TOP EVENTS AND CATALYSTS

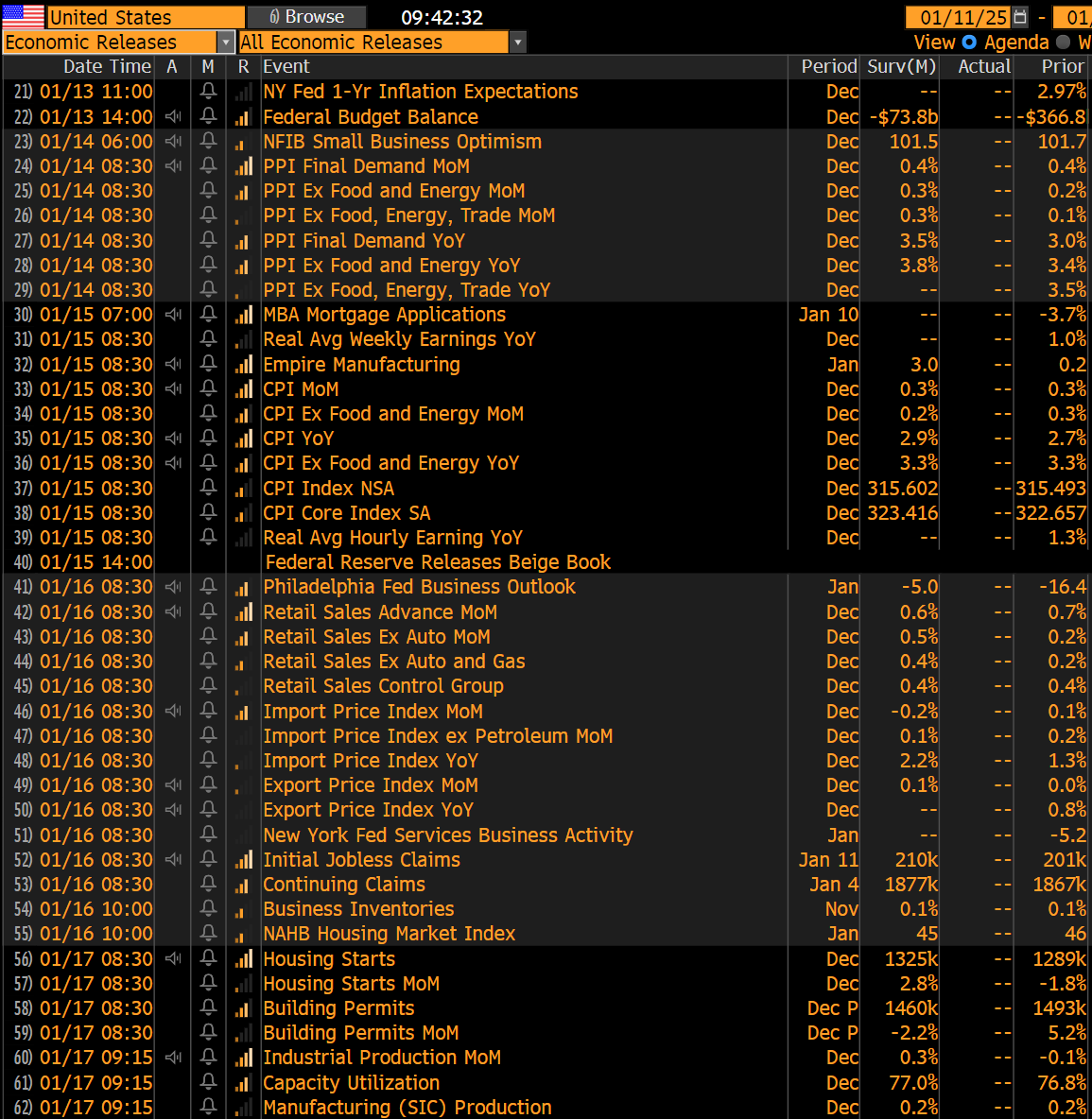

The main macro events this week include China’s import/export numbers for December tonight, the US PPI for December on Tuesday, and the US CPI for December on Wednesday; the Street is looking for a 20bps acceleration on headline to +2.9% Y/Y while core holds steady at +3.3%), US Retail Sales on Thursday; South Korea’s rate decision on Wednesday night, and China’s Q4 GDP and December industrial production/retail sales on Thursday night.

Q4 earnings reports will start to ramp up, including Wednesday premarket: C, BK, BLK, GS, JPM, WFC; Thursday premarket: BAC, MS, PNC, TSMC, UNH, USB; and Friday premarket: CFG, RF, SLB, STT, TFC. In Europe, the Richemont results on Thursday will be watched closely for an update on the state of the luxury industry.

Some of the Trump staffing confirmation hearings will happen this week, including on Tuesday (Hegseth and Burgum), Wednesday (Wright), and Thursday (Bessent). The week will be the final week for Fed speakers before the communications blackout is imposed ahead of the January 29th decision.

