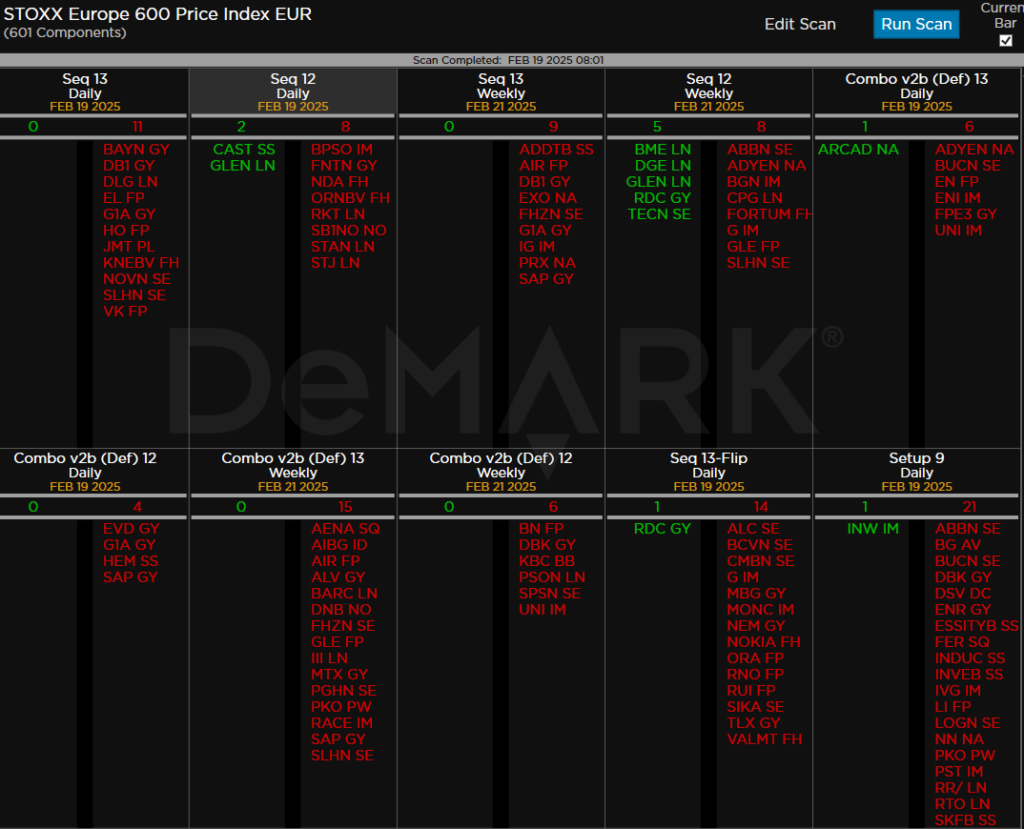

- S&P and Nasdaq futures down 0.1% in Wednesday morning trading. Treasuries mixed to weaker at the back end after yields backed up on Tuesday. Dollar index up 0.1%. Gold up 0.25%. Bitcoin up 0.7%. WTI crude up 0.9%. European indexes lower by 0.75% with new DeMark Sequential and Combo sell Countdown 13’s with DAX Index and Euro Stoxx 50

- Trade Ideas Sheet: ETSY had a mixed report which wasn’t that much of a surprise as sentiment has been poor. I will be listening to the call at 8:30am to decide to hold or cut. CPRI up on more stories on potential Versace sale to Prada.

- Trump signaled 25% tariffs on autos, chips and pharmaceuticals, though market may be cushioned by lack of details/delayed implementation, which leaves the door open for negotiations. Headlines continue to highlight GOP struggles on reaching a consensus for Trump’s legislative priorities, with the TCJA extension the biggest issue for the market. Nothing particularly incremental out of the recent US-Russia talks regarding the war in Ukraine, though a lot of headlines about Trump blaming Kyiv for starting it and needing to hold elections as part of any peace agreement. No meaningful macro read-throughs from latest batch of earnings, with the waiting game for WMT on Thursday and NVDA next week. UK headline inflation hotter on food prices, though services inflation surprised to the downside. RBNZ cut rates by 50 bp and statement guided for further easing this year.

- January housing starts and building permits on the economic calendar this morning. Weather mentioned as a likely headwind. This afternoon brings the minutes from the January FOMC meeting. January FOMC statement featured a hawkish tweak, scrapping the mention that inflation “had made progress”. Powell pointed out policy was still meaningfully restrictive, Fed not in a hurry to raise rates and still facing a lot of uncertainty when it comes to potential policy changes under new administration. Fed Vice Chair Jefferson speaks after the close.

- ETSY mixed report with EPS beat, better margins but revs and GMS lower. Prada reportedly working with advisors to evaluate potential offer for Capri’s Versace unit — Bloomberg. ANET down on only slight bump to FY25 guide and some concerns around Meta loss. ADI highlighted sequential growth in Industrial, Autos. CDNS takeaways focused on big backlog beat and weaker FY25 revenue guide. OXY Q4 better but Q1 oil guidance disappointed. HPQ acquired assets from AI startup Humane for approx. $116M. STZ announced executive departure. DVN volume guide ahead on lower capex. IFF Q4 better but 2025 guide light. TOL missed on Q1 closings/orders and talked about mixed spring selling season.

