HIGHLIGHTS AND THEMES

- Overall the Bloomberg Commodity Index has continued to move sideways.

- The two heaviest weighted commodities gold and crude have been under pressure

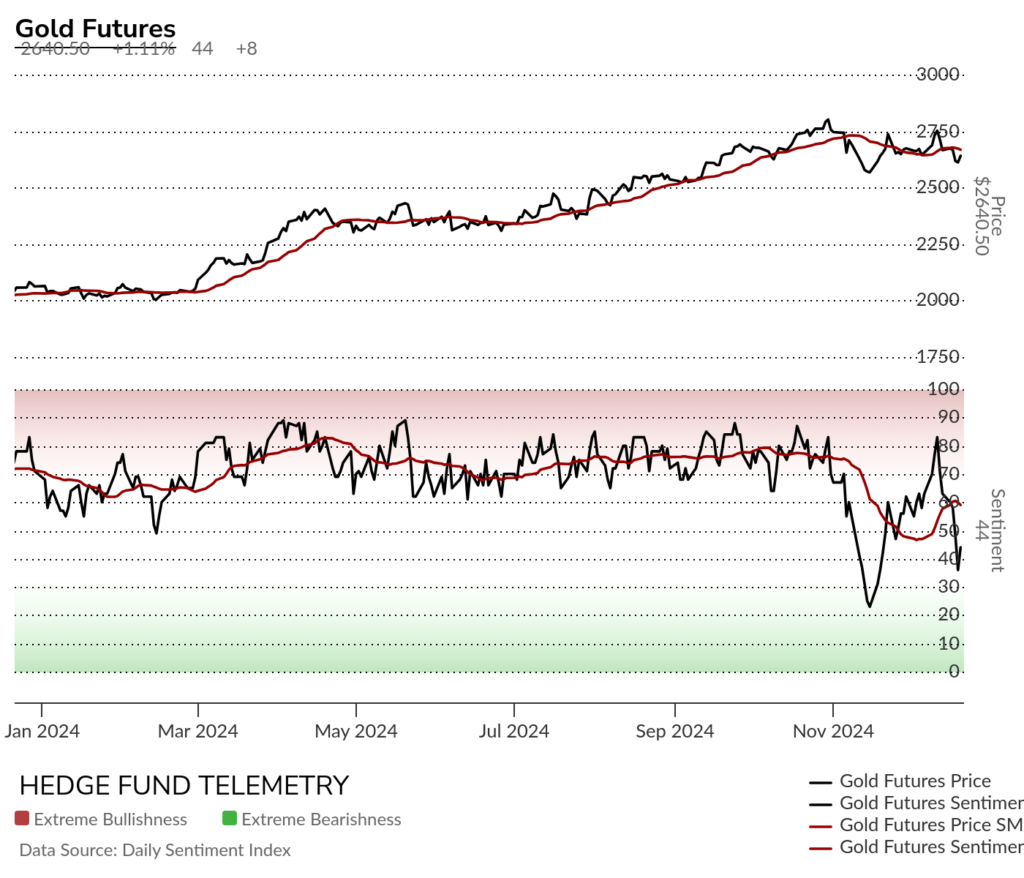

- Gold still has risk lower that could qualify the DeMark Sequential buy Countdown 13

