Hans Christian Anderson’s The Emperor’s New Clothes is a tale about an emperor who has an obsession with fancy new clothes and spends lavishly on them at the expense of state matters. One day, two con-men visit the emperor’s capital. Posing as weavers, they offer to supply him with magnificent clothes that are invisible to those who are either incompetent or stupid. The gullible emperor hires them, and they set up looms and pretend to go to work. A succession of officials, starting with the emperor’s wise and competent minister, and then ending with the emperor himself, visit them to check their progress. Each sees that the looms are empty but pretends otherwise to avoid being thought a fool.

Finally, the weavers report that the emperor’s suit is finished. They mime-dress him, and he sets off in a procession before the whole city. The townsfolk uncomfortably go along with the pretense, not wanting to appear inept or stupid, until a child blurts out that the emperor is wearing nothing at all. The people then realize that they have all been fooled. The emperor uncomfortably realizes it too, but opts to continue the procession, walking more proudly than ever.

Tesla and Elon Musk might be similar as the electric vehicle company has morphed from selling more EVs as its mission to selling autonomous driving, robotaxis, and robots (stuff that doesn’t work or exist). Building EVs is not a proprietary thing, as every automaker now has EVs on the market. Elon Musk, an increasingly polarizing figure (to say the least) has become the richest man with his company now with one of the largest market caps in the world. It’s larger than every combined automaker market cap in the world. The problem for Tesla is business is slowing and has for the last two years in delivery numbers, earnings, and margins. Elon Musk has now pivoted from EV’s (barely a comment on their core EV business last night) to autonomous driving, robo-taxi’s and robots, which again does not work or exist. The fantasy of these product segments make up about 75% of Tesla’s $1.3 trillion market cap, being generous to the slowing EV business valuation.

Elon Musk had a few doozy comments last night that pumped up the fans, stating he believes Tesla will have a larger market cap than the combined top 5 market cap companies (about $15 trillion). He also said the Optimus robot one day could have revenues of $10 trillion (that’s with a T, not a B). Last quarter, Elon stated there would be big growth in the 4th quarter (there wasn’t) and for 2025 growth of 20-30%. This sent the stock higher last quarter. This quarter he spent time discussing how driverless robo-taxi’s will be in service in Austin in June. I’d say this was an aggressive statement that whitewashed the terrible earnings. There have never been any filings in any state for robo-taxi service. Texas would probably grant him whatever he wanted and now that he’s tight with Trump, federal regulations will be relaxed. But there is one problem.

Getting the autonomous software to work is a challenge that has been the case for nine years as Elon Musk has promised it “coming soon” and sold many Tesla owners the ‘beta’ version. It works as a level 2 system that many other automakers have, too, and not at the level 4 for full self-driving. Waymo has working robotaxis in many cities and will expand in Austin (ironically) and other cities in 2025. Waymo indemnifies its cars for any accidents or deaths. Tesla will have to indemnify their software and cars, and that detail doesn’t get enough attention.

I covered the short a while back, recognizing that market participants are more than willing to buy the promises Elon states on every conference call. The issue now is June is four months away and I doubt what Elon has promised as his timing record on delivering things such as full self driving, a roadster, a semi-truck and lots of other things that he’s sometimes mentioned randomly on earnings calls. The SEC and regulators in the past would have questions (putting it lightly) for a CEO who took deposits for some things and didn’t deliver, let alone putting out guidance that was in fact a lie.

With June on the clock for driverless robotaxis, many people will be watching. Will the pumps keep the focus off declining US and European sales? With Elon’s favorability dropping in the US and Europe for his colorful and political views, could 2025 be the year that the markets discover Elon’s pumps are just like the Emperor’s new clothes? These are questions I hope get answered.

Quick Market Views

Stocks: Another flip-flop day with Mag 7 lagging the broad market. Breadth is strong, while earnings have been mixed, with more companies failing to impress. Notably weak earnings: CAT, WHR, UPS, NOW, CMCSA, CI, MSFT, CHRW, TER, DOW, AVY, TSCO, and IP. Many of the strong names after earnings fall into the category of better than feared: IBM, LVS, LRCX, PH, WM, DOV. AAPL might fall into the better-than-feared category as the street expects an underwhelming rollout of the iPhone 16 with AI. AMZN is also the other big one with high expectations, but MSFT cloud business, which AMZN competes with, had soft guidance.

