My day became one of distractions, and I missed some print deadlines. Thanks to all who joined me on today’s webinar. I hope you picked up a few of the rules with the DeMark Indicators and increased your understanding. This note is something I’ve been pondering for a while, and I thought I’d put it out after the market, when the market video game we play all day isn’t blinking.

Since the markets in 2025 have moved 99% in response to what the Trump administration is doing and saying with tariffs, yesterday’s pivot was an attempt at a possible kinder and gentler approach, backing off of some recent inflammatory comments. I’m not sure how long this pivot will last, but I suspect it was in response to the “yippy” nature of the bond market’s refusal to bounce as lower rates have been the stated goal of Bessent and Trump. Lower Treasury rates have a huge positives for the economy and the Treasury. The housing market has been frozen with high mortgage rates. The Treasury has trillions in refunding in 2025. Having lower rates requires confidence in the US government and economy. Right now, with a strong approach to tariffs, calling other countries names, or accusing them of ripping off the US, and a weakening equity market, countries are selling and bringing their money home. It has also been reflected in a weakening dollar. Lastly, investors lose confidence when the President threatens to fire the Chairman of the Federal Reserve, demanding he needs to cut rates. A Fed chairman he appointed! I’m glad he’s backed off from this latest rant.

As a reminder, I am an independent and have had plenty of things to say about Biden and his policies which in many respects got the US into deeper debt. Trump has achieved something important: people are now talking about the massive US deficits, debt, and trade deficits at a time when there is no recession or war. As they say, the first step is admitting you have a problem! The fiscal problems have not yet hit the proverbial fan as there isn’t risk of default. As much as Trump may call Powell “a major loser,” they have more in common. Powell said late last year, “The U.S. federal budget is on an unsustainable path. The debt is not at an unsustainable level, but the path is unsustainable, and we know that we have to change that.”

The polarization of political beliefs in the US is wide if you watch cable news. It’s generally true but not discussed enough that Americans agree on more than they disagree on. There will always be differences, but what unites us is the belief that the US is a great, free country full of opportunity for those who strive for good things for themselves and their families. That’s why so many people want to immigrate to the US, despite all the problems.

The problems the US has were not created by the last administration or even in the previous few decades, and won’t be solved in the first few months of a new Presidency. The hard part of fixing or changing the path of the problems so they don’t get worse will take time and an ounce bipartisan cooperation might increase the odds of success. Again, I give Trump an A for bringing real attention to the government deficits, massive debt, and trade deficits. I give him an F for the way he has approached these problems impulsively and without a better, coherent plan.

If I could give Trump some advice, I’d suggest building more consensus with the Democrats. He already has his base and they would probably not blink, no matter what he says, but doing the unthinkable and reaching out to the other side would be a much more effective way of resolving the problems that both parties share equal blame. And if they refuse to meet with him, who’s going to look worse? Bill Maher, a noted liberal and critic of Trump, recently had dinner at the White House. His take had liberals’ heads explode as he found Trump to be a different person from the brash persona we all see daily. I’m not naive to think Trump will ever drop his tough guy persona, but if Bill Maher and he could have dinner and discuss things cordially, why not a few Democrats over dinner? Bill and Trump even found common ground on some issues and shared a few laughs. Perhaps more of that could happen. It would get more accomplished if the US had a united front, and it would be the strongest negotiating tactic that other countries would respect and perhaps fear. And that, to quote Trump, would hold the best cards.

And to my Democrat friends, as much as you might want to scream for the next 1,367 days, you might see some of the value in finding common ground, too. Trump is a deal maker, and if the Democratic leaders figure out what they need to get out of a common ground deal, the better they will ultimately look. They should adopt the Reagan quote, ‘trust but verify,’ when considering any compromise deal with Trump. Holding that card puts the risk on Trump breaking any agreed deal. And who’s going to look worse breaking a deal? Yeah, the guy who wrote the book about the Art of the Deal!

You might disagree with me, and that’s okay. Problems when they do hit the fan, as they have in the past, will, however, require bipartisan cooperation to fix, so why not think about getting ahead of it?

I’m sending this to a friend who is close to Scott Bessent, and perhaps he’ll read it. I believe Scott is a very level-headed, intelligent man who importantly has Trump’s ear. As Trump says, “We’ll see what happens…”

Quick Market Views

Stocks: Another solid day with gains and breadth. Nitpicky, but the highs were in the first hour, and a moderate fade occurred all day. Late today Trump was speaking in the White House. I decided to mute it and watch a car drive upside down. And the McMurtry Speirling breaking the Top Gear track record by 3 seconds over an F1 car. This car sucks, literally.

