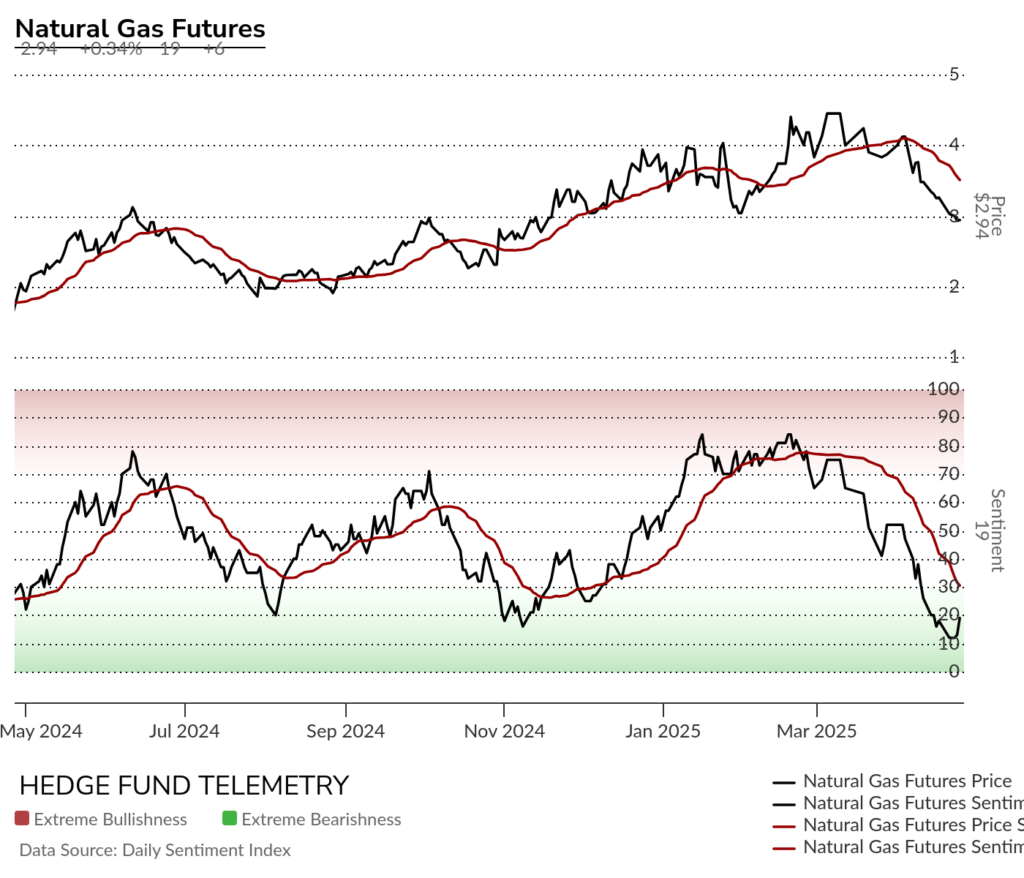

HIGHLIGHTS AND THEMES

- Commodities were mixed this past week. The Bloomberg Commodity index daily has both upside and downside wave patterns that are concurrently in play. The weekly has been in a tight range and with the slight upside week 4 of 13 qualified. It really need to breakout to matter and that will take some time at this rate.

- Gold reversed down after DeMark exhaustion signals on almost ever time frame. Sentiment also dropped as it’s been a haven during all the tariff craziness. I believe it’s crowded and any stability in other markets could see more rotation out of gold. Several downside price targets mentioned on the charts.

- Crude can’t seem to get momentum going however it’s still very oversold and has some potential for upside.

- Natural Gas continued lower and I can’t say it’s bottomed yet.

- Grains are mixed but look decent with a few of them poking higher.

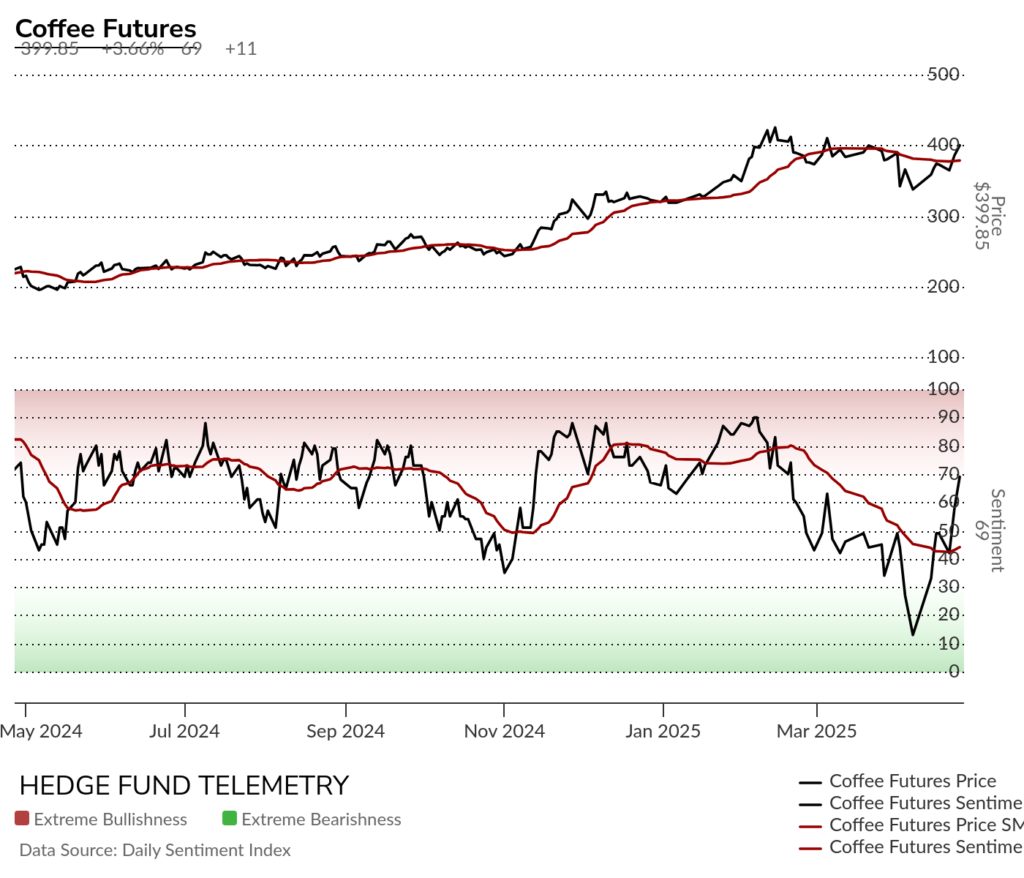

- Coffee and Cocoa were very strong while Sugar remains sluggish.

