Highlights and themes

- US Dollar sentiment has been extreme for the last month over 80%.

- Several DeMark sell Setup 9’s on daily and weekly qualified as the Dollar lifted into upside wave 5 of 5

- Crosses also made lows including Euro and Pound

- Yen weakness has persisted and might continue

- Crypto has started to top with decent sized reversals after DeMark sell Countdown 13’s

- Crypto has held recent support levels that were previous resistance levels.

Comments on charts. If you have questions or would like more context, please email.

Currency Sentiment Overview

Currency sentiment highlights has had strong dollar sentiment that remains at 81% extreme. The 20 day moving average of Dollar sentiment is also extreme now at 80%.

US Dollar Indexes

DXY US Dollar Index daily has a new Sell Setup 9 and decent reversal off highs Friday. A pending Sequential remain on day 10 of 13 now in upside wave 5 of 5.

DXY US Dollar Index weekly has upside trend potential continuing with a new Sequential Countdown

Bloomberg US Dollar Index daily reversed on Friday with new Sell Setup 9. 9-13-9 pattern needs a price flip down to confirm near term top.

Bloomberg US Dollar Index weekly has upside trend potential continuing with a new Sequential Countdown

US Dollar bullish sentiment has remained in the extreme zone for December with a decent sized drop on Friday.

US Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. The question of upside Sequential Countdown continuing the trend remains.

Major USD Crosses

EURUSD Euro / US Dollar hit a new recent low this week with a Sequential remaining in progress

Euro bullish sentiment with big up tick after 10% on Thursday

Euro Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

GBPUSD British Pound Sterling / US Dollar hit a new low with new Combo 13 and Setup on day 8 of 9

British Pound Sterling bullish sentiment hit a new 2024 low this week

British Pound Sterling Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

AUDUSD Australian Dollar / US Dollar trend has continued

Australian Dollar bullish sentiment oversold still

Australian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDCAD US Dollar / Canadian Dollar hit the upside wave 5 price objective

Canadian Dollar bullish sentiment slight turn off low

Canadian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. New Combo and Sequential weekly 13’s.

