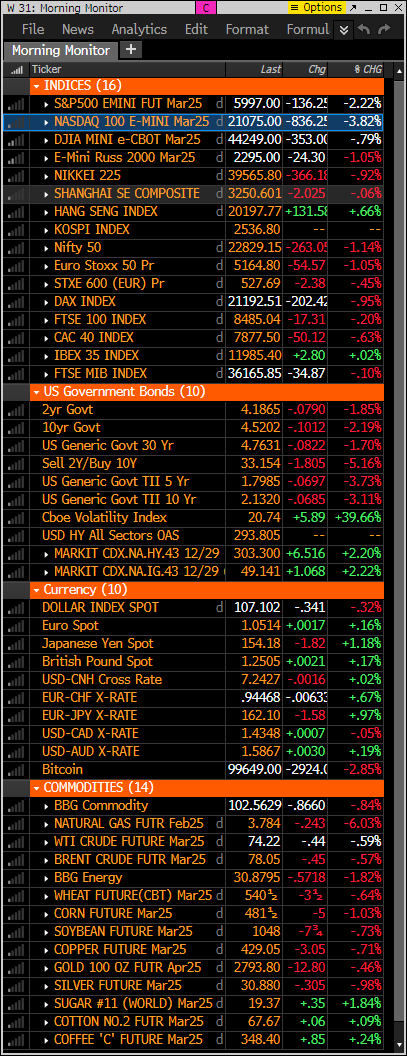

- S&P futures are down 2.2% and Nasdaq futures are down 3.8% in Monday morning trading off the lows. Asian markets mixed overnight with the Nikkei and China’s Shenzhen Composite among the laggards while Hong Kong outperformed. European markets under pressure, down 1%. Treasuries rallying across the curve. Dollar index down 0.3%. Gold off 0.4%. Bitcoin down 3%. WTI crude down 0.6%.

- Trade Ideas Sheet: Take the gift of this gap down and cover some shorts: META, GOOGL, XLC, XLK, SPY and QQQ. I will cover half of SMH to bring it to 2.5% from 5%.

- Selloff is a function of all the buzz surrounding Chinese AI startup DeepSeek, whose open-source models have rivaled the performance of the leading US chatbots but at just a fraction of the cost. This has heaped scrutiny on the outsized hyperscaler capex ramp, as well as pockets of the broader US exceptionalism theme. Also plays into longstanding concerns about concentration risk (as I showed yesterday on Week Ahead) and has potential exacerbate US-China tech war. More tariff headline volatility over the weekend with Colombia in the crosshairs before acquiescing to Trump’s demands to take deported migrants. Politico article also discussed how despite some relief surrounding initial lack of action on tariffs, they are still very much in the pipeline. Another report also noted Trump aides want to hit Mexico and Canada with tariffs as soon as February 1st. On the data front, China manufacturing PMI fell back into contraction.

- Big earnings week ahead with ~40% of the S&P 500 market cap scheduled to report, including 5 of the Mag 7 names. NVDA one of the big decliners amid all the DeepSeek attention. Bloomberg reported on Friday that AAPL executive Kim Vorrath has been enlisted to help fix AI and Siri. The Information discussed how AMZN is trimming spending on original shows and movies in Prime Video and boosting spending on sports and amount of 3P content. FT said BHP has cooled on making another bid for rival NGLOY. X US Steel under activist pressure with Ancora Holdings looking to oust CEO and get the company to pursue takeout talks beyond Nippon.

- New home sales on the US economic calendar this morning.

- Key Upgrades/Downgrades: Electronic Arts downgraded to neutral from outperform at BNP Paribas Exane. Twilio upgraded to buy from neutral at Goldman Sachs. Qorvo upgraded to overweight at Piper Sandler. Ralph Lauren downgraded to market perform from outperform at Raymond James. Take-Two Interactive upgraded to buy from neutral at UBS. Keefe, Bruyette & Woods downgrades FMCC, FNMA.

market snapshot

economic reports today

premarket trading

US MARKET SENTIMENT

S&P and Nasdaq bullish sentiment dropped on Friday and likely will see big declines if today’s early action remains weak through the day.

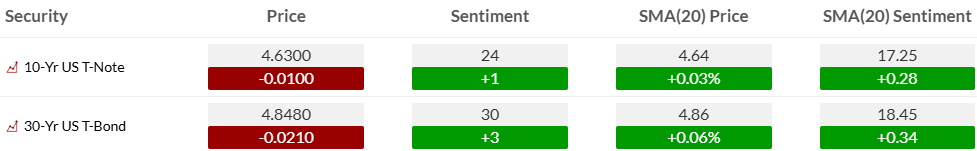

Bond bullish sentiment has ticked higher after recent very oversold reading of 10%.

Currency bullish sentiment highlighted with the large drop with US Dollar sentiment last week.

