HIGHLIGHTS AND THEMES

- It was an eventful week with the Bloomberg Commodity Index with daily and weekly DeMark Sell Countdown 13’s in play.

- A pullback is possible for commodities as crude looks vulnerable to the downside while Natural Gas is overbought.

- Gold remains fine despite the recent daily and weekly sell Countdown 13’s.

- If Gold and Crude give way to the downside expect a deeper move of 5% or more on the index.

- Livestock has reversed lower

- Coffee and Cocoa recent strong performers are also breaking down. Good for the DBA ETF short.

- We had some site issues last week and couldn’t get notes out. Bloomberg also has not updated COT data.

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily with recent Sequential and Combo sell Countdown 13’s. RSI has been overbought so expect a pullback.

Bloomberg Commodity Index Weekly with new Sequential sell Countdown 13 we have been watching since the start of the Sequential started last year. The new Setup 9 is interesting because if this continues to rise a new Sequential will begin. Of course if this happens, I’ll be all over it.

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY

Bloomberg Energy Index daily looks more like Natural Gas vs Crude with sell Setup 9.

WTI Crude futures daily looks vulnerable to more downside with current Sequential Countdown in progress.

WTI Crude futures bullish sentiment remains under pressure of breaking recent low ~40%.

Natural Gas futures daily has been one I have liked long for a while and still do but expect a pullback with recent Setup 9 and hopefully warmer weather on the East Coast (specifically in CT please)

Natural Gas futures bullish sentiment remains in the extreme zone >80%

Metals

Gold daily has been the most resilient commodity this year with nominal pullbacks after Sell Countdown 13’s. I still believe some sort of pullback is due.

Gold bullish sentiment remains in the elevated zone.

Silver daily might not get the Setup 9 if below day 5 on Monday’s close.

Silver bullish sentiment in the elevated zone

Copper futures daily consolidating after a strong move. I would stay with Copper as a long.

Copper futures bullish sentiment with some big recent swings

Platinum daily consolidating after recent Setup 9.

Platinum bullish sentiment reversed after decent move.

