- The jobs data has come and gone. There is a little for everyone. None of the strong upside gains as MS thought +200k or Ana Wong at Bloomberg who thought a negative number was possible. My view is that the real job declines will start to show up on the next and future reports, as the jobs data surveys are done each month on the 12th, so the recent government layoffs didn’t get reflected in this data.

- Perhaps the main event today is Fed Chairman Powell’s speech at 12:30 ET. We ask “WWJD,” What will Jerome do? The Fed has a quandary: slowing growth, rising unemployment, and potentially higher inflation, especially with the pending tariffs going into effect next month. Stagflation is not a good scenario for the Fed. What will he focus on?

- Here’s an early headline: *POWELL: FED DOESN’T NEED TO HURRY, CAN WAIT FOR GREATER CLARITY

- Trump says he’s not even looking at the equity markets. (Who believes him?) Does this mean he’s fine with indexes declining which will help rates move lower? I wouldn’t doubt that and if a recession happens some time this year it might be similar in some ways to when Reagan came in during his first term. Equity markets lifted into his start, fell hard, causing a recession, rates peaked and moved lower which also had inflation drop hard. It’s not exactly similar however, that might be the plan.

- Secretary Bessent said today that the expansion under the Biden administration was artificially supported by government spending and that there will be a “detox period” as the economy adjusts. I can’t say I disagree; however, it’s hard to detox (I’ve only given up coffee a few times and felt like I was going to die as the detox was brutal). The US consumer, investor, and trader might have a rough detox period after a long period of government/Fed stimulus that has supported stocks and a strong labor market.

- If you expect long ideas to work in this environment, think again. I’m not pleased with some recent carnage with a few long ideas, but my goal is to hold the highest conviction for long ideas and add to them when I see fit. I will always hold some longs and I see no change in fundamentals in some such as Pure Cycle or Golar. I still like others bought recently and will give them a chance to work.

- Some have asked why I am not more weighted short. It’s not that easy with the various headlines that have caused sharp up-and-down moves lasting a few days. My goal has been to be more consistent this year, and I want to build up some positive PNL in Q1 so I can take more risk and deploy more capital throughout the year. That’s the plan, and it’s working.

- I don’t have the options trades in the Trade Ideas PNL. I’m working on getting a page with the few options trades I recommend. It’s hard to size them properly, and the pricing issue might be resolved.

- I actually like the idea of the US crypto reserve if the US keeps the forfeited seized stuff rather than buying more on the open market with debt. Crypto bros might disagree.

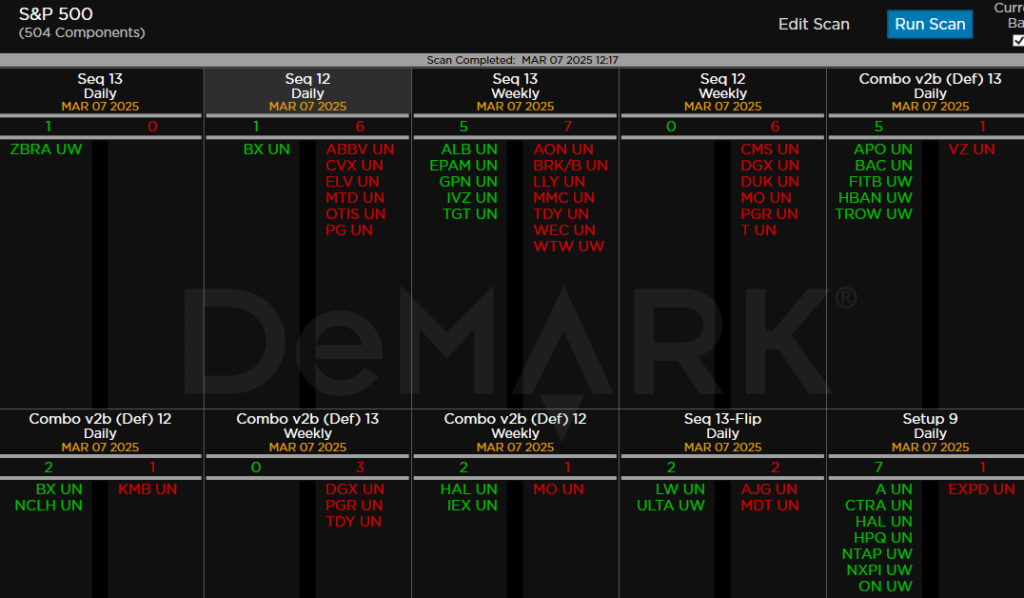

- I get asked what I want to see for a bottom: Sentiment oversold at or under 20%, a decent amount DeMark Sequential buy Countdown 13’s on indexes, sectors, and stocks, internals oversold, the proverbial “traders with hand on face.”

