HIGHLIGHTS AND THEMES

- Recently the Bloomberg Commodity Index has broken out to the upside on the daily chart with still some levels on the weekly to achieve. Last week saw consolidation.

- Energy, notably Crude, backed off with sentiment dropping near levels where it bounced several times in the past year. We’ll watch if this can hold/reverse or go even lower to deeper oversold levels.

- Natural Gas has been volatile but remains a buy-the-dip story.

- Gold looks good, better than silver. Copper backed off but remains a buy if you added it lower, as I did.

- Platinum and Palladium also look ok but needs to see some upside momentum kick in.

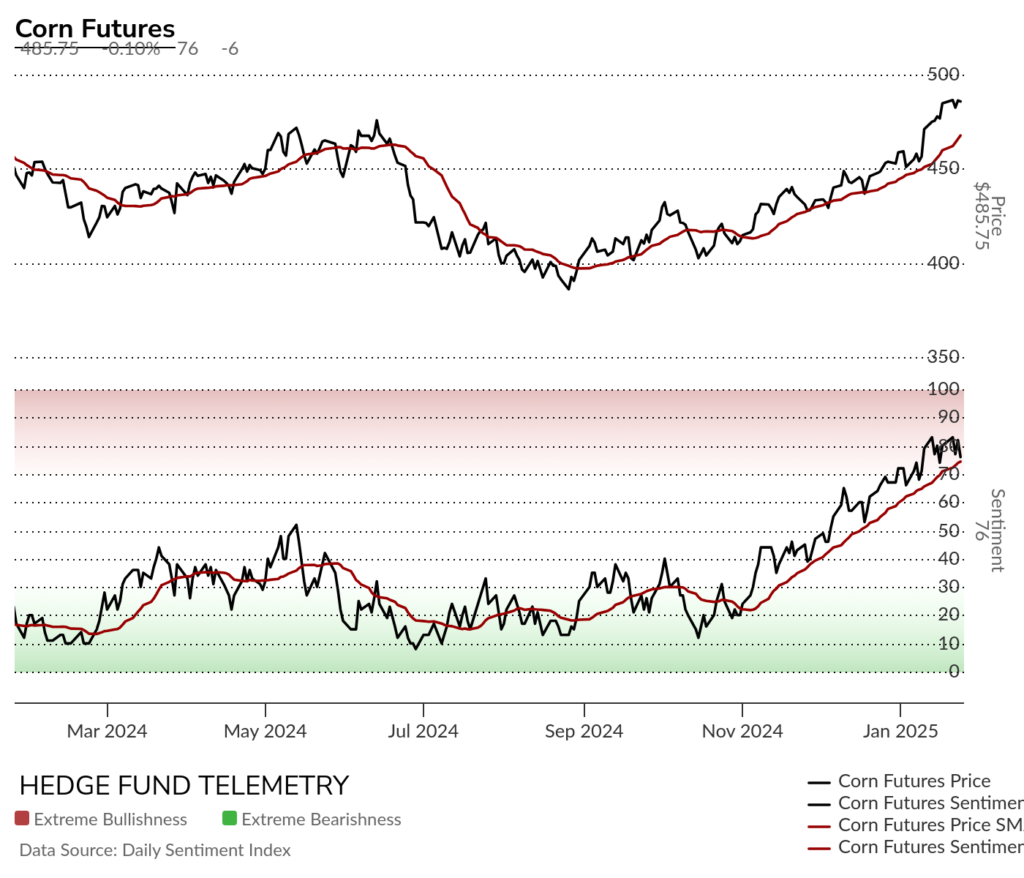

- Grains are mixed with Wheat still under pressure and Soybeans trying to work. Corn has been a good long idea and I would take profits if you followed.

- Livestock still working higher

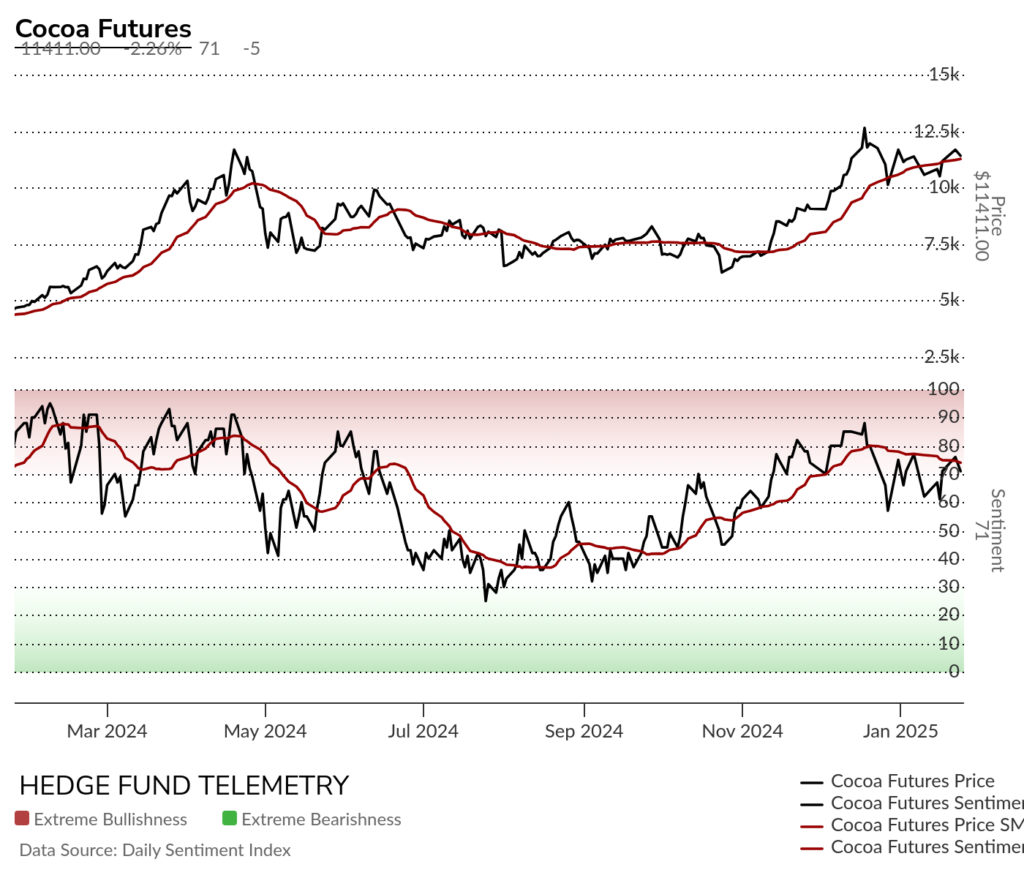

- Coffee remains strong but watch recent Combo 13. Cocoa still has a pending upside Sequential Countdown. Sugar bouncing after a new buy Setup 9

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily broke out higher recently and has consolidated the gains without losing much. Upside Sequential pending on day 6 of 13.

Bloomberg Commodity Index Weekly still has the Sequential in progress and hurdle over the 2024 pending.

