- Monday is a national holiday in the US. Memorial Day reminds us of the US armed forces who died serving our country. Their sacrifice has created a free world for the US and many other countries.

- I will likely be around my desk on Monday, yet won’t be posting notes.

- Tariff risk remains and Trump reminded us with his threats increasing EU tariffs to 50% and Apple with 25% if they don’t make iPhones in the US. I continue to hear that Trump is just talking and will cave like he did with China.

- As traders anticipate the “cave” tweet, the markets are not down that much.

- The bond market might be anticipating the cave tweet too as rates are back to nearly unchanged after early drop.

- The Uranium long trade is working as Trump will sign executive orders today that aim to jumpstart the nuclear energy industry by easing the regulatory process on approvals for new reactors and strengthening fuel supply chains. This is something I have been expecting. Energy self-reliance and clean energy gives a country the ability to grow. China is in the process of building 30 new reactors and last year two new US nuclear plants opened – the first in 30 years. The technology from the earlier nuclear plants is like the telephone in the 1970’s vs. a new iPhone today. China will have a big demand for Uranium as their plants open so this trade could last a while.

- I didn’t go to Harvard, but I did speak at the Harvard Business School investment symposium a few years back with my friends Grant Williams and Julian Brigden. We’ll never be invited back. Regardless, Trump’s obsession with Harvard is strange. Perhaps he was turned down from Harvard? I don’t know, but it’s just weird.

- Nvidia reports on Wednesday next week. This should be the highlight of the week. I continue to hold it long and likely will continue to hold it because I doubt the growth rate has slowed enough to send it lower. I will re-evaluate next week with an earnings preview.

- Volumes are down today, and it’s quiet. A trader in our Bloomberg chat said, “Everyone is at the beach.” He isn’t in the NY/CT area, as it’s in the 50s, and we’re all still wearing parkas. Nobody is at the beach. It’s been a long winter and hopefully it will end soon.

- This weekend has a lot of great sports stuff: I am going to see my Dodgers play the Mets, Knicks hope not to choke again vs the Pacers (the ESPN 30 for 30 on the 1995 Knicks Pacers was on last night). For racing fans, Monaco F1 and the Indy 500, which bores and scares me since the speeds leave little room for error.

- Have a great long weekend. Thank you for your continued support of Hedge Fund Telemetry.

Quick Market Views

Stocks: Indexes are down 0.8%-1% which isn’t that bad with more tariff threats. Breadth is negative as gap downs usually have negative breadth all day. Utiily sector is the only sector positive and by only 0.05%. Tech is weakest down 1.3% and since Apple is a top weight along with MSFT and NVDA all down today. Many people talk about people selling ahead of the 3 day weekend but I don’t think it matters much anymore.

Bonds: After Trump’s tariff tweets rates dropped and bonds caught a bid but they are mostly unchanged with 30 year yield ticking higher small.

Commodities: Crude is up 0.75%, Natural Gas up 1.8%. Gold up 1.75%, Silver up 0.5%. Copper up 2%. Grain down 1%.

