Highlights and themes

- Dollar strength has seen some moderate consolidation while sentiment remains elevated

- Crypto sentiment and price action remains overbought but no reversals to note

- Dollar crosses have bounced small

- Yen strength returned quietly

- Yen crosses have reversed and a few are not that far from the Yen carry trade unwind

Comments on charts. If you have questions or would like more context, please email.

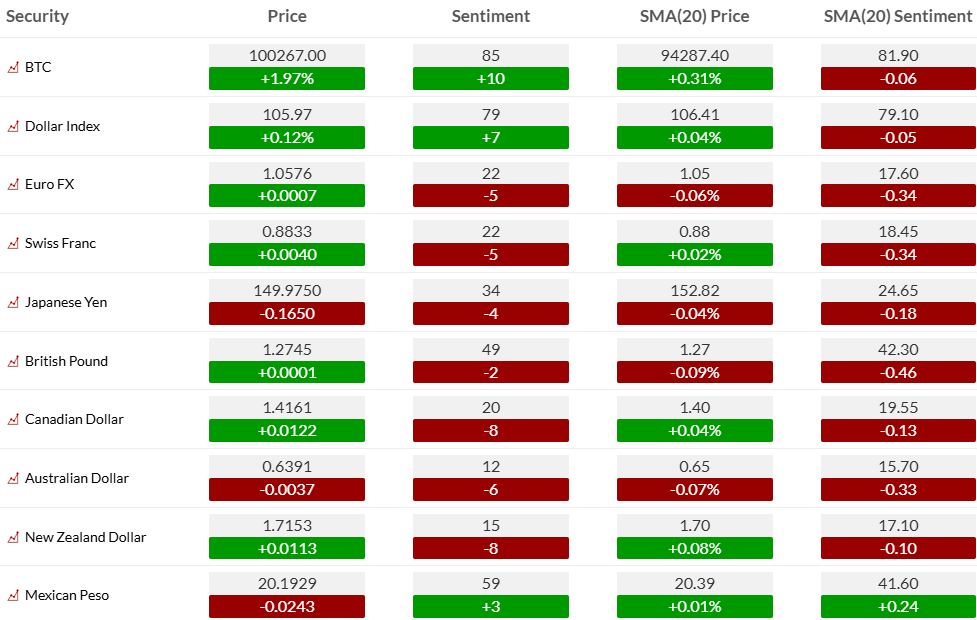

Currency Sentiment Overview

Currency sentiment highlights with both US Dollar and Bitcoin remaining exceptionally strong.

