HIGHLIGHTS AND THEMES

- Could this be the start of commodities rising again? A large base has been built, and a 10% upside move is possible. Maybe more, but at this point, continuation will be watched.

- Energy has been strong and leading the Bloomberg Commodity Index

- Metals are also seeing some upside. It’s worth buying metals using recent lows as stops.

- This includes gold, silver, copper, platinum and palladium

- Corn has been strong and a recommended long idea

- Soybeans put in a strong move on Friday while wheat still struggles oversold.

- Livestock has been mixed with cattle hitting new highs and hogs consolidating.

- Softs do not look strong, although cocoa and coffee have been consolidating recent gains.

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily has been lifting to the recent highs in the range from October and broke out on Friday with a potential new Sequential Countdown starting. This is positive and moved into upside wave 3 of 5 with a potential upside price objective of 107.85

Bloomberg Commodity Index Weekly had a strong week and perhaps a start to new upside after very sluggish action. There has been a pending Sequential which now has week 8 of 13. There is an Aggressive Sequential (amber 13) which I would ignore as the Sequential takes priority. Let’s see if this continues in the coming week with a huge base. A 10% upside move from here is possible.

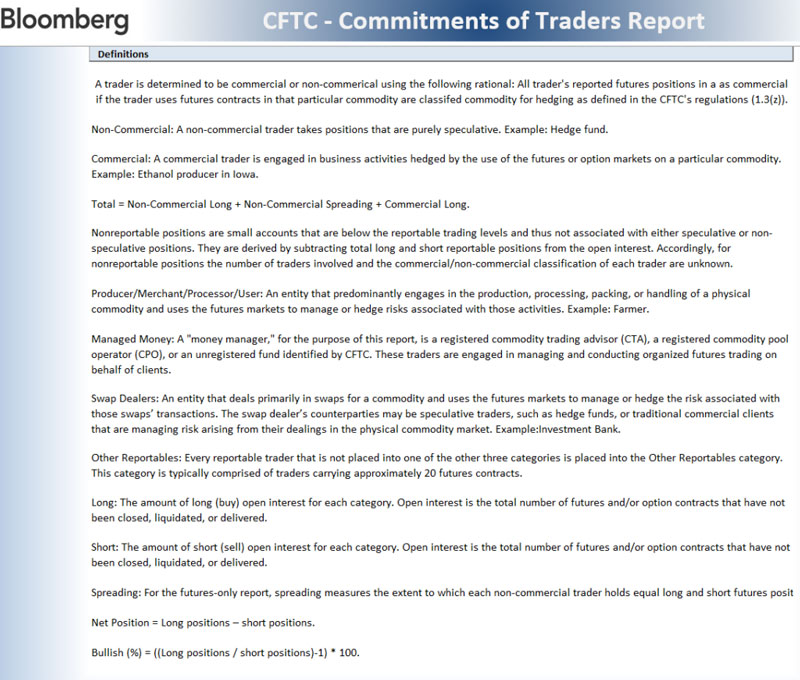

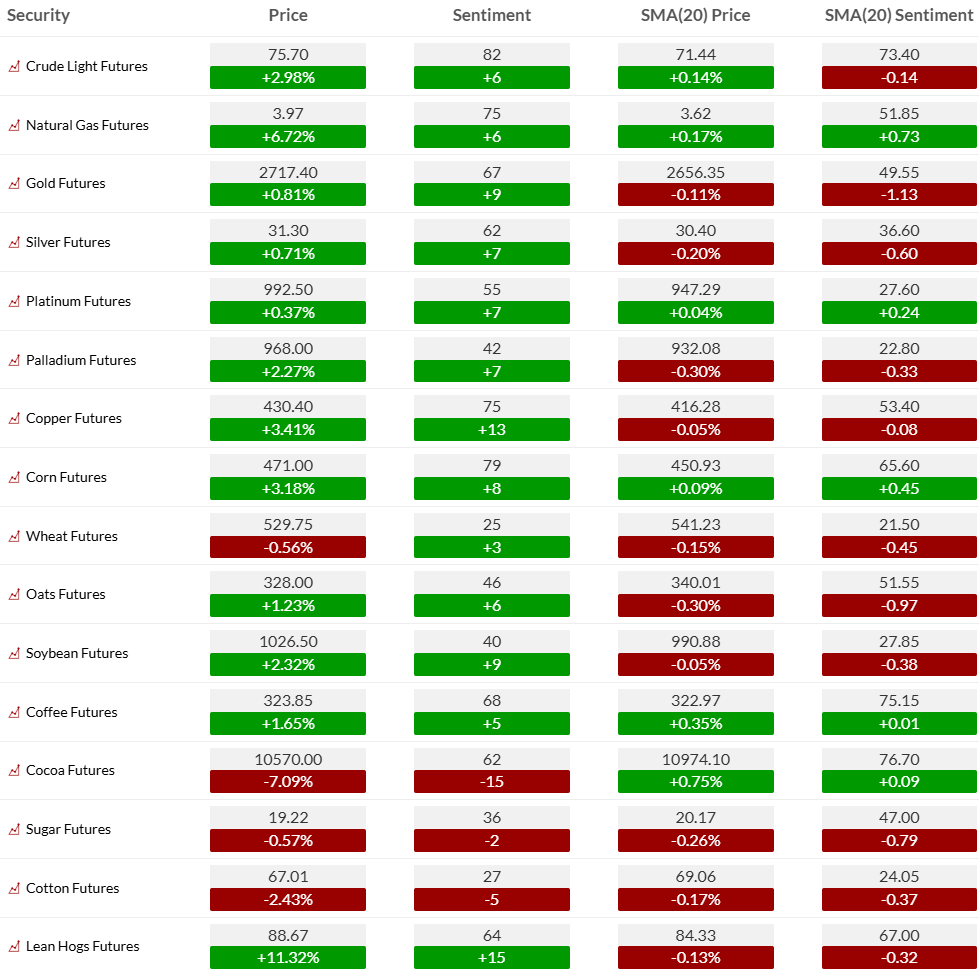

COMMODITY SENTIMENT OVERVIEW

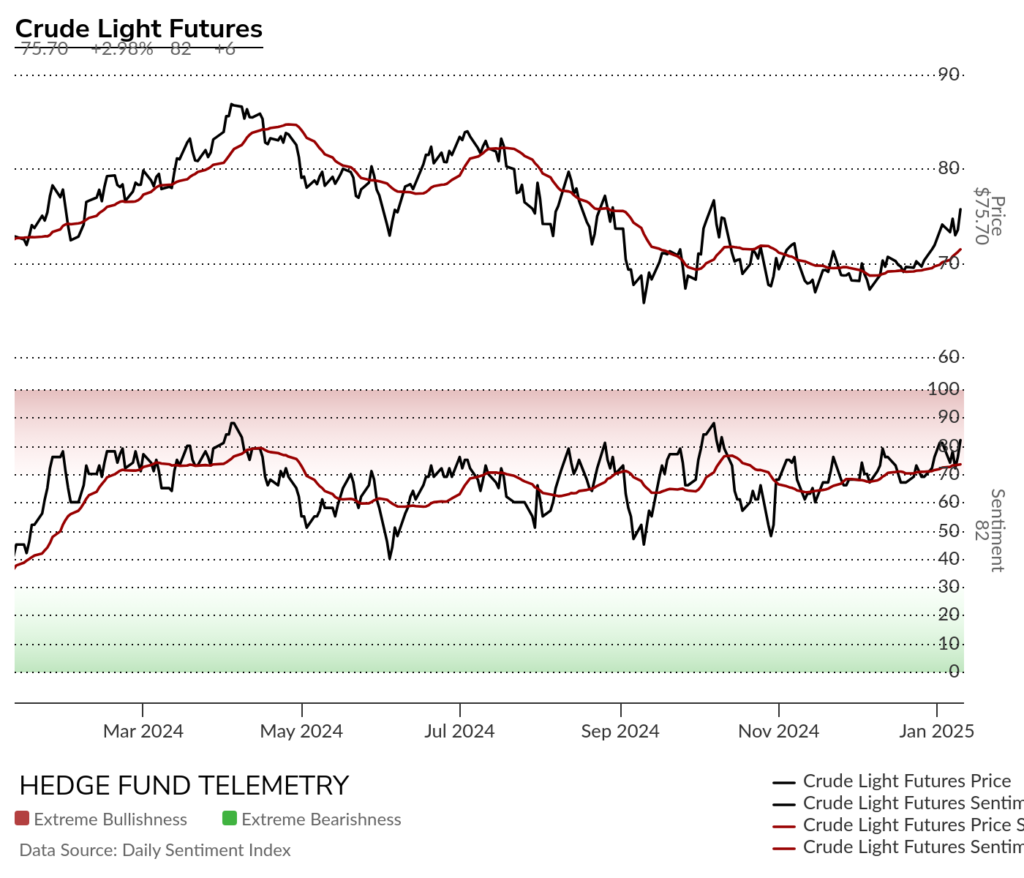

OIL AND ENERGY

Bloomberg Energy Index daily has been improving in recent weeks and spiked on Friday with new Sequential that started after the recent Setup 9.

The weekly has been improving with upside Setup on week 5 of 9 above a few moving averages. If the upside Setup 9 completes in a month then the pending Sequential on the downside will cancel.

WTI Crude futures daily achieved the upside Propulsion target and continued higher above the 200 day. I’d add this to the long side although small size

WTI Crude futures bullish sentiment has been stronger vs price action with it back in the extreme zone

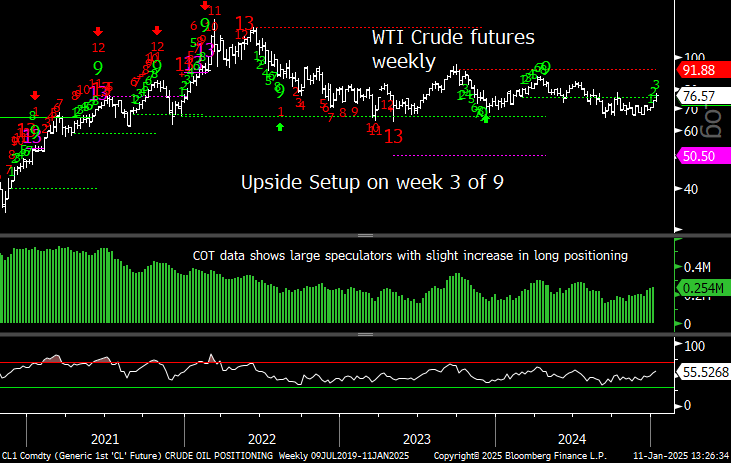

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

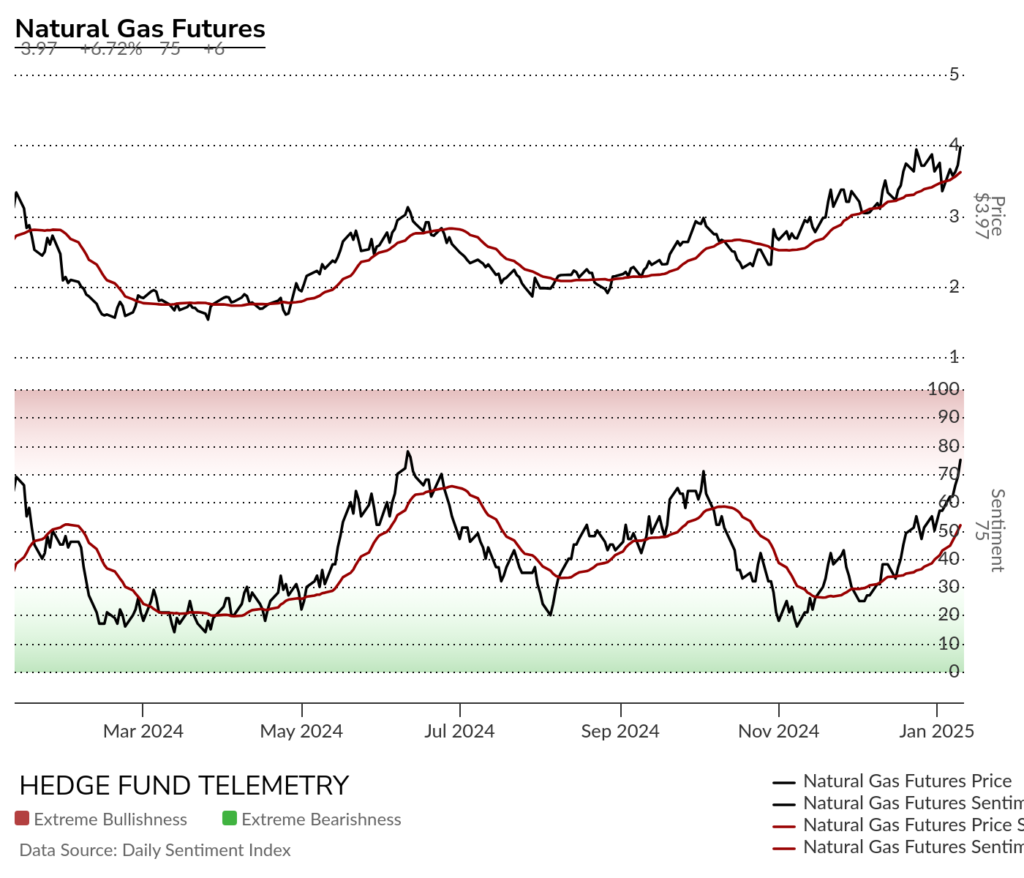

Natural Gas futures daily remains in a bullish pattern, albeit it has been volatile

Natural Gas futures bullish sentiment continues higher

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Metals

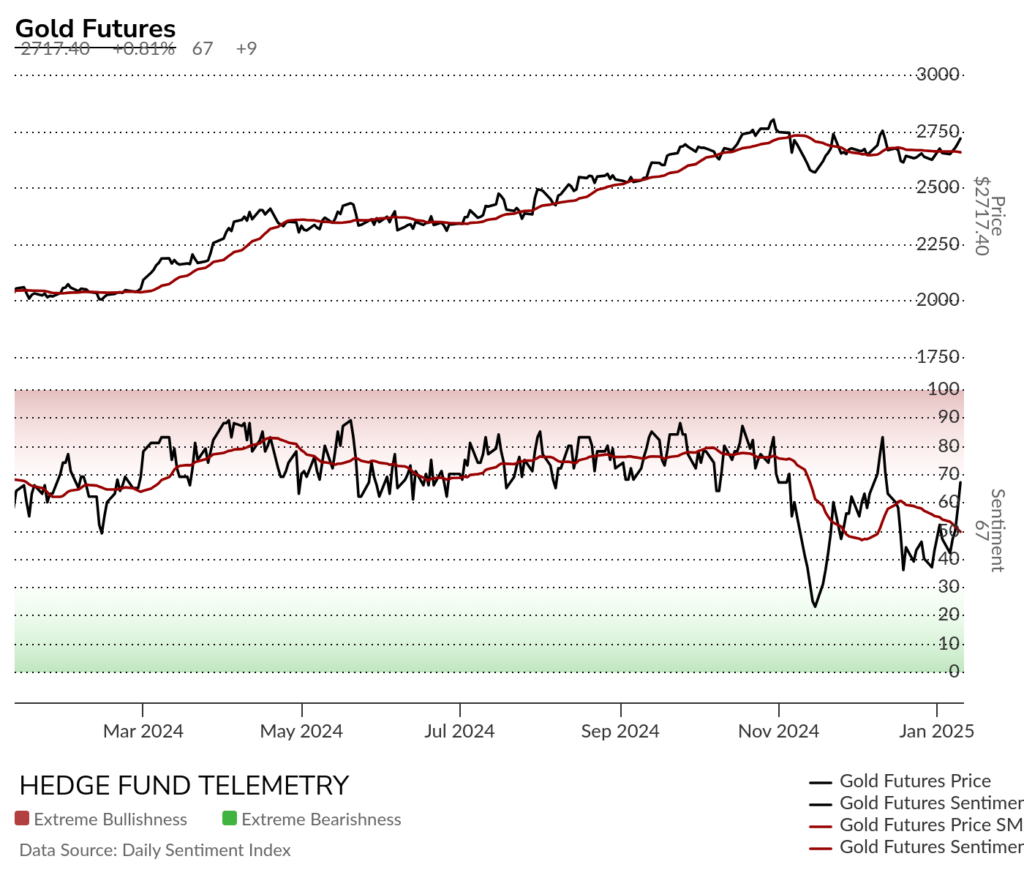

Gold daily with recent DeMark Sequential buy Countdown 13 and upside Setup 9 possible on Monday.

