- Our new short interest webinar is starting now. Here’s the link to join.

- I believe George Noble’s online conference will be well worth your time to watch. A diverse smart group of speakers. (I am not speaking, so overall quality is high) Here’s the link with details. Use the code “SAVE100” in check out to get $100 bucks off. I’m happy to support George with this conference.

- I said on the Week Ahead the next week will be focused on tariffs. It was the legal ruling against the tariffs, and perhaps so was TACO (Trump Always Chickens Out). Trump didn’t seem very pleased to be “meme’d” with this moniker and his tweet today saying China is breaking agreements is back to the tough guy approach. Scott Bessent said the talks with China stalled and again not a surprise tough-guy Trump tweets ensued.

- Uncertainty will remain with the latest tariff news. Talks have stalled, Trump’s leverage lost. It’s going to be a long summer.

- The S&P is up strong for May 5.5%. I was up 2.5%. I’m okay with this, as the last two weeks have been moving sideways.

- There is the potential for an end of the month pension rebalance with ~$20 billion moving from equities to bonds. A lot of times this gets priced in.

- It’s Elon Musk’s last day working for the government. His goal of cutting government spending fell short of the lowest end of expectations. I’m not very surprised as it’s difficult to cut waste in a short period of time and the real meat that needs to be addressed are on Trump’s untouchable list. Elon’s going back to Tesla but I doubt his customers are coming back as the brand damage was severe. Elon managed to have every legal risk, including criminal inquiries, dropped, which could have led to him going to jail. $250 million well spent!

- Costco is the one stock I wish I had bought several years ago. They are incredible retail operators.

- Knicks fans are happy today after the team beat the Pacers last night. Two more do-or-die games ahead.

- Need to cut it off here to get to the webinar. Have a great weekend

Quick Market Views

Stocks: Breadth is down on the day with moderate declines with the indexes. Short baskets are mostly lower with defensive ETFs showing strength. Still waiting on the Sequential Countdowns

Bonds: Rates are down 1-2bps after econ data

Commodities: Mostly a down day with Crude down 0.5%, Natural Gas down 0.75%, Gold down 1%, Silver down 0.6%. Coffee has been dropping hard recently.

