HIGHLIGHTS AND THEMES

- The narrow trading range for the Bloomberg Commodity Index remains

- Gold and Crude have held recent lows but lack upside momentum, and these two matter the most for commodity index

- Copper can be bought here, at this point it’s a low-conviction buy, so keep the size down for now. Add higher and stop out at 400

- Corn trades well on the long and still can be bought. Other grains still struggle

- Livestock consolidating with Cattle still stronger than Hogs

- Softs have more risk of moving lower – Sugar, Cocoa, and Coffee

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily has been been in a narrow trading range with clear breakout levels at 99.50-100. A pending Sequential on the downside remains on day 12 of 13 and would need a drop to the November lows to qualify the 13.

Bloomberg Commodity Index Weekly had held the TDST Setup Trend support at 95.19 and has a pending Sequential on week 7 of 13.

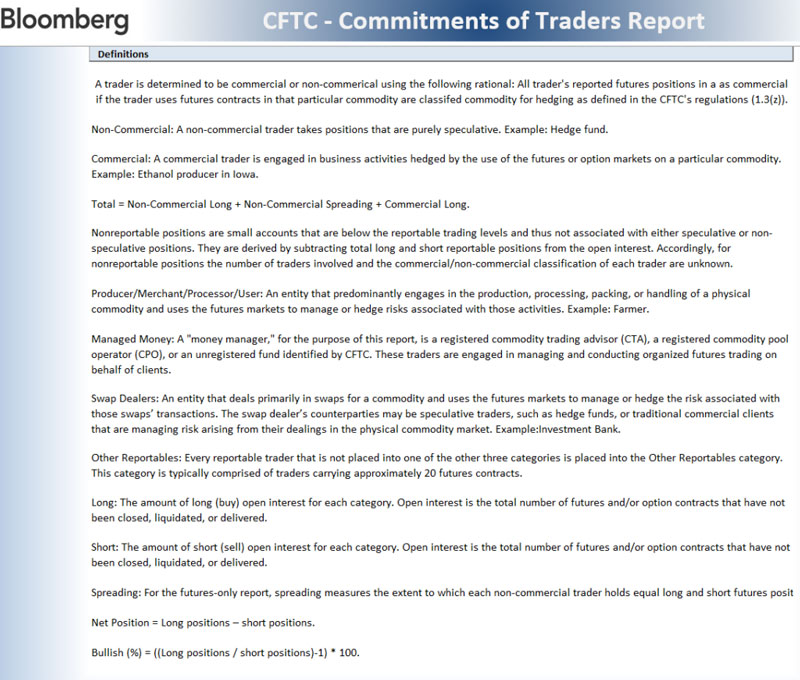

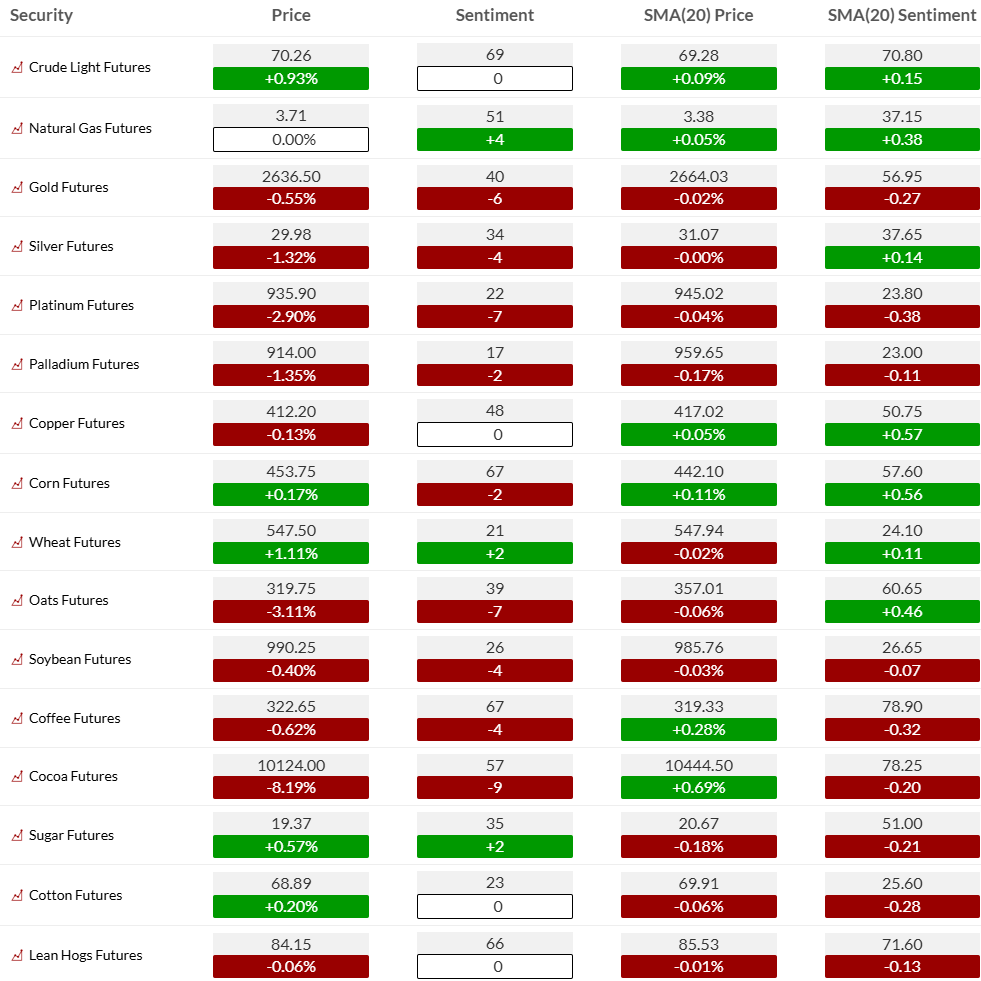