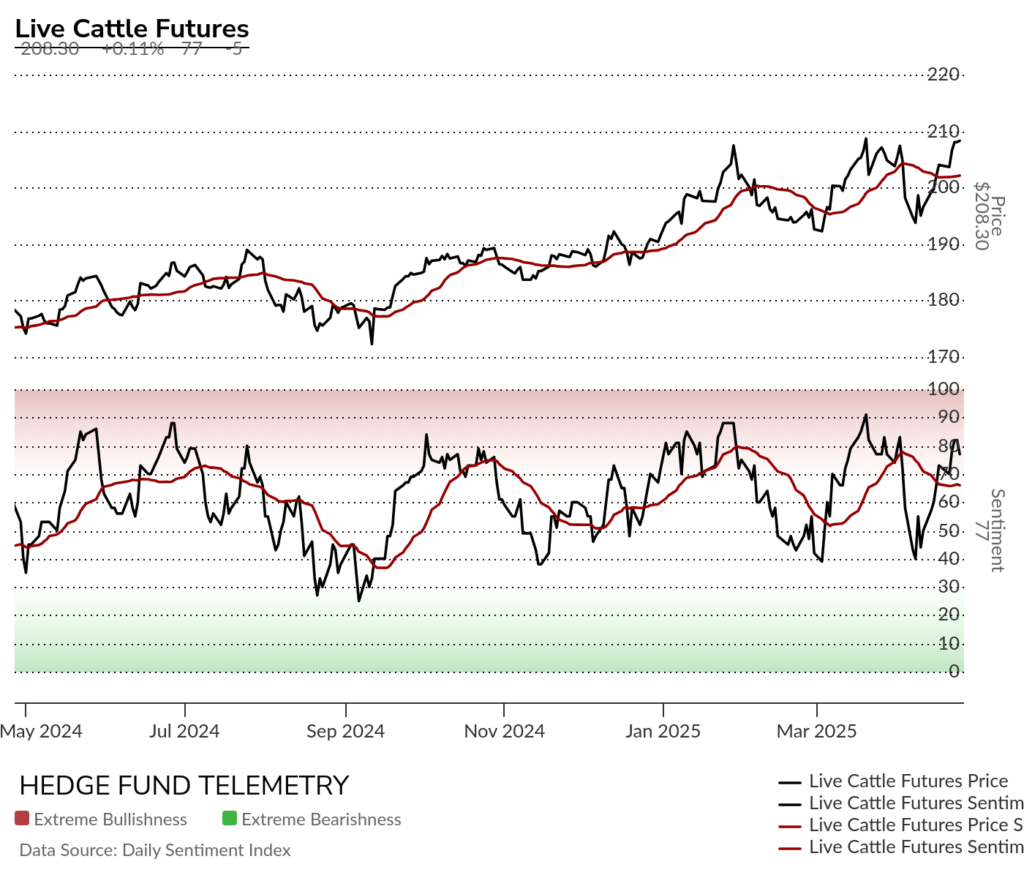

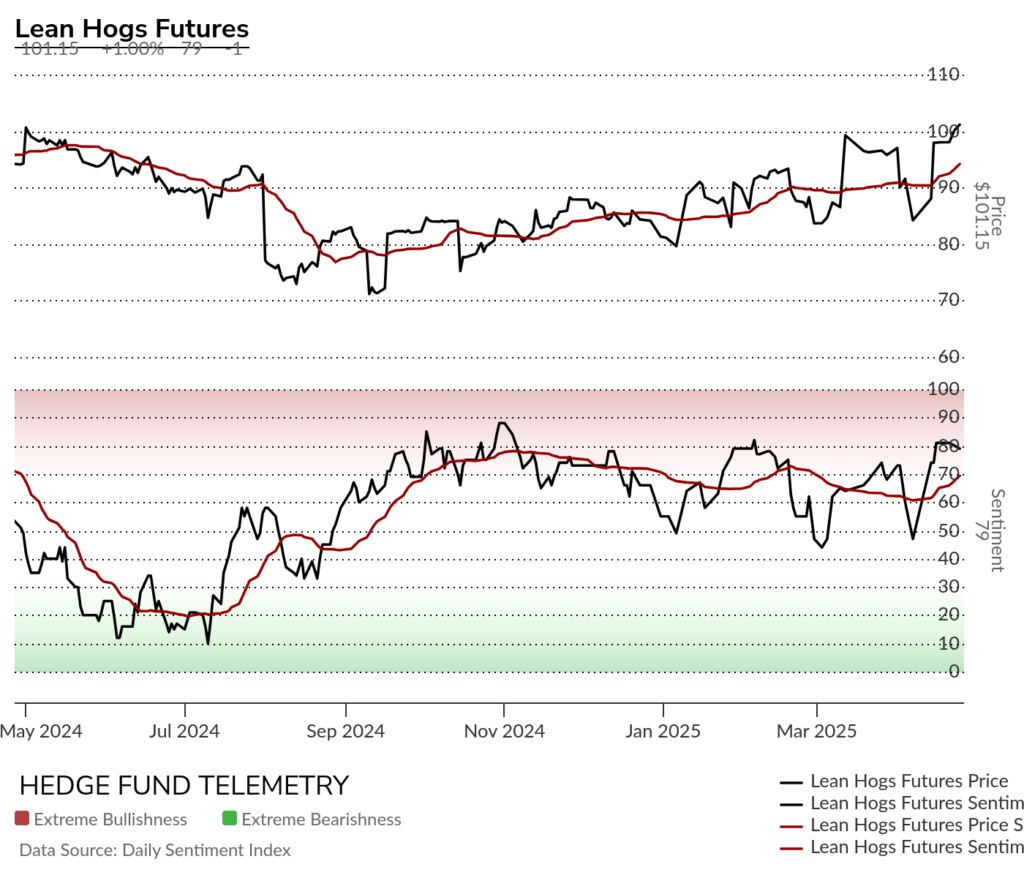

- Livestock is overbought and have some DeMark sell signals in play.

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily dropped hard after the recent Sequential sell Countdown 13. There are two wave patterns to watch. Both upside and downside wave 4’s are possible. The recent downside move could be a corrective higher low wave 4 of 5 with a move over the February would qualify into wave 5 of 5. The bounce could be a lower high corrective wave 4 of 5 and a break of the recent wave 3 (yellow 3) low would qualify into wave 5 of 5. I will keep us updated and my guess is that resolution won’t happen soon.

Bloomberg Commodity Index Weekly has moved in a range and I have mentioned the potential for the Sequential (a secondary one) starting and last week it recorded week 4 of 13. There is an upside wave 3 price objective of 114.93 which seems like a minor upside type of move but that’s due to commodities having a tough time.

