HIGHLIGHTS AND THEMES

- The Bloomberg Commodity Index has not made much upside progress and still has a Sequential on the downside in play. It will take a decent move lower to achieve the 13.

- Crude continues the pattern of lower highs and drifts lower

- Natural Gas is trying to make a breakout move but stalled at the 200 day

- Gold and Silver both have downside DeMark Sequential Countdowns in progress with corrective lower high bounces.

- Copper also looks lower but had held support for two weeks.

- Livestock is getting toppy but the trend has been decent.

- Grains still don’t have any upside momentum and that’s been the case for 18 months.

- Soft have done better recently with Cocoa and Coffee nearing new upside DeMark Sequential and Combo sell Countdown 13’s

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily still has the Sequential pending on day 11 of 13. Keep in mind To get the 13 it would have to close under the 8th red bar ~96

Bloomberg Commodity Index Weekly has not made any upside or downside progress.

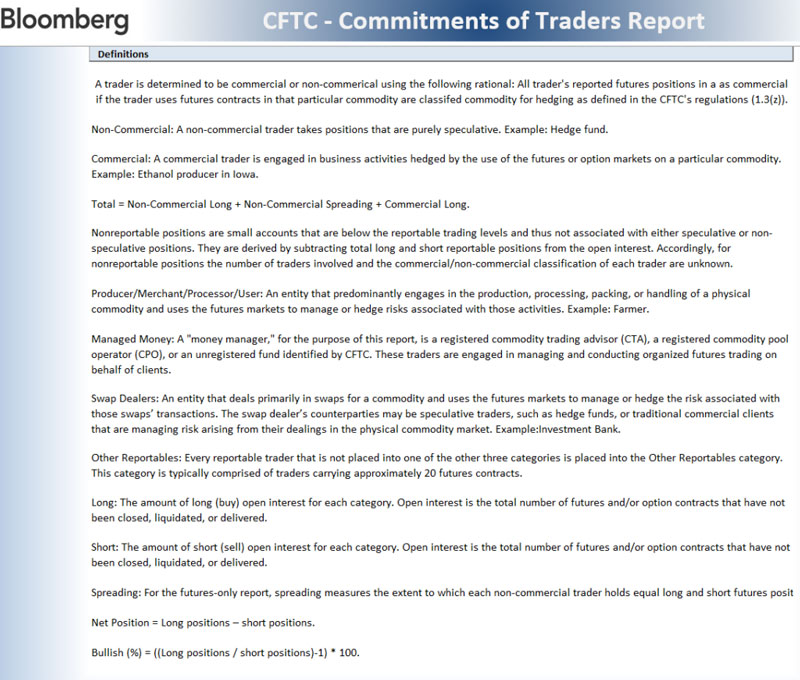

COMMODITY SENTIMENT OVERVIEW

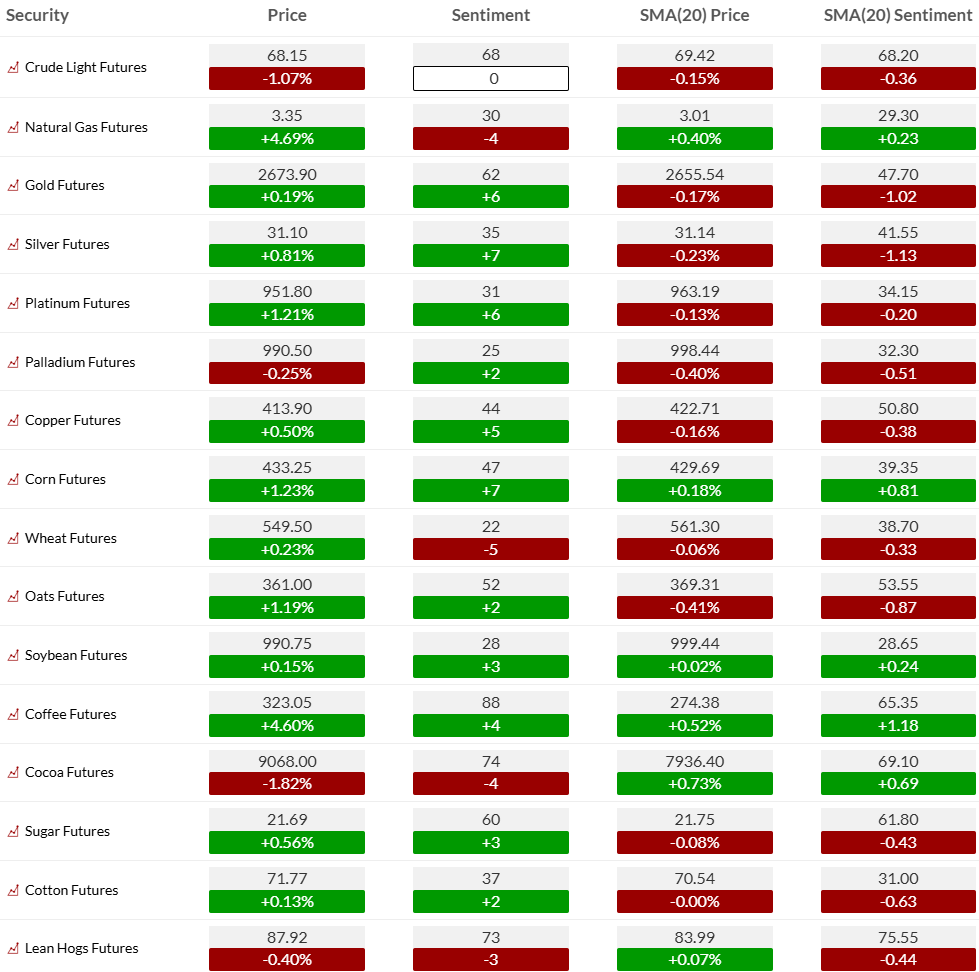

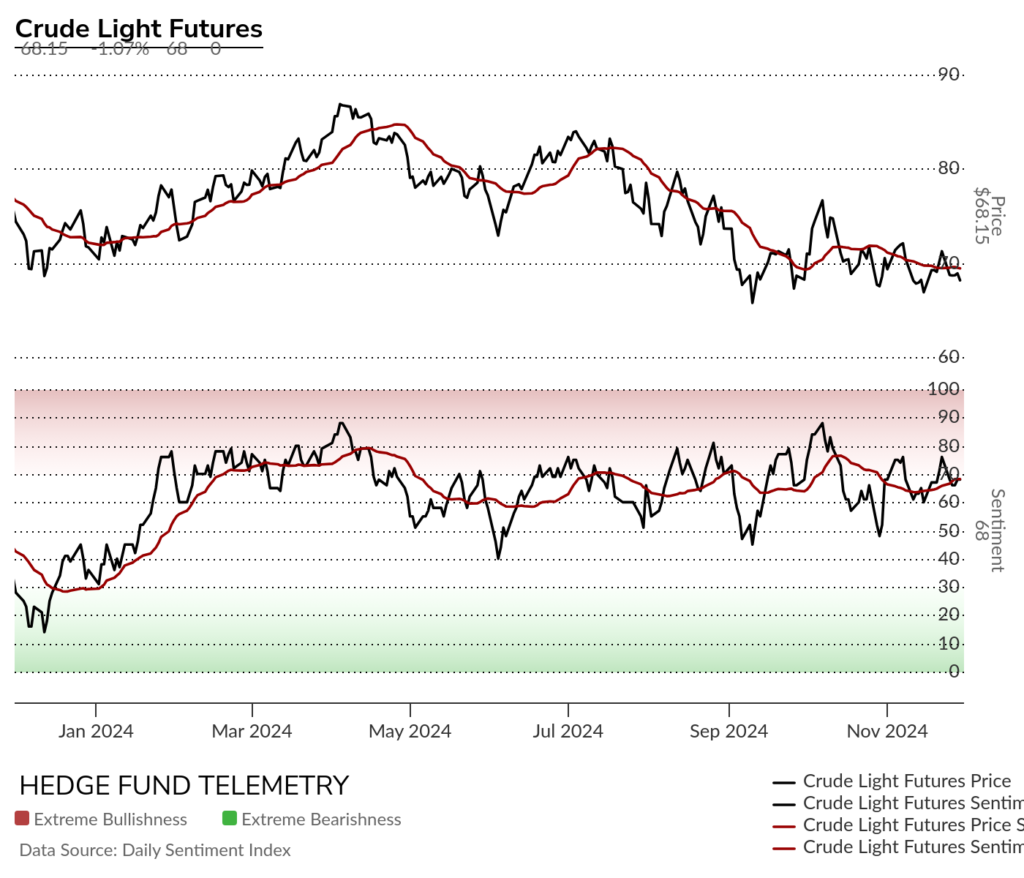

OIL AND ENERGY

Bloomberg Energy Index daily has not been able to turn anything bullish and has a downside Sequential on day 5 of 13.

