HIGHLIGHTS AND THEMES

- The Bloomberg Commodity Index had an OK week yet faded late in the week.

- The weekly chart shows the frustratingly narrow range lacking continued upside.

- Energy had a decent week lead by crude as gas faded hard on Friday

- Gold and Silver still have lower high wave 2 of 5 patterns with downside DeMark Sequential Countdown’s still in progress.

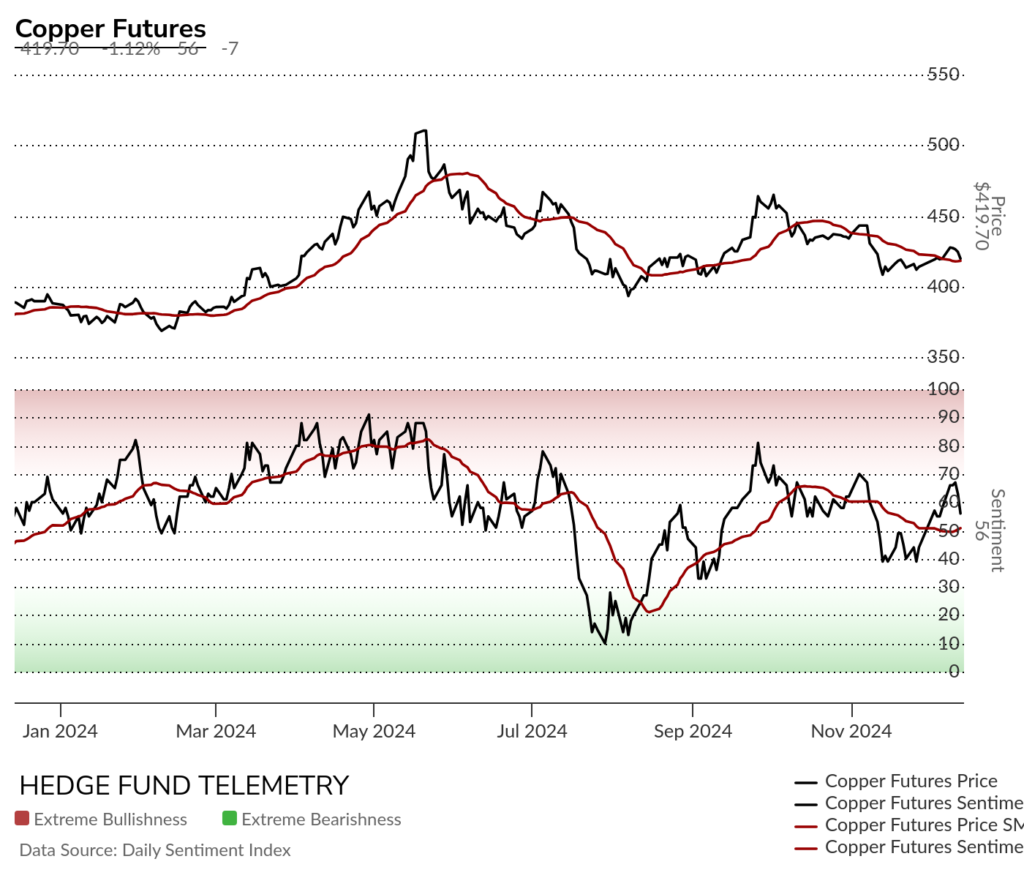

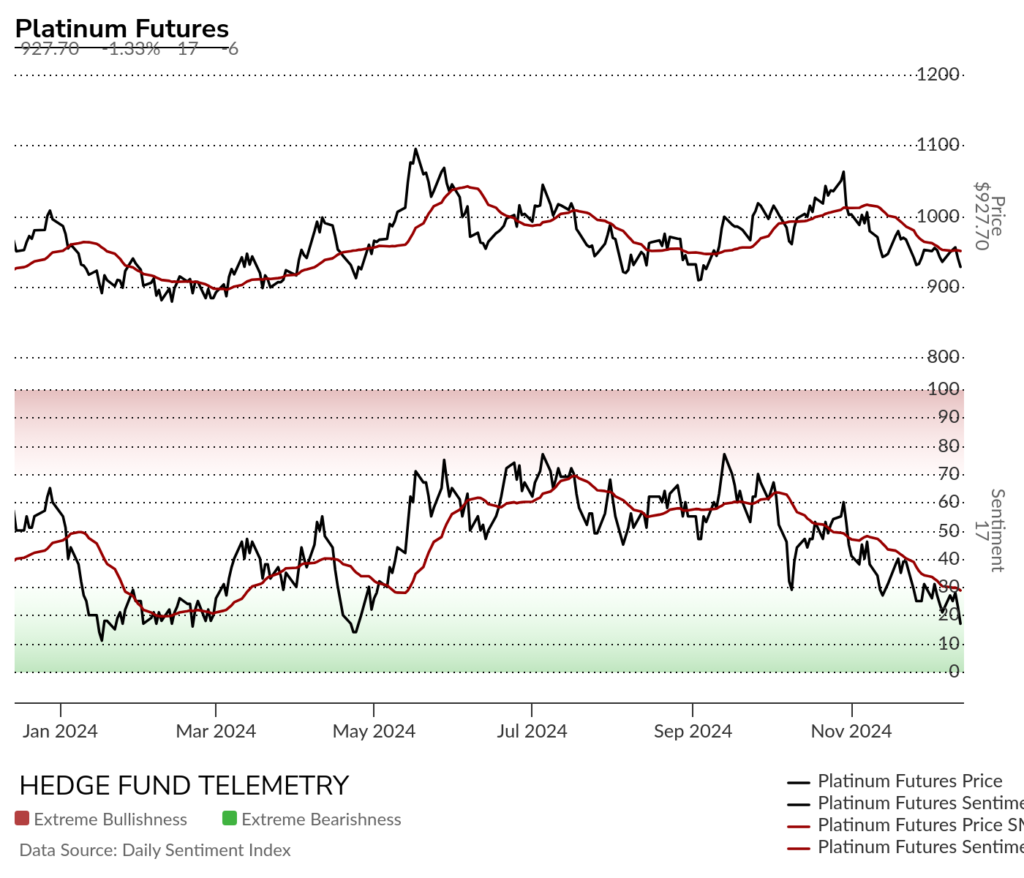

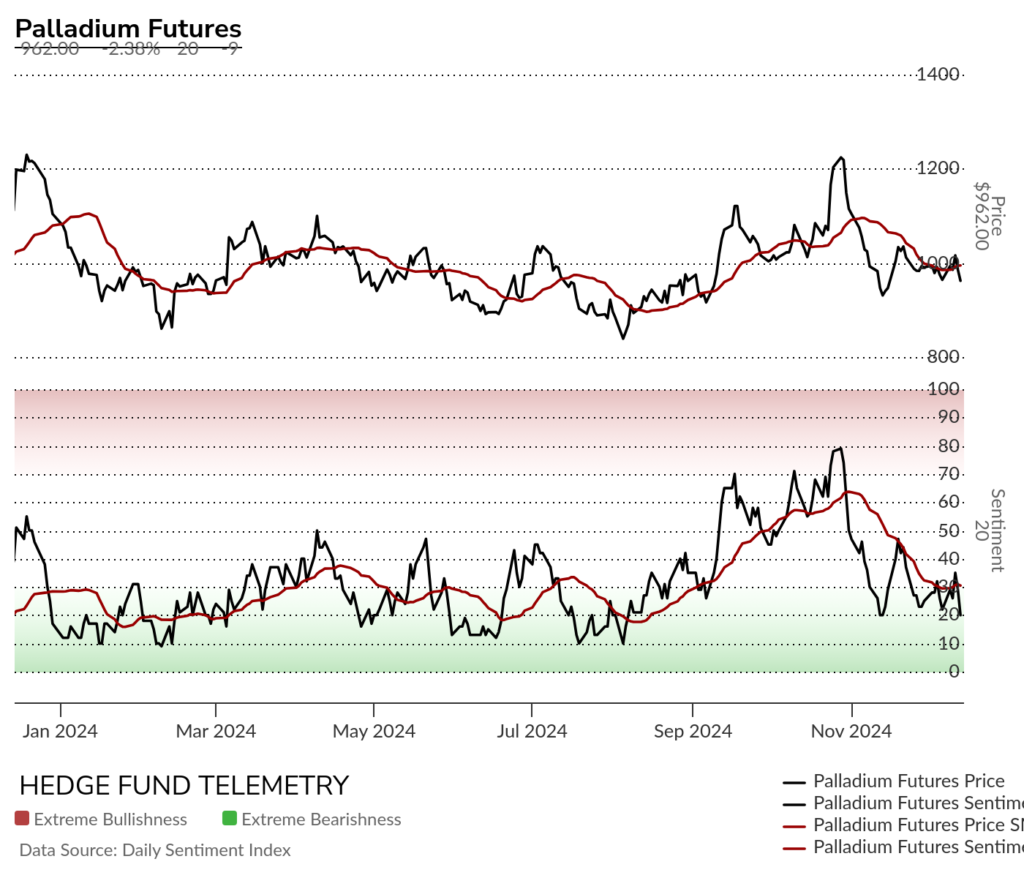

- Other metals trade poorly including Platinum, Palladium while Copper could get a downside Sequential soon which I’d be a buyer.

- Livestock has been strong and is due for a pullback.

