Before I begin, I’m down with the flu right now, so I’m doing my best to stay in front of the screens. A lot has been discussed about “Pod firms” blowing up. A pod firm is a multi-strat fund with experts in a particular asset class, sector, etc. They have been wildly successful over the years; however, when things go south, so does the firm’s performance. A few things: they lever up big and have processes that keep them hedged with some mandated to be market neutral. In other words, if you are long something you are short a like amount of something else. Companies such as Citadel, Millenium, Schoenfeld, Balasny, and Point 72 are notable firms that have groups or pods. (full disclosure we have clients at all of these firms) Some of the risk perimeters the firms have on these pods are brutally tight. A drawdown of 3% could see an allocation cut and a drop of more than 5%; you might lose your job. It’s not easy to survive at these firms when volatility picks up.

I get asked a lot by younger people who want to get into the hedge fund business what is the best path to land a job as a portfolio manager at a hedge fund. I stress it’s not easy to get in, and one should have experience at an investment bank to learn fundamental modeling, some experience at a long-term only, or a hedge fund at a junior level. Having a skillset within a sector is better than a generalist. Many of these funds now use training programs to build talent internally, which is also a coveted position to get early in a career. Landing within a pod is challenging as you’re constantly evaluated on the performance and risk. The cowboy hedge fund trader days are long gone. These sophisticated institutional firms do not debate whether they need to cut exposure or what jobs they cut. They just do it. It’s part of the business.

So, the pods cut in the last few weeks will eventually end up at another competing firm. It’s a carousel of job movement for the pod people.

Risk managers at these pod firms have one mandate: to reduce risk quickly. They are graded on getting exposure swiftly removed and don’t care about price sensitivity. This unwind has unmercifully killed the high beta trades. Considering the crowding and concentration in US megacap, it has hit indexes hard. The sector pods that were cut also have seen sectors such as industrials, tech, consumer, and financials have large, outsized downside moves even if the fundamentals are intact. We have a few of those longs that sucks when they get hit but should work as things settle down.

The new administration is perhaps taking a page from the Reagan/Volker playbook. They want rates, inflation, and consumer prices lower. Sacrificing the equity market or perhaps allowing a recession (shallow is obviously what they want). There will be labor problems with increased unemployment, and consumer confidence will drop. It’s a tricky strategy, especially with the big difference from Reagan’s first term to today, having a massive debt and deficit to deal with. I’m for reining in the out-of-control government spending and addressing the debt, but it will take time and won’t be easy or guaranteed. Having a non-government oligarch in charge of this process is another issue I don’t need to address. It’s nuts.