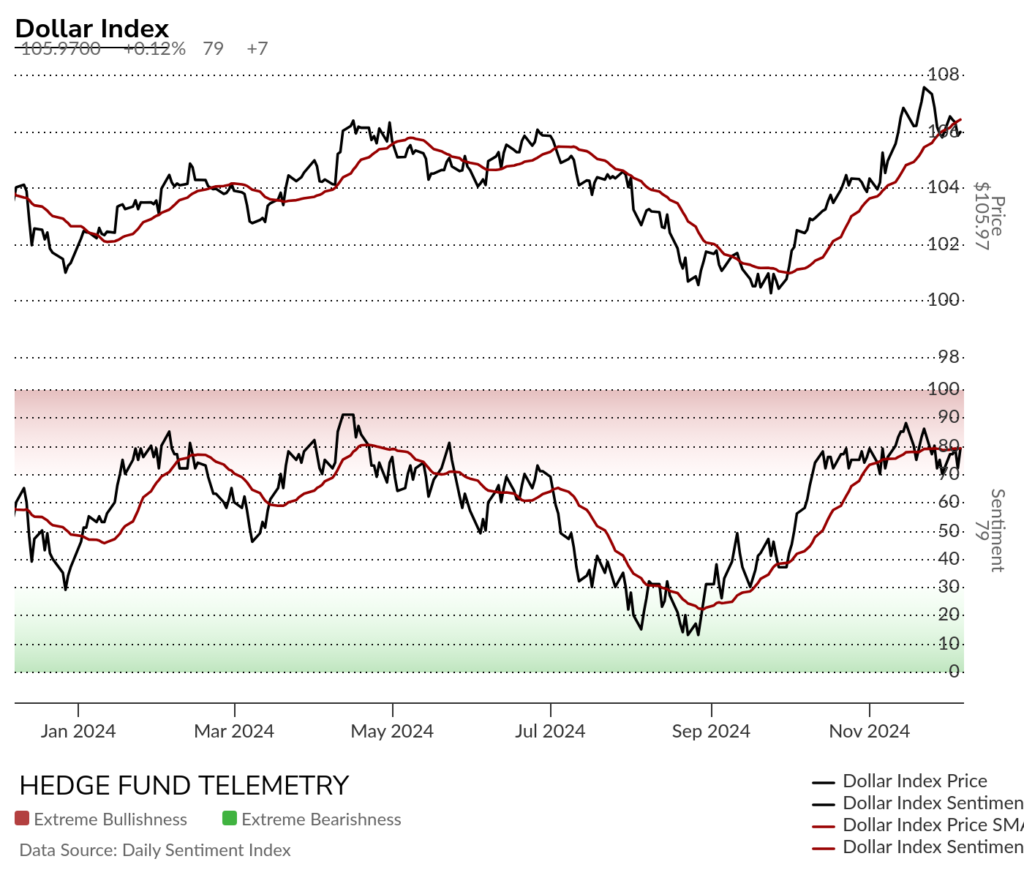

US Dollar Indexes

DXY US Dollar Index daily stalling with the recent DeMark Sequential and Combo sell Countdown 13s and sell Setup 9. A secondary sequence is pending on day 4 of 13 that should be watched. You’ll see it develop on First Call.

DXY US Dollar Index weekly with DeMark Sell Setup 9

Bloomberg US Dollar Index daily stalling after the 13’s

Bloomberg US Dollar Index weekly with sell Setup 9 which has seen reversals the last two times.

US Dollar bullish sentiment remains in the elevated/extreme zone.