Currencies: US Dollar Index is up 0.25%. Bitcoin is down .0.1%

Trade Ideas Sheet: A little give back today

Changes: No change

US INDEXES

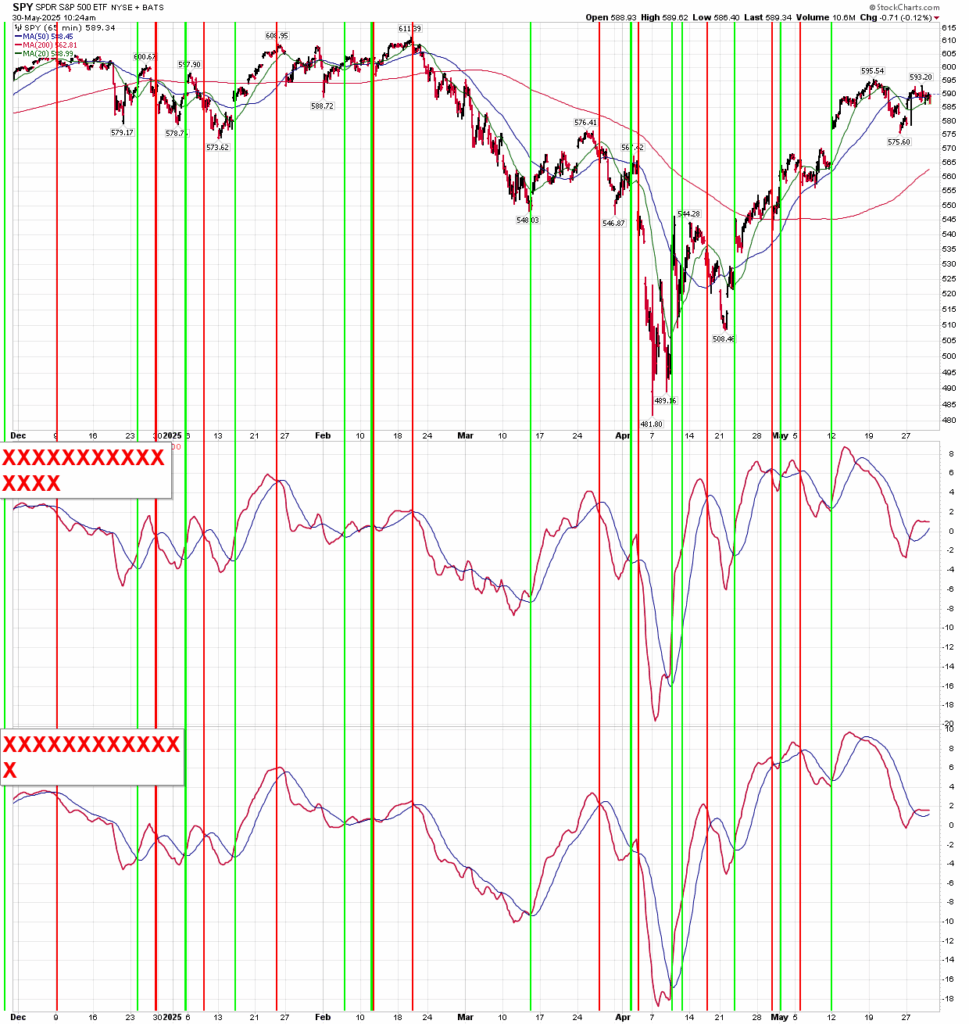

S&P futures 60-minute tactical time frame holding TDST support

S&P 500 Index daily

Nasdaq 100 futures 60-minute tactical time frame

Nasdaq 100 Index daily still chopping sideways with Sequential pending

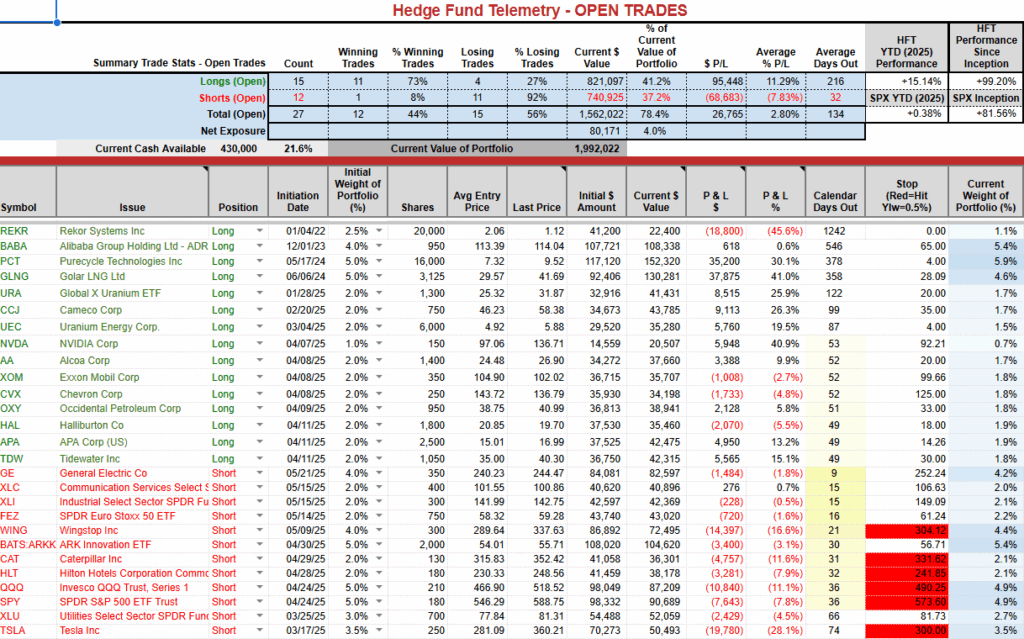

Trade Ideas Sheet

The short term SPY and QQQ momentum is technically on a buy but I want more confirmation