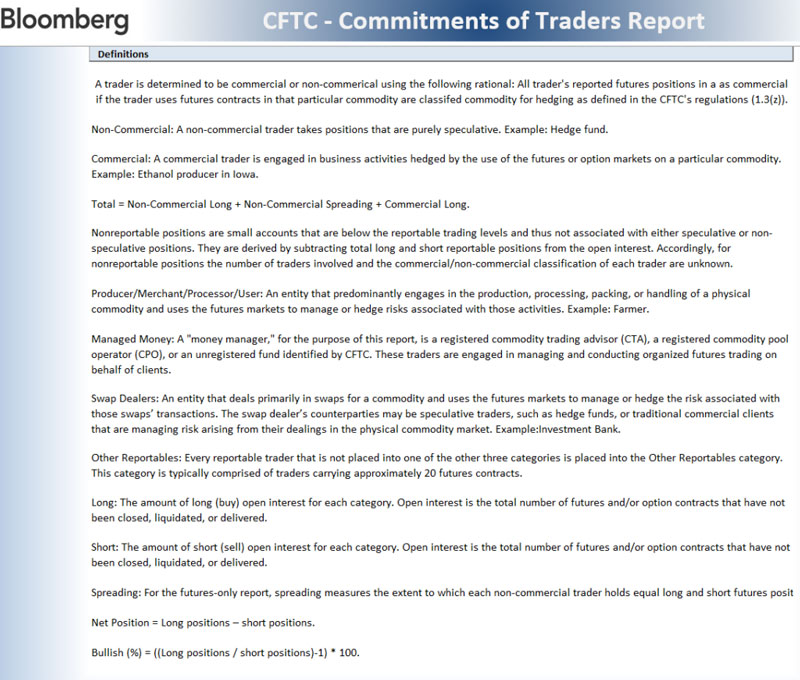

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY

Bloomberg Energy Index weekly shows the recent upside stalling at the 2024 highs. A breakout above this level would be exactly what energy bulls would want.

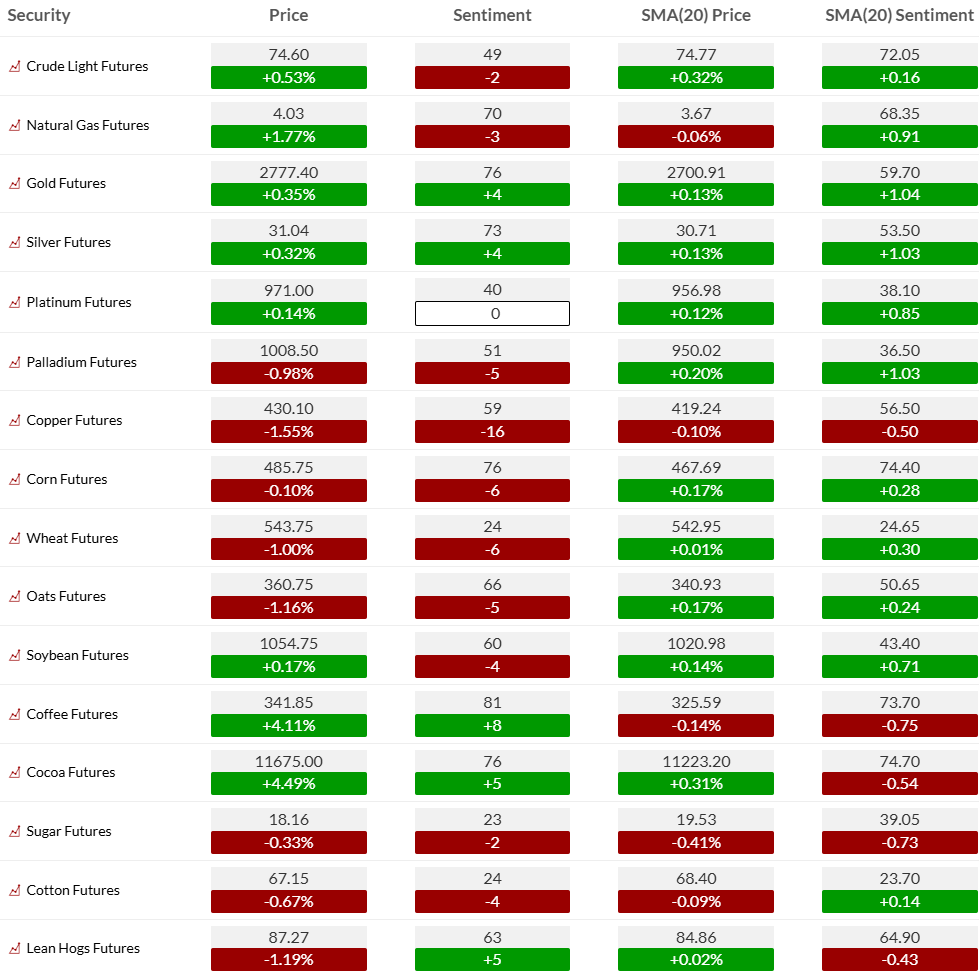

WTI Crude futures daily backed off after moving over the 200 day recently. Setup on day 6 of 9 so the 9 possible mid week might signal a low. I’ll have this on the First Call note several times this week.

WTI Crude futures bullish sentiment fell very hard last week, breaking the 50% midpoint level. This has found some support in the last year near so let’s see if that happens again.

