TOP EVENTS AND CATALYSTS

Monday is a holiday in the US, and markets are closed. I will post a note and possibly a video examining the current market environment. I posted earlier today the Q4 hedge fund holdings 13F wrap-up report. One big positive takeaway was news that Stanley Druckenmiller’s firm initiated a new long position with PCT Pure Cycle. The news had the stock up over 10% in after-hours trading. This is significant because Stan is by far one of the most successful and respected fund managers… of all time! It brings validation for PCT, and we expect other funds to follow.

A few key macro events in the week ahead include the RBA rate decision on Monday night (a rate cut is expected), the UK CPI for January on Wednesday, the FOMC meeting minutes on Wednesday afternoon, and the flash PMIs for February on Friday. A handful of Fed officials are set to speak: Waller, Bowman, and Harker on Monday, Barr on Tuesday, Jefferson on Wednesday, and Goolsbee, Musalem, Kugler, and Barr on Thursday. The markets will be on alert for more details of Trump’s peace proposal and summit with Zelensky and Putin. And more tariff news, which last week’s news seemed to alleviate market concerns of imminent implementation.

The main US earnings include: Tuesday premarket: BIDU, MDT, VMC, WSO; Tuesday postmarket: ANET, CDNS, CE, CSGP, IFF, OXY, TOL; Wednesday premarket: ADI, CRL, ETSY; Wednesday postmarket: ANSS, CF, NTR, TOST; Thursday premarket: BABA, BAX, HAS, W, WMT; and Thursday postmarket: AKAM, BKNG, LYV, XYZ. In addition, Berkshire will publish Q4 results on Saturday morning, with Buffett’s annual report published that day. Apple will unveil the new low-priced iPhone SE refresh on Wednesday.

The important European earnings include Intercontinental Hotels on Tuesday, BAE Systems, Glencore, HSBC, and Philips on Wednesday, and Accor, Airbus, BE Semiconductor, Mercedes-Benz, Renault, and Schneider Electric on Thursday.

