TOP EVENTS AND CATALYSTS

The week ahead has some important macro events focused on US inflation data. This week will start with the US JOLTs report for January on Tuesday; the US CPI for February on Wednesday, with consensus looking for a modest cooling in headline/core to +2.9%/+3.2% vs. +3%/+3.3% in January, the Bank of Canada rate decision on Wednesday with a 25bps rate cut widely expected. Investors will be listening closely for how the forward guidance evolves in light of Trump’s trade war, the US PPI for February on Thursday, and the Michigan sentiment report for March on Friday; investors will be watching very closely to see if confidence falls further while inflation expectations extend their gains. The Fed will be in a blackout period ahead of the 3/19 FOMC meeting. Friday, 3/14, is the budget deadline – if a deal isn’t in place by then, a government shutdown will occur (although the odds of a shutdown have been fading of late).

The key earnings reports include: Monday postmarket: ASAN, MTN, ORCL; Tuesday premarket: CIEN, DKS, KSS; Wednesday postmarket: ADBE, AEO, CCI; Thursday premarket: DG; and Thursday postmarket: DOCU, ULTA. Conferences during the week of 3/10 include and might have some comments from managements on how Q1 is developing: BNB Paribas Exane TMT; Cantor Global Technology; Citi Global Consumer & Retail; Deutsche Bank Media, Internet, Telecom; JPMorgan Industrials; UBS Global Consumer and Retail; Wolfe FinTech.

Weekend News

- The dominant macro topic (by far) is tariff uncertainty. Nothing from the weekend changed the narrative as the world waits on the edge of its seat to see what will happen with the Mexico/Canada tariffs and the April 2 reciprocal tariff announcement.

- Apple suffered another AI setback when the company confirmed it wouldn’t be releasing an enhanced version of Siri for the foreseeable future Bloomberg

- Index changes: The SPX, after the close on Friday, said DASH (DoorDash), TKO (TKO Group), WSM (Williams-Sonoma), and EXE (Expand Energy) will join the S&P 500, replacing BWA (Borgwarner), TFX (Teleflex), CE (Celanese), and FMC (FMC Corp). COIN was on the shortlist of many inclusion strategists, which is why I bought it last week. I will likely exit on Monday.

- DeepSeek could face sig. US restrictions as the White House considers banning it from the iOS and Android app stores and imposing limits on the ability of cloud providers to offer its models to customers WSJ

- GOOGL Alphabet– the DOJ largely reaffirmed a Biden-era proposal that would force Google to divest its Chrome browser and halt placement payments for its search engine, dealing a blow not only to the company but the tech industry in general, who were hoping for a more relaxed regulatory stance from the Trump administration Washington Post

- Microsoft has made significant progress on its own internal AI technology and is testing models from Anthropic, xAI, Meta, and DeepSeek as the firm continues to separate from OpenAI The Information

- DOGE/Musk – a NYT profile article discussed the rising tensions between Musk and some of Trump’s cabinet secretaries while the WSJ recently noted the enormous damage being done to Tesla’s brand by Musk’s public image. This brings up the potential for Elon to take a step back from his new government focus and back to Tesla.

I went through a lot of charts today and wanted to highlight some that I don’t always show and some that I do show often. Can a bounce happen? Possibly. However, the evidence I want to see for a better low-risk buying opportunity is not yet there with many of the indicators. Hopefully, the extra commentary will explain it in more detail.

One of our subscribers is the founder of Tommy Rotter – a fine bourbon I recommend. Check it out.

I will post the Currency and Commodity weekly notes later. I have a few emails to return, so if you emailed, I’ll get back to you.

Charts to watch: are we oversold yet?