Currencies: US Dollar index is down 0.6%. Bitcoin is down 2%

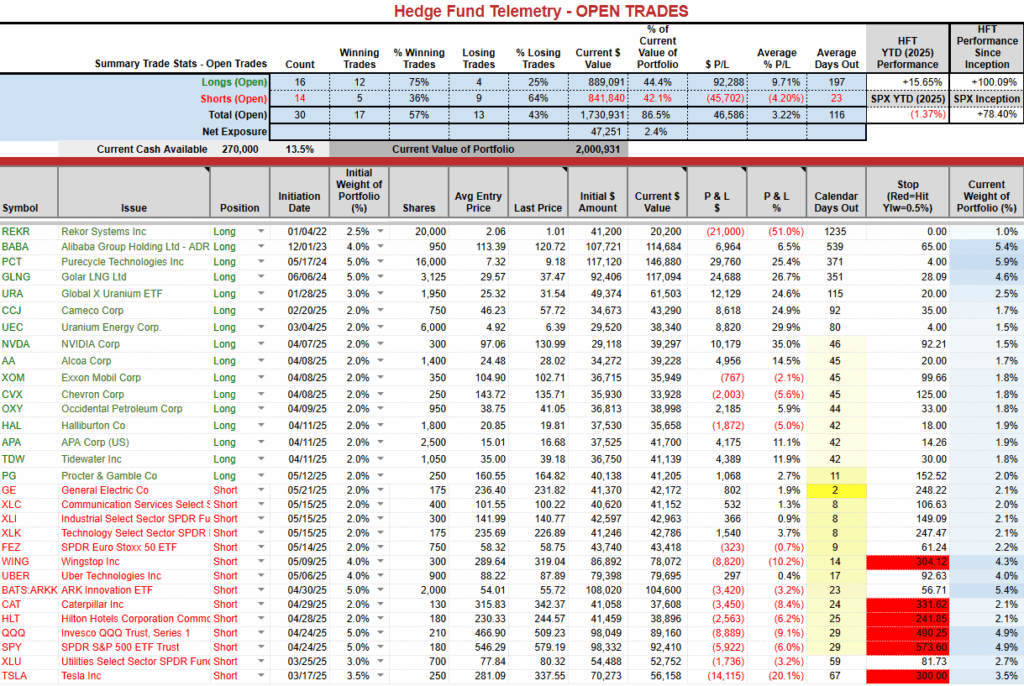

Trade Ideas Sheet: PNL glowing today with Uranium strength +15.6% YTD vs SPX -1.7%

Changes: If you bought the SPY and QQQ June put spreads (SPY 590-570 paid $4.75 now ~$8.50, QQQ 515-490 paid $5.45 now ~$8.75) recommended on May 16th, take the nice gains on half or all. Your call.

XLK Technology short is up ~4% for us and I will take the gain and cover.

US INDEXES

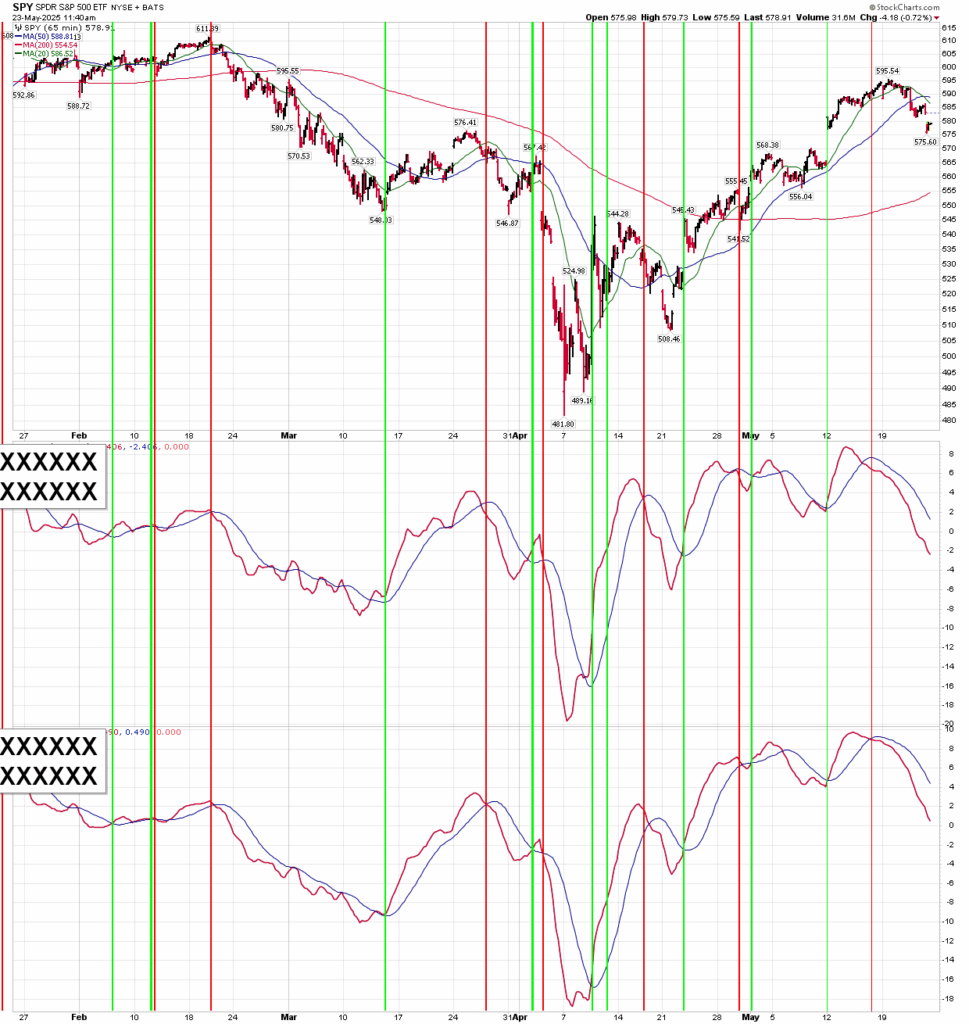

S&P futures 60-minute tactical time frame had a new Sequential 13 as shown on First Call. A bounce is sort of happening but I also showed the 240 minute time frame with downside Sequential Countdowns in progress. The 240 is a good in between the 60 min and daily.

S&P 500 Index daily with it back to the flat 200 day which doesn’t matter as I would say the 50 day is more relevant at 5584. Momentum is decreasing

Nasdaq 100 futures 60-minute tactical time frame bounced off earlier lows.

