Highlights and themes

- Dollar strength has not reversed much after consolidating in the last week

- Risk of continued dollar strength remains despite sentiment elevated.

- Weekly charts after recent Setup 9’s on Dollar and various crosses have new potential Sequential Countdowns starting

- Yen weakness is a major contributor to the dollar strength

- Yen crosses illustrate this action

- Crypto is consolidating after recent DeMark sell Countdown 13’s but no major support levels have broken yet. Bitcoin 90k and Ethereum 3k are the important levels to watch.

Comments on charts. If you have questions or would like more context, please email.

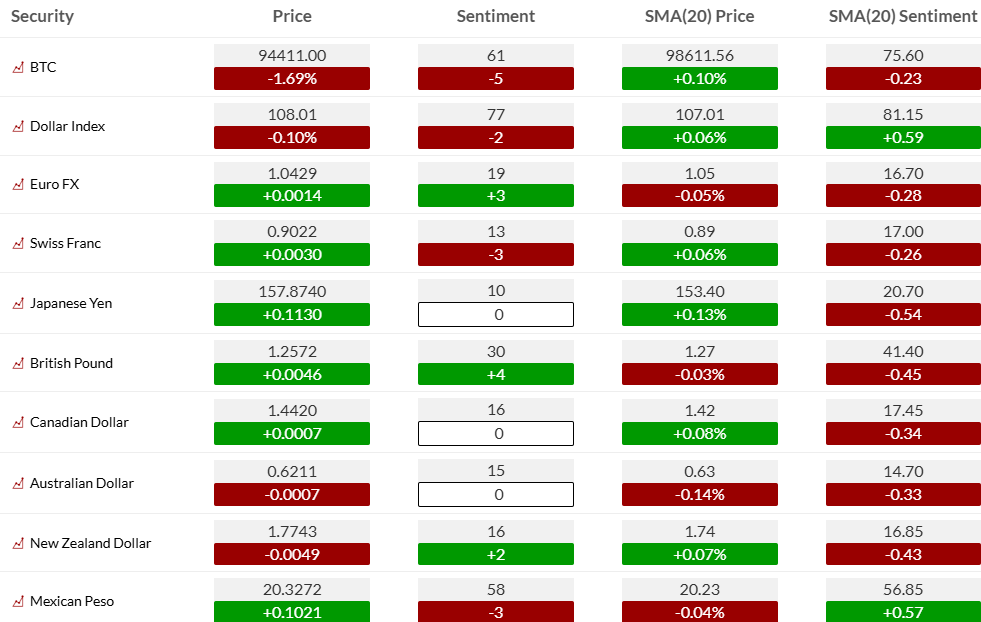

Currency Sentiment Overview

Currency sentiment highlights

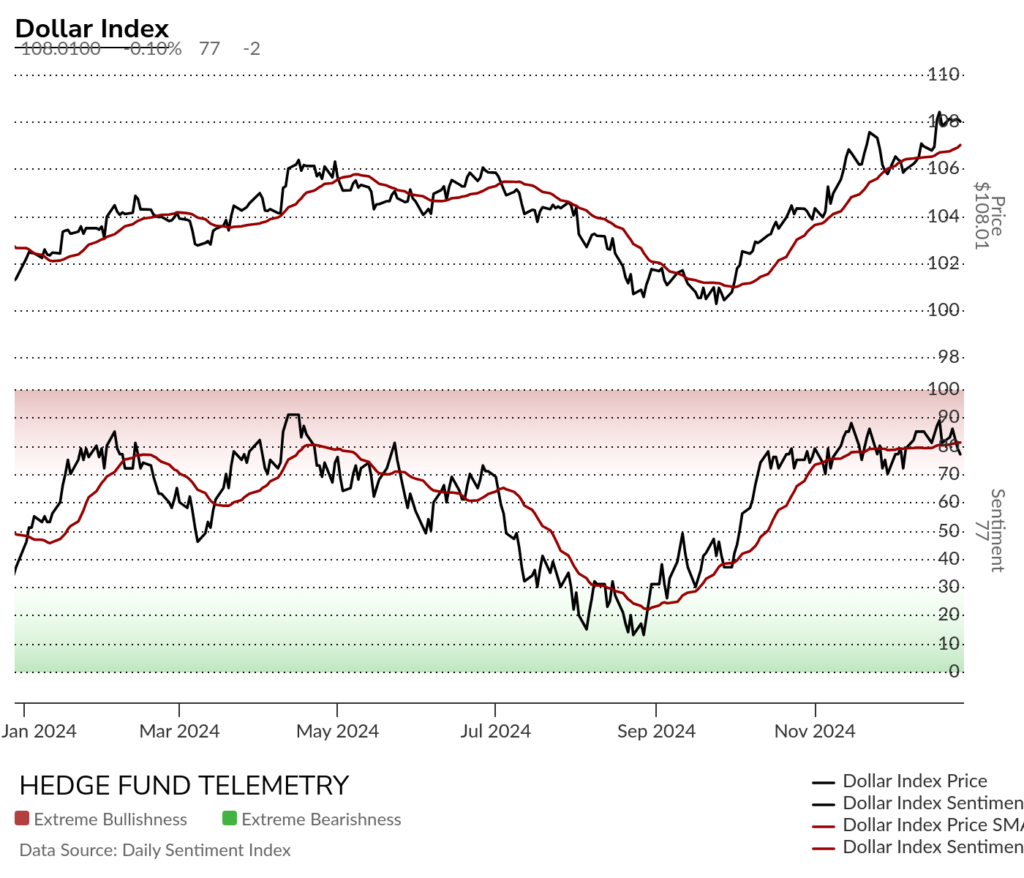

US Dollar Indexes

DXY US Dollar Index daily has consolidated after the recent Setup 9 while a pending Sequential on day 10 remains some thing to watch

DXY US Dollar Index weekly has risk of stronger dollar with new Sequential on week 2 of 13

Bloomberg US Dollar Index daily in upside wave 5 of 5 with sell Setup 9 causing a bit of a pause with risk of new upside Sequential on day 2 of 13.