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

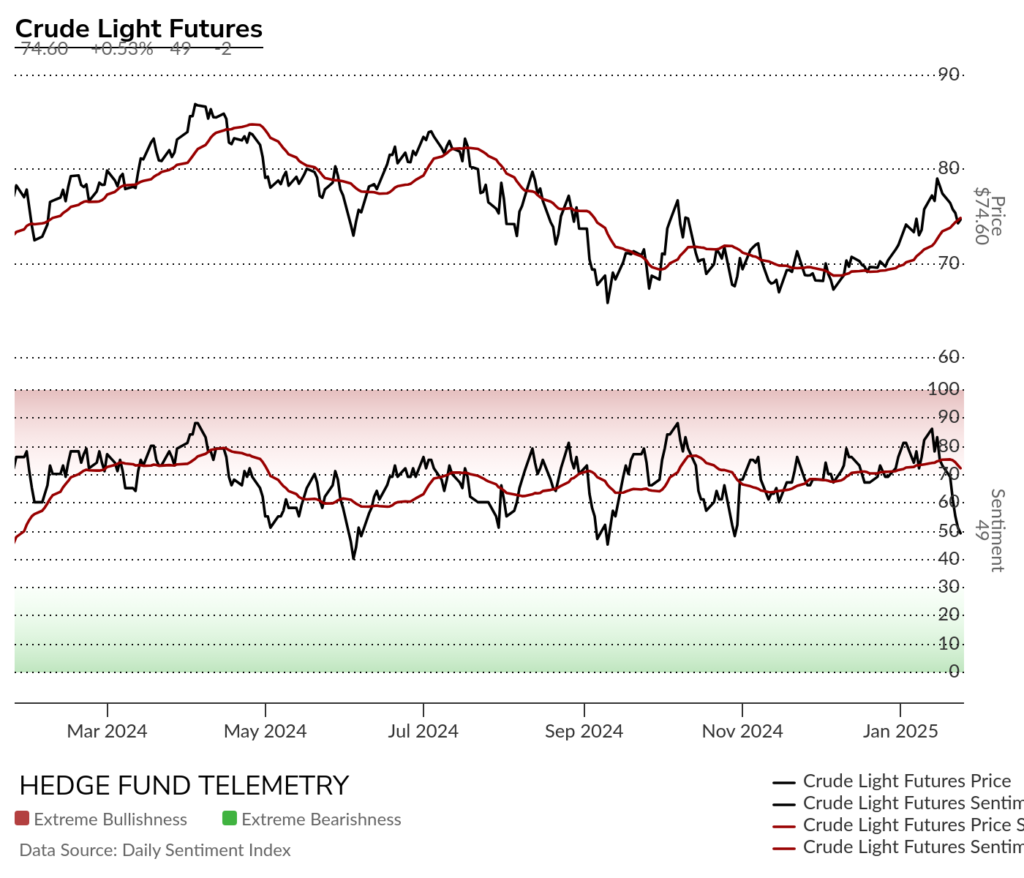

Natural Gas futures daily still has a bullish pattern with very volatile action. A pullback to the 50/200 day might be a good spot to buy this.

Natural Gas futures bullish sentiment backing off after hitting new year highs in the extreme zone.

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Metals

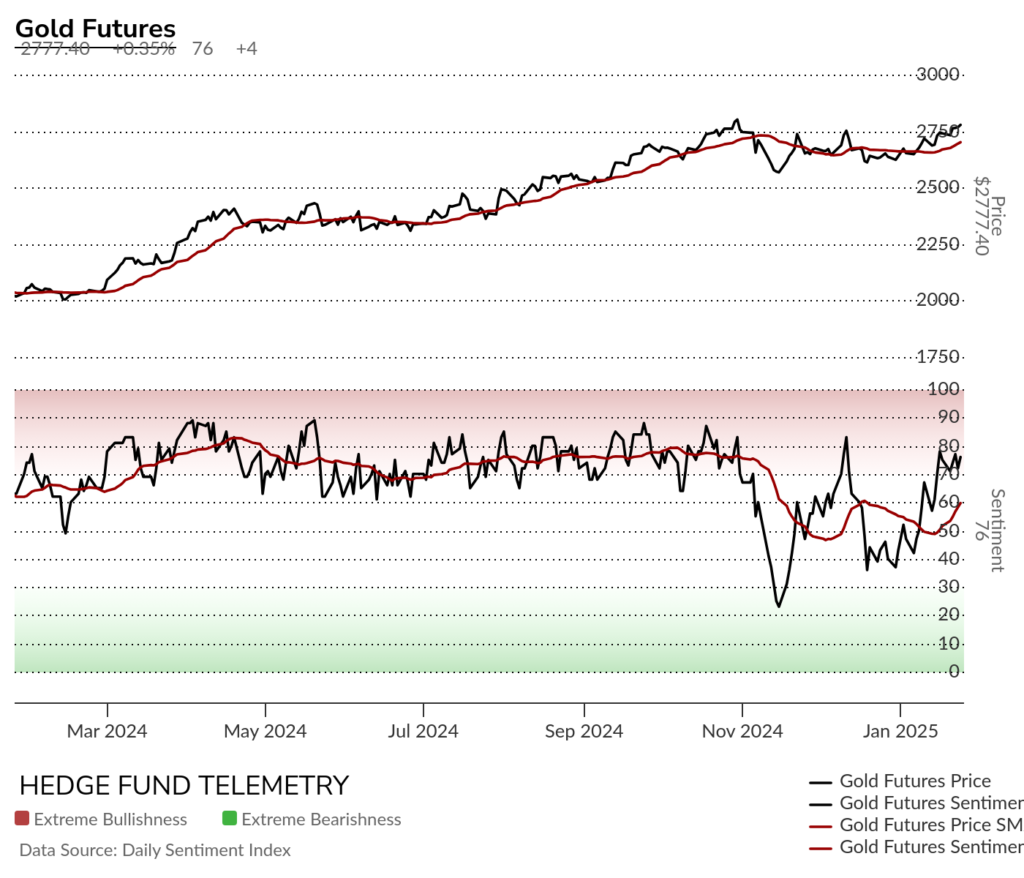

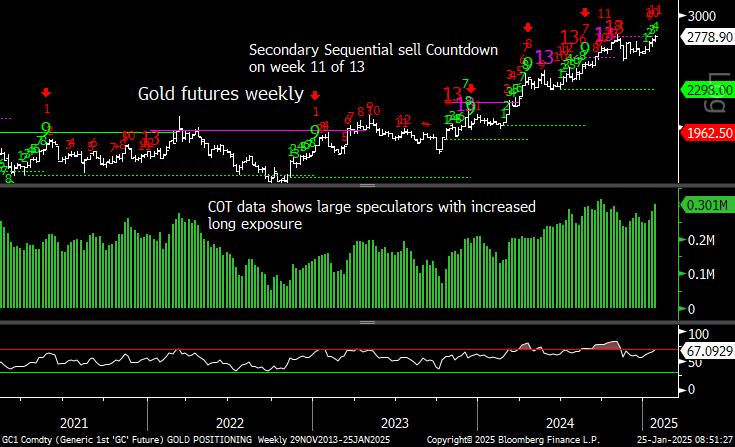

Gold daily has potential to move higher with the Sequential Countdown in progress.

Gold bullish sentiment back into the elevated zone.