Gold bullish sentiment with spike late last week.

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

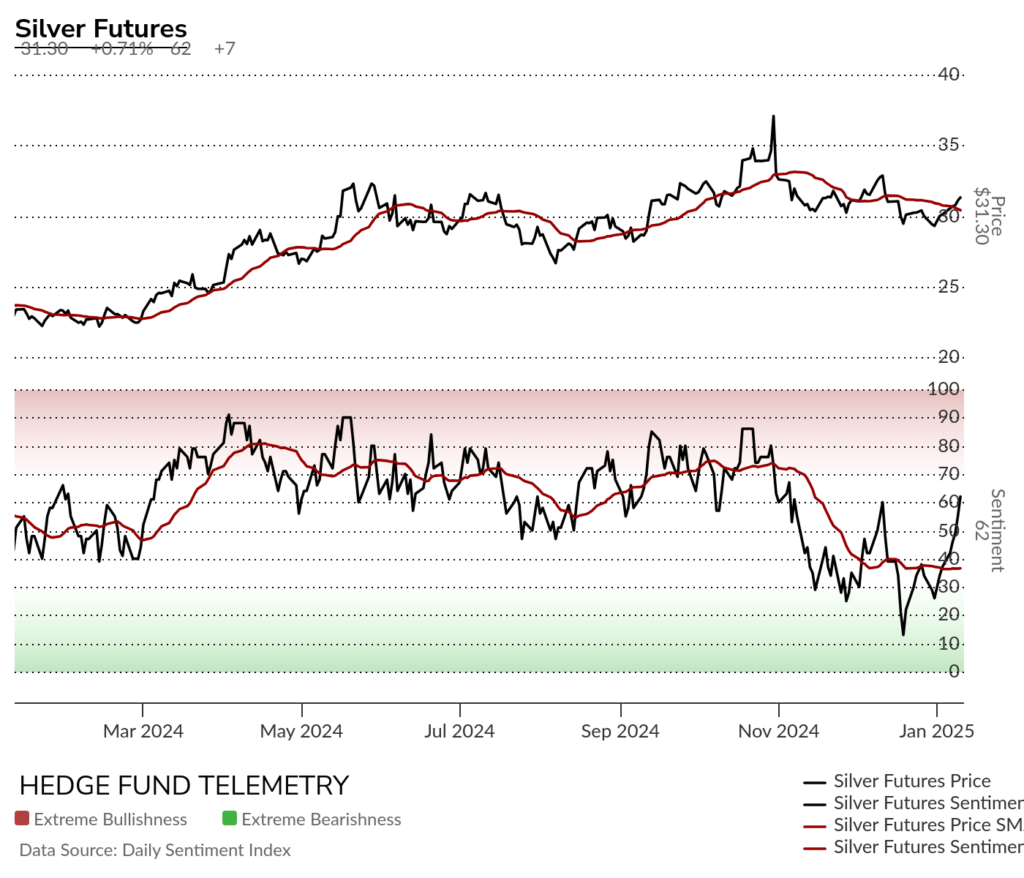

Silver daily had an OK week however is this another lower high bounce (wave 4 of 5)

Silver bullish sentiment with strong spike higher this past week.

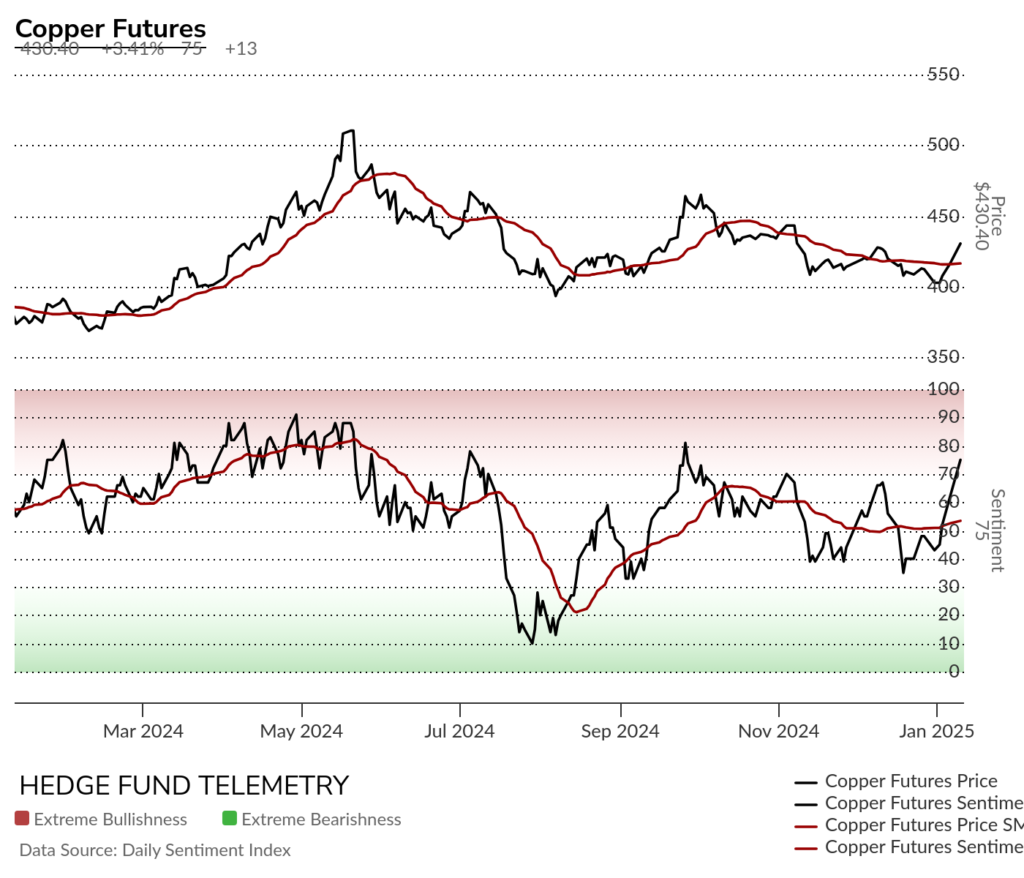

Copper futures daily has been a recent long idea and started to work this past week.