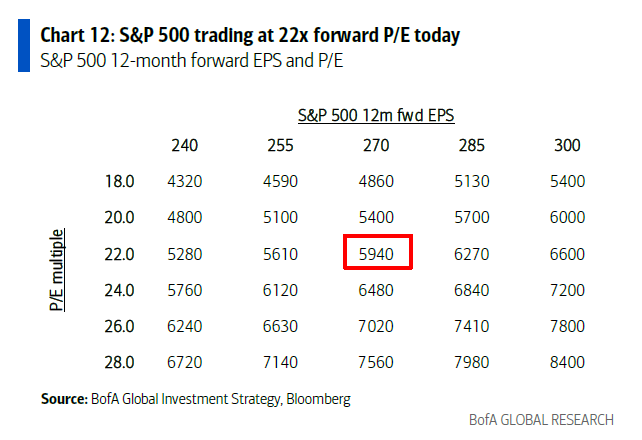

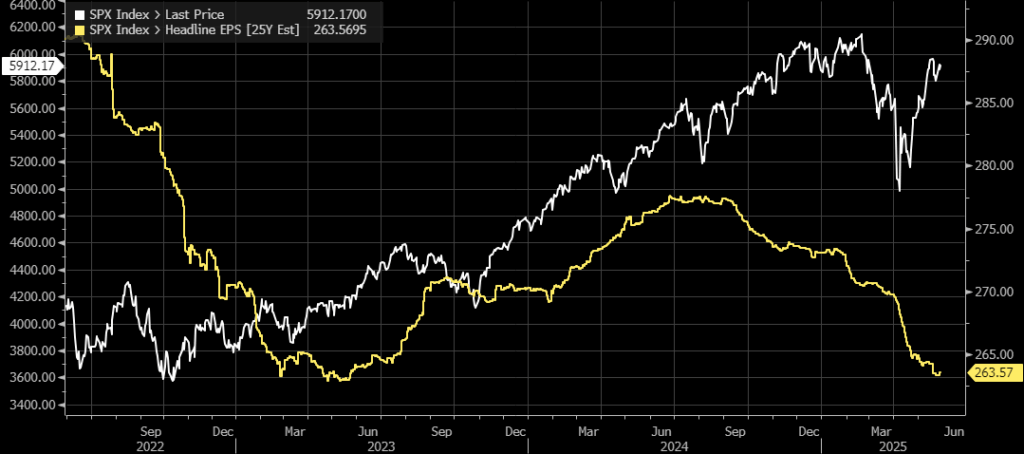

Bank of America – harnett charts

Here are some charts from this week’s Michael Hartnett of BofA Flow Show

This is a handy table that shows the S&P earnings and multiples. BofA sees $270 per share currently with the S&P trading now at 22x. Not what I would call cheap.

Thank you Darren S in our Bloomberg chatroom (if you’re on bberg, we’ll add you). The current consensus is $263 which would make the S&P PE multiple at 22.5X

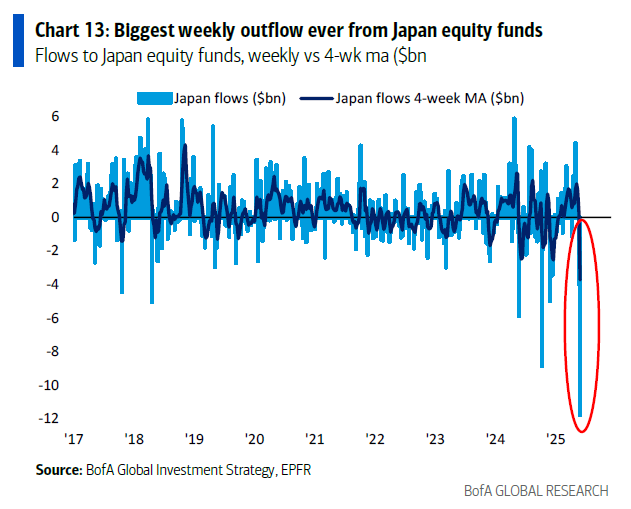

This was surprising to me as the Japan market did see a short lived dip last week and bounced right back.

I showed the Nikkei the other day and still awaiting the upside sell Countdown 13’s. DXJ Japan ETF still has exhaustion signals nearing as well.

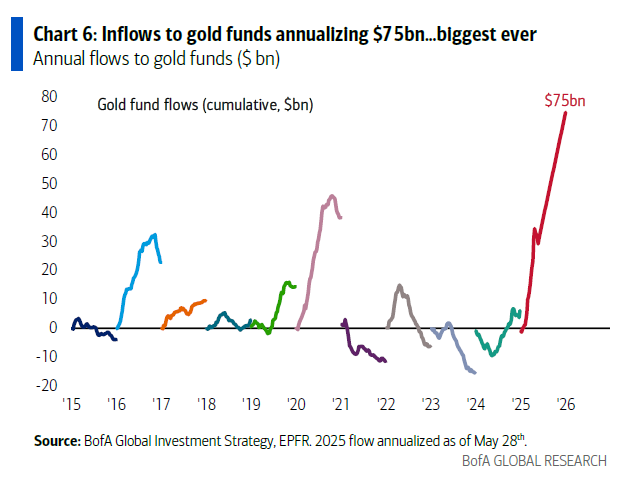

Gold has been the safe haven and if I was long Gold this is NOT what I would want to see because this has the potential to see sellers and supply come into this with a decline. Trapped buyer potential and the most significant buying is in the PAST.

