Here are some earnings previews for tomorrow morning and afternoon. As usual, some comments and details from my friend at Vital Knowledge, the chart view, implied move, and Erlanger Research with short interest and Options Rank.

I am not adding any of these to the Trade Ideas but you might find the info enough to add a position. Some of these might be better to trade after the earnings reports too. Some have a lot of questions that management need to answer concerning the new administration policies as well turnaround plans.

I will have another normal note out before the close.

- BA (Boeing) FQ4 earnings preview (reports Tues 1/28 before the US open) – the company already preannounced most of the big Q4 numbers, including EPS of -5.46, sales of $15.2B, and op. cash flow of -$3.5B. Sentiment isn’t positive on near-term fundamentals as the firm has a slew of problems still to work through, but investors are hopeful the worst is behind it. The keys for the conf. call will be guidance on free cash flow (the Street is modeling free cash flow of -$3.4B in Q1 and -$3.7B for 2025, w/positive free cash flow in Q3) and the projected pace of 737 production.

BA has had a strong move off the lows with the union strike over and Trump move. There are several DeMark Sell Countdown 13’s in play. Short interest has been elevated while there has been call buyers – a mixed picture. They already preannounced and didn’t go down so that has some bullish elements.

The implied move is only 3.37% slightly below the average move.

The short interest is high with 2.63 days to cover. On the Options Rank there has been moderately heavy call buying with the red dots. This is a mixed picture.

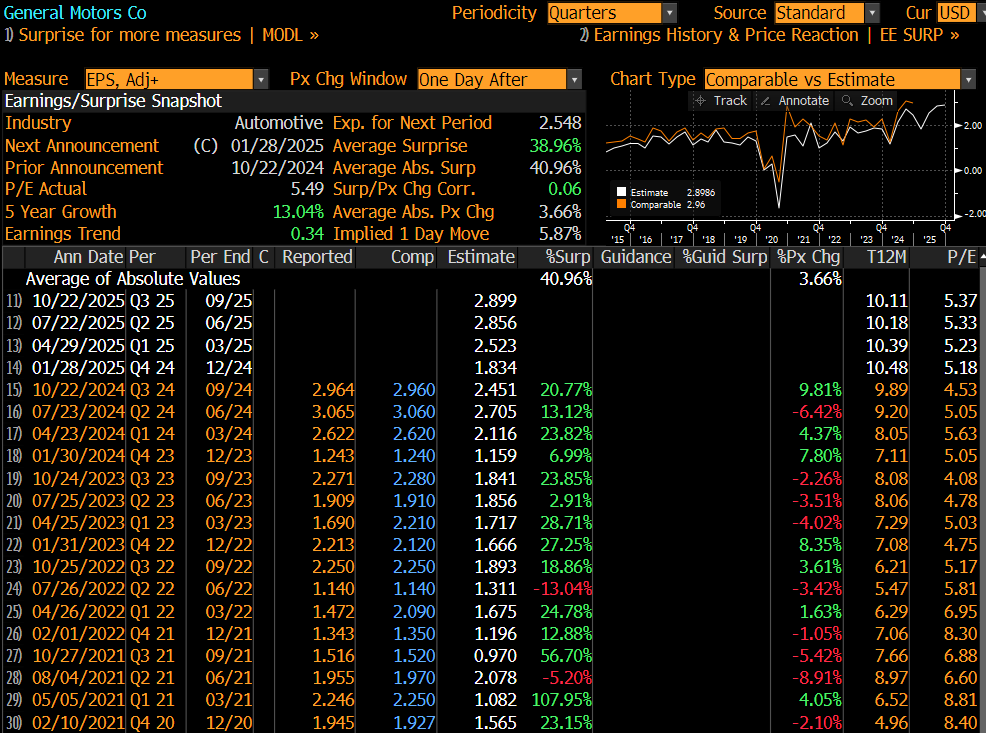

- GM (General Motors) FQ4 earnings preview (reports Tues 1/28 before the US open) – the company has been executing very well, trades at a cheap PE, and returns a healthy amount of cash to shareholders (primarily via the buyback). However, sentiment is cautious given secular worries about the ICE-to-EV/hybrid transition, increased competition from Chinese OEMs, and Trump 2.0 trade policies. The Street is looking for Q4 EPS of 1.62 with sales of $43B. For 2025, the Street is modeling EPS of ~10.30 with revenue of ~$178.4B.