WTI Crude futures daily has made lower highs from March. Until that pattern can break this just drifts lower.

WTI Crude futures bullish sentiment has remained rather elevated vs the price action

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

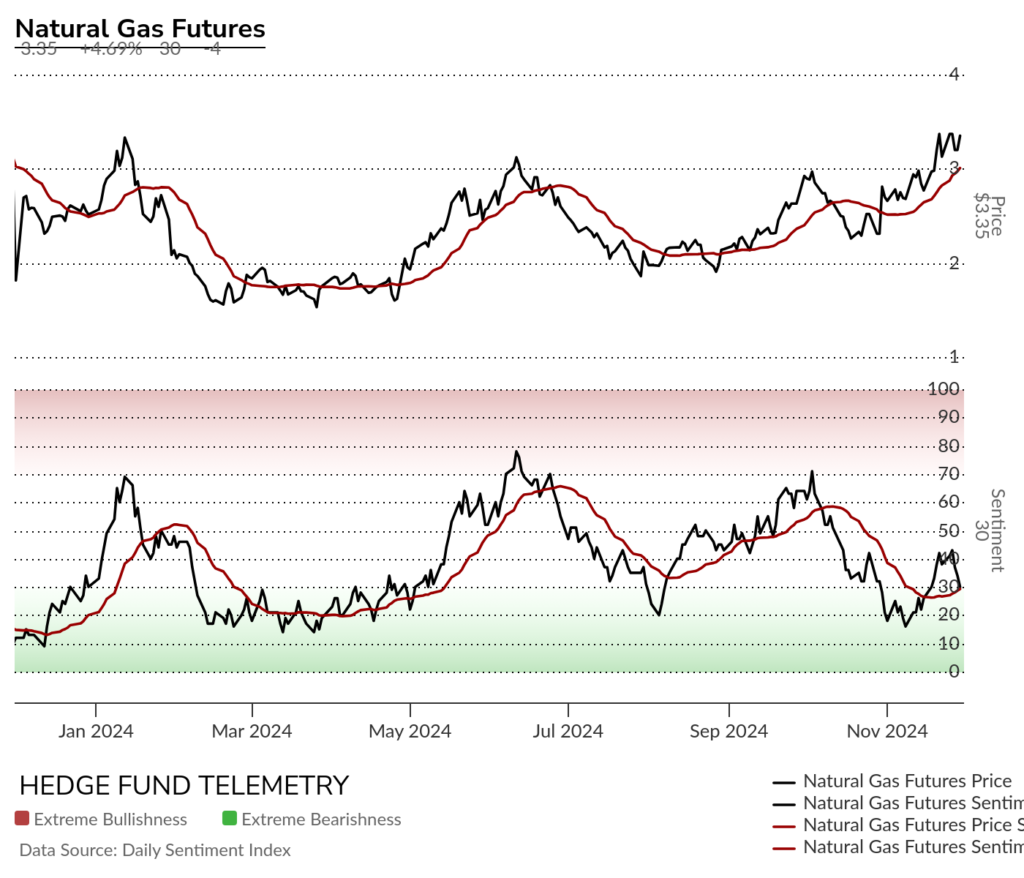

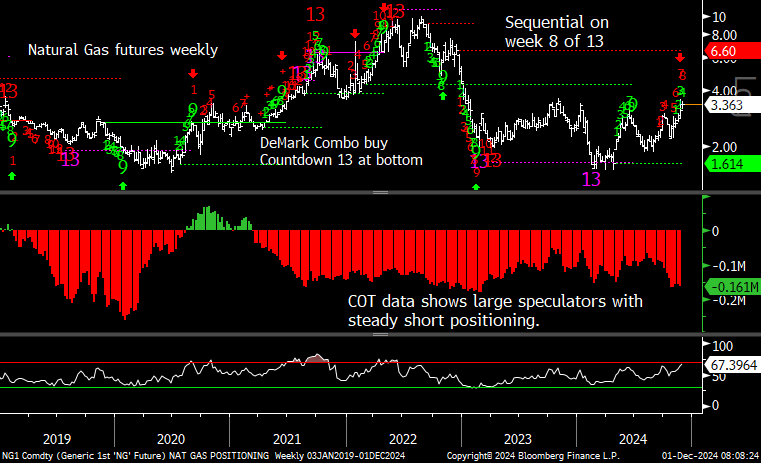

Natural Gas futures daily has seen some spiky action but failed at the 200 day. Let’s see if this makes a higher low.

Natural Gas futures bullish sentiment has really lagged the price action

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. This shows the potential for a breakout

