TOP EVENTS AND CATALYSTS

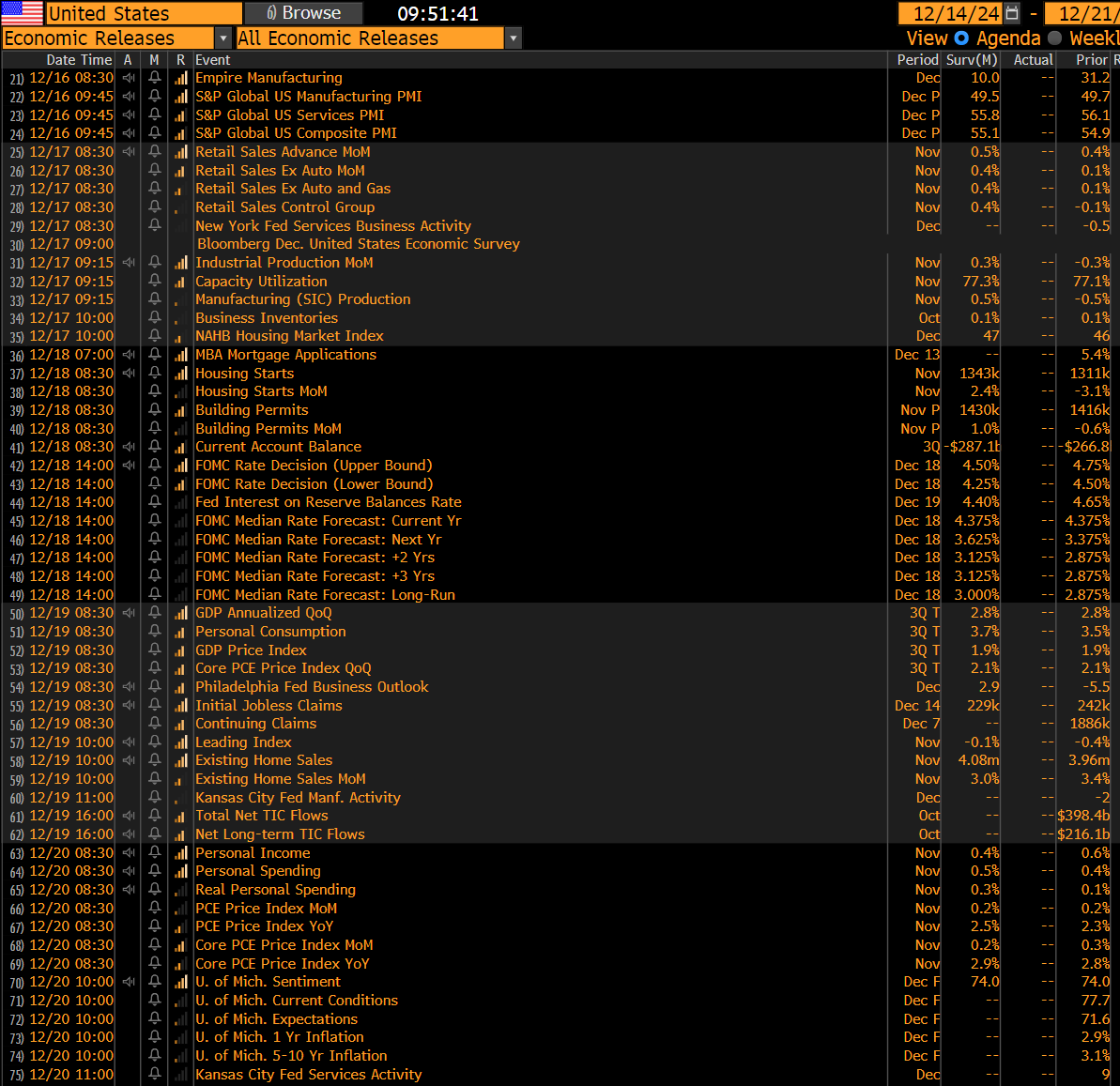

The main macro events this week include China’s November industrial production/retail sales on Sunday night, the flash PMIs for December on Monday, US Retail Sales on Tuesday, the FOMC decision Wednesday; a 25bps rate cut is widely expected, but the 2025 dot likely gets taken up ~30bps while Powell could signal that rates will stay on hold at the January meeting, the BOJ decision Wednesday night; rates are expected to stay unchanged, Putin’s annual press conference Thursday morning, the BOE decision Thursday morning; rates are expected to stay unchanged, and the US PCE for November on Friday; the core PCE is seen ticking up to +2.9% vs. +2.8% in October while headline accelerates to +2.5% vs. +2.3% in October.

On the earnings front, the major reports include Wednesday premarket: GIS, JBL; Wednesday postmarket: LEN, MU; Thursday premarket: ACN, CAG, CTAS, DRI, KMX, PAYX; Thursday postmarket: FDX, NKE. In addition, Pfizer will provide 2025 guidance on Tuesday.