- Crude has held support and needs to make a breakout move higher

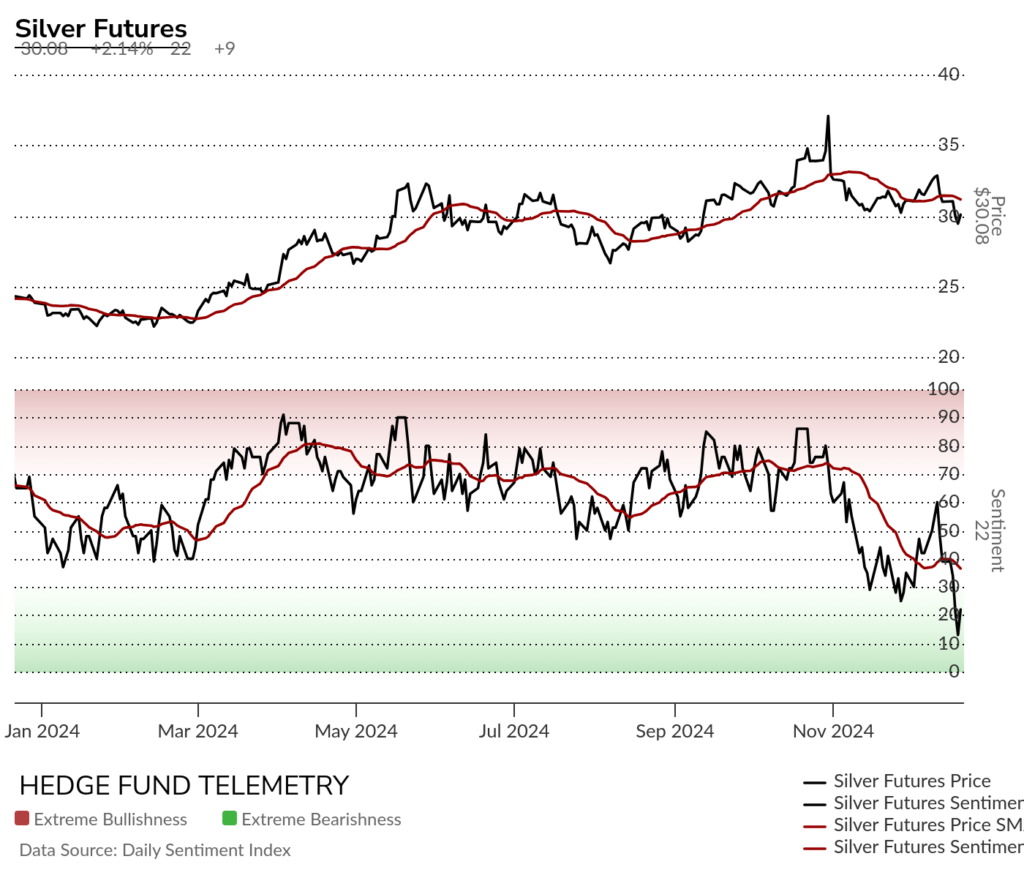

- Silver has been volatile and doesn’t have a clear signal of a bottom yet

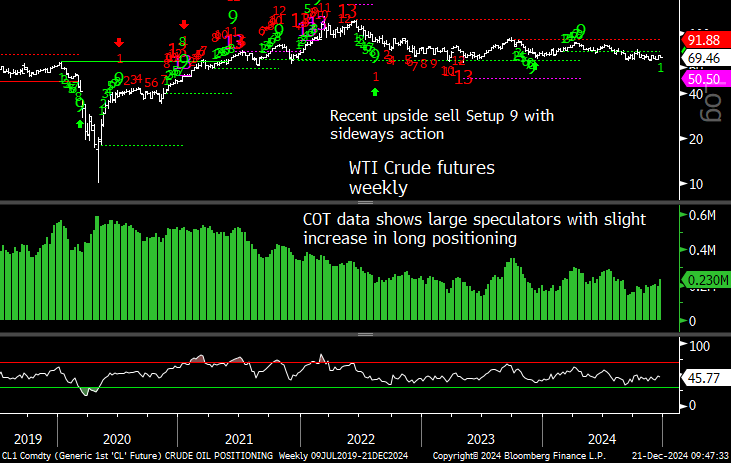

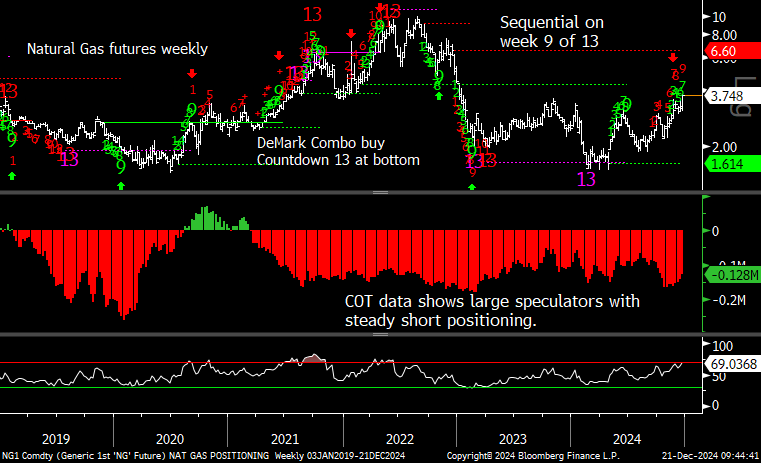

- Natural Gas has been performing well finally clearing the 200 day and is worth a long position

- Copper has been under pressure and did get a new DeMark Sequential buy Countdown 13 and I would start a position long here with some equity exposure in Copper related names looking worthy of initiating long positions too. I will highlight them this week.

- Livestock has been strong and is consolidating gains

- Cotton is trying to move higher with clear breakout levels near

- Grains remain under pressure with several making new lows this past week

- Sugar broke down with Coffee and Cocoa overbought with DeMark sell Countdown 13’s and can be shorted with stops at recent highs.

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily continues to chop sideways with a Sequential still pending on day 12 of 13. Range bound with support at 95 and resistance at 99.50 the 200 day.