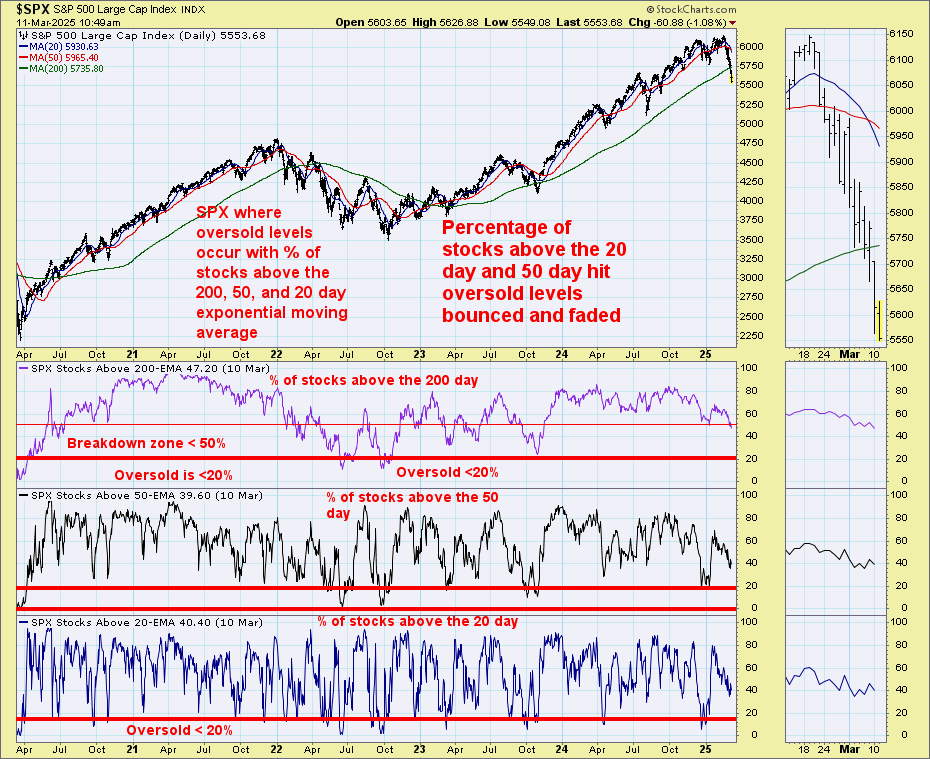

So, has the market bottomed? Everyone I hear seems to have called a few bottoms recently. Some oversold signals are developing. However, markets tend to bottom when everyone wants out, nobody trusts any bounce, and the sentiment is dire. I have a few internals below as an update. See yesterday’s note if you missed it, which includes some sell-side and buy-side comments on what they are hearing. Carnage but no capitulation yet.

Today’s latest tariff news is an increase on Canadian steel. The markets have not and still don’t like tariffs; they are unfriendly to businesses. CEO’s and managements are frozen on making plans with the day to day tariff announcements.

Fun fact: The original Invasion of the Body Snatchers was directed by my next-door neighbor, and I remember him playing it for us (he had a small theater in his house). I was very young and scared out of my mind for the next three years.

Quick Market Views

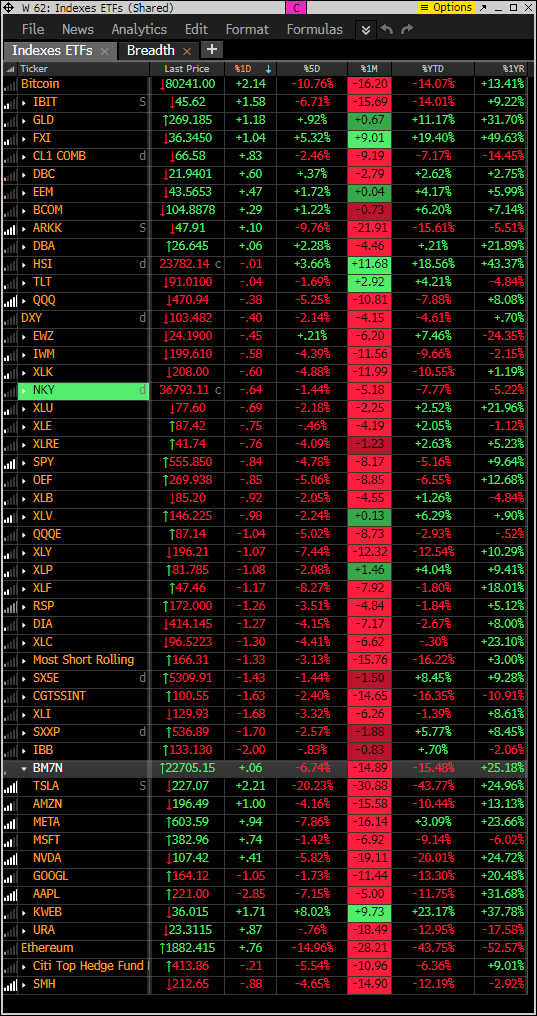

Stocks: Indexes are off earlier lows, and SPY and QQQ are at today’s VWAP (558.20/472.85). It seems so many people are trying to buy a bounce or call a low. Tomorrow’s CPI inflation data is expected to come in a tick cooler, and that might be a catalyst for a bounce, but if it surprises again with a hotter number, fasten your chinstrap on your helmet and prepare for a rough landing. Breadth has remarkably been less bad than you’d expect. NYSE is down 950 issues, and Nasdaq is down 550 issues. That’s a positive however after the decline recently a stronger breadth reading is needed. Thinking breadth thrust.