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

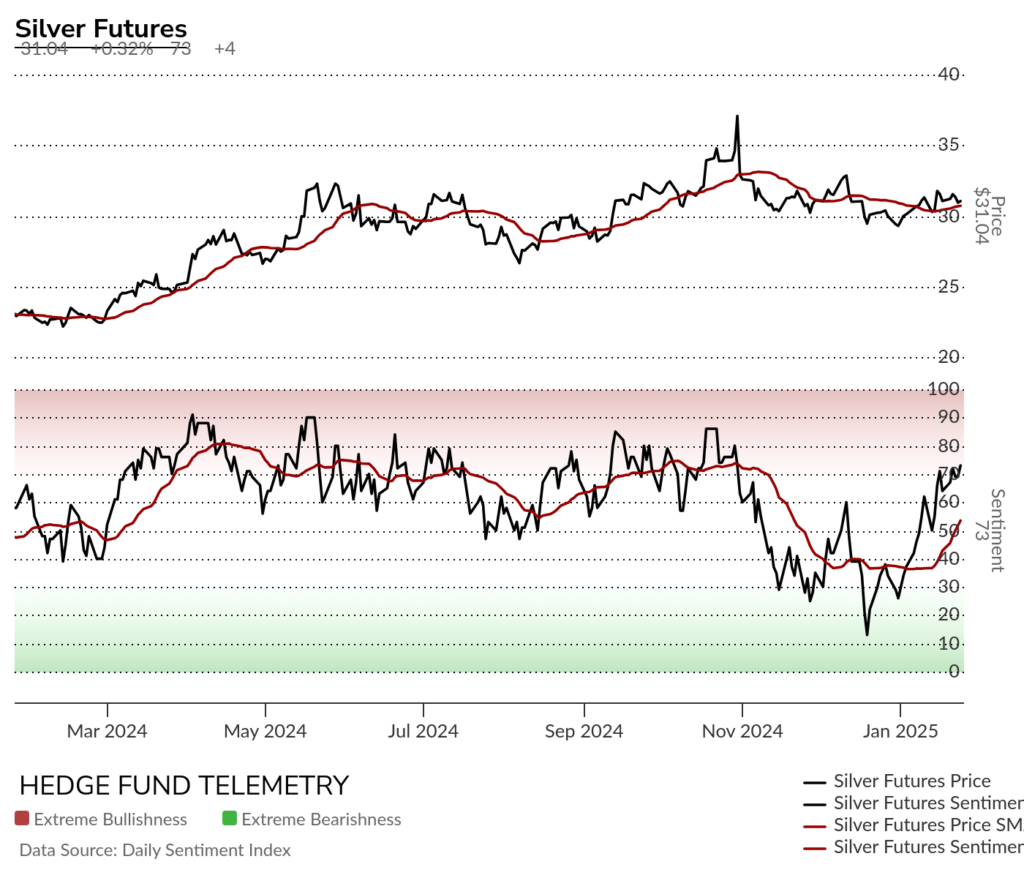

Silver daily has been making lower highs with wave 4 of 5. Breaking the wave 3 low will qualify downside wave 5

Silver bullish sentiment has moved stronger vs price action.

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

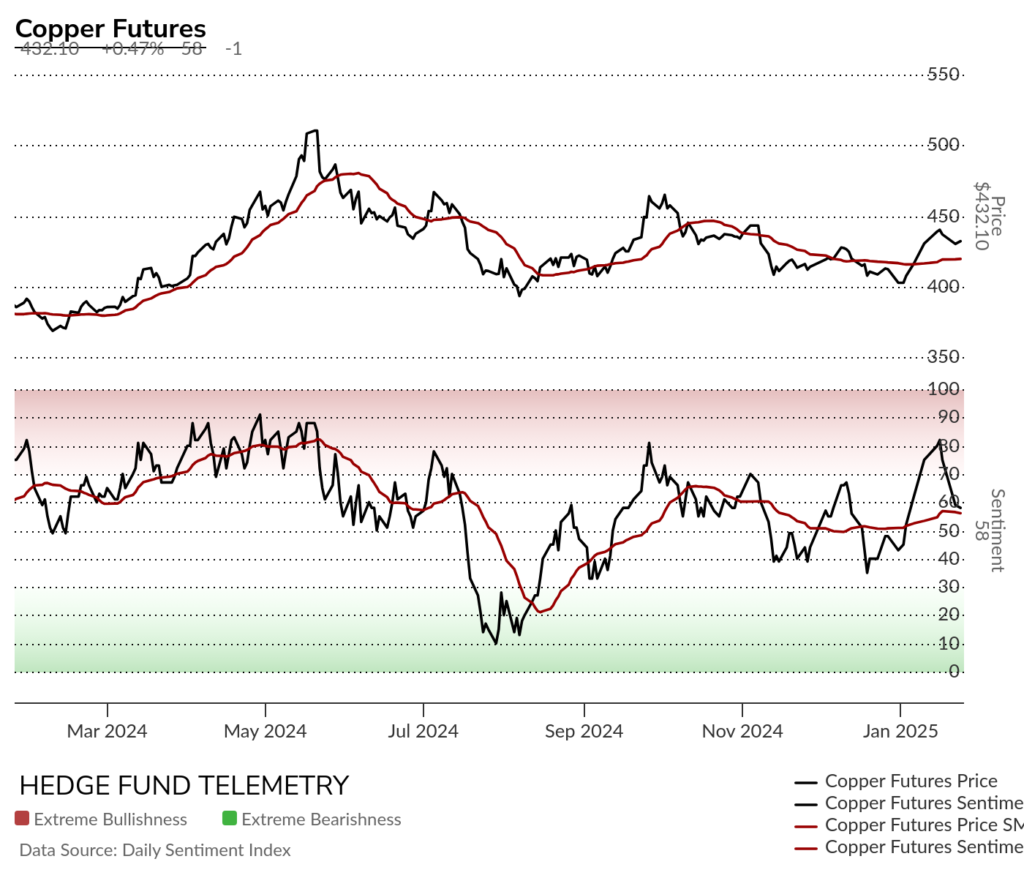

Copper futures daily had a strong gain and I would stay long after buying it around 410