Weekend News

- Biden to deliver a farewell address to the nation Wednesday evening at 8pmET

- Republicans face an impossible math problem of executing on the myriad Trump tax priorities without worsening the country’s fiscal trajectory and pretty soon, something will need to give (either the tax ambitions are dialed back dramatically, some “third rail” spending buckets are touched, massive tariffs are implemented to generate revenue, deficit hawks lose their religion, or the whole initiative collapses) The Hill

- Trump suggests he is open to raising the SALT deduction during meetings with “SALTy” House Republicans, but there is no consensus around the specifics (how much to increase by? Index for inflation going forward? Means test the deduction with phase-outs for certain income thresholds?), adding one more thorny issue for the GOP to negotiate Politico, Bloomberg

- DOGE (which Musk recently said may only recommend $1T in cuts instead of his original goal of $2T) is unlikely to incorporate as an organized outside entity or nonprofit, and doesn’t have any power to actually cut spending within the gov’t (instead, the group will likely simply be a brand for an “interlinked group of aspirational leaders” who are on joint group Signal chats and pledge loyalty to Musk and Ramaswamy) NYT

- Trump’s border czar warns Republicans in Congress to temper their expectations on deportations given limited resources CNN

- X (US Steel) – CFIUS approved an extension on the deadline by which Nippon must abandon its takeout of US Steel from 2/2 to 6/18 Bloomberg

I’ll post the 2025 subscriber expectations and surprises tomorrow. If you have any last minute submissions, send an email to info@hedgefundtelemetry.com

A heartfelt thank you to all who have reached out with support, as I’m a Los Angeles native with family and friends who have lost homes (and everything) with most in Brentwood, which is OK at this point. Life can change in a moment, and taking a step back and appreciating life with gratitude is the positive energy I hope we can all manifest in 2025 and beyond. Lee Ann and I donated some clothes to be sent to LA, and if you can help in any way, it will be appreciated by those affected.

Charts we are watching

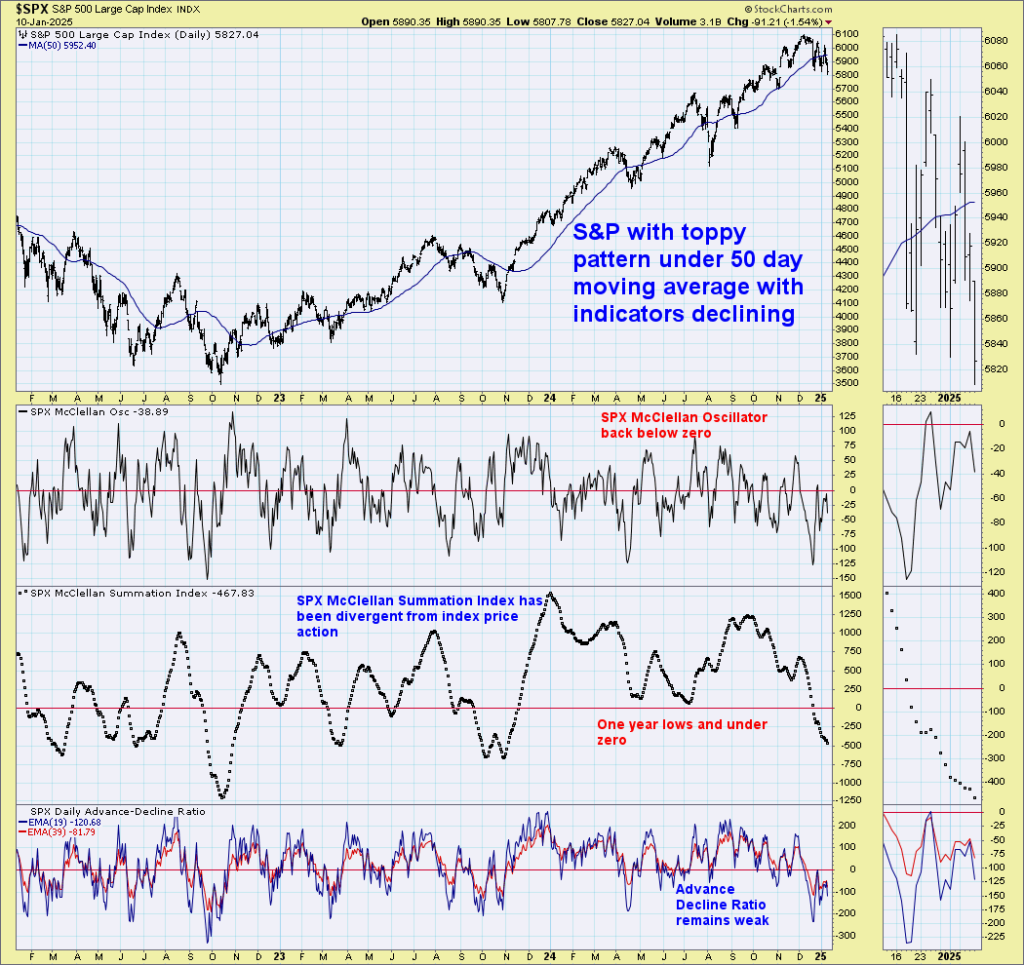

All three-time frames for the S&P – 60 minute, 240 minute and daily show risk low with the gains after the election gone. Breaking decisively below could see a large unwind of the massive inflows after the election with buyers trapped.