Bonds: Rates are down 1bps.

Commodities: Crude is flat with Natural Gas down 3.6%. Grains mostly lower after yesterday’s gain. Metals are strong. Gold up 1.2%, Silver up 3.5% and Copper up 0.7%. I’ve shown gold with the potential for further upside with the Sequential in progress on the upside.

Currencies: US Dollar Index is down 0.15%. Yen strength could be starting with USDJPY at 154.20. A break of 150 would set off some alarm bells. Bitcoin is up 1.5%.

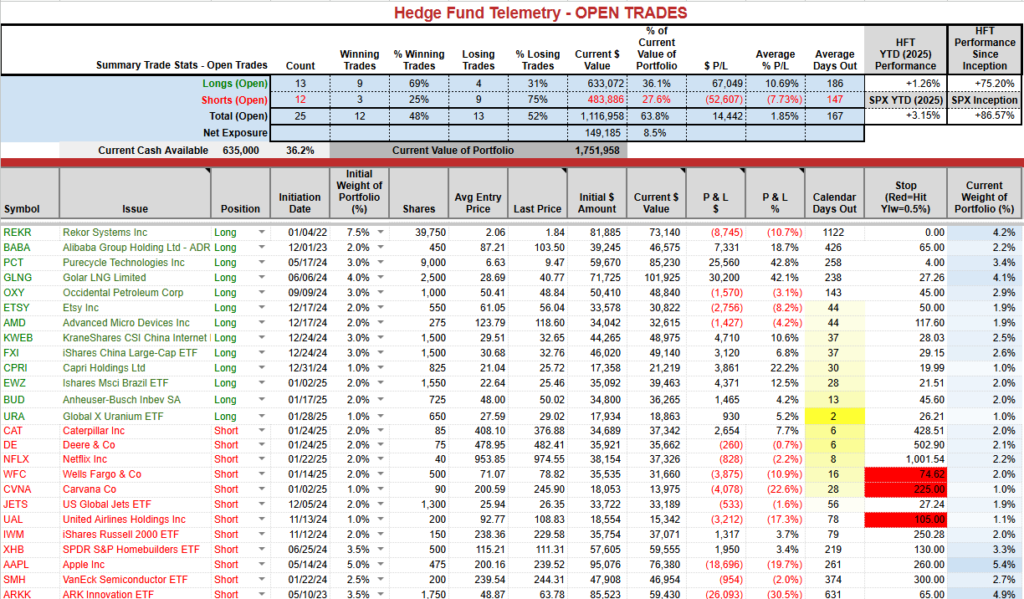

Trade Ideas Sheet: Finishing the month up has been a priority. Up 25% in 2025 is the goal.

Changes: I recently recommended buying a March expiration KWEB 33-40 call spread for $0.55. The current price is ~$1.45. If you followed along let’s take a gain on half and let the remainder ride.

Thoughts: The long side has been working well with a few that need to kick it into gear. Happy to see GLNG back over 40 and have high conviction for this one in 2025. The China exposure is at 8% now and I’m fine holding them for now. I trimmed BABA yesterday and it’s up again. It’s OK as trimming something with a 12% gain when it could easily have a tariff tweet sink it down 10%. REKR is having a nice day with no news that I can find. Let’s see how AAPL does later today. I had a recent put spread that made us money which doesn’t get into the PNL so I’d like AAPL shares to move back down and that might not be with today’s earnings but I expect it in Q1.

US INDEXES

Here is a primer on the DeMark Setup and Sequential indicators.