Bloomberg US Dollar Index weekly has risk of moving higher with Sequential on week 2 of 13

US Dollar bullish sentiment consolidating after moving into the elevated/extreme zone.

US Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Risk of Dollar strength continuing with Sequential on week 2 of 13

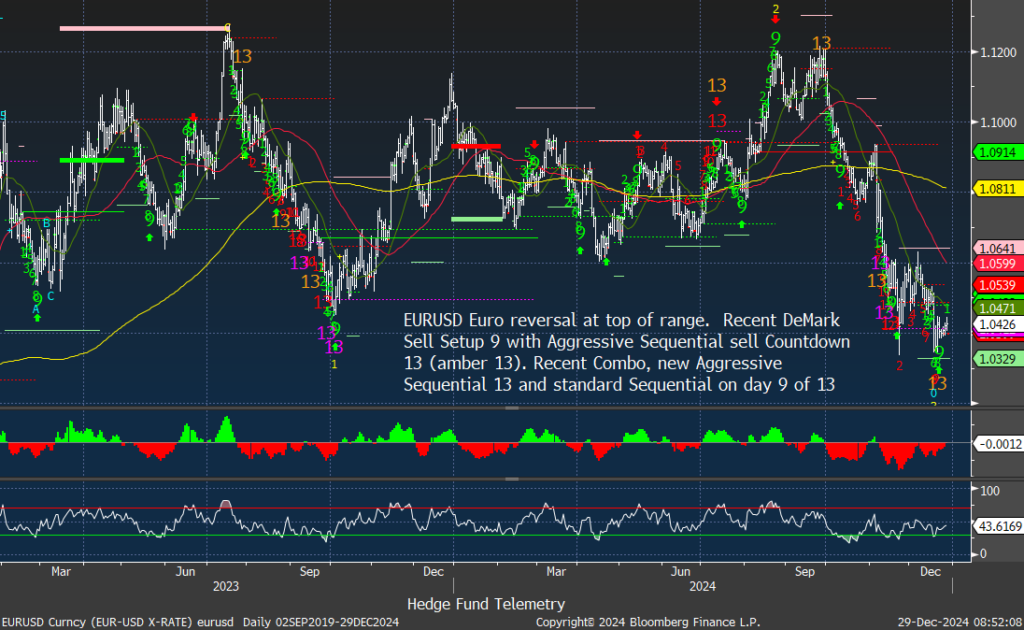

Major USD Crosses

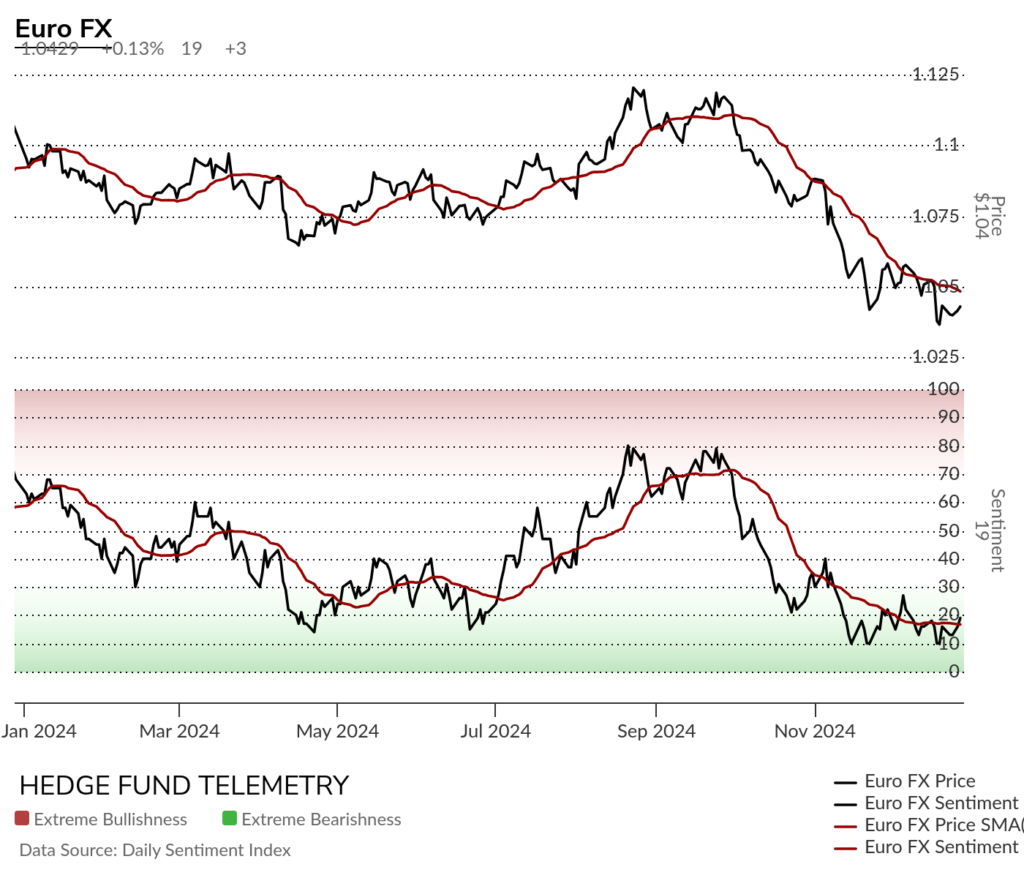

EURUSD Euro / US Dollar has been making new 2024 lows

Euro bullish sentiment has been oversold with slight turn on Friday

Euro Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Risk lower with Sequential on week 2 of 13