Copper futures bullish sentiment backed off hard after the recent gains

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

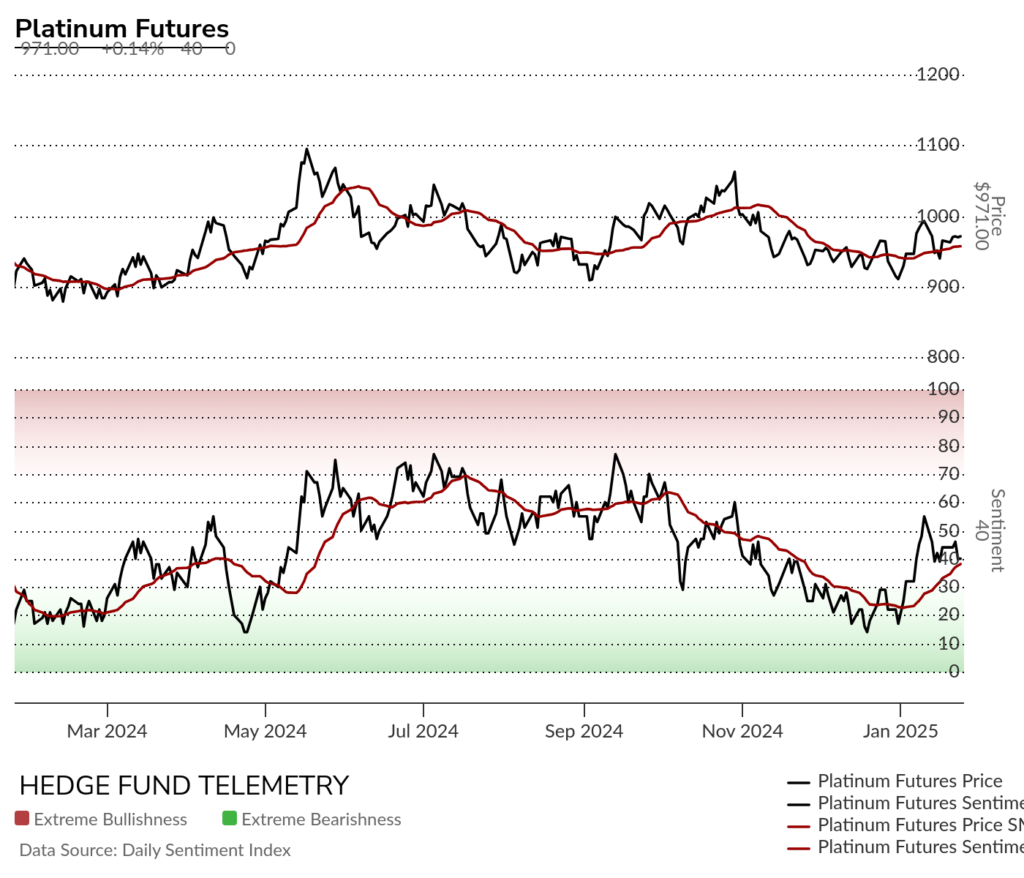

Platinum daily has clear breakout potential over the 200 day

Platinum bullish sentiment backed off but I still think this might work higher

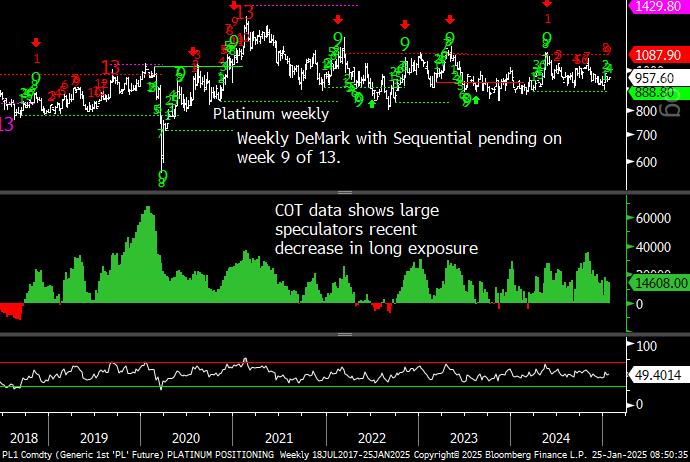

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

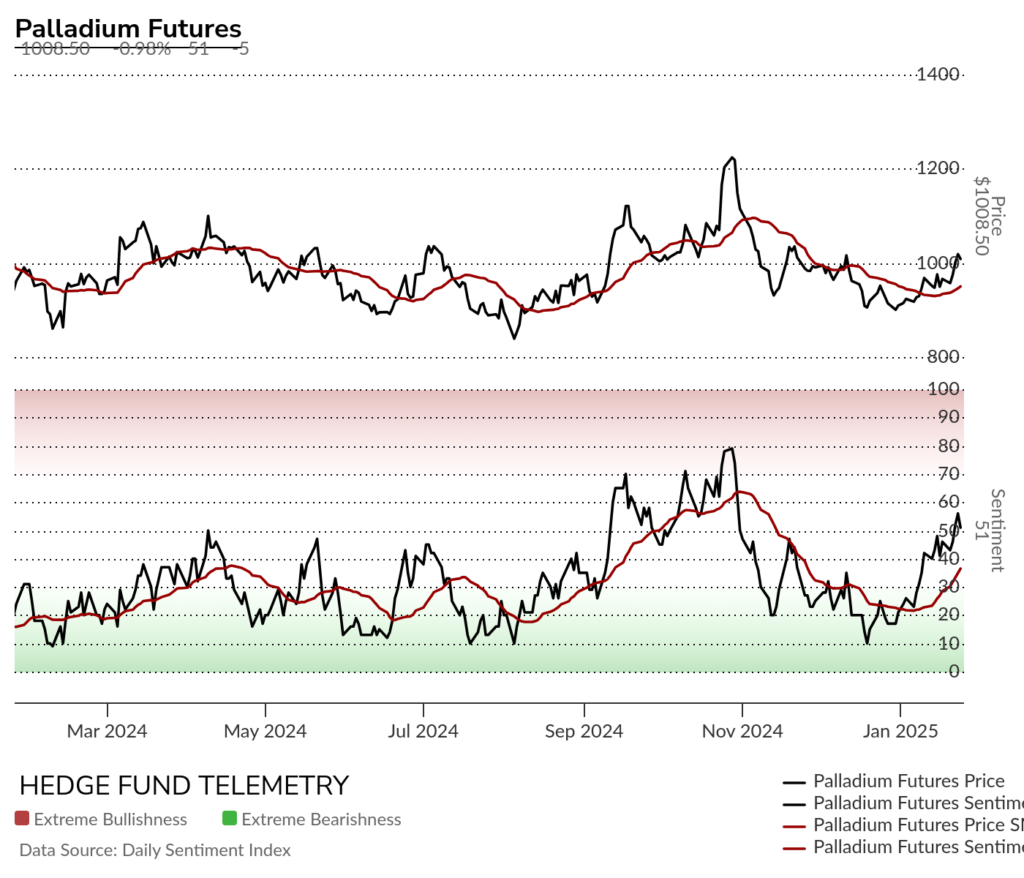

Palladium daily has potential for upside and I would stay long

Palladium bullish sentiment with a reversal up

Grains

Corn futures daily has been one long idea I’ve liked for several months and I would take gains if you followed.

Corn futures bullish sentiment is extended and backed off on Friday

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

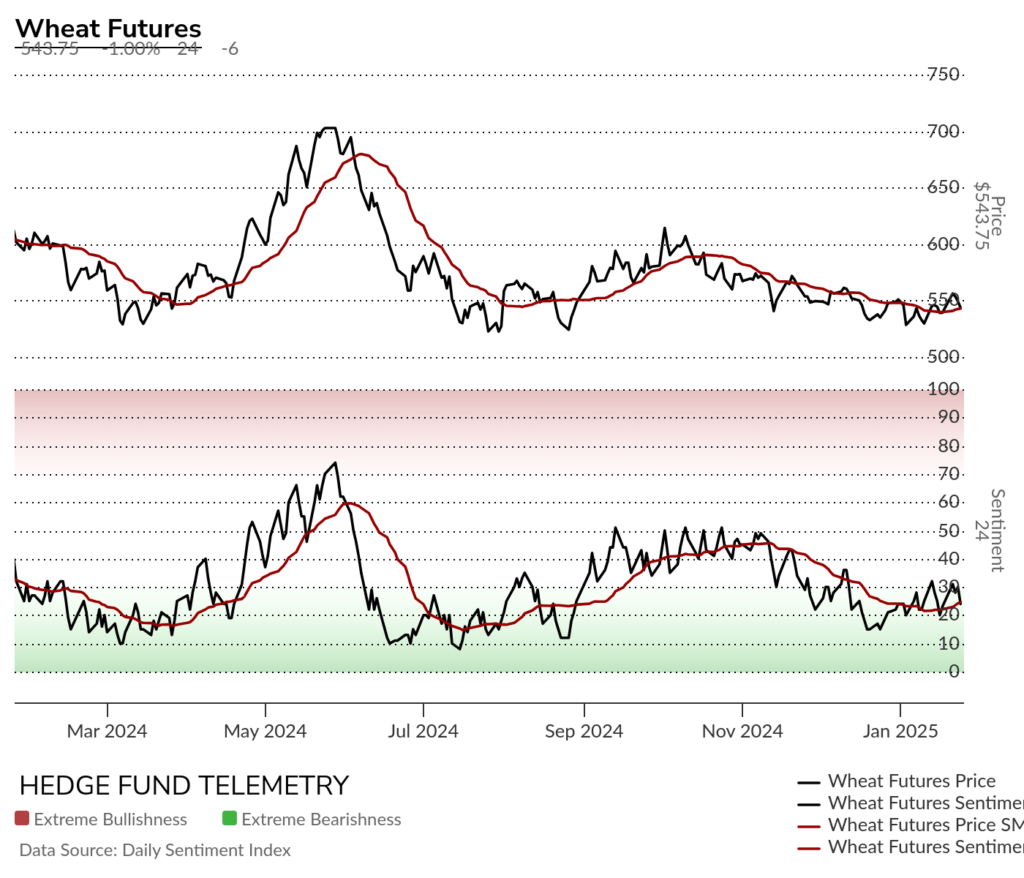

Wheat futures daily remains under pressure.

