HIGHLIGHTS AND THEMES

- The Bloomberg Commodity Index lifted last week making a high not seen since early April

- Energy has upside potential if it can move just a little further to confirm

- Metals – Gold has been moving sideways, Silver getting to overbought levels

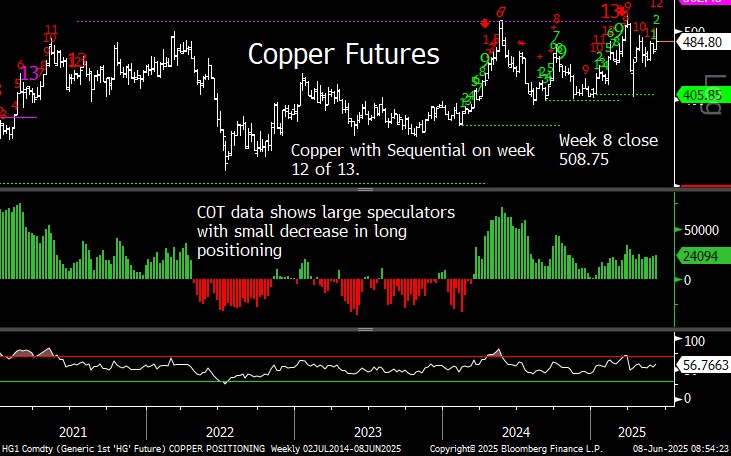

- Copper still has potential upside

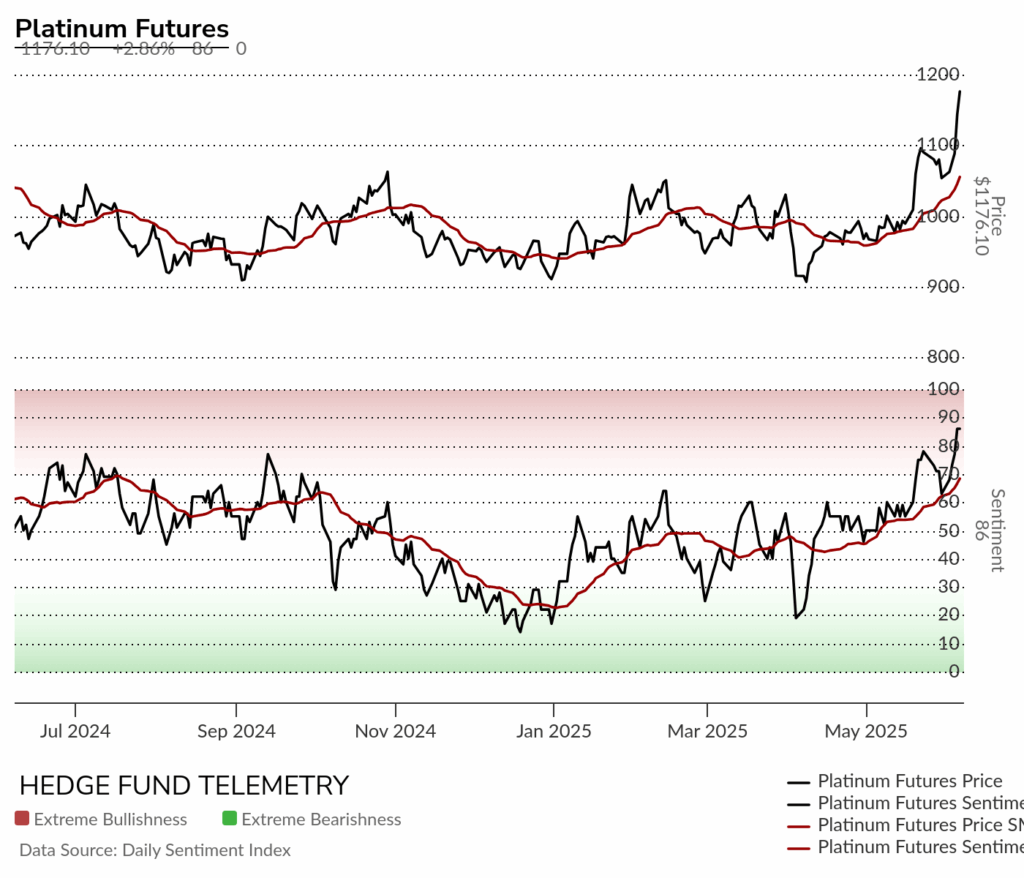