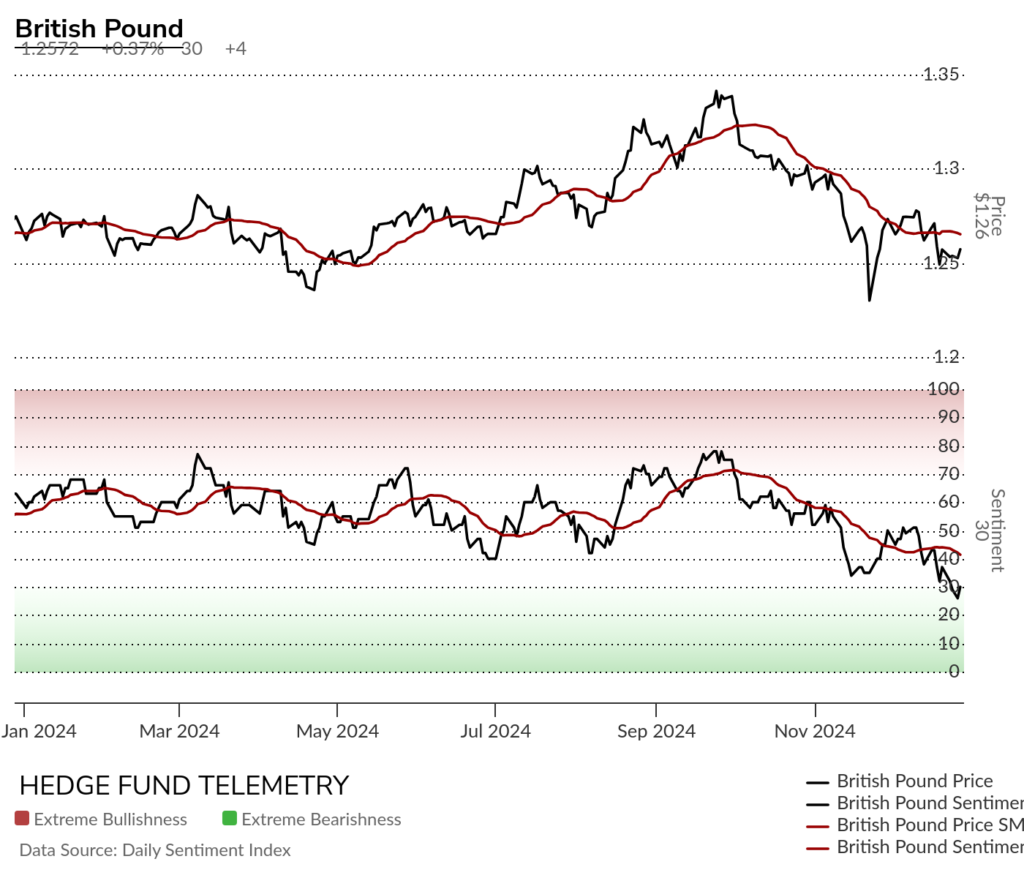

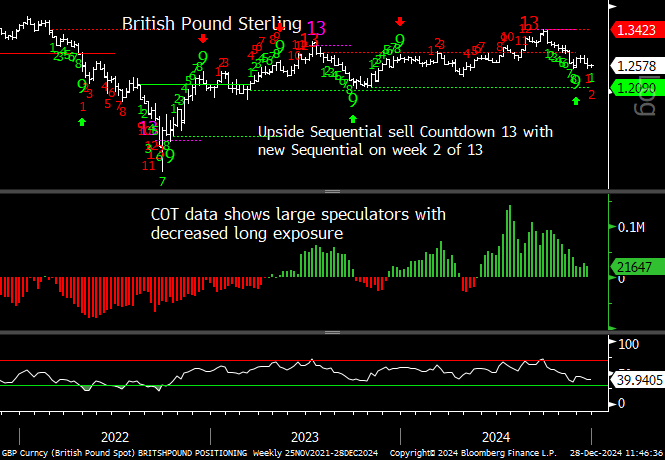

GBPUSD British Pound Sterling / US Dollar trying to hold 1.25 with a Combo and Aggressive Sequential 13 (amber 13) and Setup 9.

British Pound Sterling bullish sentiment has been making new 2024 lows

British Pound Sterling Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Risk of continuation with Sequential on week 2 of 13. TDST support at 1.2090