Copper futures bullish sentiment with strong reversal up

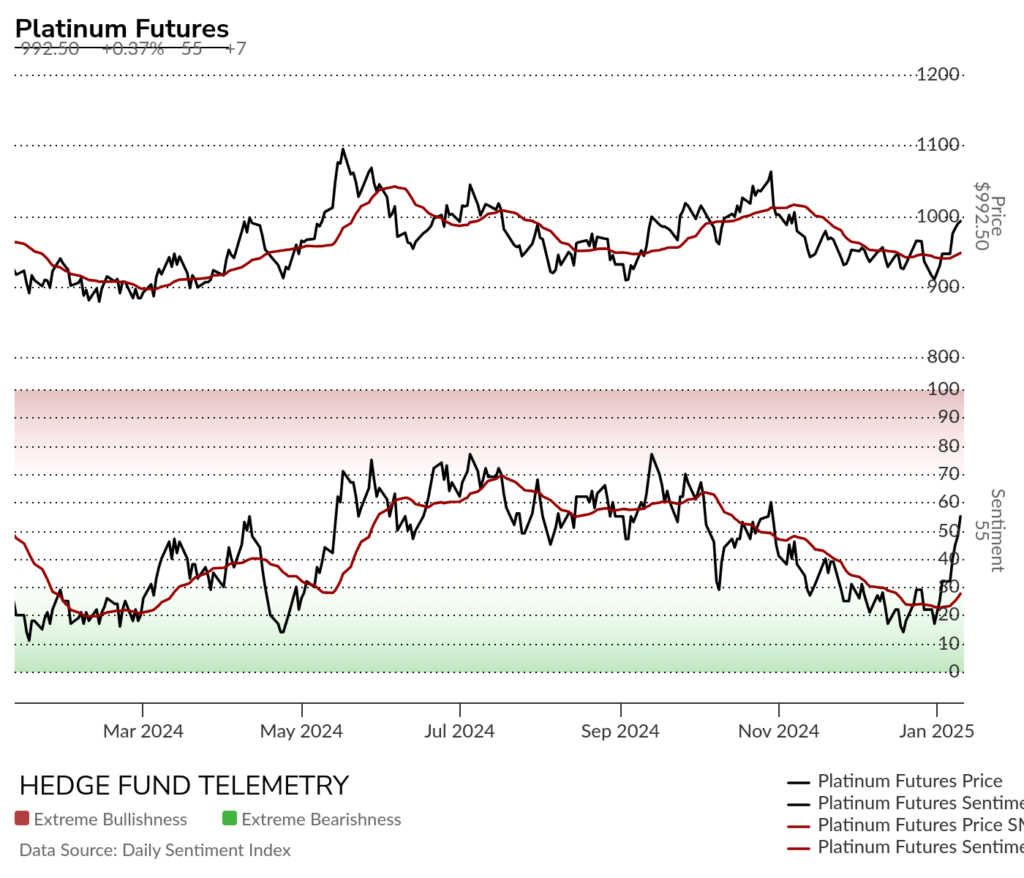

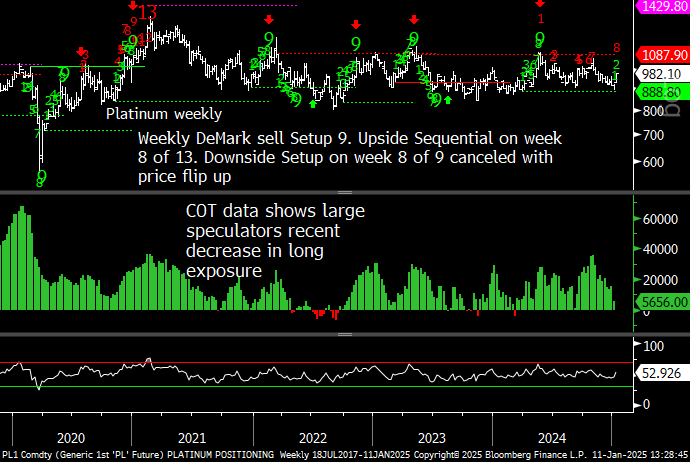

Platinum daily was in no man’s land and started a decent reversal. Add as a small long

Platinum bullish sentiment spiked this past week

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

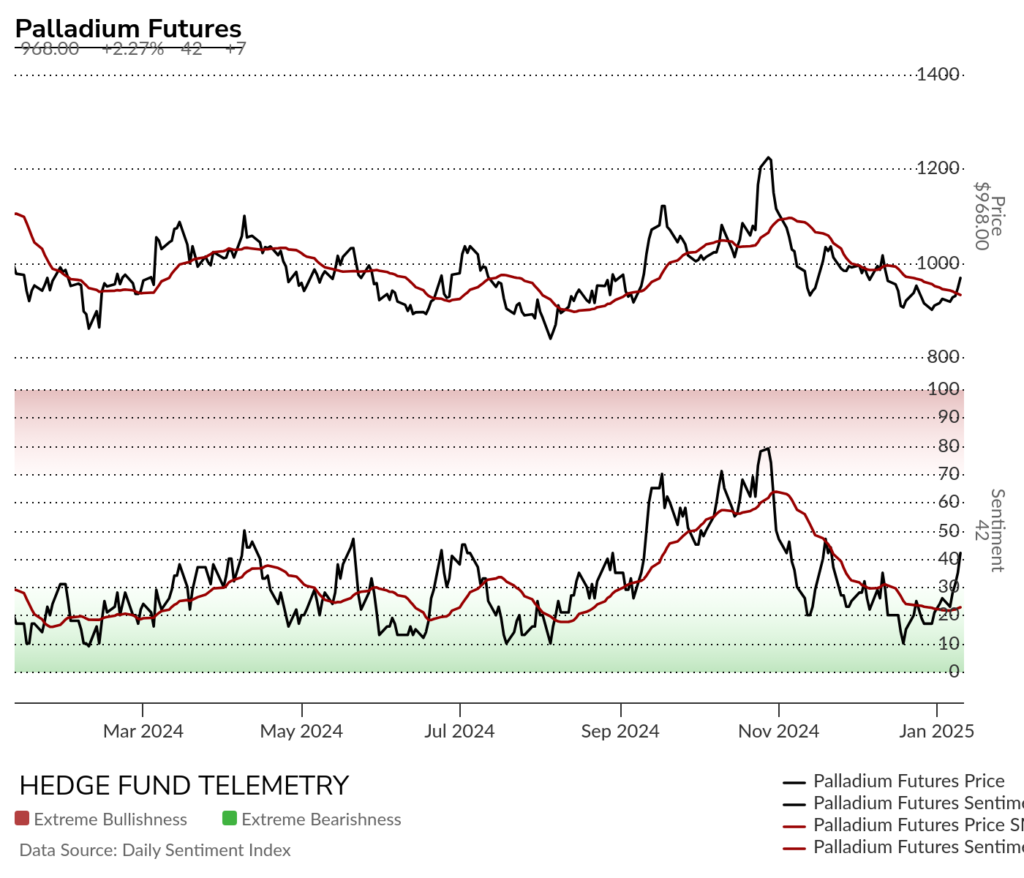

Palladium daily could see upside from here after the recent DeMark Sequential buy Countdown 13. Add as a long idea

Palladium bullish sentiment woke up with a decent turn this past week.