Later today, I will post unlocked Currency and Commodity weekly notes on the site and will post links on First Call tomorrow. We are very grateful for the support of many Hedge Fund Telemetry subscribers who have added this to their subscription. It’s a labor of love that takes considerable time to research and put together each week. Our subscribers have said it’s been helpful for those focused on currencies and commodities and those who trade equities as it rounds out quickly the full macro view. We offer these a la carte and, for current Hedge Fund Telemetry subscribers, a discounted rate of $250 for both. If you want these notes, please email us, and we will get you hooked up.

I’ll post notes and work through the holiday season, although I might have just one note some days. We have nearly fixed the email issue that landed on my desk last week. We want to ensure everyone always gets emails, but some corporate emails bounce back with tough spam filters and knock people off the distribution list. Morgan Stanley and a few other brokerage firms are notable for this annoyance. To help ensure you get our emails, save us as a contact/safe sender. If you ever seem to not get our emails, drop us an email. Thanks, everyone!

Weekend News

- Trump tariff anxiety is rising among corporate executives as companies struggle to convince the president-elect to deviate from what they insist will be an economically destructive policy WSJ

- Barron’s latest cover story says stocks could rally another ~20% in 2025 due to deregulation and continued AI strength, and advises investors to “embrace the bubble” Barron’s

- Barron’s stock picks for 2025: ASML, BABA, BRK, C, EG, GOOGL, LVMH, MRNA, SLB, and UBER Barron’s A few of these I can endorse

- Apple plans to introduce new iPhones (including thinner models and foldable ones as well) as the firm prepares to offer more radical design changes to help accelerate growth WSJ

- Auto industry globally is facing enormous headwinds as demand cools, price hikes wane, competition rises (Chinese OEMs are becoming a major force), technological transitions accelerate, and tariff threats grow NYT

- The incoming Trump team is considering scrapping a car-crash reporting requirement opposed by Tesla Reuters

- AXON (Axon), MSTR (MicroStrategy), and PLTR (Palantir) will be added to the Nasdaq 100 before the open on 12/23

- Chinese government official says the country’s growth this year will be “about 5%” Reuters

- Chinese official said the PBOC will cut interest rates and the reserve requirement ratio (RRR) in 2025 Bloomberg)

- South Korea’s parliament on Saturday voted to impeach president Yoon Suk Yeol CNN

Charts we are watching

I’m working on another “Where were the signs part 2“ note for tomorrow, but I thought I’d just mention it since Barron’s is saying people should “embrace the bubble” and show a few charts that encapsulate the bubble. I covered Tesla recently and added a put spread. I am fully expecting to see this collapse in 2025. Maybe I’m crazy and this can go up the equivalent of GM’s market cap daily? Tesla at 180x earnings?

Tesla earnings per share 2024 and 2025 remain well below where expectations were a year ago. I’m not quite sure how Tesla will increase earnings next year since they have an aging model lineup and only have talked up a lower-priced car that hasn’t been unveiled, which will also cannibalize the decent selling current low-end cars they sell now. I’ll make anyone a bet Full that driving still will not be fully autonomous by the end of 2025, and no Robo-taxi will be operating as Waymo is currently in 2025 as well. If this is isn’t a bubble I don’t know what is.

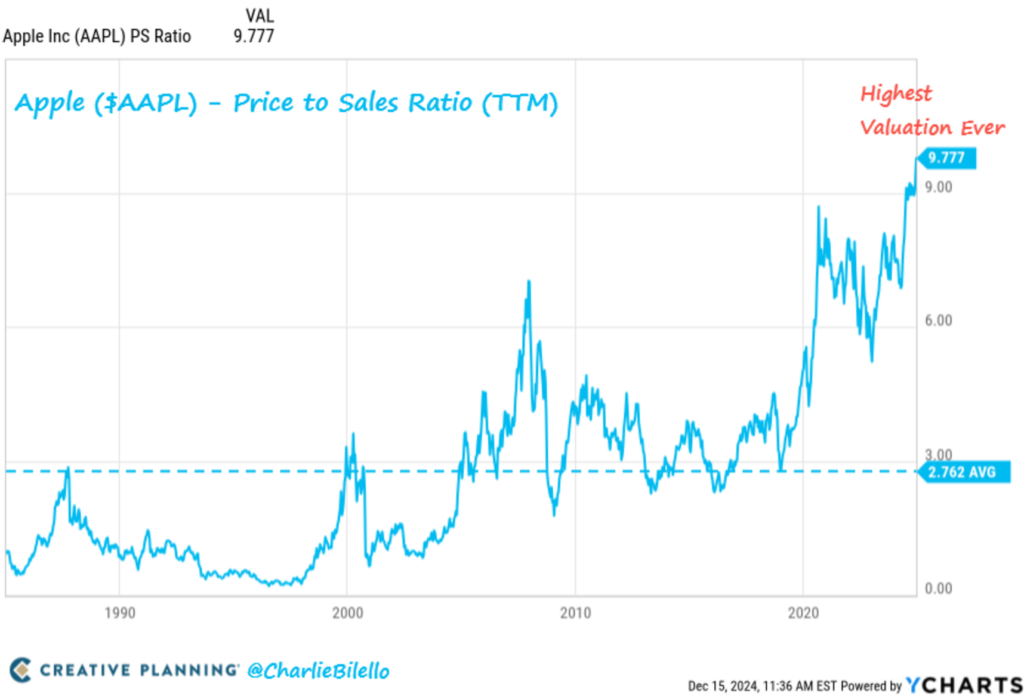

Charlie Bilello posted a chart of Apple with a price to sales ratio at 10x the highest valuation ever.

