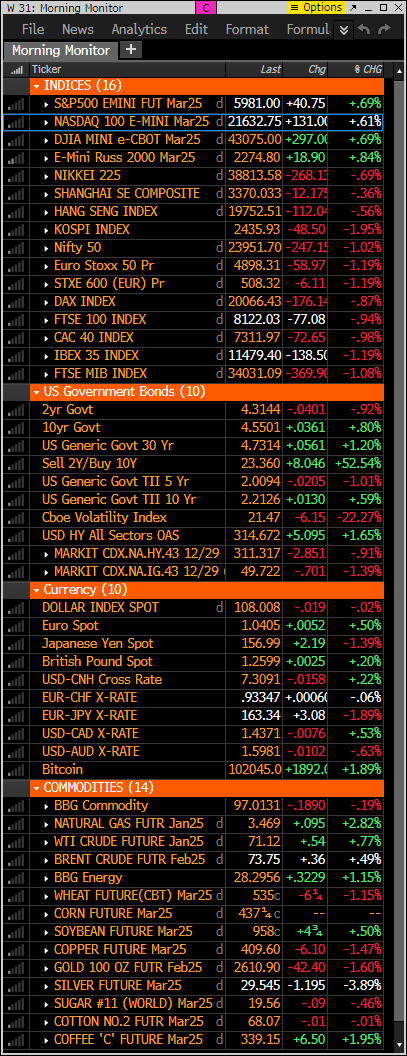

- S&P futures up 0.6% and Nasdaq futures up 0.5% in Thursday morning trading off earlier highs. Comes after US equities sold off sharply on Wednesday with the S&P suffering its worst performance since early August (VIX/yen event) and its second-biggest decline of 2024. Dow fell for a tenth straight session and R2K experienced its worst performance since June of 2022. Treasuries mixed with the curve steepening following a big backup in rates on Wednesday that saw 10-year yields close above 4.5% for first time since May. Dollar index down 0.1%. Yen weakness the story in FX. Gold down 1.6%. Bitcoin up 2%. WTI crude up 0.7%.

- I’ll have a technical damage assessment in the next note.

- Market trying to bounce following a big Thursday selloff chalked up to the hawkish guidance that accompanied the Fed’s 25 bps rate cut. Headlines out of Washington did not help sentiment either as the risk of a government shutdown later this week ratcheted higher. Breadth deterioration, upward pressure on rates, dollar strength, VIX spike, stretched valuations, tariff worries, legislative complications and G7 (and beyond) political uncertainty the go-to bearish talking points. Bulls still focused on favorable seasonality, strong inflows, soft-/no-landing macro narrative traction, LDD% S&P 500 EPS growth expectations and Trump administration deregulatory push.

- Weekly initial jobless claims came in at 220K, below consensus and a notable slide from prior jump to 242K. Continuing claims softer as well. Final Q3 GDP reading moved up to 3.1% vs 2.8% in the prior estimate; uptick tabbed to revisions in consumer spending and exports. December Philadelphia Fed manufacturing index printed at (16.4), well below forecasts for +3.5, as new orders and shipments turned negative. November existing home sales report out later this morning. BoE left rates unchanged at today’s meeting. Follows BoJ decision to leave rates unchanged (Ueda’s comments leaned dovish), a 25 bps rate cut out of the Philippines and hawkish 25 bps rate cut from Sweden’s Riksbank. Friday brings the personal spending and income report, which includes PCE inflation, along with final University of Michigan consumer sentiment (and inflation expectations) for December.

- MU under pressure on much weaker than expected Feb Q guidance that management chalked up to inventory digestion in consumer markets, NAND oversupply and demand slowdown in data center SSDs. However, takeaways positive on HBM. ACN a standout on higher FY25 organic growth guidance. LEN also weak on soft fiscal Q4 results and guidance with the company flagging affordability limitations from higher interest rates. DRI up big on better comps with Olive Garden a bright spot. FDS beat and reaffirmed FY guidance. CAG cut FY EPS guide on inflation and FX. KMX up on better units and EPS. LW another big decliner after it missed and cut guidance, noting higher manufacturing costs and softer volumes. FDX and NKE report after the close today. Outside of earnings, AAPL reportedly in talks with Tencent and ByteDance to integrate their AI models into iPhones sold in China. VRTX down on disappointing trial results. Positive story for GLNG.

- Key Upgrades/Downgrades: Western Digital downgraded to hold from buy at Benchmark Company LLC. Micron Technology downgraded to neutral from buy at BofA. Affirm Holdings upgraded to buy from hold at Jefferies. Block, Inc. upgraded to outperform from perform at Oppenheimer. Piper Sandler initiates oil drillers BKR, FTI, HAL, TS overweight, NOV, SLB, WFRD neutral. RBC Capital Markets upgrades HXL, RTX; downgrades GD, VVX. Restoration Hardware upgraded to outperform from market perform at Telsey Advisory Group. Palantir Technologies initiated neutral at UBS. Oklo, Inc. initiated outperform at Wedbush Securities. RBLX/ABNB/ETSY: hearing uptick in weekly Yip data

market snapshot

economic reports today – strong economy

premarket trading

Watch the VWAP levels after the open if they can hold or break.

US MARKET SENTIMENT

S&P and Nasdaq bullish sentiment fell very hard yesterday. Both are below the 20 day moving average of bullish sentiment. A breakdown under 50% would add to the conviction of a deeper move lower.