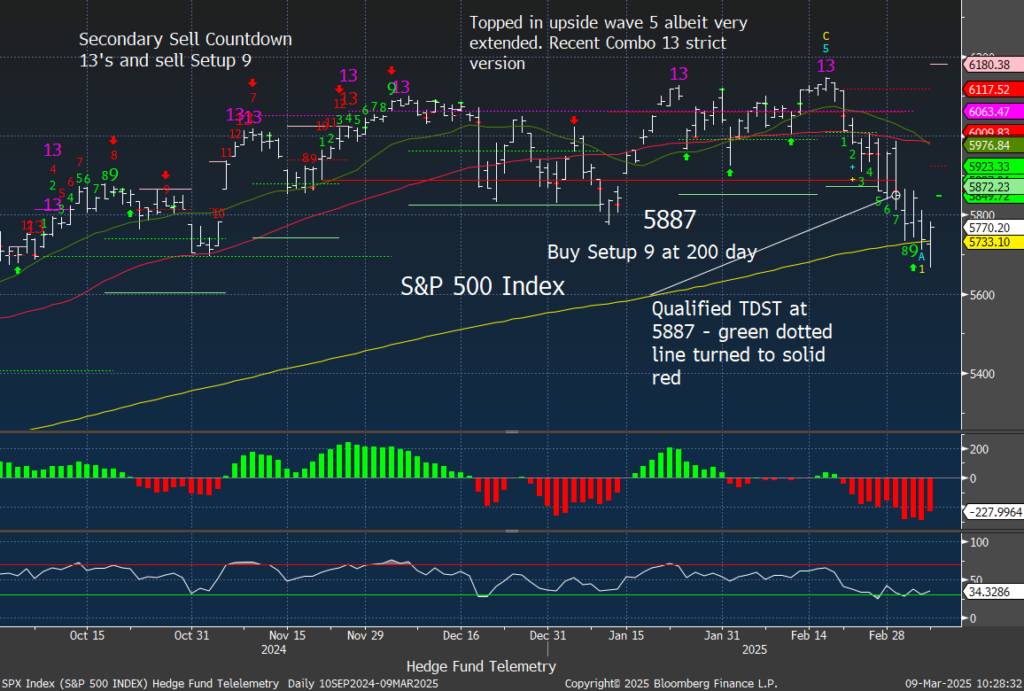

I am getting many questions from subscribers asking the big question: Are we oversold yet? Overall, it is not fully oversold based on the evidence, but a bounce can and might happen. Considering the persistent trend in the last 18 months and how buy-the-dip buyers have been rewarded despite elevated valuation and sentiment not fully oversold, most people are overeager to buy. I thought I’d go through some charts to show some of the evidence of where things are oversold in the short term and where good oversold conditions could move to that would be a decent buying opportunity. Markets never move straight down and just like in 2022 and other corrective periods, there are times to buy and exploit upside bounces. Let’s start with this chart that shows the topping pattern that gapped higher after the election that saw massive inflows with both retail and institutional buyers who are now trapped higher (see below with VWAP levels). SPY is now below the 50 day moving average by 3.42%. Decent bottoms for short term bounces have occured with it by >5%. Some of the strongest buying opportunities were at 10% below the 50 day. The recent DeMark buy Setup 9 can be a buying opportunity and might see a bounce however a breakdown below the lows also could start a new downside Sequential which has now occurred since 2022. The red solid line at 587.45 is a concern as it is a qualified TDST Setup Trend line. It happened in 2022 and a Sequential 13 qualified lower. There was one in 2023 after a Setup 9 with a bounce to the TDST line and failed that might happen again.

This is the S&P percentage of stocks above the 20, 50, and 200 day moving averages. It’s easy to replicate but rather effective to watch for good oversold conditions. I normally don’t discuss the percentage of stocks above the 200 day however it’s at 52% and has been above 50% from the lows in late 2023. When under 50% markets tend to struggle. Both the 20 day and 50 day data in January fell to oversold levels at 20%. This was mostly due to the flattening with the longer term trend extended. Currently both did not get oversold on this pullback now at 40%. On the right side the 20 day is crossing below the 50 day – a silver cross.

The S&P cash index moved to the 200 day which I believed possible from the highs. It’s higher than I expected at 5733 mostly due to the range bound action didn’t break. The Setup 9 could see a bounce. However here’s the definition and perimeters needed for the Sequential: Once a Setup 9 completes the Sequential Countdown process begins. Sequential (red 1-13 numbers) measure the depletion of buyers/sellers in the market after the Setup phase has determined the direction of the trend.

The Countdown is calculated by comparing the close of the current bar to the high/low of two bars earlier. Each fulfilled comparison produces a number, which helps to describe the stage of the current trend. Unlike the Setup, the Countdown doesn’t have to be an uninterrupted sequence of qualifying price bars; the Countdown process simply stops when markets are trading sideways, resumes when prices start trending in the current trend direction again. To complete a Countdown bar thirteen must be greater/less than or equal to the close of the 8th bar and the normal pattern of the thirteenth bar must be greater/less than or equal to the high/low of two earlier bars.

The weekly S&P has moved lower after making a new high with only three weeks down. Breaking the trendline is a concern and again, considering the massive inflows higher, the risk is that the bounce, if it happens, doesn’t get people back to whole after buying higher.