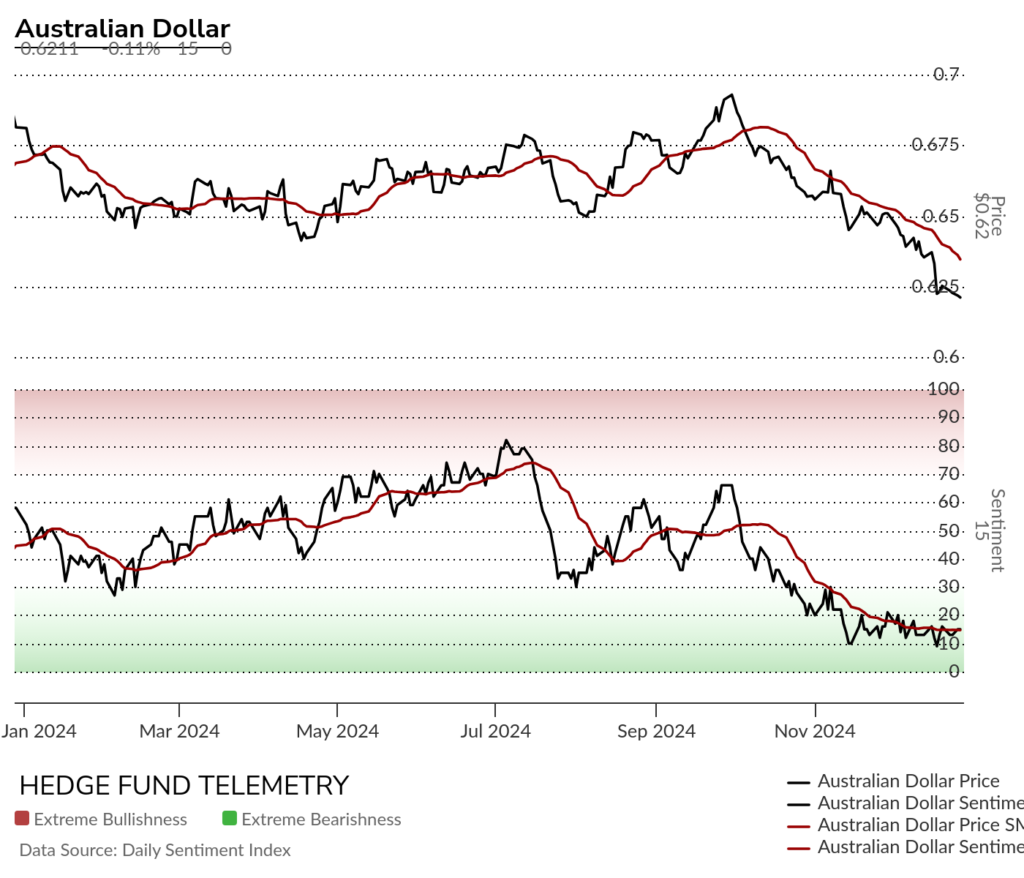

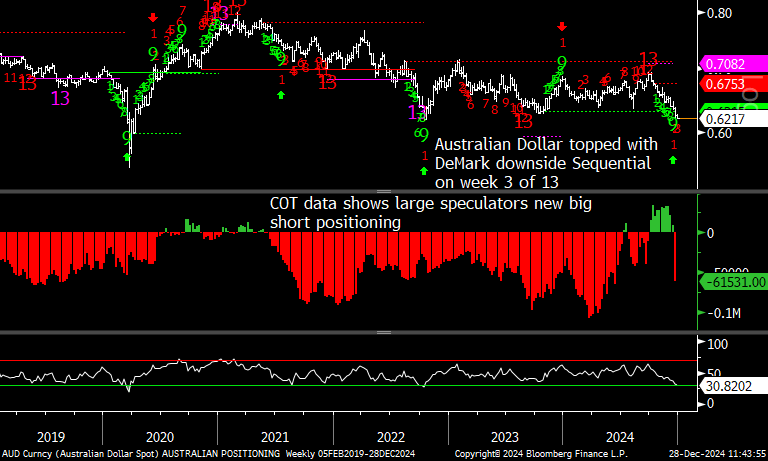

AUDUSD Australian Dollar / US Dollar with Sequential on day 5 of 13 continuing trend

Australian Dollar bullish sentiment remains under pressure

Australian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Risk lower with Sequential on week 3 of 13

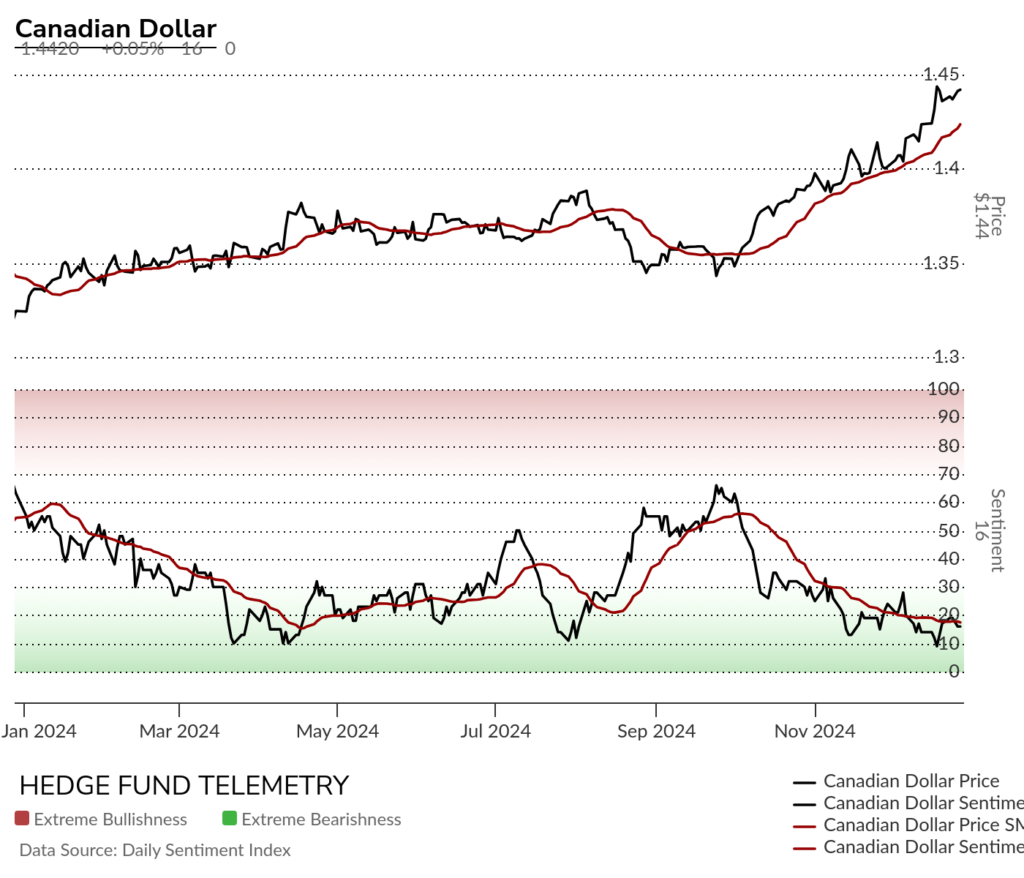

USDCAD US Dollar / Canadian Dollar is stretched with new Sequential on day 6 of 13 at the wave 5 price objective

Canadian Dollar bullish sentiment remains under pressure.