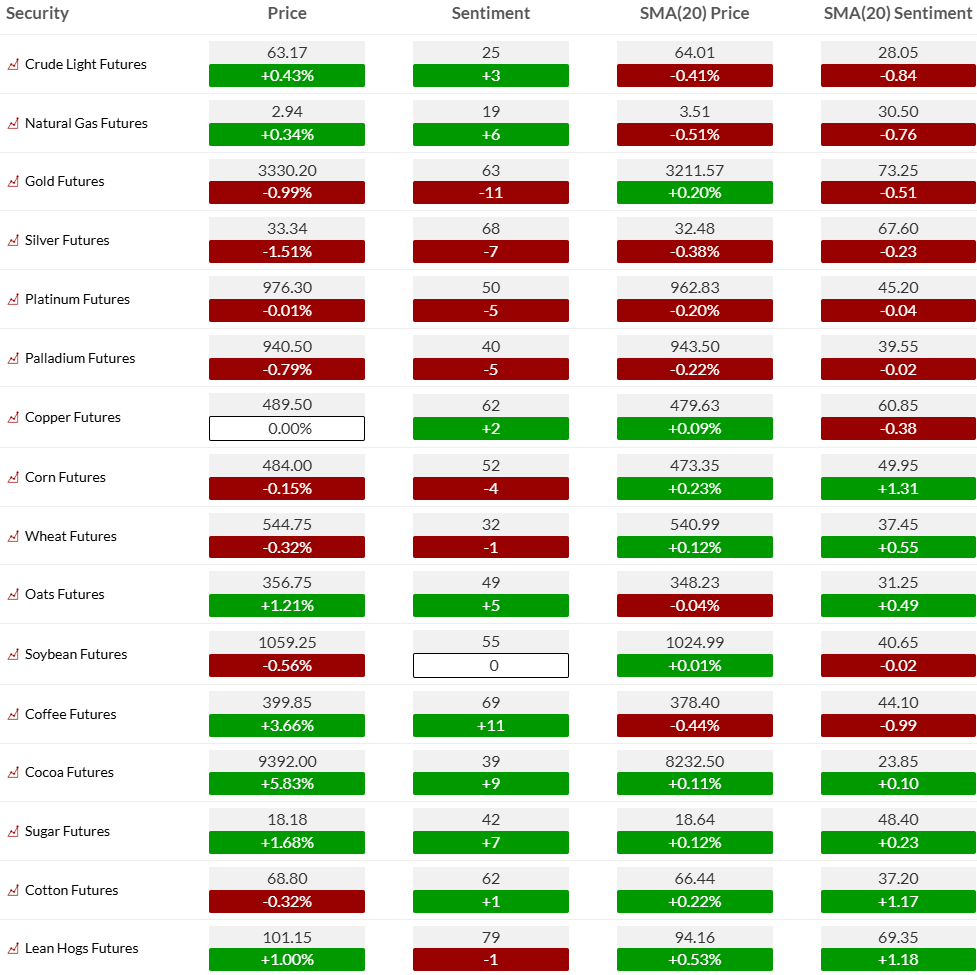

COMMODITY SENTIMENT OVERVIEW

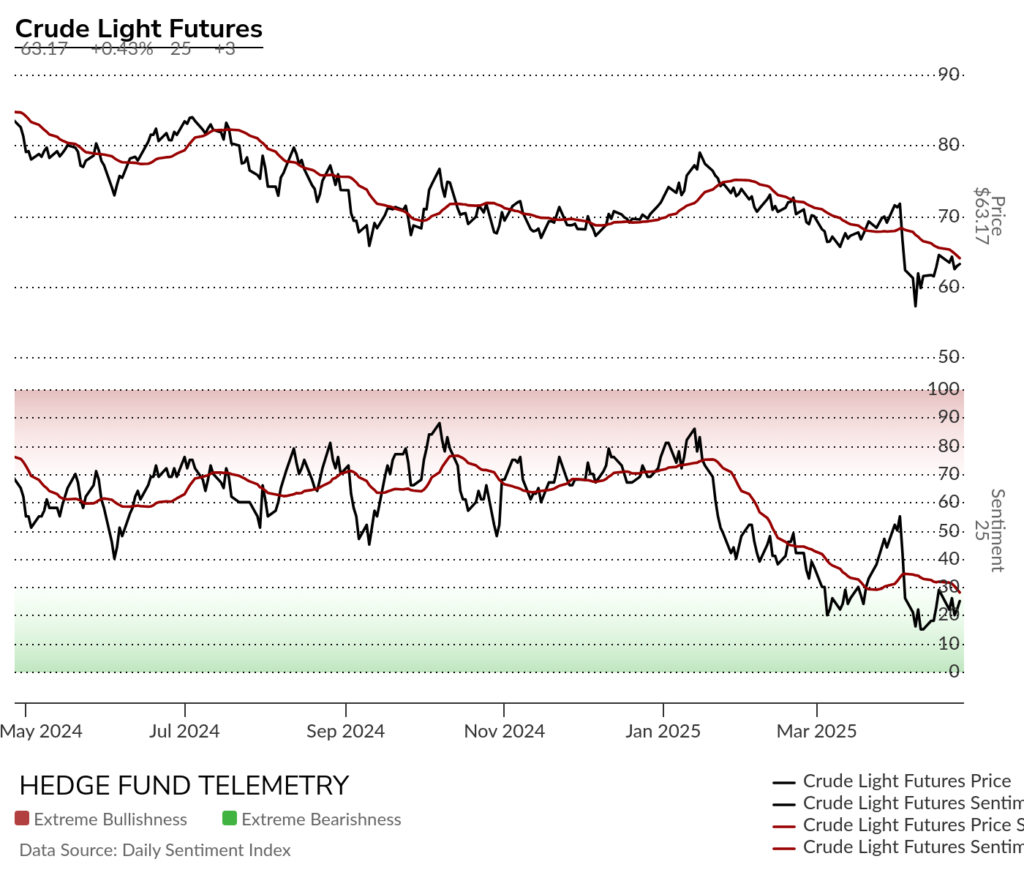

OIL AND ENERGY

Bloomberg Energy Index daily has moved sideways back nearly to December levels.

WTI Crude futures daily surpassed the downside wave 5 price objective. It needs to clear the 20 day at 64 and then the 50 day at 66.90

Crude hit the downside Propulsion target with buy Setup 9 however there is the potential for Sequential starting.

WTI Crude futures bullish sentiment remains under pressure until the 20 day moving average of sentiment is surpassed

Natural Gas futures daily has continued trend lower and I can’t say it’s done with the Sequential Countdown in progress.