COMMODITY SENTIMENT OVERVIEW

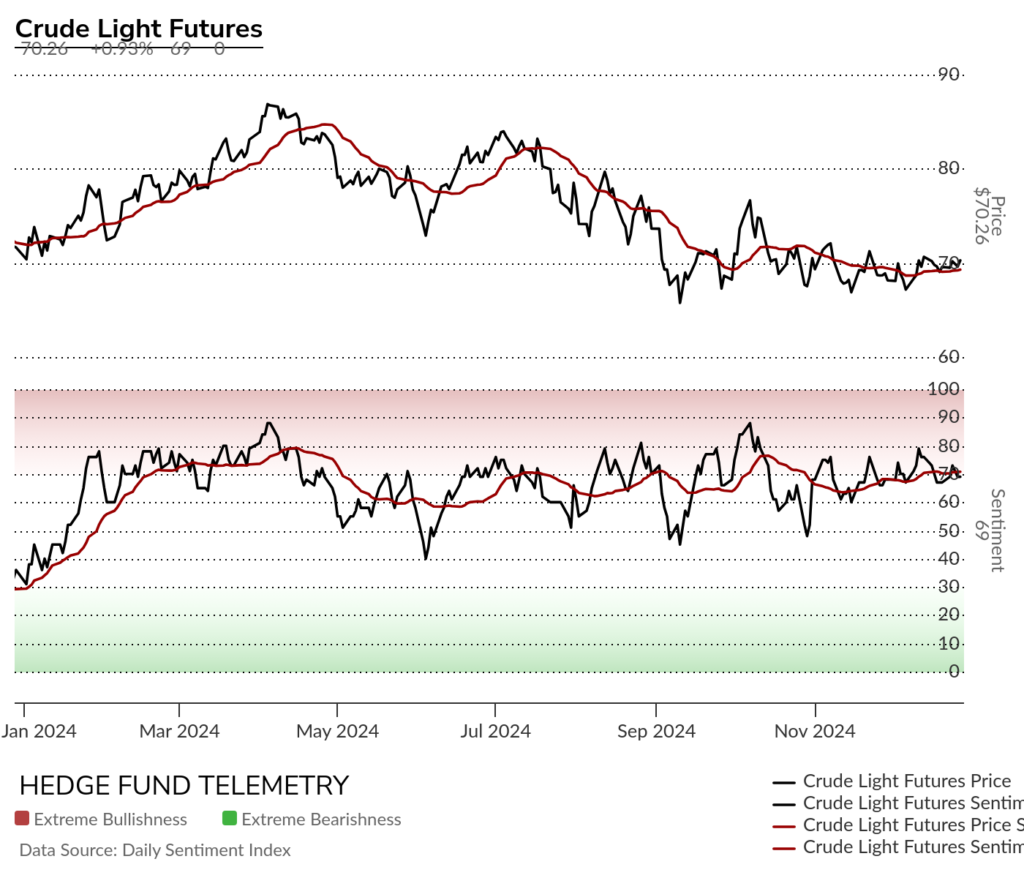

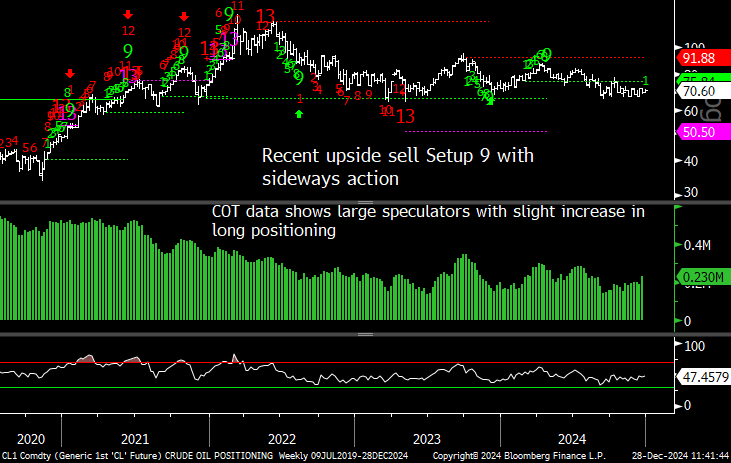

OIL AND ENERGY

Bloomberg Energy Index daily has had relatively narrow trading range illustrated better on the weekly chart

WTI Crude futures daily continues to trade in a narrow range not far from lows. A move to the upside Propulsion target of 73.21 is possible.

WTI Crude futures bullish sentiment remains elevated vs the poor price action

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Shows the narrow trading range in the last quarter.

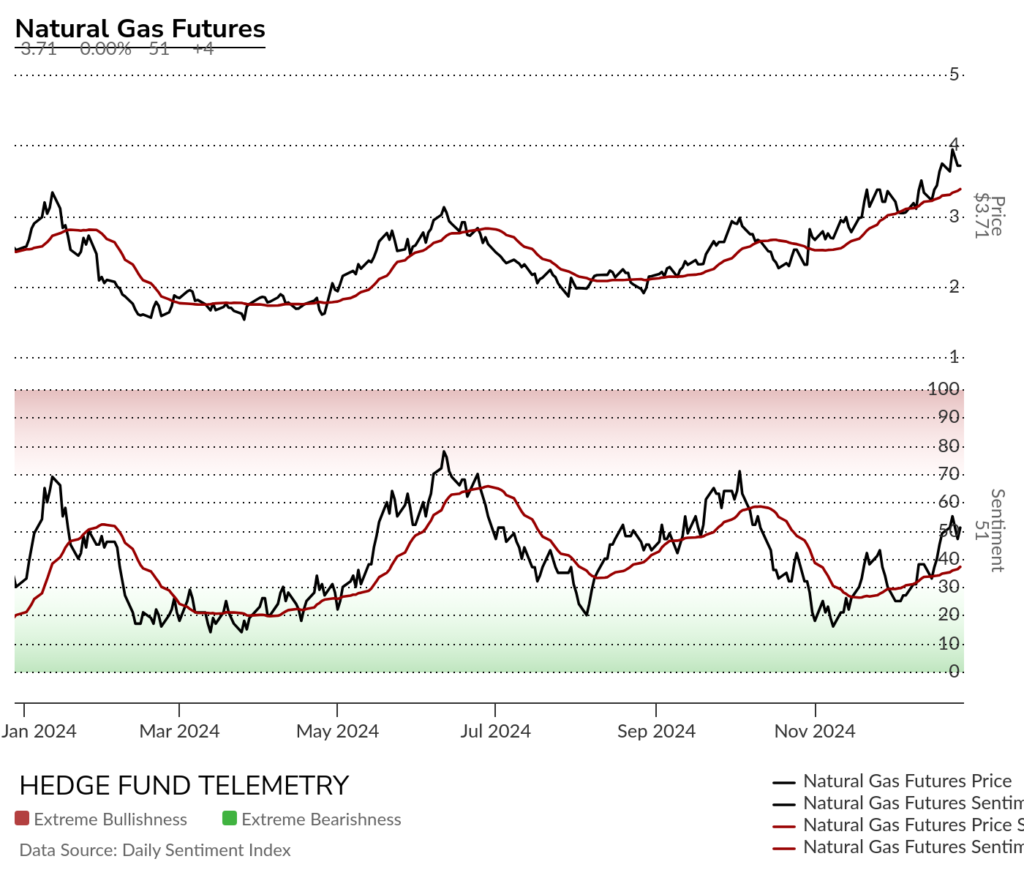

Natural Gas futures daily feel back at the TDST resistance at 3.53. It’s been a struggle but I’d give the benefit of the doubt to the bullish side

Natural Gas futures bullish sentiment at the 50% midpoint majority level.

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Sell Setup 9 due this week with current weekly Sequential pending on week 9 of 13 could continue but it’s been a struggle