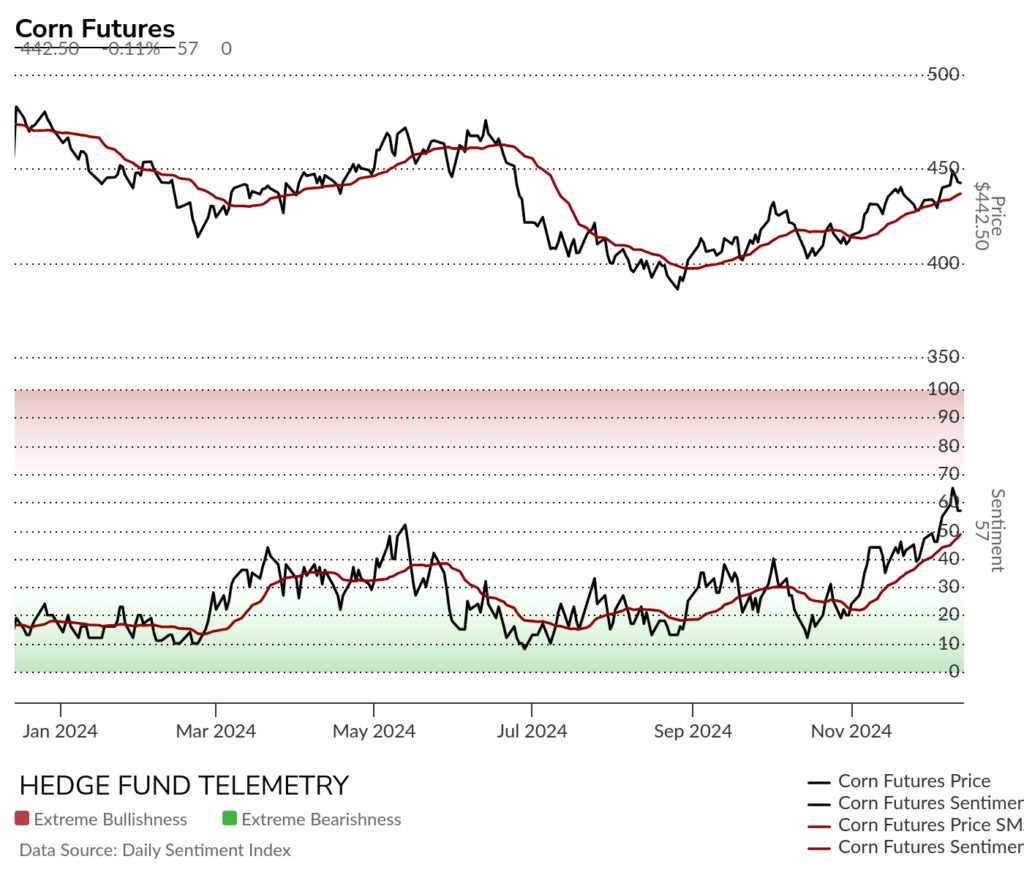

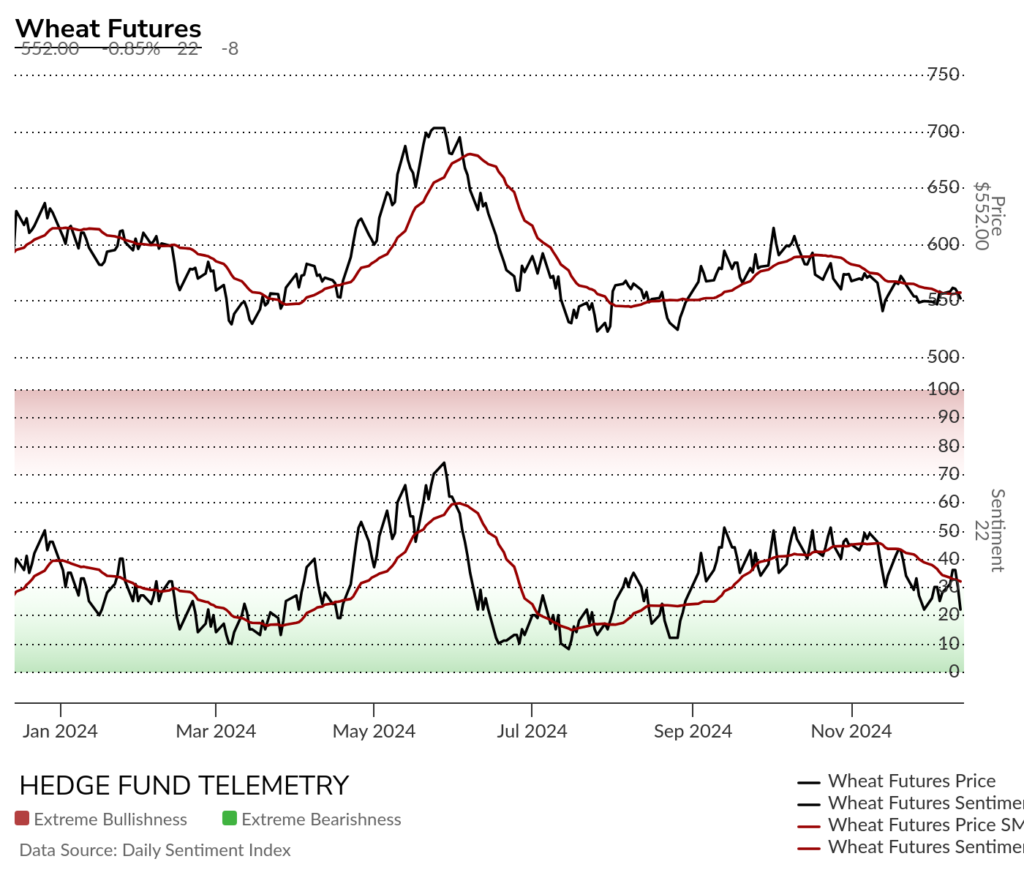

- Grains still trade terrible lacking upside and downside trends. Sideways

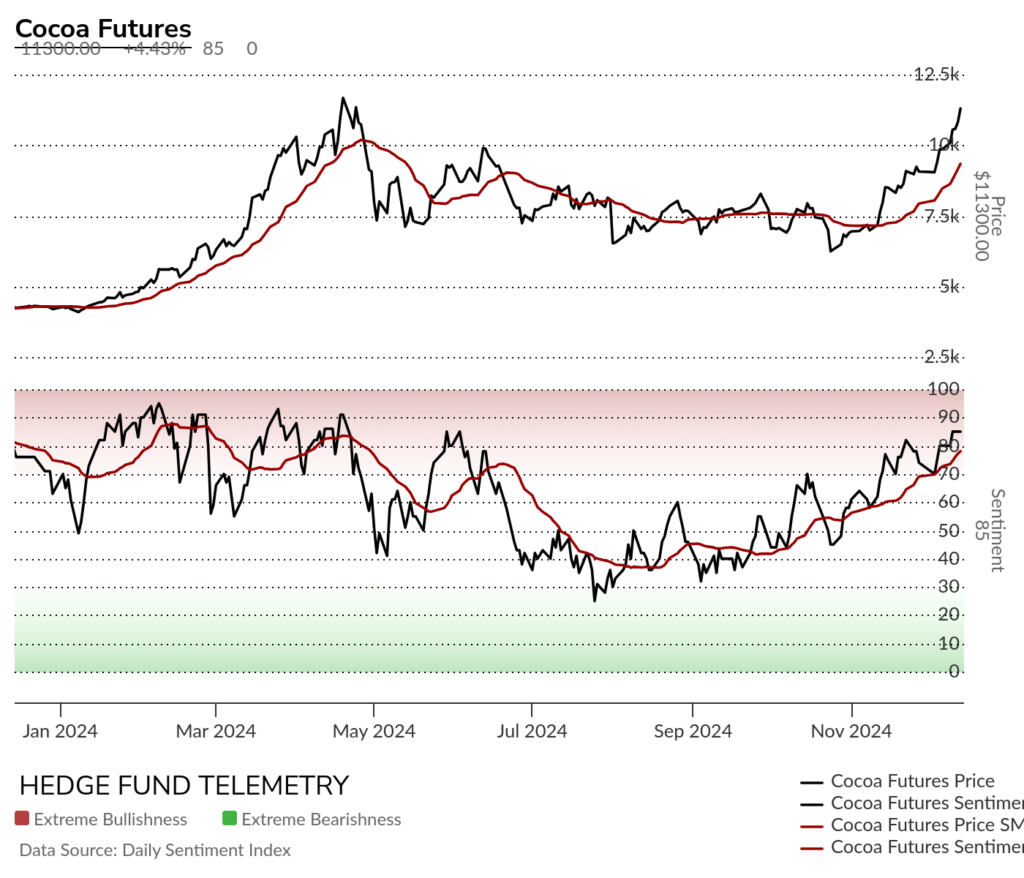