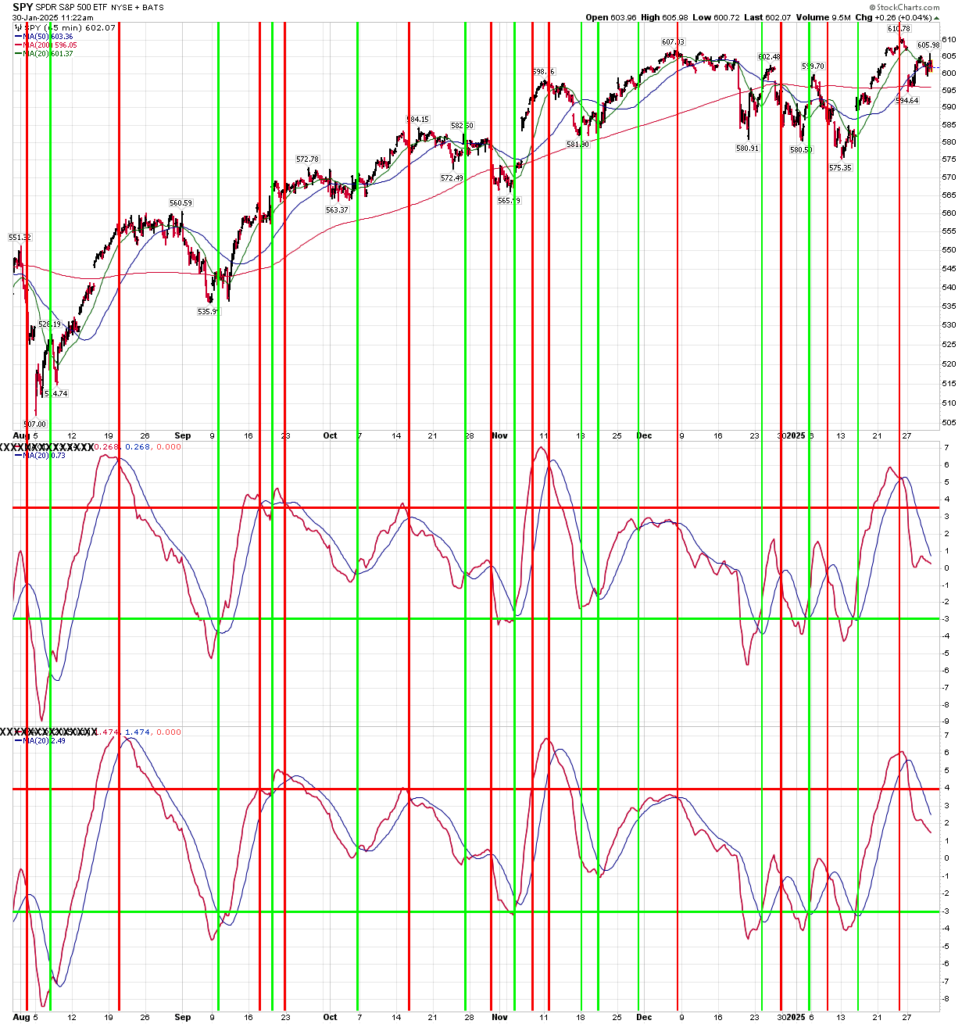

S&P futures 60-minute tactical time frame has been moving sideways, lacking any upside or downside momentum.

S&P 500 Index daily off the early highs with better short term relative performance vs Nasdaq 100.

Nasdaq 100 futures 60-minute tactical time frame shows the lack of action today.

Nasdaq 100 Index daily off opening prices. Very tricky trading in the last month.

Trade Ideas Sheet

The SPY momentum indicator is a short term trading indicator that has seen extreme moves in the last month making it difficult especially with some strong gaps. This remains on a sell signal for now and I’m glad I took gains on the open on Monday with SPY down 2.8% and QQQ down 4%. I’m sitting on the sidelines for now.