internals – update

Advance decline data doesn’t look great on bounces

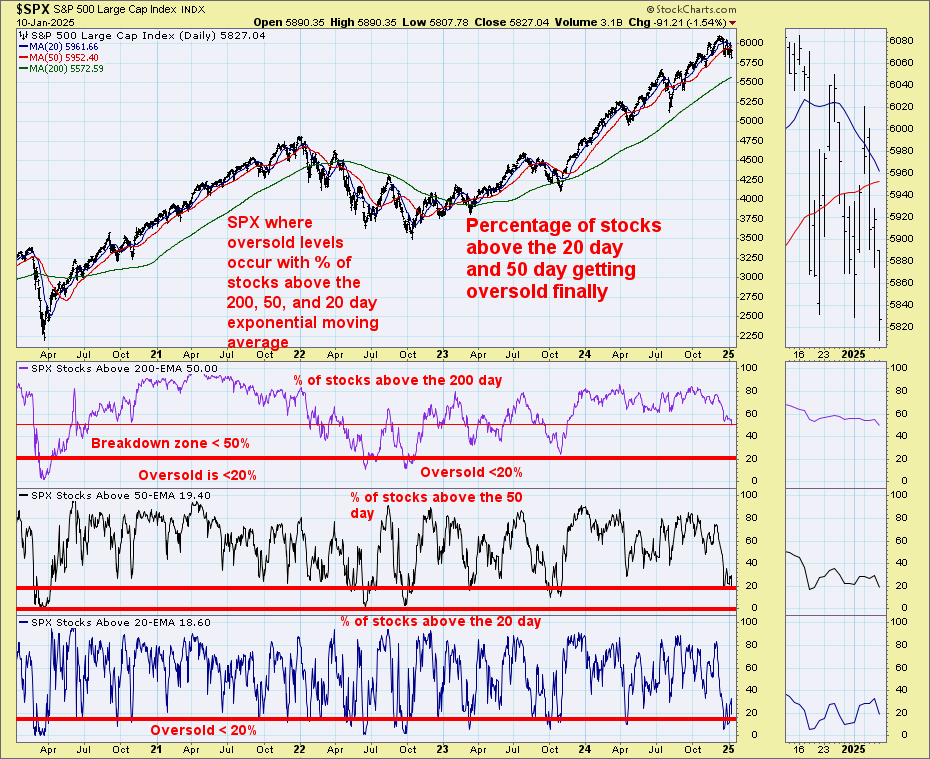

The percentage of S&P stocks above the 20 and 50 day are in oversold territory while the percentage above the 200 day is at 50%. When this one is below 50% trouble is brewing.

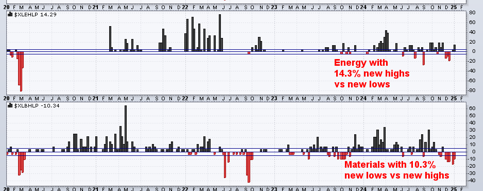

S&P had 4.4% more new 52 week lows vs highs last week with most sectors seeing more new lows vs highs. Energy and Industrials saw more new highs vs lows.