Canadian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Canadian Dollar is stretched on the downside (inverse chart)

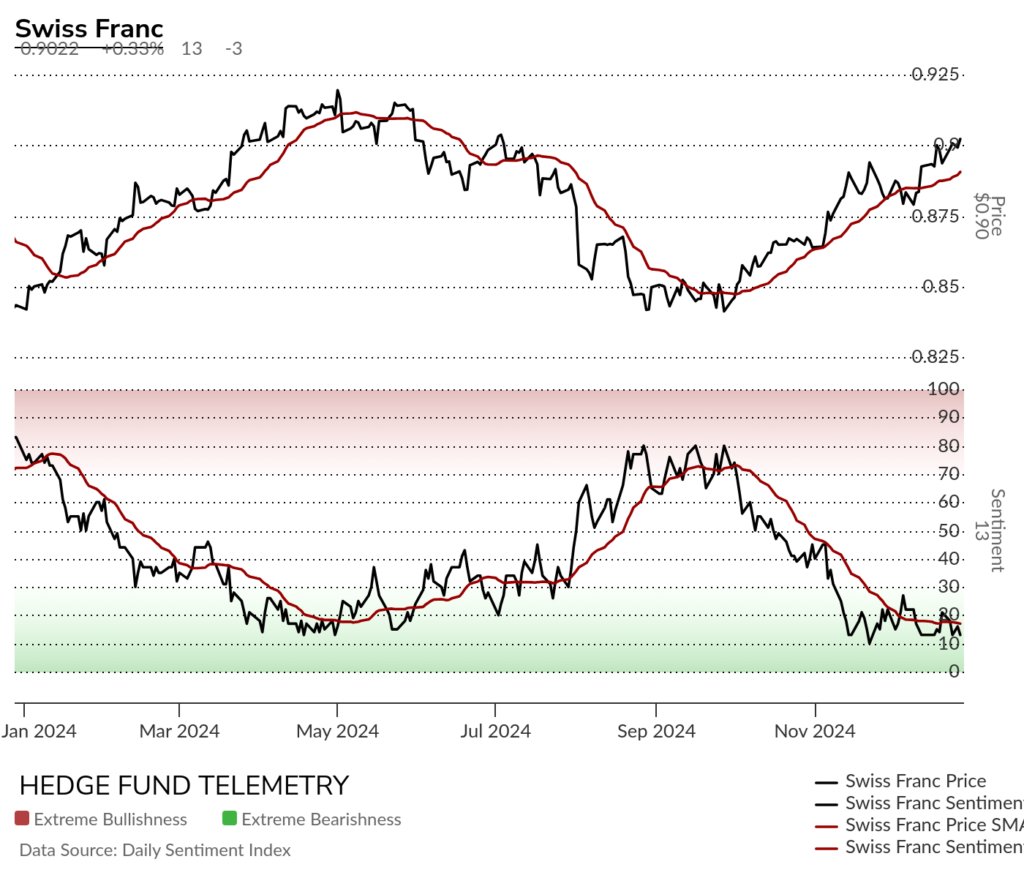

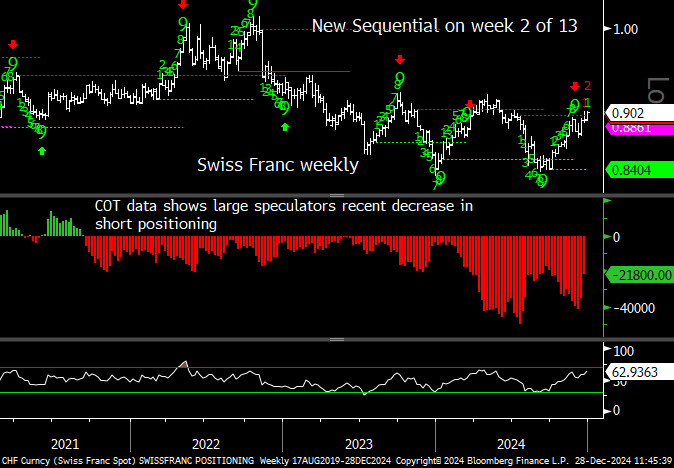

USDCHF US Dollar / Swiss Franc nas new Sequential sell Countdown 13

Swiss Franc bullish sentiment remains oversold and under pressure.

Swiss Franc Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Risk of continuation with new Sequential.