Metals

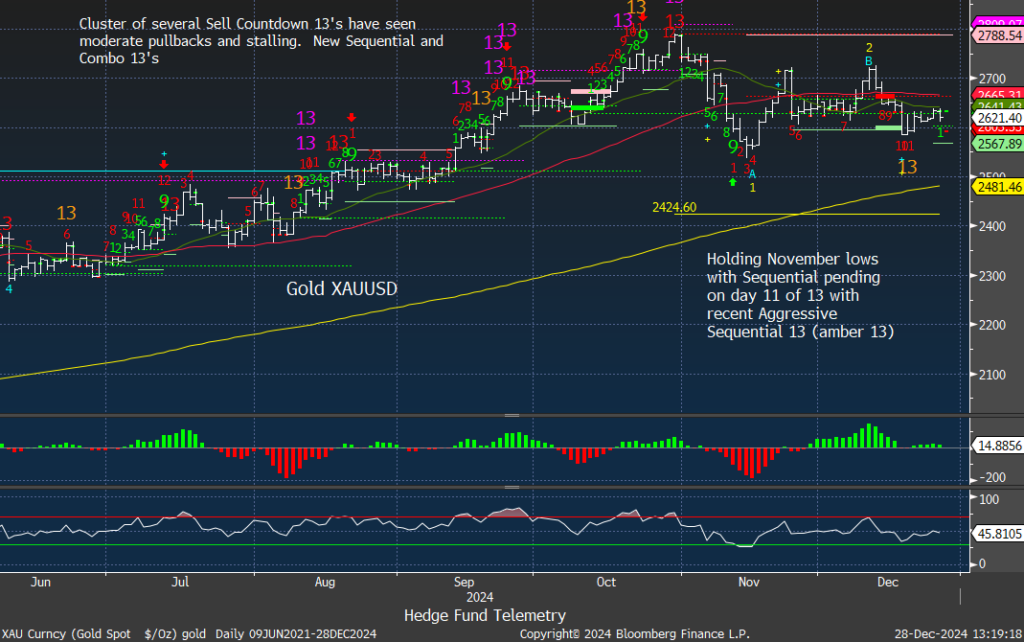

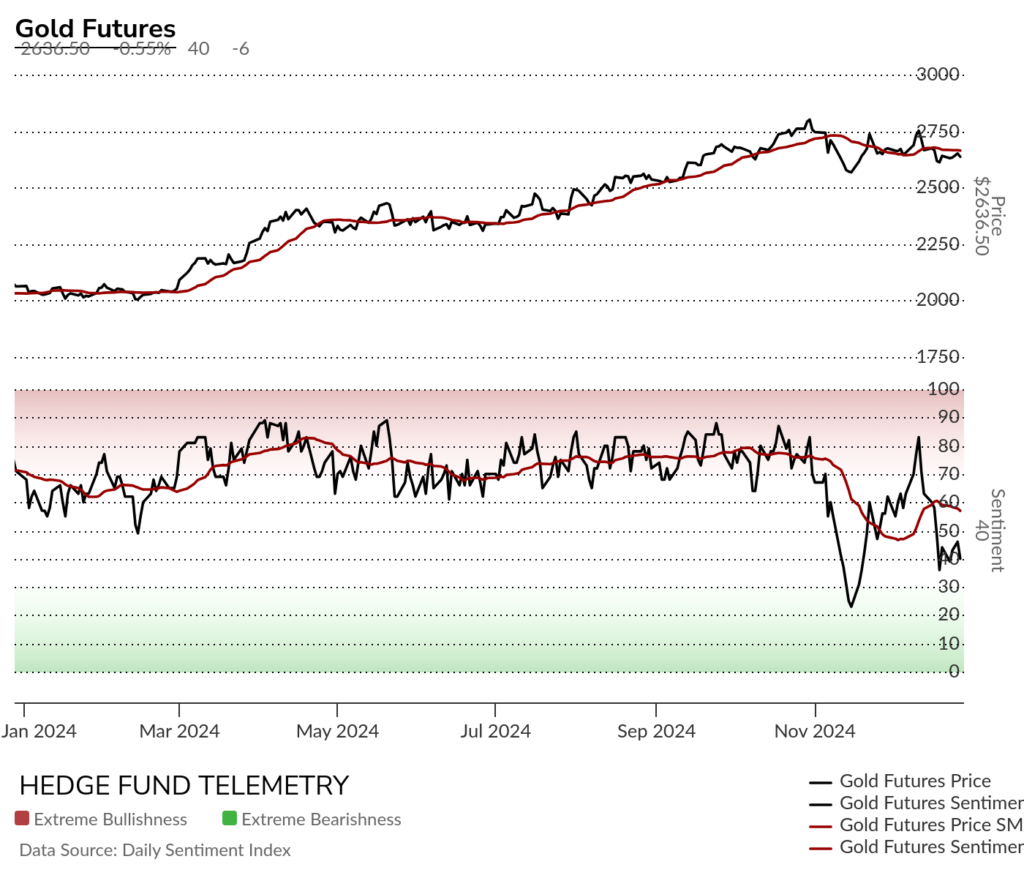

Gold daily still has the Sequential pending and needs to make a low under November levels.

Gold bullish sentiment remains under pressure and not oversold

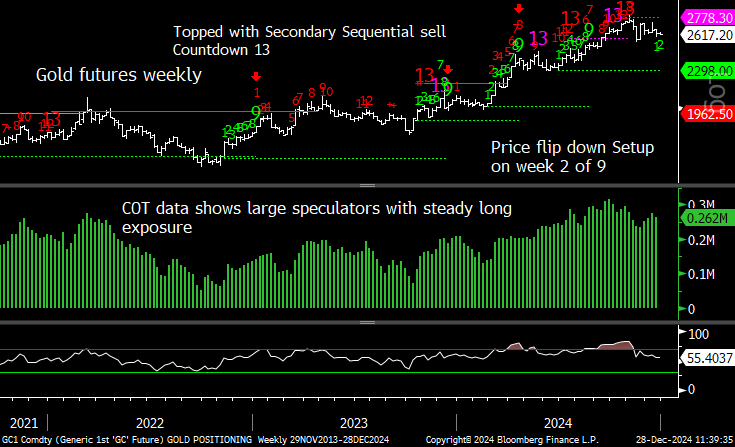

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

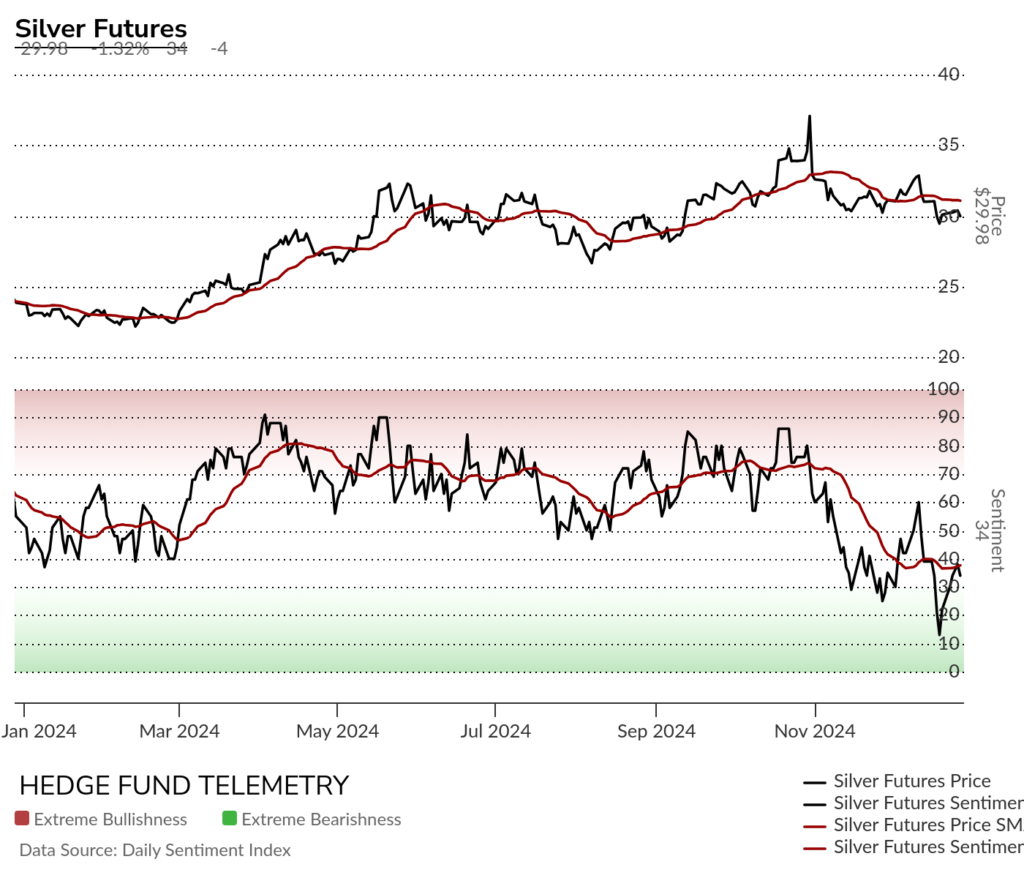

Silver daily with lower highs trying to hold the 200 day. In downside wave 3 of 5