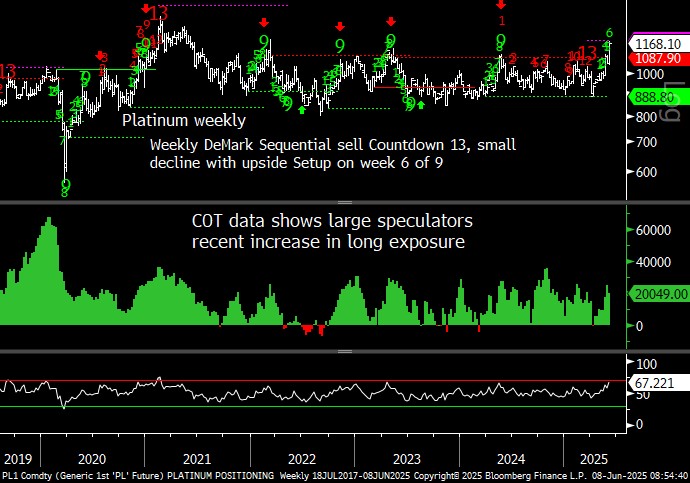

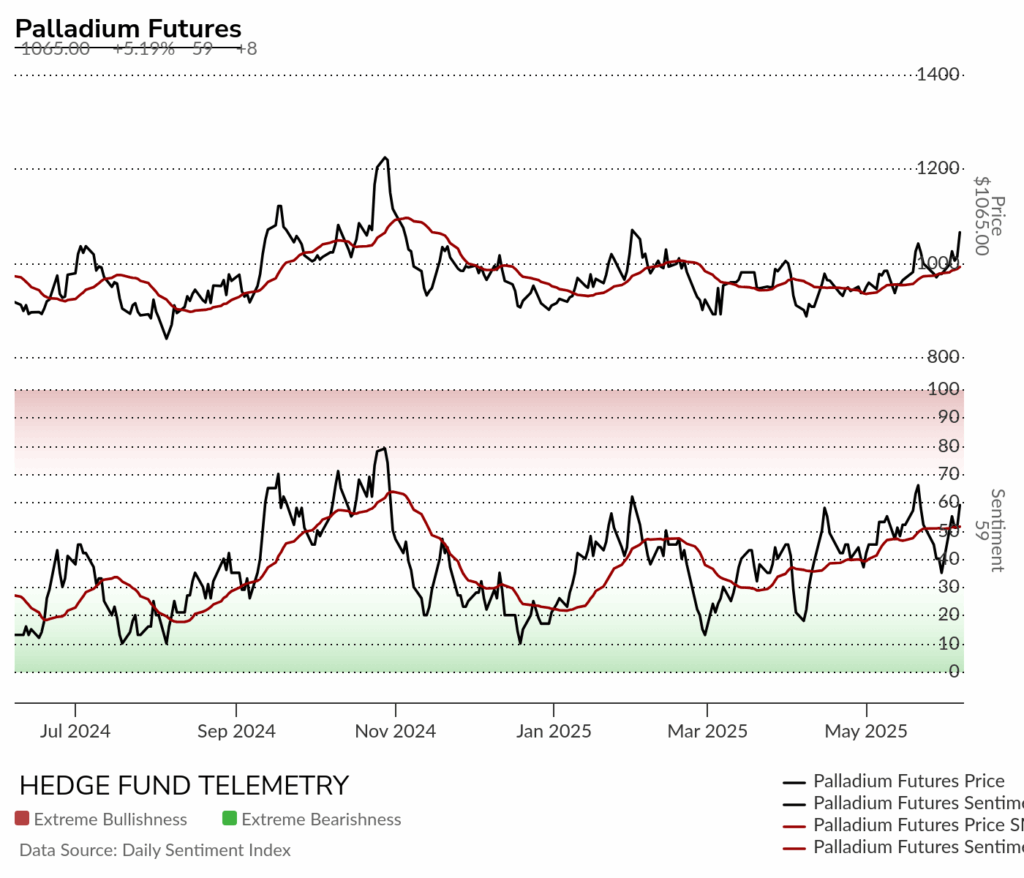

- Laggards – Platinum and Palladium lifting. Platinum spike higher

- Livestock with more upside exhaustion

- Soft mixed with Cotton lagging and potential for bounces with Sugar, Coffee and Cocoa.

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily held the 200 day again and