More on positioning

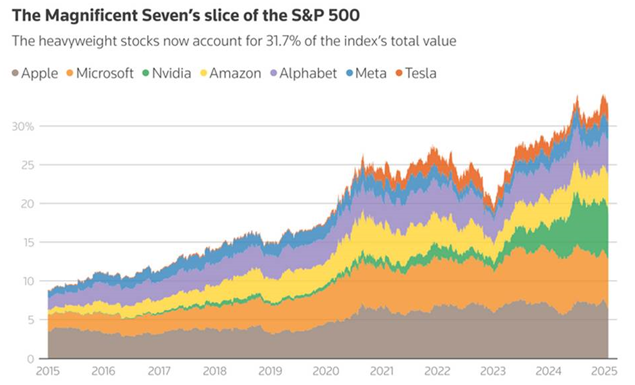

All of the brokerage firms have shown very crowded and overly long positioning with Interacitve Brokers mentioning margin debt has never been higher. It may not matter yet but after seeing NVDA get whacked for a $600b market cap loss risk is pretty high for more unwinding. MSFT unwind today is the latest one to sting investors.

Mag 7 is nearly 1/3 of the entire S&P. Apple and Amazon report after the bell.

china and Brazil update

BABA has started to spike and I’m pleased to have taken a gain yesterday of 12%. Locking in gains – for all or partial position will be a big focus this year. Just as these go up fast there is risk always of a quick reversal. The potential for a new Sequential starting on day 2 of 13 is there but RSI at 89 is extended thus taking some off isn’t a bad idea.

KWEB Hong Kong/China tech ETF with Sequential on day 3 of 13. RSI is overbought but it can move even higher as it did in late summer. The solid green and pink lines are the DeMark Propulsion indicator that is qualified today but tomorrow to qualify an up open is required and one uptick. I will let you know if this occurs. The Propulsion is one of the few DeMark indicators that is an offensive signal. 34.51 is the target is confirmed. Up nearly 10% so far.

EWZ Brazil ETF is moving above the 50 day for the first time since late September when it broke down. There is a potential new upside DeMark Sequential on day 2 of 13. This peaked back in the Summer near the 200 day so I’ll be pleased with it going to 28. Up 12% so far.

Hedge Fund Telemetry ETF Percentage Price Oscillator Monitor

The PPO monitor (percentage price oscillator) force ranks ETFs by percentage above/below the 50-day moving average. For information on this monitor, please refer to this primer. This monitor and others are offered to Hedge Fund Telemetry subscribers on Bloomberg. Another flip flop day with strong breadth and tech underperformance.

Index ETF and select factor performance

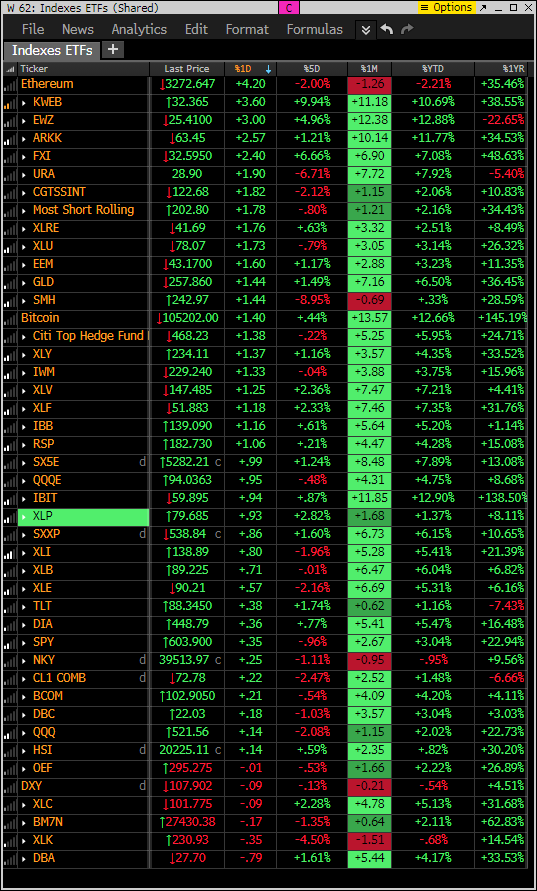

ETF with today’s 5-day, 1-month, and 1-year rolling performance YTD. I am pleased to have China, Brazil, and Uranium ETFs long ideas at the top of the monitor.

Goldman Sachs Most Shorted baskets vs. S&P Indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets.