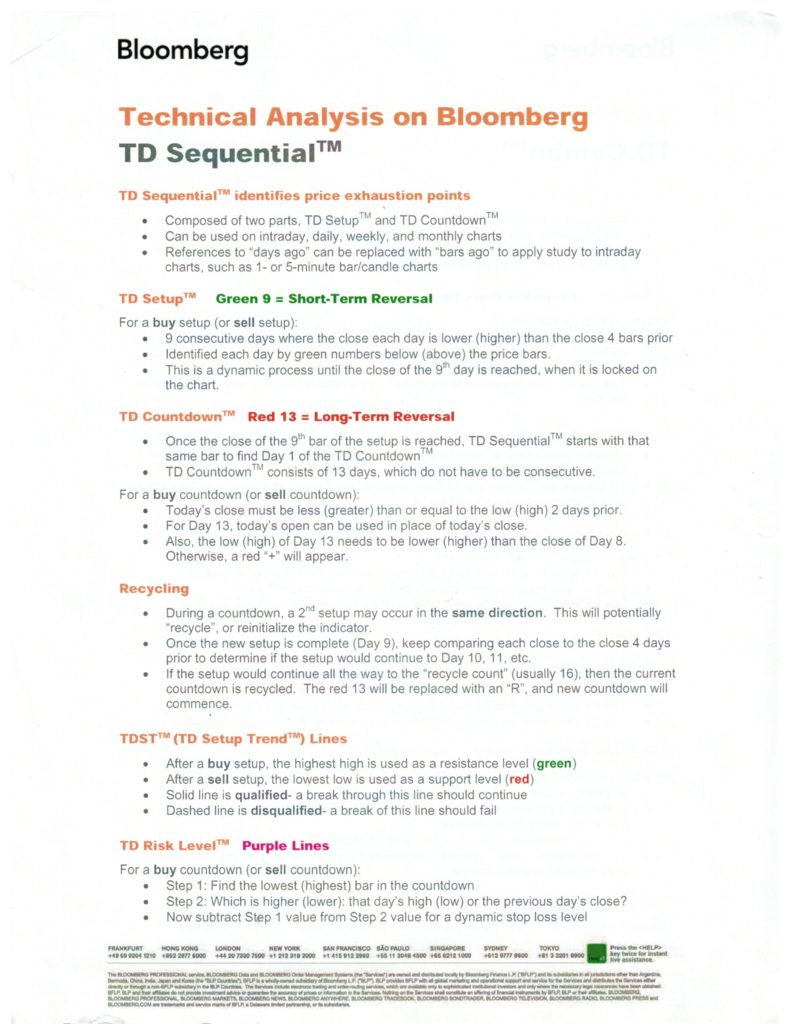

Palladium daily sideways with pending Sequential

Palladium bullish sentiment stalled

Grains

Corn futures daily with new Combo 13 and reversal. Watch the 20 day for confirmation of a top if it breaks.

Corn futures bullish sentiment has been strong and reversed on Friday

Wheat futures daily has been improving but stalled at the 200 day again.

Wheat futures bullish sentiment has been improving but stalled on Friday

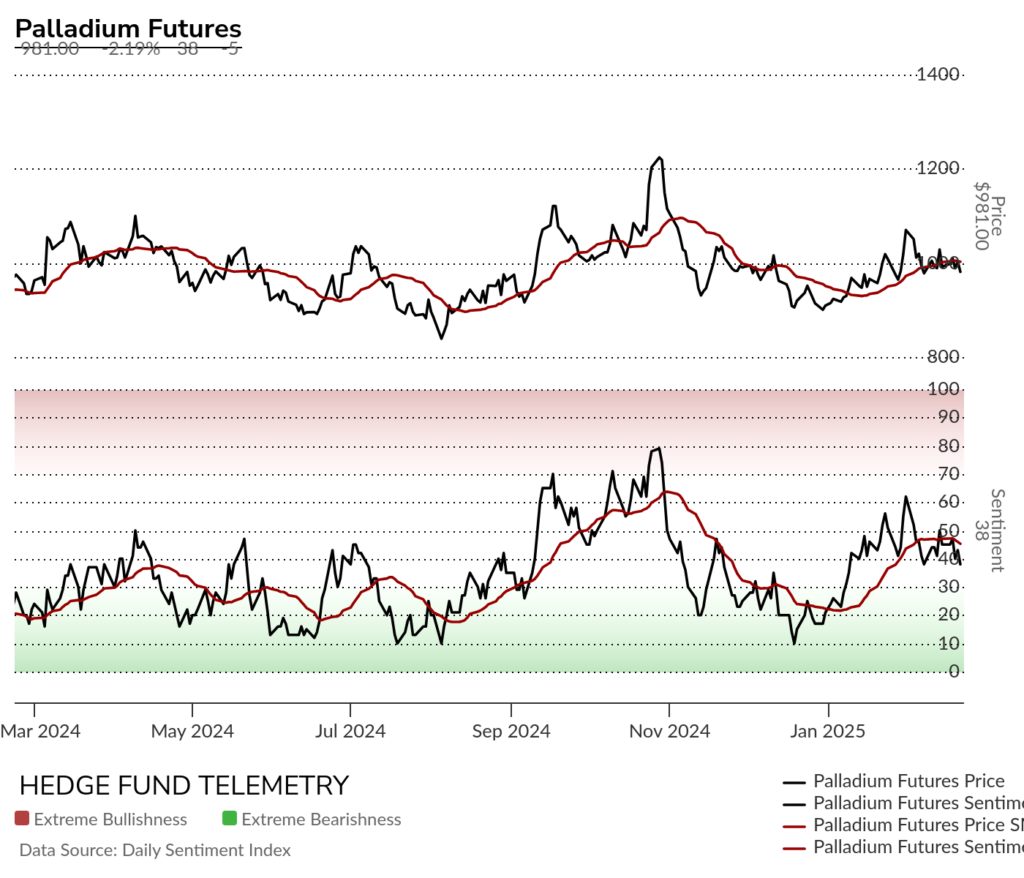

Soybean futures daily holding the 50 day

Soybean futures bullish sentiment fell back but maybe a higher low?