Metals

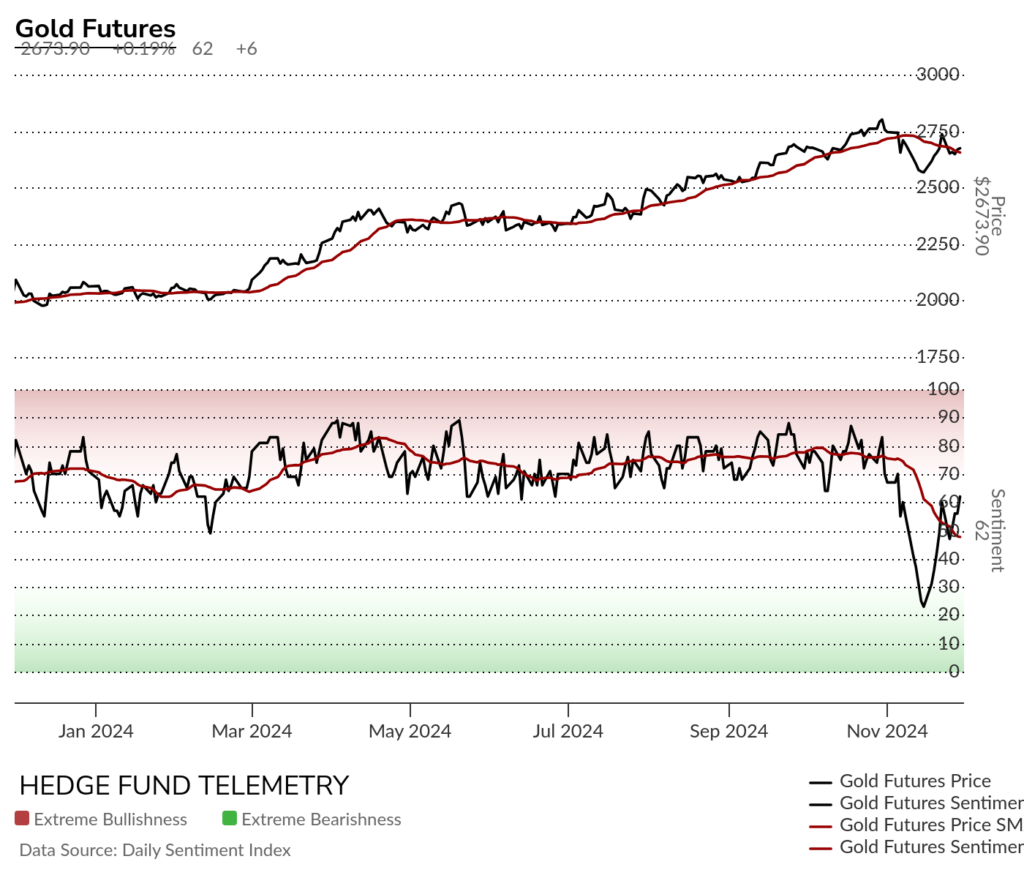

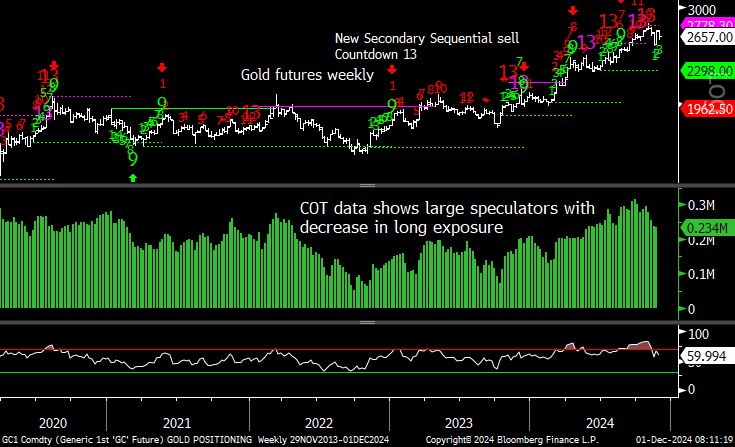

Gold daily was short term oversold mid November and we went long. I cut the long as I was concerned about a lower high wave 2 bounce that could see new lower lows. Downside Sequential pending on day 6 of 13 keeps this view.

Gold bullish sentiment bounced off oversold levels

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Weekly 13’s and reversal down.

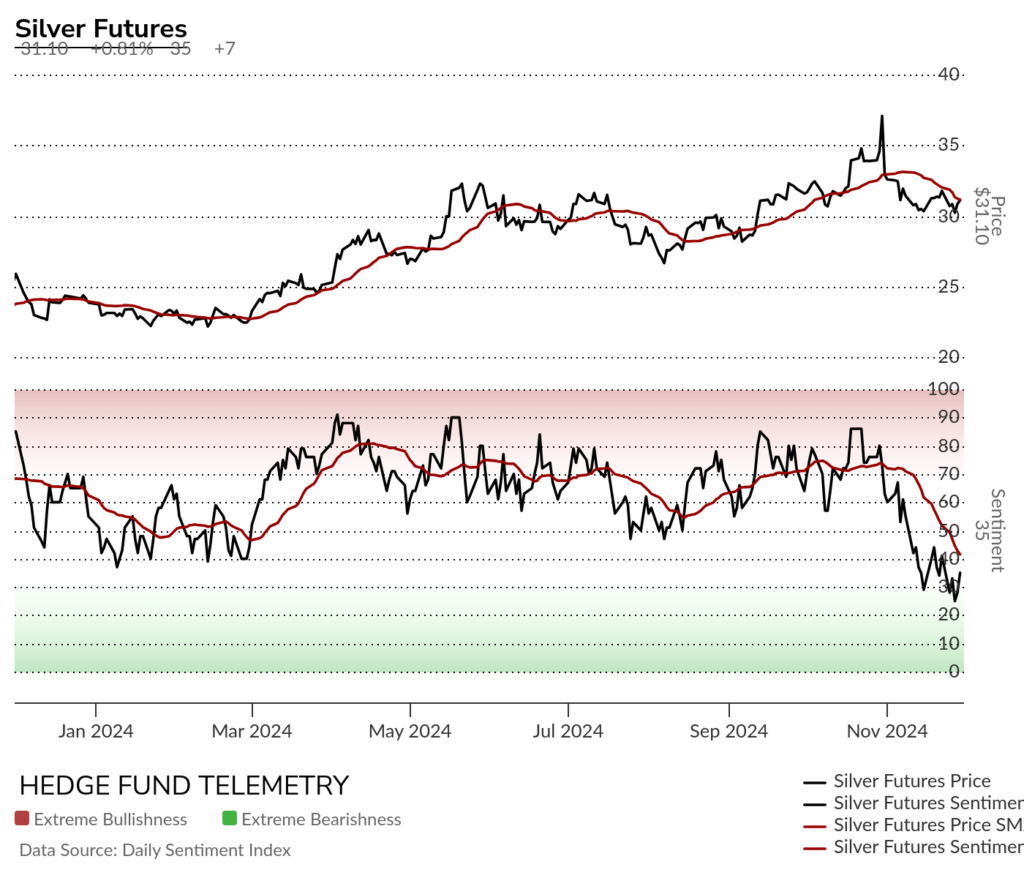

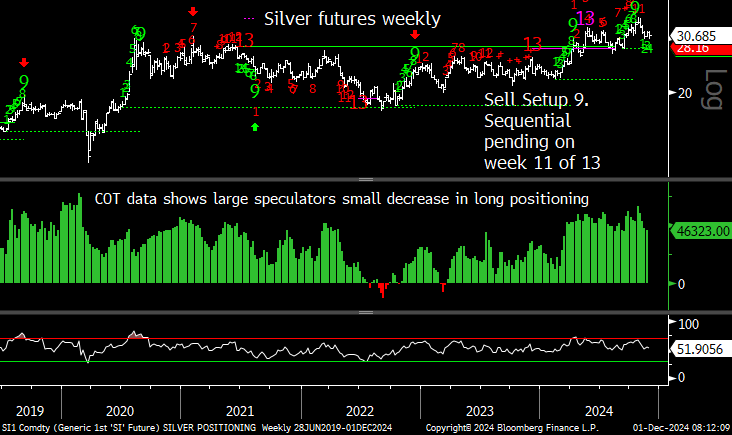

Silver daily remains under pressure with a downside Sequential pending on day 6 of 13.