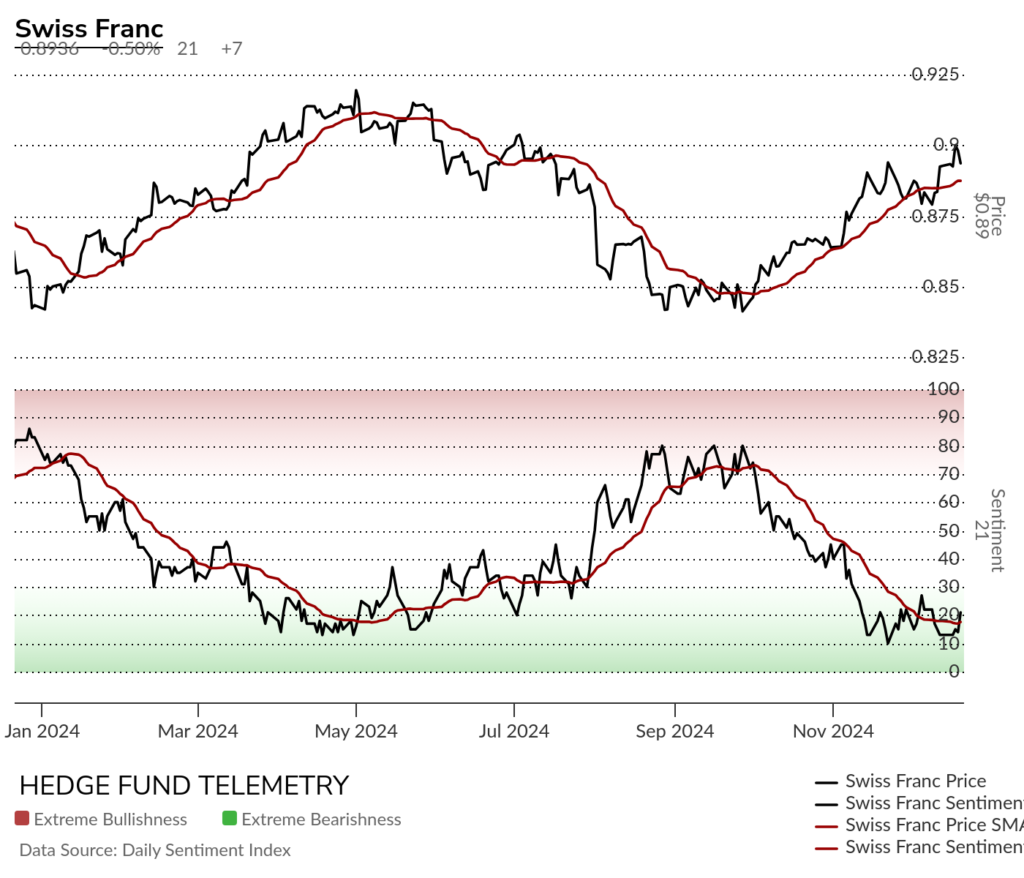

USDCHF US Dollar / Swiss Franc still has the Sequential in progress now in upside wave 5.

Swiss Franc bullish sentiment with a strong move on Friday in oversold zone.