Major USD Crosses

EURUSD Euro / US Dollar holding levels seen a year ago

Euro bullish sentiment has been oversold but lacking a solid turn so far

Euro Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

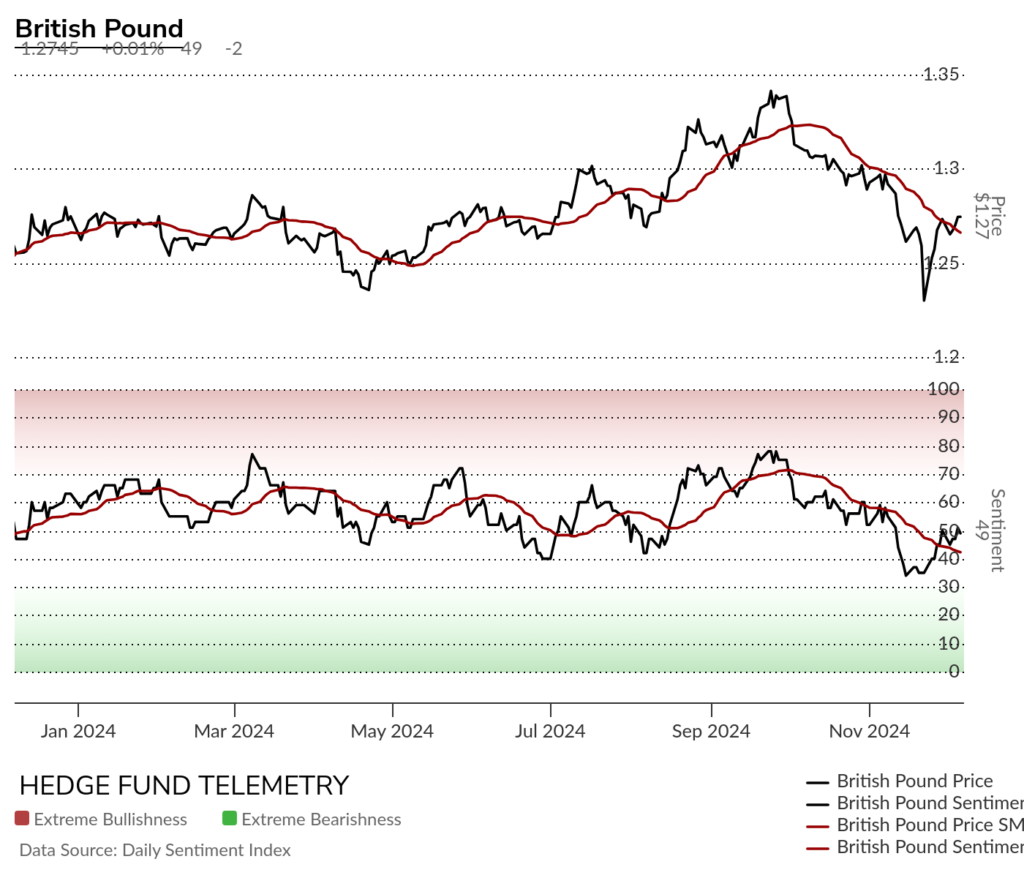

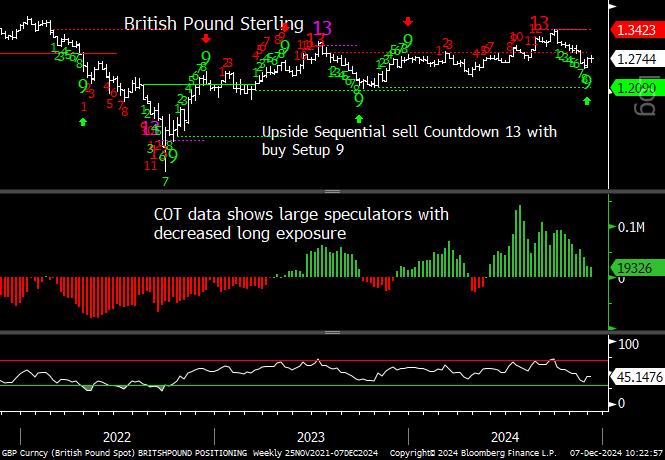

GBPUSD British Pound Sterling / US Dollar had some 13’s the got a bounce but this qualified another lower high wave 4 of 5 bounce.