Silver bullish sentiment has falling to new 2024 lows

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

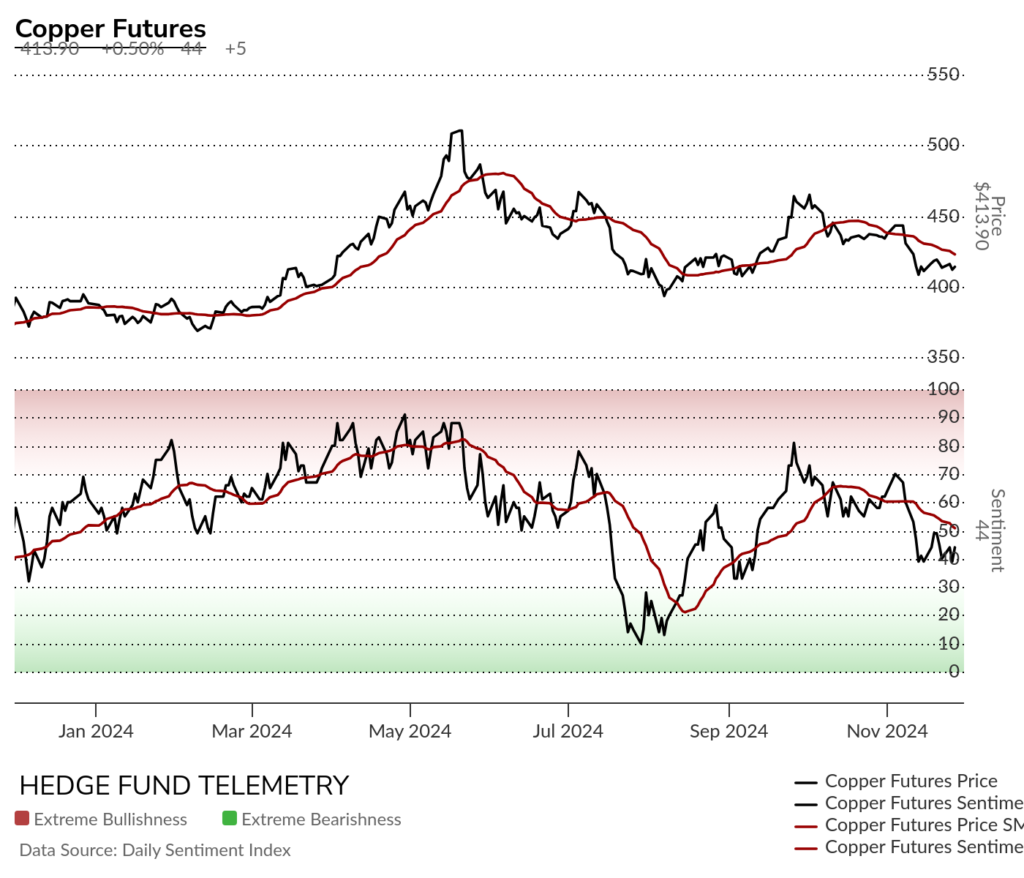

Copper futures daily has been making lower highs with a pending downside Sequential on day 9 of 13 holding the TDST support line for the last two weeks.

Copper futures bullish sentiment has fallen off the highs and is not oversold.