Wheat futures bullish sentiment remains under pressure

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

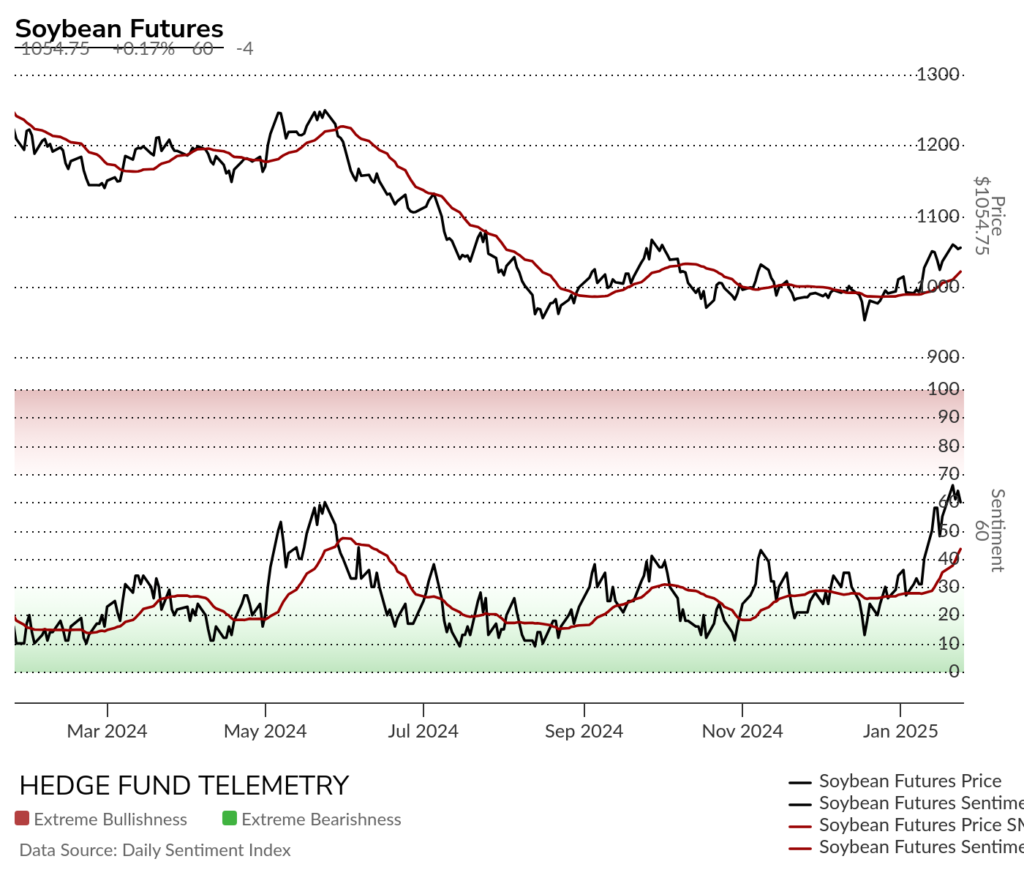

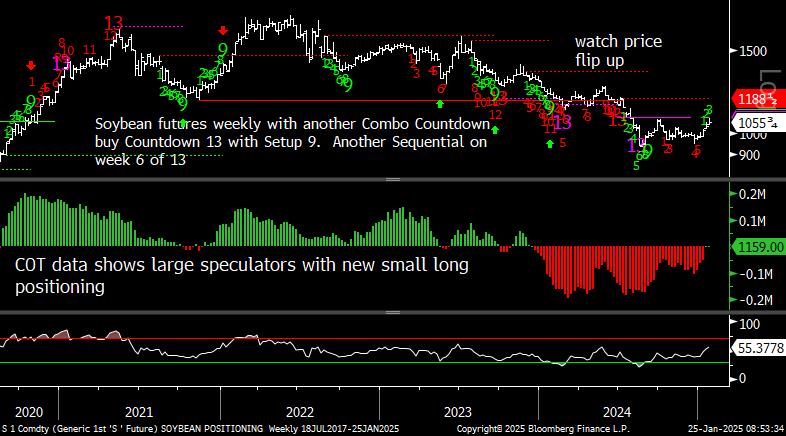

Soybean futures daily trying to turn with 200 day as resistance. Worth buying on dips.