- Coffee and Cocoa are extended

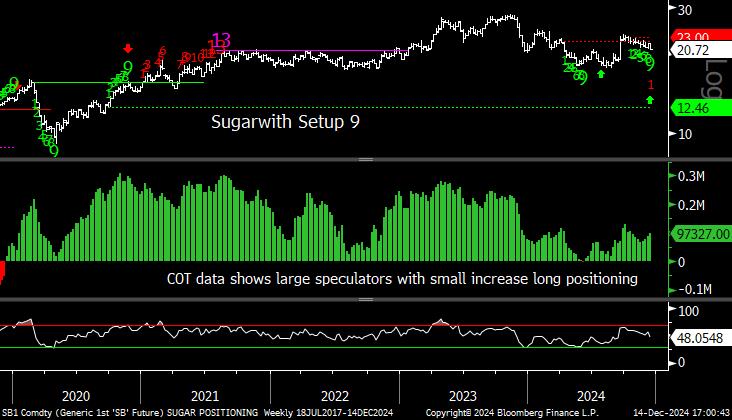

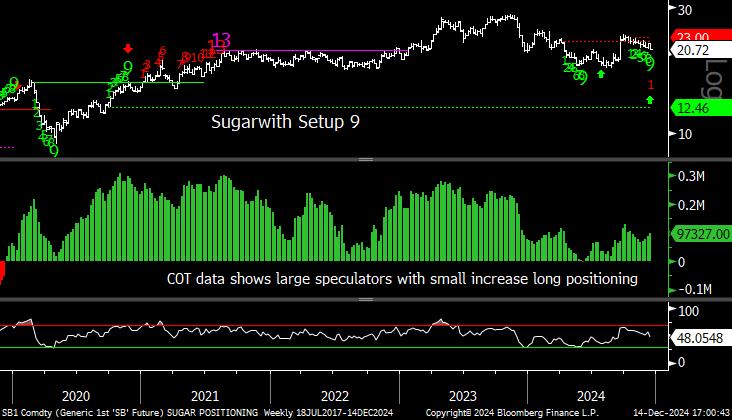

- Sugar has been fading making a new recent low this past week with a DeMark Setup 9 it could bounce (or should).