Bloomberg Commodity Index Weekly down on the week

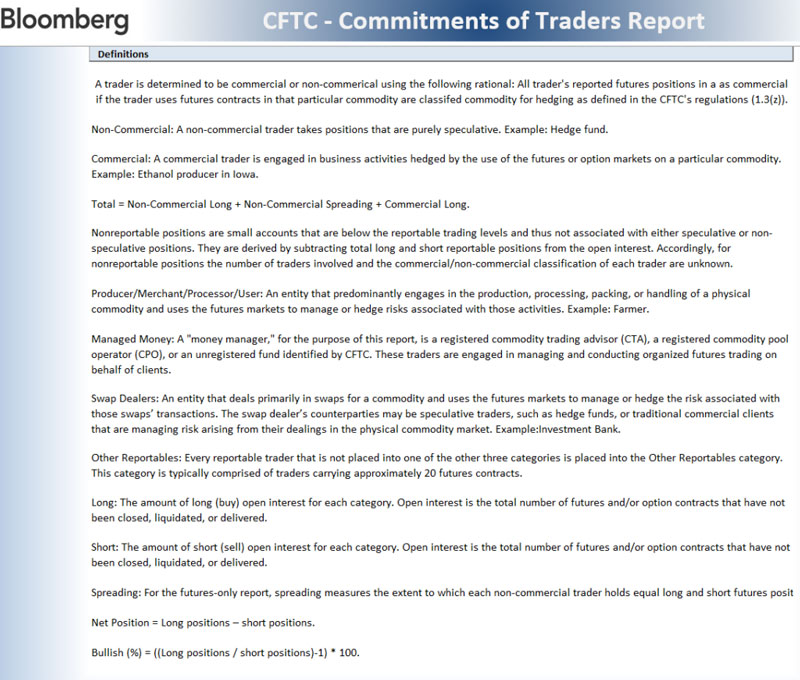

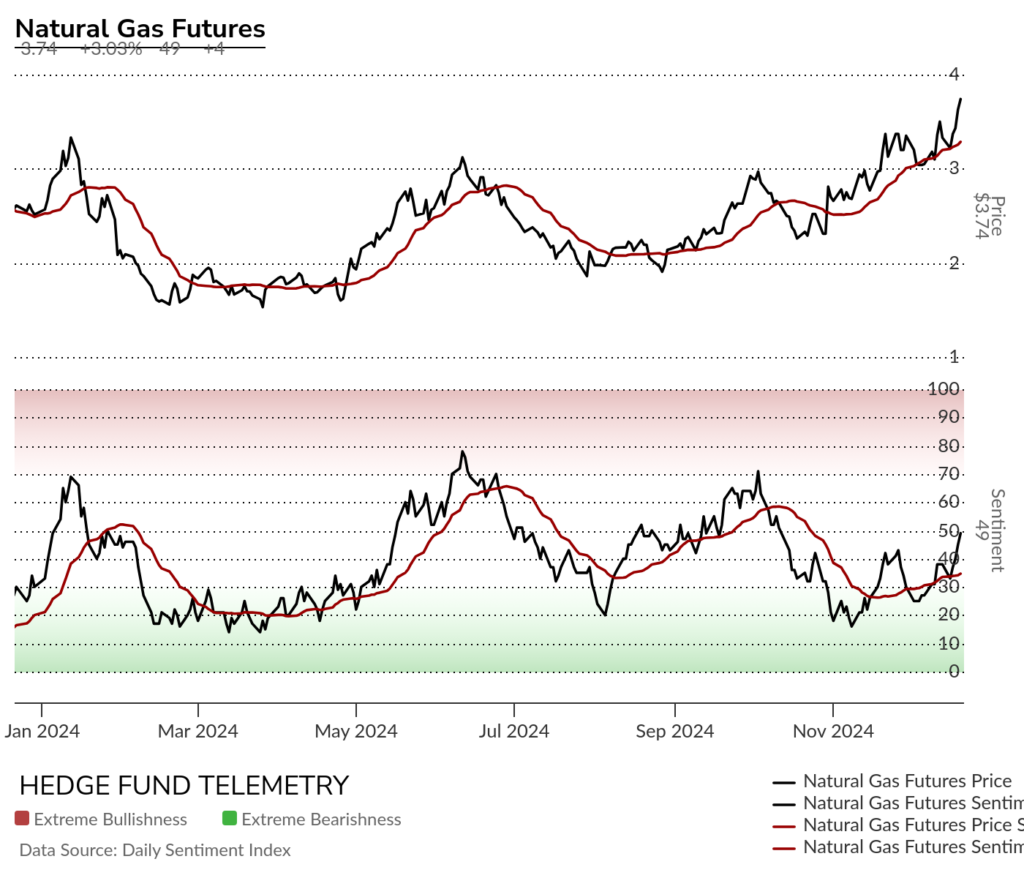

COMMODITY SENTIMENT OVERVIEW

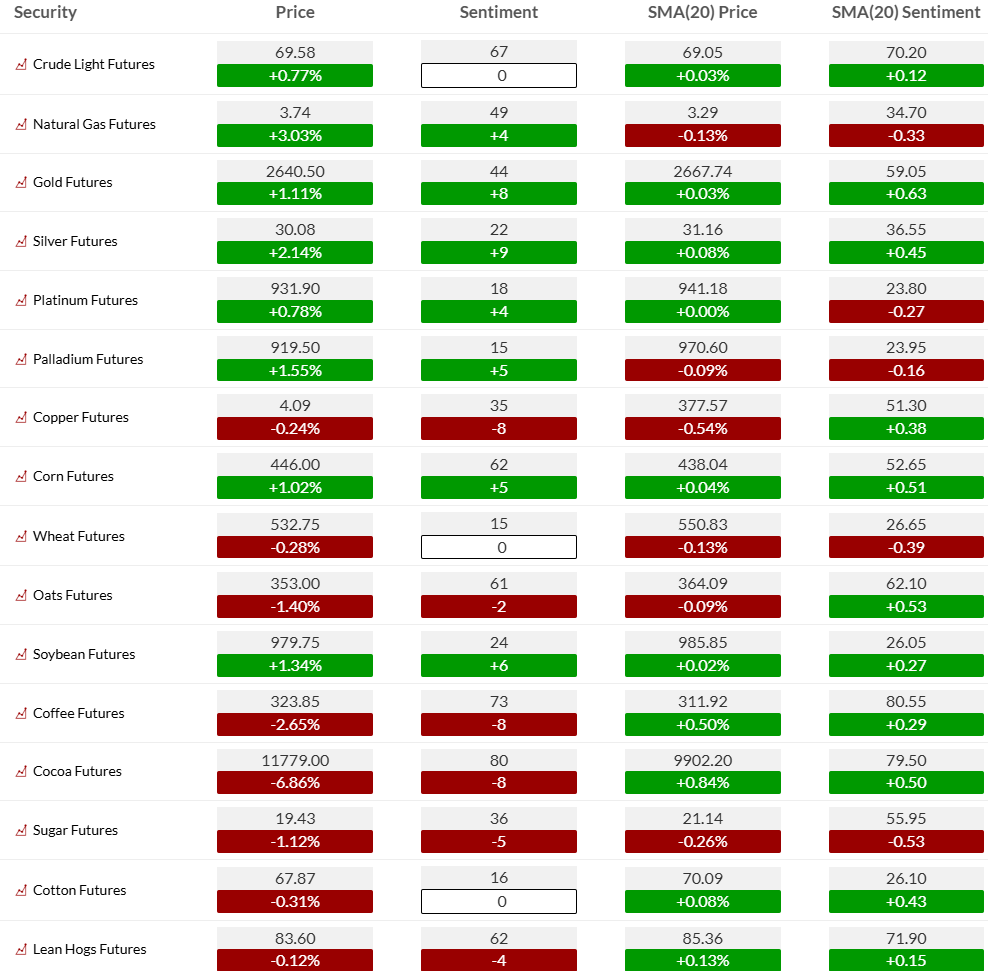

OIL AND ENERGY

Bloomberg Energy Index daily and weekly remains depressed making lower highs. A move over 29 would be a start on the upside.

WTI Crude futures daily has been holding support chopping sideways.

WTI Crude futures bullish sentiment has remained elevated despite the poor price action.

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Natural Gas futures daily has been failing at the 200 day since June. Despite this being very volatile I think this can work higher in the intermediate term.