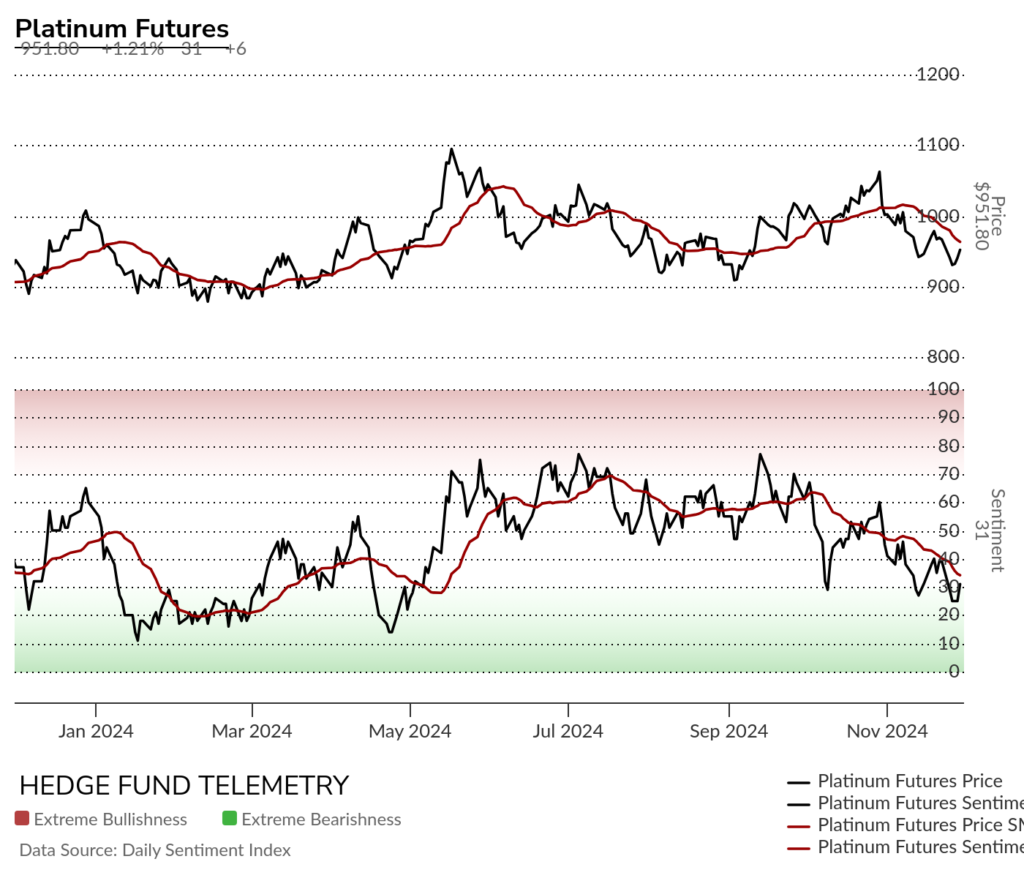

Platinum daily doesn’t have any DeMark Signals and remains in no-mans land

Platinum bullish sentiment remains under pressure

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

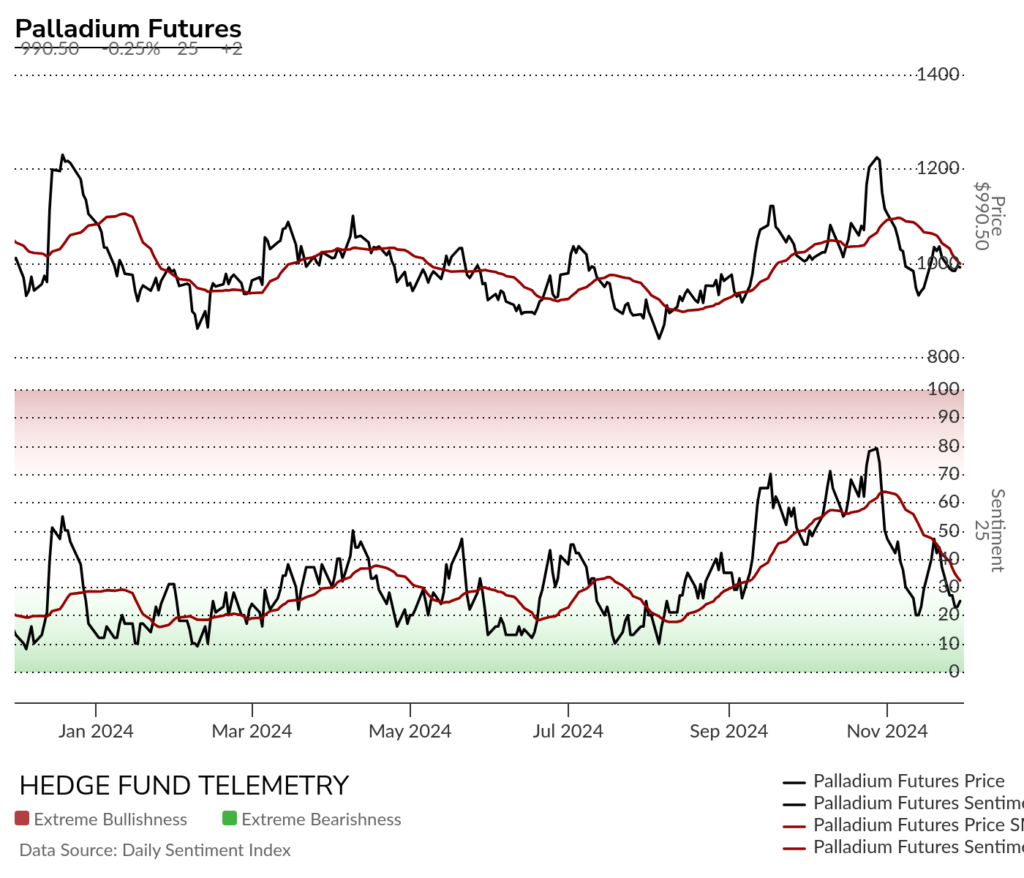

Palladium daily remains under pressure

Palladium bullish sentiment remains under pressure

Grains

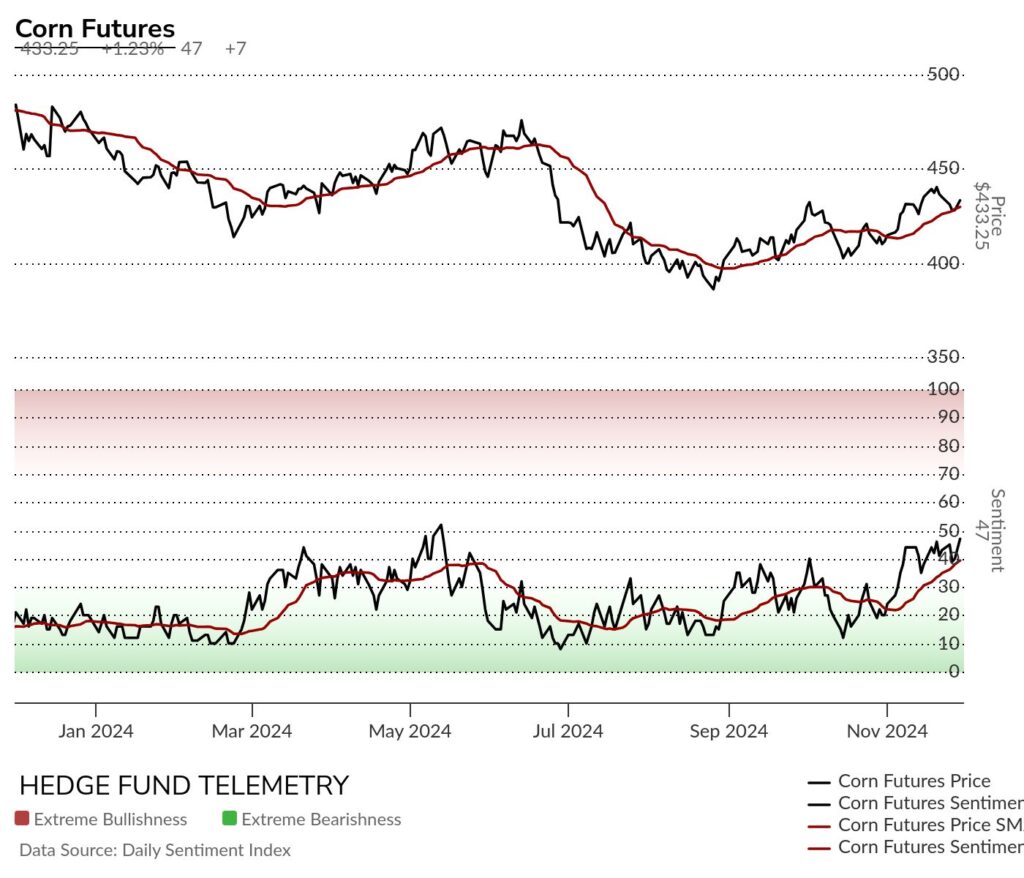

Corn futures daily has been grinding sideways and will need to clear the early November highs to matter.

Corn futures bullish sentiment looking like it wants to breakout above 50%

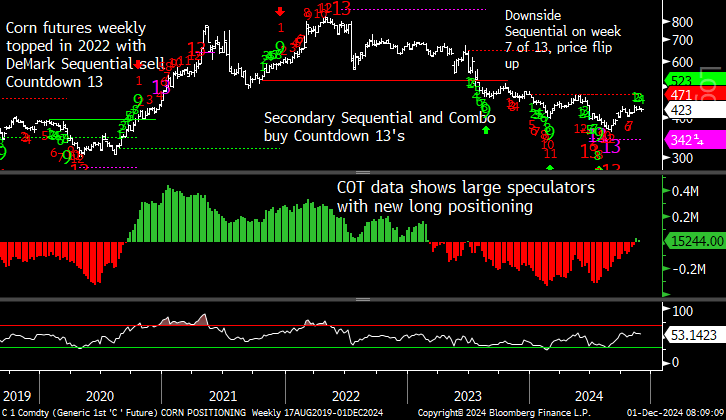

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

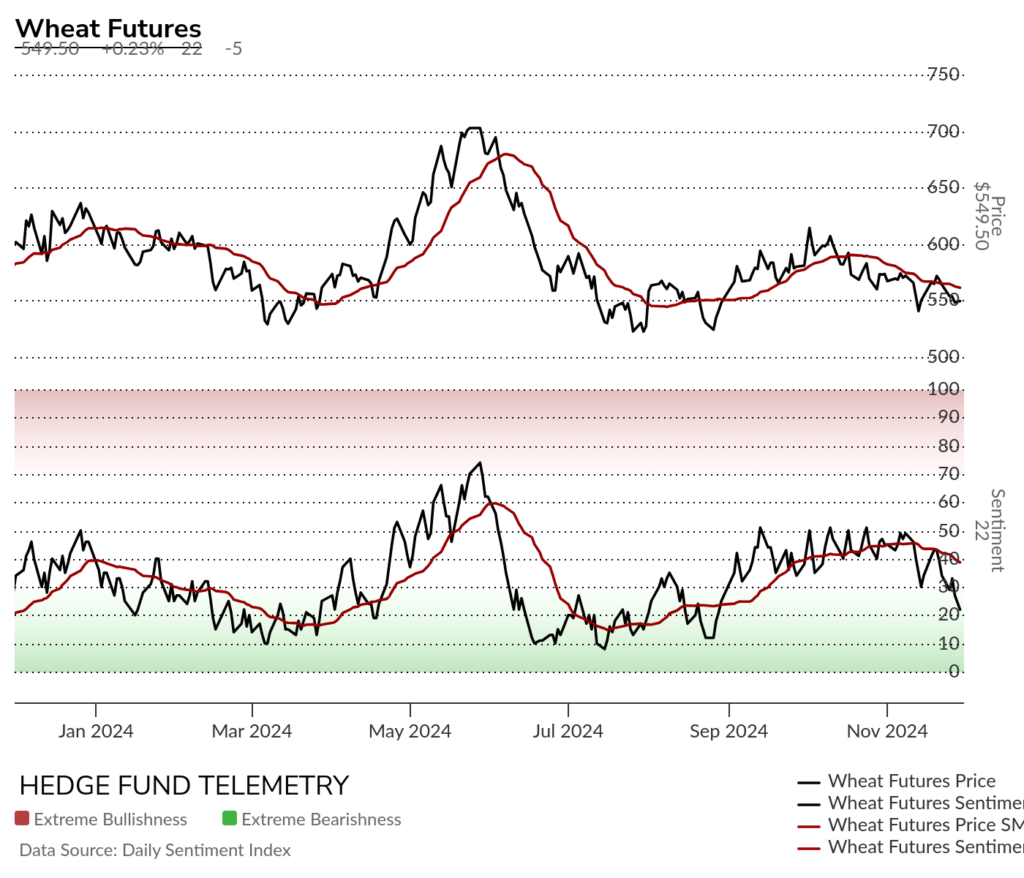

Wheat futures daily had a short lived Sequential buy Countdown 13 bounce but might move lower to the 523 downside Propulsion target.

Wheat futures bullish sentiment has been highlighted in the last two months failing to clear 50% midpoint level.