British Pound Sterling bullish sentiment holding recent lows

British Pound Sterling Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

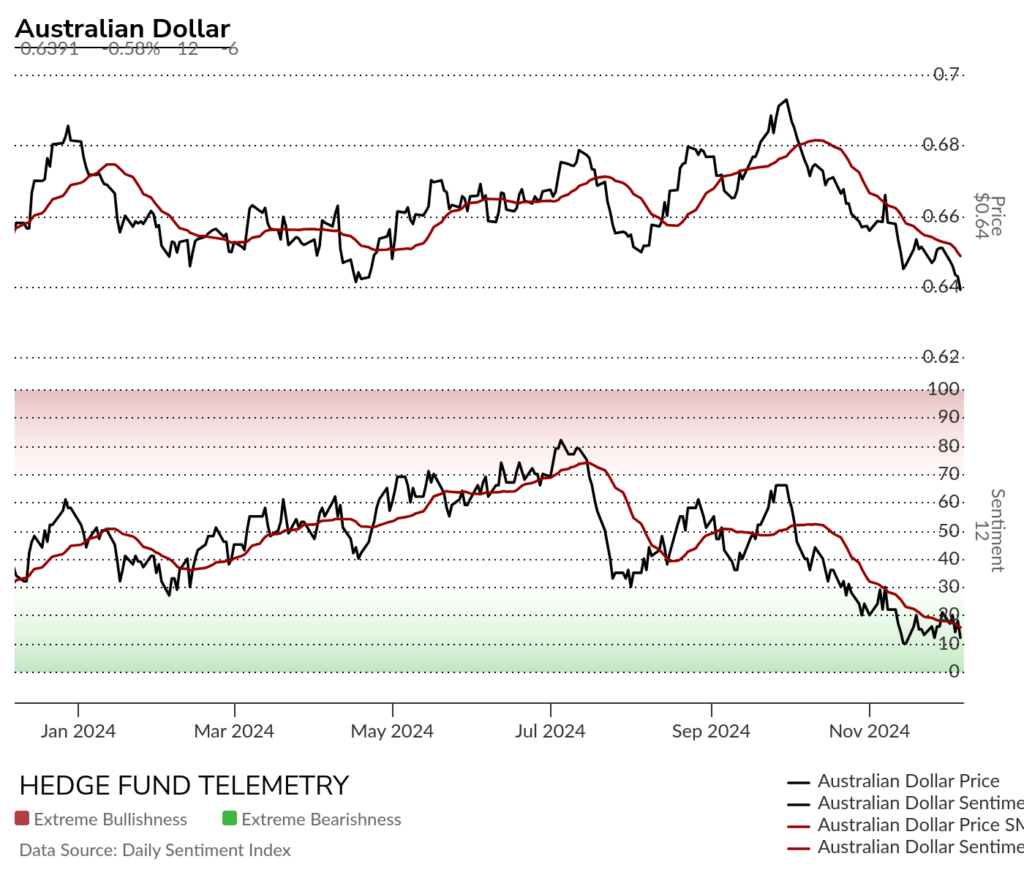

AUDUSD Australian Dollar / US Dollar still very weak making a new closing low

Australian Dollar bullish sentiment remains under pressure

Australian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

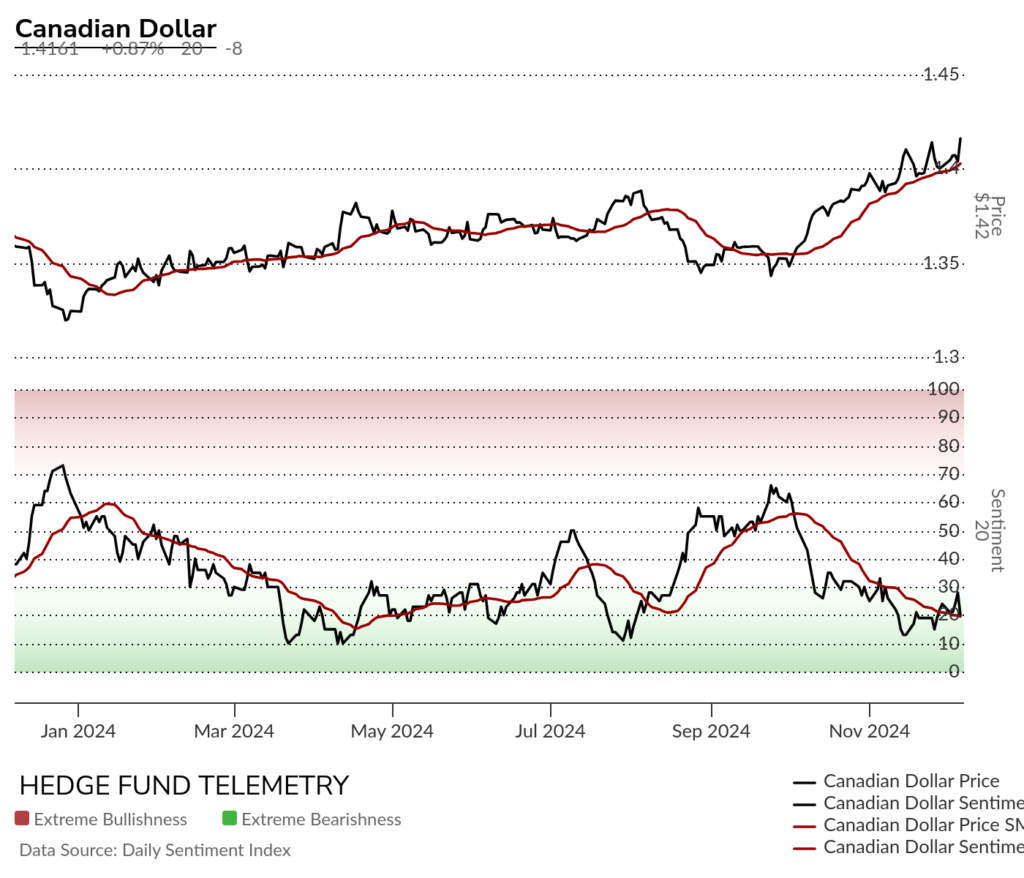

USDCAD US Dollar / Canadian Dollar with a big move lower for Canadian Dollar last Friday

Canadian Dollar bullish sentiment remain under pressure

Canadian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. New weekly Sequential sell Countdown 13