Natural Gas futures bullish sentiment back to very oversold levels

Metals

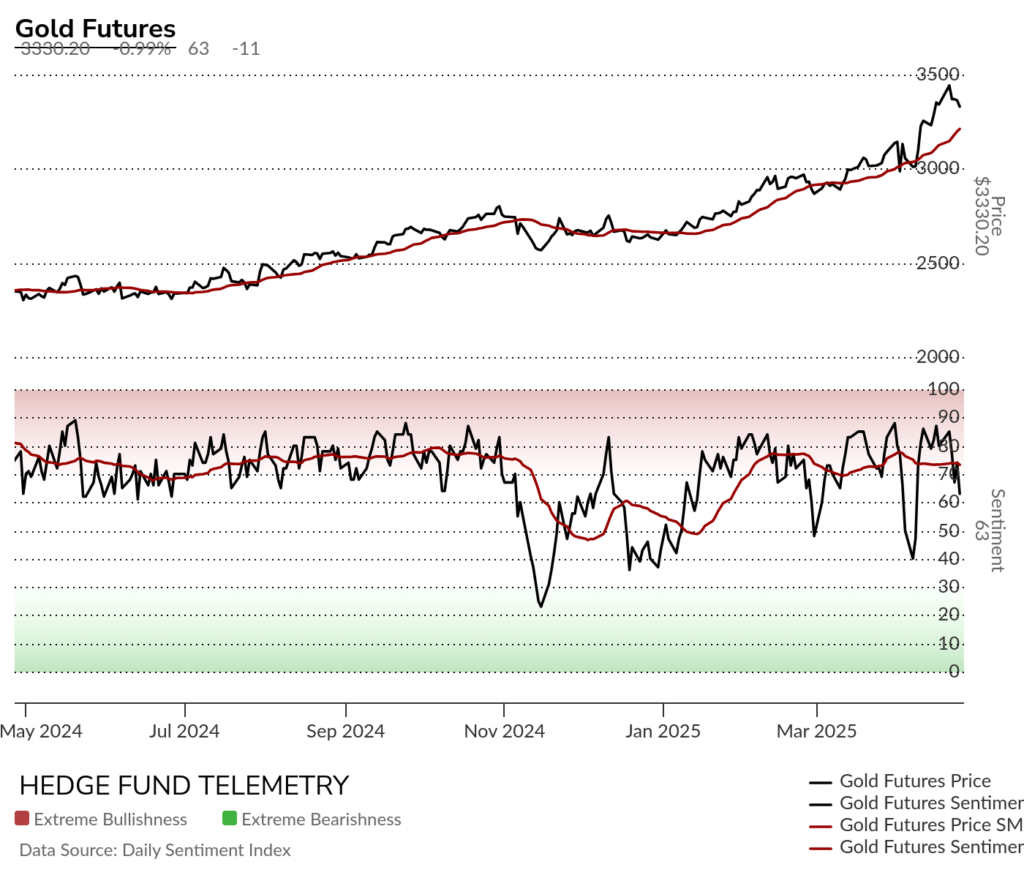

Gold daily with a blow off top type move and reversal down this past week. A break of the 20 day ~3200 would give me confidence of a deeper pullback to the 50 day. The downside TDST at also at the 200 day and that’s worst case if this moves lower

Gold bullish sentiment still has not hit the 90% extreme level but regardless it’s reversing down hard again

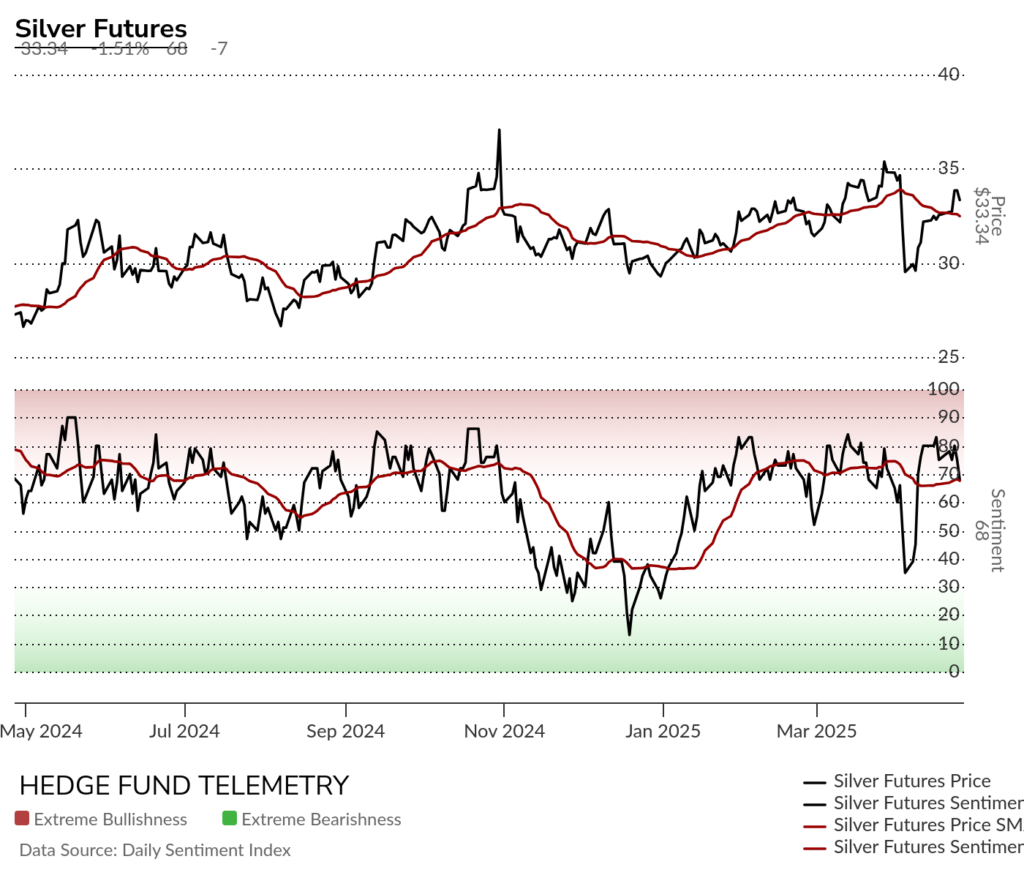

Silver daily has a new sell Setup 9. 9’s have seen several inflection points.

Silver bullish sentiment reversed down this week and volatile action.

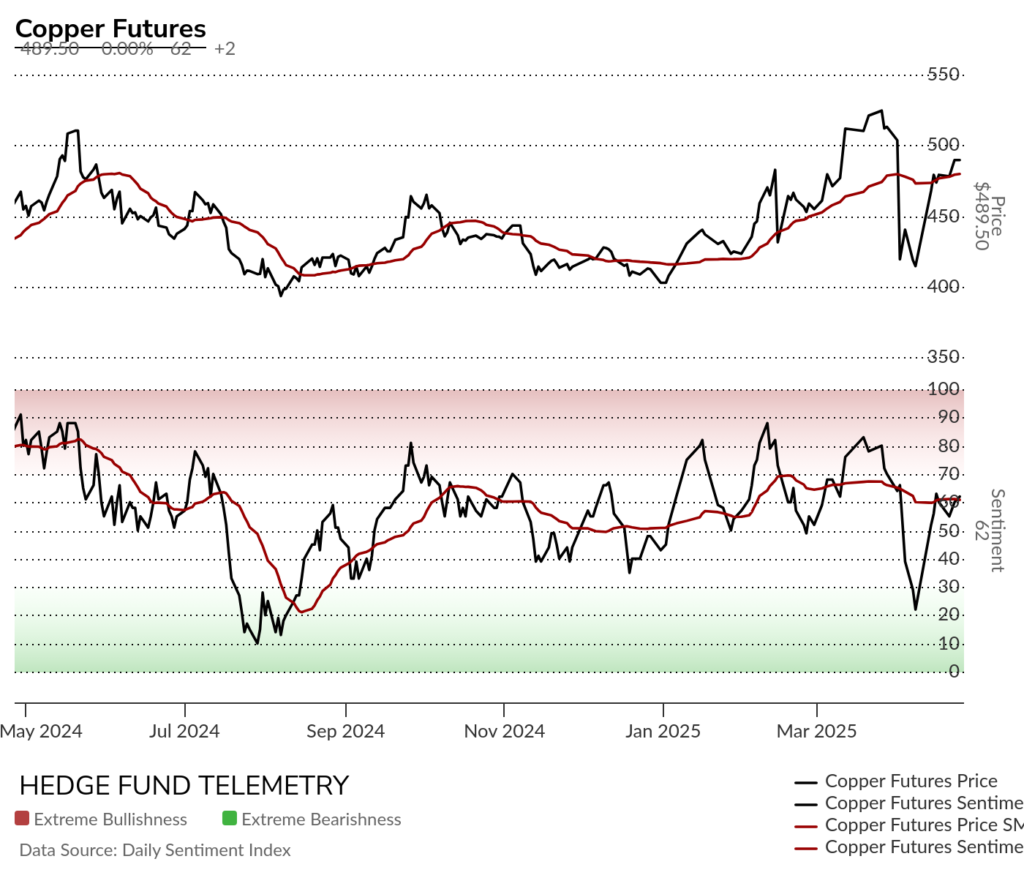

Copper futures daily fell hard and bounced with new Sell Setup 9 in potential lower high wave 2 of 5. The pullback also was a corrective higher low wave 4 (I know it was a huge pullback) and if this moves above the wave 3 recent high then the downside pattern cancels and this moves into upside wave 5 of 5.