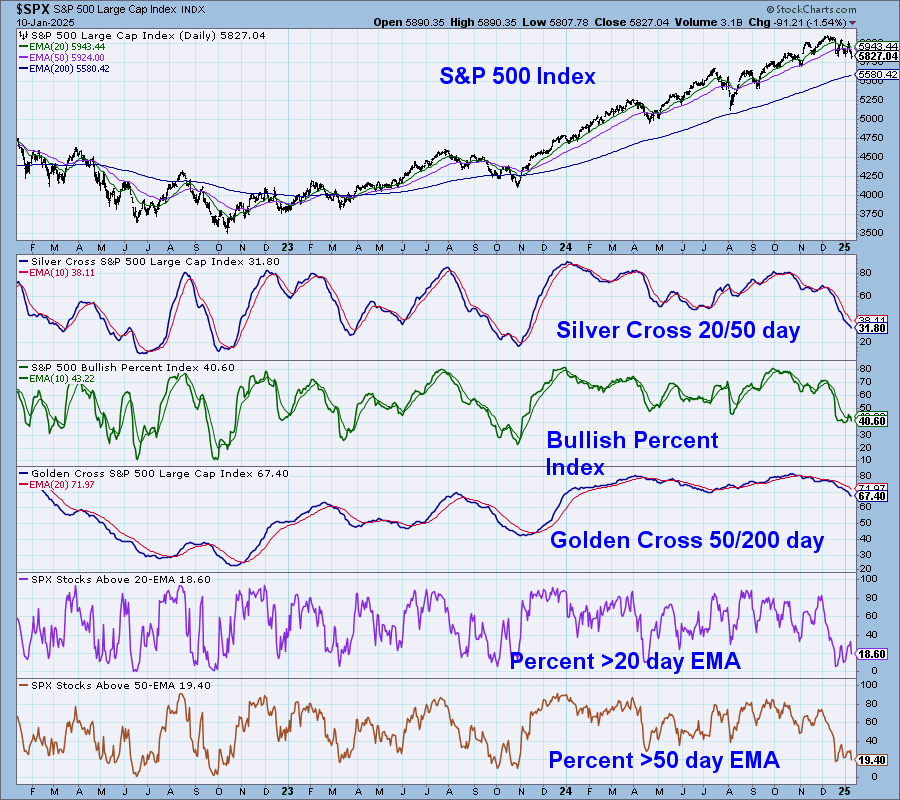

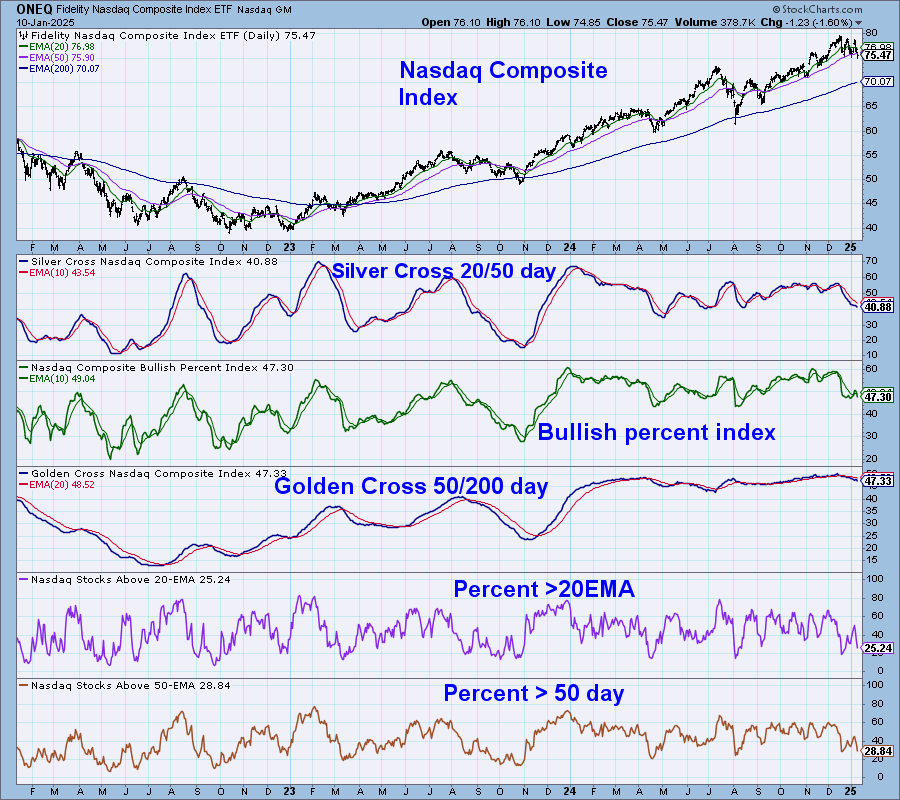

S&P and Nasdaq Composite indicators have been weakening and might continue to weaken

Nasdaq 100 with McClellan indicators have been weakening and still might move lower