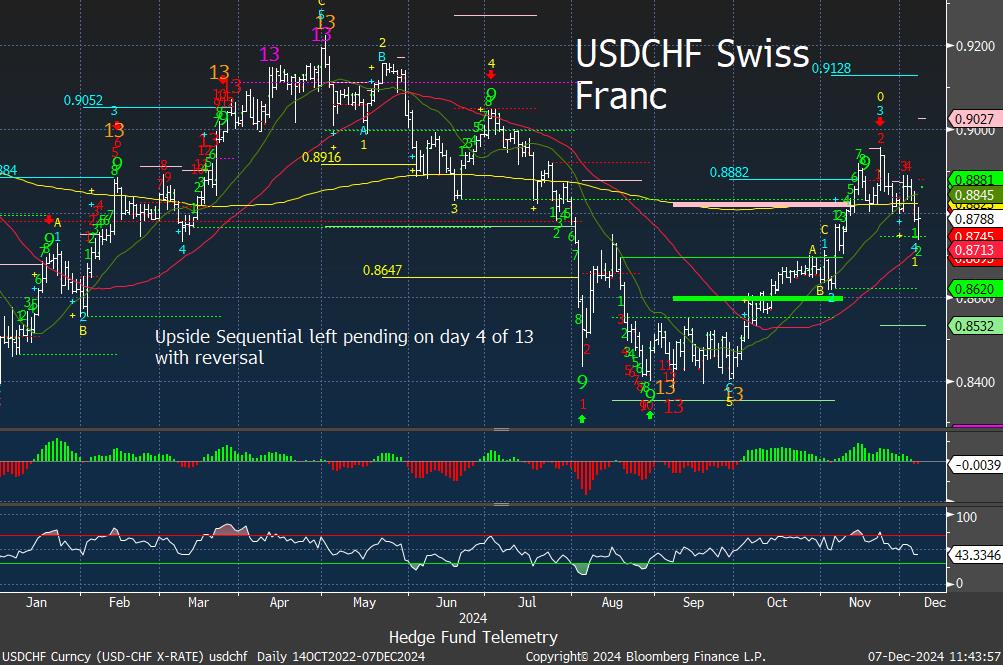

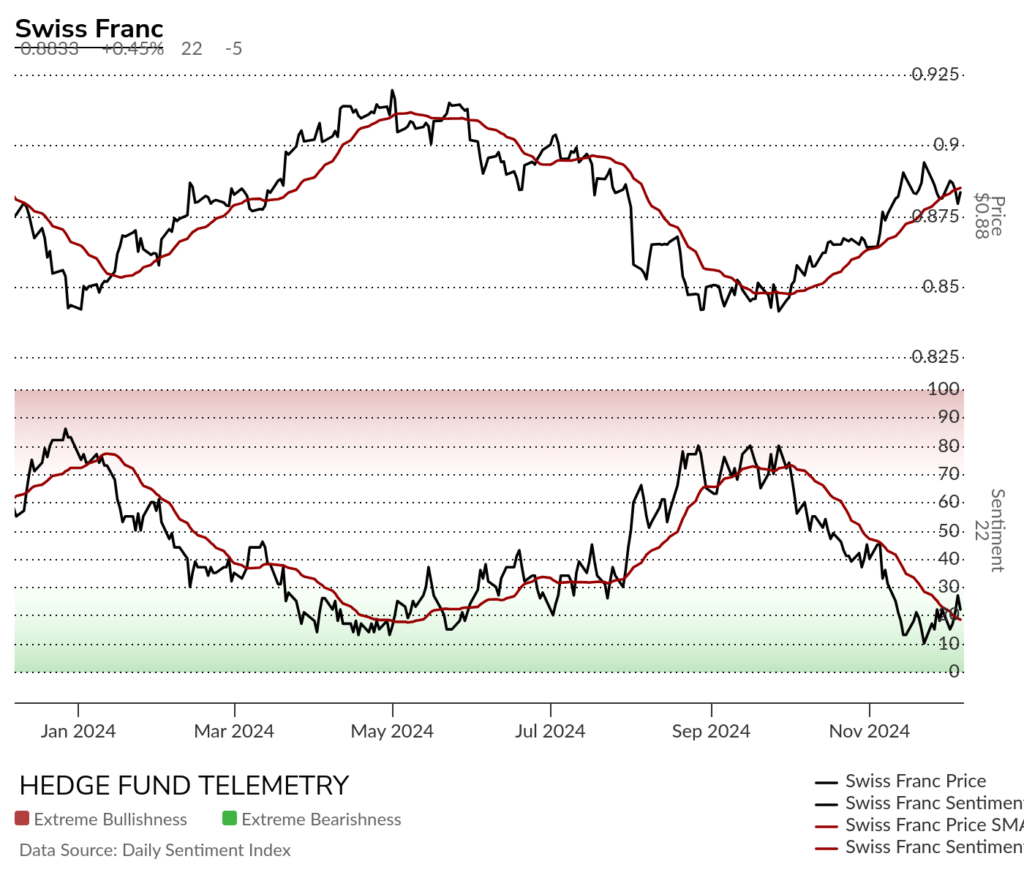

USDCHF US Dollar / Swiss Franc trying to reverse however watch the upside Sequential pending

Swiss Franc bullish sentiment remains under pressure

