Nvidia is today’s story on Deepseek news, which could replicate AI functionality cheaply. There’s been a lot discussed online, and I don’t need to get into the weeds of AI functionality or the merits of Deepseek. The stock is getting absolutely destroyed today, seeing one of the largest market cap declines for one day ever. As I have mentioned recently, crowding into tech by funds and individual investors posed a risk for some unwind. The move could change investors’ narrative and confidence in the AI trade, in which Nvidia has been the poster child for successful monetization. Nvidia has cornered the market with its chips and kept the momentum going by releasing even better chipsets that has the hyperscalers (mega cap tech) ordering them in a bit of an AI arms race. If Meta is raising capex so will others as they have the money and would rather keep the narrative going that they are investing in only the best and latest.

But a quarter ago Nvidia’s CEO on the conference call was asked by several sell side analysts about the ROI for the companies buying their technology. I was surprised by the CEO’s response – “They will be saving money immediately when these go live.” The better answer would have been to say customers were making more money. Now, with Deepseek or any other new AI software company, the new narrative will be about whether they can deliver something that uses less computing power and works similarly… for less money.

Lastly, if the market is punishing NVDA, a stock that has attributed by itself more than 30% of the gains in the last 18 months, confirming this is very crowded, could they also punish other crowded longs? Many mega-cap stocks are and have been very crowded, and today’s action tells me that investors won’t have much patience if their earnings and story are not stellar.

Quick Market Views

Stocks: An ugly day for tech and the tech short basket having one of the best days since Covid. Breadth overall isn’t terrible with NYSE down only 65 issues while the Nasdaq is worse down nearly 1000 issues. A lot of earnings this week with the Fed will cause more volatility. Getting through a lot of unknowns early in the year is the plan. No need to get too aggressive.

Bonds: Rates are lower by 7-10bps as the equity market slides.

Commodities: Bloomberg Commodity Index is down hard 1.5%. Energy is very weak with Natural Gas down 8.5%, Crude down 2%. Livestock is higher. Grains lower led by Wheat. Copper down nearly 2%, Gold down 1.3%, Silver down 1.4%

Currencies: Actually very quiet with US dollar index down 0.1%. Crypto is getting hit hard. With Bitcoin down 3%.

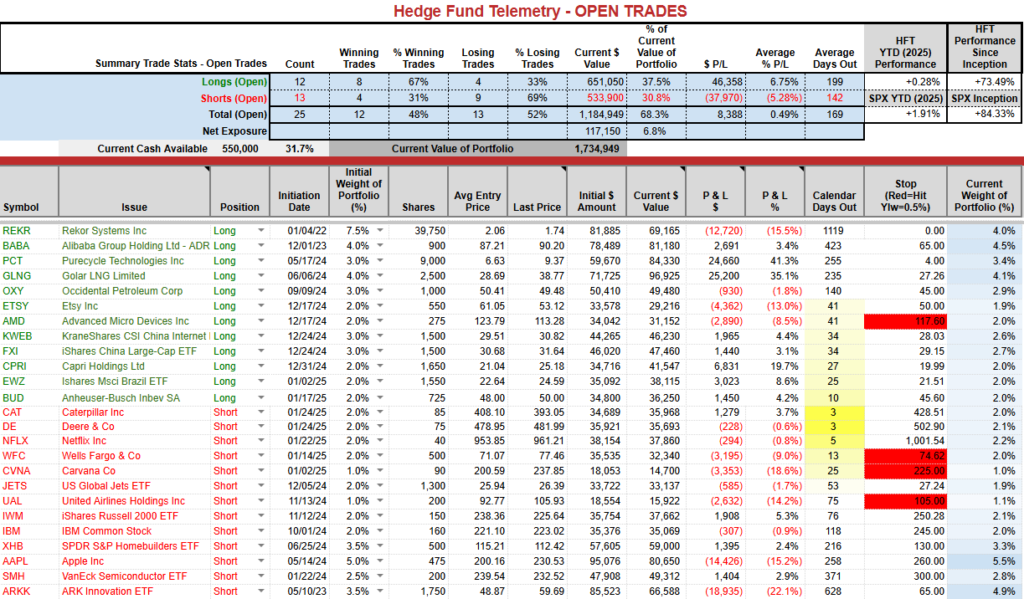

Trade Ideas Sheet: Holding 30% cash

Changes: Earlier I covered six short ideas on the gap lower. I am fine sitting tight in cash.