The charts is not terrible as there was a bounce recently with the DeMark Sequential 13 and Setup 9. Tomorrorw could get the Setup 9 which might signal a top. It’s cheap and I would agree they have been managing the business well. Mary Barra is a very good CEO.

The implied move is 5.87%

Short interest is not a factor although on the Options Rank there has been moderately heavy put buying on the downside move with the green dots.

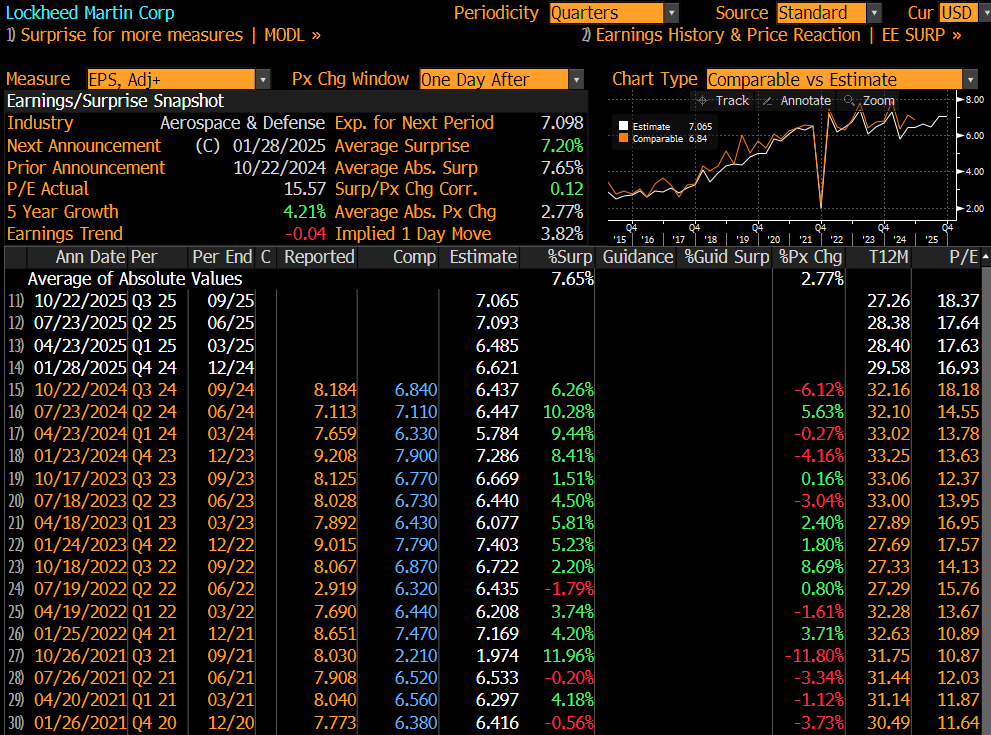

- LMT (Lockheed) FQ4 earnings preview (reports Tues 1/28 before the US open) – sentiment is cautious on LMT due to worries about how the defense budget will evolve in a second Trump term (more specifically, there has been a lot of neg. headlines about the F35 given Musk’s criticisms of the jet). For Q4, the Street is modeling EPS of 6.59 with sales of $18.8B.

LMT also bounced withthe recent DeMark 13 and 9 after failing a few times. A new sell Setup 9 at the 50 day below the 200 day is a concern. If this does OK it might be a buy tomorrow even if higher.

The implied move is 3.82%

Short interest has increased with the downside move in the last quarter. There was heavy put buying all the way down on the Options Rank with the green dots. The bounce could be part of the put squeeze unwind.