Copper futures bullish sentiment with volatile action and stalling

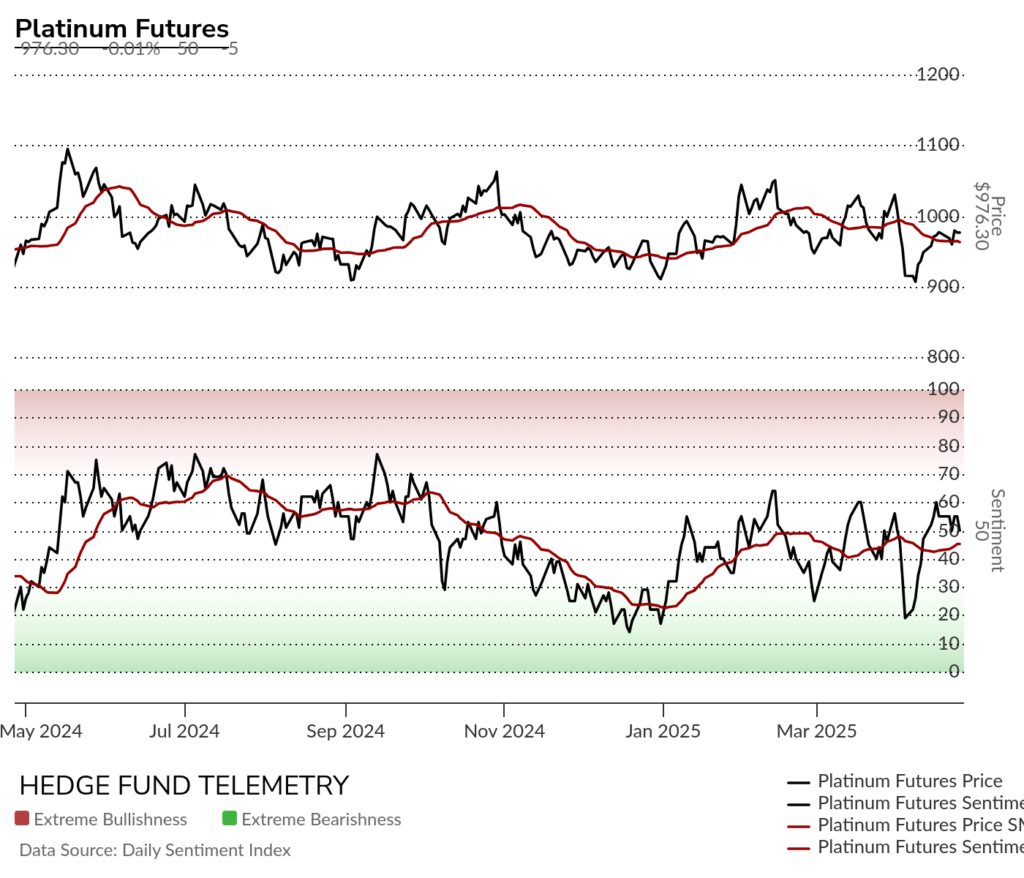

Platinum daily bounced but has a lot of resistance at upside TDST red dotted line