Nasdaq 100 Index daily similar to the S&P with momentum fading

Trade Ideas Sheet

Pre changes

Short term SPY and QQQ momentum indicators turned to sell recently and remain on sells.

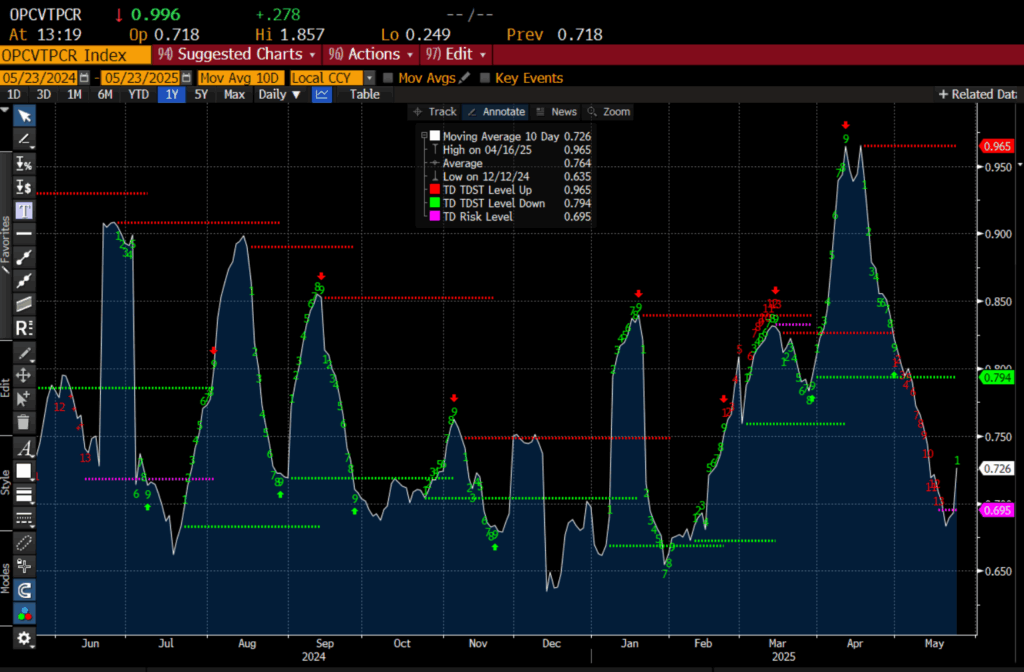

Put call ratio reversal

I borrowed this chart and need to replicate it on my Bloomberg. This is the 10 day moving average of the put call ratio. When this drops as it has there has been heavy call buying. Buy the market when this spikes higher, sell the market when this drops

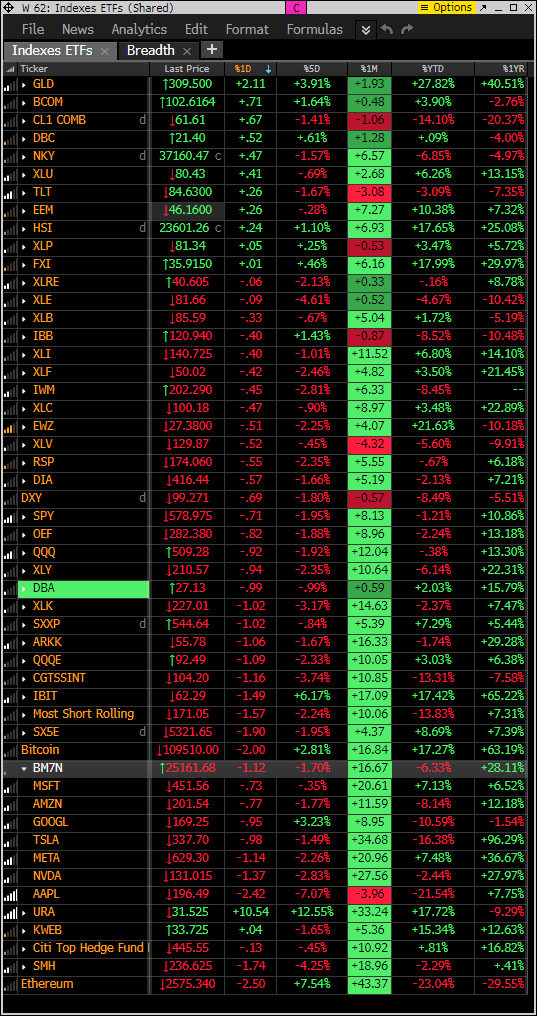

Hedge Fund Telemetry ETF Percentage Price Oscillator Monitor

The PPO monitor (percentage price oscillator) force ranks ETFs by percentage above/below the 50-day moving average. This monitor and others are offered to Hedge Fund Telemetry subscribers on Bloomberg. URA Uranium was on the bottom of this monitor not so long ago and I was questioned if I still liked Uranium. I said many times I liked this all the way up. It’s now getting extended

Index ETF and select factor performance

ETF with today’s performance with 5-day, 1-month, and 1-year rolling performance YTD. Commodity strength

Goldman Sachs Most Shorted baskets vs. S&P Indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Short baskets are mostly down with notable exception of Energy most shorted basket up 1.3%.