Natural Gas futures bullish sentiment has been lagging the price action with higher lows and now higher high nearly breaking out above 50% midpoint sentiment level.

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. This is a bullish chart

Metals

Gold daily has been featured a few times in the past week on First Call with my view this can move a bit lower for the Sequential 13’s.

Gold bullish sentiment has been choppy (very) after steady upside move in elevated/extreme zone.

Silver daily made a new multi month low.

Silver bullish sentiment broke down hard and bounced

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Copper futures daily with a new DeMark Sequential 13. This is developing into a buy as there are several equities that also have 13’s – FCX and COPX.

Copper futures bullish sentiment

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

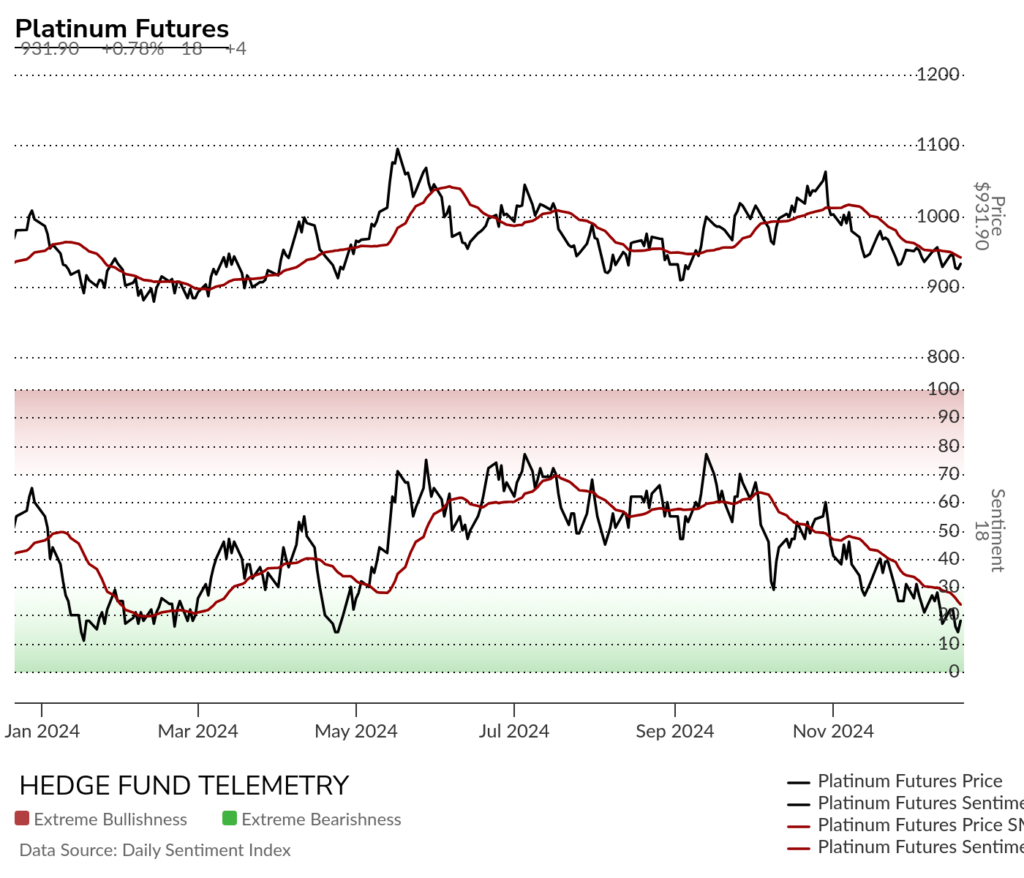

Platinum daily with no signals in no mans land.

Platinum bullish sentiment remains oversold and under pressure.

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

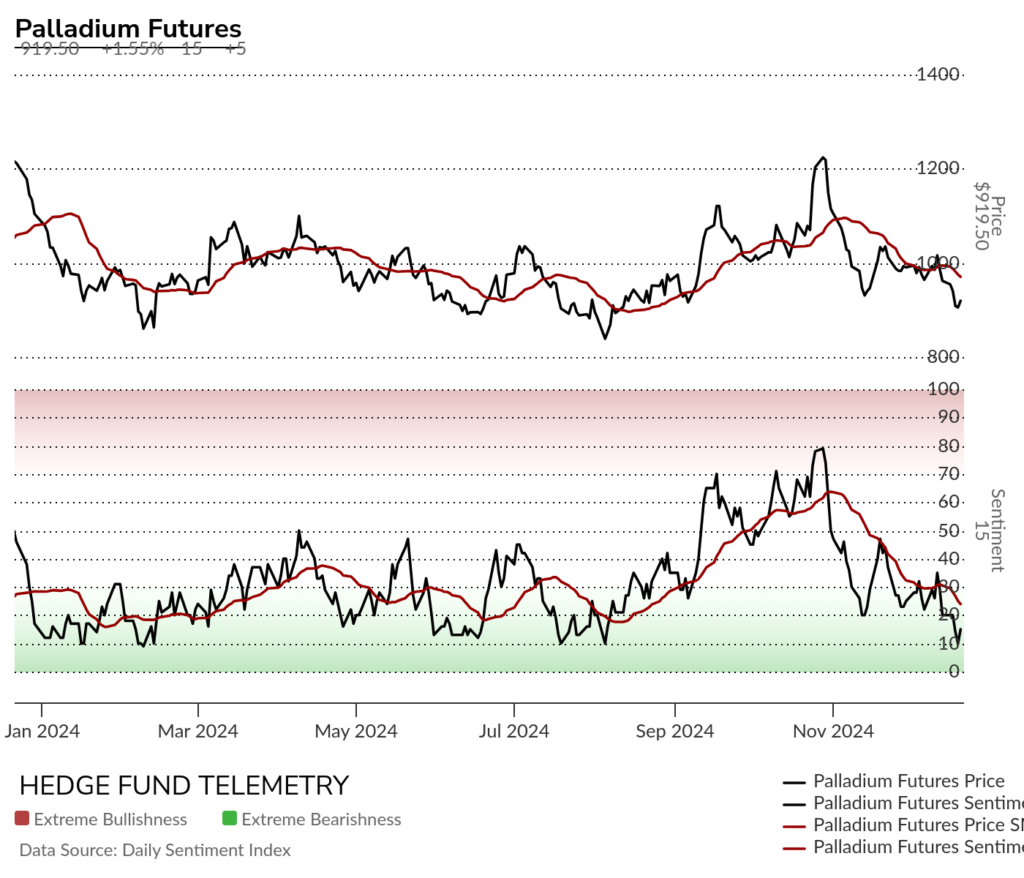

Palladium daily is nearing a new Sequential buy Countdown 13. A bounce is possible, but don’t expect much.