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

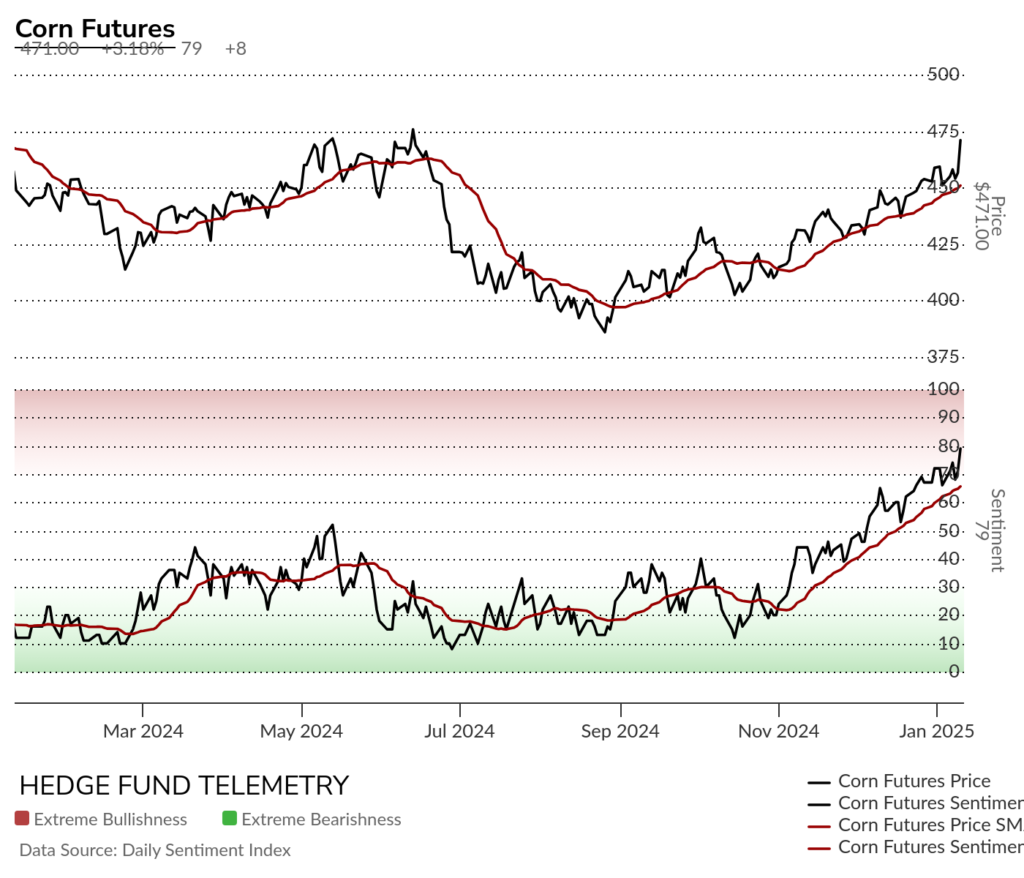

Corn futures daily has been a long idea that spiked higher on Friday. The Sequential is on day 7 of 13. Aggressive Sequential (amber 13) triggered which is a liberal setting vs standard Sequential always triggers ahead of Sequential or with Sequential. This remains a long idea although some of Friday’s gain might give back some which would be OK to buy.

Corn futures bullish sentiment continues higher

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Upside TDST line as resistance is nearly cleared to the upside.

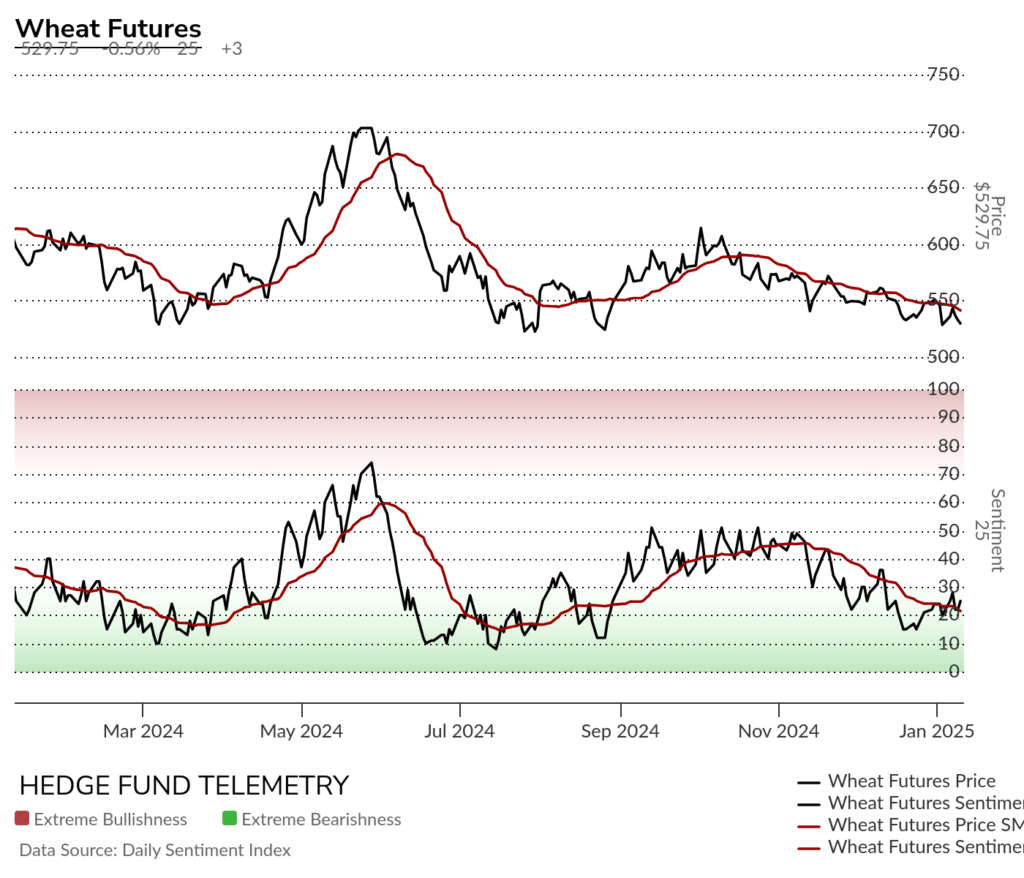

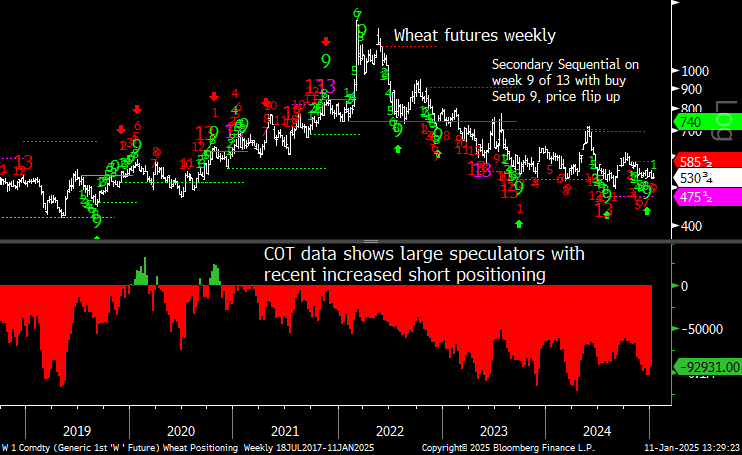

Wheat futures daily hit a new low on Friday and has 20 day moving average resistance.

Wheat futures bullish sentiment might have a slight higher low and above the 20 day moving average of bullish sentiment yet has a lot of work to do.