Platinum bullish sentiment range bound

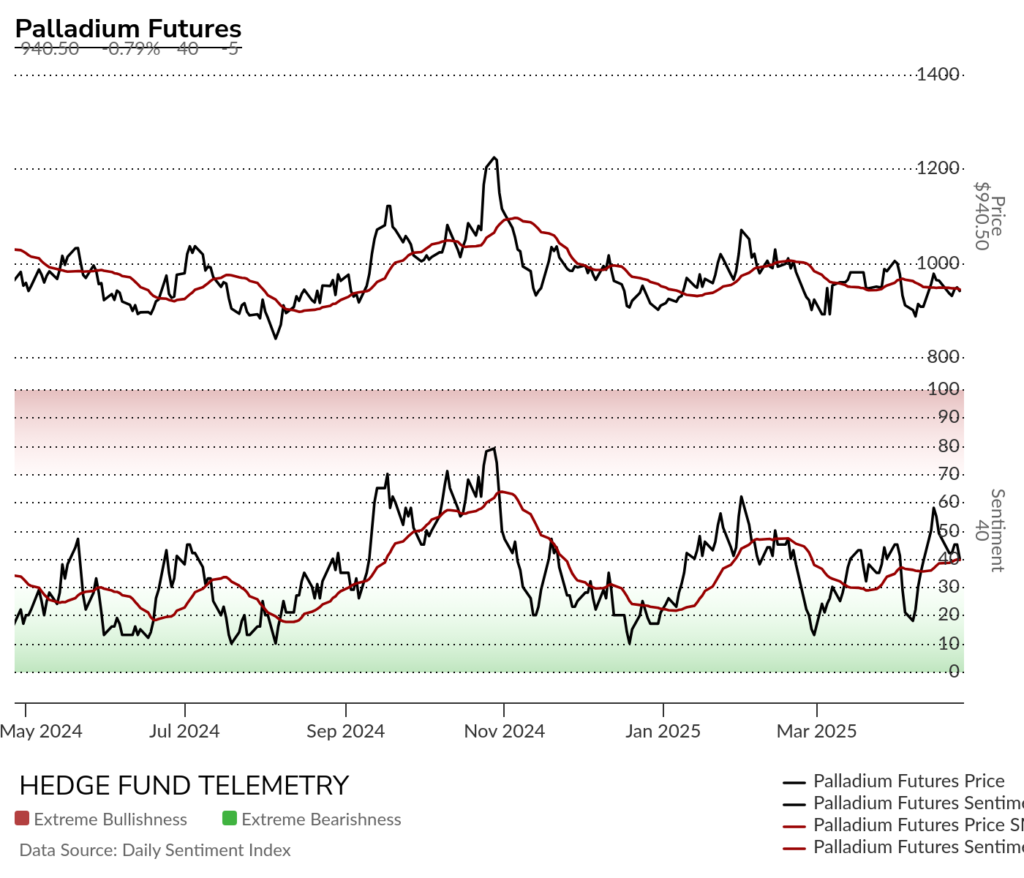

Palladium daily remains range bound

Palladium bullish sentiment range bounce with sentiment too

Grains

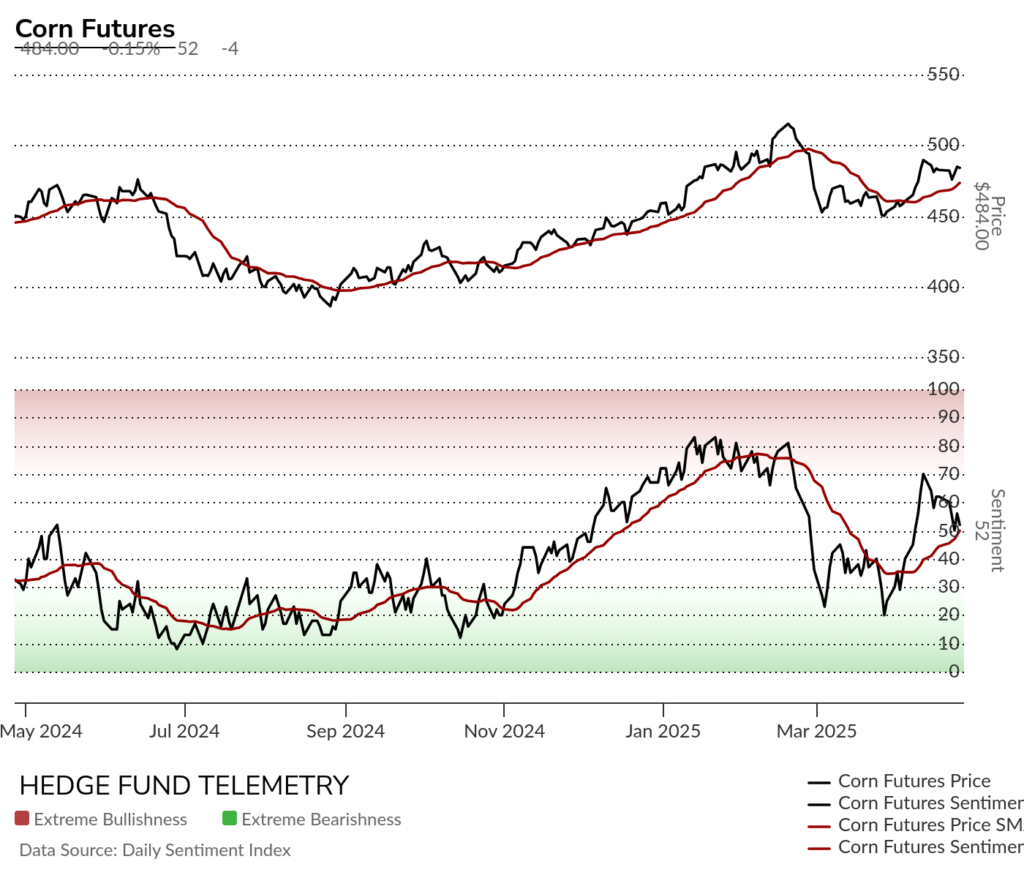

Corn futures daily with possible lower high wave 2 of 5 after Sell Setup 9. There is a Sequential and backing off to the 50 day might be a buy the dip opportunity.

Corn futures bullish sentiment with lower high bounce back to upsloping 20 day moving average of sentiment.

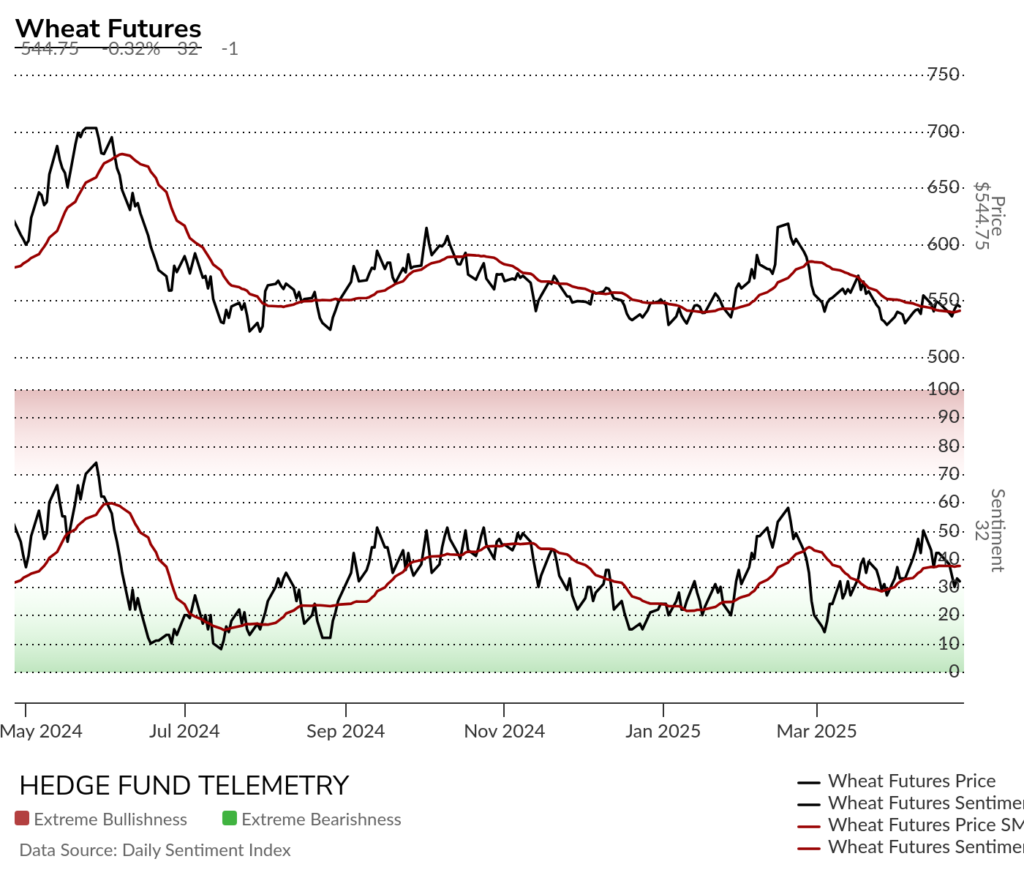

Wheat futures daily with Sequential on day 11 of 13 near recent lows.

Wheat futures bullish sentiment remains under pressure.