Livestock

Live Cattle futures daily with downside Sequential in progress with 200 day in view.

Live Cattle futures bullish sentiment had been fading

Lean Hogs futures daily breakddown

Lean Hogs bullish sentiment breakdown

Softs

Cotton futures daily can’t seem to turn

Cotton futures bullish sentiment remains under pressure

Coffee futures daily at the 20 day after recent DeMark sell Countdown 13’s

Coffee futures bullish sentiment breaking down

Sugar futures daily getting late with Setup 9 count and Sequential too

Sugar futures bullish sentiment improved quickly

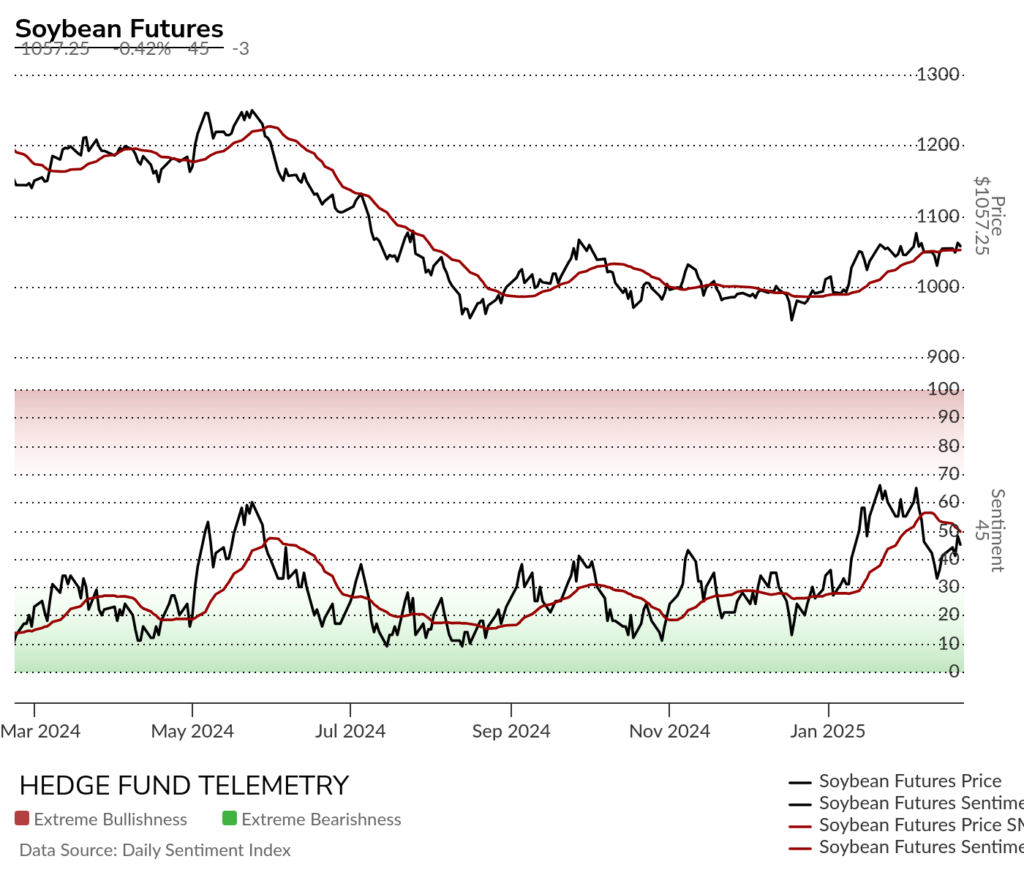

Cocoa futures daily with large breakdown

Cocoa futures bullish sentiment breaking down

DeMark Sequential Basics