had a good upside week making a new high from early April.

Bloomberg Commodity Index Weekly bounced last week now on week 5 of 13 that has been pending.

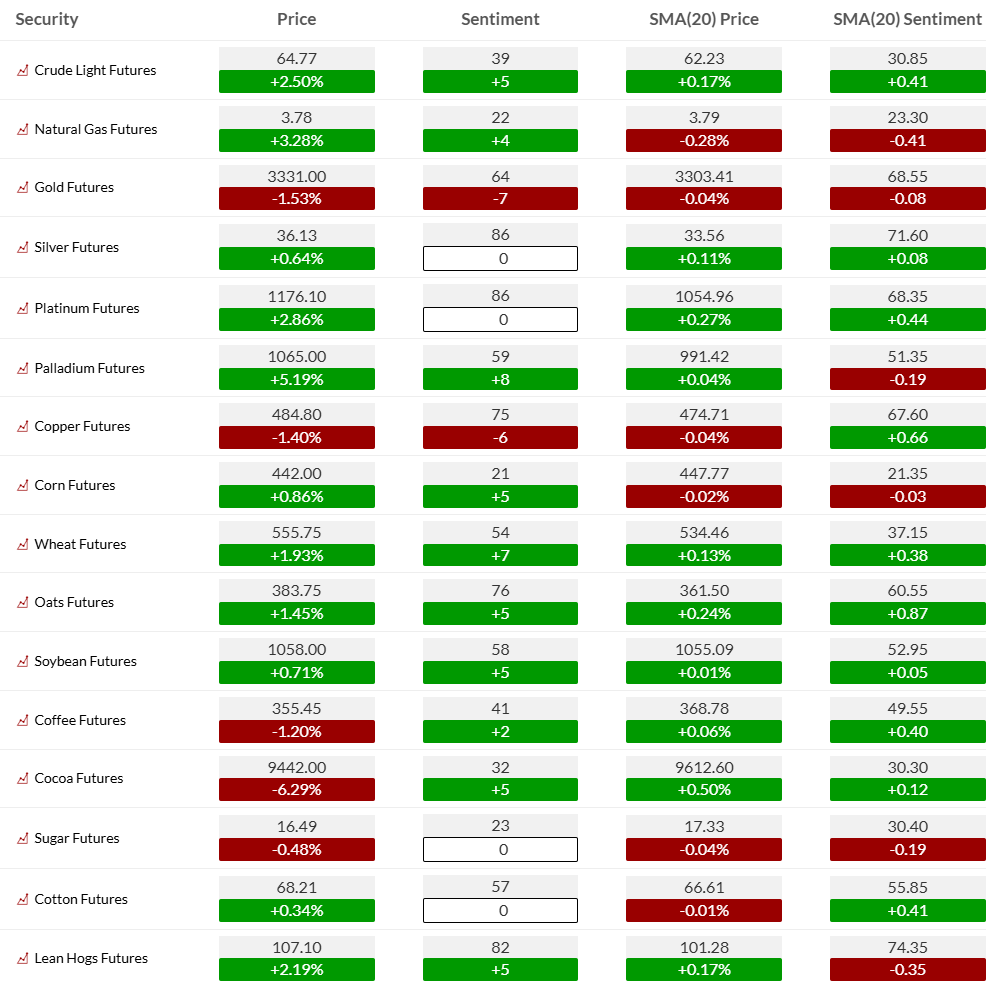

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY – potential for crude upside

Bloomberg Energy Index daily lifted last week still has some upside to prove upside conviction.