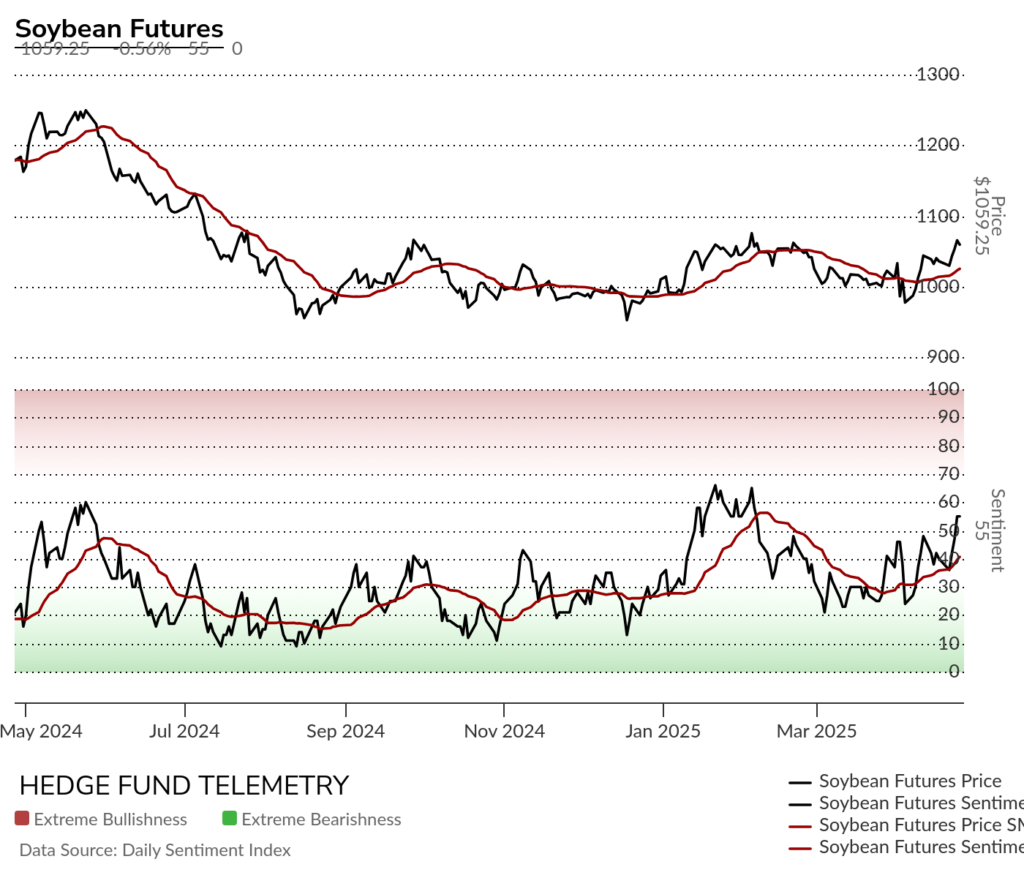

Soybean futures daily with another attempt to hold above the 200 day.

Soybean futures bullish sentiment has been making higher lows but really needs to hold and move above the 50% level.

Livestock

Live Cattle futures daily with new Sequential 13 and Sell Setup 9 near the upside propulsion target.

Live Cattle futures bullish sentiment has bounced off the 40% level and reached the extreme zone again.

Lean Hogs futures daily with new Sell Setup 9 and RSI moderately overbought

Lean Hogs bullish sentiment hanging around the extreme zone with decent bounces off 50% midpoint level – this is why I watch 50% so closely.

Softs

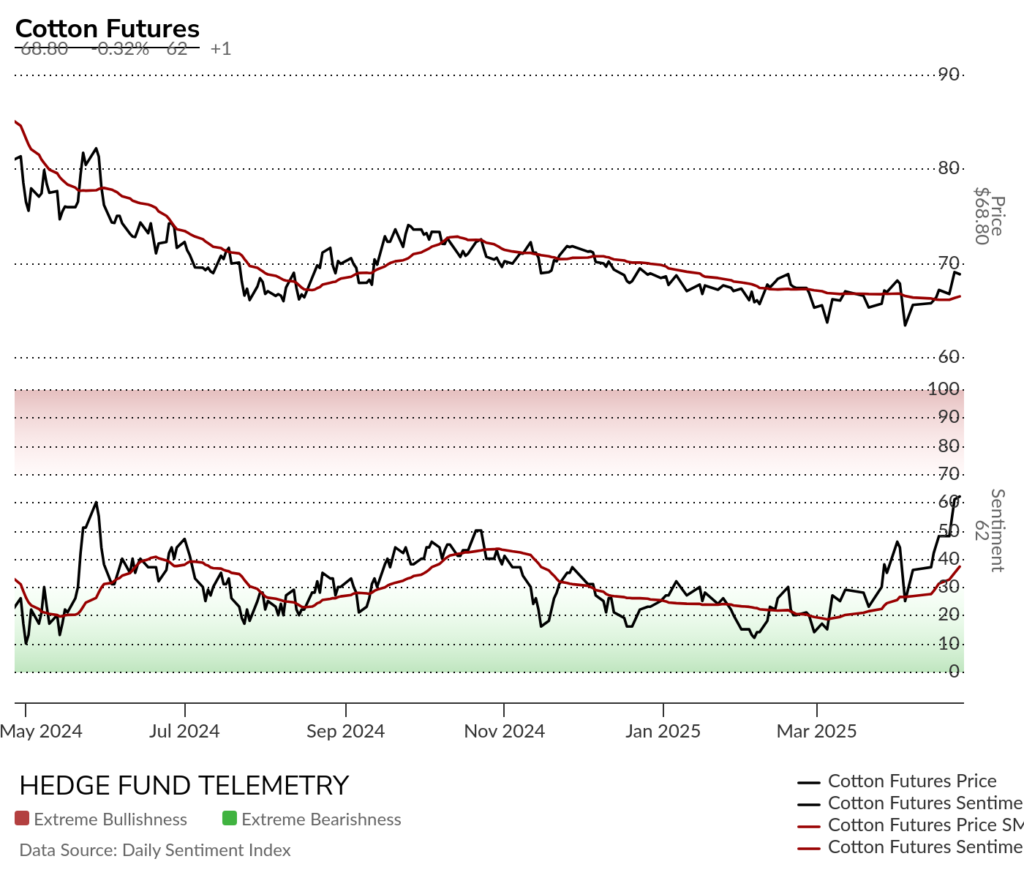

Cotton futures daily has been in a downtrend and looks to be rising near breakout levels over the TDST resistance

Cotton futures bullish sentiment has been sneaking higher with a new 1 year high in sentiment

Coffee futures daily with sell Setup 9 under TDST but maybe the Sequential starting will continue. Seems overbought short term