Palladium bullish sentiment is very oversold

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

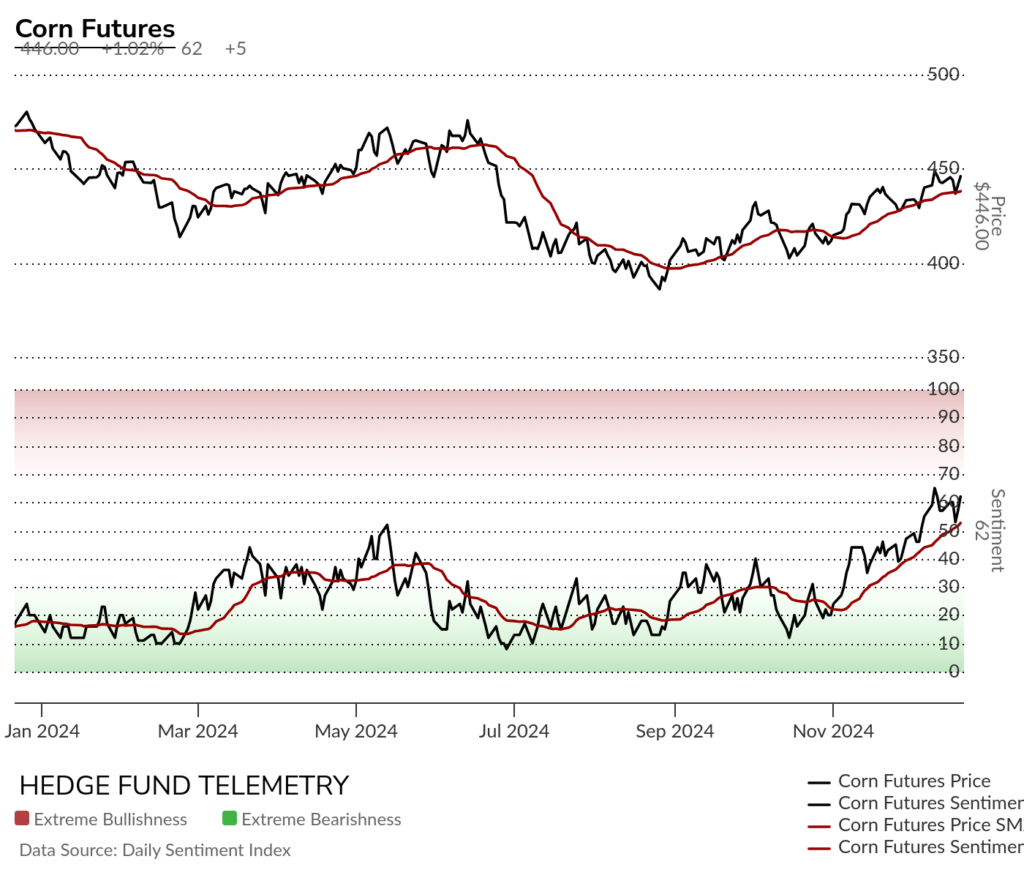

Corn futures daily has made higher lows but needs to clear the 200 day and possibly start a new upside Sequential Countdown.