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

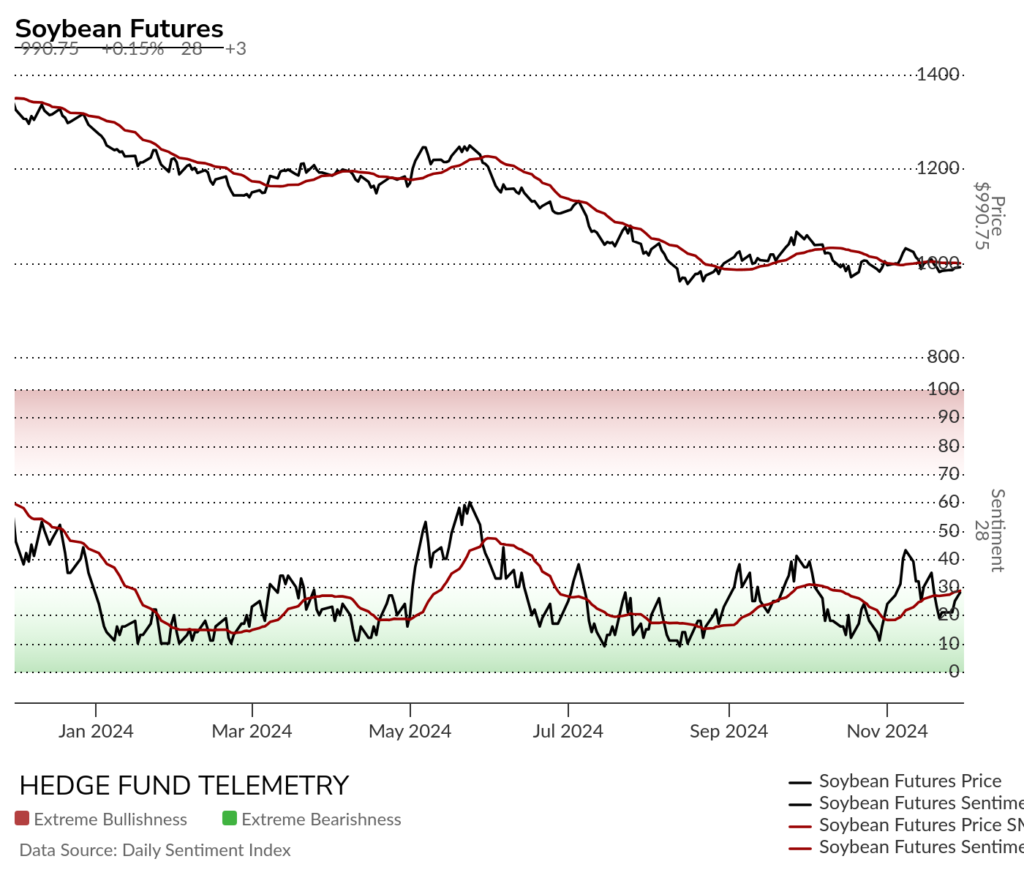

Soybean futures daily remains under pressure with a Sequential left pending on day 11 of 13

Soybean futures bullish sentiment with small bounce but will need to clear the recent highs to add any conviction.

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

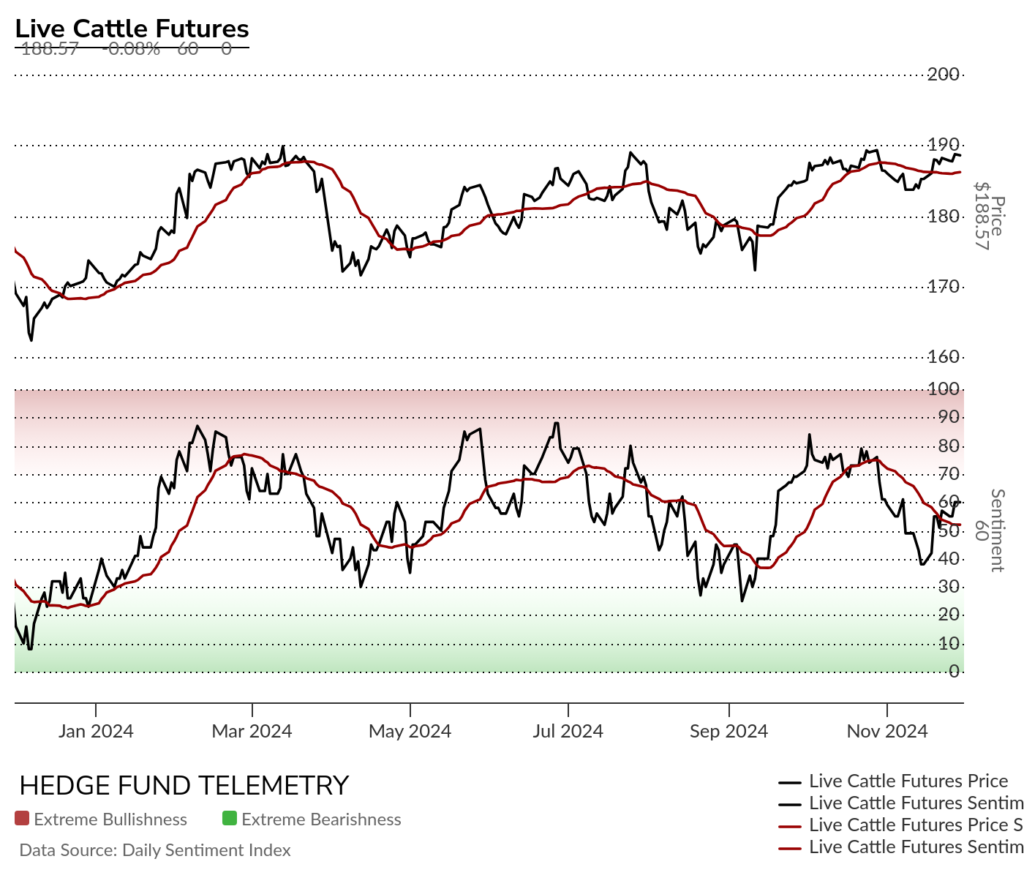

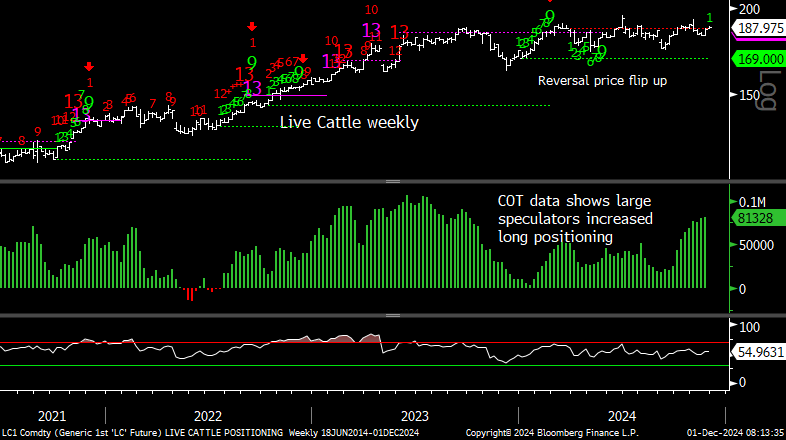

Live Cattle futures daily bounced off TDST support at 185.14 but did qualify the Sequential sell Countdown 13.

Live Cattle futures bullish sentiment with a decent reversal in progress.