Silver bullish sentiment has made lower highs

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

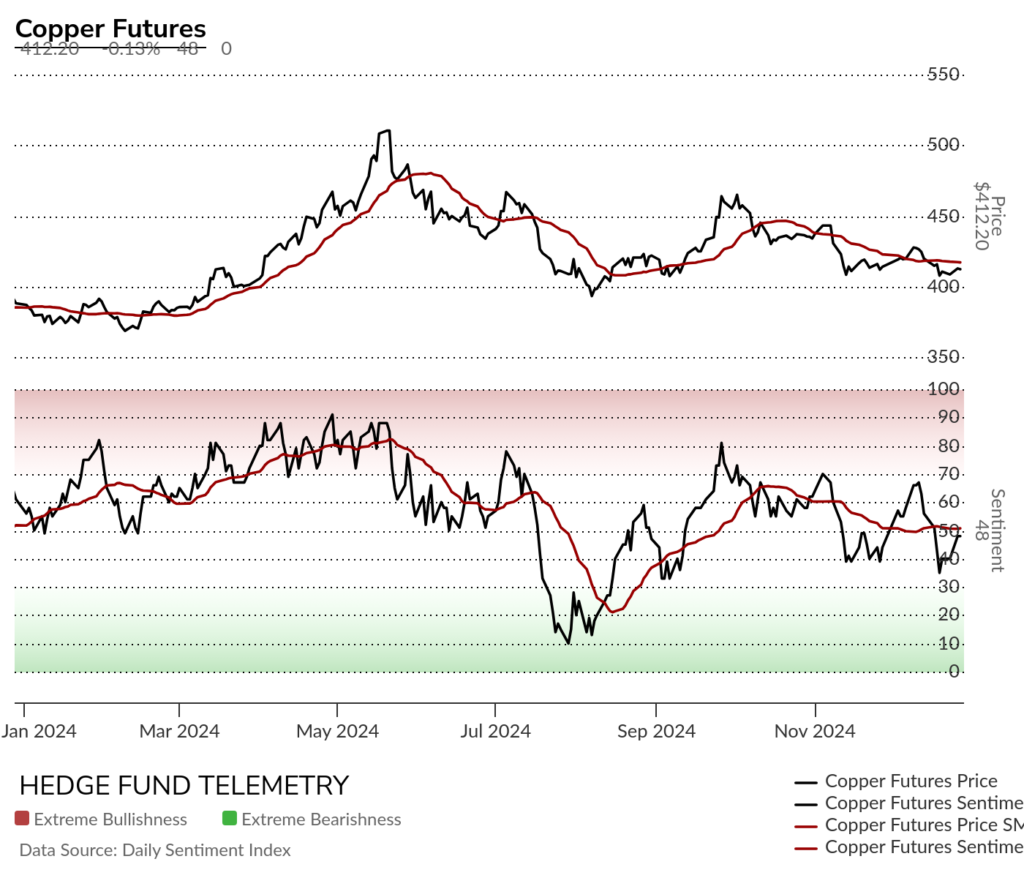

Copper futures daily with recent DeMark Sequential buy Countdown 13. Small price flip up lacking upside momentum. I would buy this with a 400 stop

Copper futures bullish sentiment bounced off ~40% level again

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Has to hold lows from Summer

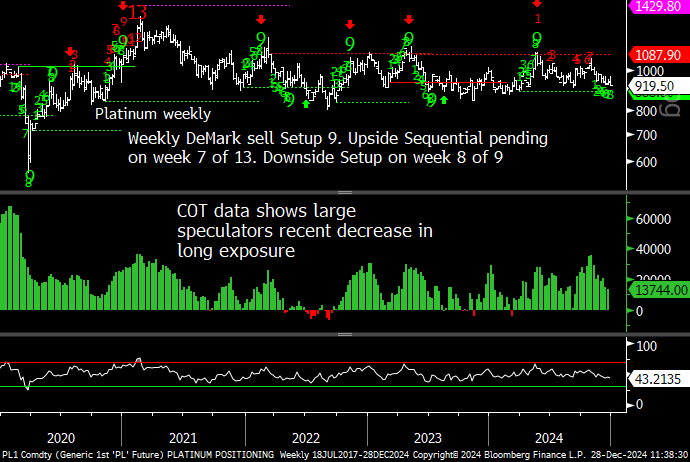

Platinum daily remains in no-mans land

Platinum bullish sentiment remains under pressure

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

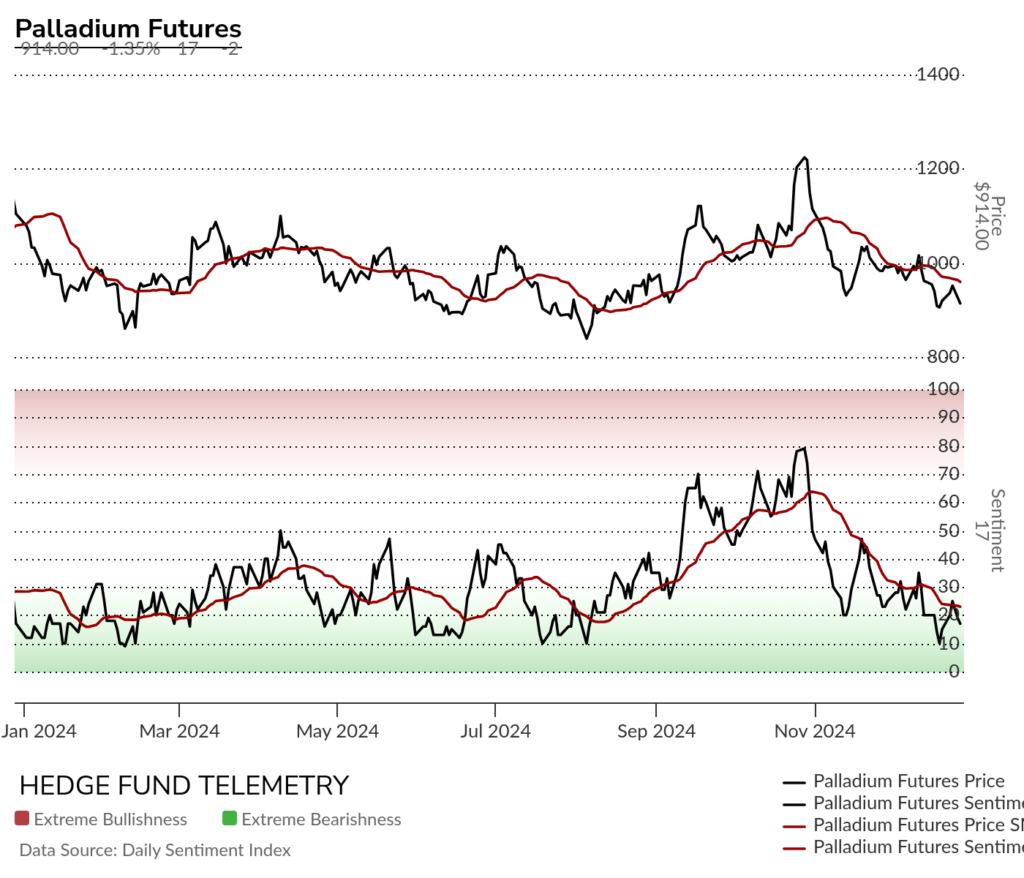

Palladium daily has a new Sequential buy Countdown 13 and will need a price flip up in the coming days/weeks to matter.