Swiss Franc Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

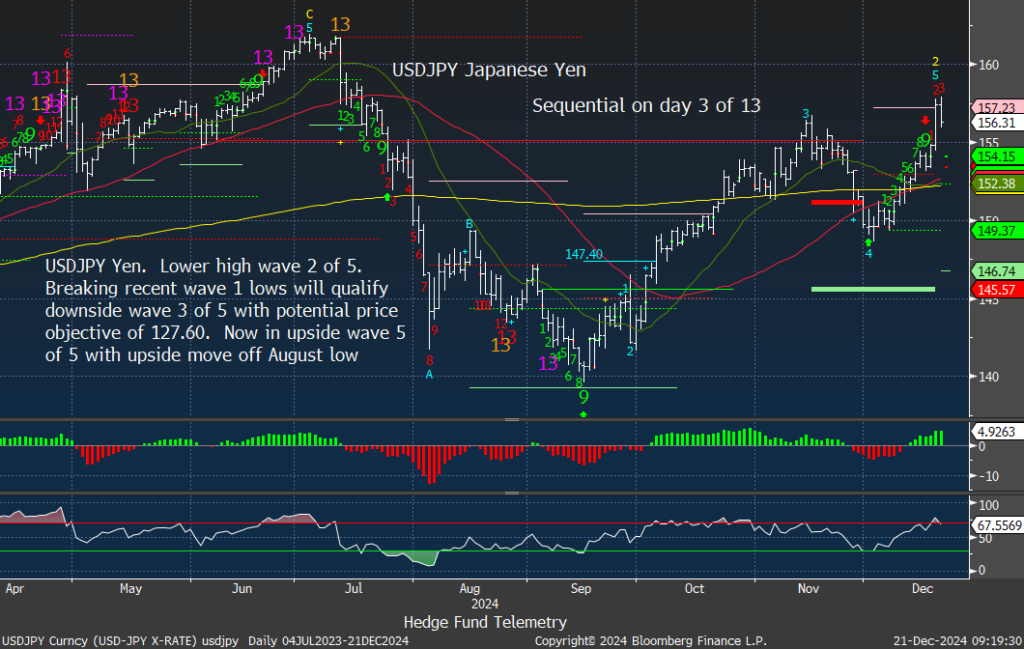

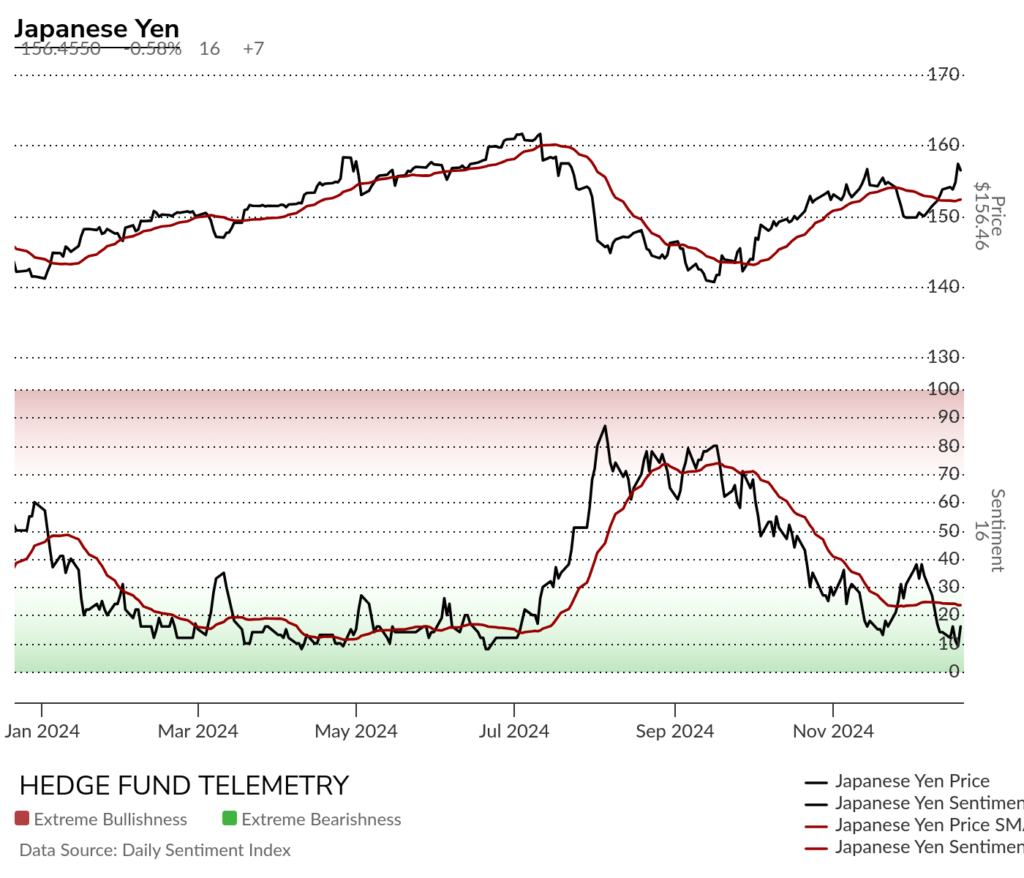

USDJPY Japanese Yen daily did move higher this past week into upside wave 5 of 5. There is a new Sequential Countdown in progress that should be monitored.

Japanese Yen bullish sentiment remains under pressure and might stay this way as it’s happened several times for an extended period of time.

Yen Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Crypto

Bitcoin daily had both Sequential and Combo 13’s together at the high. Sideways action from mid November will only be confirmed broken with 1. a break of the 50 day and 2. a break of the big round number 90k

Bitcoin bullish sentiment made a new 5 week low.

Ethereum reversed hard after several Combo 13’s (several versions)

Three major Yen crosses

EURJPY Euro / Japanese Yen with lower high pattern

GBPJPY British Pound Sterling / Japanese Yen with lower high pattern

AUDJPY Australian Dollar / Japanese Yen notably weaker Aussie

US Dollar vs Emerging Markets

USDBRL US Dollar / Brazilian Real despite some choppy action the trend remains. Several 13’s could see a pullback to 5.74 TDST support