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily with a flat 200 day failing again this past week.

Bloomberg Commodity Index Weekly shows the small changes all year long.

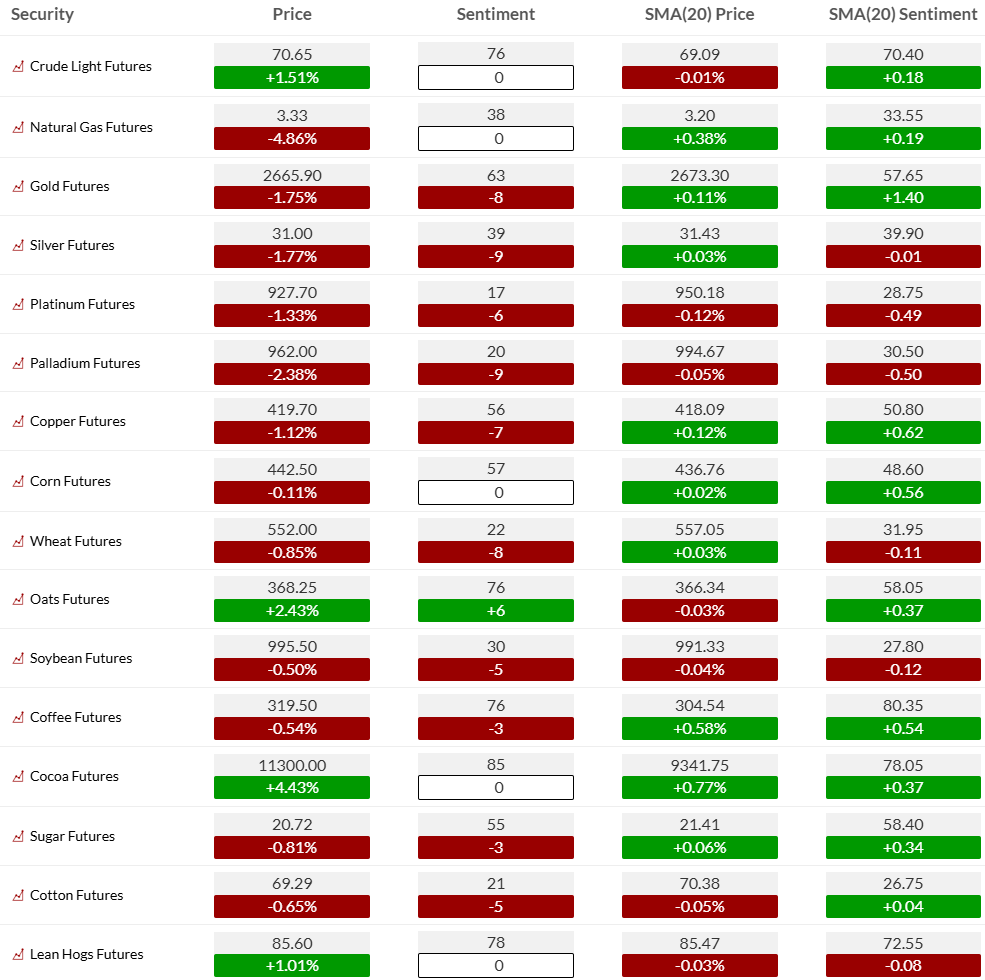

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY

Bloomberg Energy Index daily and weekly have been chopping sideways from the Summer.

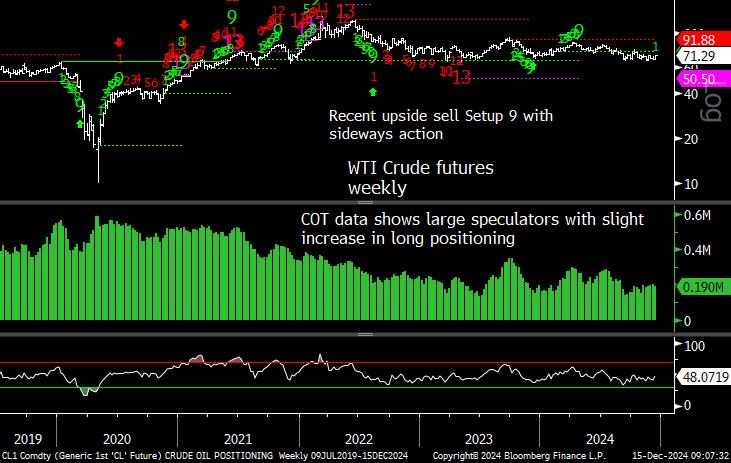

WTI Crude futures daily had a decent week holding the ~67 level again. Many lower highs in the last year needs to break

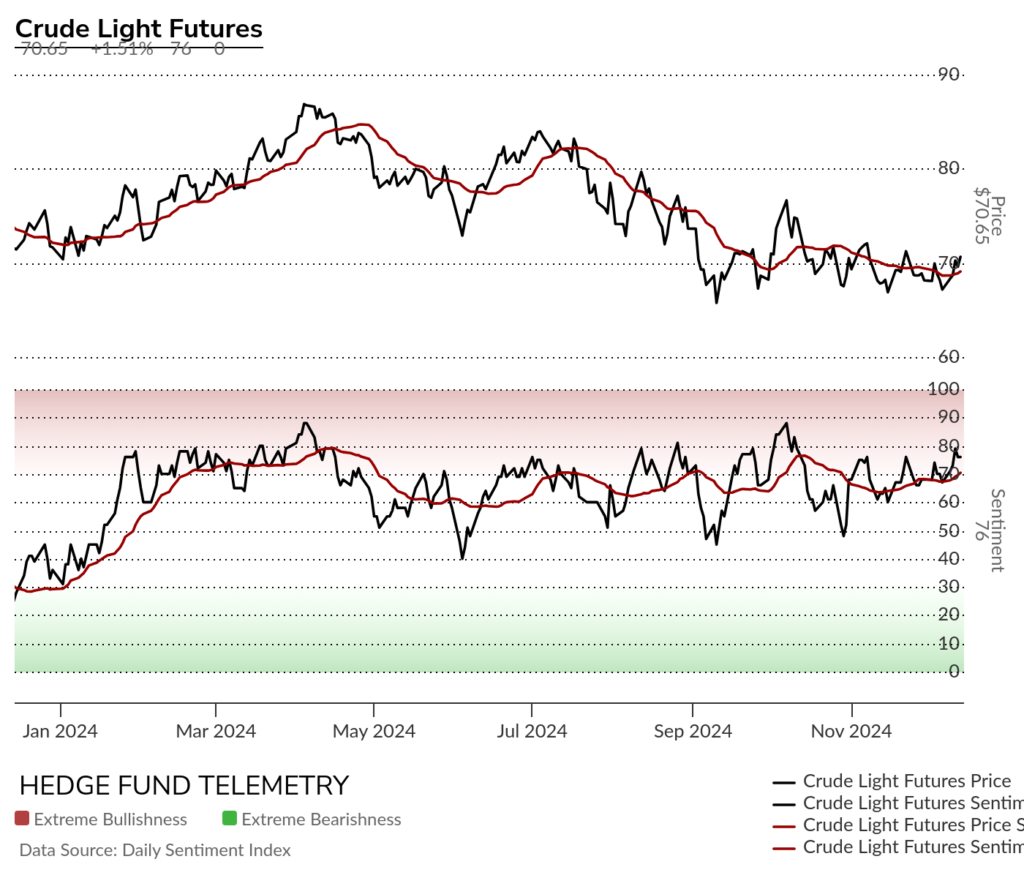

WTI Crude futures bullish sentiment remains elevated and curiously stronger than price.