Swiss Franc Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Another 9, which has been good at inflection points.

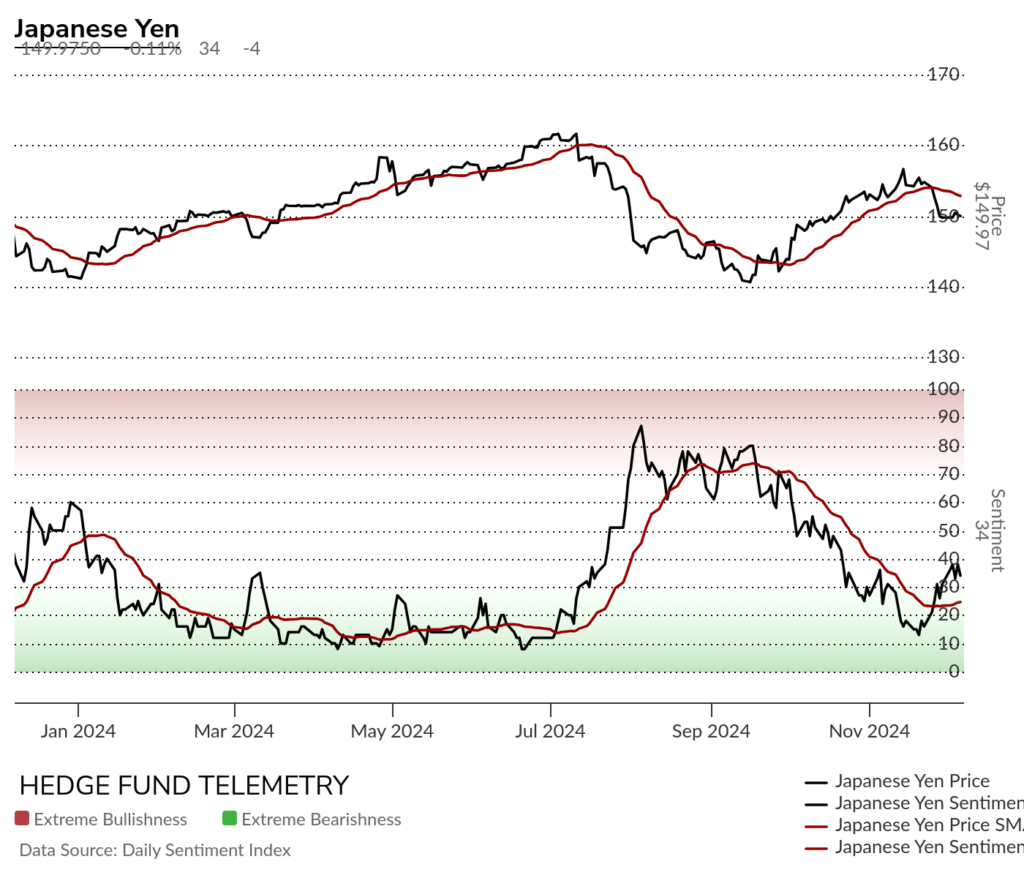

USDJPY Japanese Yen daily well off the recent highs and could move to 145.57 the DeMark Propulsion target that is qualified and confirmed.