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

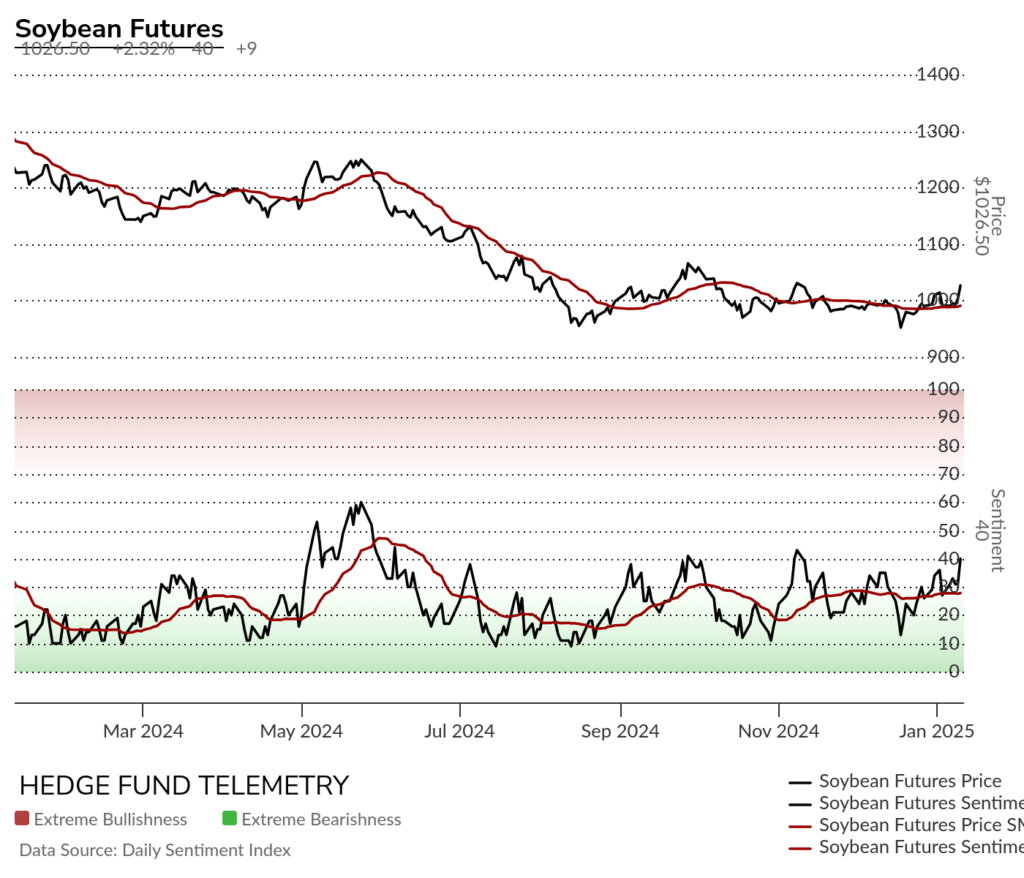

Soybean futures daily had a big move on Friday. Can it continue?

Soybean futures bullish sentiment trying to lift again

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

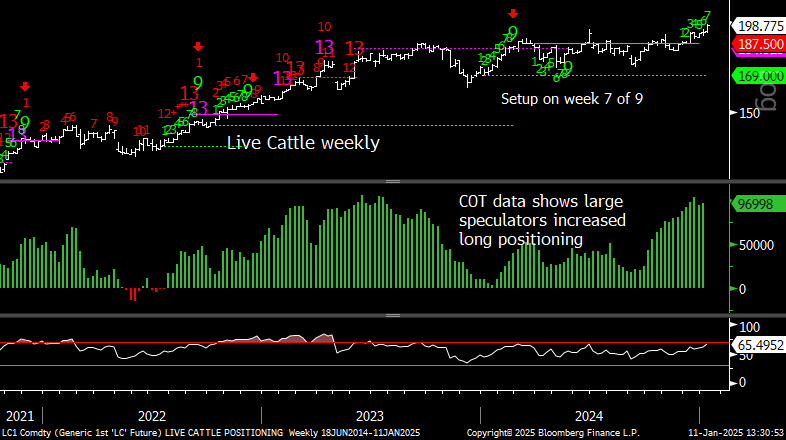

Livestock

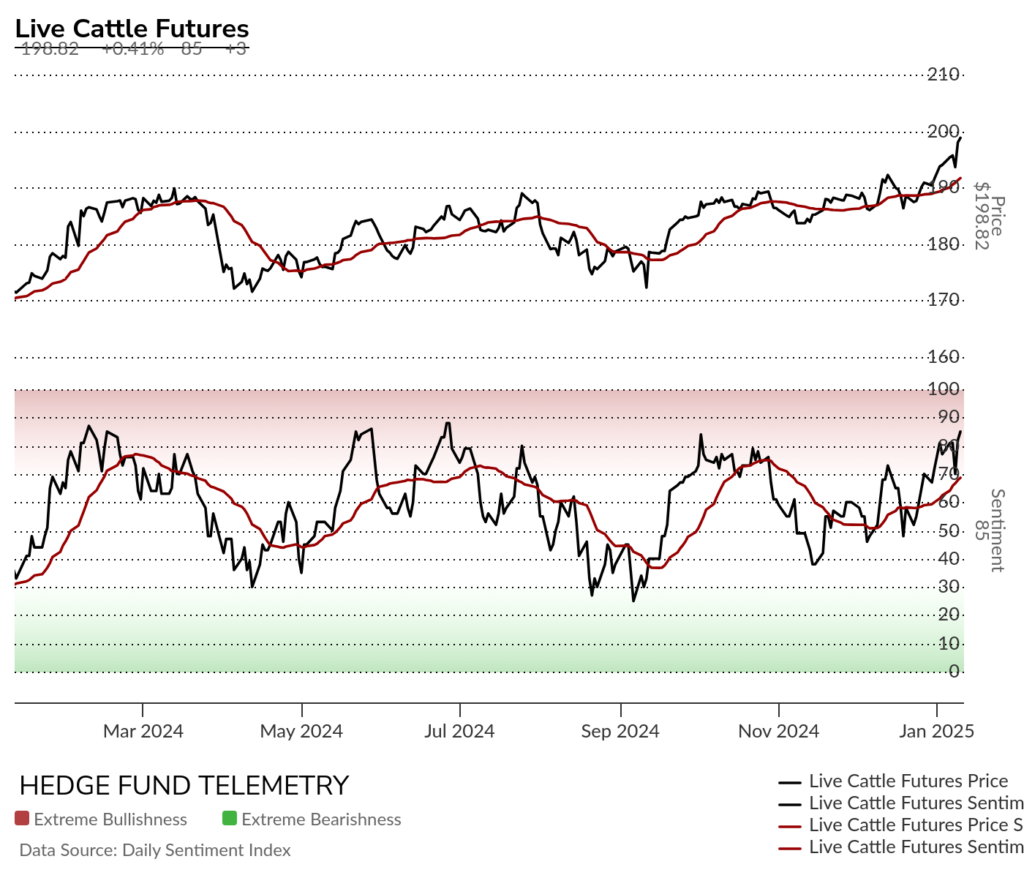

Live Cattle futures daily made a new high

Live Cattle futures bullish sentiment remains in the extreme zone at 85%

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

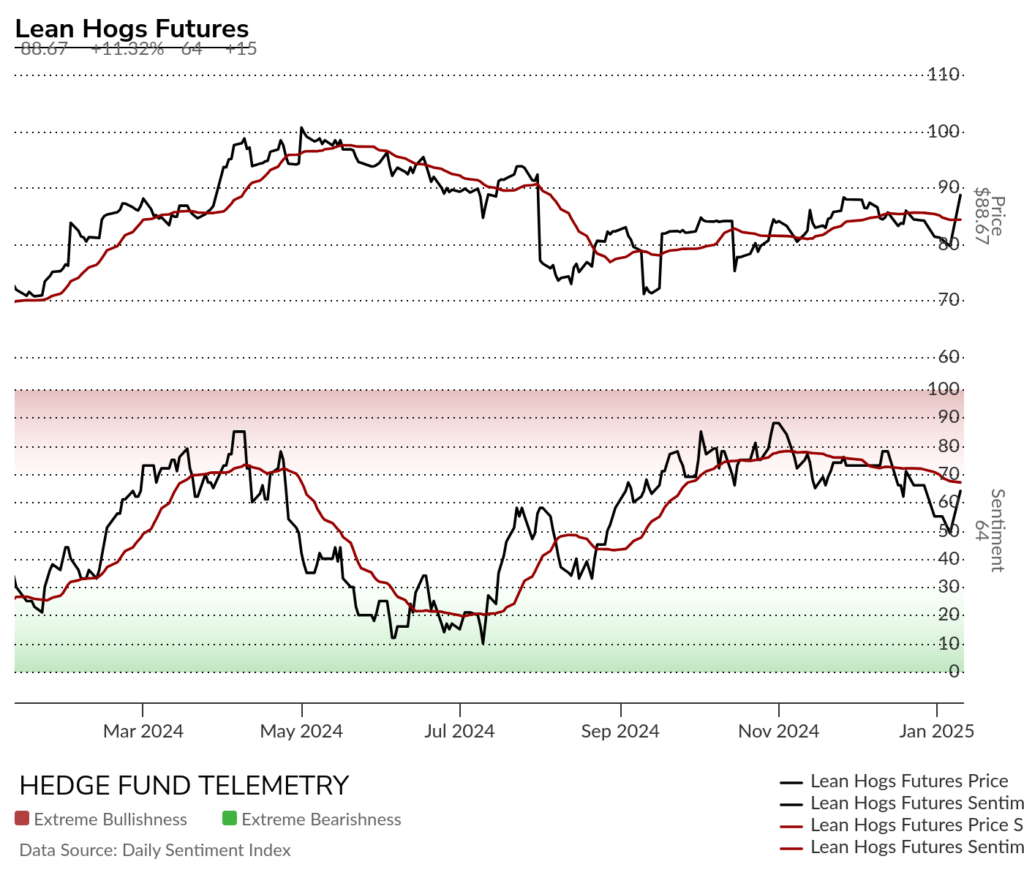

Lean Hogs futures daily backed on to wave 3 downside price objective with strong bounce.