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

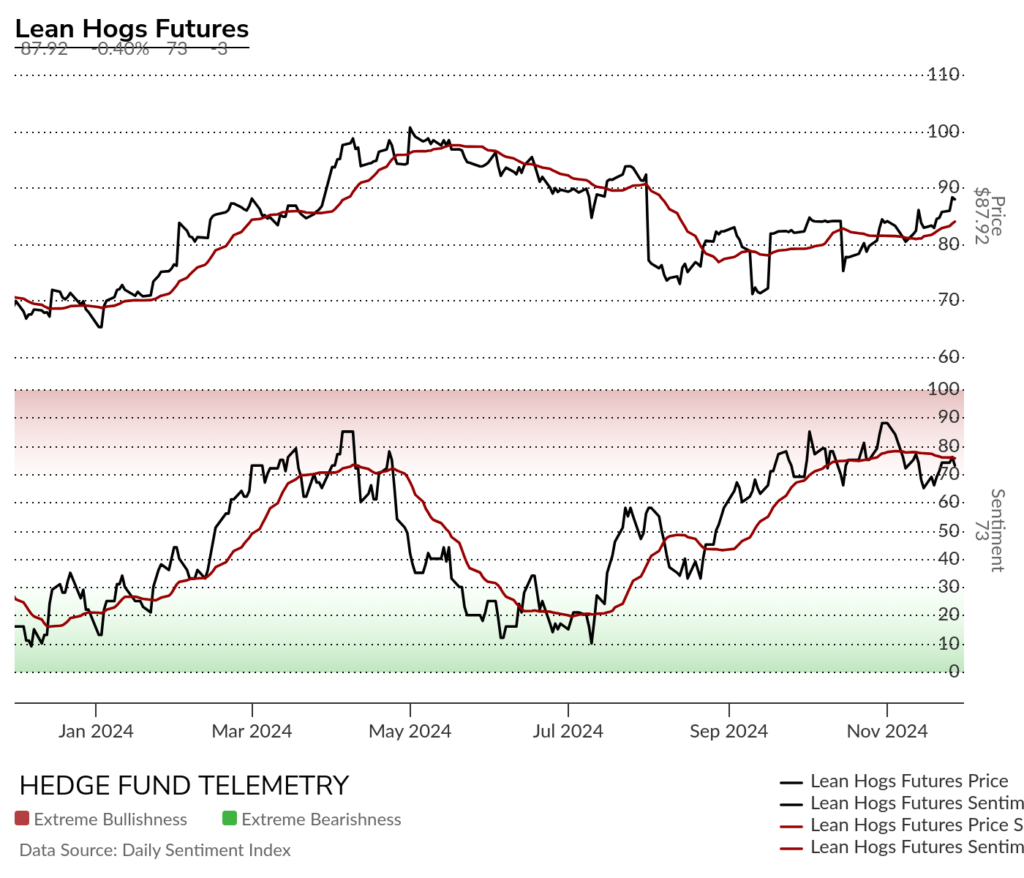

Lean Hogs futures daily could get the Sequential 13 this week even by not making a new high.

Lean Hogs bullish sentiment has moderated but still in elevated zone

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

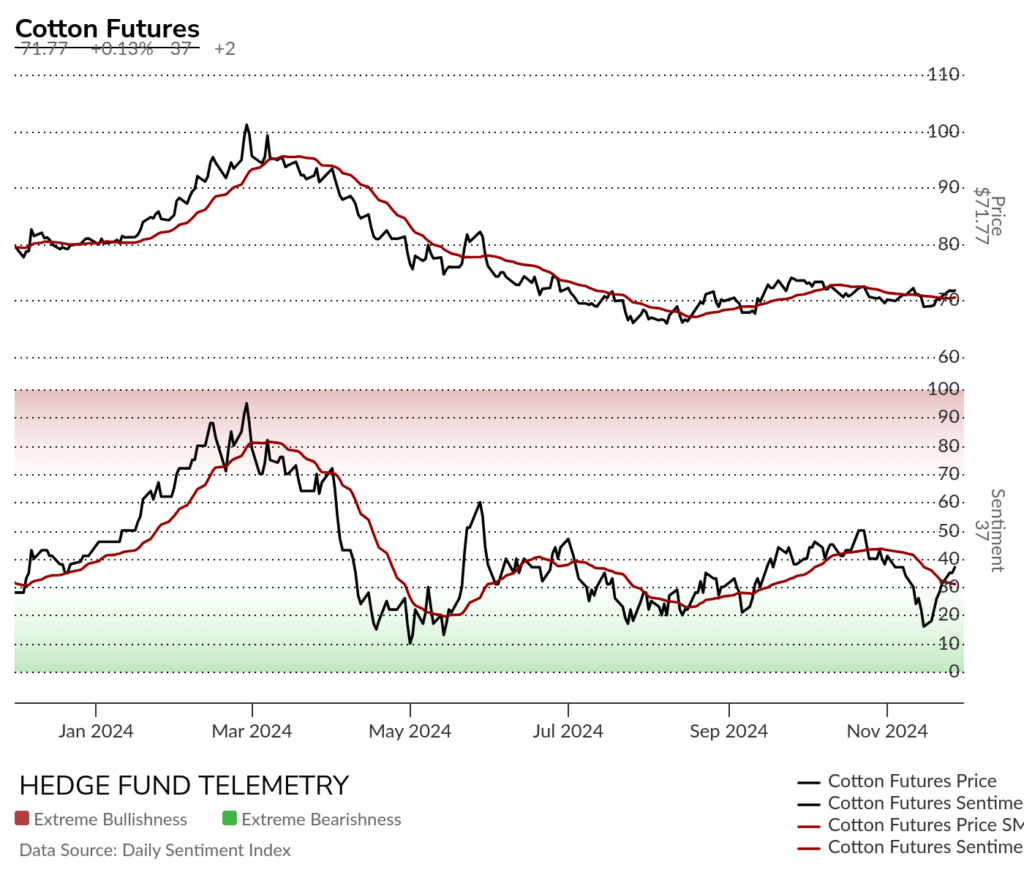

Cotton futures daily didn’t get the Sequential 13 but did get an aggressive Sequential 13. A move over 73 the 50 day would add to upside potential with higher conviction.

Cotton futures bullish sentiment with a decent reversal attempt starting. Needs to clear 50% midpoint level.

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. New Sequential 13 working so far

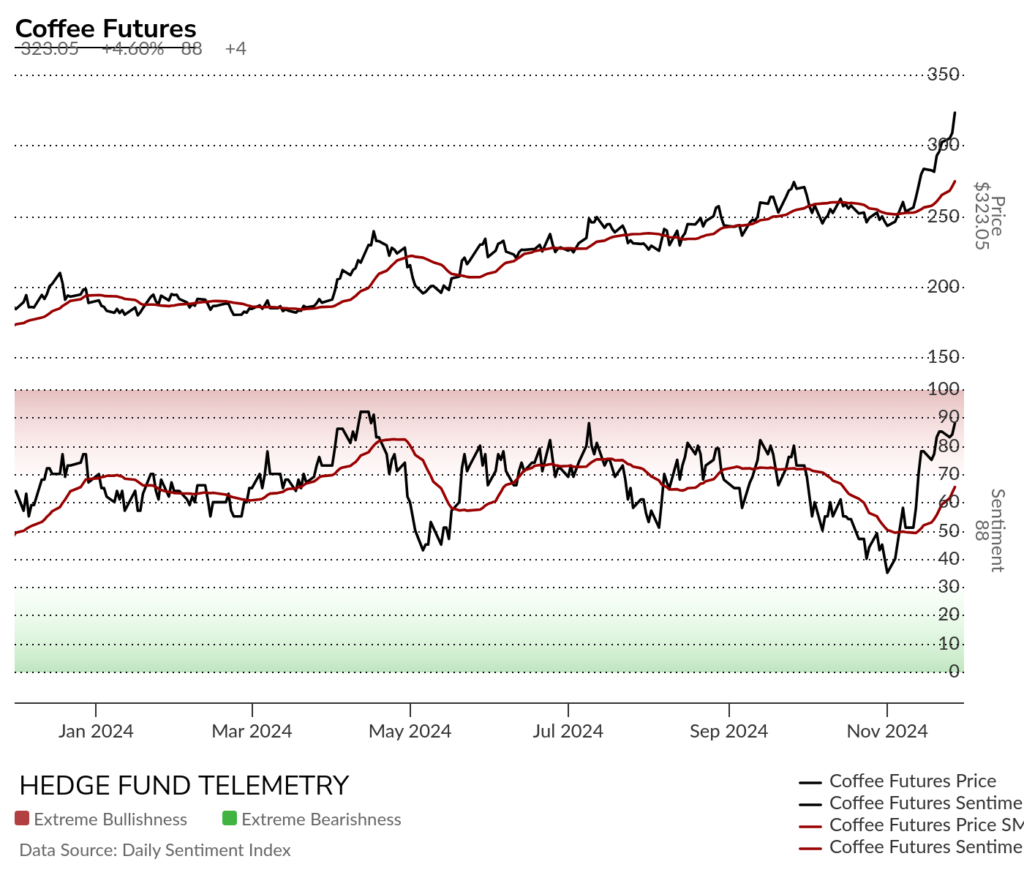

Coffee futures daily has moved higher in the last month with new Combo 13 and secondary Sequential on day 8 of 13. Big reversal on Friday will need to see if it continues lower.