I am, however, going to suggest a Tesla put spread expiring this Friday that will capture Wednesday’s earnings. I like the Jan 31 expiration 375-350 put spread for ~$7.00. I have a few SPY, QQQ and a few other put spreads I’ve been looking at but might want to add these in a day or two perhaps after the Fed meeting.

Thoughts: GLNG trades poorly. Could be natural gas down, VG IPO breaking price, or countries not needing gas to power data centers. I don’t know. I do know they have a strong catalyst ahead with several vessels to be contracted this year. By the end of the year they will have four vessels under contract with a value of each one of $15-20 each. That keeps me very involved as a long idea. It’s not a matter of if but when. Several longs are working despite the carnage: KWEB, BABA, FXI, CPRI, EWZ, OXY, ETSY and BUD. AAPL is bouncing and I wonder if this was a consensus short vs NVDA long. I might add another put spread tomorrow ahead of Thursday’s earnings.

US INDEXES and sentiment

S&P and Nasdaq sentiment recently bounced off of levels that were not oversold. Friday saw dips and today’s data should see some steep declines – possibly near 50% again.

Here is a primer on the DeMark Setup and Sequential indicators.

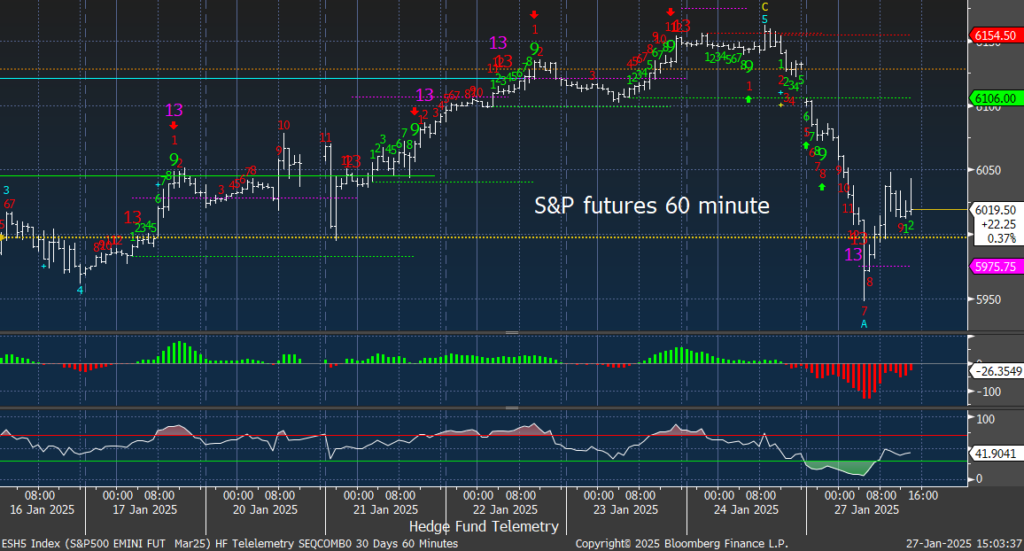

S&P futures 60-minute tactical time frame did have Sequential and Combo 13’s near the lows premarket and did bounce however there is a secondary Sequential that might say this can drip lower.

S&P 500 Index daily had a new Combo sell Countdown 13 on Friday. 20 day and 50 day support here then 5887 TDST Setup Trend support. Under 5800 will be the major line in the sand for the bulls.

Nasdaq 100 futures 60-minute tactical time frame did get the Sequential buy Countdown 13.

Nasdaq 100 Index daily has bigger support at 20,500. Terrible gap down and trading on the lows. UGLY

Trade Ideas Sheet

I was max short 5% weight both SPY and QQQ and today’s huge gap lower was important to cover. It’s still on a sell signal. I might add the some short weight back but I would rather see how a few earnings reports are absorbed. I also thought wrongly that NVDA would bounce on the huge gap lower.

BUD trading well. I still see this as actionable as a long idea.

BABA reports on Wednesday morning and is trading well along with FXI and KWEB below. A good report could go a long way getting people to rush back into China tech.