This shows several moving averages 20, 50, 200 with both the 20 and 50 higher and at the 200 day currently. From the election illustrating the trapped positioning is the VWAP (volume weighted average price) at 593.99 and the VWAP from the high on February 19th of 588.69. A bounce to these VWAP levels would not surprise me if they failed there.

Quietly the 10 year yield bounced late in the week. The CPI/PPI inflation data this week if not cooler could see a further increase in rates. A lot of people have been wanting to buy bonds recently too.

Bitcoin continues to look weak with the Sequential now on day 9 of 13 making another lower highs last week. Crypto is a reflection of risk on type behavior and I’m told a measure of liquidity.

The Daily Sentiment Index charts have shown sentiment declining now in mid 40% levels (see below). The CNN Fear and Greed is a good sentiment indicator that shows what traders are doing vs how they feel about markets. It’s now moved down into the extreme fear zone at 20%. When going through the 7 components I fail to see actual extreme fear. The charts only go back a year and some of the inputs are not even at levels seen last summer.

Market momentum and stock price strength are labeled as extreme fear. Stock price strength was lower in January vs now.

Stock price breadth and the 5 day average of the put call ratio are also labeled in the extreme fear zone however I fail to see this as “extreme” vs other periods.

The S&P McClellan Oscillator and Summation Index are above the January lows and historically not oversold.

The VIX is above the flat and rather low 50 day moving average. A VIX at 23 is not what I would label as “extreme fear” Stock vs bonds returns has been trending lower but not even close to the lows from last summer.

Junk Bond demand remains in the extreme greed zone. When high yield falls, stocks tend to fall as well. The demand for credit remains very strong – especially with “private credit” which might be a black swan one day in the future.

The ratio between HYG High Yield and LQD Investment grade has been rolling over and also has a new DeMark buy Setup 9. I would not be surprised to see another lower high short lived bounce and then a lower low under wave 3 of 5.

This is the weekly of the CDX High Yield credit spread. It has widened in the last two weeks. No alarm bells are ringing with this move yet. The Yen carry trade unwind last summer saw this spike to 400. If spreads continue to widen (move higher on this chart) then there is a bigger risk developing.

US economic data for the week

KEY MARKET SENTIMENT

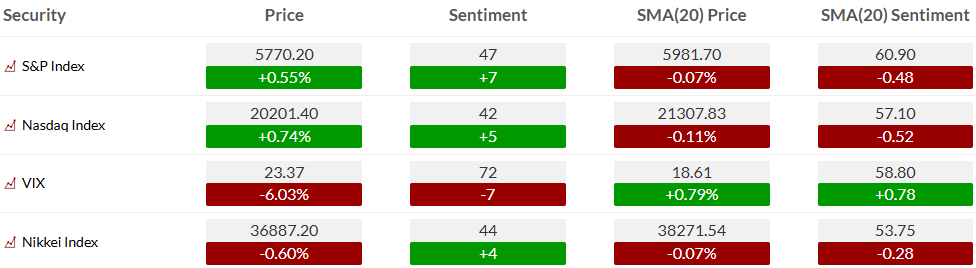

Equity bullish sentiment remains under 50% midpoint level and in mid 40%’s.

S&P and Nasdaq bullish sentiment is not oversold. One of the frustrating things in the last 18 months has been not getting oversold levels.

Bond bullish sentiment stalled recently after getting to the 50% midpoint majority level. Many times 50% can be resistance/support and why I talk about it so much.