Bonds: The bond market started off strong and also faded through the day with rates rising to nearly unchanged. 2’s up 5bps, and 10’s and 30’s again were nearly unchanged on the day.

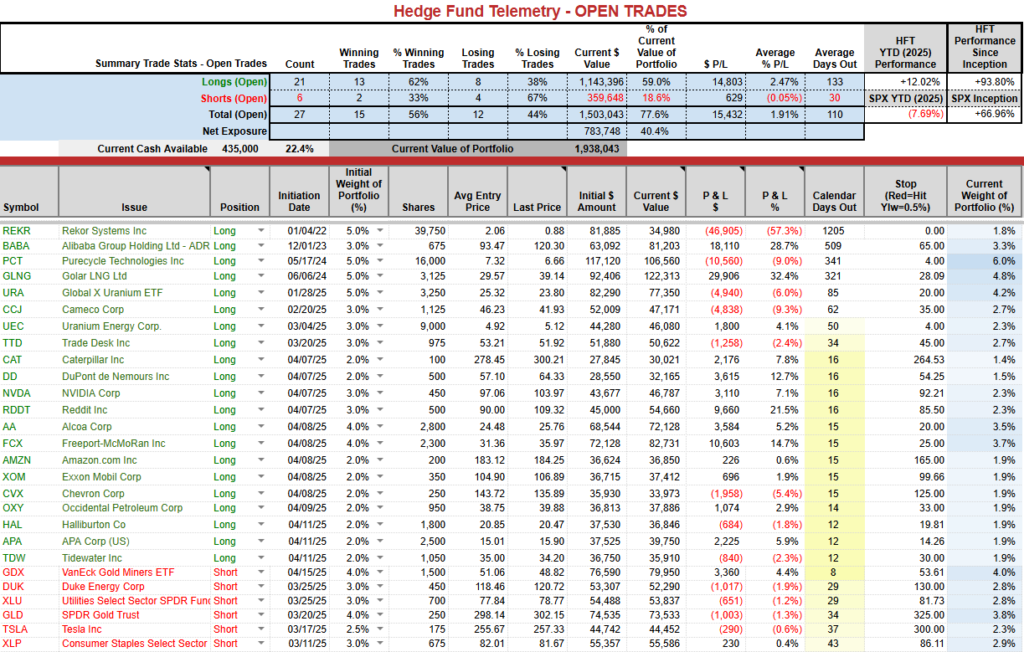

Trade Ideas Sheet: Up 1% on the day to now YTD +11.18% vs S&P -8.60% and NDX -11%

Changes: no changes

Thoughts: FCX reports tomorrow and our long position is up 12% and should give us cushion if this slips. I like this to move back into the 40’s. Uranium stuff had a strong day and like this sector in 2025 very much. I’ll have more tomorrow on current positions.

US INDEXES

Here is a primer on the DeMark Setup and Sequential indicators.

S&P futures 60-minute tactical time frame capped with another sell Setup 9 as mentioned possible on early First Call note

Nasdaq 100 futures 60-minute tactical time frame ditto

Trade Ideas Sheet

I set out this year with the goal of 25% in 2025. Almost half way there. I’m focused and motivated after the shit performance last year.