Lean Hogs bullish sentiment has been falling holding the 50% with large +15% increase on Friday

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

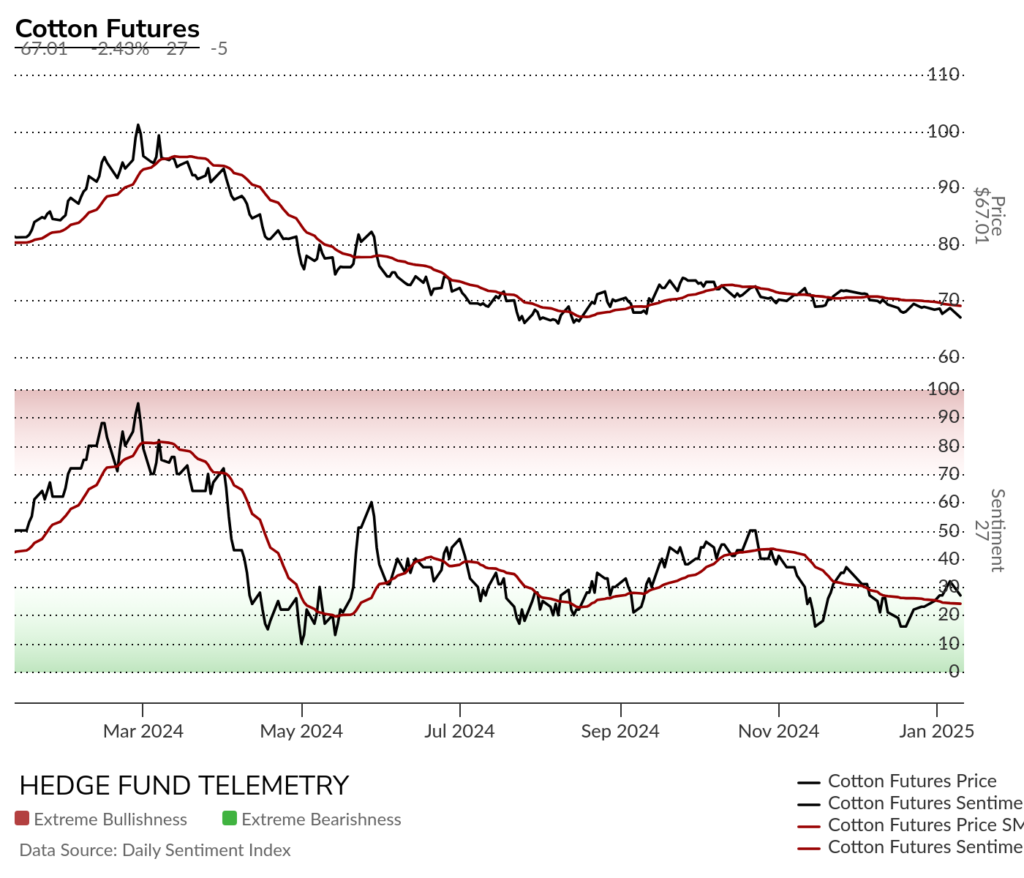

Softs

Cotton futures daily has made a new low with a secondary Sequential in progress

Cotton futures bullish sentiment remains under pressure

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

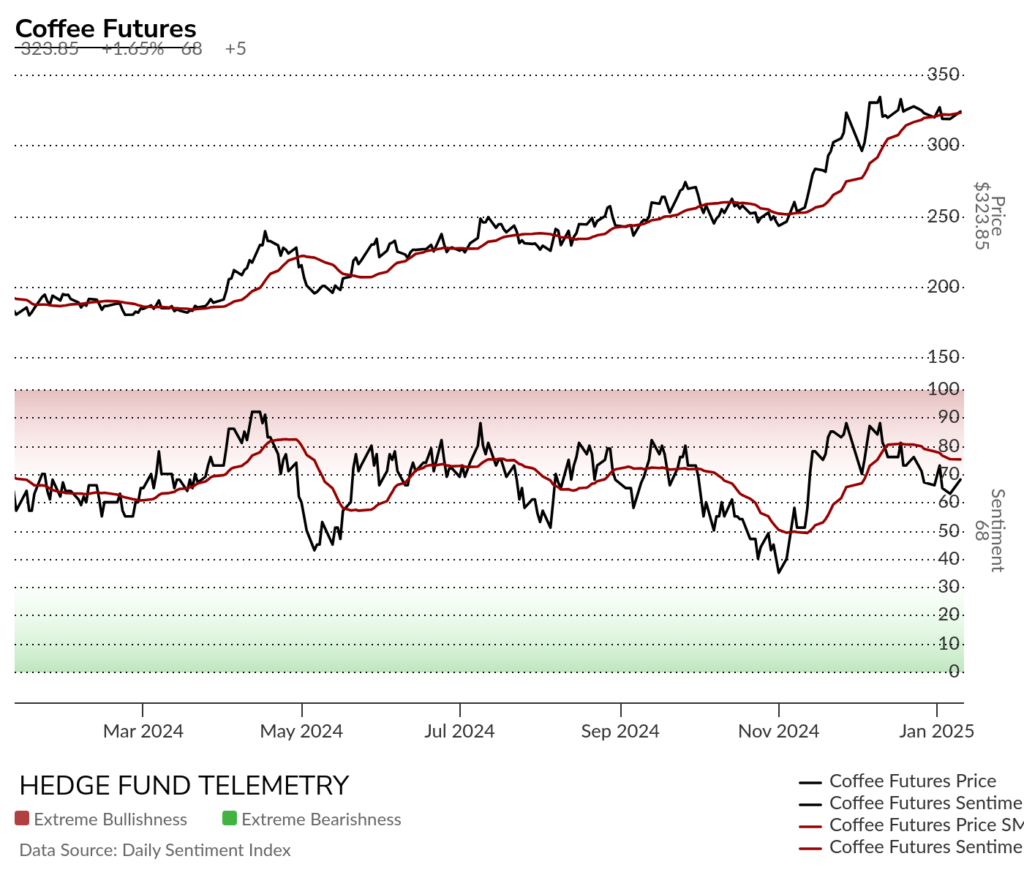

Coffee futures daily stalled with the recent DeMark 13’s exhausting buyers with no strong breakdown