Going to leave it here today. I have a sector ETF focus below as well a look at internals that are not oversold. It’s been another wild week, and I hope to get a link for the Grant Williams interview I did and will post it on the Week Ahead. Have a great weekend. I might have another brief note later if something extreme occurs.

TRADE IDEAS

Pre changes. I will remove the AVGO short with a 4% loss. I will also take the gain on the COST short with a 8% gain. If you followed the COST March 1000-950 put spread it’s below the lower strike. Take off half of all of it for over a 3x gain. I will cover the AFRM short with a 35% gain. I will also remove the WFC short with a 2% gain (took a while I know). I will add 1% more to bring to 5% max long with PCT and GLNG. I will continue to hold a big cash position to avoid some of the whips.

US MARKETS

Here is a primer on the basics of DeMark Setup and Sequential indicators.

S&P 500 futures 60-minute time frame short term stability with the recent 13’s but the trend lower has been strong which is a feature when the short term 13’s don’t get strong reversals.

S&P daily with risk of a new Sequential Countdown beginning. More evidence will be needed next week.

S&P weekly with breakdown under trend line

RSP S&P equal weight below TDST Setup Trend support on day 5 of 9. Completion of Setup 9 next week if it happens will cancel pending Sequential.

Nasdaq 100 daily lost the 200 day

Nasdaq 100 weekly also with trendline break

QQQE Equal weight breaking January lows

Russell 2000 daily nearing the wave 3 price objective. Covered this a little early

Dow Jones broke TDST support with January lows now in sight.

US SECTOR ETF FOCUS

Comments on charts

XLK Technology and SMH Semis breaking below recent range

XLY Consumer Discretionary with potential new Sequential starting

XLI Industrials with downside Sequential on day 5 of 13 near support which I see breaking lower.

XLF Financials and KRE Regional Banks are breaking down

XLE Energy still has the pending Sequential nearing on the downside. I want to buy the 13’s

XLV Healthcare with Sell Countdown 13’s in play right now Toppy.

XLP Consumer Staples will likely get the Sequential 13 on Monday.

XLC Communications Services breaking down with potential new Sequential starting.

XLB Materials fading despite the upside Sequential in progress/pending

XLRE Real Estate has been strong but has lost momentum

XLU Utilities holding support for now. I want to buy lower

IYT Transports near support

ARKK might be close to breaking. I am debating adding this back as a short. We sold more short with the Combo 13

FEZ Euro Stoxx 50 with new daily Sequential 13 as well weekly.

FXI China Hong Kong ETF has remained strong. Buyer on pullbacks.

KWEB China Internet remains solid despite the recent 13’s A pullback is due and I will be a buyer

GLD Gold remains the most resilient commodity

Internals – not oversold yet

The Advance Decline data is not oversold yet. I will update on Sunday’s note if any get oversold.

S&P 500 percentage of stocks above the 20, 50, and 200-day moving averages have been fading again and are not oversold yet

5 Day Moving Average Equity Put/Call Ratio started to see a lift in put buying off the 18 month low. A spike over the green line will be an oversold market.

Nasdaq Summation Index weekly has been dropping with the momentum indicators not yet oversold.

The McClellan indicators are reversing down and are not oversold. NDX and SPX below.