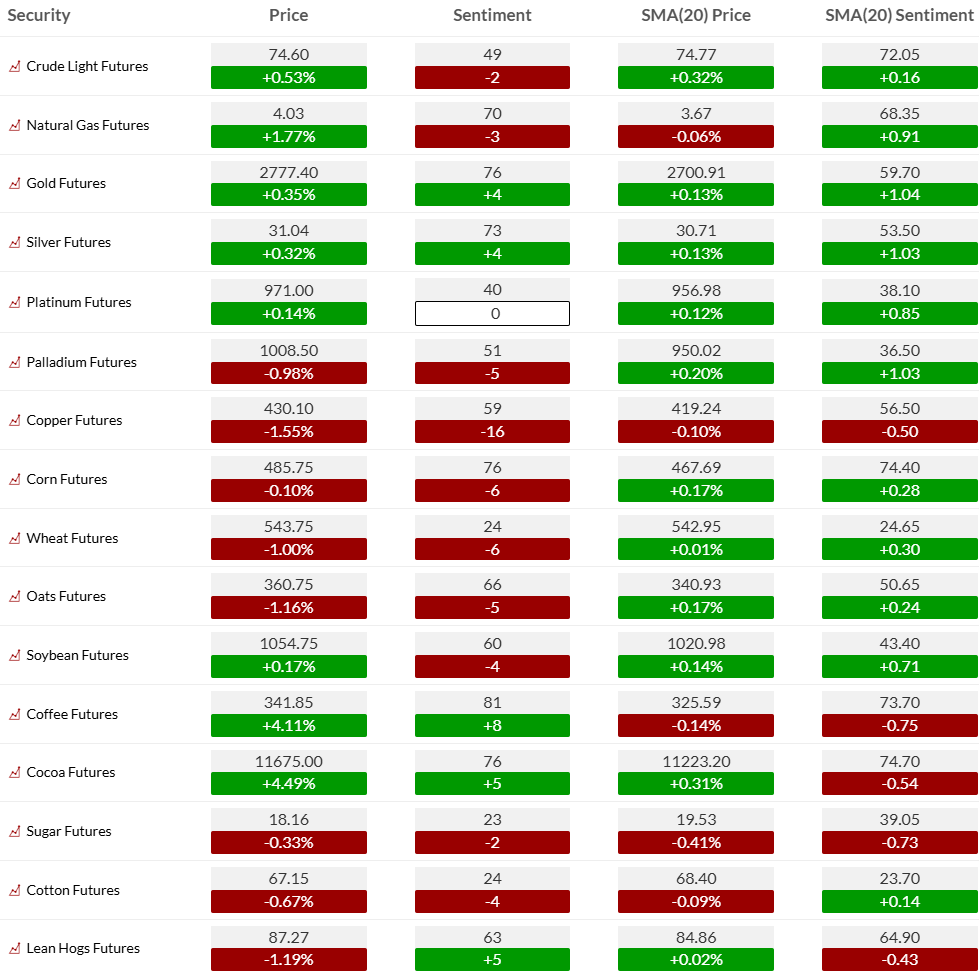

Commodity bullish sentiment highlighted with Crude drop last Friday under 50%.

US MARKETS

S&P futures 60-minute tactical time frame with new Sequential and Combo 13’s. Since there was two Setup 9’s on the downside there is a secondary Sequential on hour bar 8 of 13.

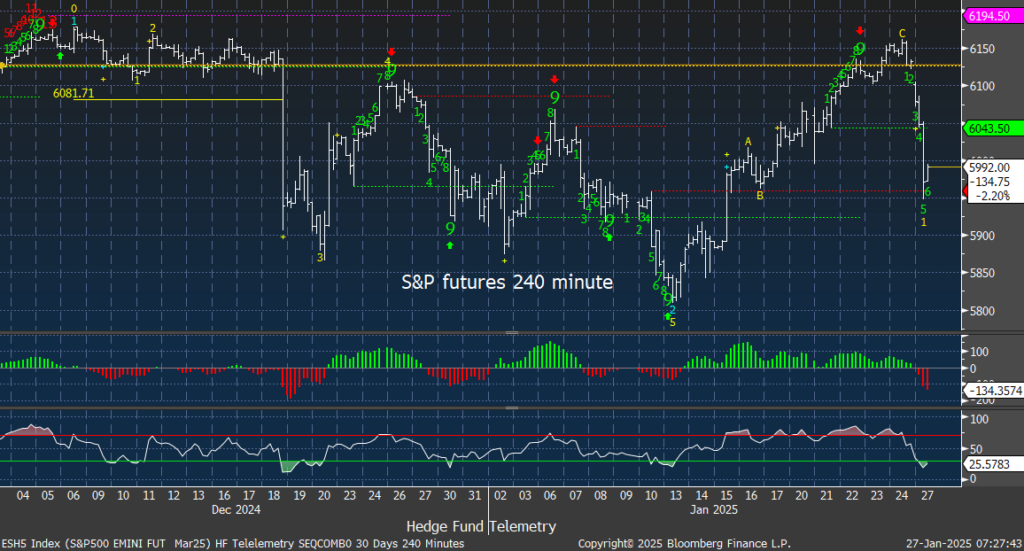

The 240 minute with S&P 500 futures has seen decent inflection with Setup 9’s.