Japanese Yen bullish sentiment has started to turn again

Yen Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Watch the downside Sequential now on week 3 of 13

Crypto

Bitcoin daily has moderated after the election surge with new highs and Sequential on day 9 of 13. A new Aggressive Sequential 13 (amber 13) just qualified and these work well in volatile markets.

Bitcoin bullish sentiment is in the extreme zone at 85%.

Ethereum is stretched like all crypto but have to watch the secondary Sequential on day 6 of 13 balanced with the recent Combo 13’s

Three major Yen crosses

All have reversed from late October but not below the Yen carry trade blow up in early August.

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

USDBRL US Dollar / Brazilian Real with enough evidence to call for a reversal.

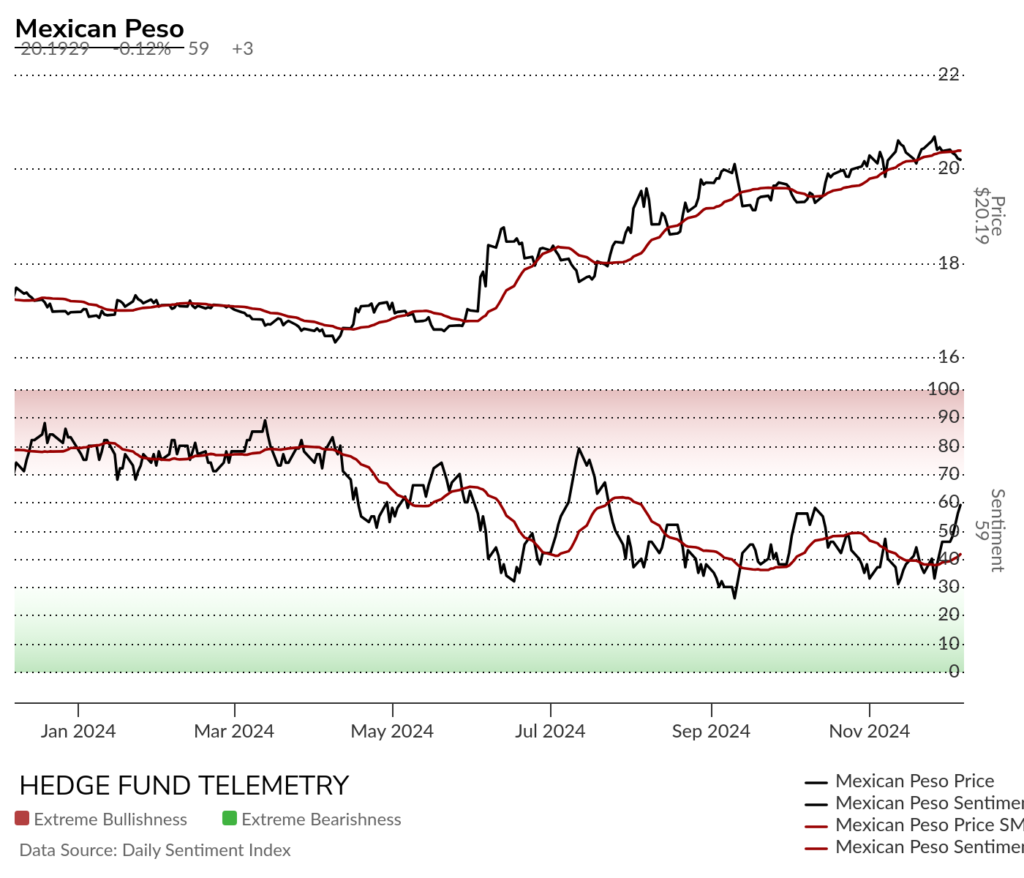

USDMXN US Dollar / Mexican Peso possibly turning here?