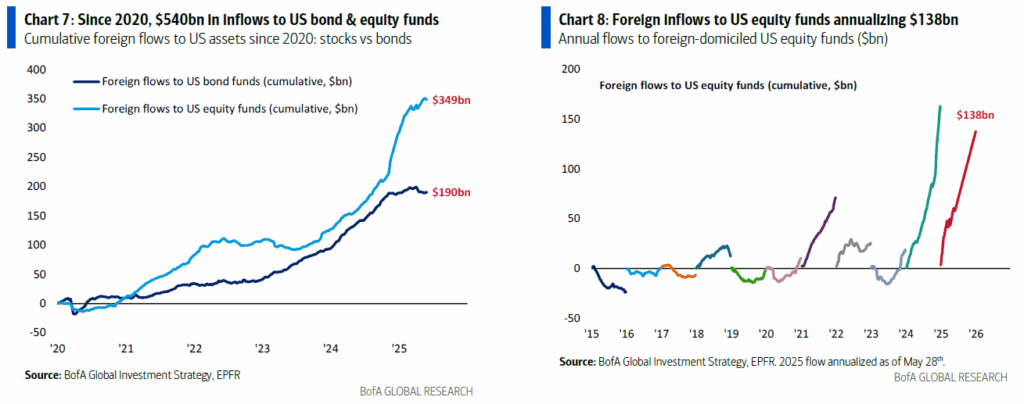

Foreign inflows into equities have leveled off in recent months, and it also comes after two significant years of inflows into equities.

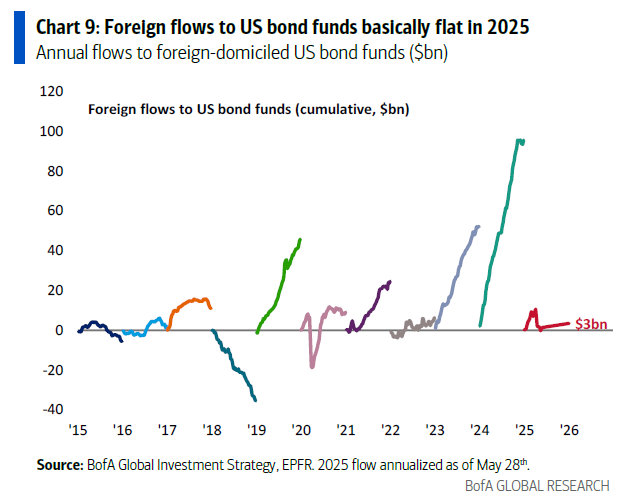

Last year, foreign flows into US bond funds were massive, and this year they are flat.