Corn futures bullish sentiment has been improving

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

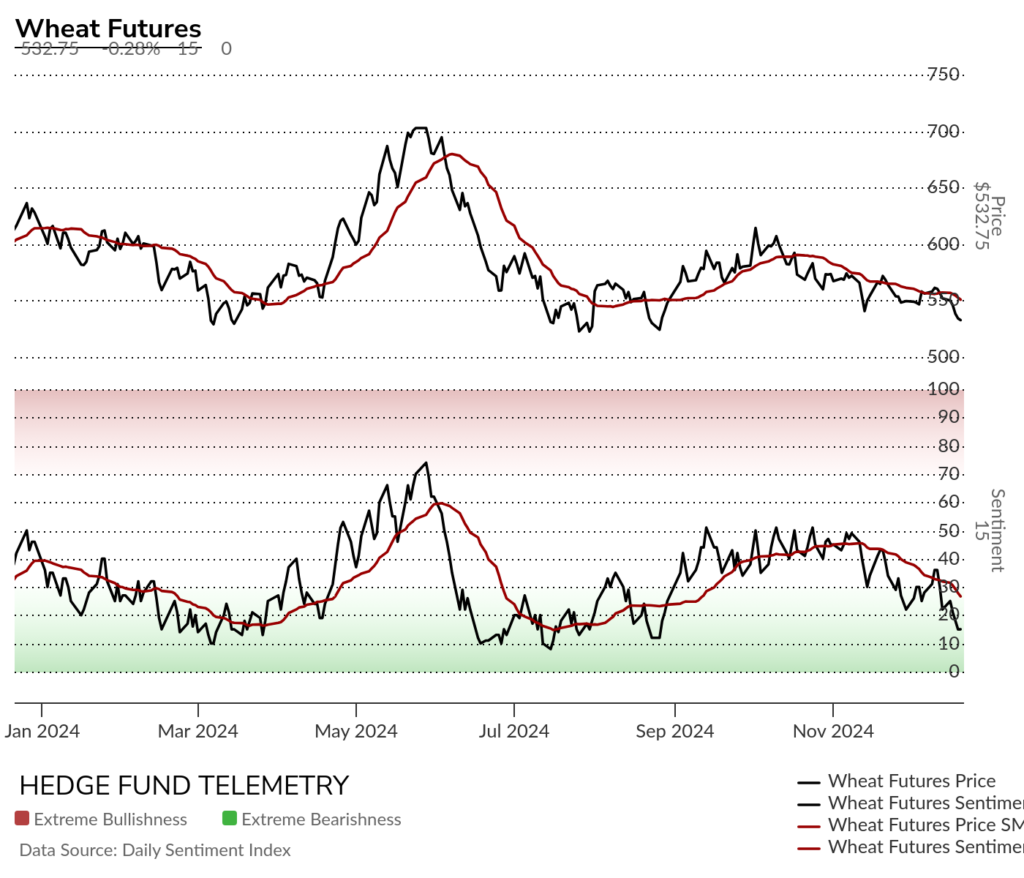

Wheat futures daily fell to new low with a new Combo 13.

Wheat futures bullish sentiment remains under pressure

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

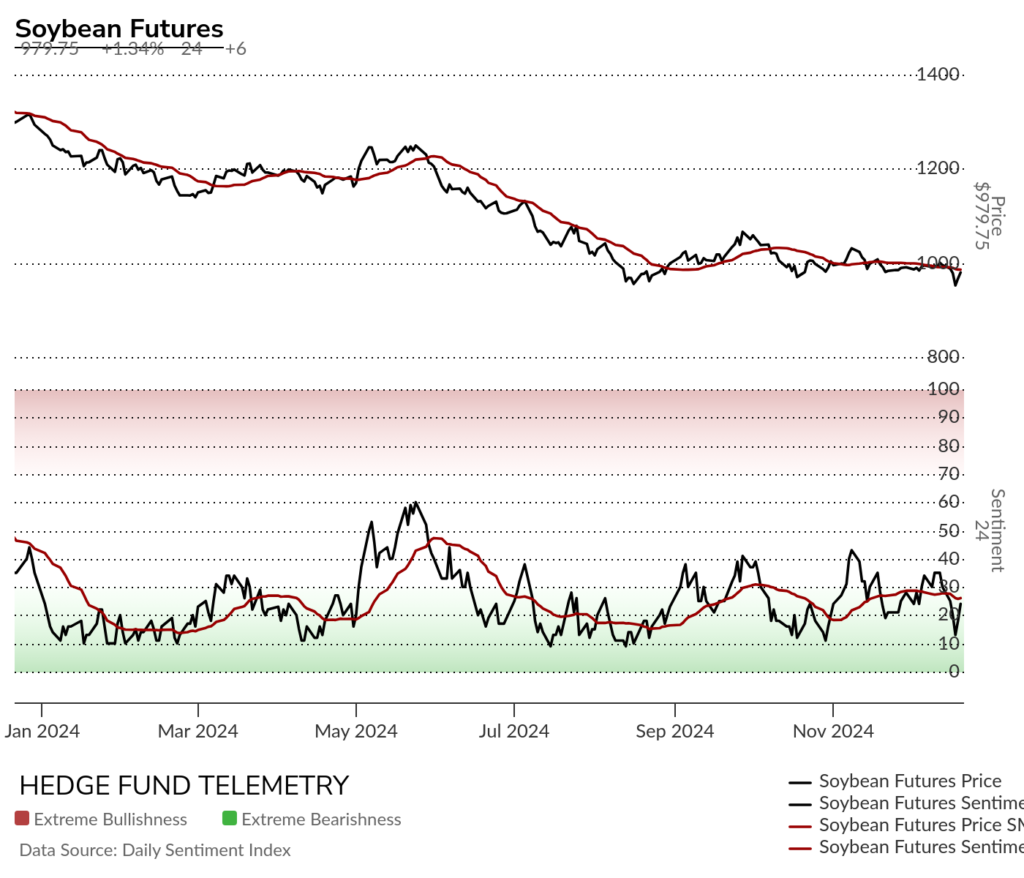

Soybean futures daily hit a new low last week and bounced off lows. Still needs to clear the 50 day for any confirmation.

Soybean futures bullish sentiment remains under pressure

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

Live Cattle futures daily holding the flat 200 day after pulling back with Combo 13’s

Live Cattle futures bullish sentiment choppy and holding the 50% level

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Lean Hogs futures daily consolidating the upside from the last year