Soybean futures bullish sentiment hit a new year high

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

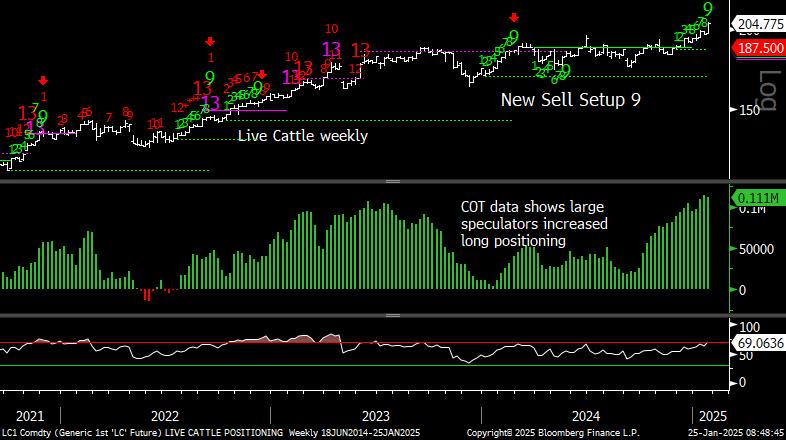

Livestock

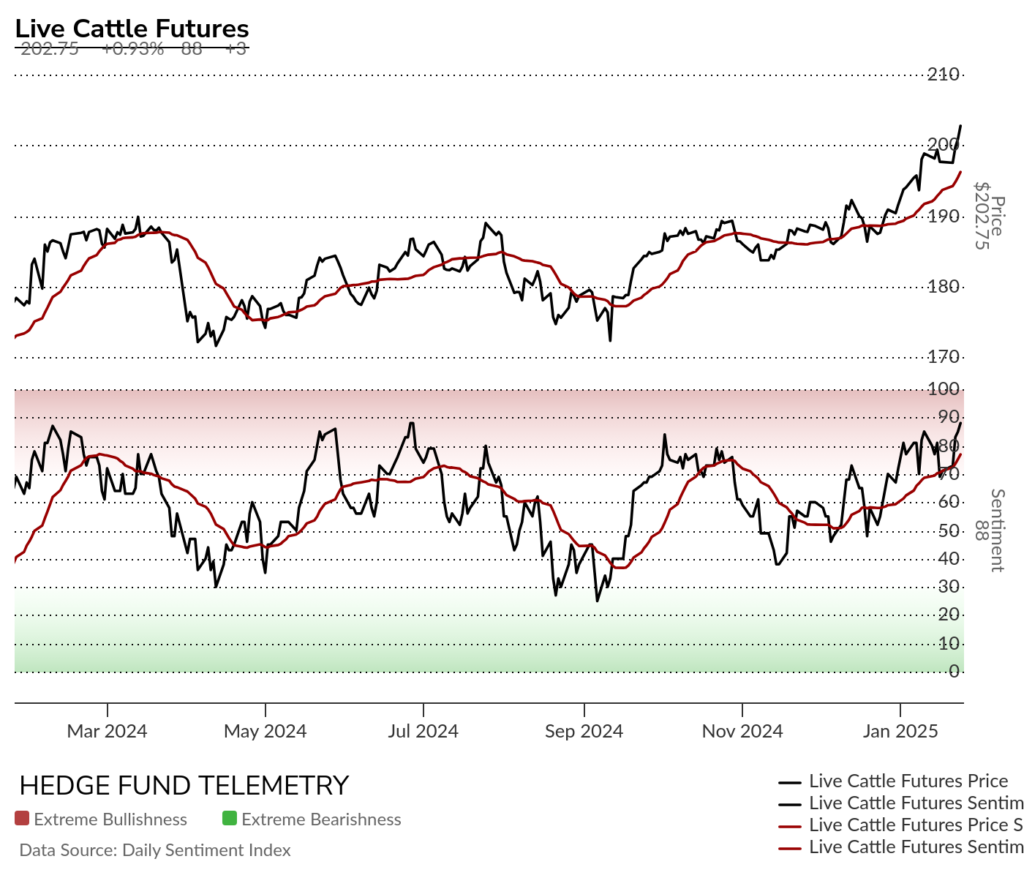

Live Cattle futures daily hit a new high and is stretched but no sign of a turn or signal

Live Cattle futures bullish sentiment hit an new multi year high at 88%

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

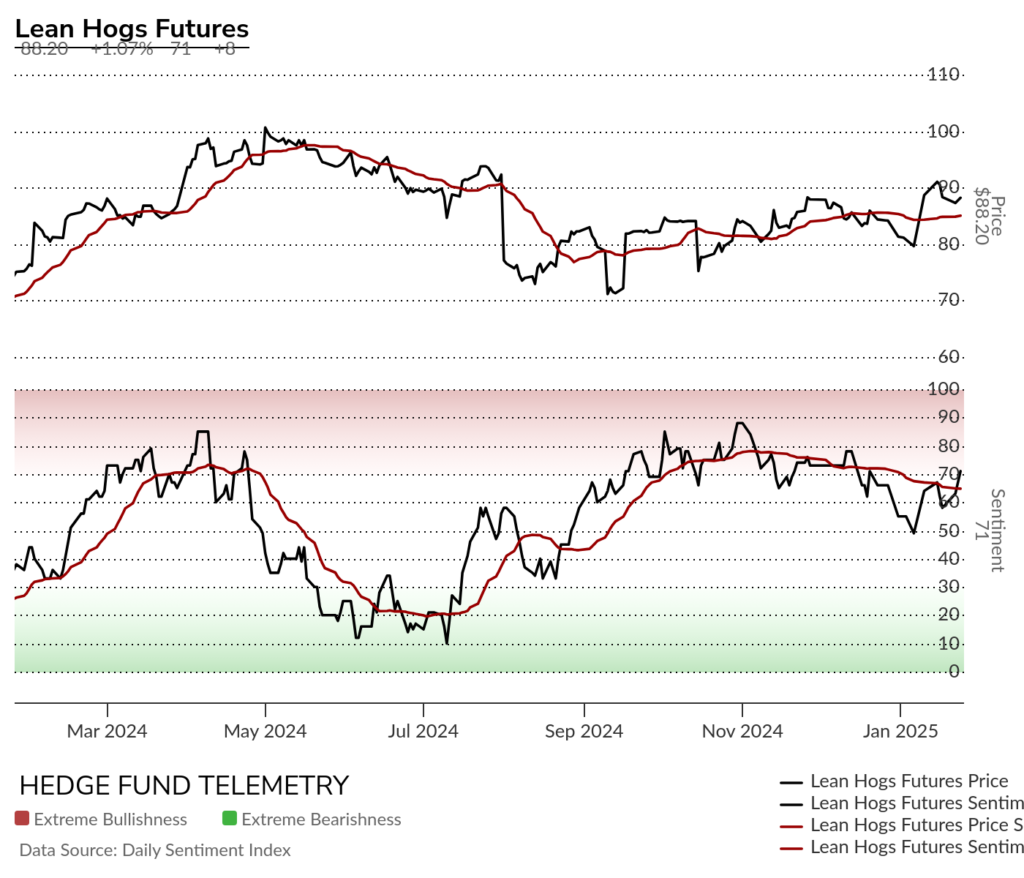

Lean Hogs futures daily has support ~85

Lean Hogs bullish sentiment remains elevated with lower highs from November high

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

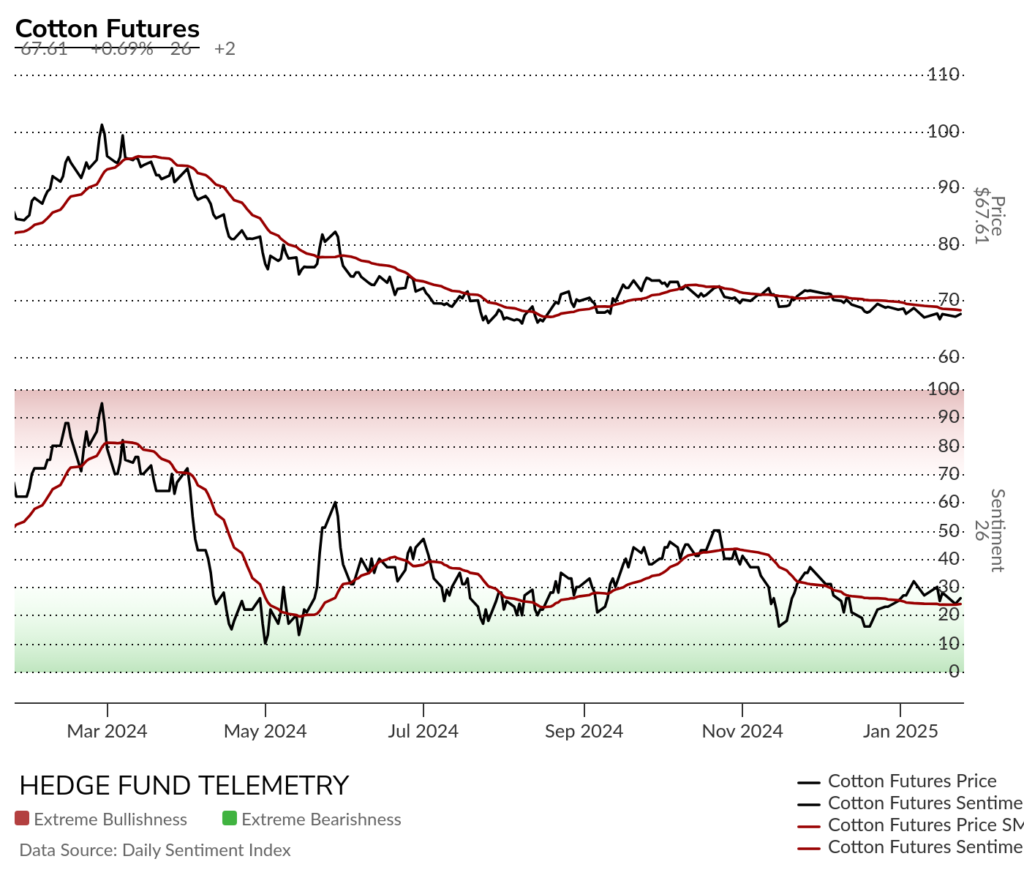

Softs

Cotton futures daily continues to trend lower although no new low last week

Cotton futures bullish sentiment remains under pressure.