NVDA and semiconductors

NVDA daily didn’t have a signal with the choppy action there couldn’t get a count going to stick – I’m thinking Setup 9’s vs Countdown 13’s. This broke the 200 day for the first time in quite a while and has TDST Setup Trend support at 103.43. Today’s VWAP is 122.45 and it has not been able to get above it today says selling is heavy and dip buyers are underwater. Another down day below today’s close could see those dip buyers give up quickly causing more selling pressure.

NVDA weekly has had an RSI divergent for a while and some recent sell Countdown 13’s and Sell Setup 9’s that triggered ahead of pullbacks. The TDST support is important and if broken 100 is doable.

SMH Semiconductor ETF as shown on Friday with a new Combo sell Countdown 13. Breaking the support ~240 and 200 day is serious. I’ll hold the 2.5% sized short for now.

AMD is a current 2% weighted long idea and continues to break lower. It’s on day 10 of 13 with the Sequential and I’ll likely add to it with the 13.

Hedge Fund Telemetry ETF Percentage Price Oscillator Monitor

The PPO monitor (percentage price oscillator) force ranks ETFs by percentage above/below the 50-day moving average. For information on this monitor, please refer to this primer. This monitor and others are offered to Hedge Fund Telemetry subscribers on Bloomberg. Mixed action today but if it’s in tech it’s under a lot of pressure. China acting well.

Index ETF performance

ETF with today’s 5-day, 1-month, and 1-year rolling performance YTD. Seeing mean reversion from last year’s worst ETFs now lifting. For example, XLV Healthcare is the best sector ETF this year. I showed on the Sector ETF focus note last week XLV has an upside Sequential in progress.

Goldman Sachs Most Shorted baskets vs. S&P Indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets.

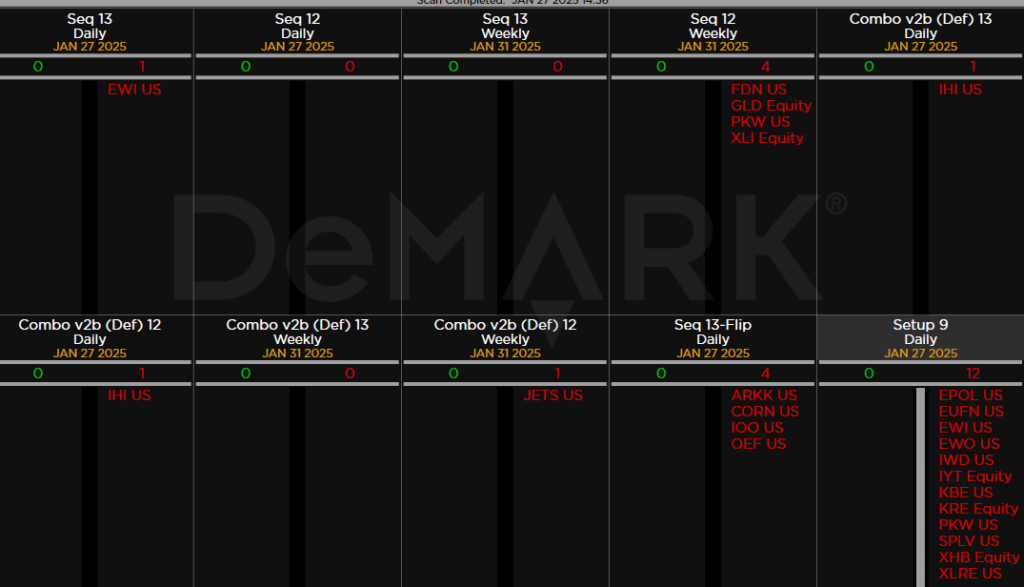

DeMark Observations

Within the S&P 500, the DeMark Sequential and Combo Countdown 13s and 12/13s on daily and weekly periods. Green = buy Setups/Countdowns, Red = sell Setups/Countdowns. Price flips are helpful to see reversals up (green) and down (red) for idea generation. The extra letters at the end of the symbols are just a Bloomberg thing. Worth noting: A lot of price flips up and down and many sell Setup 9’s

Major ETFs among a 160+ ETF universe. Some important sell Setup 9’s today – banks, transports, real estate. Bounce over?

If you have any questions or comments, please email us. Data sources: Bloomberg, DeMark Analytics, Goldman Sachs, Street Account, Vital Knowledge, Daily Sentiment Index, and Erlanger Research