Palladium bullish sentiment remains under pressure

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

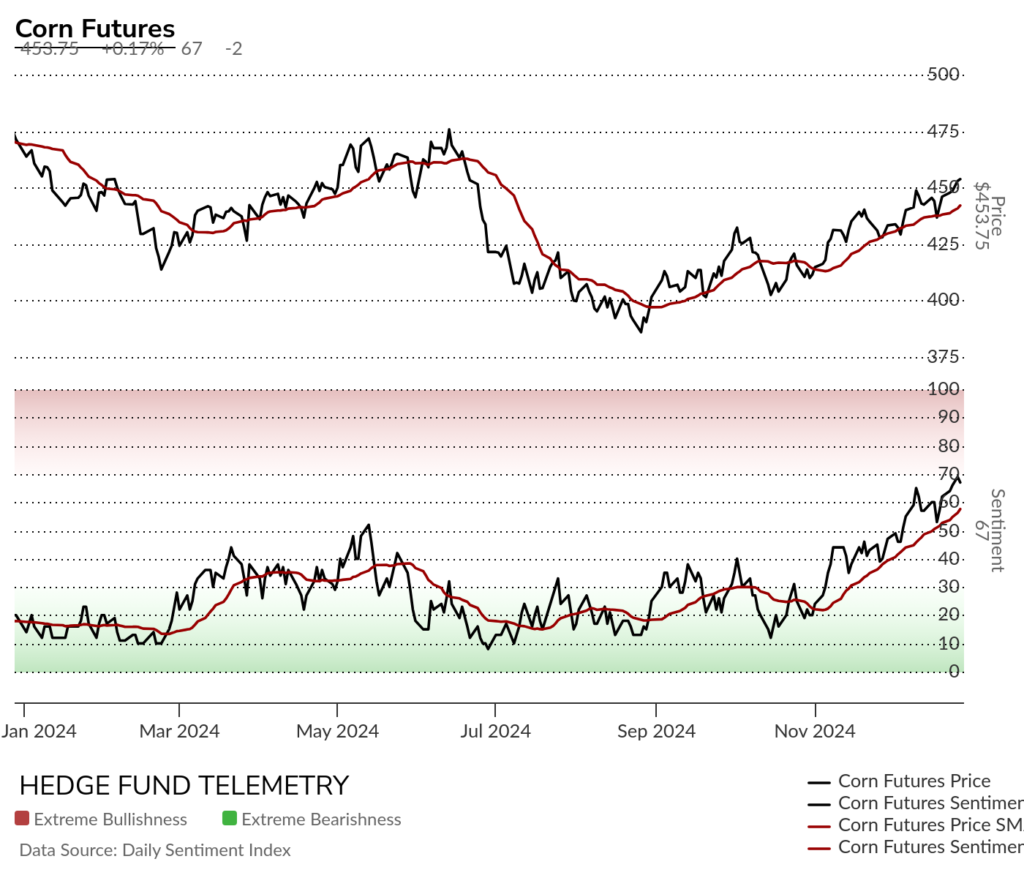

Corn futures daily has an upside Sequential Countdown and traded to a new recent high. Looks good as a long

Corn futures bullish sentiment continues to improve

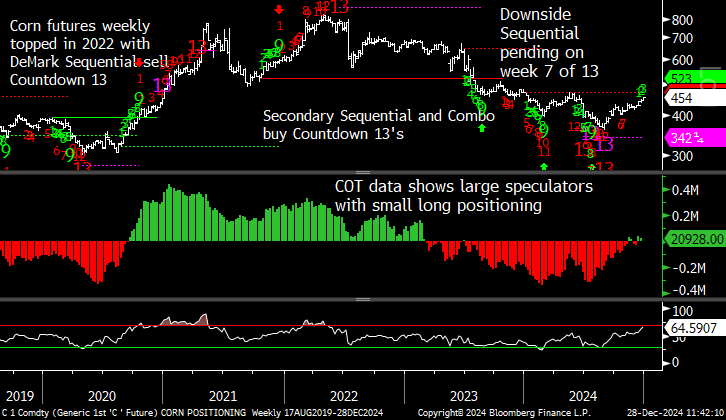

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

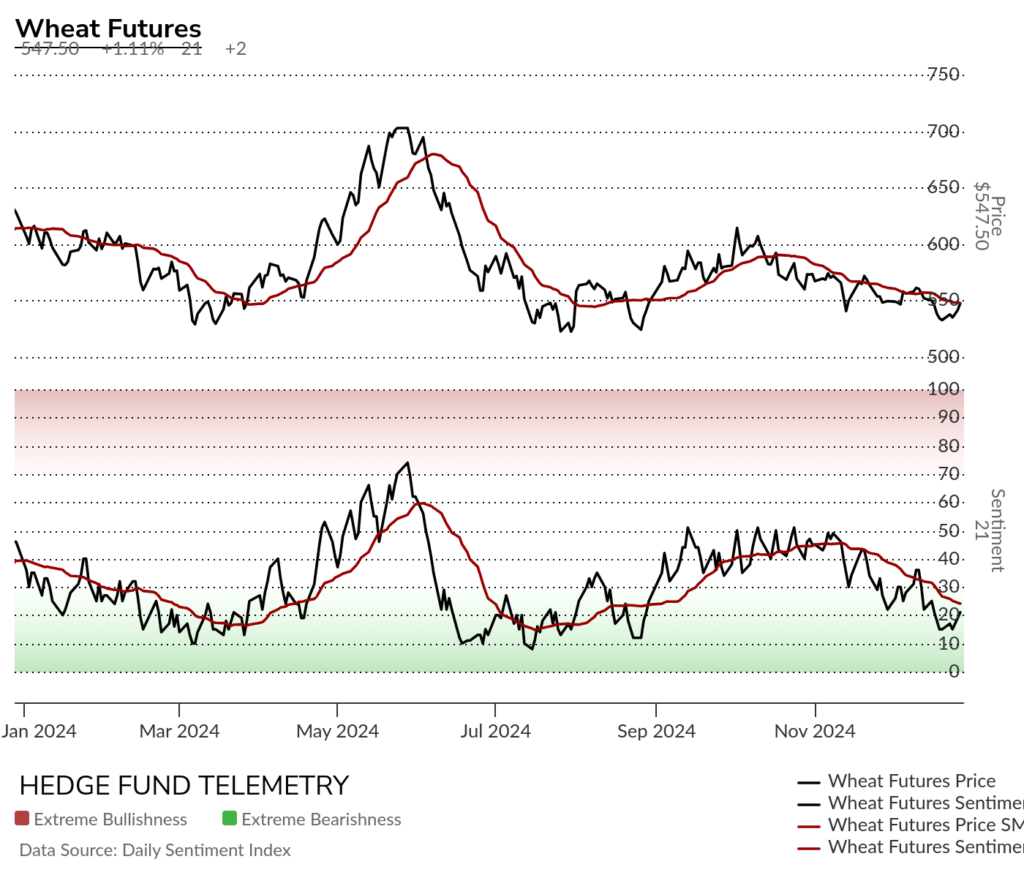

Wheat futures daily with new Combo 13 and price flip up at the 20 day. Lower high pattern needs to break for a durable long trade.

Wheat futures bullish sentiment remains under pressure with slight reveral

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

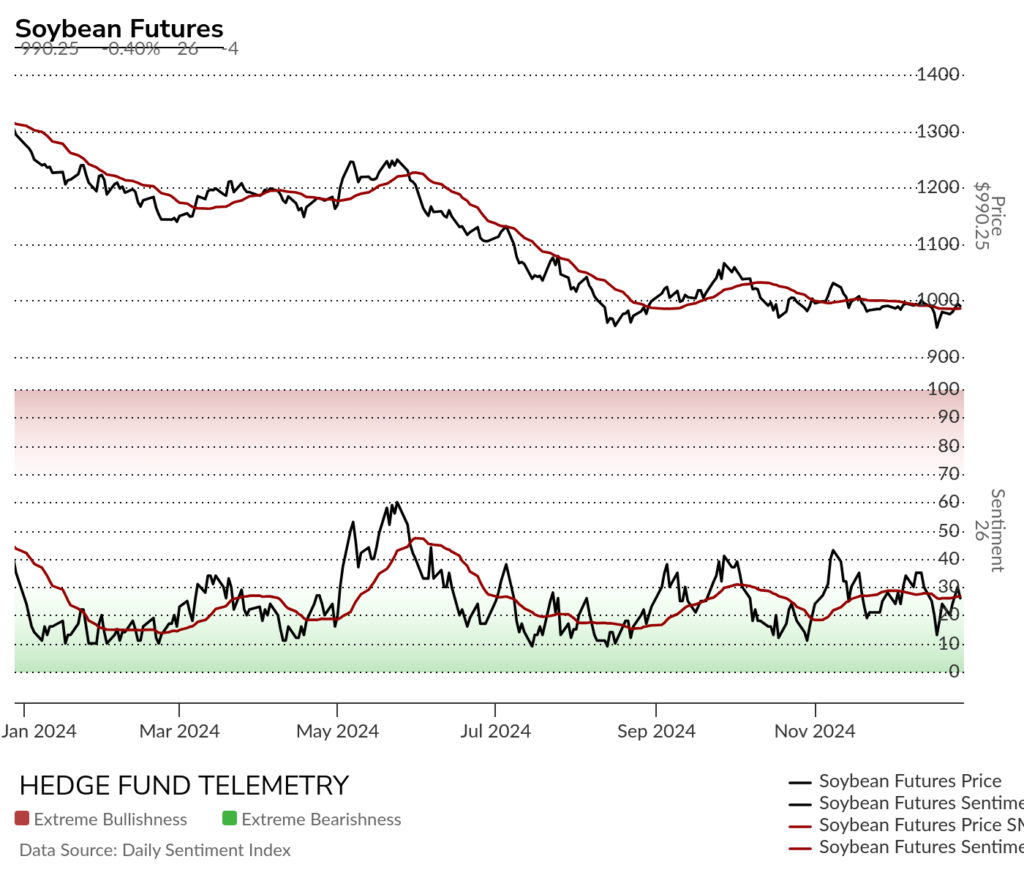

Soybean futures daily nice bounce off recent lows but needs to clear and move higher over 50 day