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Coffee futures daily remains very strong however watch these new signals

Coffee futures bullish sentiment back to 87% an extreme level

Sugar futures daily bounced with buy Setup 9 while a pending Sequential remains something to watch.

Sugar futures bullish sentiment bounced last week

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Cocoa futures daily still with a pending upside Sequential

Cocoa futures bullish sentiment remains elevated

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

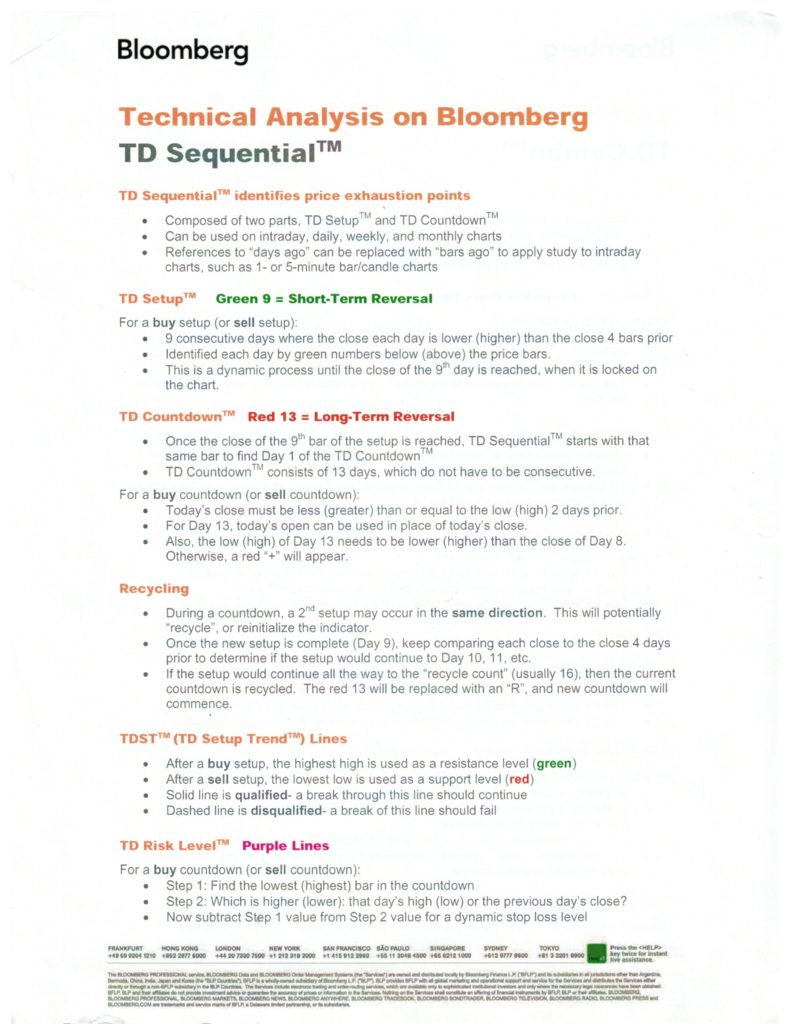

DeMark Sequential Basics

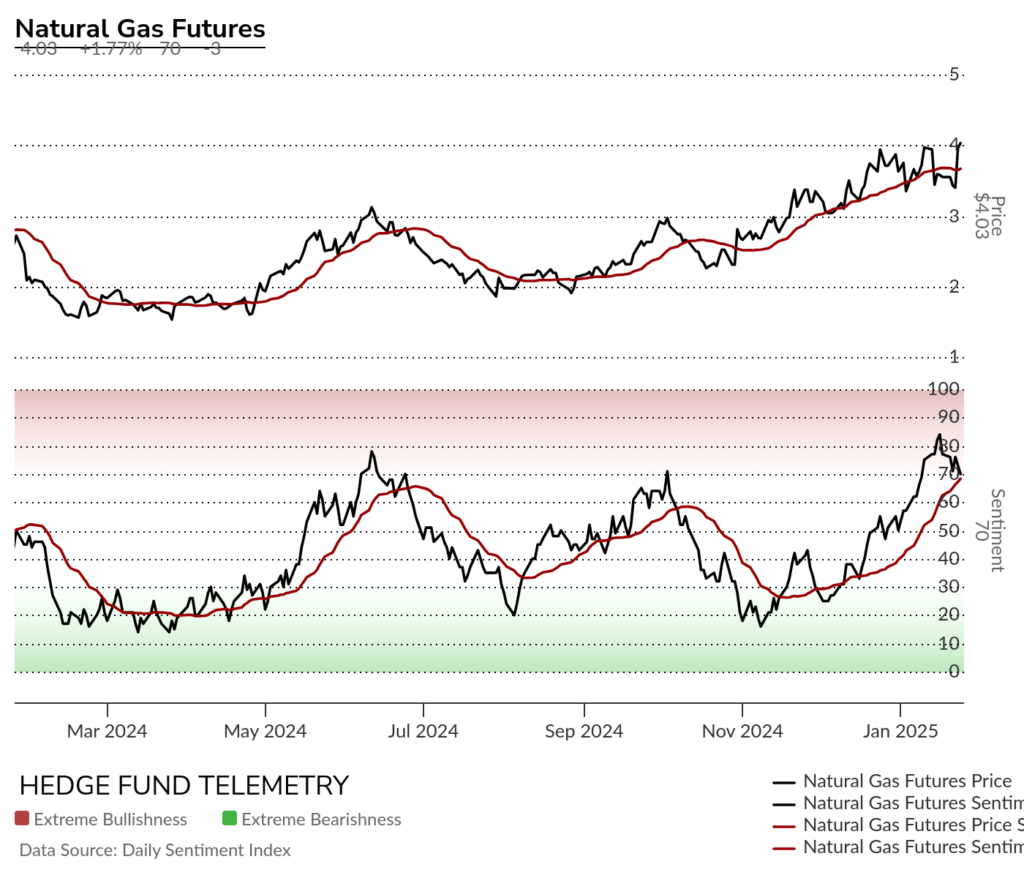

DETAILED COMMITMENT OF TRADERS DEFINITIONS