Valuation doesn’t matter, I’m told. The Trump Trade has lifted the S&P to 25x earnings. When he started in 2017 the S&P traded at 17x earnings and there was much less speculation in the markets. I’d happily see a pullback to 22x earnings to find some long ideas.

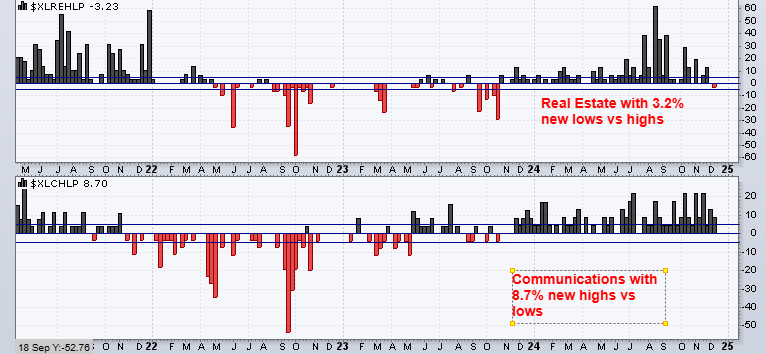

This is poorly formatted, sorry. This shows the S&P making 1.4% new 52 week lows vs highs in the last week. Not saying this is exactly like the end of 2021 ahead of a tough down 2022 but several sectors with the largest weights are holding up the indexes while several sectors are seeing more new 52 week lows than highs.

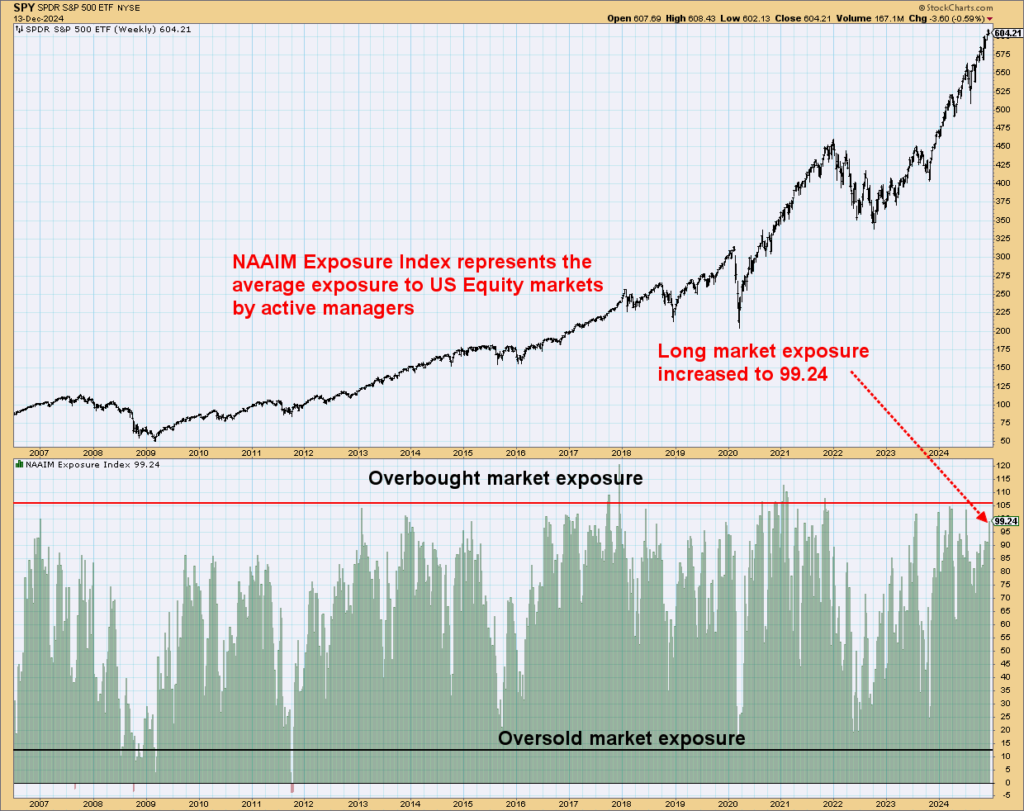

Active managers exposure is at 99.24%. Sure it can go a little higher however it shows investors are all in right now.

I’ve shown the Advance Decline data declining as a sign of weakening internals divergent from the S&P index action.