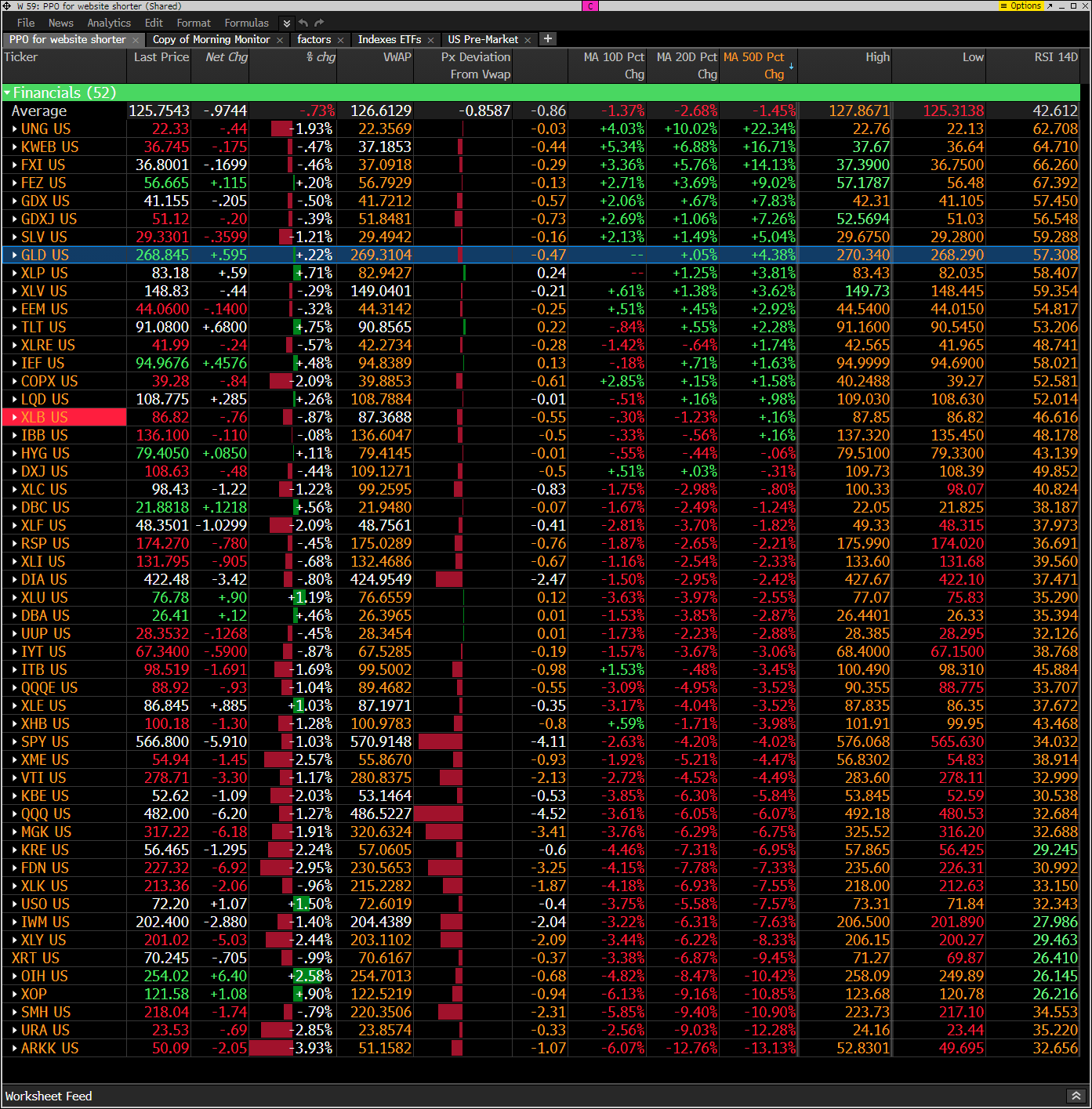

FACTORS, GOLDMAN SACHS SHORT BASKETS AND PPO MONITOR UPDATE

Factor monitor shows some ugly action today, last 5 days, last 1 month rolling and many YTD now

This is similar to the above monitor with various ETFs other indexes. Defensive type of action today. YTD seeing a lot more down on the year. Mag 7 is down 12.67% with META nearly turning negative.

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Today, the shorts baskets are down moderately vs recent action of deeper declines. Energy squeezing higher.

The PPO monitor (percentage price oscillator) force ranks ETF’s by percentage above/below the 50 day moving average. For information on this monitor please refer to this primer. This monitor is offered to Hedge Fund Telemetry subscribers who are on Bloomberg. Notable: The risk on/off sectors are in the lower half of this monitor. Upside days these are green and today very red.

DeMark observations

Not yet seeing enough buy Countdown 13’s for a bottom. Risk of Countdowns just starting!