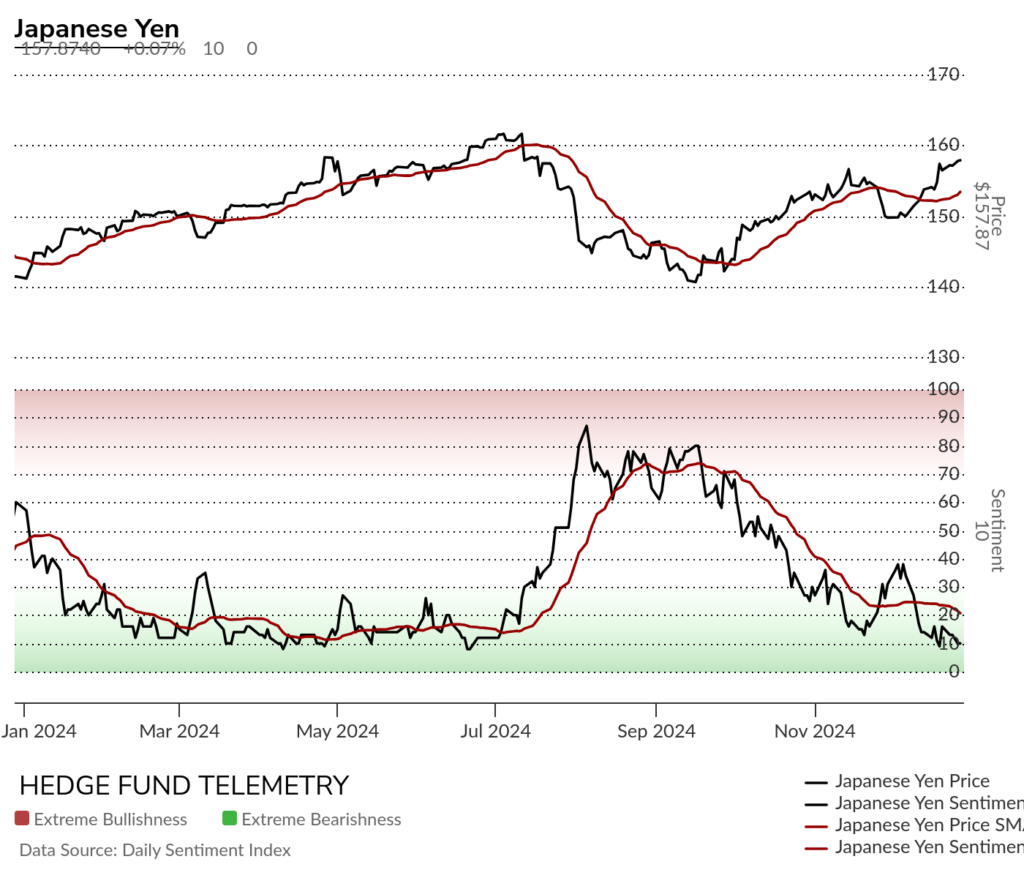

USDJPY Japanese Yen daily shows potential for more Yen weakness with Sequential on day 6 of 13

Japanese Yen bullish sentiment is oversold again at 10% and might stay depressed as it has done so often in the past.

Yen Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Sequential left pending on week 3 of 13.

Crypto

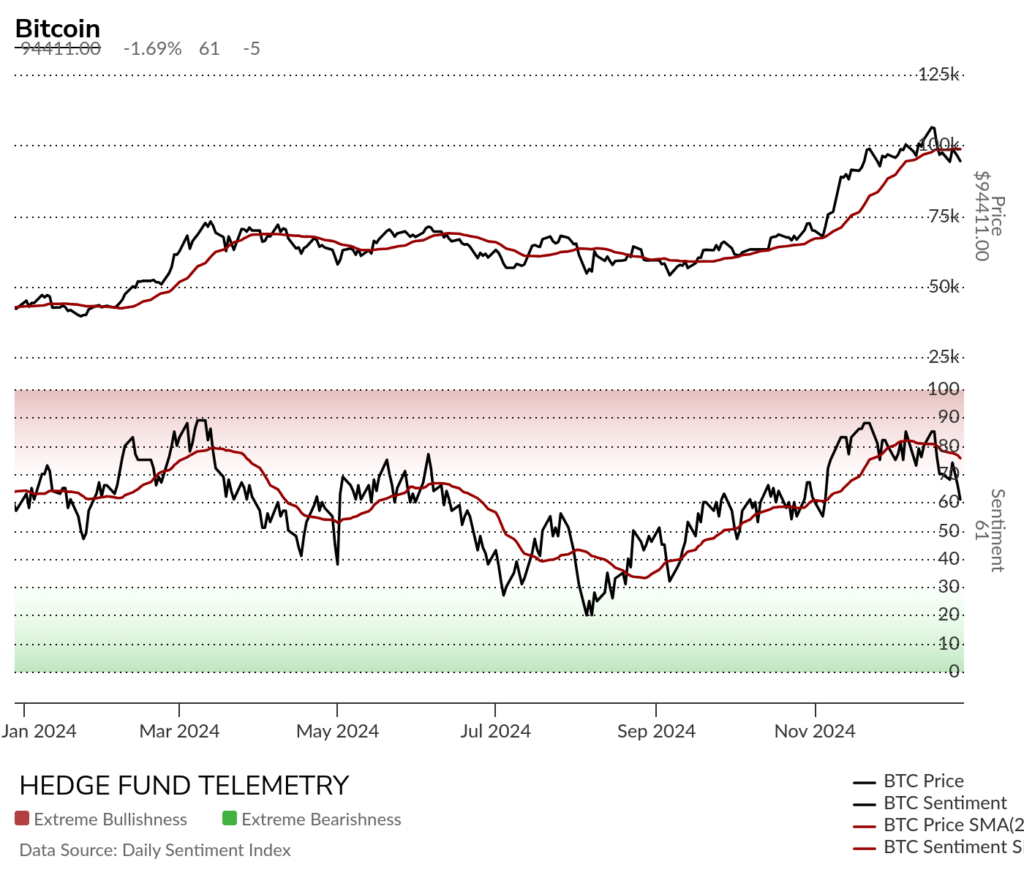

Bitcoin daily has consolidated after several Sell Countdown 13’s. Just a bit below the 50 day with 90k the ‘big round number’ support. Breaking that level has little support below until 200 day at 71k

Bitcoin bullish sentiment has been reversing lower after spending time in the extreme zone.

Ethereum reversed down recently and has support at 3000 near the TDST and flat 200 day. Breaking this support could see quick selling as it happened in August

Three major Yen crosses

Weak Yen continues vs crosses – less so with AUDJPY but more pronounced with EUR and GBP

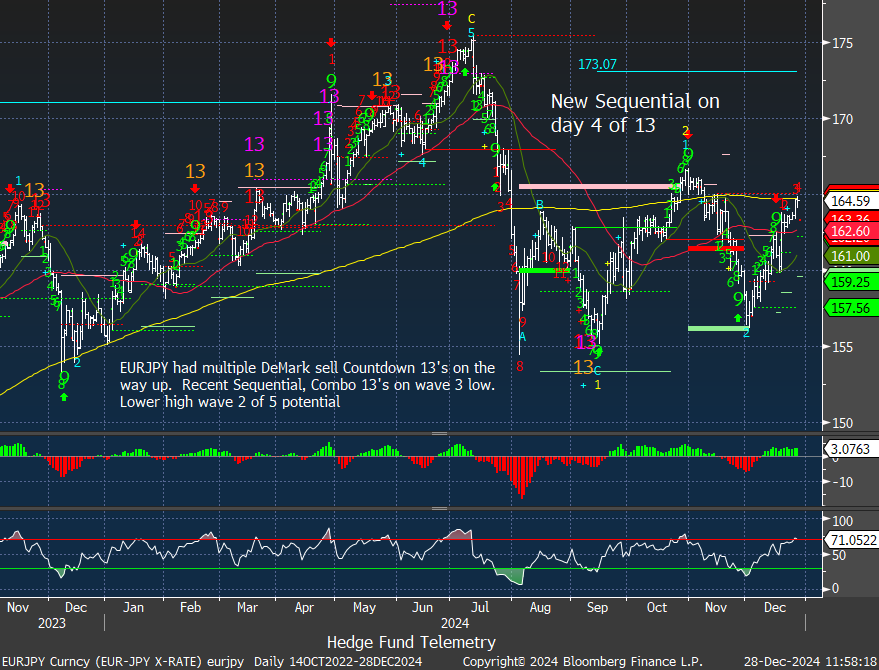

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen.