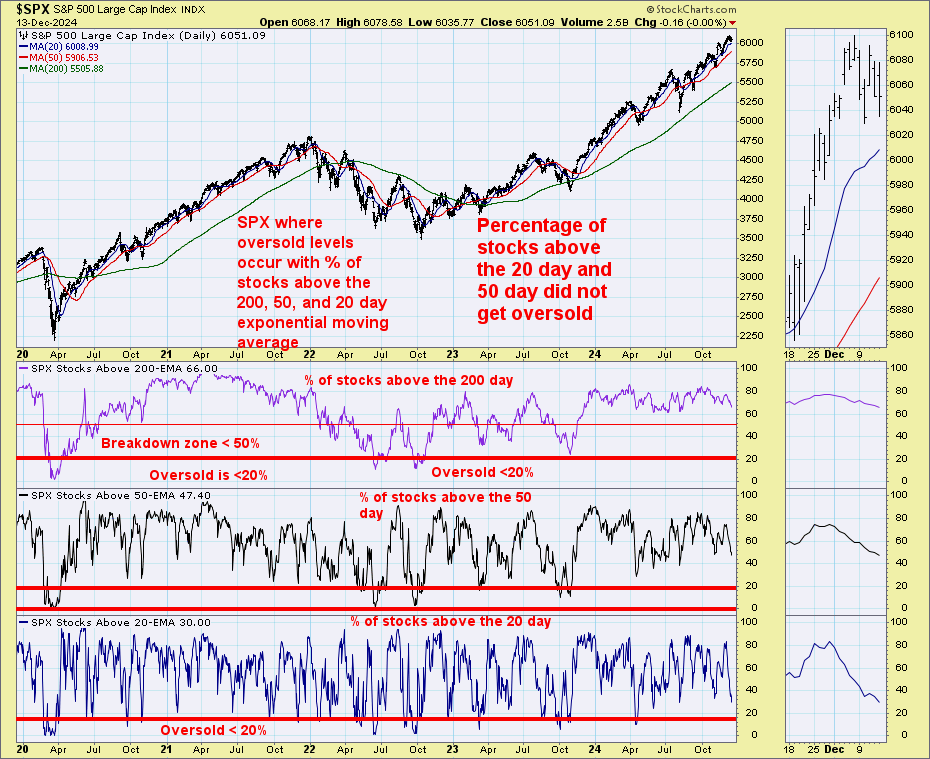

The percentage of S&P stocks above the 20 day and 50 day are dropping and might get oversold. What I think could happen is a catch down with the mega-cap to the rest of the market which would give us an opportunity on the long side.

The S&P McClellan indicators have been dropping and can be added into the negative divergence column of the technical ledger.