Bonds: Rates are higher by 3-5bps. That bond rotation sure is making it tough for those hoping for lower rates.

Commodities: Commodites are bouncing with Crude up 1%, Natural Gas down 1.3%, Copper up 1.8%, Gold up 0.8%, and Silver up 1.9%

Currencies: Dollar index continues lower down 0.5%. USDJPY is at 147.56. Bitcoin up 3%

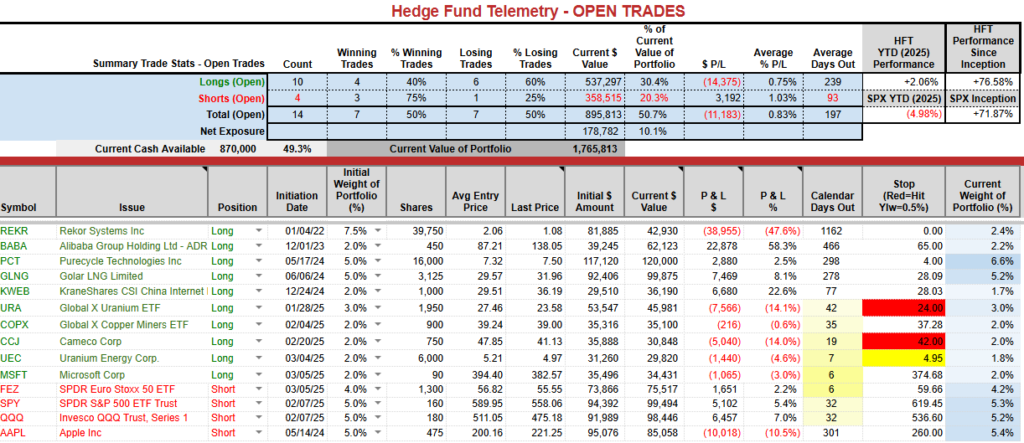

Trade Ideas Sheet: Stay in the game, heavy in cash, long patience.

Changes: I will add a 2% weight with XLP Consumer Staples short.

Thoughts: Seeing a bounce with a few longs, some shorts are still under pressure with AAPL notable. I would love to be more exposed and might miss some short term bounces or cover some things too early. I will remain focused on the process.

US INDEXES

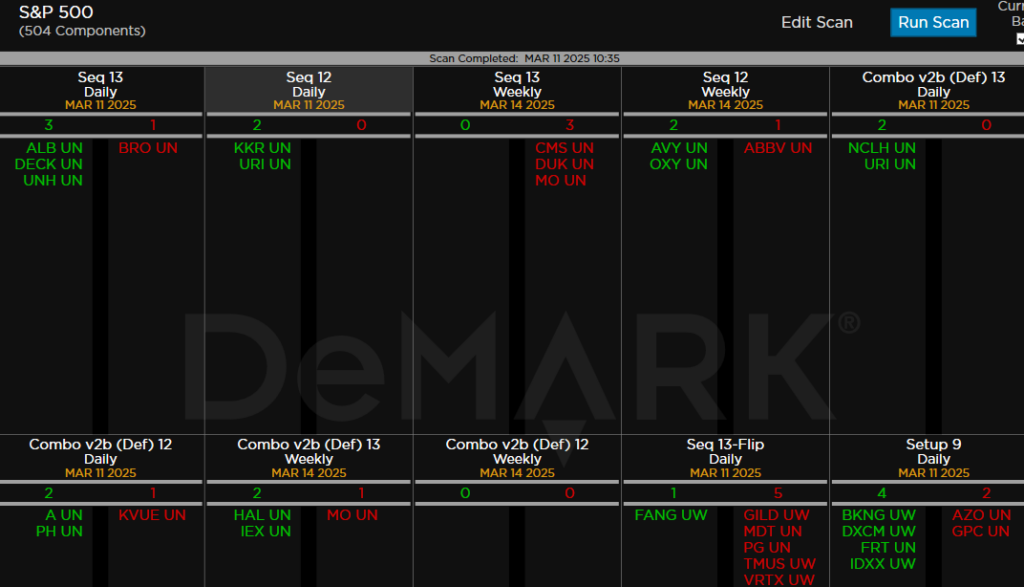

Here is a primer on the DeMark Setup and Sequential indicators.