Mexican Peso bullish sentiment with a decent sized reversal last week

Mexican Peso Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDZAR US Dollar / South African Rand stalling

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan) back at resistance

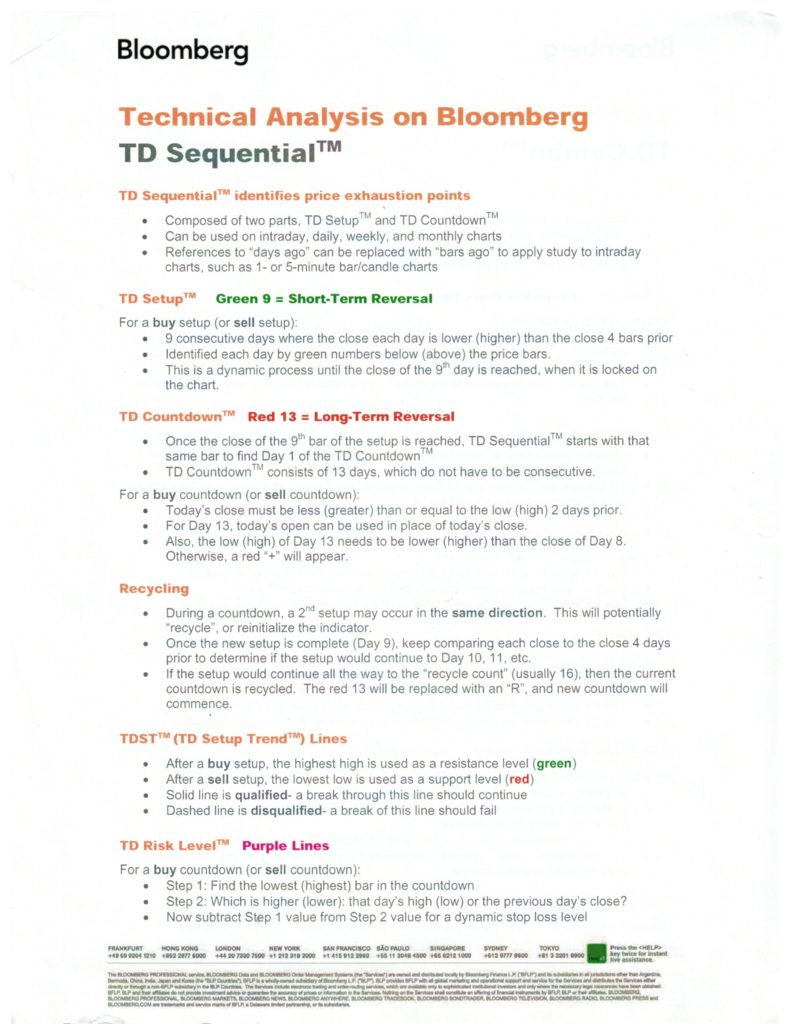

DeMark Sequential Basics from Bloomberg

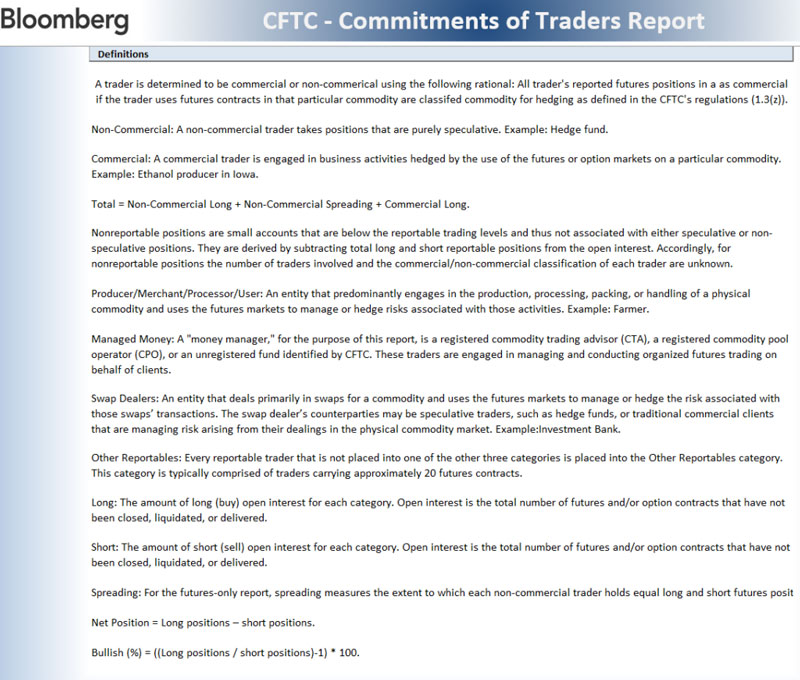

Detailed Commitment of Traders explanation