US economic data for the week – busy

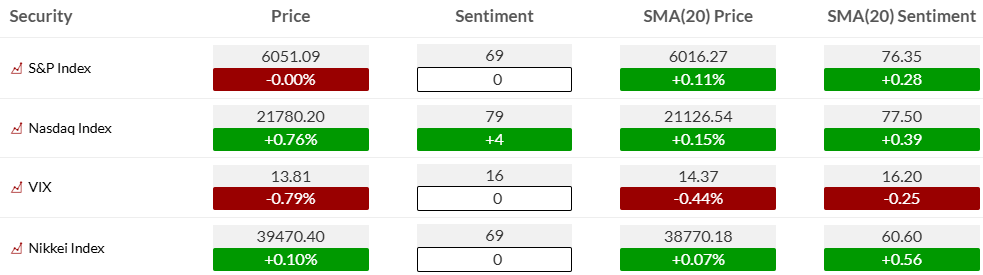

KEY MARKET SENTIMENT

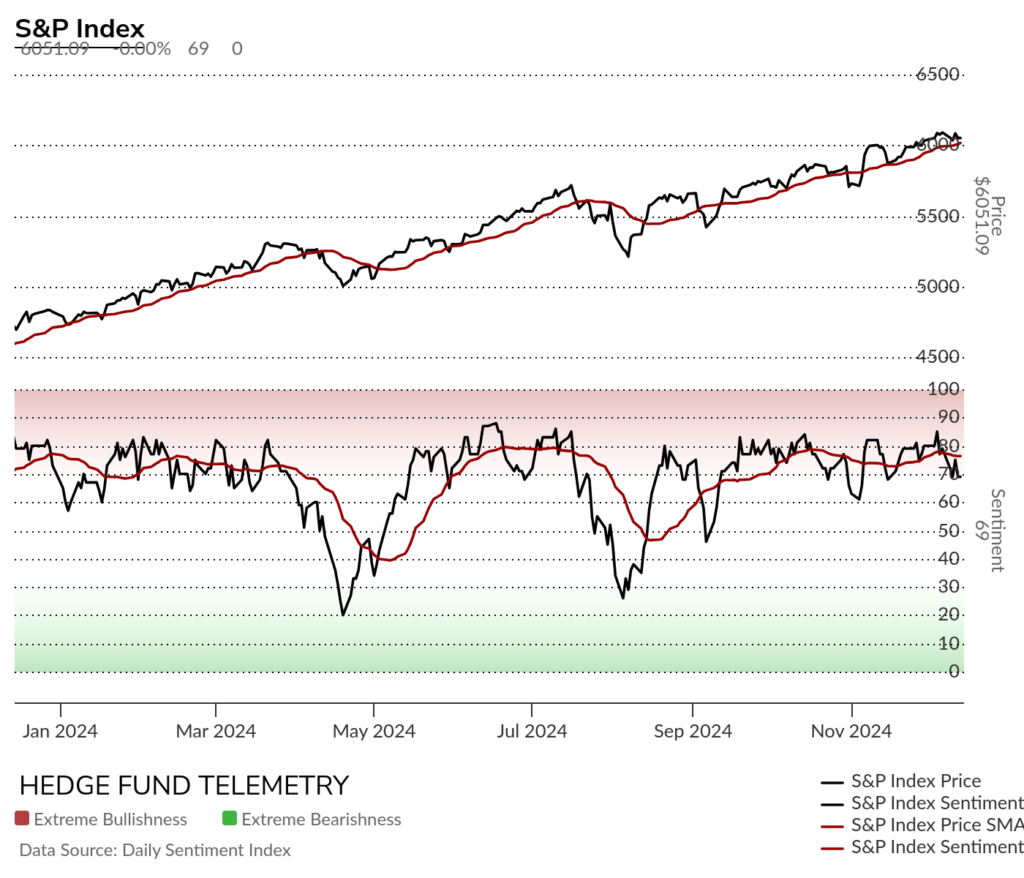

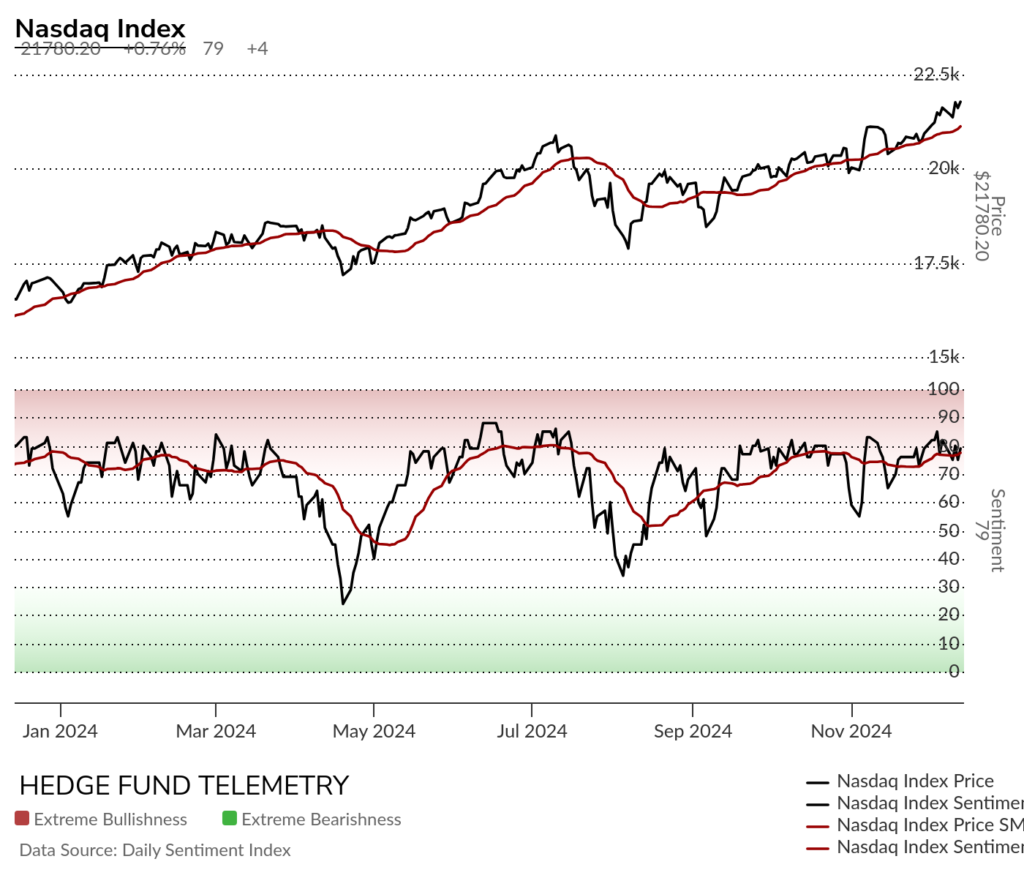

Equity bullish sentiment has been diverging with S&P weaker vs Nasdaq nearly in the extreme zone.

S&P and Nasdaq bullish sentiment has support ~60%. A break below could signal a trend change.