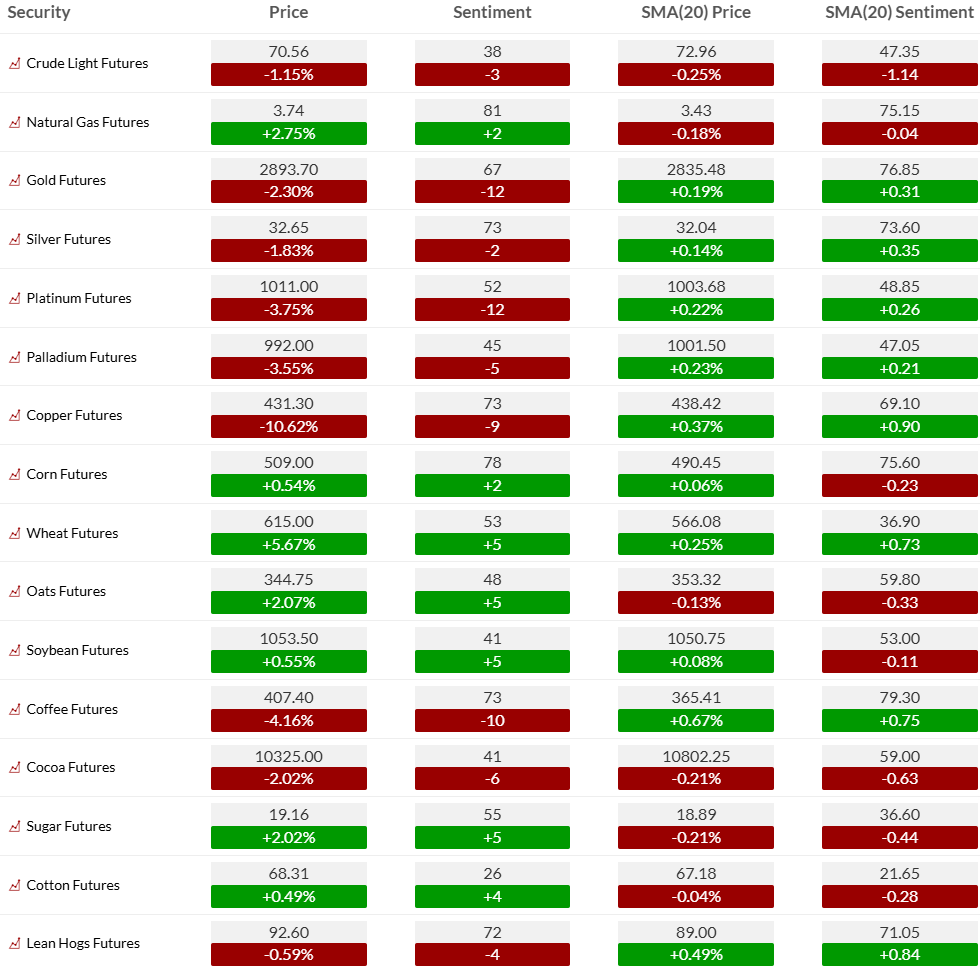

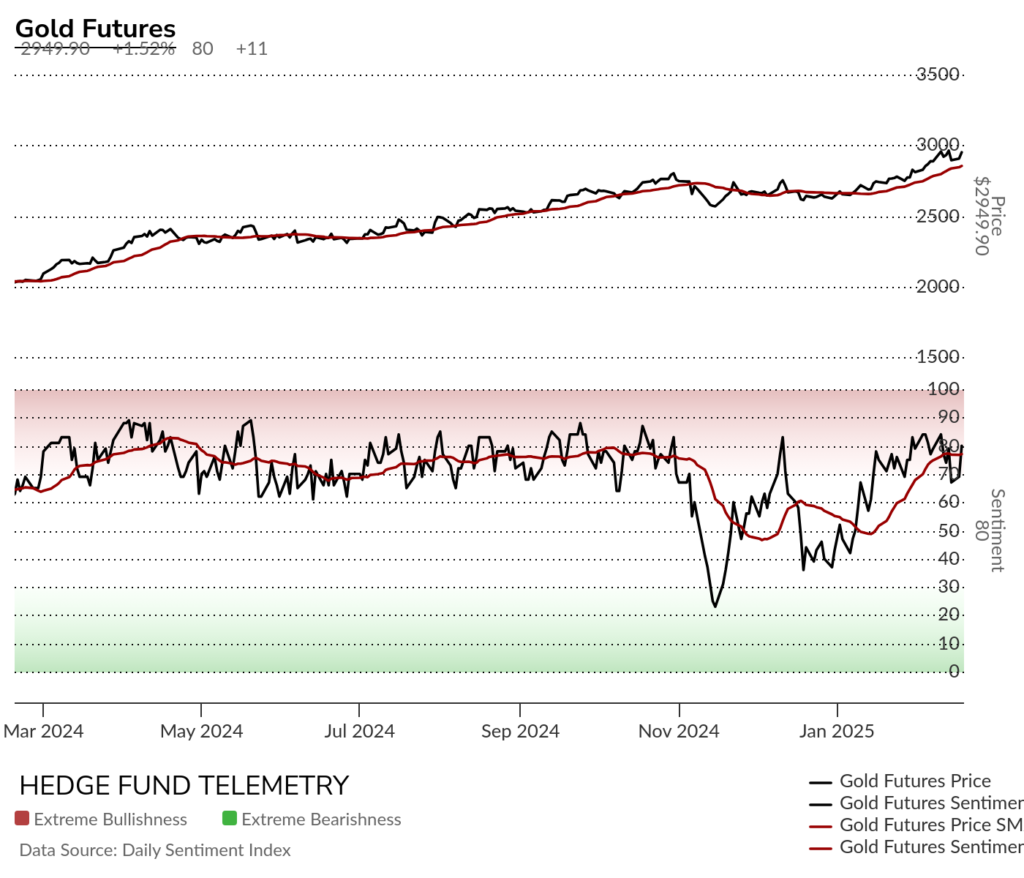

The Currency and Commodity weekly notes are nearly done and will be published this afternoon. The Commodity markets are especially important right now after seeing both crude and gold at risk – two of the largest weights in the Bloomberg Commodity index. We’ve offered these with a discounted rate of $250 for both and if you would like these added to your subscription, please email us.