S&P futures 60-minute tactical time frame with a pattern trending lower of lower highs and lower lows.

S&P 500 Index daily is on day 2 of 13 with a new Sequential Countdown 13. It can and might bounce despite the Sequential Countdown starting. Risk remains lower as the most dangerous markets are when people believe markets are oversold. Oversold markets that fail have seen crashes. It’s been very orderly but it won’t take much to hit this down to 5000.

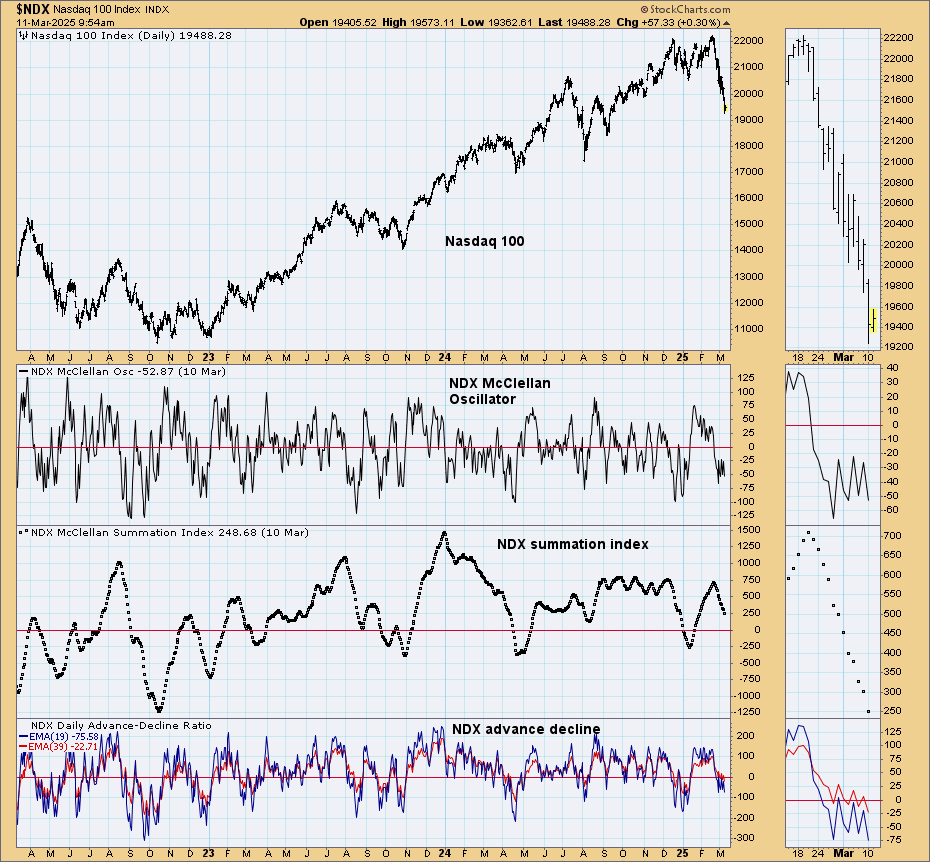

Nasdaq 100 futures 60-minute tactical time frame with pattern of short lived bounces and failures.

Nasdaq 100 Index daily didn’t qualify the downside Setup 9 on day 9 by the way. So no Sequential Countdown.

Trade Ideas Sheet

The new short term SPY and QQQ momentum indicator has been on a sell signal from the top tick day – luck. It usually takes a move lower to turn the momentum. And when this turns up, don’t be surprised if there is a gap higher and a lag. That is a feature of momentum strategies. I did take a little off and added it back and remain with max size 5% on both short.

XLP Consumer staples has been a nice hiding place. Yesterday’s Sequential 13 and PG 13 marked a top. I will add a 2% short position if this trade unwinds.