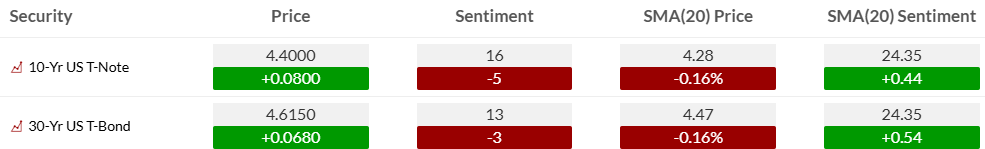

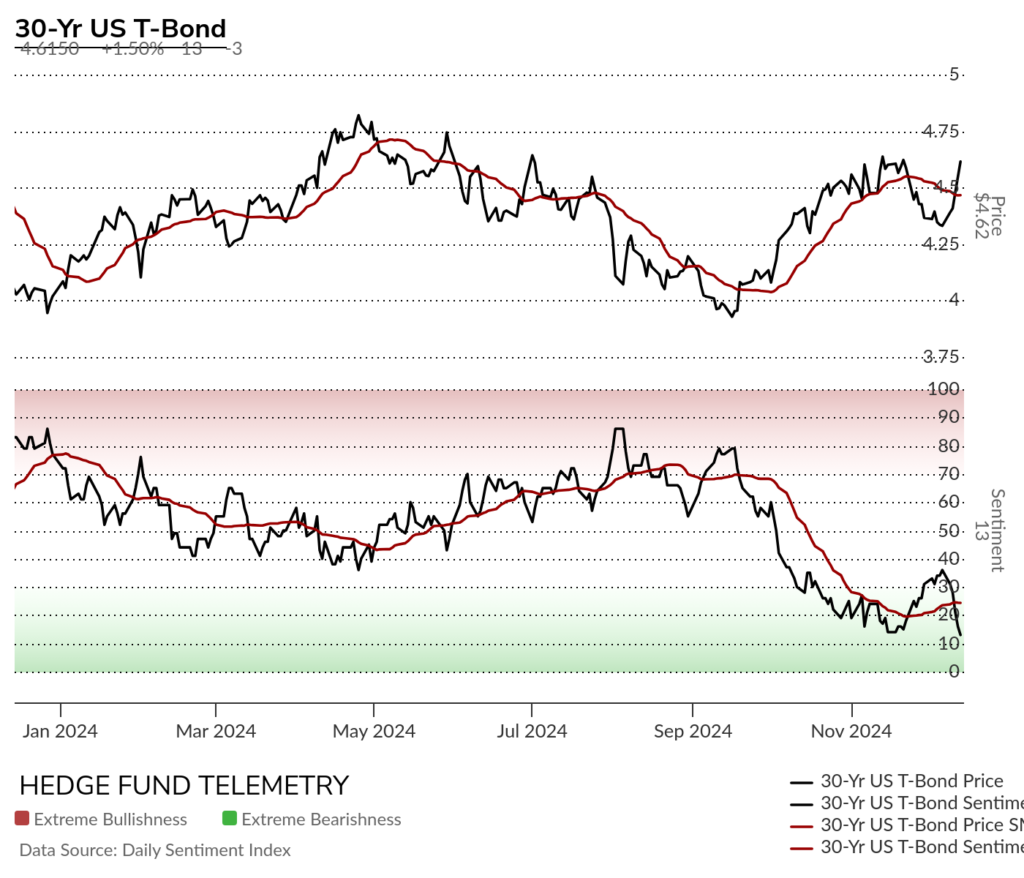

Bond bullish sentiment continued lower and made a new 2024 low with sentiment at 13%