Weekend News

- It was a relatively quiet weekend of news with tariffs with markets thinking there is a bit of a timing reprieve.

- It has also been a quiet boring weekend with few sports as it is always in February.

- Apple – Engineering problems, software bugs threaten to postpone Apple’s Siri AI overhaul – Bloomberg

- Corporate America’s Souring Profit Outlook Clouds Equity Rally – Bloomberg

- Trump’s Tariffs Are a Mystery, So Investors Keep Buying Stocks – Bloomberg

- Intelcould be split apart and sold in pieces, with AVGO (Broadcom) purchasing the chip design/marketing business while TSM (TSMC) assumes control of the manufacturing operation WSJ

- If you like cars as I do, may I suggest watching Mat Armstrong’s YouTube videos? Mat is a lovely guy that finds crashed cars and remarkably rebuilds them. His videos are engaging and entertaining, And you really learn a lot of about how cars are constructed. Here’s his latest, part 3 of a Porsche GT3 RS. A good watch for the weekends.

Charts we are watching

The major indexes have been in a choppy range-bound environment for the past two months. The markets have seen dispersion with earnings reports, unlike anything in the last few years. The S&P is extremely overvalued on all historical measures, with elevated P/E, price to sales, etc. Growth rate expectations are high, extreme retail buying, continued high speculation and risks with new government policies are the wild cards.

I can’t say this environment is upsetting me since volatility works well for my process, uncovering opportunities on both the long and short side. We can make money in this environment with the goal of 25% in 2025. Not having a fat pitch on either the long or short side keeps my exposure measured. We need to keep moving forward with the goal of hitting singles and doubles. The froth in markets will eventually subside, and when there are cracks, we’ll be there for the downside while having a healthy cash weighting to take advantage of lower-risk opportunities.

The S&P cash index 60-minute tactical time frame has a new Sequential and Combo 13 and Sell Setup 9 in upside wave 5 of 5. Downside TDST Setup Trend support is at 6050.

The 240 minute of the S&P futures has seen inflection with Setup 9’s working well from early December.

The S&P Index daily is at the top of the range lacking momentum as shown on the Bloomberg Fear and Greed oscillator histogram. This isn’t a sentiment indicator but rather a momentum indicator. The 50 day at 6007 and considering that’s a ‘big round number’ type of support a test or break is possible with the shorter term charts showing upside exhaustion.

The Nasdaq 100 futures 60 minute also has new DeMark Sequential and Combo sell Countdown 13’s from Friday. TDST support is down at 21,787

The 240 minute also has seen decent inflection with Setup 9’s and there is another one from Thursday. This is the first Sequential sell Countdown 13 since December too.

US economic data for the week

KEY MARKET SENTIMENT

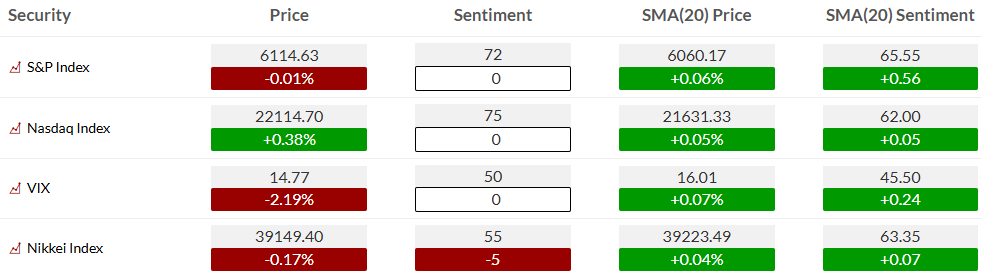

Equity bullish sentiment was unchanged on Friday holding in the elevated zone >70%.

S&P and Nasdaq bullish sentiment has held the 20 day moving average of bullish sentiment which is first support.