S&P futures daily with a sharp gap down expected for cash indexes something that has happened up and down a lot in the last month.

Nasdaq 100 60-minute tactical time frame with a new Combo 13 and Sequential on hour bar 11 of 13.

The 240 minute with Nasdaq 100 futures also has seen decent inflection with Setup 9’s.

Nasdaq 100 futures daily with a large drop which is nothing new in the last month.

Extra charts we’re watching

US Dollar Index daily falling again today with TDST support and Setup on day 5 of 9. Completing the Setup 9 this week if it happens will cancel the secondary Sequential Countdown left pending on day 7 of 13.

US 10-Year Yield falling with equity markets under pressure.

Bitcoin Daily still has both upside and downside wave patterns as price moves sideways. Breaking the January closing low qualifies downside wave 3 or moving above December highs qualifies upside wave 5.

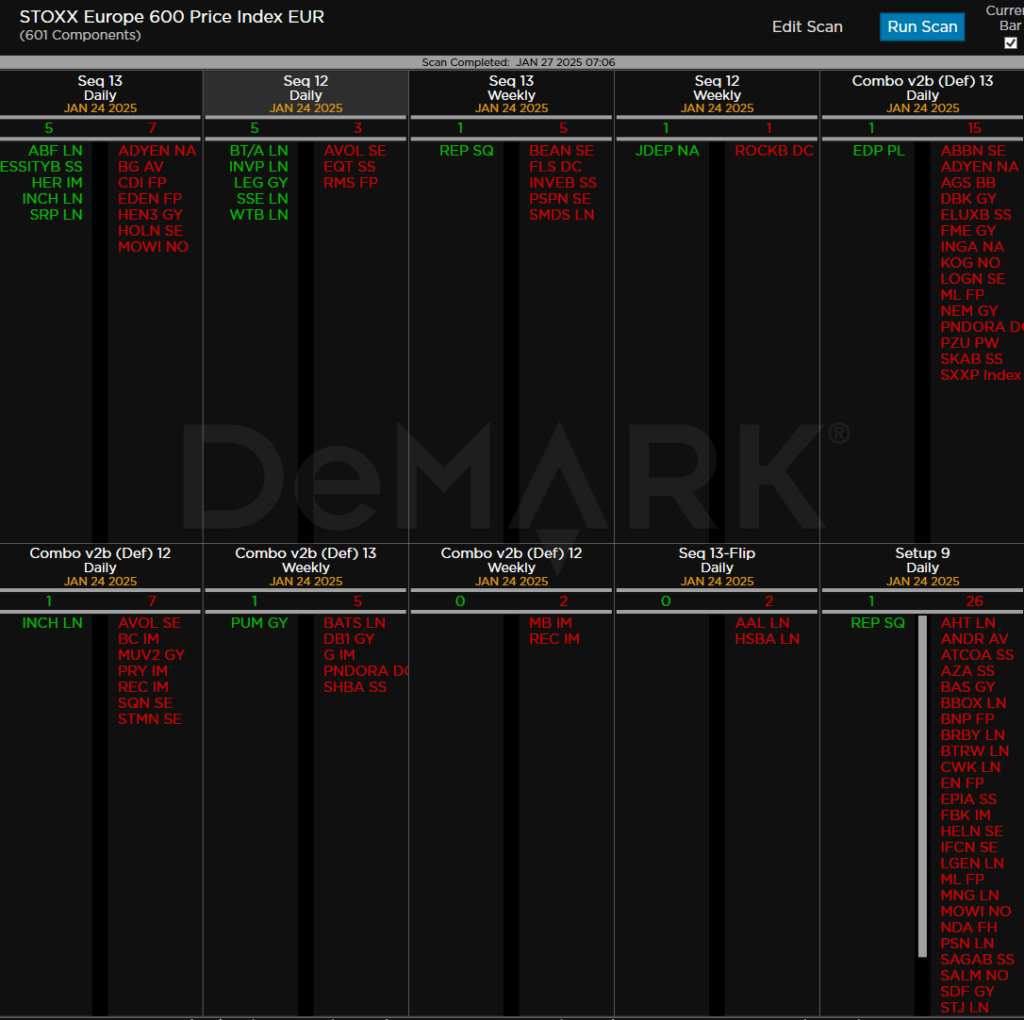

DeMark Observations – Euro Stoxx 600