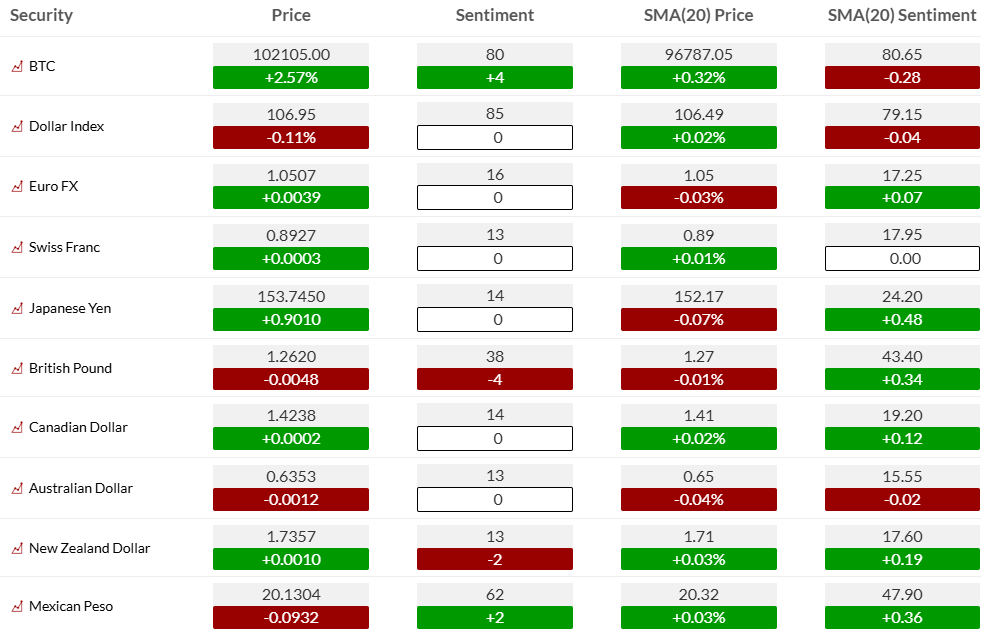

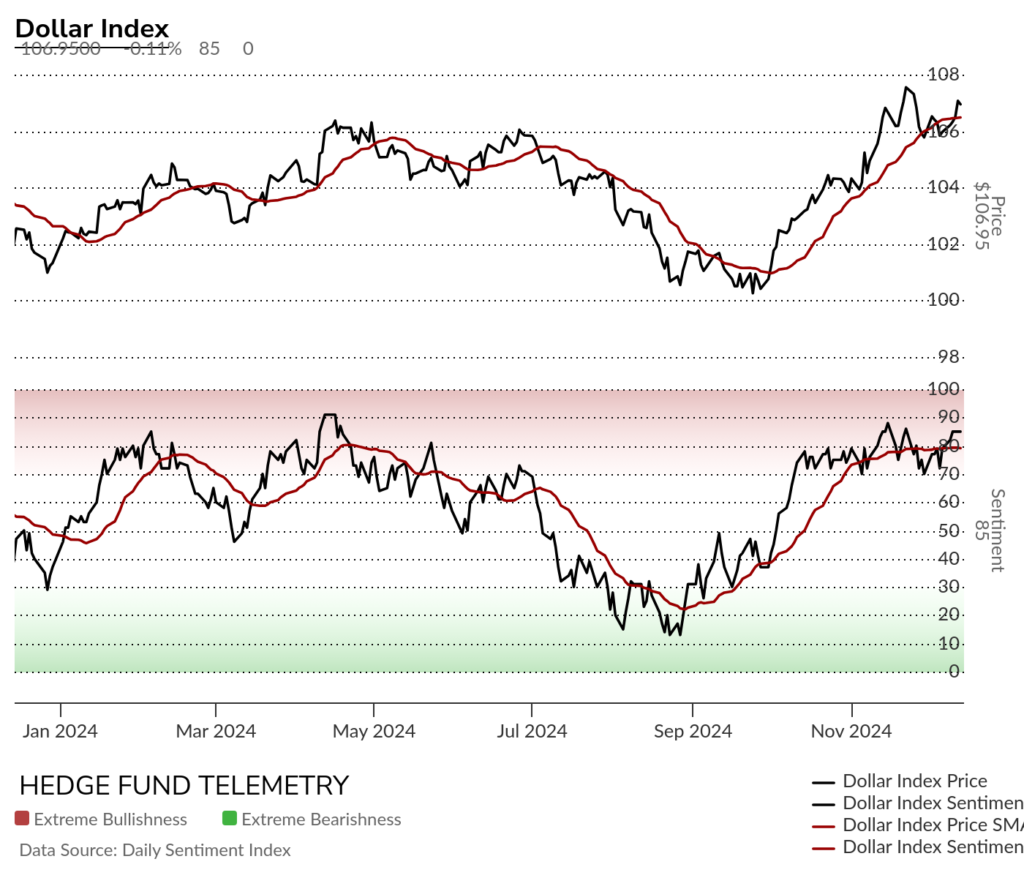

Currency bullish sentiment with US Dollar bullish sentiment unchanged at 85% extreme. For more please visit and subscribe to the Currency Weekly to support our effort.

Bitcoin bullish sentiment remains in the extreme zone at 80%.