Coffee futures bullish sentiment off extreme levels but has not broken down yet

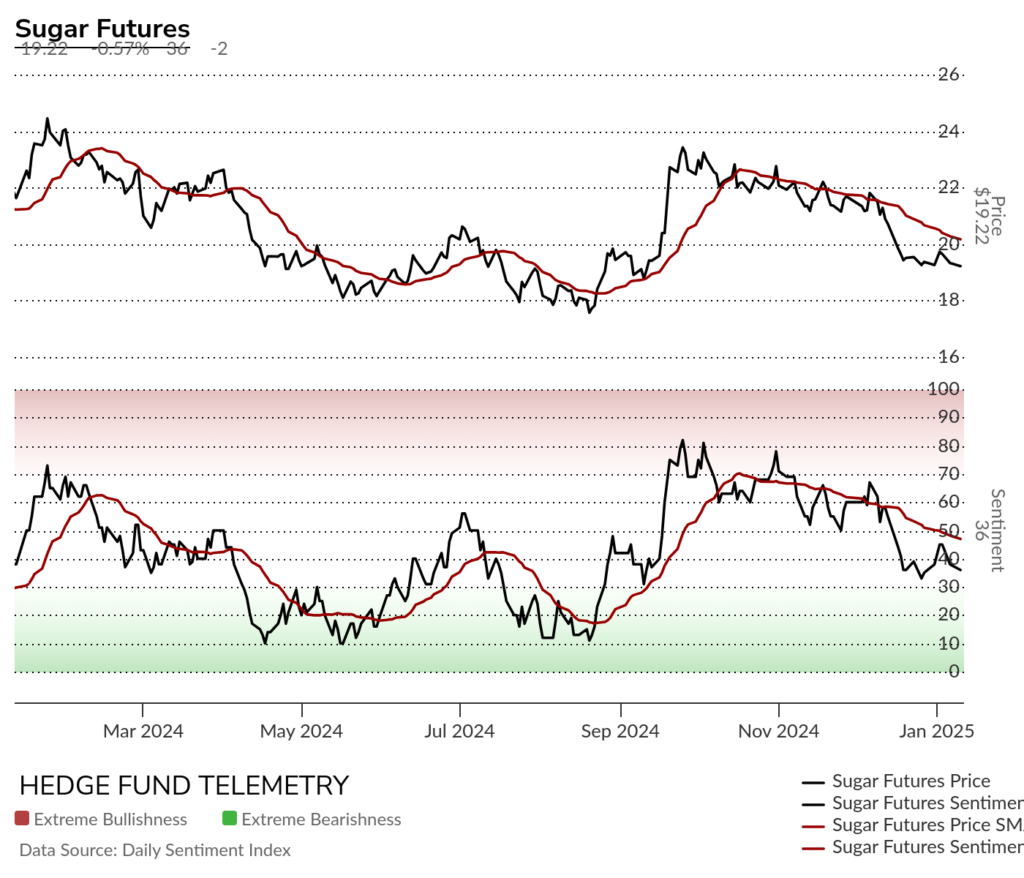

Sugar futures daily has important support at 19 with pending Sequential Countdown in progress

Sugar futures bullish sentiment broke below 50% midpoint level and is not oversold.

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

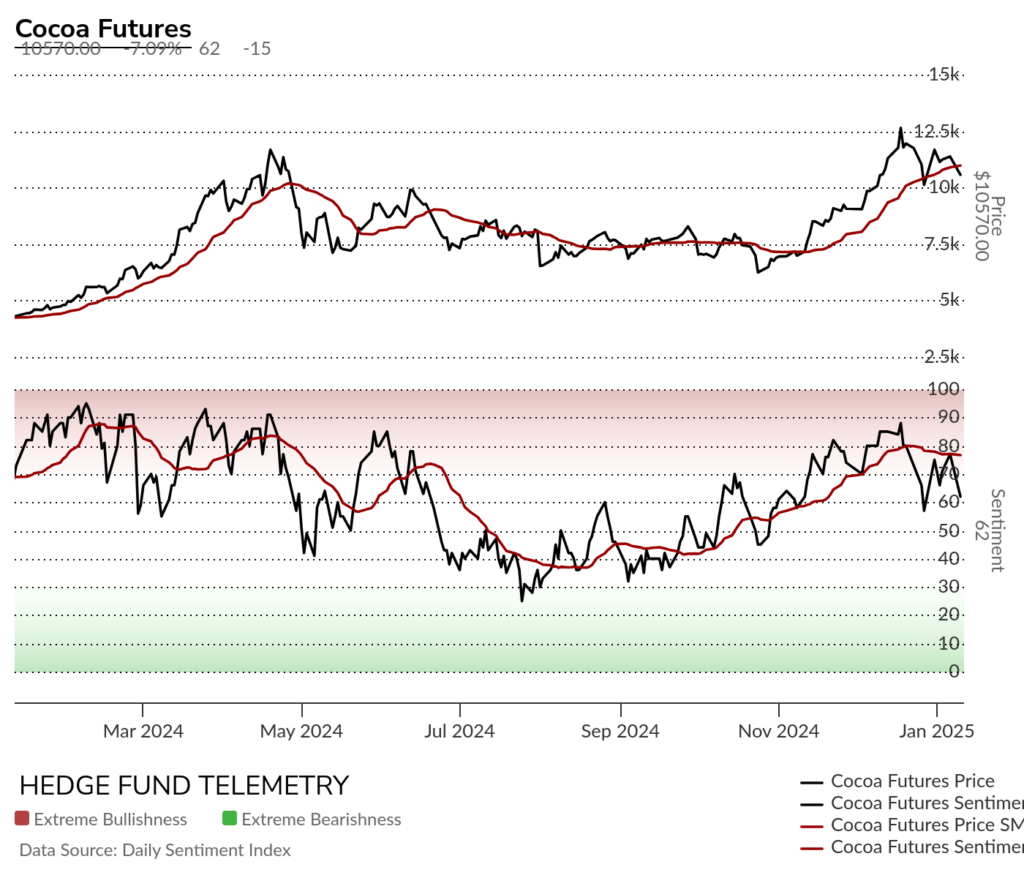

Cocoa futures daily continues to trade moderately lower after the recent exhaustion signals

Cocoa futures bullish sentiment with possible higher low

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

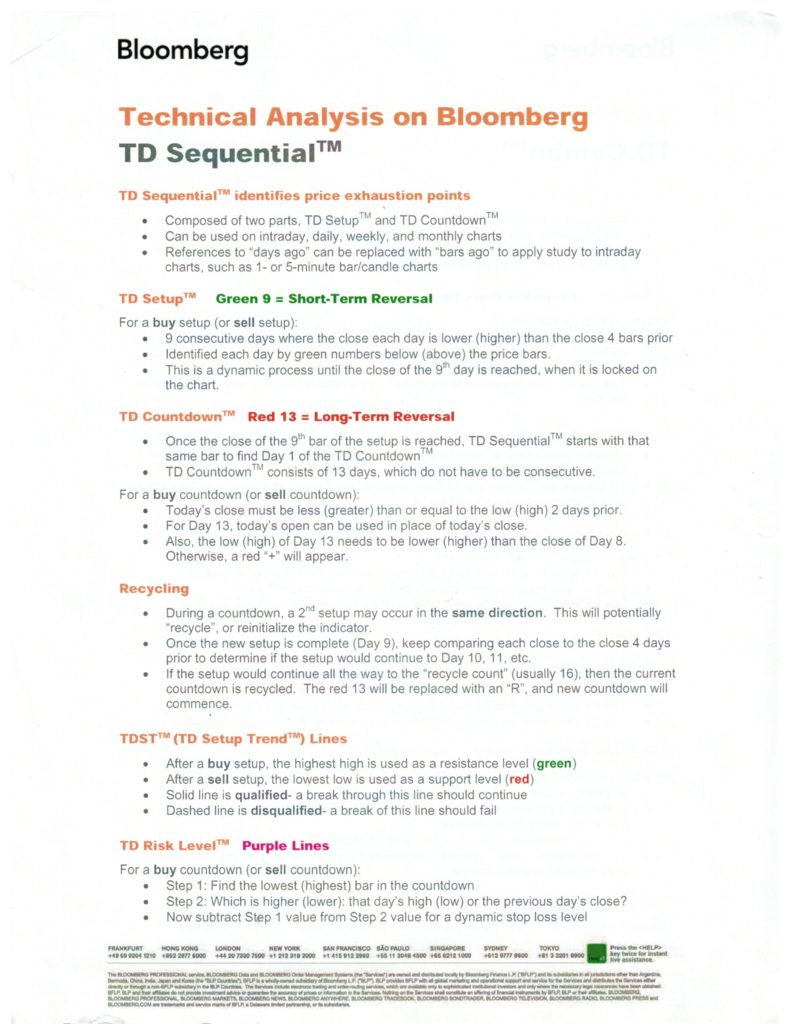

DeMark Sequential Basics

DETAILED COMMITMENT OF TRADERS DEFINITIONS