AMZN is typical of a stock with a DeMark Sequential in progress and one everyone wants to buy. I’ll wait for the Sequential buy Countdown 13

Internals – update

The advance decline data has been moving down but not at oversold levels.

The percentage of stocks in the S&P above the 20, 50, and 200 day are not yet at oversold levels.

The 5 day moving average of equity put call ratio has started to rise but backed off in last few days. I would expect this to be higher with more put buying. A move over the green dotted line would be a level where people are buying puts too late and risk getting squeezed higher.

The S&P and Nasdaq 100 daily charts with McClellan indicators are pointed lower yet not at recent lows from December or even at levels seen in recent years.

The S&P and Nasdaq Composite internals on these charts are also not oversold. Some are not yet at January lows or other historically low levels.

Hedge Fund Telemetry ETF Percentage Price Oscillator Monitor

The PPO monitor (percentage price oscillator) force ranks ETFs by percentage above/below the 50-day moving average. For information on this monitor, please refer to this primer. This monitor and others are offered to Hedge Fund Telemetry subscribers on Bloomberg. Nice to see China tech still strong and URA also up with it nearly at the bottom of the monitor. One thing I will want to see with some that are down is a lift above the 10 day and 20 day moving average. Keep an eye on this monitor in the coming days.

Index ETF and select factor performance

ETF with today’s 5-day, 1-month, and 1-year rolling performance YTD. Most are all down today. Some of the Mag 7 components are trying to bounce but there are no buy signals yet

Goldman Sachs Most Shorted baskets vs. S&P Indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Moderate declines with short baskets with continued S&P weakness.

DeMark Observations

Within the S&P 500, the DeMark Sequential and Combo Countdown 13s and 12/13s on daily and weekly periods. Green = buy Setups/Countdowns, Red = sell Setups/Countdowns. Price flips are helpful to see reversals up (green) and down (red) for idea generation. The extra letters at the end of the symbols are just a Bloomberg thing. Worth noting: Still very few buy Countdown 13’s – it will take time to get these buy signals.

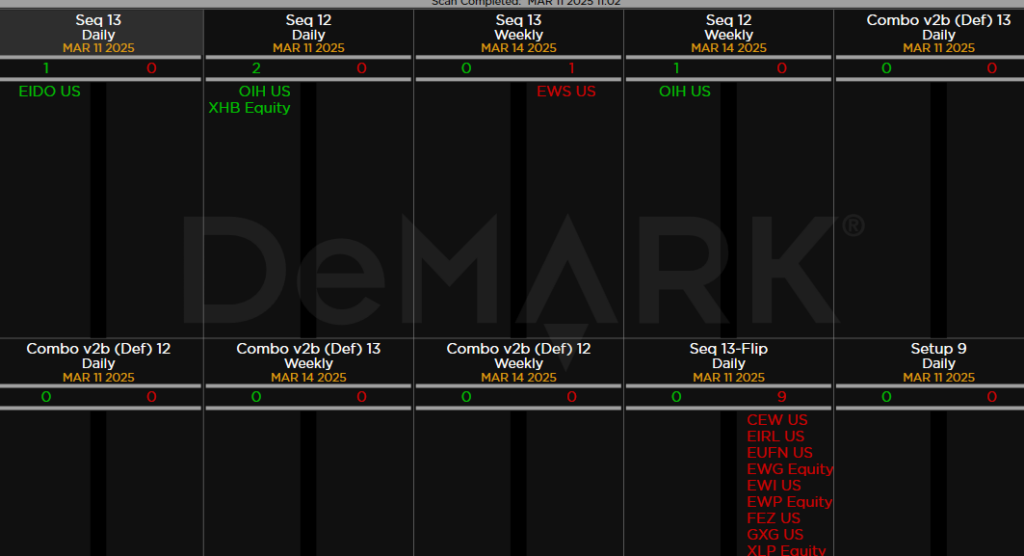

Major ETFs among a 160+ ETF universe. Same story with ETFS.

If you have any questions or comments, please email us. Data sources: Bloomberg, DeMark Analytics, Goldman Sachs, Street Account, Vital Knowledge, Daily Sentiment Index, and Erlanger Research