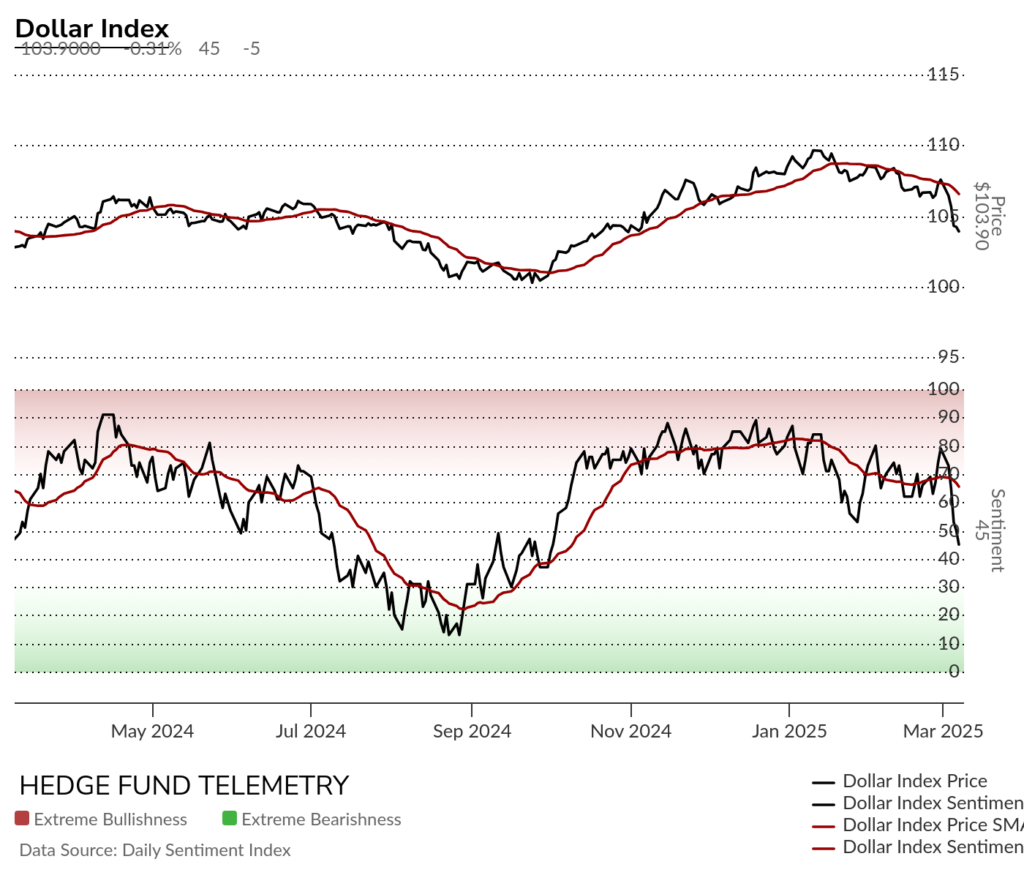

Currency bullish sentiment with US Dollar bullish sentiment falling now under 50%. Bitcoin sentiment also is moving lower