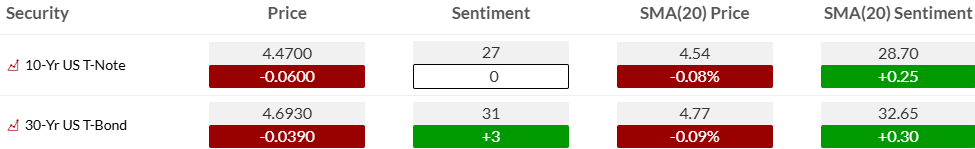

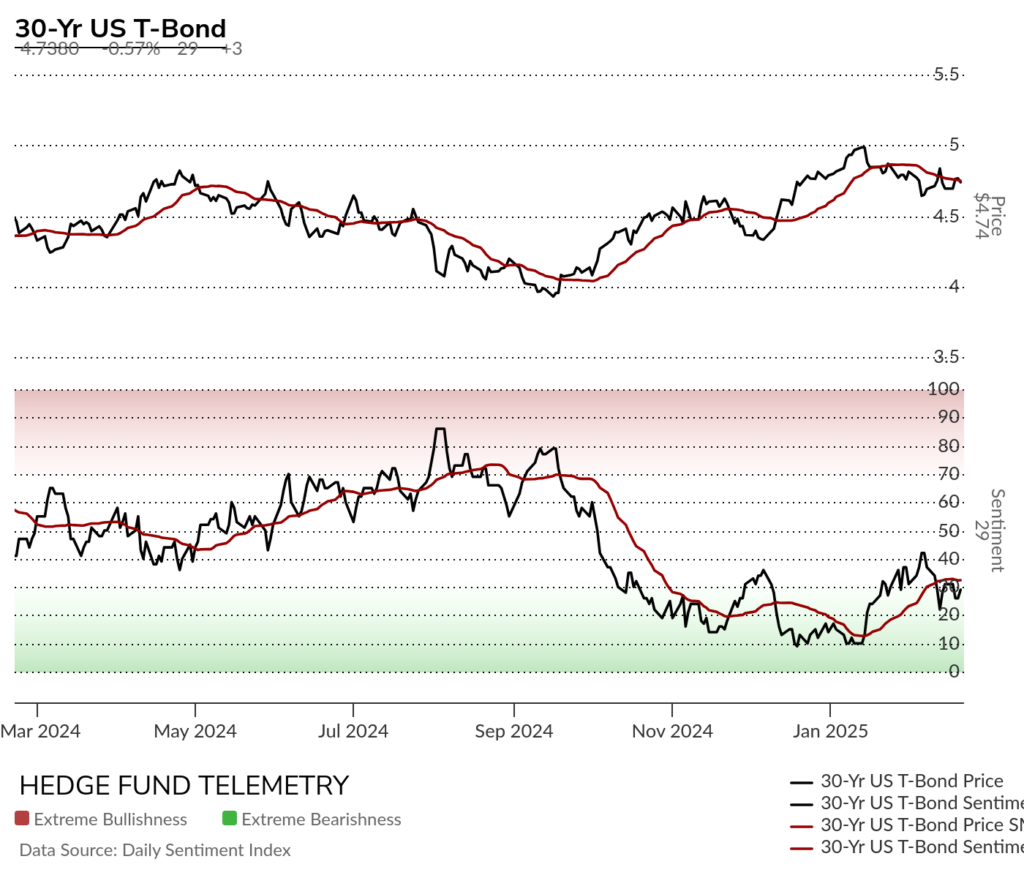

Bond bullish sentiment has been whippy with the stronger inflation data