WTI Crude futures daily has a pending Sequential Countdown however with the upside Setup on day 5 of 9 and the nearing of the TDST Setup Trend red dotted line resistance at 64.87 the potential for the pending downside Sequential could cancel this week. If it does I will post on First Call.

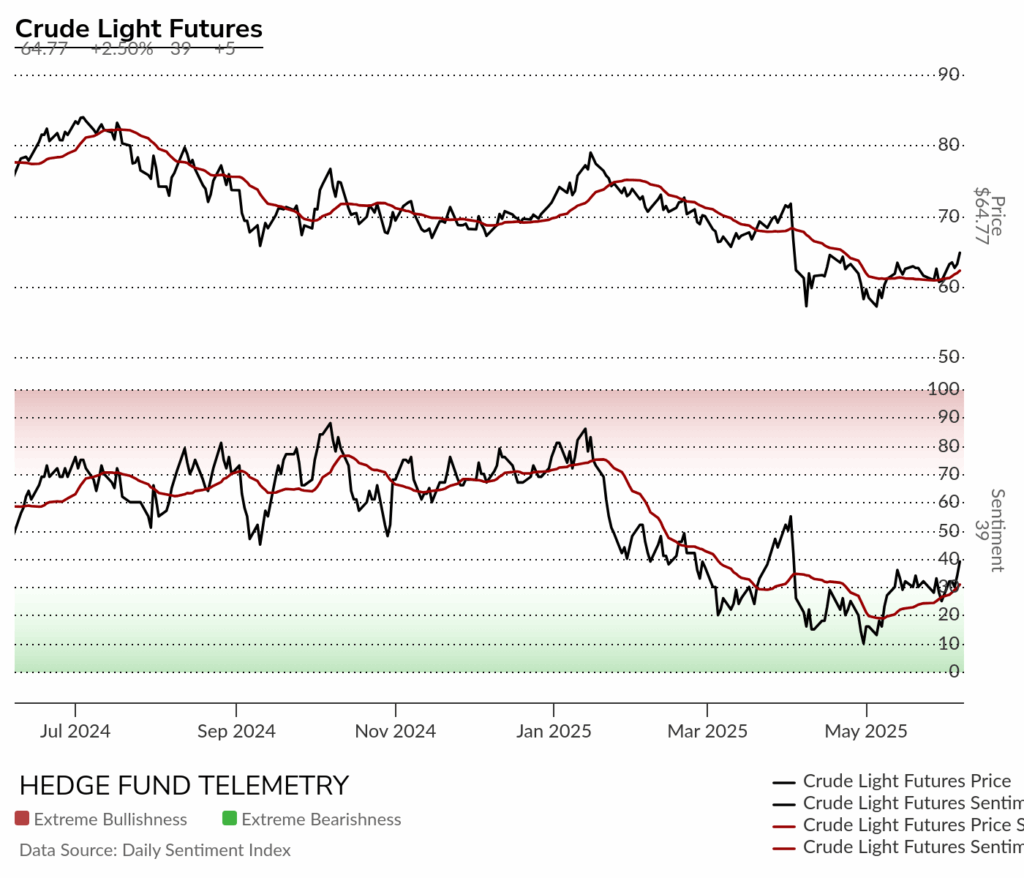

WTI Crude futures bullish sentiment with a higher low and nice move on Friday. Can it continue? Maybe