- RTX (RTX Corp.) FQ4 earnings preview (reports Tues 1/28 before the US open) – sentiment is bullish on RTX given strong secular commercial aerospace tailwinds in the Pratt and Collins businesses. For Q4, the Street is modeling EPS of 1.39 with sales +3.5% to $20.5B (including Pratt +8.6% to $6.99B and Collins +2% to $7.26B).

RTX also bounced with the recent DeMark Sequential 13 and has a new sell Setup 9.

The implied move is 4.32%

Short interest is low and not a factor. With the recent move lower it’s attracted a lot of heavy put buying on the Options Rank with the green dots. This could have caused a recent squeeze higher.

- LVMH FQ4 earnings preview (reports Tues 1/28 after the EU close) – sentiment has been relatively cautious on the luxury stocks given signs of global demand softness, especially in China, but the recent Richemont/Burberry blowouts have caused expectations for the whole group to get nudged higher. For LVMH’s Q4, the Street is looking for organic revenue -1% overall, including Fashion & Leather -3%, Wines & Spirits -7%, Perfume & Cosmetics +3.5%, Watches & Jewelry -3%, and Selective Retailing +3.1%.

This is very stretched after the positive surprise report with Richemont. Tomorrow could have a new Sequential sell Countdown 13 and sell Setup 9 which I would probably sell tomorrow.

- CB (Chubb) FQ4 earnings preview (reports Tues 1/28 after the US close) – the non-life insurance industry has enjoyed a favorable macro backdrop for several quarters given robust pricing power and elevated rates (which are bolstering investment income), but investors are worried about cat losses (for CB specifically, there is concern about the company’s exposure to the high-end homeowners market in LA). The Street is looking for Q4 EPS of 5.45 with NPW growth of 5.1% on a reported basis, net investment income of ~$1.5B, and cat losses of ~$630MM.

CB had a new Sequential buy Countdown 13 is is up today. A lot of concerns about the exposure with the LA fires need to be discussed and have investors comfortable if this can work higher.

The implied move is 3.12% and this doesn’t move much historically.

Short interest is not a factor with 1.9 days to cover. On the Options Rank there was moderate put buying on the drop after the LA fires.

- QRVO (Qorvo) FQ3 earnings preview (reports Tues 1/28 after the US close) – sentiment has been fairly gloomy on the fundamental outlook after the awful guidance provided back in Oct (which caused the stock to crater), although the Starboard stake news has caused shares to rebound modestly (there’s also a hope that the outlook won’t require another downward revision). For FQ3/Dec, the Street is looking for EPS of 1.21 with sales of $901MM and GMs of 45%.

QRVO saw a huge 27% drop the last earnings report and has bounced reclaiming a lot of the downside. A new activist lifted this but might still be at risk if estimates are not low enough. Short interest was high so the bounce was mostly a short squeeze and with shorts likely gone or many of them the risk for a drop is elevated.

The implied move is 7% with two recent quarters with huge declines.

Short interest has spiked in the last report possibly setting up this recent squeeze higher. On the Options Rank there was heavy put buying at the lows with the green dots. It’s now setup more neutral