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

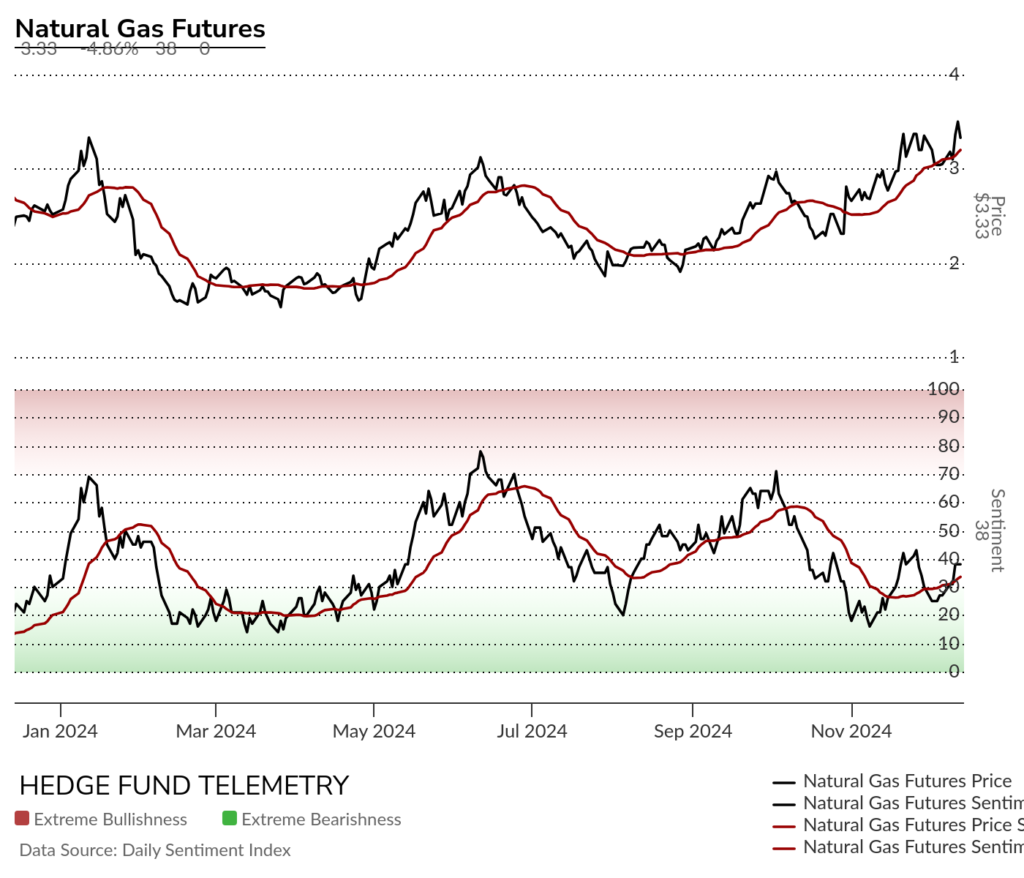

Natural Gas futures daily failed again at the 200 day

Natural Gas futures bullish sentiment lifted this week but can’t seem to get above 50%

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Metals

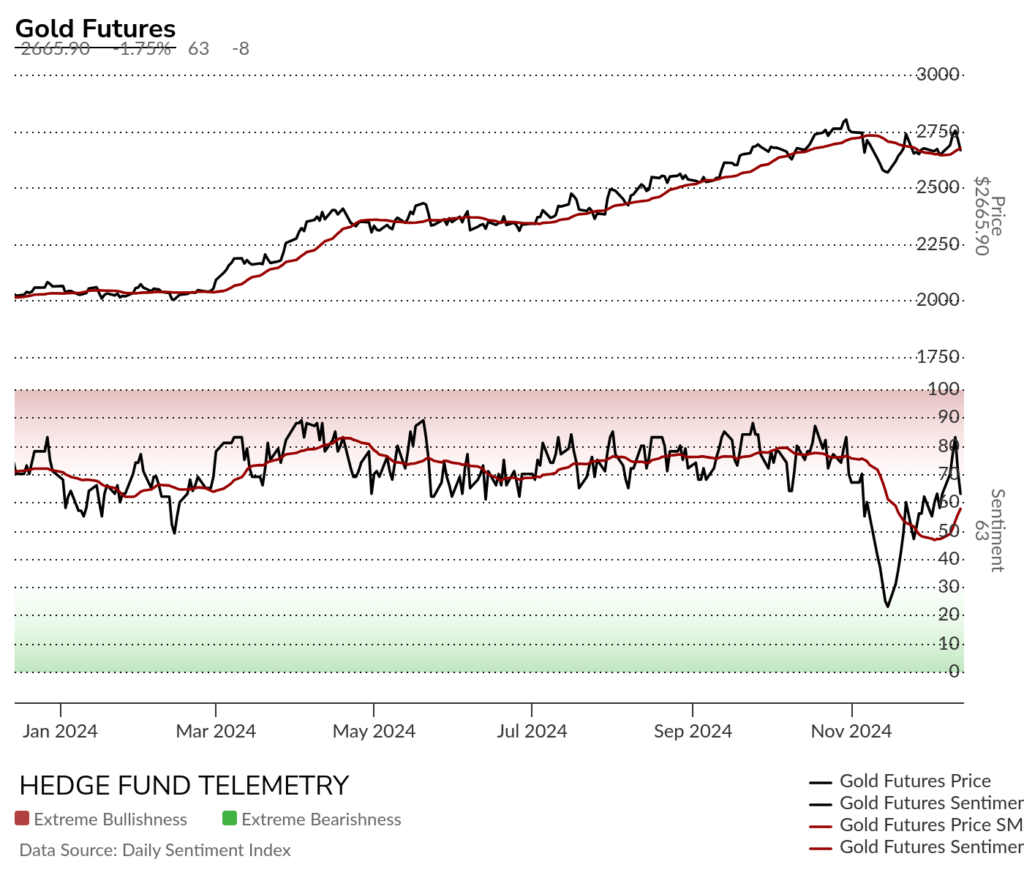

Gold daily still has the lower high wave 2 of 5 potential and Sequential now on day 8 of 13

Gold bullish sentiment bounced after that quick move deeply lower, into the extreme zone and falling hard in the last few days. Remember when this just traveled sideways for a year?