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

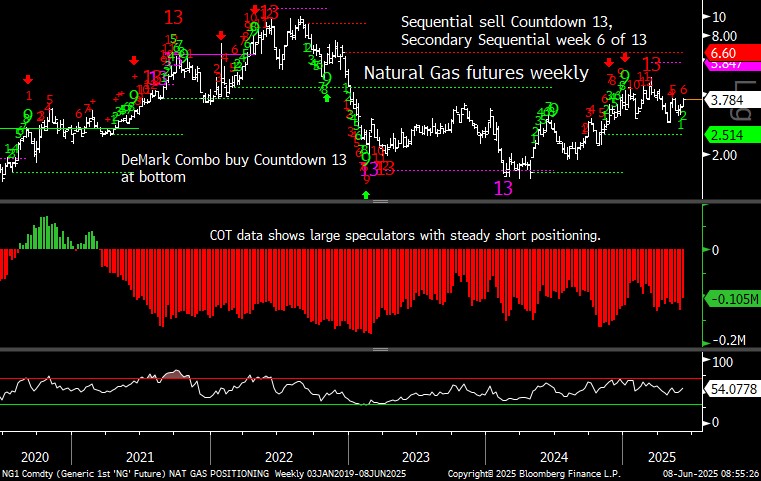

Natural Gas futures daily holding lows and still has pending Sequential. The upside Setup on day 4 of 9 near the 50 day has me thinking of the potential if this can lift and complete the Setup 9, the pending Sequential will cancel.

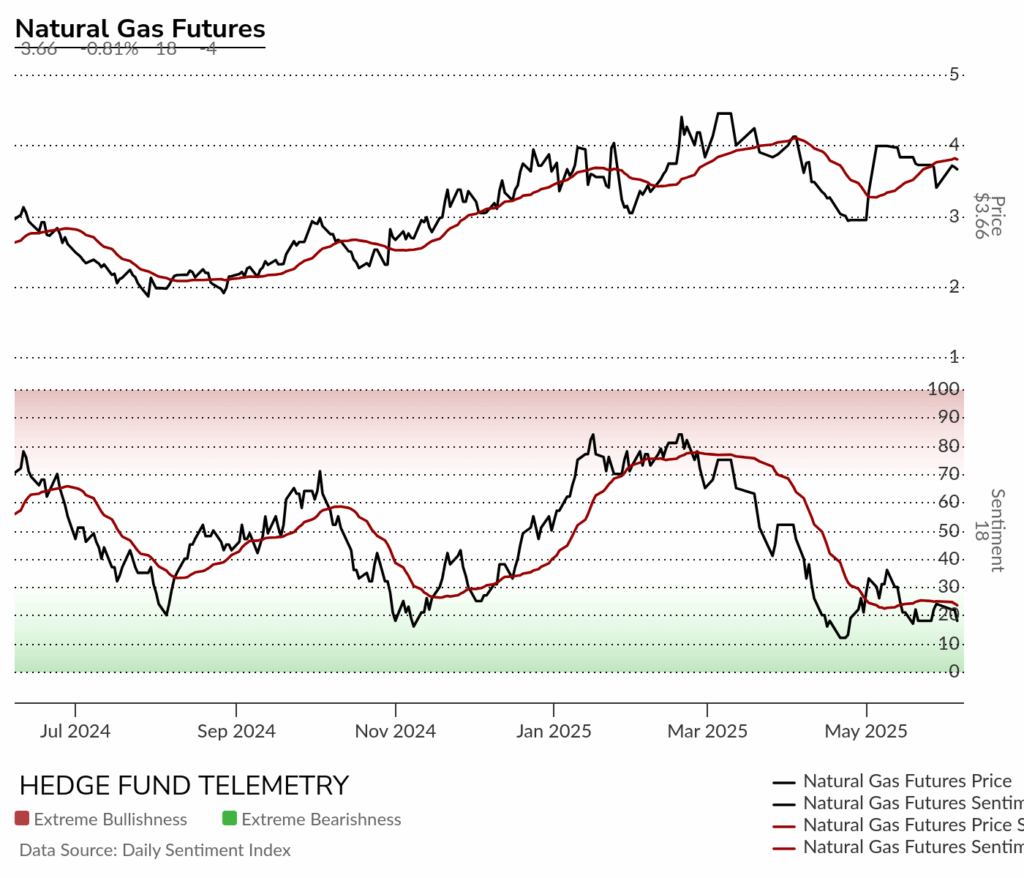

Natural Gas futures bullish sentiment remains under pressure

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Metals – mixed with laggards leading