Soybean futures bullish sentiment remains under pressure

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Sequential in progress on week 5 of 13

Livestock

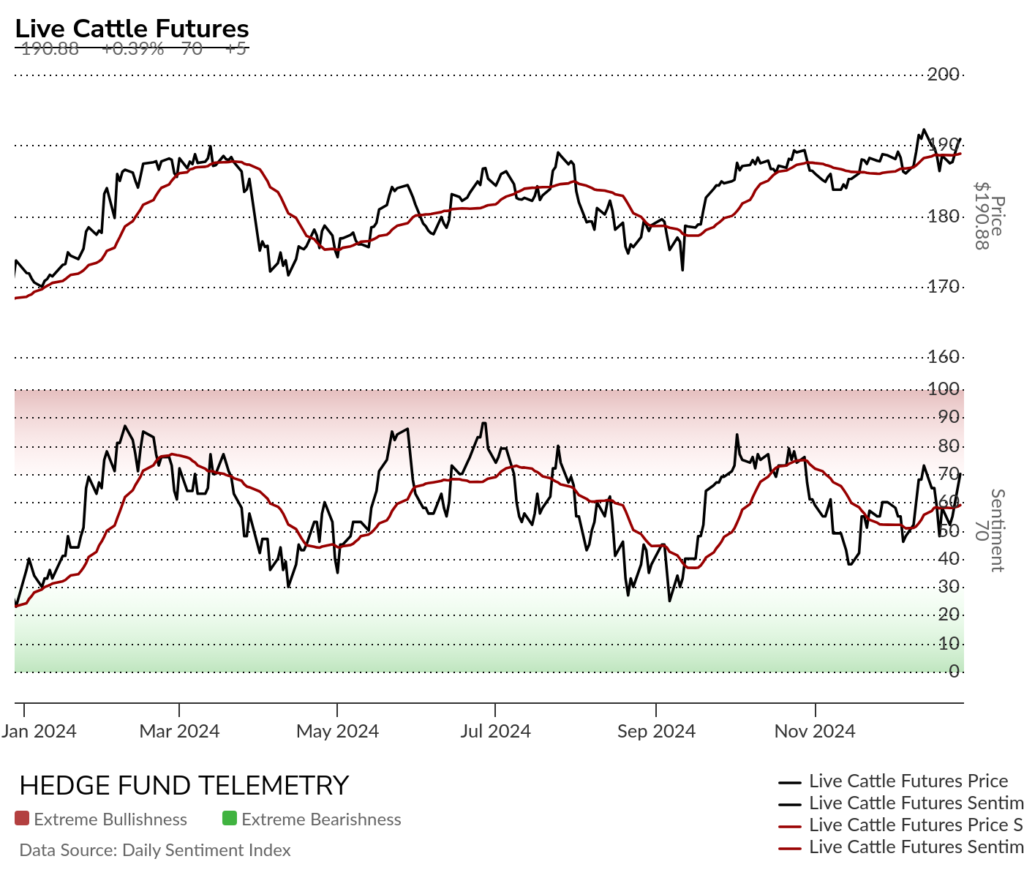

Live Cattle futures daily has seen nominal consolidation with recent 13’s. 200 day support.

Live Cattle futures bullish sentiment remains supportive

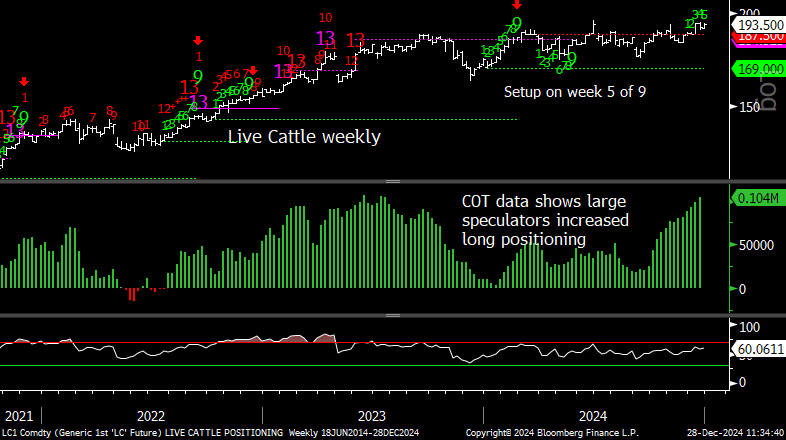

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Higher lows, higher highs

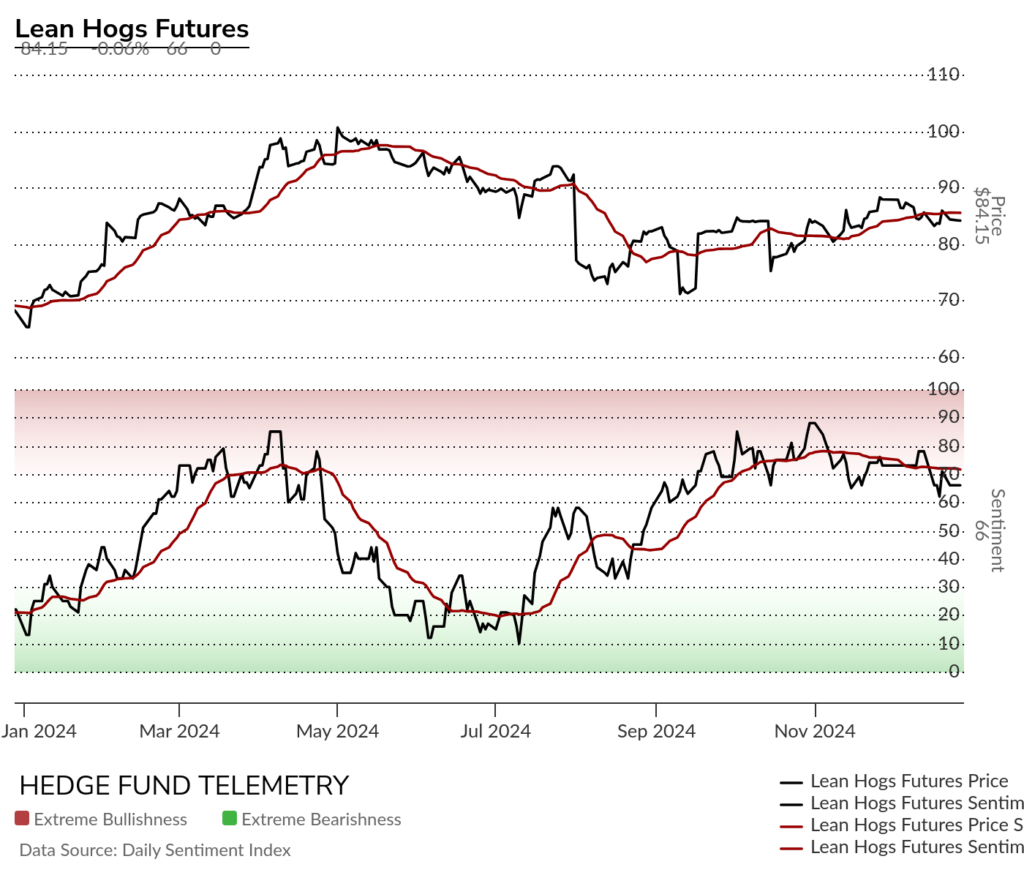

Lean Hogs futures daily consolidating with downside wave 3 risk to watch if wave 1 low breaks