- Key Upgrades/Downgrades: Airbnb upgraded to buy from hold at Argus Research. Capital One Financial upgraded to buy from neutral at BofA. NetApp upgraded to neutral from underperform at BofA. Workday downgraded to equal-weight from overweight at Morgan Stanley.

market snapshot

economic reports today

premarket trading

US MARKET SENTIMENT

S&P and Nasdaq bullish sentiment mixed action in the elevated zone >70%

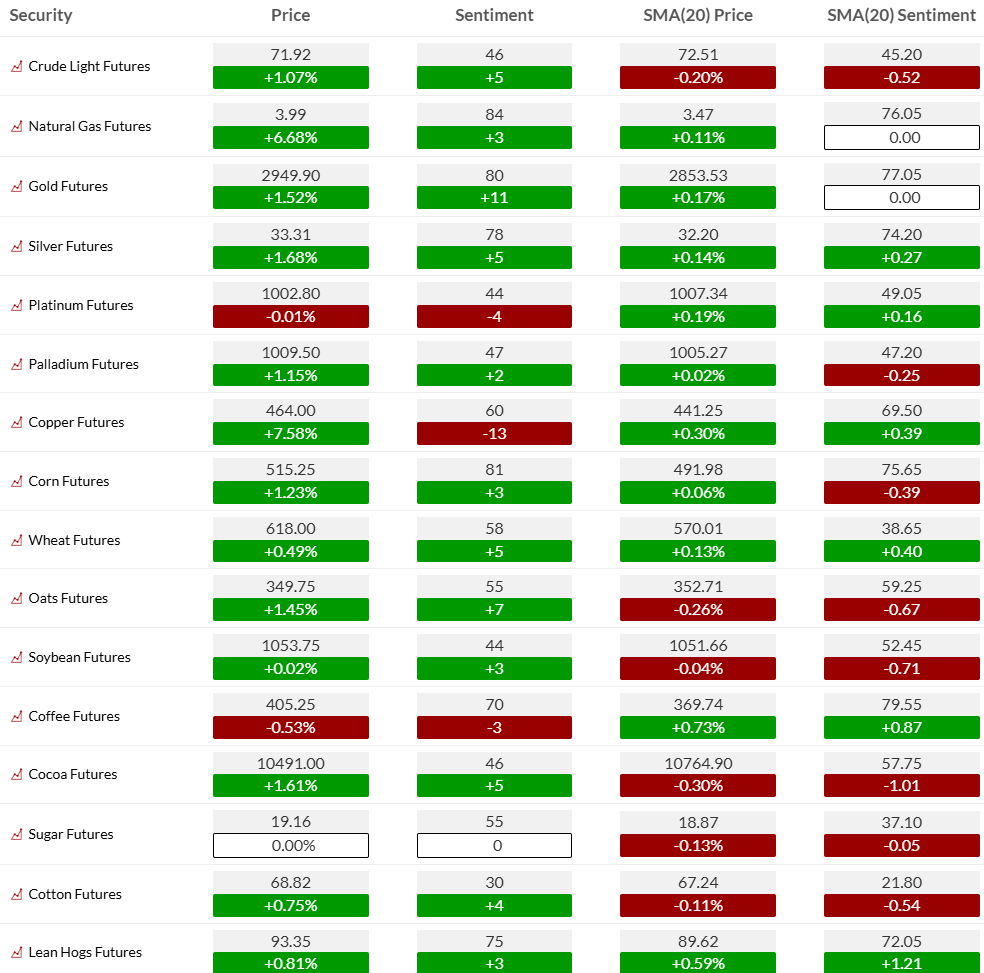

Bond bullish sentiment continues under pressure

Currency bullish sentiment with all sentiment down except the US Dollar

Commodity bullish sentiment with mostly a decent day with energy and mixed metals

US MARKETS

S&P futures 60-minute tactical time frame lacks momentum in the last week with bigger support at TDST Setup Trend at 6063

S&P futures daily at the top of the range

Nasdaq 100 60-minute tactical time frame with minor fade after recent DeMark sell Countdown 13’s and Setup 9

Nasdaq 100 futures daily slightly below the December highs

Extra charts we’re watching

German DAX Index with new cluster of DeMark Sell Countdown 13’s and sell Setup 9 with very extended overbought RSI.

Euro Stoxx 50 joins Euro Stoxx 600 with new DeMark Sequential and Combo sell Countdown 13’s.

US Dollar Index daily up again this morning trying to bounce after holding the TDST support at 106.

US 10-Year Yield slightly holding above the 50 day again

Bitcoin Daily continues to hold the recent support levels 95k-90k more important with a new downside Sequential pending in progress on downside.

DeMark Observations – Euro Stoxx 600

Elevated number of new Sell Countdown 13’s on both daily and weekly time frames.