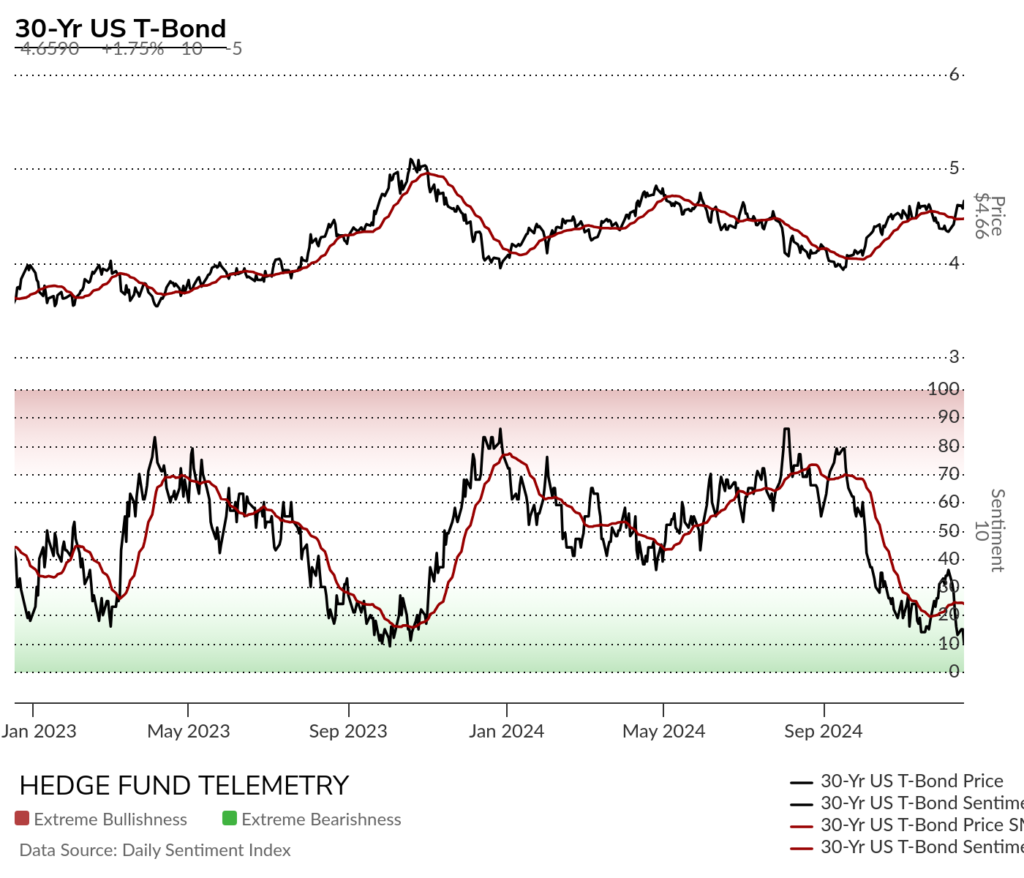

Bond bullish sentiment fell hard again and remains in the deep oversold zone. In September 2023 it hit 9%.

Currency bullish sentiment highlighted with US Dollar sentiment in the extreme zone. Bitcoin sentiment broke below the 20 day moving average of bullish sentiment. See chart below

Commodity bullish sentiment with metals in focus breaking down hard.

Gold bullish sentiment in the last few months has turned volatile after steady move in elevated/extreme zone.

US MARKETS

S&P futures 60-minute tactical time frame broke down hard and is trying to bounce. Setup on hour bar 7 of 9.

The 240 minute chart shows the 6125 TDST support break that held 3x. To qualify the lower high corrective bounce wave 4 of 5 a 13 bar closing high is required.

S&P futures daily sideways action broke down below both the 20 day and 50 day.

Nasdaq 100 60-minute tactical time frame moved lower in wave 3 of 5. The bounce qualified a potential lower high wave 4 of 5 bounce. Setup on hour bar 8 of 9. To qualify a wave 4 a 13 bar closing high is required which was met. Breaking yesterday’s wave 3 low would qualify downside wave 5 with a potential wave 5 price objective of 20,860

The 240 minute chart shows a first downside wave 1 of 5. To qualify the lower high corrective bounce wave 2 of 5 an 8 bar closing high is required.

Nasdaq 100 futures daily fell hard but held the 50 day. A break of yesterday’s lows is critical.

Extra charts we’re watching

AMZN was on the DeMark Observations screen a couple of days ago. Big price flip down. Depending on the bounce I might add this as a new short idea.

Gold futures has the DeMark Sequential on day 12 of 13 using the default version. Below I have the 8 vs 5 elective setting which is sometimes better to use when a true bottom or new low has not occured.

This is Gold futures with the elective 8 vs 5 setting which shows the Sequential on day 9 of 13. The default Sequential Countdown 13 requires the 13th bar must be greater/less than or equal to the close of the 8th bar. Because the Sequential can accrue in a sideways market, requiring the 13 to exceed the 8bar’s close, be it on the upside or downside, assures the there is some trend intact and provides a higher level of accuracy as the chart reaches a completion. The elective Sequential Countdown 8 vs 5 deferral rule is designed to ensure that the body of the Countdown phase is properly configured. The 8 vs 5 elective affords greater comfort that the trend remains intact. In summary: having the 8th bar over the 5th bar is more conservative for an exhaustion signal. Most of the time the 8th bar is higher but when it’s not the Sequential has been sideways in a range. This makes it clearer that the upper end of the range is exhausted.

US Dollar Index daily moved higher yesterday with the Sequential in progress on day 10 of 13. Upside wave 5 is qualified with a potential upside price objective of 111.98

US 10-Year Yield spiked significantly and is higher again this morning with Setup on day 8 of 9. In upside wave 5 now with a wave 5 price objective of 4.96%. Not sure it gets there with Setup 9 pending.

Bitcoin Daily did get the price flip down but remains in this trend channel. A break of 9000 is probably where people could get worried. A “price flip” is defined as a contra-trend move identified by a close that is higher/lower than the close four price bars earlier.

DeMark Observations – Euro Stoxx 600