Coffee futures bullish sentiment also ripped higher at is off 2024 highs

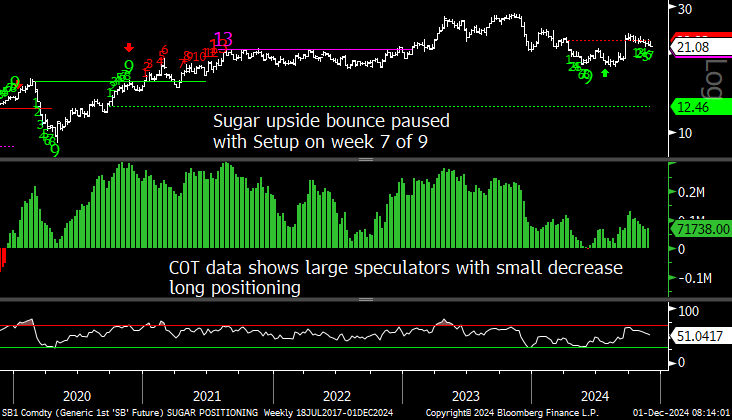

Sugar futures daily has been making lower highs and lower lows nearly breaking to new recent low

Sugar futures bullish sentiment has been making lower highs and lower lows but holding 50%

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

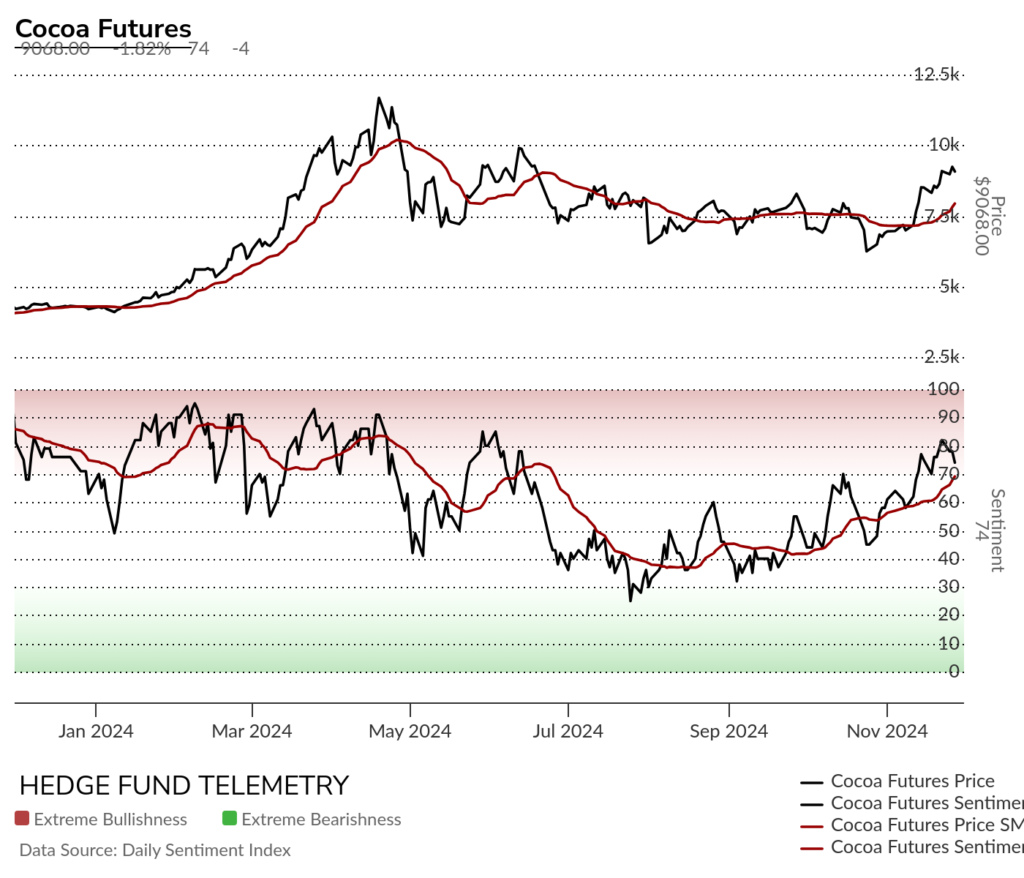

Cocoa futures daily should get the Sequential sell Countdown 13 on Monday

Cocoa futures bullish sentiment backed off from the extreme zone but still elevated

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

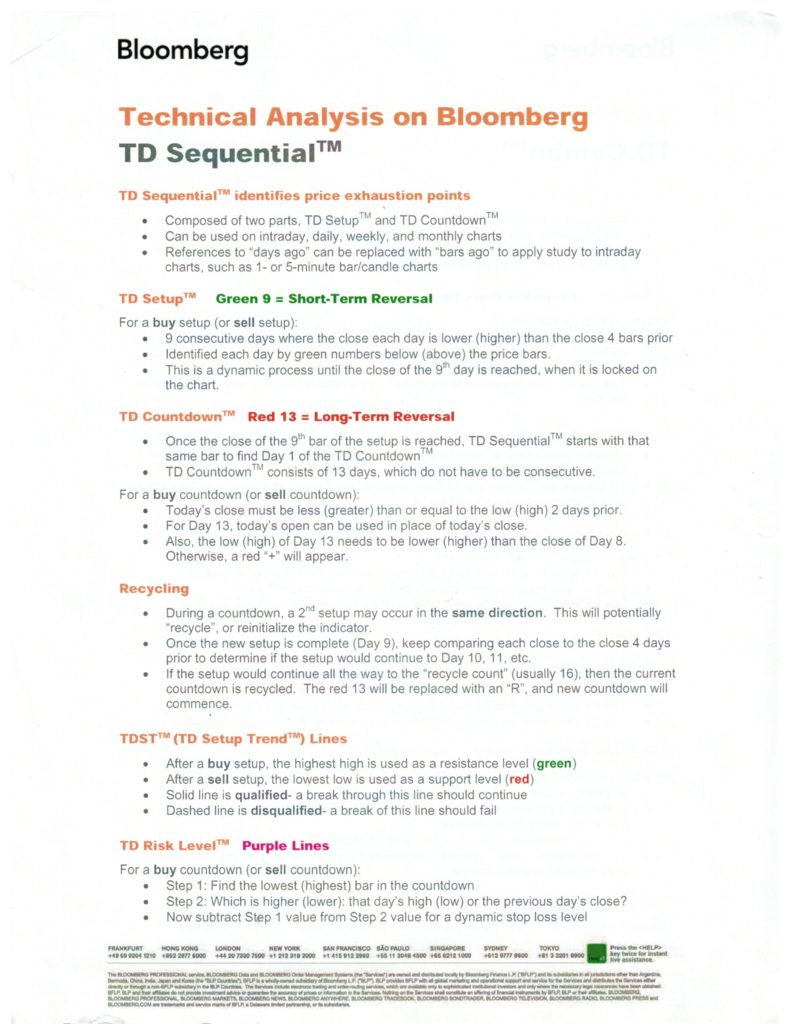

DeMark Sequential Basics

DETAILED COMMITMENT OF TRADERS DEFINITIONS