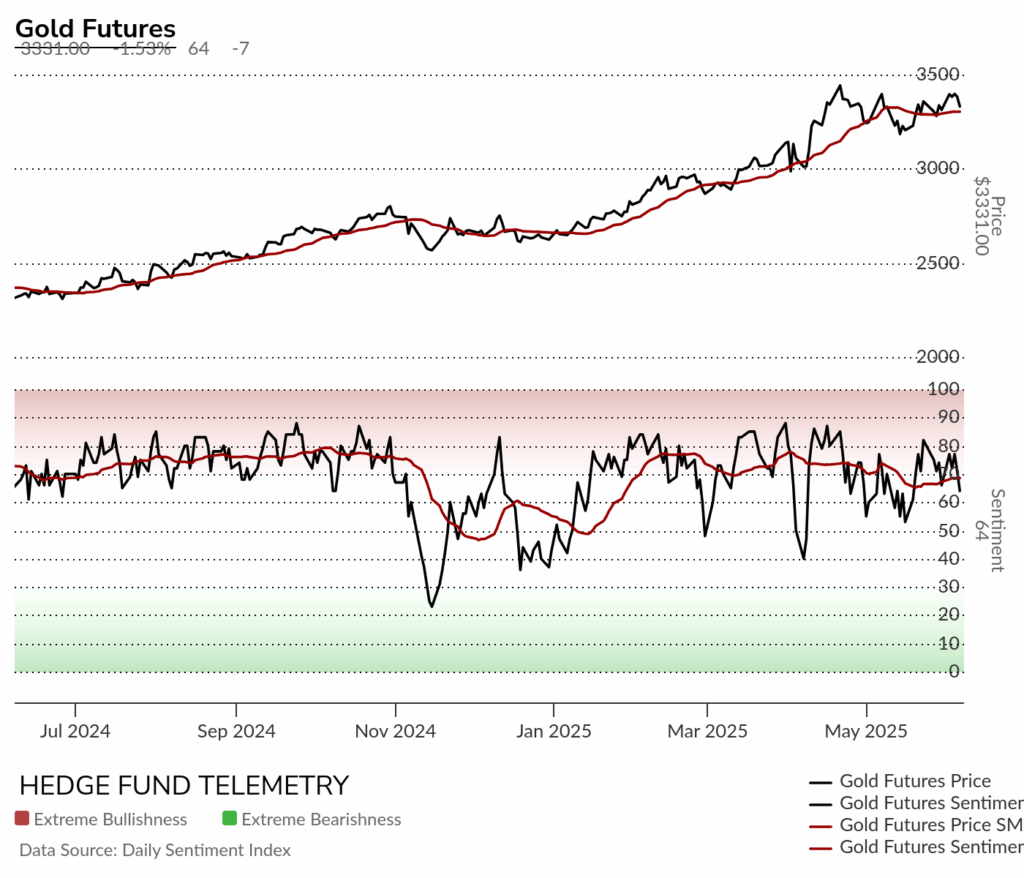

Gold daily has moved sideways in the last two months and downside move on Friday.