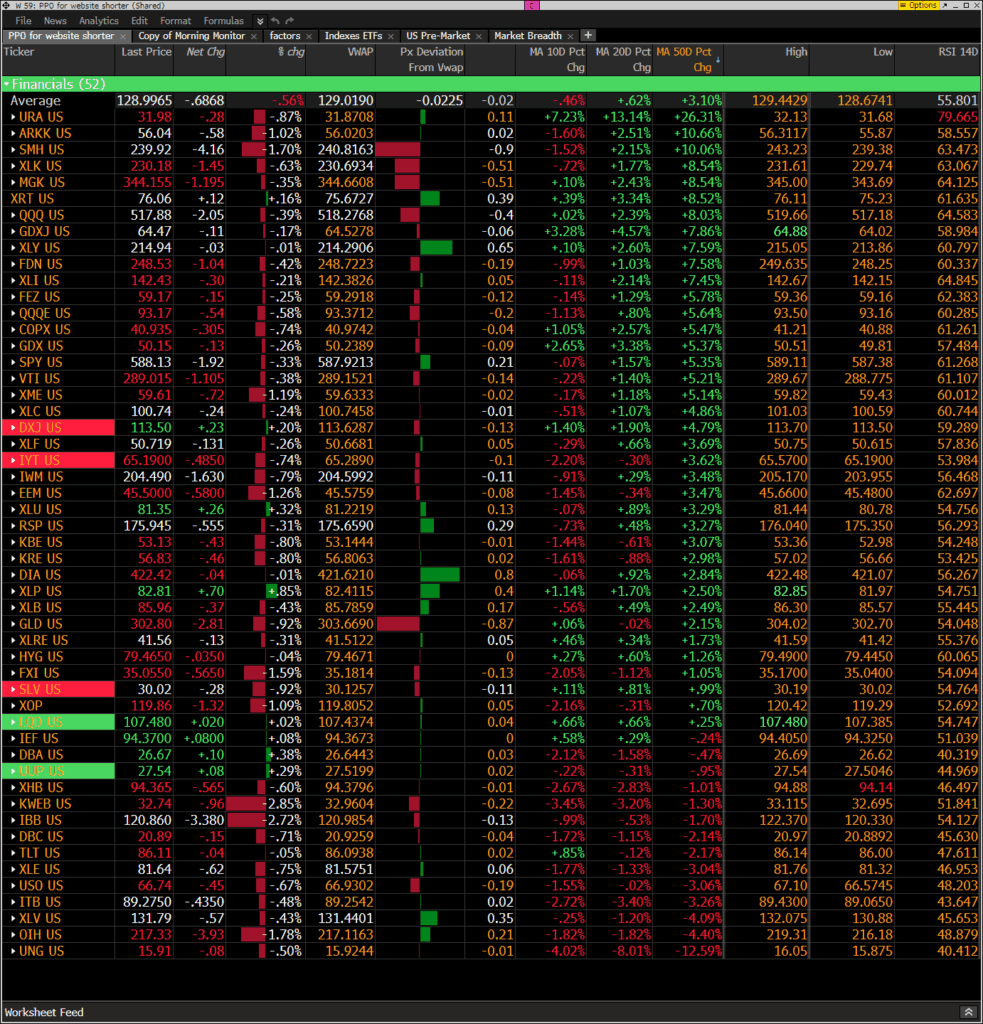

Hedge Fund Telemetry ETF Percentage Price Oscillator Monitor

The PPO monitor (percentage price oscillator) force ranks ETFs by percentage above/below the 50-day moving average. This monitor, along with others, is offered to Hedge Fund Telemetry subscribers on Bloomberg. Tech weak today along with China ETFs with Trump’s tweet. Defensive ETFs strong today

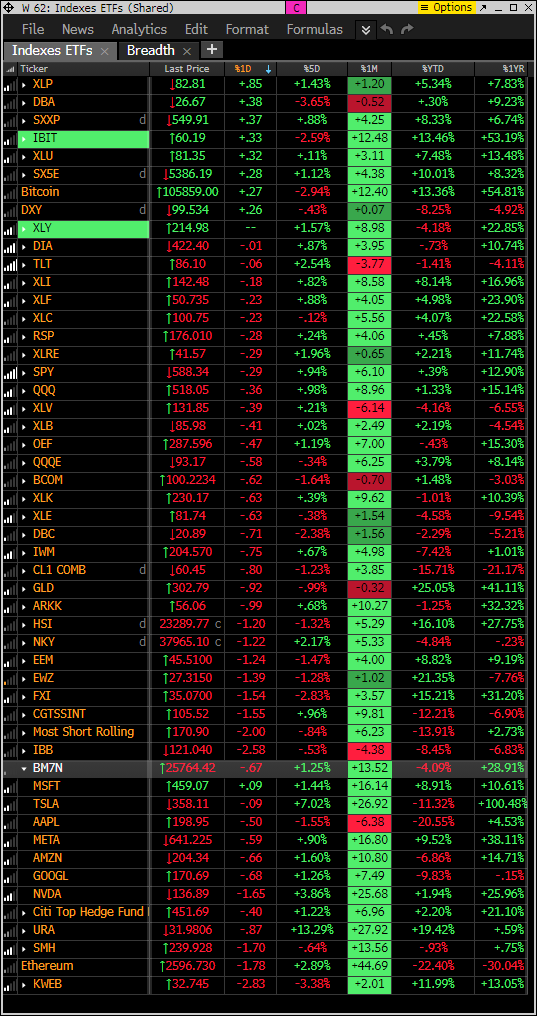

Index ETF and select factor performance

ETF with today’s performance with 5-day, 1-month, and 1-year rolling performance YTD. Defensive tone

Goldman Sachs Most Shorted baskets vs. S&P Indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Short baskets are down hard today except with defensive sectors staples and utilities