Lean Hogs bullish sentiment holding steady with slight decline

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

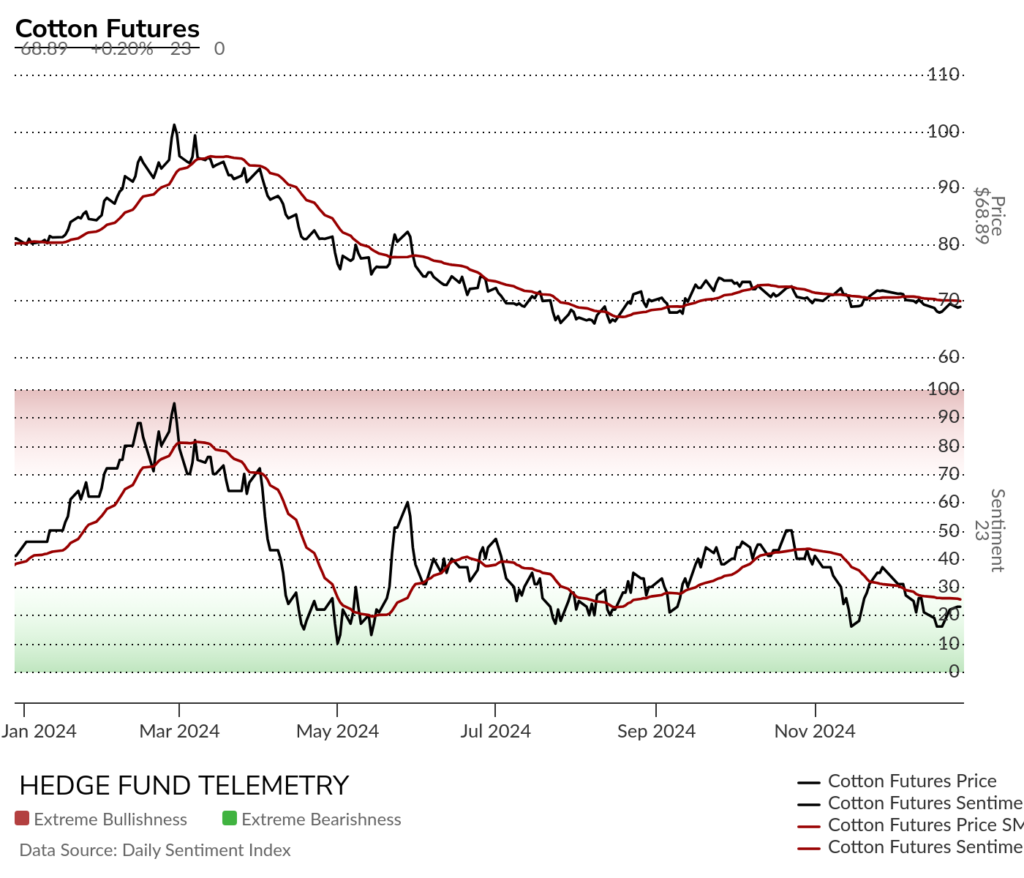

Cotton futures daily has not been able to make any turn higher

Cotton futures bullish sentiment remains under pressure

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

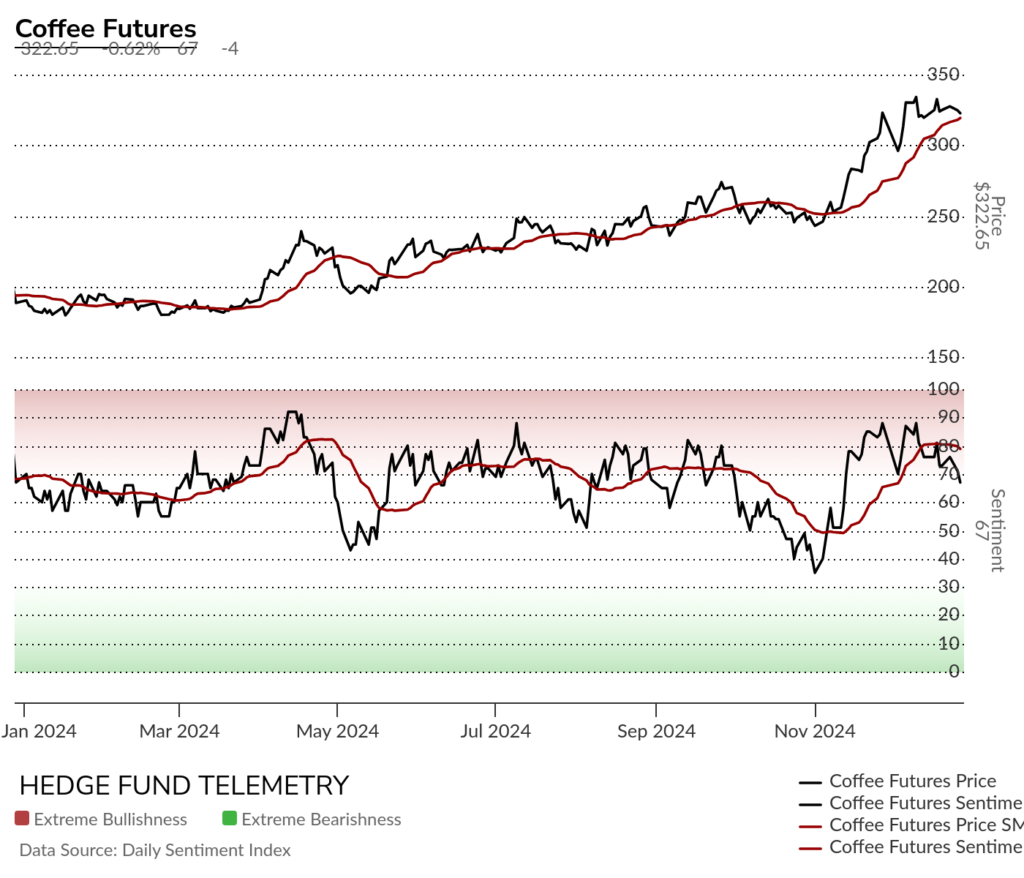

Coffee futures daily holding the 20 day for now.