US Dollar vs Emerging Markets

USDBRL US Dollar / Brazilian Real still has the weak Real trend intact

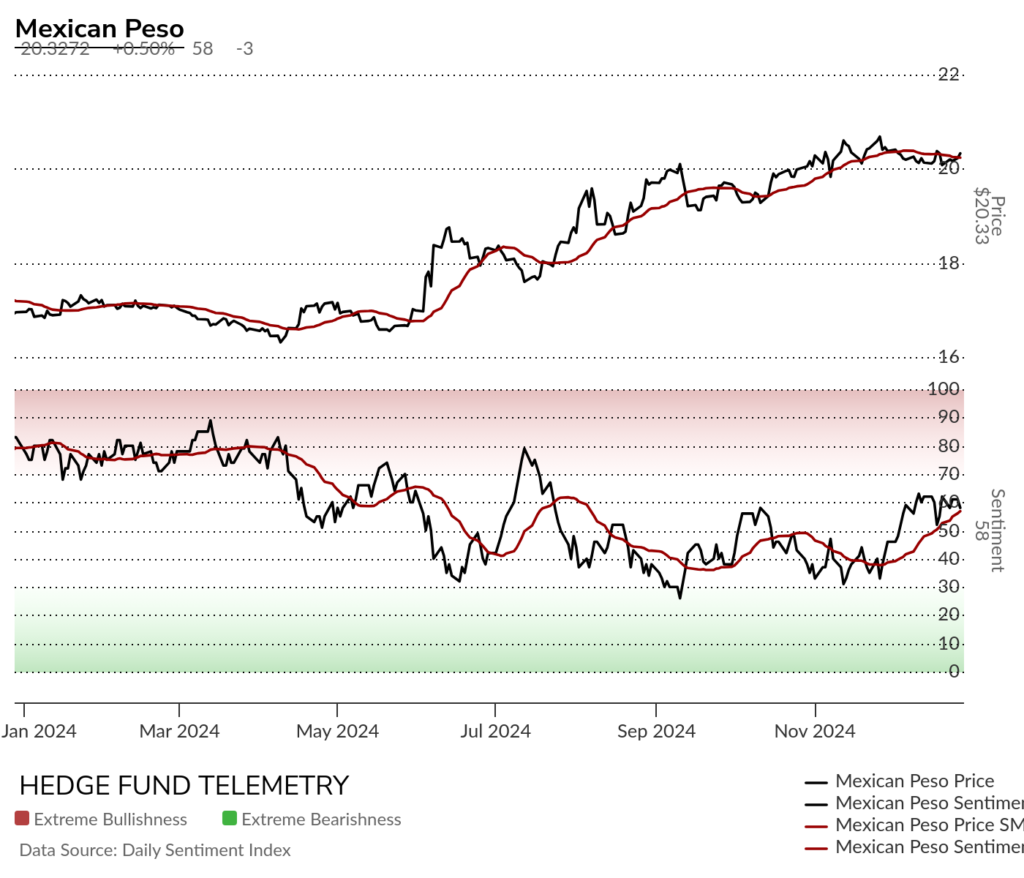

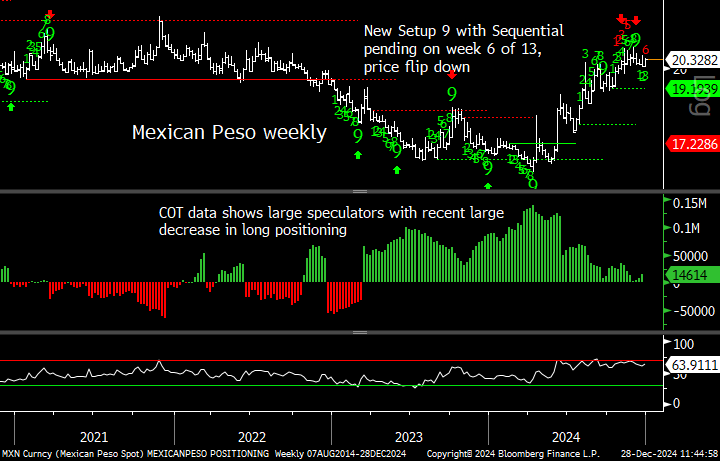

USDMXN US Dollar / Mexican Peso – sideways

Mexican Peso bullish sentiment has been improving but stalled

Mexican Peso Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