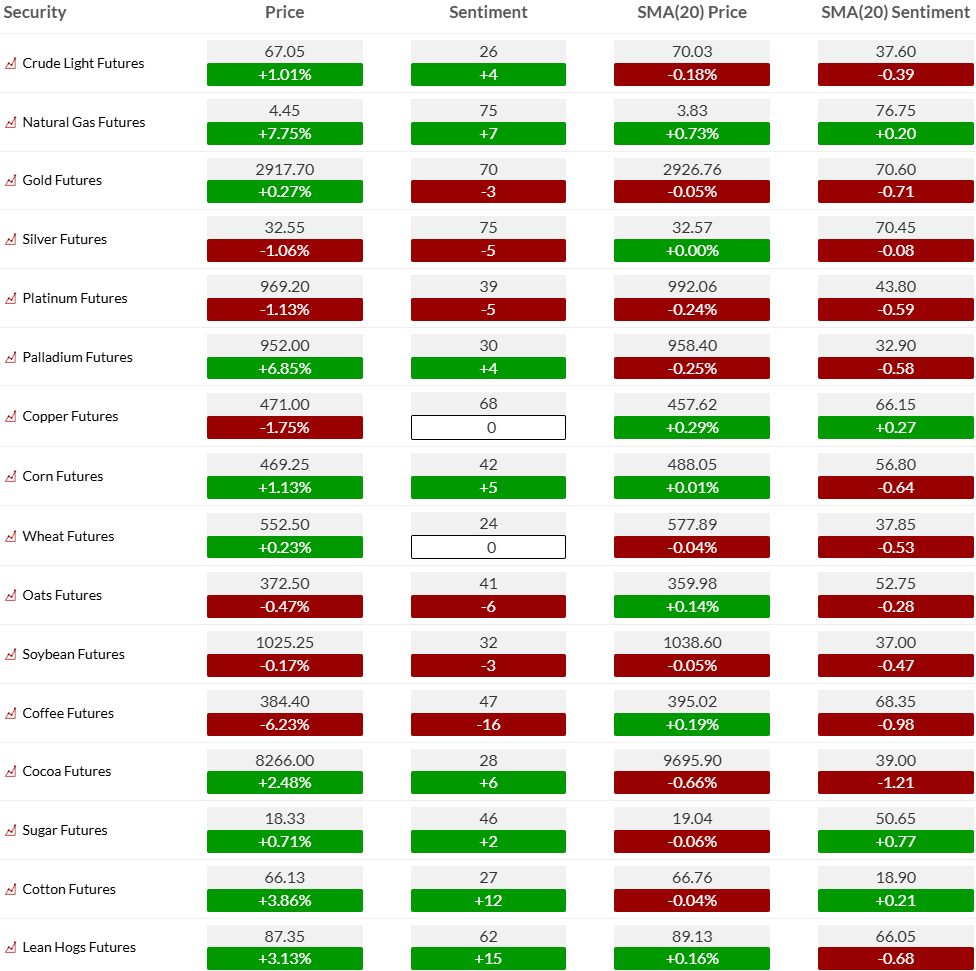

Commodity bullish sentiment continues to be mixed with metals a little soft on Friday.

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 10-Mar:

- Corporate:

- Earnings:

- Pre-open: BNTX, DRIO, GLRE, GNE, NPWR, RAND, TLS, URGN, WLFC

- Post-close: ASAN, AUNA, AVO, BEEP, CHRS, CVGI, FTK, GAIA, GECC, HPK, LCTX, LFMD, LMB, MTN, MYO, MYPS, NCSM, NX, ORCL, PAY, RDW, SARO, SEG, SST, TBRG, YALA

- Analyst/Investor Events: AMPL, ARQ, CINF

- Brokerage Conference:

- American Academy of Dermatology Meeting

- Leerink Partners Global Healthcare Conference

- BofA Business Services, Leisure and Transport Conference

- Canaccord Genuity Musculoskeletal Conference

- BNP Paribas Exane TMT Conference

- Loop Capital Markets Investor Conference

- Citi Global Consumer & Retail Conference

- Deutsche Bank Media, Internet & Telecom Conference

- Economic Impact: Sustainability Week

- CERAWeek 2025: Moving Ahead: Energy Strategies for a Complex World

- Earnings:

- Economic

- Europe: Manufacturing Production y/y, Industrial Production y/y, CPI y/y, PPI y/y, Industrial Production m/m, Trade Balance, Sentix Economic Index

- Asia: Real Household Consumption Expenditure y/y, Real Household Income y/y, revised GDP q/q annualized

- Corporate:

- Tuesday 11-Mar:

- Corporate:

- Earnings:

- Pre-open: AGEN, BVS, BWAY, CIEN, CMT, DKS, DOUG, ECX, ELTK, EVEX, EWCZ, FCEL, FERG, FWRG, GAUZ, GBLI, HLLY, KFY, KSS, LEGN, NUWE, QSG, RERE, SGA, SMC, SYRA, ULBI, UNFI, VIK, VRCA, XGN

- Post-close: BBCP, BIRD, BWMN, CASY, CDRE, CURI, EML, FOA, GROV, GRPN, HRTG, LDI, MXCT, NATR, NRGV, ODC, PRSU, SFIX, SGC, SIGA, SMSI, SNCR, SSP, SSSS, VTS, VYGR, WEST, ZVRA, ZYXI

- Analyst/Investor Events: BIGC, ENVB, SLAB, TER

- Syndicate Calendar: +RCT IPO (~$22M)

- Brokerage Conference:

- American Academy of Dermatology Meeting

- Leerink Partners Global Healthcare Conference

- BNP Paribas Exane TMT Conference

- Loop Capital Markets Investor Conference

- Citi Global Consumer & Retail Conference

- Deutsche Bank Media, Internet & Telecom Conference

- Economic Impact: Sustainability Week

- CERAWeek 2025: Moving Ahead: Energy Strategies for a Complex World

- J.P. Morgan Consumer Ingredients Forum

- Stifel NYC Technology One-on-One Conference

- BofA Global Industrials Conference

- Association of Mining and Exploration Investor Conference

- Cathay Investment Forum

- CLSA India Consumer Tour

- Jefferies Biotech on the Bay Summit

- Citi TMT Conference

- BNP Paribas Exane Consumer Ingredients Conference

- Wolfe FinTech Forum

- Cantor Fitzgerald Global Technology Conference

- Bank of America Consumer & Retail Conference

- Barclays Global Healthcare Conference

- Carnegie Nordic Healthcare Seminar

- J.P Morgan European Opportunities Forum

- J.P. Morgan Industrials Conference

- Embedded World Conference

- Earnings:

- Economic

- US: NFIB Small Business Index, JOLTS, Redbook Chain Store, API Crude Inventories