S&P with McClellan indicators have been weak and still have risk lower

US economic data for the week

KEY MARKET SENTIMENT

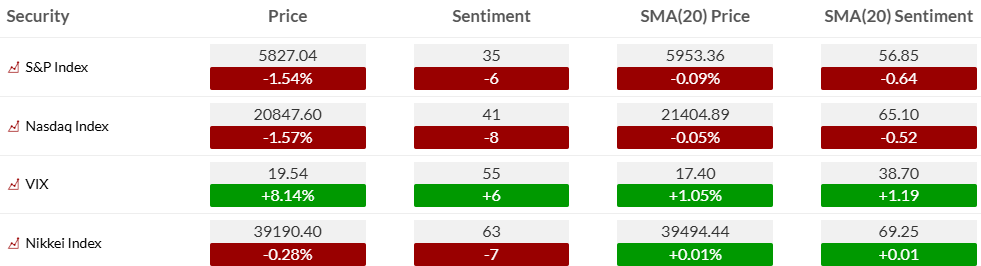

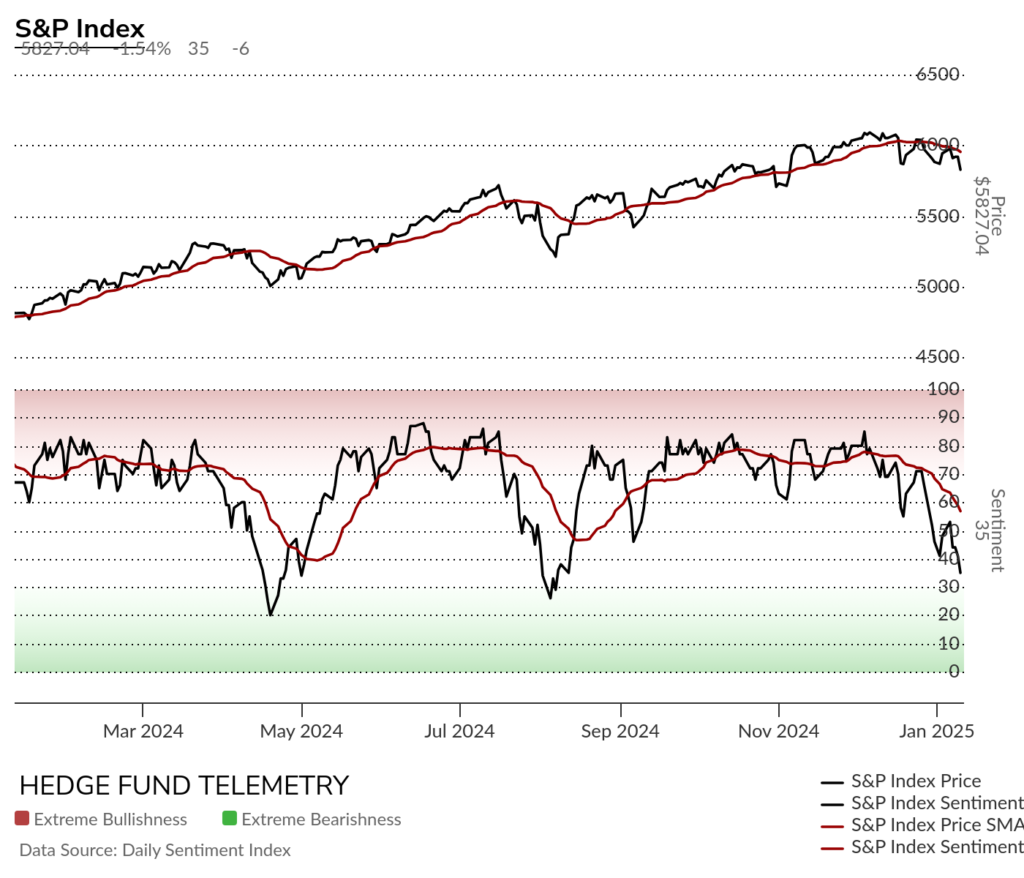

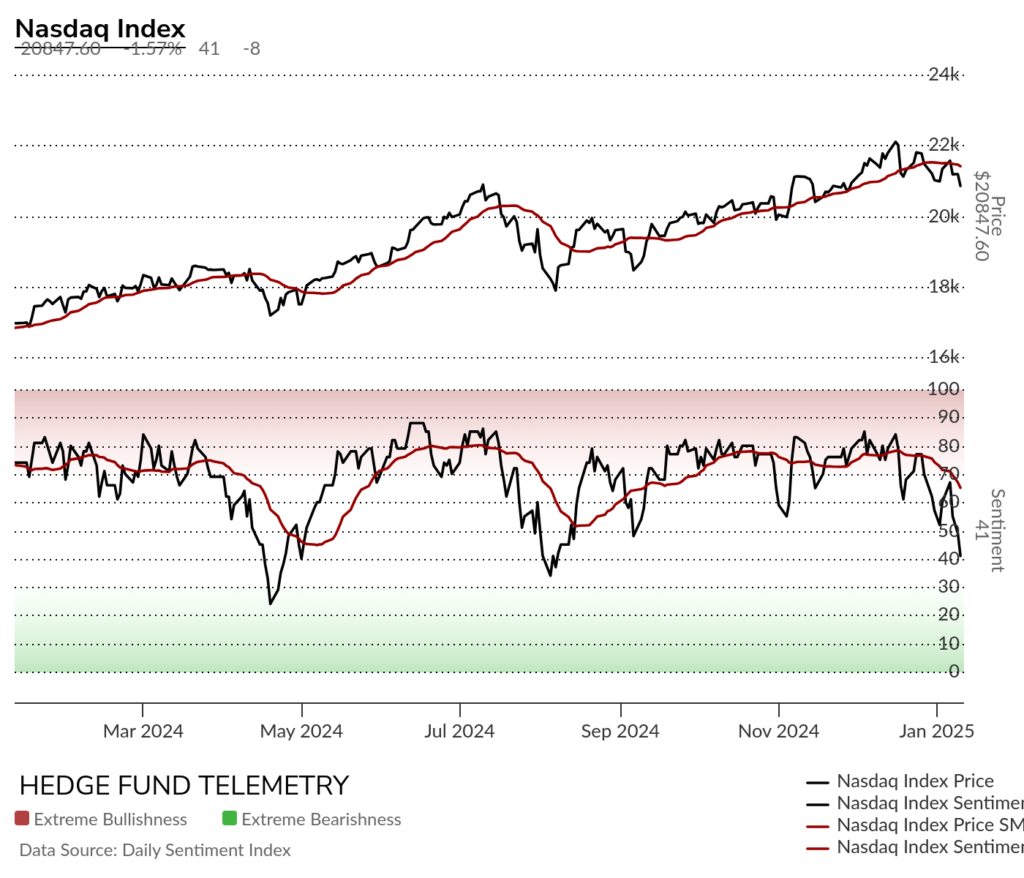

Equity bullish sentiment moving lower and not yet at oversold levels

S&P and Nasdaq bullish sentiment

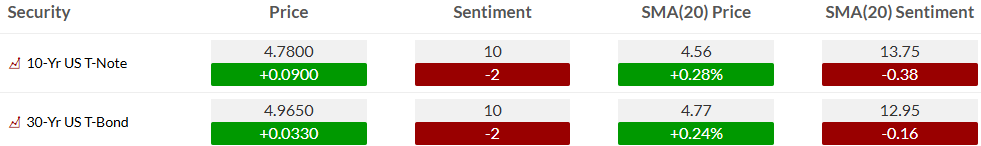