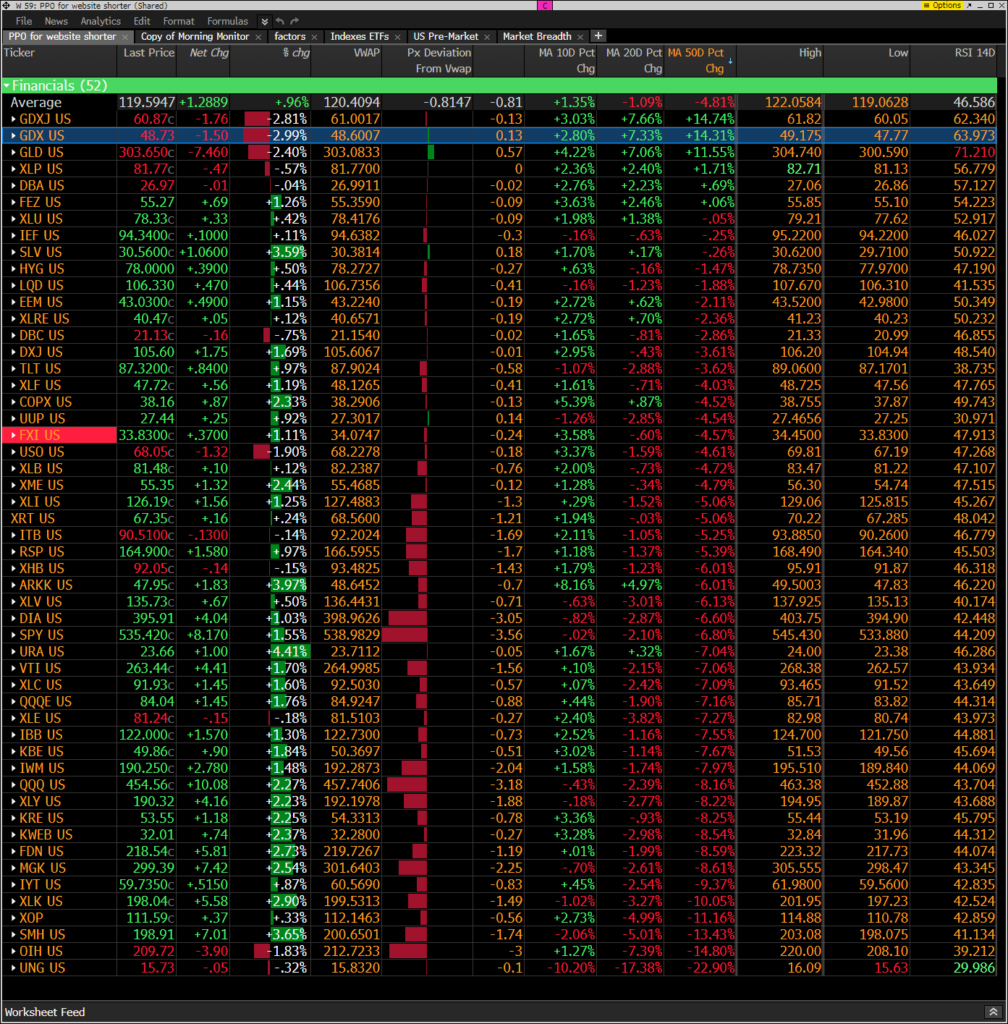

Hedge Fund Telemetry ETF Percentage Price Oscillator Monitor

The PPO monitor (percentage price oscillator) force ranks ETFs by percentage above/below the 50-day moving average. For information on this monitor, please refer to this primer. This monitor and others are offered to Hedge Fund Telemetry subscribers on Bloomberg. Strong day for those on the lower half although they lost today’s VWAP levels. Gold and Gold Miners have the the most overbought at the top of the monitor faded hard helping out shorts of GLD and GDX. URA a 5% weight long was the strongest performer on the day.

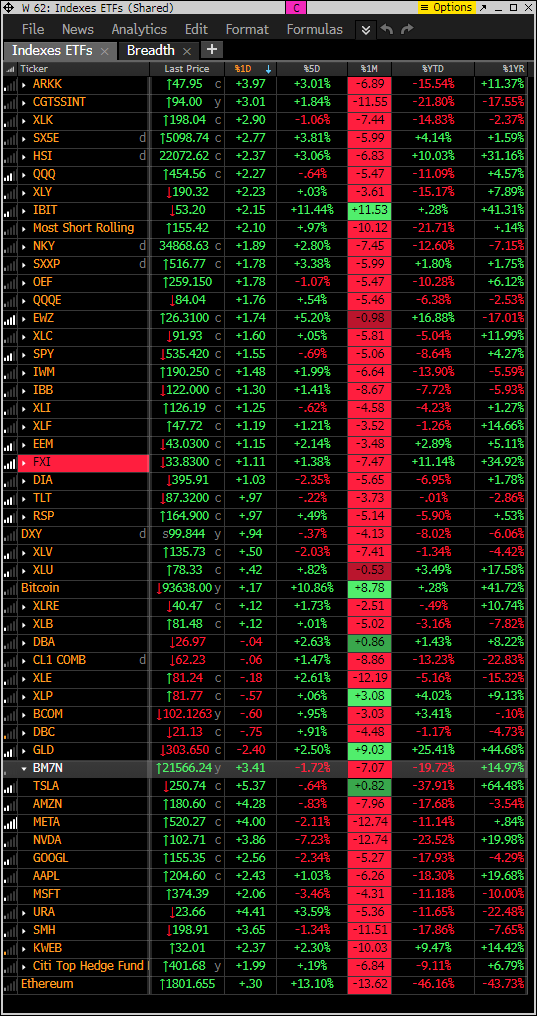

Index ETF and select factor performance

ETF with today’s performance with 5-day, 1-month, and 1-year rolling performance YTD. Strong day with more positive in the last 5 days while most remain negative in the last month and YTD

Goldman Sachs Most Shorted baskets vs. S&P Indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Short baskets and indexes were both higher today.