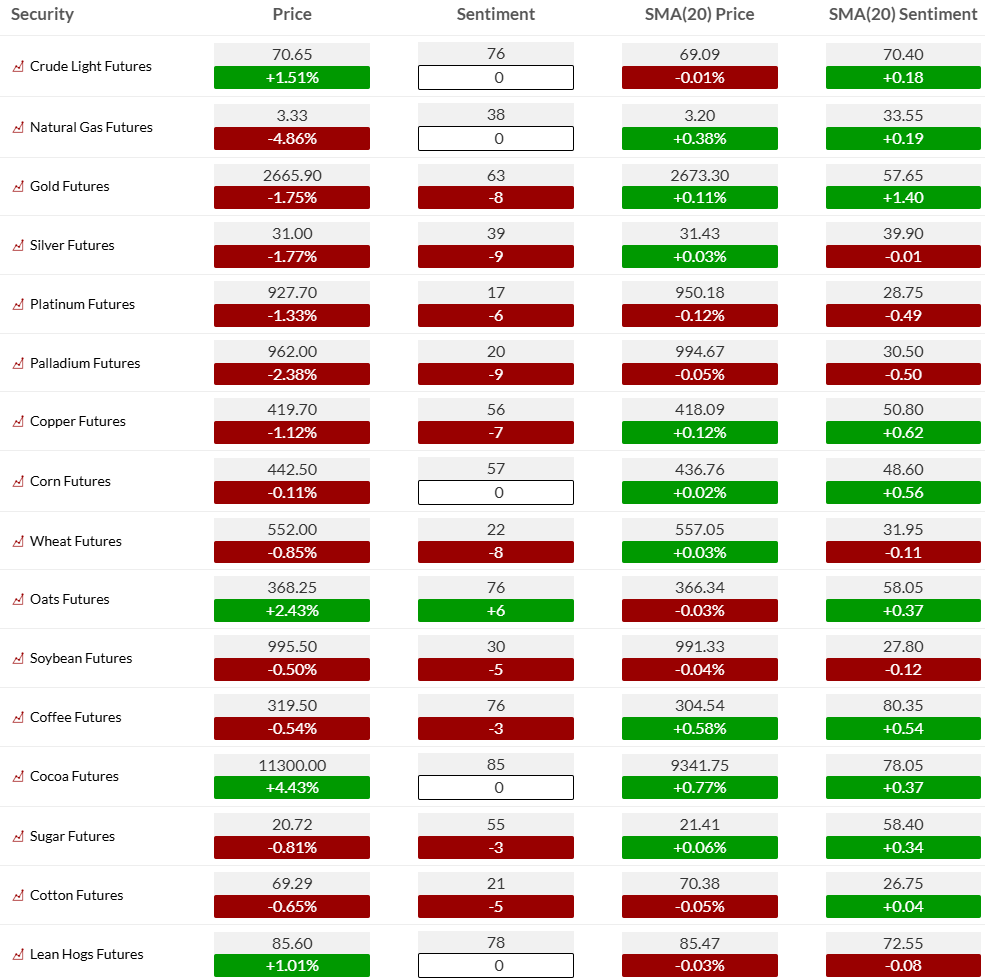

Commodity bullish sentiment highlighted with metals sentiment falling again hard. For more please visit and subscribe to the Commodity Weekly to support our effort.

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 16-Dec:

- Corporate:

- Earnings:

- Pre-open: ZDGE

- Post-close: ARKR, CMP, MAMA, OPTT, QIPT, RCAT, RICK, STRM

- Analyst/Investor Events: GNLX, IDYA

- Brokerage Conference:

- Motilal Oswal India Ideation Conference

- Citi India Financials Tour

- Earnings:

- Economic

- US: Empire Manufacturing, PMI Manufacturing Preliminary, PMI Services Preliminary

- Canada: Housing Start

- Europe: Trade Balance, PPI y/y, CPI y/y

- Asia: Non-Oil Domestic Export NSA Y/Y

- Corporate:

- Tuesday 17-Dec:

- Corporate:

- Earnings:

- Pre-open: AMTM, CMCM, NMTC, REE

- Post-close: HEI, WOR

- Analyst/Investor Events: A, ALXO, IR, LOVE, PDSB, RNXT

- Brokerage Conference:

- Motilal Oswal India Ideation Conference

- Citi India Financials Tour

- UBS Global Specialty Insurance Reinsurance Conference

- NYC Summit

- Earnings:

- Economic

- US: Retail Sales, Capacity Utilization, Industrial Production, Business Inventories, NAHB Housing Market Index, Redbook Chain Store, API Crude Inventories

- Canada: Core Inflation (m/m), CPI (m/m)

- Europe: ILO Unemployment Rate, Trade Balance, IFO Business Climate, ZEW Economic Sentiment Indicator

- Asia: Trade Balance

- Corporate:

- Wednesday 18-Dec:

- Corporate:

- Earnings:

- Pre-open: ABM, JBL, TTC

- Post-close: EPAC, LEN, MLKN, MU, SCS, WS

- Analyst/Investor Events: ILLR, RGLD

- Brokerage Conference:

- Citi India Financials Tour

- NYC Summit

- Earnings:

- Economic

- US: FOMC Meeting/Fed Funds Rate, MBA Mortgage Purchase Applications, Building Permits, Current Account Balance, Housing Starts, DOE Crude Inventories

- Europe: CPI y/y, Output PPI y/y, PPI y/y

- Corporate:

- Thursday 19-Dec:

- Corporate:

- Earnings:

- Pre-open: ACN, CTAS, DRI, FCEL, FDS, KMX, PAYX

- Post-close: AVO, BB, FDX, ISSC, MOBX, NKE, SCHL

- Analyst/Investor Events: AGCO, GNRC

- Brokerage Conference:

- NYC Summit

- PDUFA: IONS (olezarsen)

- Earnings:

- Economic

- US: GDP Chain Price (second revision), GDP (second revision), Weekly Jobless Claims, Philadelphia Fed Index, Existing Home Sales, Leading Indicators, TIC Flows, EIA Natural Gas Inventories

- Europe: Unemployment Rate, GfK Consumer Confidence, Manufacturing Business Climate, Business Survey, Trade Balance

- Asia: CPI Core National y/y, CPI ex-Fresh Food and Energy, CPI National y/y

- Corporate:

- Friday 20-Dec:

- Corporate:

- Earnings:

- Pre-open: CCL, WGO

- Analyst/Investor Events: GNRC

- PDUFA: LXRX (INPEFA)

- Earnings:

- Economic

- US: Core PCE, Personal Spending, Personal Income, Michigan Consumer Sentiment (Final)

- Canada: Retail sales (m/m)

- Europe: PPI y/y, Retail Sales y/y, Final GDP q/q, PPI m/m, Business Confidence, Consumer Confidence, Retail Sales, Flash Consumer Confidence

- Corporate:

- Factset owns StreetAccount, the producer of this content

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.