Lean Hogs bullish sentiment broke to a multi month low

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

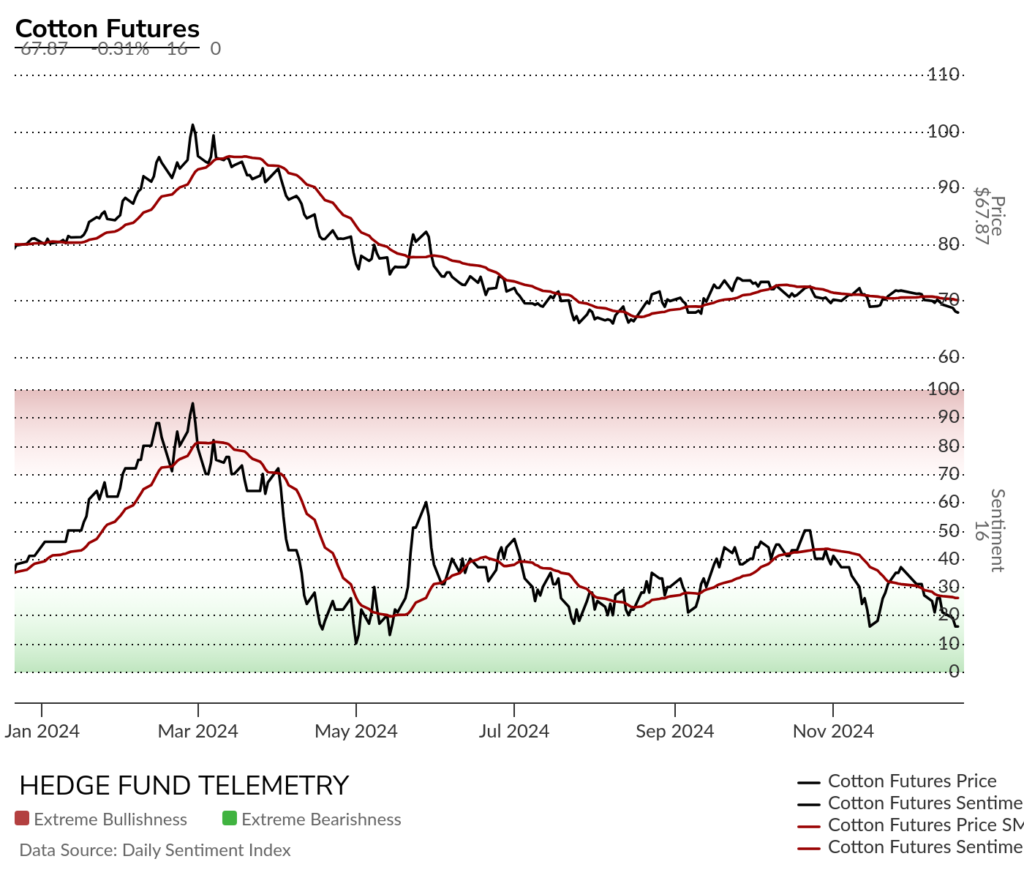

Cotton futures daily can’t seem to change the trend

Cotton futures bullish sentiment remains oversold under pressure

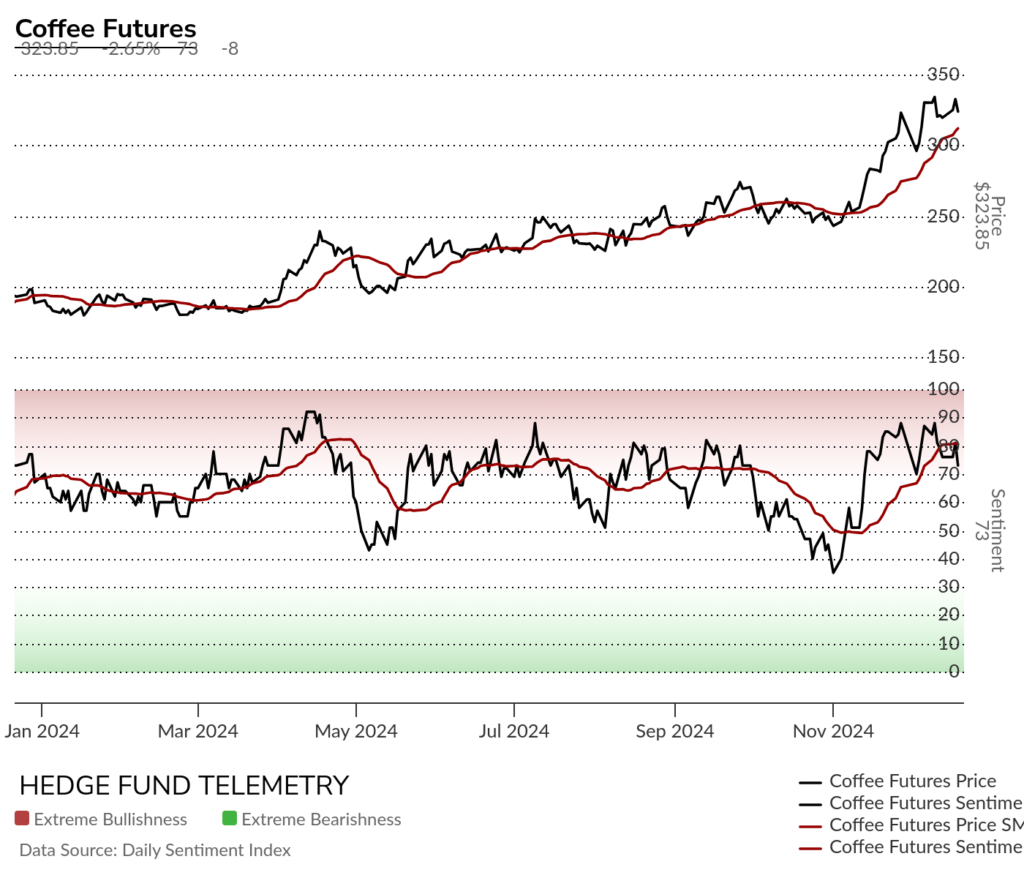

Coffee futures daily with several Sell Countdown 13’s holding the 20 day. A break of 315 would confirm a near term top.

Coffee futures bullish sentiment has been extreme and reversed under the 20 day moving average of bullish sentiment.

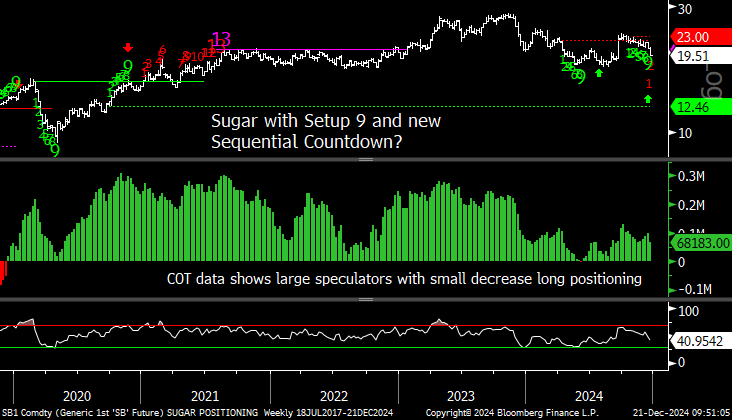

Sugar futures daily has been drifting lower despite the Sequential and broke hard this week near TDST support now.