DeMark Observations

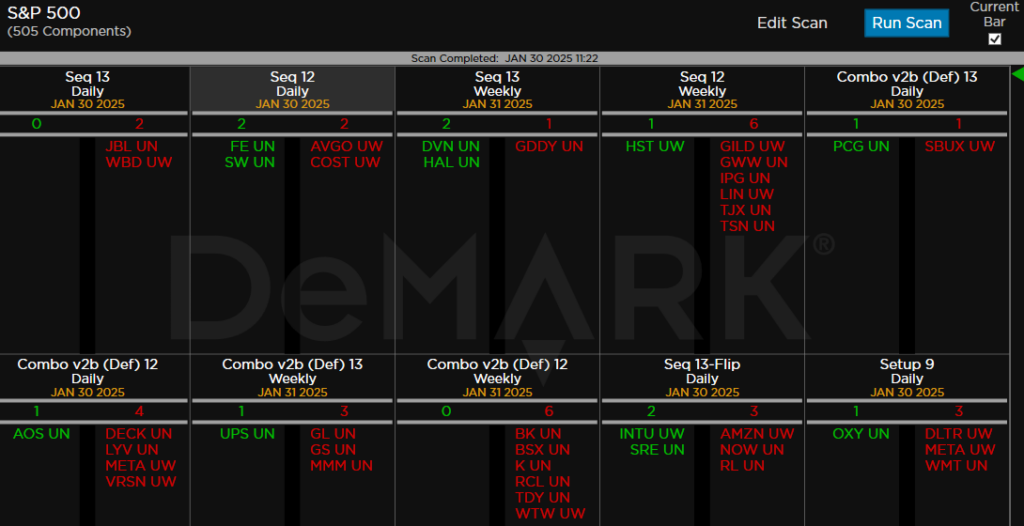

Within the S&P 500, the DeMark Sequential and Combo Countdown 13s and 12/13s on daily and weekly periods. Green = buy Setups/Countdowns, Red = sell Setups/Countdowns. Price flips are helpful to see reversals up (green) and down (red) for idea generation. The extra letters at the end of the symbols are just a Bloomberg thing. Worth noting: Mixed signals with some high fliers like COST and AVGO on day 12 of 13 with Sequential.

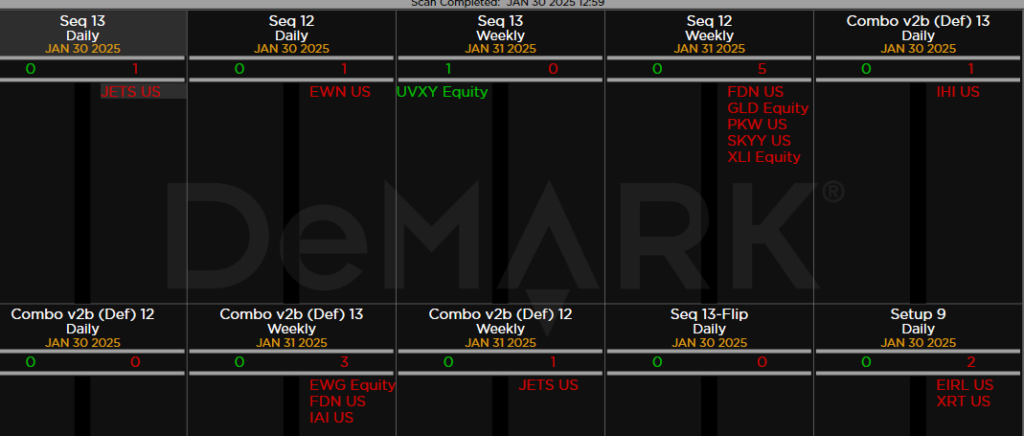

Major ETFs among a 160+ ETF universe. JETS Airline ETF with new Sequential sell Ccountdown 13.

If you have any questions or comments, please email us. Data sources: Bloomberg, DeMark Analytics, Goldman Sachs, Street Account, Vital Knowledge, Daily Sentiment Index, and Erlanger Research