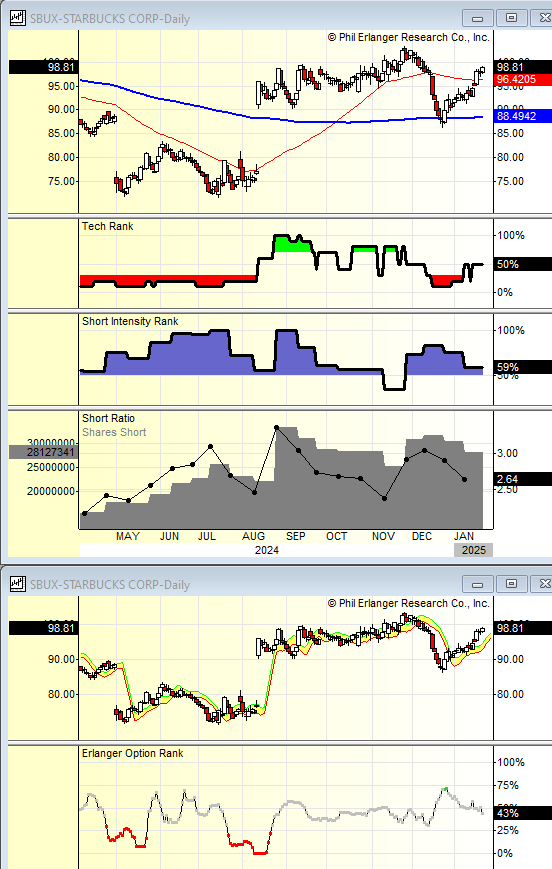

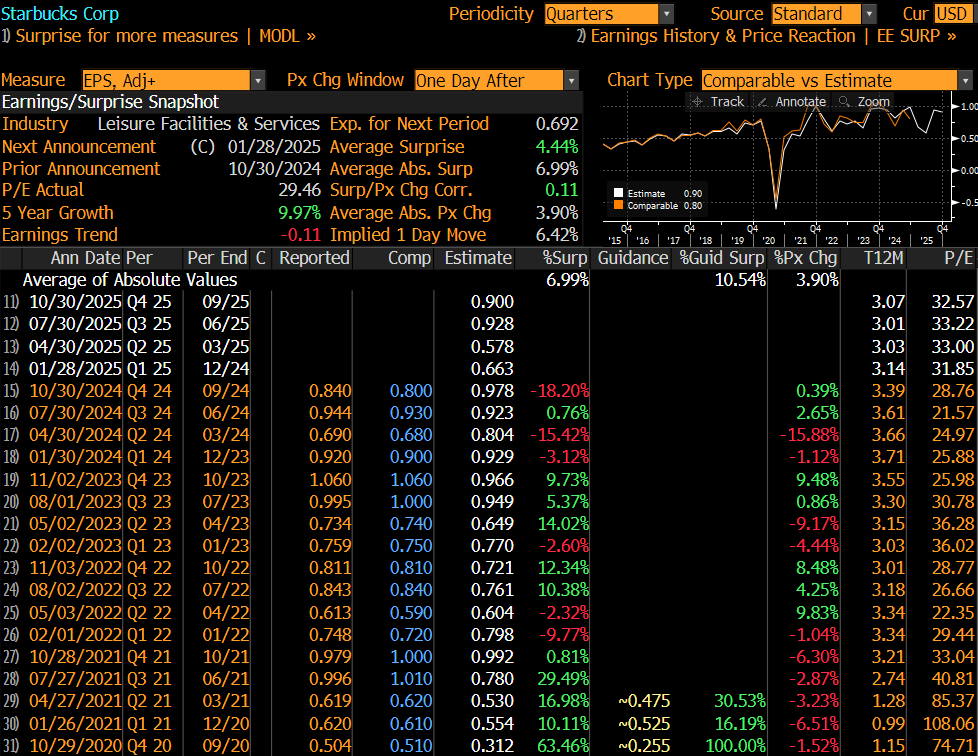

- SBUX (Starbucks) FQ1 earnings preview (reports Tues 1/28 after the US close) – sentiment is bullish on CEO Brian Niccol’s ability to engineer a turnaround of the company, but the near-term numbers will probably stay under pressure given a continuation of existing headwinds. Investors will be listening for updates on cost cutting (Niccol recently suggested there will be more job cuts) and strategic options for the China business. In FQ1, the Street is looking for EPS of 67c with comps -5.4% (including US -4.2% and China -9.3%) and op. margins of 11.9%.

SBUX has a decent looking chart with it moving near the recent highs. A sell Setup 9 however that is the second one and an upside Sequential remains in progress on day 7 of 13. Shorts are still hanging around this one and a lift over the recent highs could see this make a decent upside move. The new CEO has a great record from CMG but it might be too early to tell if a turnaround is taking hold.

The implied move is 6.42%

Short interest has been elevated with the short interest ratio declining to 2.6 days to cover. On the Options Rank it’s neutral.