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Silver daily has a new sell Setup 9 and 9’s have been decent at inflection points. I am concerned this breaks through into downside wave 3 soon with a new low.

Silver bullish sentiment with a strong bounce and fail

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. New Setup 9 which could bounce however I’m concerned a new downside Sequential will start.

Copper futures daily has been struggling and has the Sequential now on day 10 of 13. The TDST support at 41.45 has held but needs to break to slightly lower on the 13th bar.

Copper futures bullish sentiment bounced and fell back late in the week.

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. There has been a weekly Sequential now on week 9 of 13.

Platinum daily remains in no-mans land.

Platinum bullish sentiment made a new recent low this week.

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Palladium daily with the downside Sequential now on day 8 of 13.

Palladium bullish sentiment remains under pressure

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

Corn futures daily hit the 200 day for the first time in ages but fell off. A bullish development would be if this can bounce from here (or soon) starting a new upside Sequential and moving above the 200 day with a similar level from late September high.

Corn futures bullish sentiment has been rising but stalled this week.

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Wheat futures daily remains under pressure

Wheat futures bullish sentiment remains under pressure.

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Secondary Sequential remains in progress on downside.

Soybean futures daily going nowhere in the last few weeks.

Soybean futures bullish sentiment remains under pressure.

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

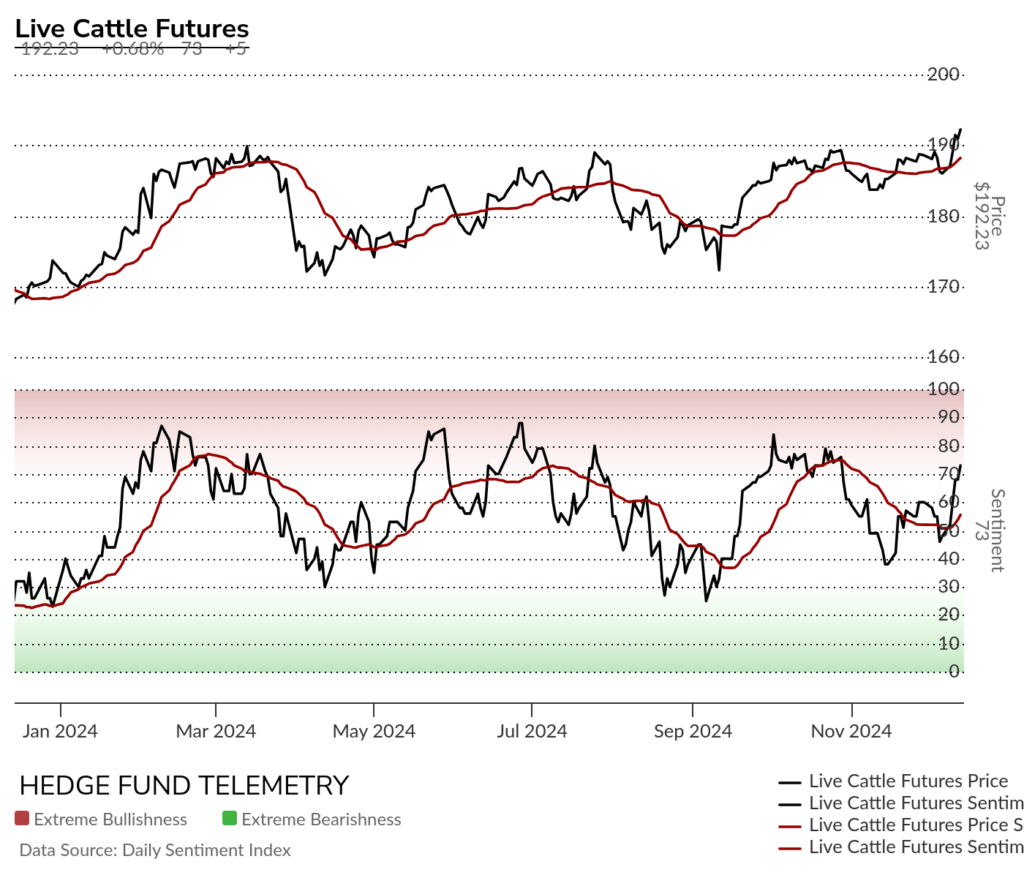

Live Cattle futures daily with a strong bounce but it qualified the Combo 13.