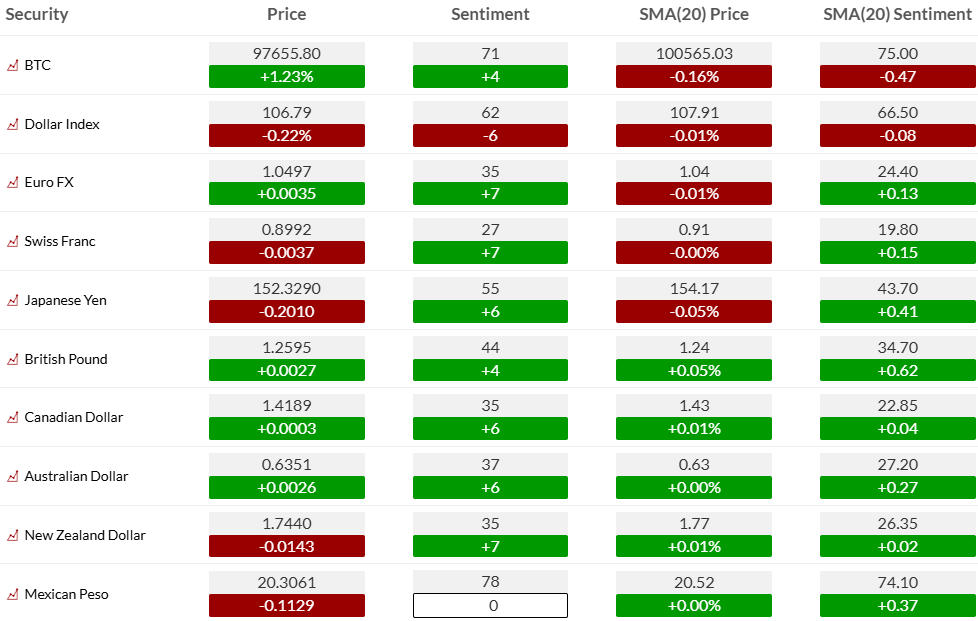

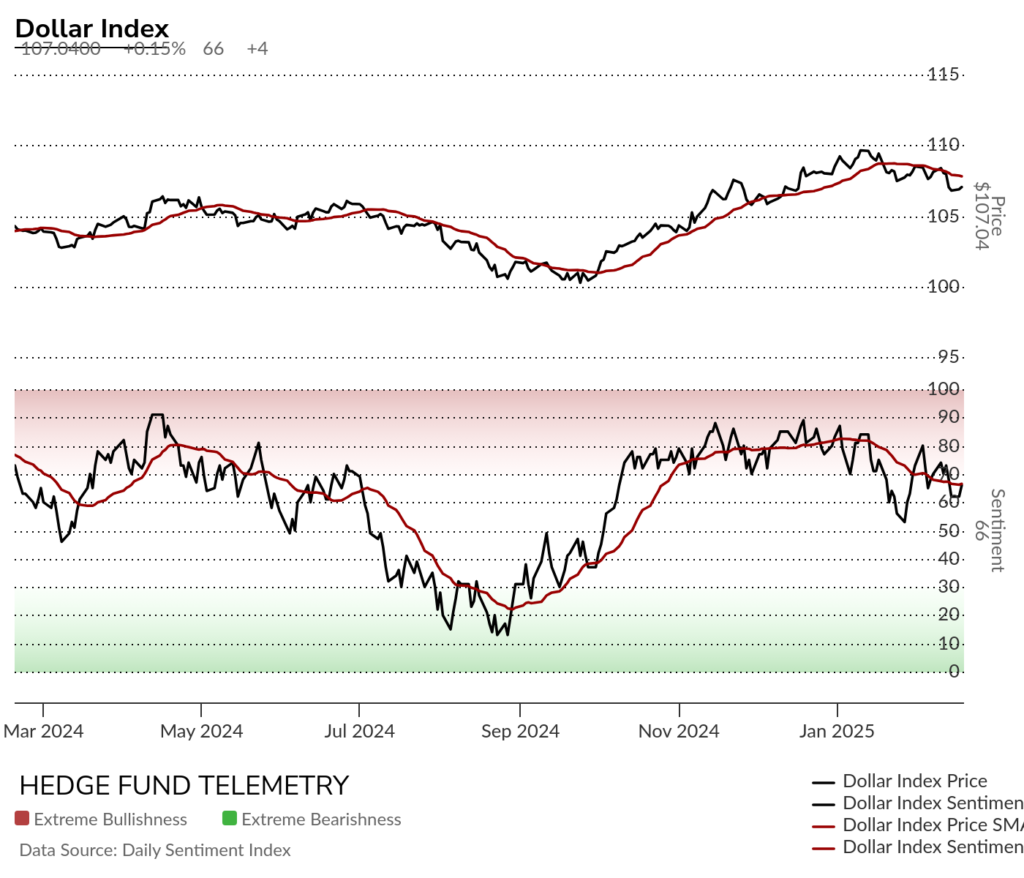

Currency bullish sentiment with US Dollar bullish sentiment falling after making a potentially lower high