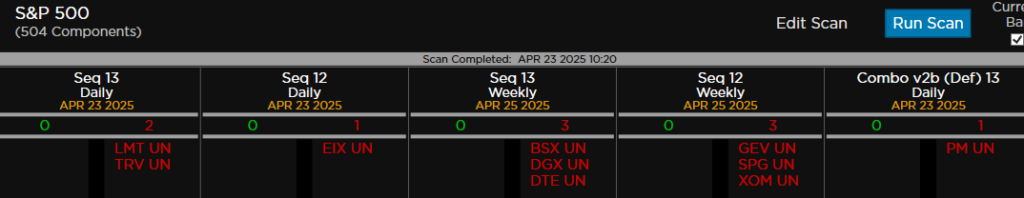

DeMark Observations

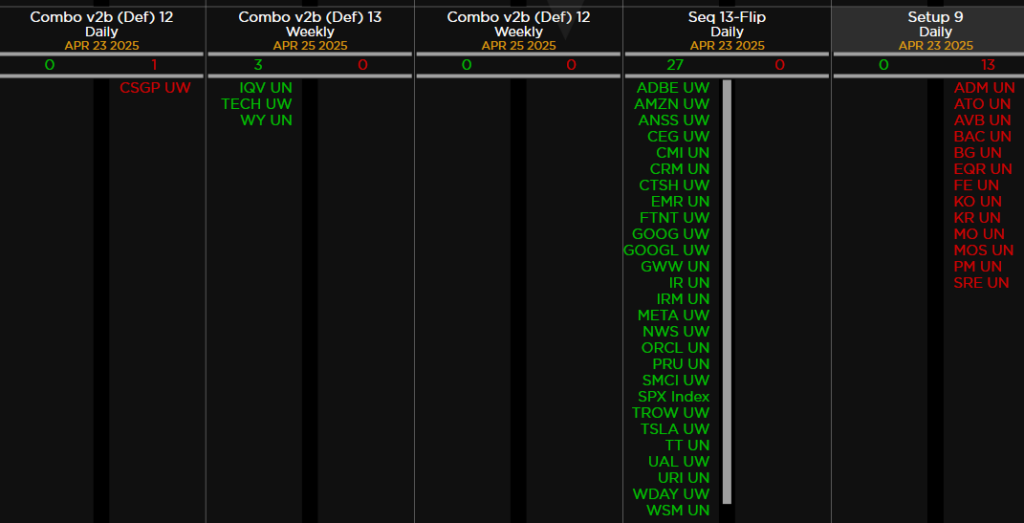

Within the S&P 500, the DeMark Sequential and Combo Countdown 13s and 12/13s on daily and weekly periods. Green = buy Setups/Countdowns, Red = sell Setups/Countdowns. Price flips are helpful to see reversals up (green) and down (red) for idea generation. The extra letters at the end of the symbols are just a Bloomberg thing. Worth noting: A few sell Countdown 13’s more sell Setup 9’s and bullishly more price flips up which could be possible long ideas if they continue in the coming days.

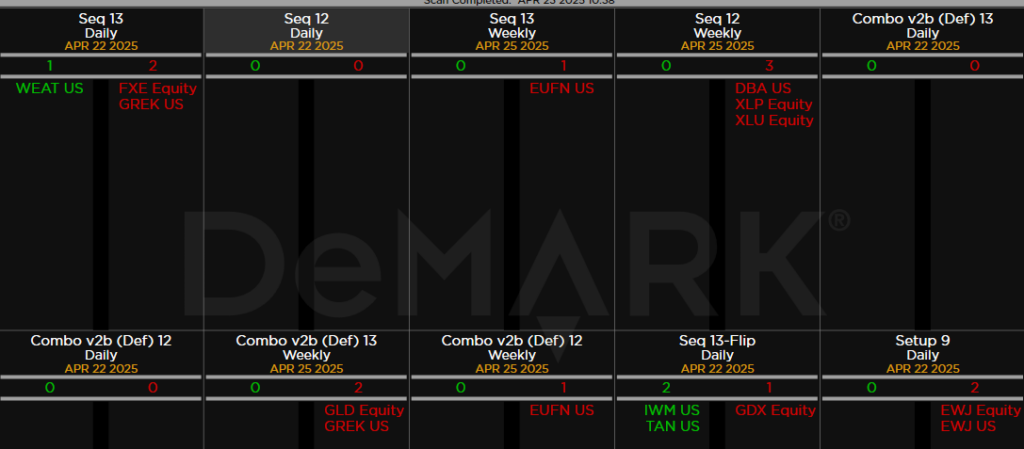

Major ETFs among a 160+ ETF universe.

If you have any questions or comments, please email us. Data sources: Bloomberg, DeMark Analytics, Goldman Sachs, Street Account, Vital Knowledge, Daily Sentiment Index, and Erlanger Research