Coffee futures bullish sentiment starting to reverse

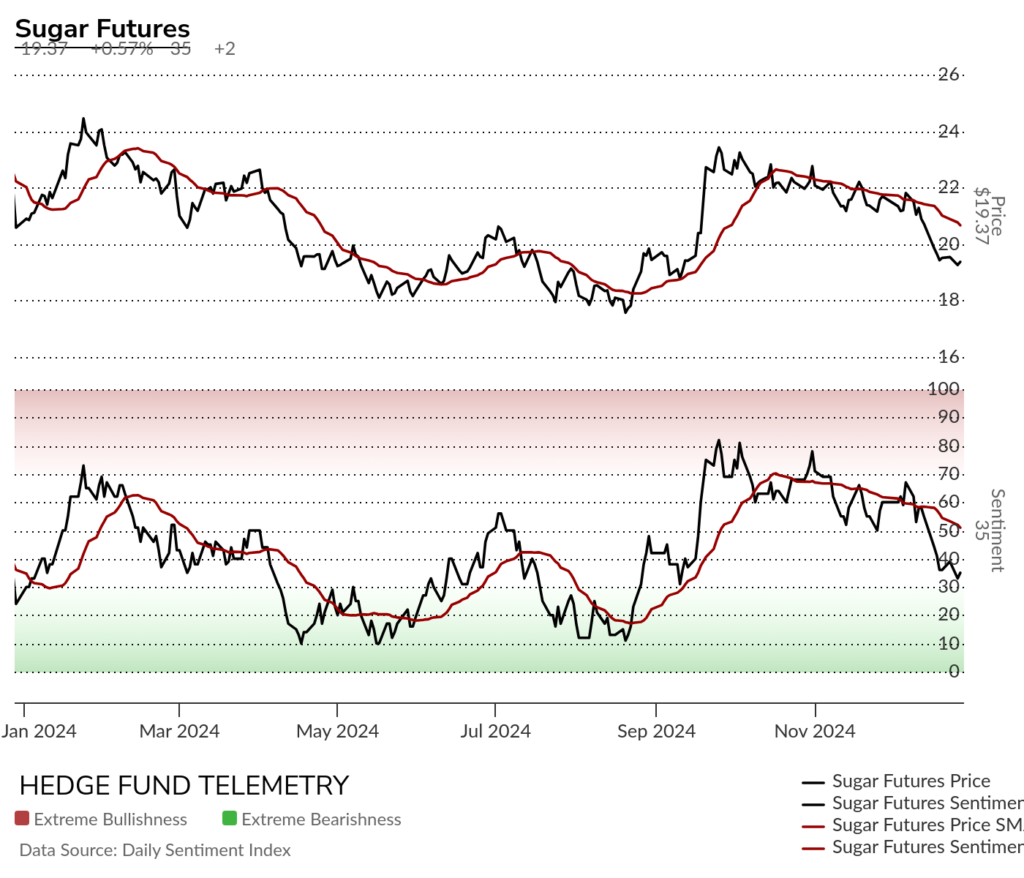

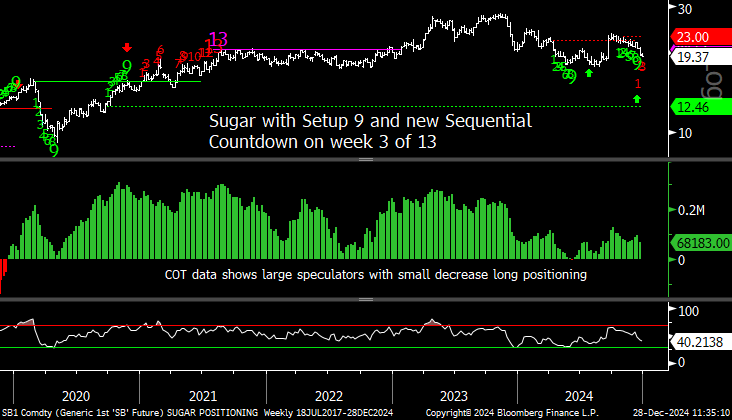

Sugar futures daily is at the TDST support line with a recent Setup 9 and potential Sequential starting. Holding this TDST is important, especially after a Setup 9.

Sugar futures bullish sentiment broke the 50% midpoint level and could move even lower

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

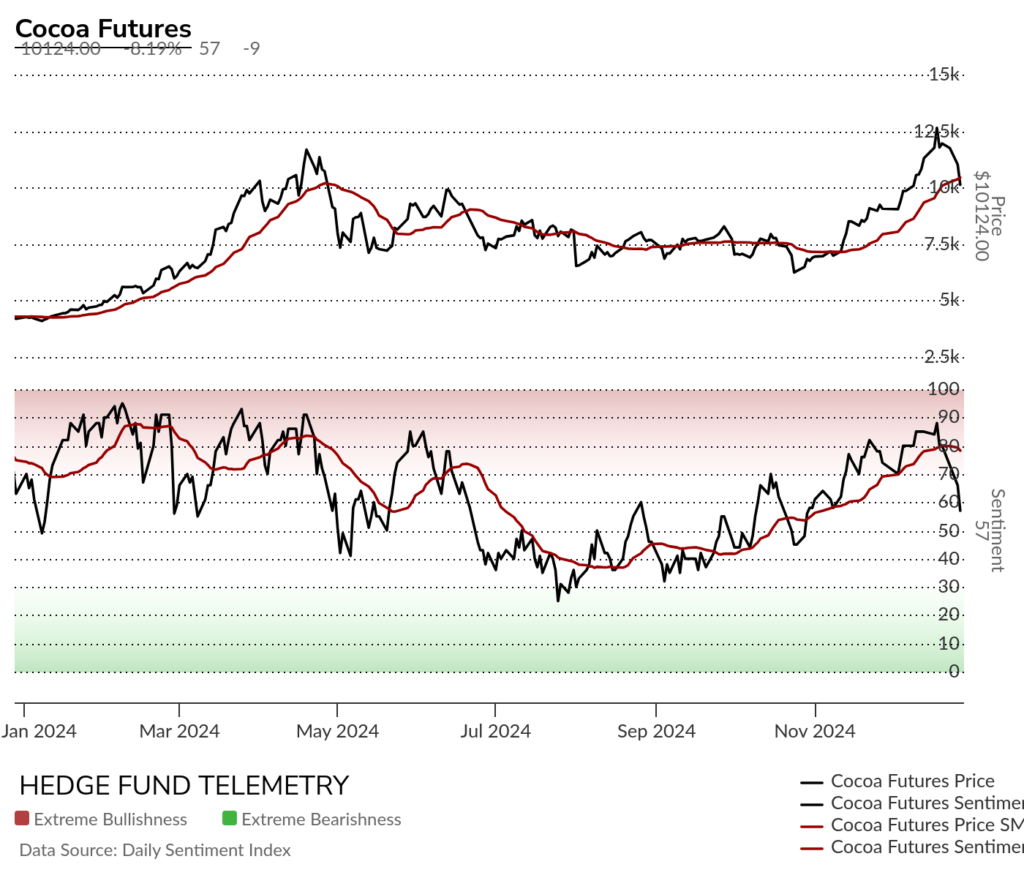

Cocoa futures daily reversal down.

Cocoa futures bullish sentiment broke down this week after moving back into the extreme zone

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

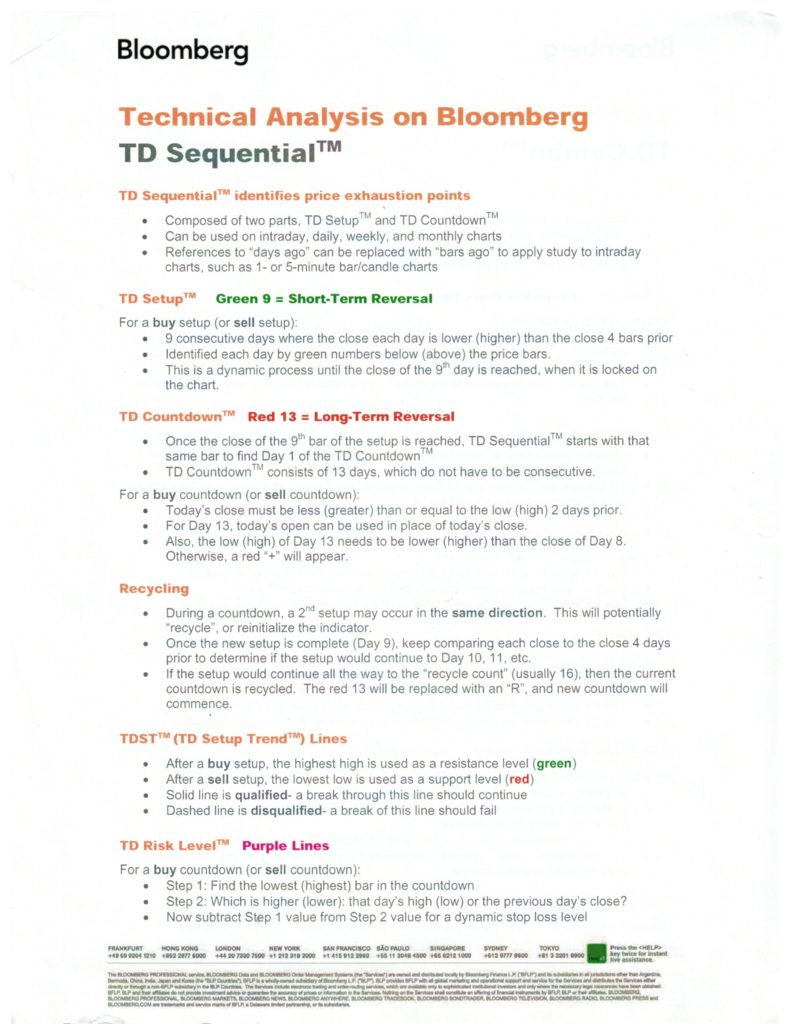

DeMark Sequential Basics

DETAILED COMMITMENT OF TRADERS DEFINITIONS