPT, CMBM, CMTG, CODX, COLL, CPAY, CPK, CTLP, CTSO, CYRX, DBX, DCGO, DH, DIOD, DOCS, DRH, DVAX, DXC, EB, EOG, ESTA, EVH, EXFY, EXPE, EXPI, FARM, FIGS, FIVN, FLYW, FNKO, FOSL, FROG, FTHM, FTNT, G, GAIN, GAU, GDEN, GDOT, GETY, GEVO, GFR, GPRO, GRND, GRNT, GSAT, GSBD, HASI, HCI, HEAR, HGBL, HRB, IBEX, III, INDI, INGN, INOD, INVE, ISDR, JAMF, JYNT, KRT, KTOS, LASR, LCID, LFMD, LGF.A, LITE, LPRO, LPSN, LPTH, LRFC, MAIN, MBI, MGNI, MLNK, MNMD, MP, MRVI, MSDL, MSI, MTD, MTUS, MYGN, NATR, NET, NR, NRDY, NUS, NWSA, OEC, OLO, ONL, ONTF, OPAL, OPEN, OPK, OS, OUST, OVV, PACB, PBI, PBPB, PBR, PBYI, PDFS, PEB, PINS, PODD, PRA, PRCH, PTCT, PTMN, PX, QDEL, QRHC, RCEL, RDFN, REZI, RIVN, RNG, RRR, RUN, RXST, SCM, SEMR, SENS, SERV, SEZL, SG, SGHT, SKYT, SLDP, SMR, SOLV, SPT, SQ, SST, STEP, SVV, SYNA, TACT, TASK, TBRG, TELA, TEM, TKNO, TOST, TPIC, TTD, U, UEIC, UPLD, UPST, VEL, VINP, VSTA, VVI, WBTN, WEST, WTI, XPOF, YELP, ZD, ZOM

- Analyst/Investor Events: CSX, INMB, VEEV

- Brokerage Conference:

- Societe Generale European ESG Conference

- ZKB Swiss Equities Conference

- Society for Immunotherapy of Cancer Meeting

- Bernstein European Sustainability Conference

- Stifel Midwest One-on-One Conference

- Proactive Investor Forum

- Truist Securities BioPharma Symposium

- BancAnalysts Association of Boston Conference

- RE+ Midwest

- American Academy of Optometry Conference

- American Association of Hip and Knee Surgeons Meeting

- Earnings:

- Economic

- US: Fed Funds Rate; FOMC Meeting, Weekly Jobless Claims, Unit Labor Costs (preliminary), Productivity (preliminary), Consumer Credit

- Europe: Manufacturing Production (s.a.) m/m, Industrial Production m/m, Halifax House Prices y/y, Trade Balance, Construction PMI, Retail Sales y/y, CPI y/y

- Asia: Real Household Consumption Expenditure y/y, Real Household Income y/y, New Loans

- Corporate:

- Friday 08-Nov:

- Corporate:

- Earnings:

- Pre-open: ADNT, AIRS, ALTI, AMCX, AMRX, ANIP, APYX, ATMU, ATSG, AXL, BAX, BBU, BEP, BLMN, CLMT, CMPO, CNH, DCTH, DIBS, ERJ, FLGT, FLO, FLR, FTRE, GCMG, GHM, GLP, GTN, HIPO, HLLY, IEP, IMXI, KOP, LAMR, LIEN, LNZA, MMI, NRG, OCGN, PAGP, PAL, PAR, PARA, PWP, TIXT, UHG, ULBI, WMS, YMAB

- Analyst/Investor Events: MOH

- Brokerage Conference:

- ZKB Swiss Equities Conference

- Society for Immunotherapy of Cancer Meeting

- RE+ Midwest

- American Academy of Optometry Conference

- American Association of Hip and Knee Surgeons Meeting

- Earnings:

- Economic

- US: Michigan Consumer Sentiment (Preliminary)

- Canada: Employment, Unemployment Rate

- Europe: Manufacturing Production y/y, Industrial Production y/y, Industrial Production m/m, Trade Balance, Industrial Production y/y (wda), CPI y/y, Retail Sales y/y

- Asia: CPI y/y, PPI y/y

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.