Coffee futures bullish sentiment with very strong bounce

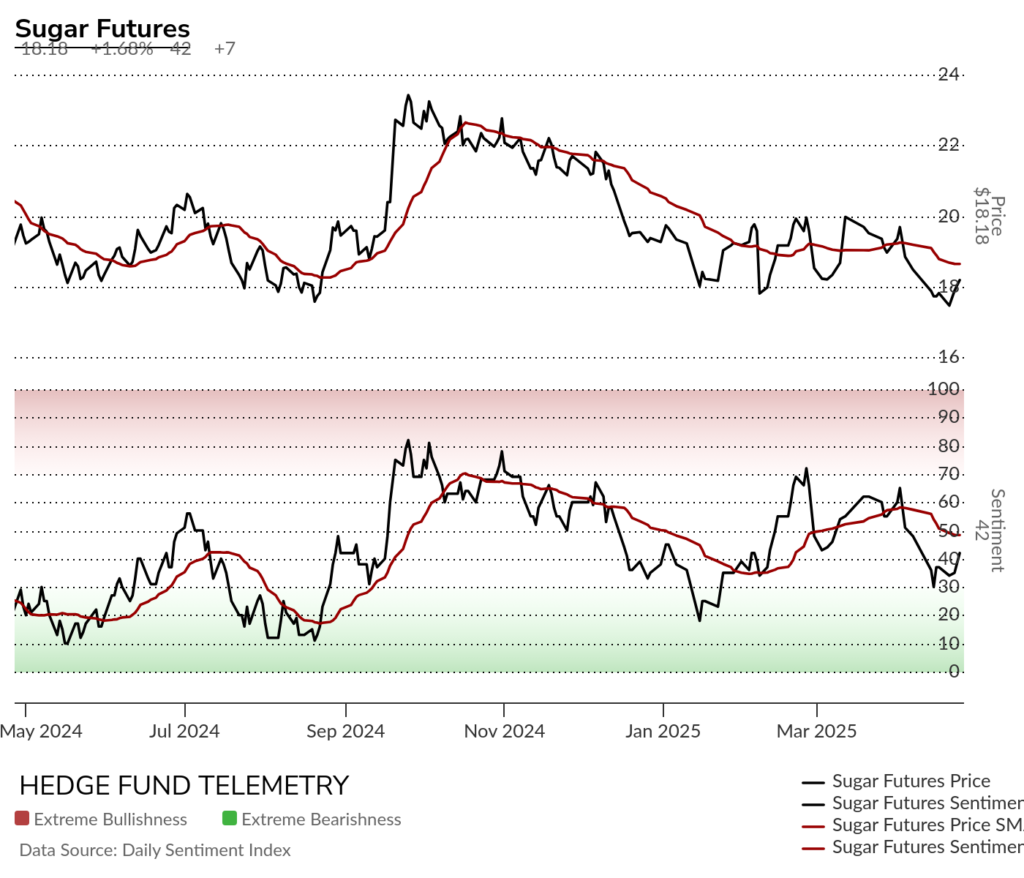

Sugar futures daily with new buy Setup 9 at TDST support

Sugar futures bullish sentiment remains under 50% and slugglish

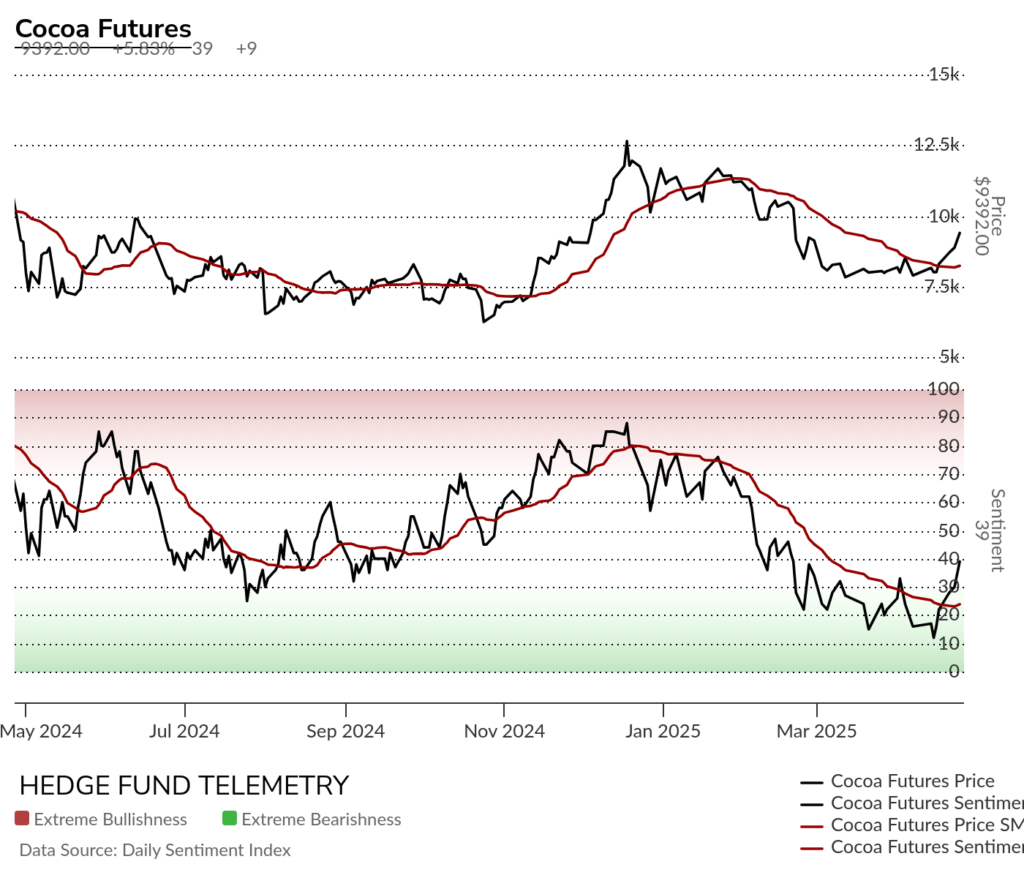

Cocoa futures daily with decent upside reversal above the recent high.

Cocoa futures bullish sentiment with decent oversold level and reversal up

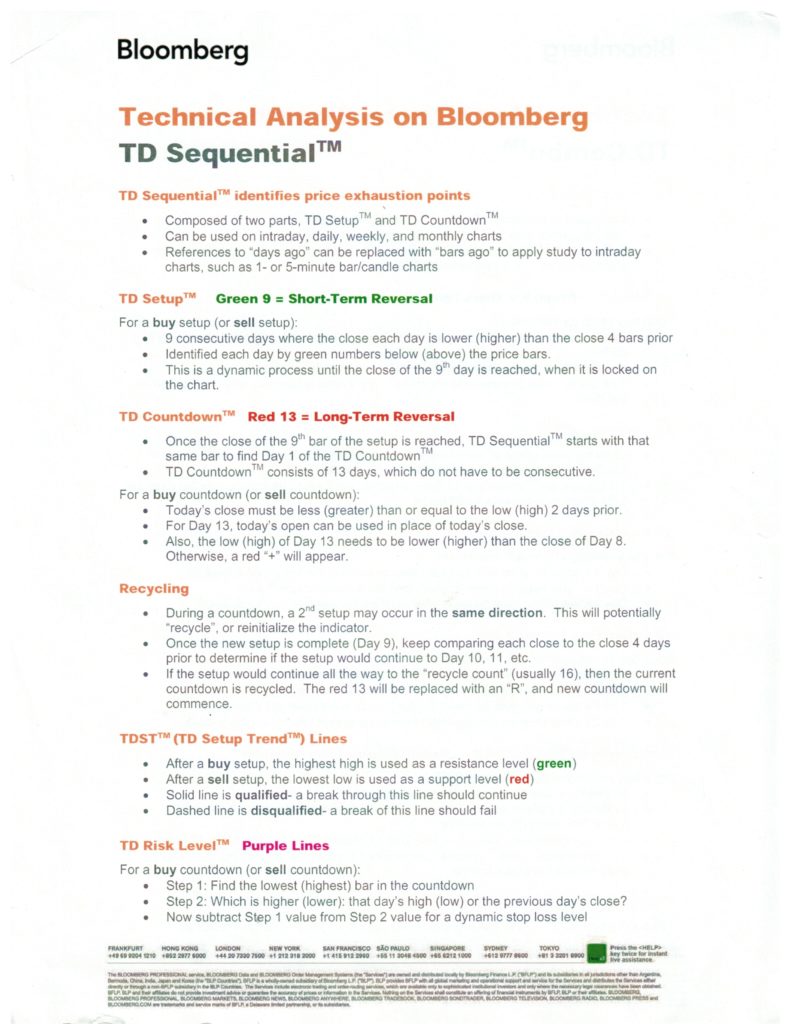

DeMark Sequential Basics