Live Cattle futures bullish sentiment with a strong week

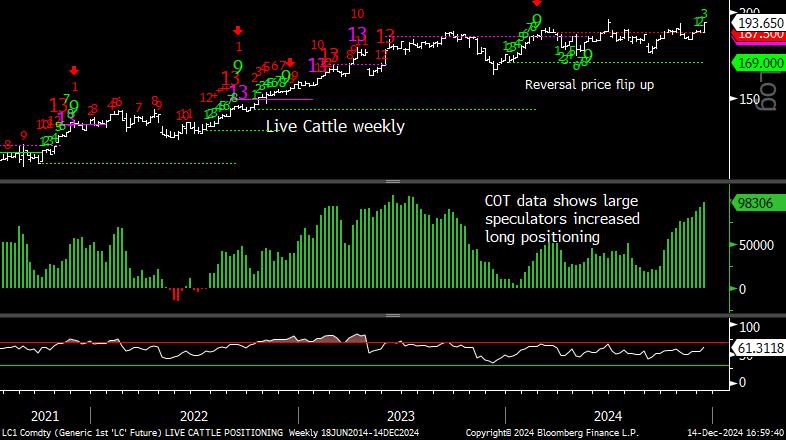

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

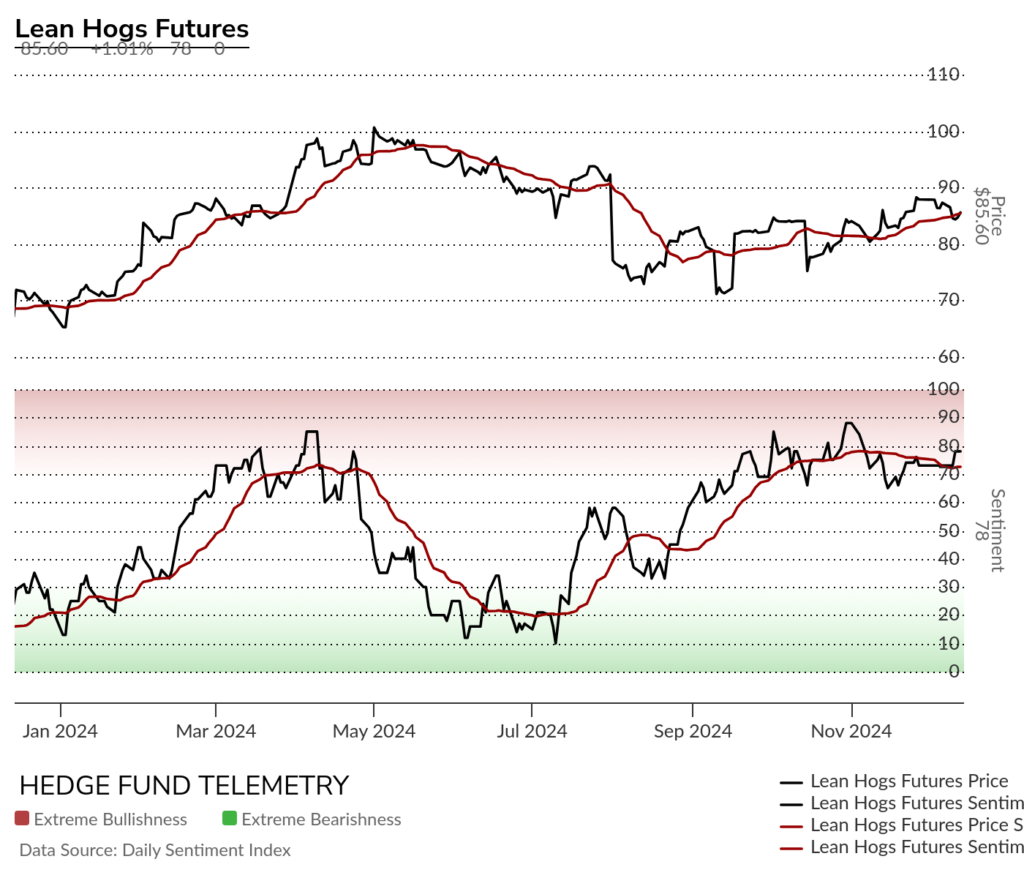

Lean Hogs futures daily has been strong but starting to moderate holding the 50 day

Lean Hogs bullish sentiment holding steady in the elevated zone.

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

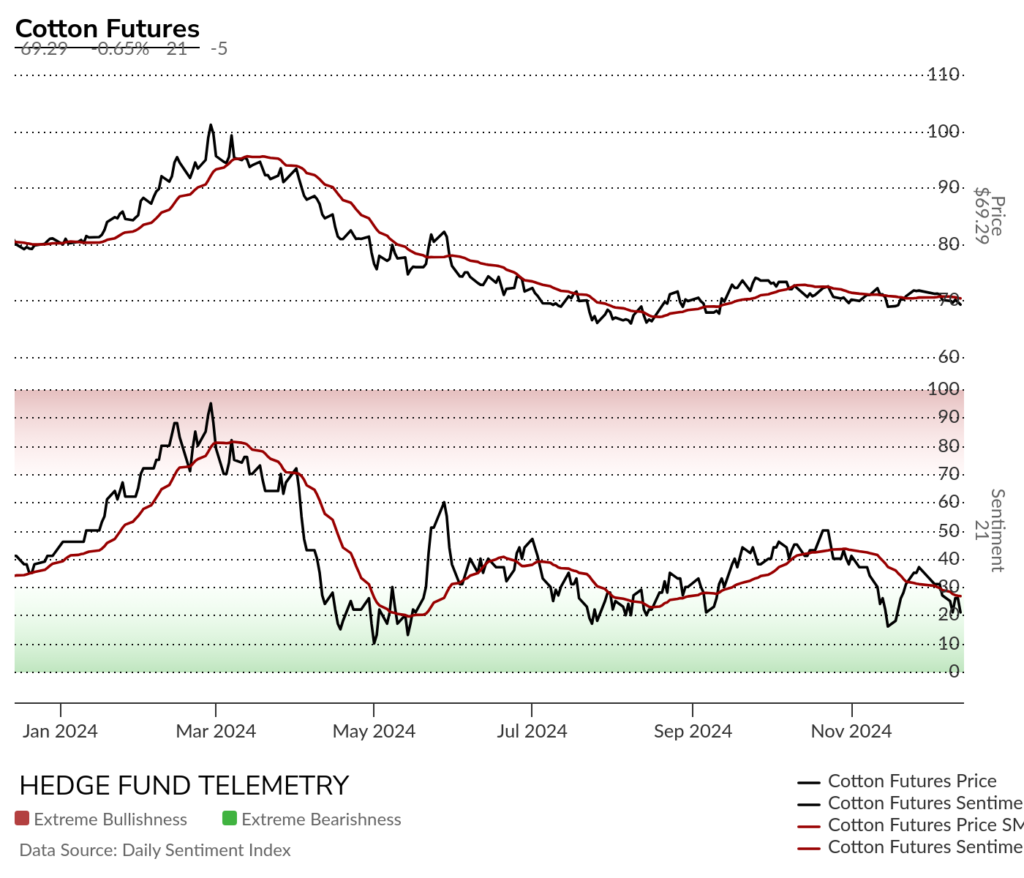

Cotton futures daily lacking any turn yet after recent Sequential 13.

Cotton futures bullish sentiment remains under pressure.

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Coffee futures daily with a few Countdown 13’s and Sequential pending on day 12 of 13. A new high isn’t needed to get the Sequential 13.

Coffee futures bullish sentiment has been in the extreme zone with a reversal down on Friday. Breaking 70% would be the first concern.