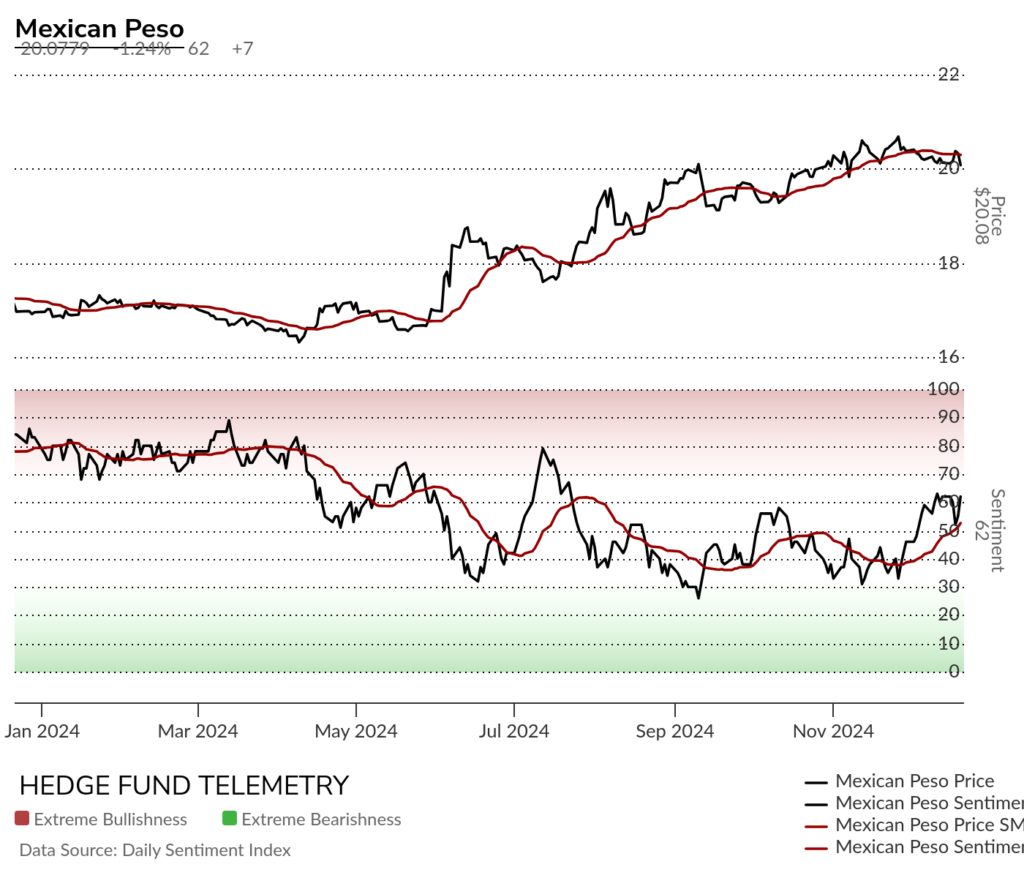

USDMXN US Dollar / Mexican Peso has moved sideways after a weaker Peso vs USD. Could the rounding be starting for a stronger Peso again?

Mexican Peso bullish sentiment has been improving recently

Mexican Peso Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDZAR US Dollar / South African Rand did qualify into upside wave 5 this week

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan) still has the trend intact with 20 day moving average support

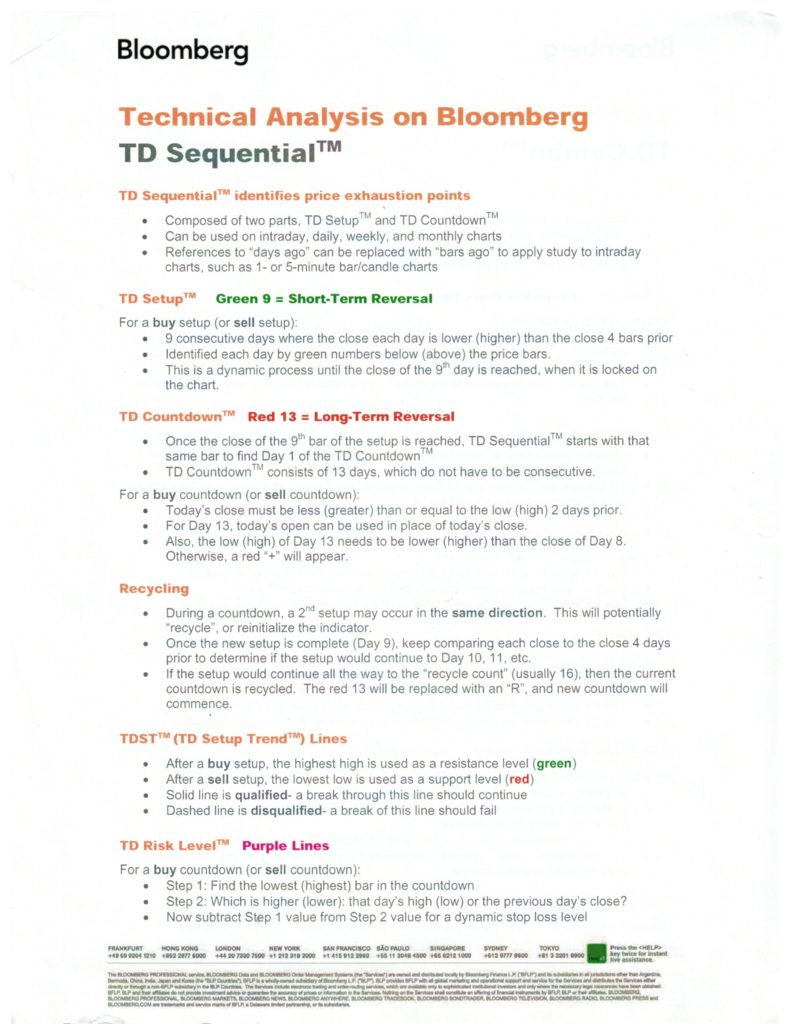

DeMark Sequential Basics from Bloomberg

Detailed Commitment of Traders explanation