Commodity bullish sentiment saw significant weakness with metals on Friday. Gold sentiment was in the extreme zone last week >80% and fell hard combined with daily and weekly DeMark Sequential and Combo sell Countdown 13’s as shown this week on several notes.

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 17-Feb: US Markets Closed for President’s Day Holiday

- Corporate:

- Earnings:

- Post-close: HUN, JELD, NE, OTTR, RIG, TNC, UFPI

- Brokerage Conference:

- ABA Community Bankers Conference

- J.P. Morgan Taiwan CEO-CFO Conference

- Kotak Chasing Growth Conference

- Citi Global Industrial Tech and Mobility Conference

- Consumer Analyst Group of New York Conference

- Economic

- US: Philly Fed Pres speaking engagement

- Canada: Housing Starts

- Europe: Trade Balance, Unemployment Rate

- Earnings:

- Corporate:

- Tuesday 18-Feb:

- Corporate:

- Earnings:

- Pre-open: ALLE, AXSM, BIDU, BLKB, CC, DFIN, ETR, FELE, FLR, GLDD, GPC, HLMN, IQ, MDT, NEO, SOHU, SPNS, TPH, TRTX, VC, VMC, VMI, WAY, WGS, WSO

- Post-close: ADEA, AIP, ANDE, ANET, BELFB, BKD, BMBL, BRSP, BXC, CDNS, CE, CHCT, COMP.EQ, CRK, CSGP, CSR, CVI, CYH, DVN, EQT, ESI, FLS, FOUR, GNW, GOOD, HALO, HCKT, IFF, ILPT, IOSP, LBTYA, LZB, MBC, MED, MFA, MGY, MTDR, NGVT, OXY, PEN, PRDO, QUAD, RNW, RUSHA, SB, SBLK, SEVN, SMLR, SON, SPNT, TCMD, TOL, TRUE, TX, UAN, UIS, WTTR

- Analyst/Investor Events: COIN, FOUR, J

- Brokerage Conference:

- ABA Community Bankers Conference

- J.P. Morgan Taiwan CEO-CFO Conference

- Kotak Chasing Growth Conference

- Citi Global Industrial Tech and Mobility Conference

- Consumer Analyst Group of New York Conference

- Earnings:

- Economic

- US: Empire Manufacturing, NAHB Housing Market Index, TIC Flows, Redbook Chain Store, API Crude Inventories

- Canada: Core Inflation (m/m), CPI (m/m)

- Europe: ILO Unemployment Rate, CPI y/y, ZEW Economic Sentiment Indicator, PPI y/y

- Asia: Core Machinery Orders m/m, Trade Balance

- Corporate:

- Wednesday 19-Feb:

- Corporate:

- Earnings:

- Pre-open: ADI, APPN, BLCO, BNL, CLH, CLVT, CNK, CRL, ETSY, FOLD, FVRR, GLBE, GRMN, HR, IONS, JLL, KPTI, KRYS, LPX, MHH, MTRN, NPO, OGE, PERI, PRG, PSN, PUMP, ROCK, SCL, SEDG, THRM, TNL, TRMB, WING, WIX, WWW

- Post-close: ACVA, AHH, AMPL, AWK, AWR, BHC, BMRN, CAKE, CCAP, CCSI, CDE, CF, CHDN, CIB, CMTG, CVNA, CWAN, ENVX, ESRT, EXAS, GNK, GSM, HLF, HST, ICLR, IIPR, IMAX, INSG, JXN, KALU, KAR, KVYO, LAND, LILAK, LOPE, LUNG, MATV, MGRC, NDSN, NOG, NRDS, NYMT, OBDC, OEC, OGS, OII, OM, PAAS, PK, PRAA, RELY, RGR, ROG, SBRA, SKT, TBI, TK, TOST, TPL, TRUP, TS, VALE, VMEO, VTLE