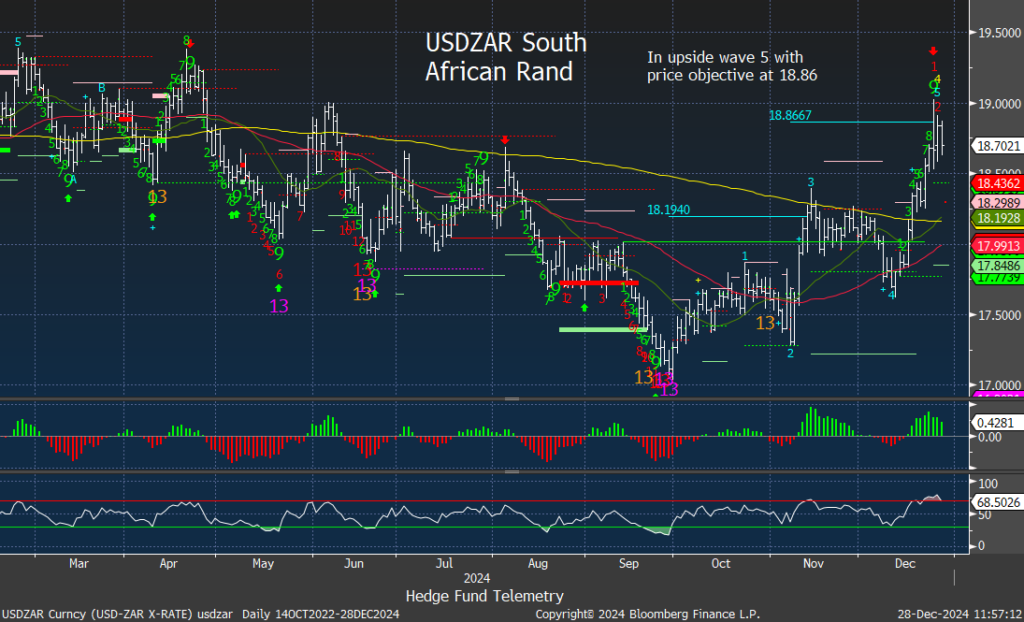

USDZAR US Dollar / South African Rand with sell Setup 9

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan) – nothing new

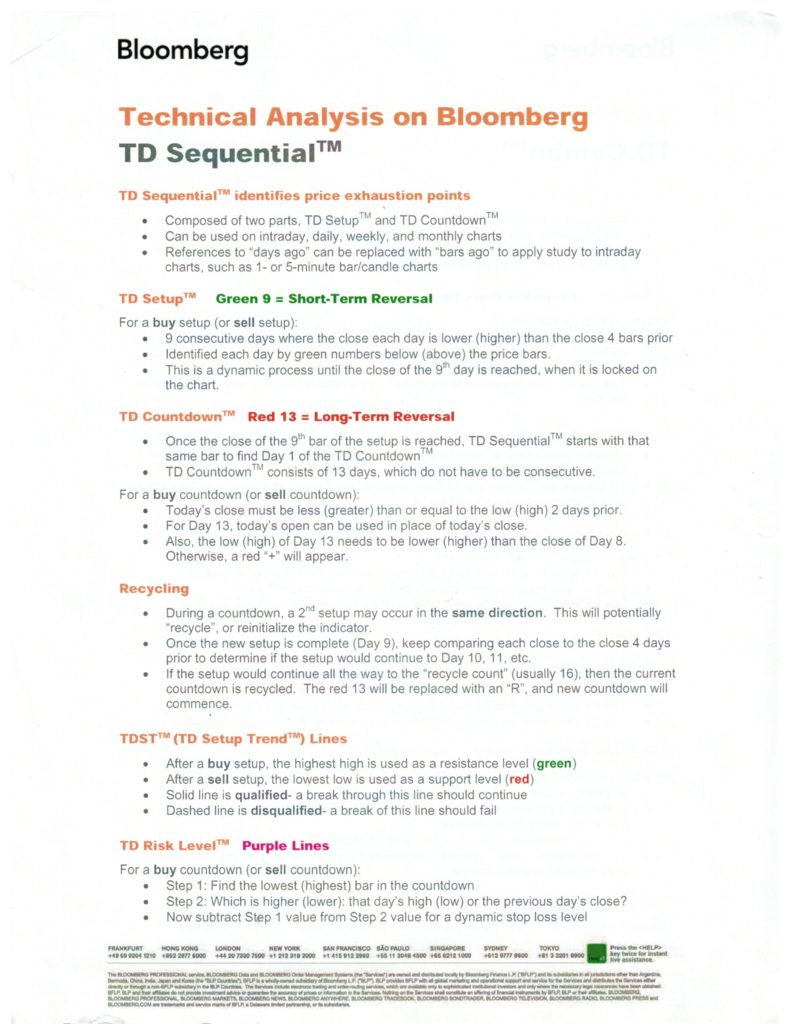

DeMark Sequential Basics from Bloomberg

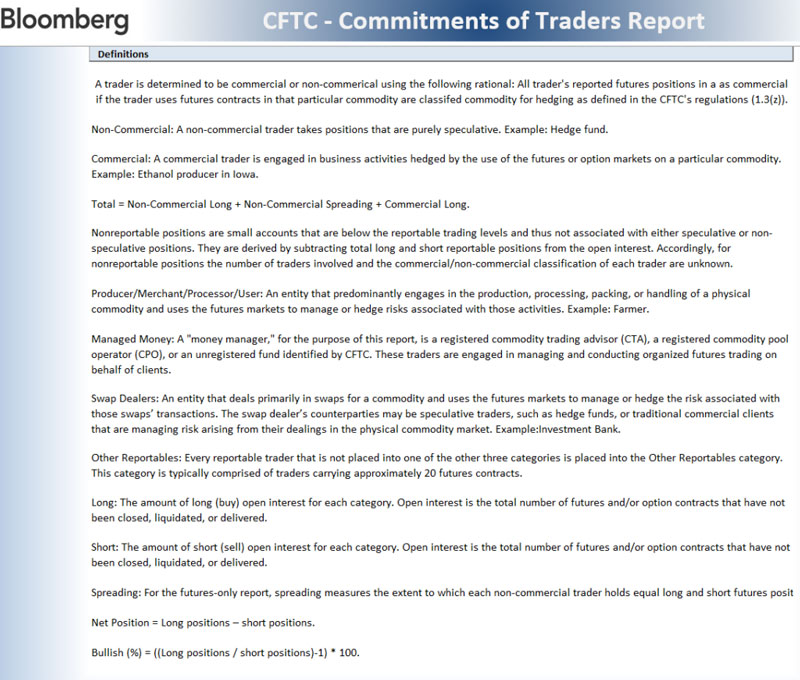

Detailed Commitment of Traders explanation