DeMark Observations

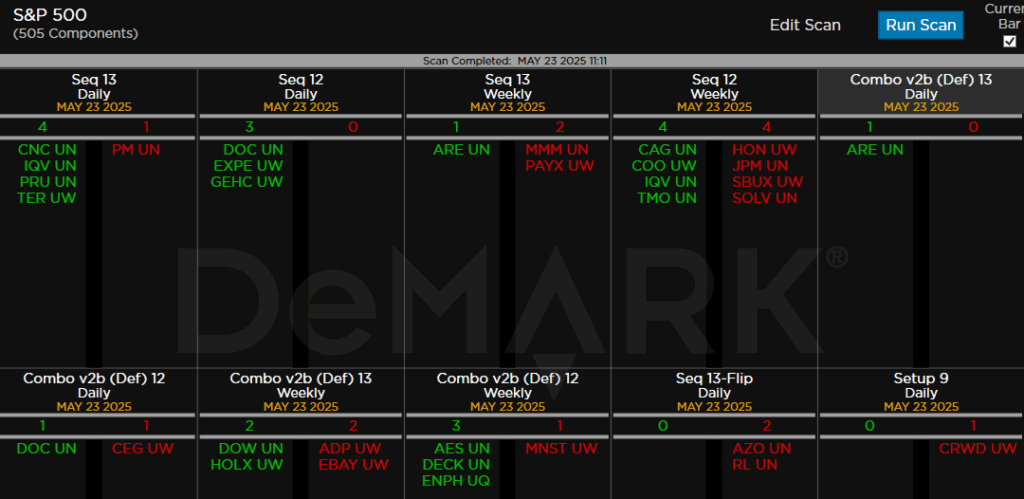

Within the S&P 500, the DeMark Sequential and Combo Countdown 13s and 12/13s on daily and weekly periods. Green = buy Setups/Countdowns, Red = sell Setups/Countdowns. Price flips are helpful to see reversals up (green) and down (red) for idea generation. The extra letters at the end of the symbols are just a Bloomberg thing. Worth noting: A few buy Countdown 13’s are showing up with the recent drop

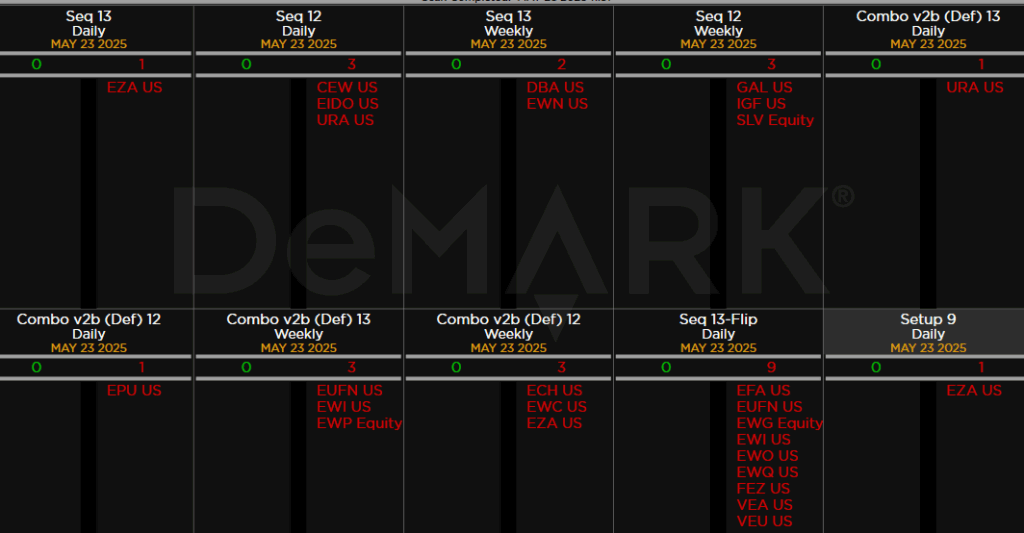

Major ETFs among a 160+ ETF universe.

If you have any questions or comments, please email us. Data sources: Bloomberg, DeMark Analytics, Goldman Sachs, Street Account, Vital Knowledge, Daily Sentiment Index, and Erlanger Research