- Europe: CPI y/y, Industrial Production m/m

- Asia: Unemployment Rate, CGPI y/y

- Corporate:

- Wednesday 12-Mar:

- Corporate:

- Earnings:

- Pre-open: ABM, AMRN, ARCO, CXM, DTC, EH, HBIO, IRBT, MOMO, MX, NESR, NSPR, NVGS, ONDS, OPRX, REFI, SDHC, SEAT, UHG, VRA, WDH, ZIM

- Post-close: ADBE, AEO, AEYE, ANIK, ASRT, BGSF, BRLT, BRY, BTMD, CCI, CDLX, CINT, EARN, FOSL, FTHM, KRMD, LEGH, LMNR, MGRM, MNTK, NKTR, NN, NOA, OTCM, PATH, PHLT, PHR, PHX, QRHC, RAIL, S, SKIN, TLYS, ULY, VSTA, ZDGE

- Analyst/Investor Events: KLTR, NET, PII, SHLS

- Brokerage Conference:

- Deutsche Bank Media, Internet & Telecom Conference

- Economic Impact: Sustainability Week

- CERAWeek 2025: Moving Ahead: Energy Strategies for a Complex World

- Jefferies Biotech on the Bay Summit

- Citi TMT Conference

- BNP Paribas Exane Consumer Ingredients Conference

- Wolfe FinTech Forum

- Cantor Fitzgerald Global Technology Conference

- Bank of America Consumer & Retail Conference

- Barclays Global Healthcare Conference

- Carnegie Nordic Healthcare Seminar

- J.P Morgan European Opportunities Forum

- J.P. Morgan Industrials Conference

- Embedded World Conference

- Society for Immunotherapy of Cancer Cell Therapy Meeting

- Oxford NextGen Biomed

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, CPI, Treasury Monthly Budget, DOE Crude Inventories, Hourly Earnings, Aveage Workweek

- Canada: BoC Interest Rate Announcement

- Europe: Retail Sales y/y, Final CPI y/y

- Corporate:

- Thursday 13-Mar:

- Corporate:

- Earnings:

- Pre-open: ACTG, AFCG, AP, APYX, AVAH, BBW, BLDE, BLDP, CCLD, CION, CLRB, DG, DLTH, FUTU, GIII, IPA, JG, LCUT, MCRB, QBTS, SOHO, VFF

- Post-close: AFYA, AGRO, ALLO, ALTI, ATYR, AUID, BEAT, BLNK, BZFD, DOCU, EGY, EVCM, GRWG, HGBL, JYNT, KRT, LRFC, MAPS, OPAL, ORGN, PANL, PD, PLBY, PSQH, PTMN, RBRK, RGNX, SMTC, SOL, TTAN, VERI, VUZI, XPOF, ZOM, ZUMZ

- Analyst/Investor Events: ALT, BECN, CHEF, FAST, INGR, NABL, NCMI, PRCH

- Brokerage Conference:

- CERAWeek 2025: Moving Ahead: Energy Strategies for a Complex World

- Barclays Global Healthcare Conference

- Carnegie Nordic Healthcare Seminar

- J.P Morgan European Opportunities Forum

- J.P. Morgan Industrials Conference

- Embedded World Conference

- Society for Immunotherapy of Cancer Cell Therapy Meeting

- Oxford NextGen Biomed

- UBS Global Consumer & Retail Conference

- J.P. Morgan Gaming, Lodging, Restaurant and Leisure Management Access Forum

- Earnings:

- Economic

- US: PPI, Weekly Jobless Claims, EIA Natural Gas Inventories

- Canada: Building Permits

- Europe: Industrial Production y/y, CPI y/y, PPI y/y

- Corporate:

- Friday 14-Mar:

- Corporate:

- Earnings:

- Pre-open: AVD, BKE, DTI, EEX, GOGO, RLX, TOUR, WRD

- Analyst/Investor Events: OI, PPC

- Syndicate Calendar: +OMSE IPO (~$50M)

- Brokerage Conference:

- CERAWeek 2025: Moving Ahead: Energy Strategies for a Complex World

- Oxford NextGen Biomed

- J.P. Morgan Gaming, Lodging, Restaurant and Leisure Management Access Forum

- Earnings:

- Economic

- US: Michigan Consumer Sentiment (Preliminary)

- Canada: Manufacturing Sales, Wholesale Inventories, Wholesale Trade

- Europe: CPI y/y, Unemployment Rate, Construction Output y/y, Industrial Production y/y, Trade Balance, Industrial Production y/y (wda)

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.