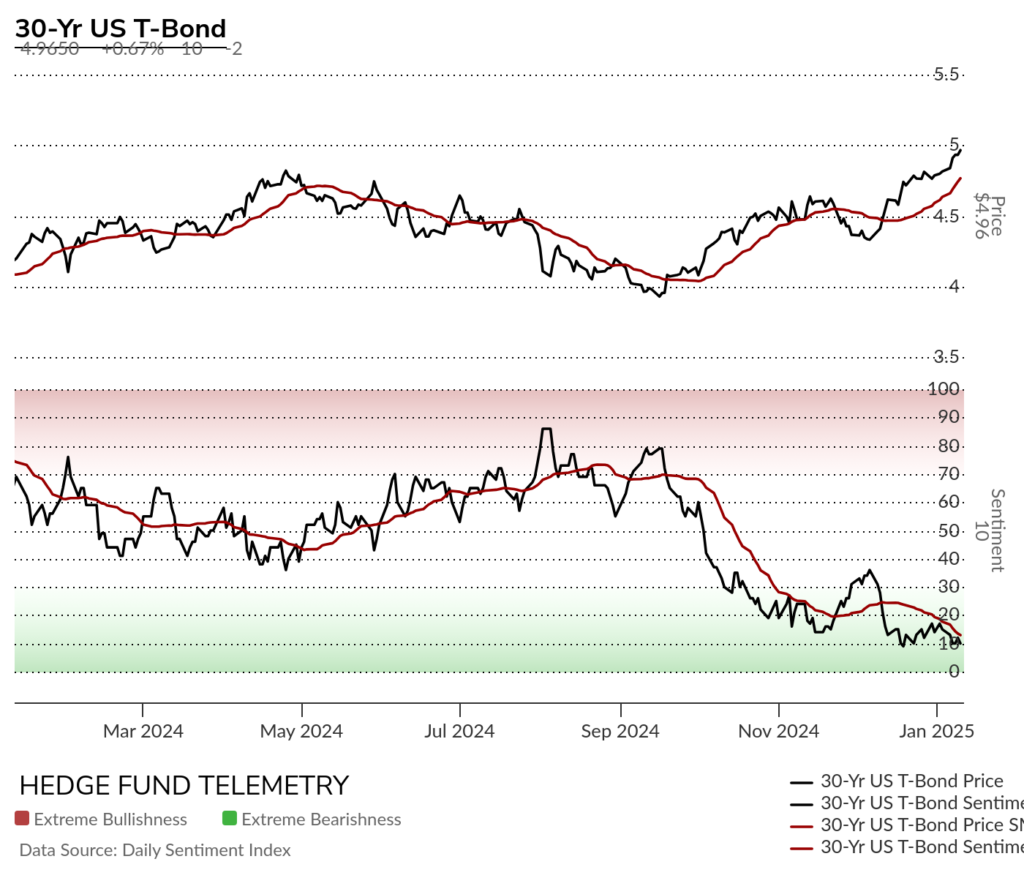

Bond bullish sentiment remains under pressure at deep oversold levels which can and might stay oversold.

Currency bullish sentiment with US Dollar bullish sentiment still in the extreme zone

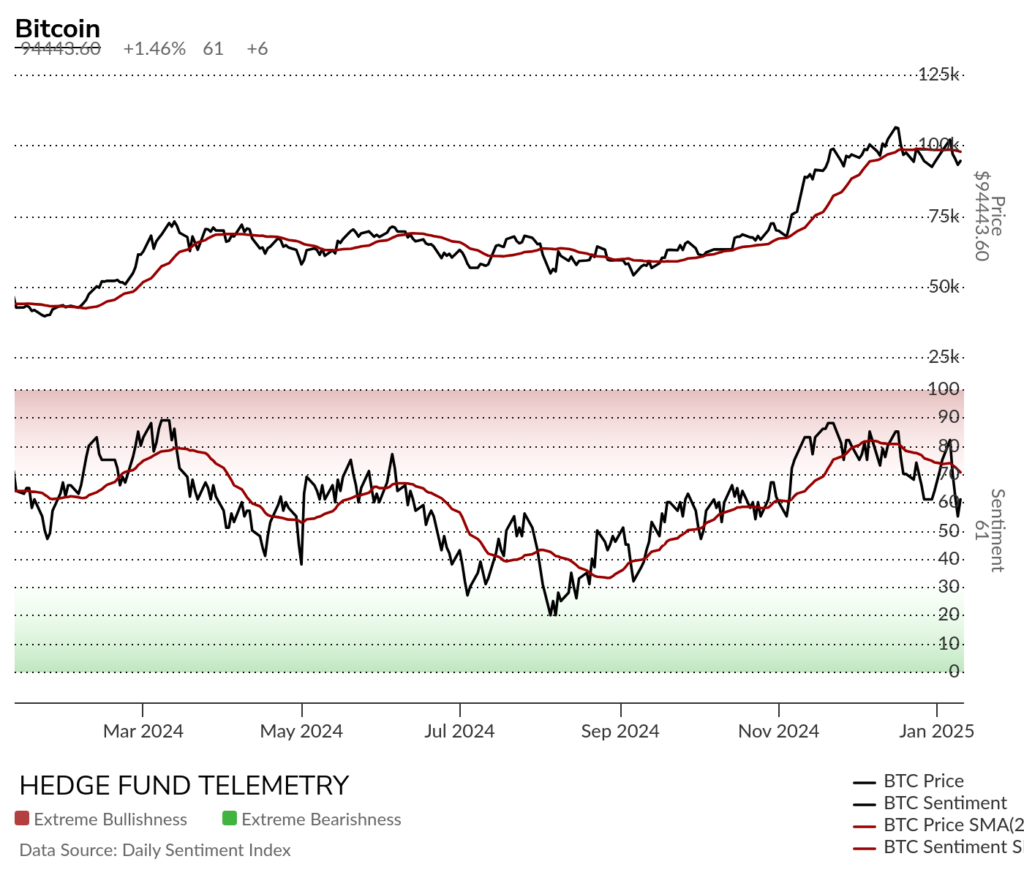

Bitcoin sentiment has reversed down, bounced on Friday and remains over the important 50% midpoint majority level.