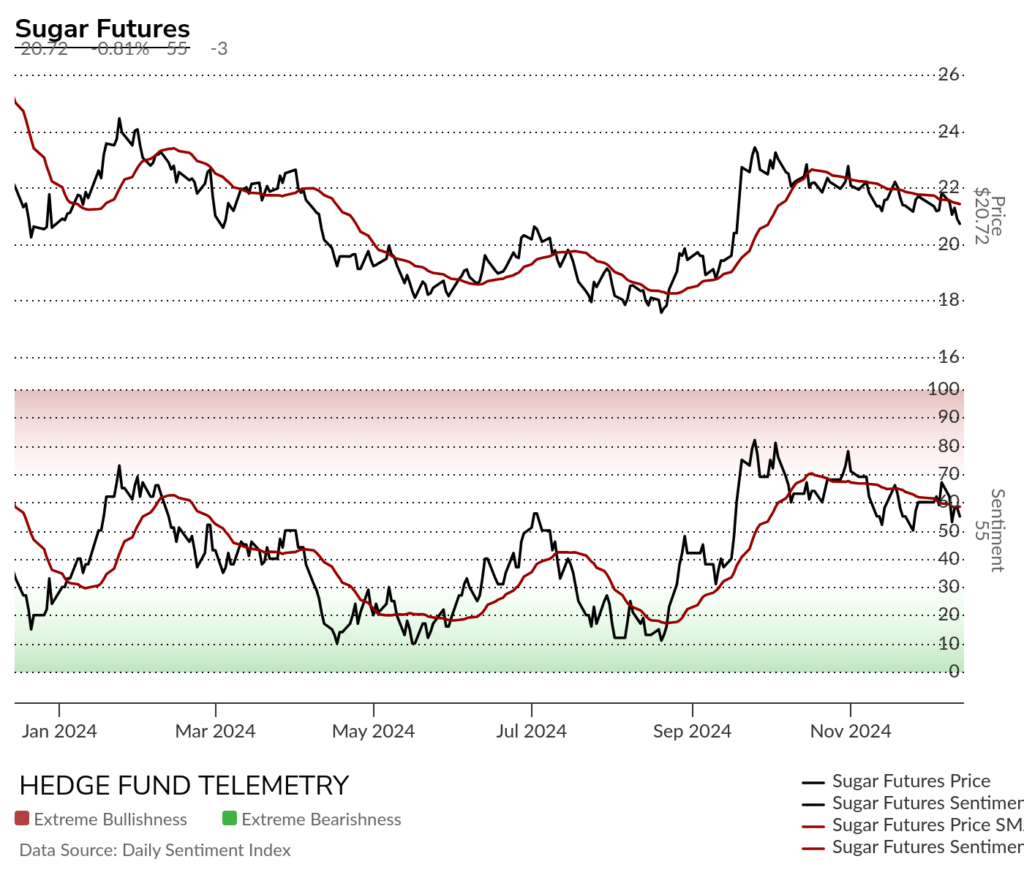

Sugar futures daily has been trending down despite the Sequential. Back to the 200 day. Will it bounce after the weekly buy Setup 9?

Sugar futures bullish sentiment grinding sideways holding 50% still.

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. New buy Setup 9.

Cocoa futures daily has ignored the recent 13’s and has a new Setup 9 due on Monday.

Cocoa future’s bullish sentiment strongly bounced off lows back in the extreme zone. Sentiment has been higher from earlier in the year so a little more upside of course is possible.

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

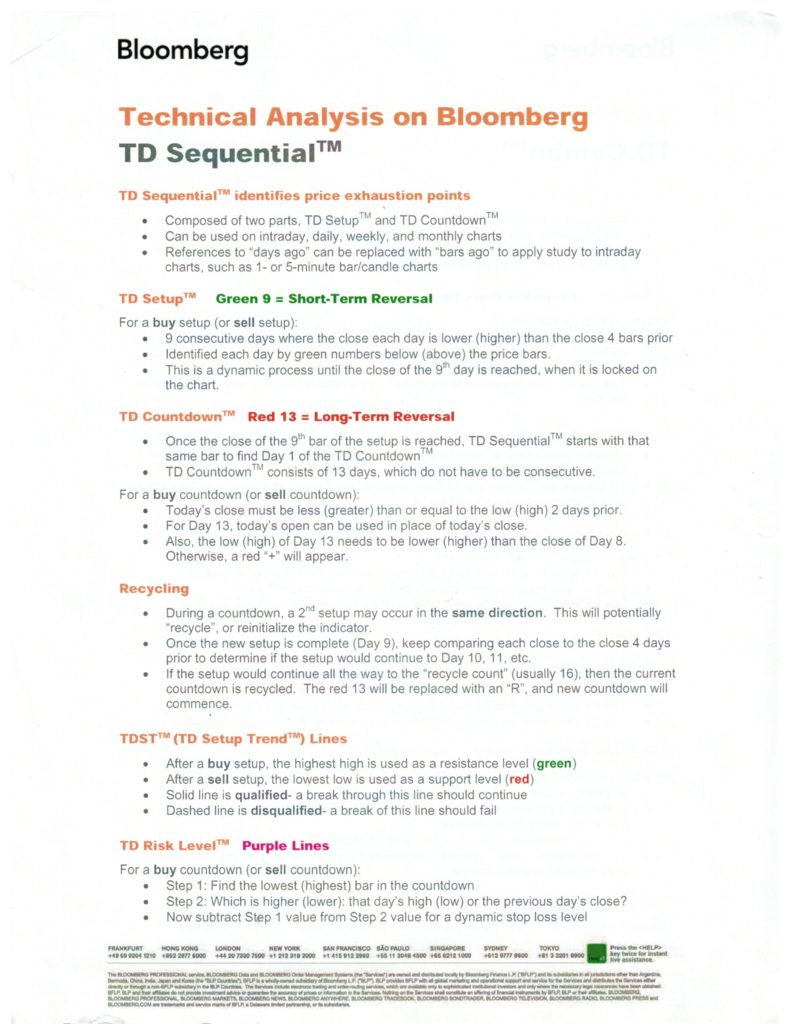

DeMark Sequential Basics

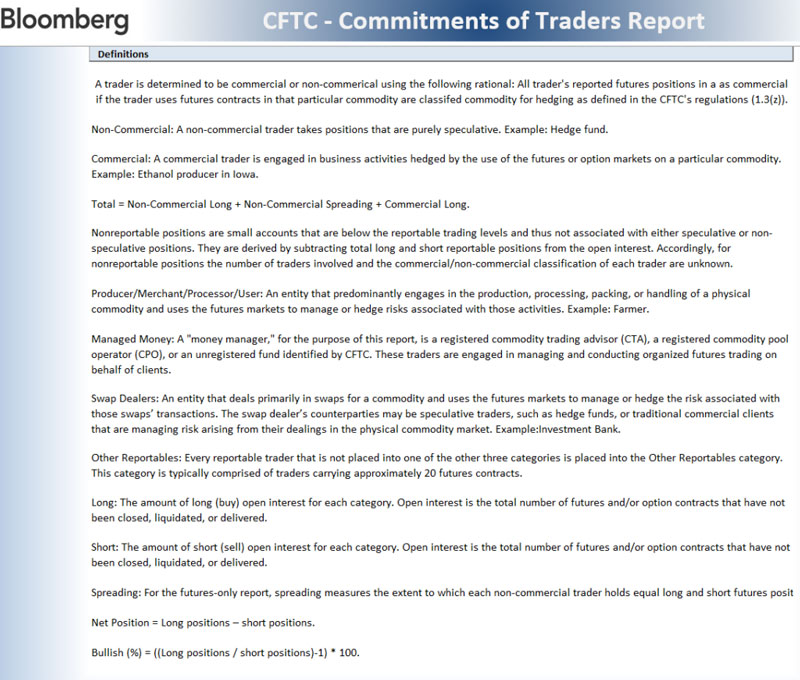

DETAILED COMMITMENT OF TRADERS DEFINITIONS