Sugar futures bullish sentiment held 50% and broke hard last week.

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

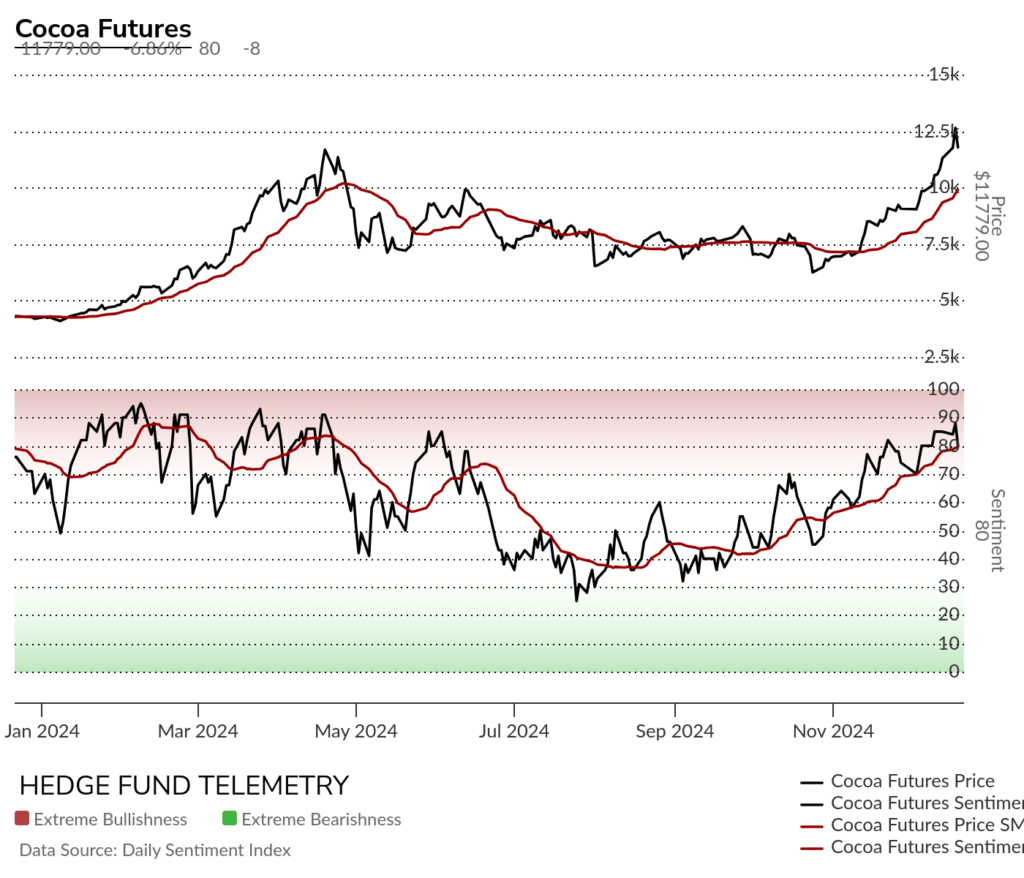

Cocoa futures daily has had several 13’s this Friday’s action the first move?

Cocoa futures bullish sentiment in the extreme zone at 80%.

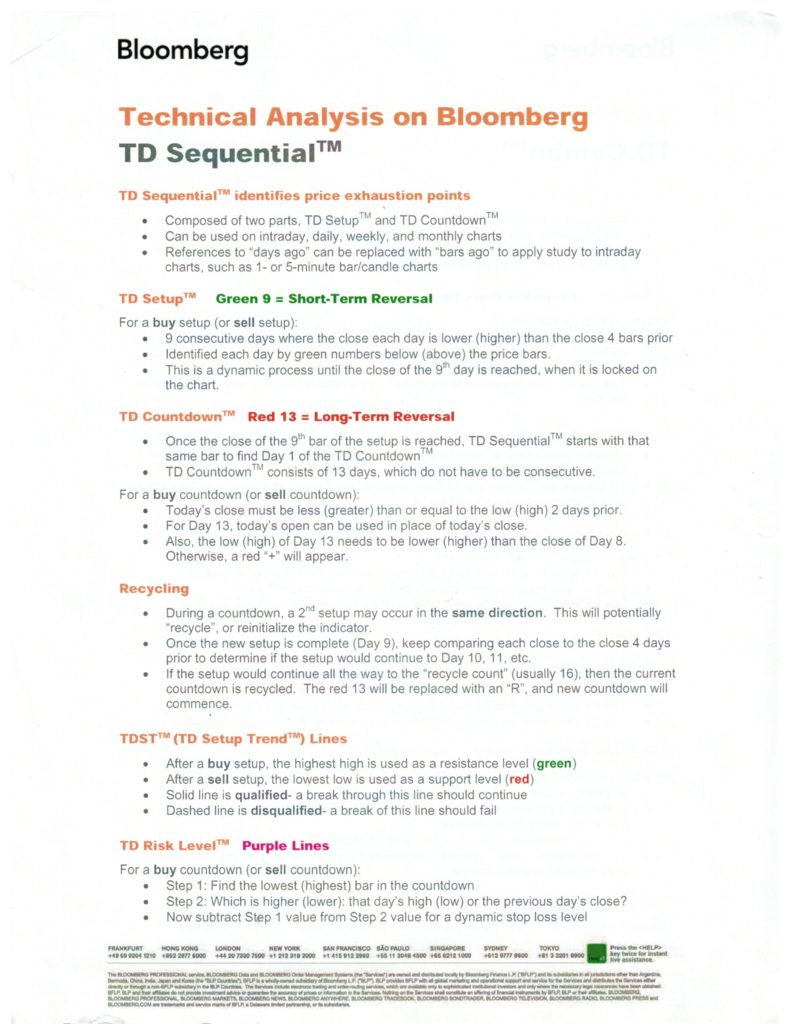

DeMark Sequential Basics

DETAILED COMMITMENT OF TRADERS DEFINITIONS