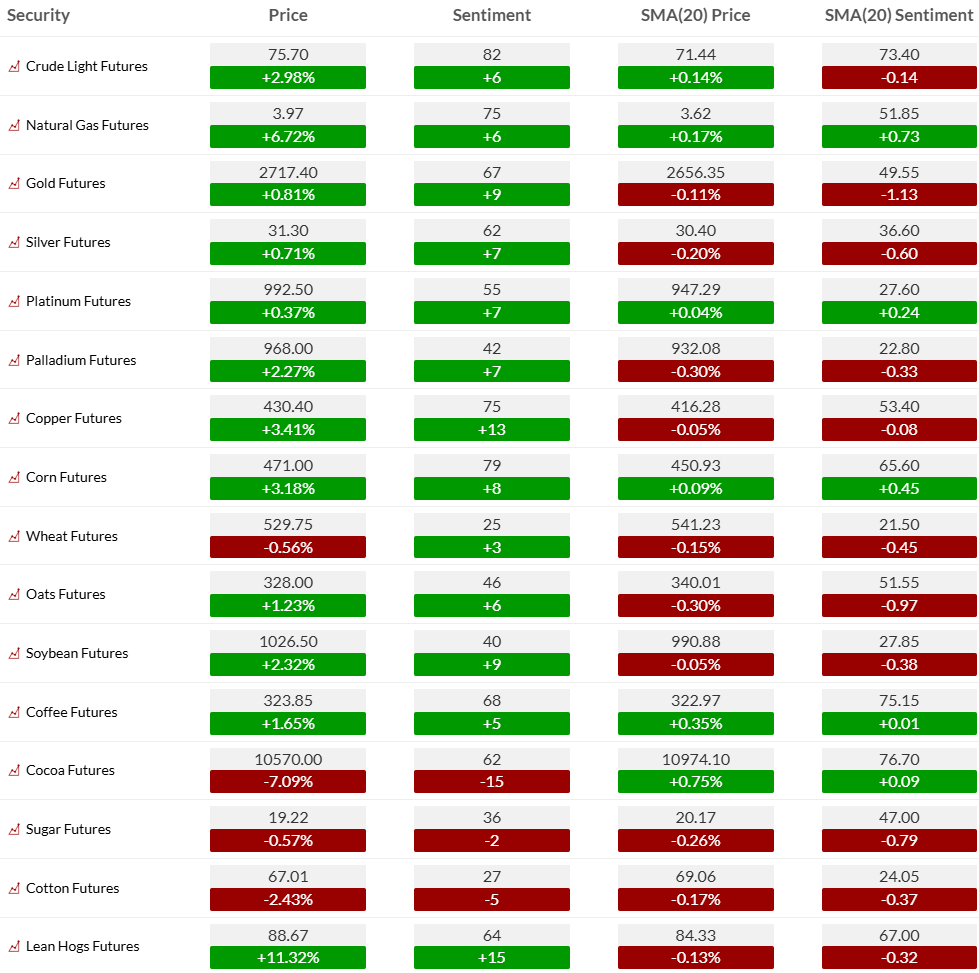

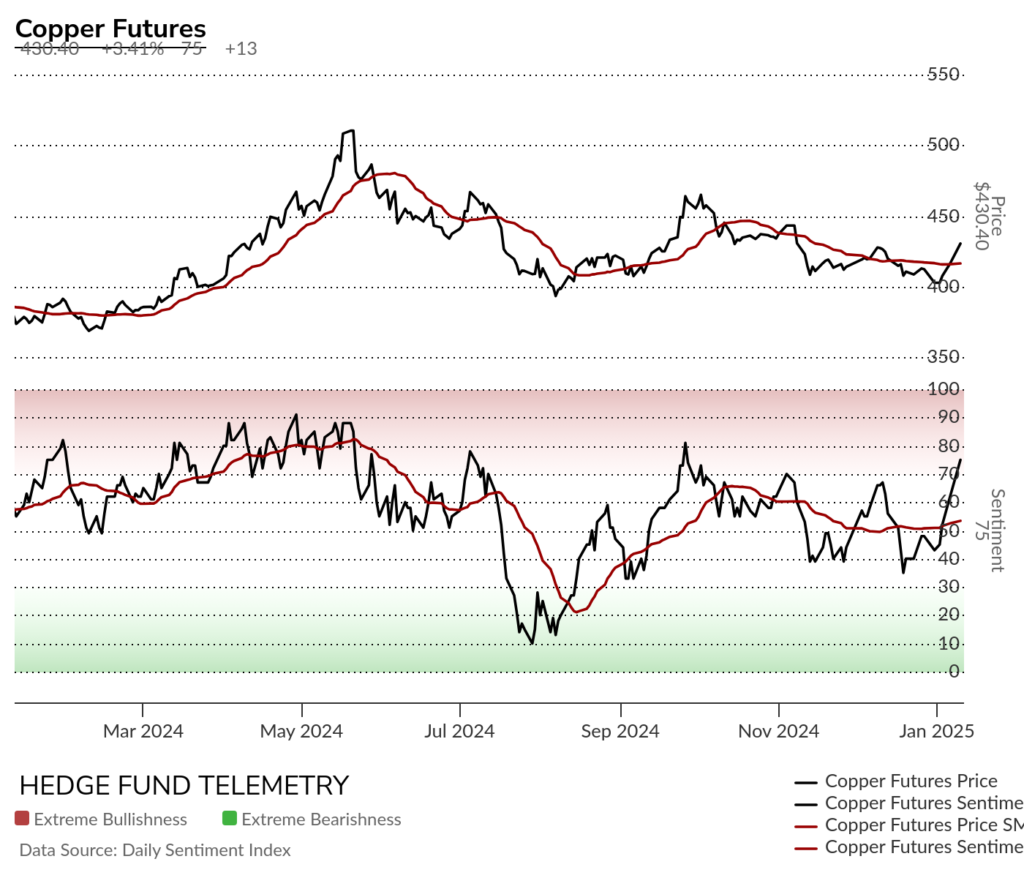

Commodity bullish sentiment saw strong moves ex softs on Friday. I started to see this move recently and has potential for more upside.

Copper has been a recent long idea for the last two weeks

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 13-Jan:

- Corporate:

- Earnings:

- Post-close: AEHR, EDUC, KBH, TTAN

- Analyst/Investor Events: BSEM

- Brokerage Conference:

- UBS Global Energy & Utilities Conference

- Lytham Partners Investor Healthcare Summit

- Commerzbank and ODDO BHF German Investment Conference

- ICR Conference

- Biotech Showcase

- JP Morgan Healthcare Conference

- Earnings:

- Economic

- US: Treasury Monthly Budget

- Europe: Industrial Production y/y, CPI y/y, Final CPI y/y, Industrial Production m/m

- Asia: Current Account NSA

- Corporate:

- Tuesday 14-Jan:

- Corporate:

- Earnings:

- Post-close: APLD, KARO

- Analyst/Investor Events: AAON, BRCC, VRNT

- Brokerage Conference:

- Commerzbank and ODDO BHF German Investment Conference

- ICR Conference

- Biotech Showcase

- JP Morgan Healthcare Conference

- CJS Securities New Ideas for the New Year Conference

- TD Securities Global Mining Conference

- XP Infra Confence

- Needham Growth Conference

- World Future Energy Summit

- Earnings:

- Economic

- US: NFIB Small Business Index, PPI, Redbook Chain Store, API Crude Inventories, NY Fed Pres Speaking Event

- Europe: CPI y/y, Industrial Production y/y (wda)

- Asia: Unemployment Rate

- Corporate:

- Wednesday 15-Jan:

- Corporate:

- Earnings:

- Pre-open: BK, BLK, C, GS, JPM, WFC

- Post-close: CNXC, FUL, HOMB, SNV

- Analyst/Investor Events: AITX, ZDGE

- Syndicate: +CRGT (~$15M raise)

- Brokerage Conference:

- ICR Conference

- Biotech Showcase

- JP Morgan Healthcare Conference

- TD Securities Global Mining Conference

- XP Infra Confence

- Needham Growth Conference

- World Future Energy Summit

- Proactive ONE2ONE Investor Forum

- BNP Spain Investors Day

- PDUFA: ATRA (Ebvallo)

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, CPI, Empire Manufacturing, DOE Crude Inventories, Hourly Earnings/Workweek, NY Fed Pres Speaking Event

- Canada: Manufacturing Sales, Wholesale Inventories, Wholesale Trade

- Europe: Trade Balance, CPI y/y, Output PPI y/y, Industrial Production y/y

- Asia: CGPI y/y, Retail Sales NSA y/y

- Corporate:

- Thursday 16-Jan:

- Corporate:

- Earnings:

- Pre-open: BAC, BSVN, FHN, IIIN, MS, MTB, PNC, UNH, USB

- Post-close: INDB, JBHT, OZK

- Analyst/Investor Events: CODI, UNFI

- Syndicate: +FLOC (~$400M raise)

- Brokerage Conference:

- JP Morgan Healthcare Conference

- Needham Growth Conference

- World Future Energy Summit

- BNP Spain Investors Day

- Earnings:

- Economic

- US: Import/Export Prices, Philadelphia Fed Index, Retail Sales, Business Inventories, NAHB Housing Market Index, Weekly Jobless Claims, EIA Natural Gas Inventories

- Canada: Housing Starts

- Europe: Unemployment Rate, Construction Output y/y, CPI y/y, Trade Balance

- Asia: Non-Oil Domestic Export NSA Y/Y, Fixed Asset Investment (ytd) y/y, GDP y/y, Industrial Production y/y, Retail Sales y/y

- Corporate:

- Friday 17-Jan:

- Corporate:

- Earnings:

- Pre-open: CFG, FAST, HBAN, RF, SLB, STT, TFC, WBS

- PDUFA: AMGN (LUMAKRAS)

- Earnings:

- Economic

- US: Building Permits, Housing Starts, Capacity Utilization, Industrial Production, TIC Flows

- Europe: Retail Sales y/y, CPI y/y, PPI y/y

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.