- Analyst/Investor Events: BV, GVA, LRCX, RGLD

- Brokerage Conference:

- Kotak Chasing Growth Conference

- Citi Global Industrial Tech and Mobility Conference

- Consumer Analyst Group of New York Conference

- Citi Virtual Oncology Leadership Summit

- Barclays Industrial Select Conference

- Green Transformation (GX) Management Week Spring

- SEMICON Korea Conference

- European Crohn and Colitis Organization Congress

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, Building Permits, Housing Starts, DOE Crude Inventories

- Europe: CPI y/y, Output PPI y/y

- Corporate:

- Thursday 20-Feb:

- Corporate:

- Earnings:

- Pre-open: ALIT, ARDX, BABA, BAND, BAX, BIGC, BIRK, BLDR, CCRD, CHH, CIO, CNP, CNR, COLD, CRAI, CSTM, CWK, DAN, DAO, DAVA, DBRG, DGICA, DINO, DNB, DRS, EPAM, ESAB, FCN, FRPT, GCI, GHI, GTX, HAS, HNI, IDA, INSM, ITGR, JMIA, KLTR, LAMR, LAUR, LNG, MD, MTLS, NBIS, NTES, NVRI, POOL, PRM, PRMB, PWR, RGEN, RS, SABR, SHAK, SHYF, SO, SWTX, TALK, TPX, TRGP, TRIP, TRN, U, ULS, UPBD, VAL, W, WMT

- Post-close: ACCO, AKAM, ALRM, AMH, AXTI, BBDC, BCC, BJRI, BKNG, CARG, CERS, CTO, DBX, DVAX, EGO, EIG, EVH, EXPI, FG, FIVN, FND, FNF, FYBR, GDYN, GH, GKOS, GLPI, GMED, HPP, INDI, INOD, IRTC, IVR, JAKK, LAW, LIDR, LNT, LYV, MERC, MP, NEM, NEXA, NU, NVEE, OLED, PAGS, PKST, PODD, REAL, REZI, RHP, RIVN, RMAX, RNG, RXT, RYAN, RYI, SEI, SEM, SFM, SVV, TPIC, TXRH, UEIC, VICI, VICR, WEAV, WKC, WSC, XYZ, ZEUS

- Analyst/Investor Events: GVA, LFWD, V

- Brokerage Conference:

- Kotak Chasing Growth Conference

- Citi Global Industrial Tech and Mobility Conference

- Consumer Analyst Group of New York Conference

- Barclays Industrial Select Conference

- Green Transformation (GX) Management Week Spring

- SEMICON Korea Conference

- European Crohn and Colitis Organization Congress

- JP Morgan Korea Conference

- Earnings:

- Economic

- US: Philadelphia Fed Index, Leading Indicators, Weekly Jobless Claims, EIA Natural Gas Inventories

- Europe: Unemployment Rate, PPI y/y, CPI y/y, Flash Consumer Confidence

- Asia: CPI Core National y/y, CPI ex-Fresh Food and Energy, CPI National y/y

- Corporate:

- Friday 21-Feb:

- Corporate:

- Earnings:

- Pre-open: AGM, ASIX, ATMU, BCPC, BRC, OIS, SHO, TDS, TXNM, UNIT, VIPS

- Post-close: HE

- Brokerage Conference:

- Consumer Analyst Group of New York Conference

- Green Transformation (GX) Management Week Spring

- SEMICON Korea Conference

- European Crohn and Colitis Organization Congress

- JP Morgan Korea Conference

- Earnings:

- Economic

- US: PMI Manufacturing Preliminary, PMI Services Preliminary, Existing Home Sales, Michigan Consumer Sentiment (Final)

- Canada: Retail sales

- Europe: Retail Sales y/y, Manufacturing Business Climate, Business Survey, CPI y/y, PPI m/m

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.