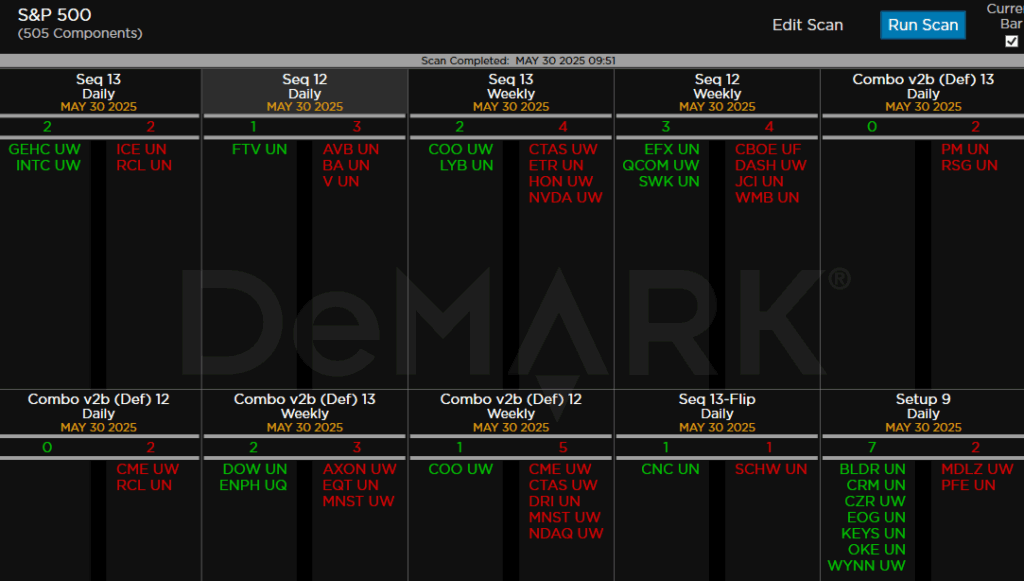

DeMark Observations

Within the S&P 500, the DeMark Sequential and Combo Countdown 13s and 12/13s on daily and weekly periods. Green = buy Setups/Countdowns, Red = sell Setups/Countdowns. Price flips are helpful to see reversals up (green) and down (red) for idea generation. The extra letters at the end of the symbols are just a Bloomberg thing. Worth noting: Mixed with nothing standing out

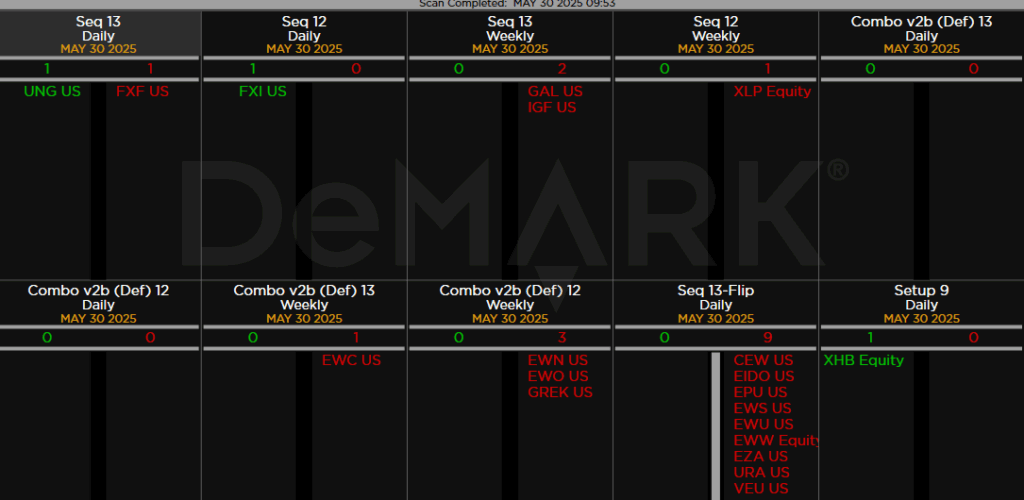

Major ETFs among a 160+ ETF universe. Decent number of price flips down. FXI on day 12 of 13 near buy

If you have any questions or comments, please email us. Data sources: Bloomberg, DeMark Analytics, Goldman Sachs, Street Account, Vital Knowledge, Daily Sentiment Index, and Erlanger Research