Gold bullish sentiment slipped last week with major support down at 50% midpoint level

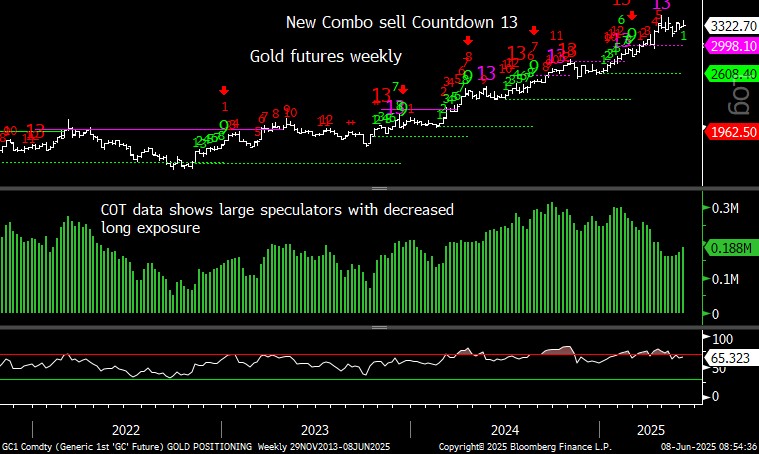

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

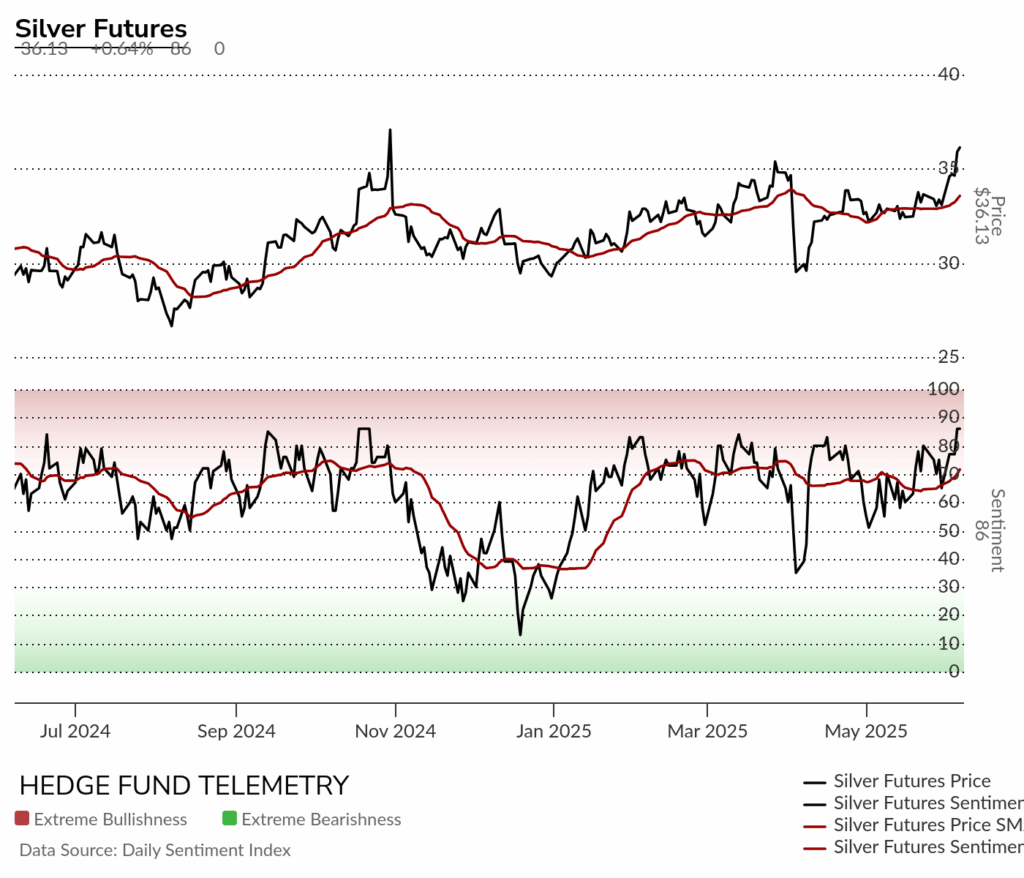

Silver daily with Sequential on day 10 of 13. This is XAG/USD – SLV on day 12 of 13 with Sequential. I added a wise guy short on Friday with SLV

Silver bullish sentiment hit a new sentiment high at 86% on Thursday.

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

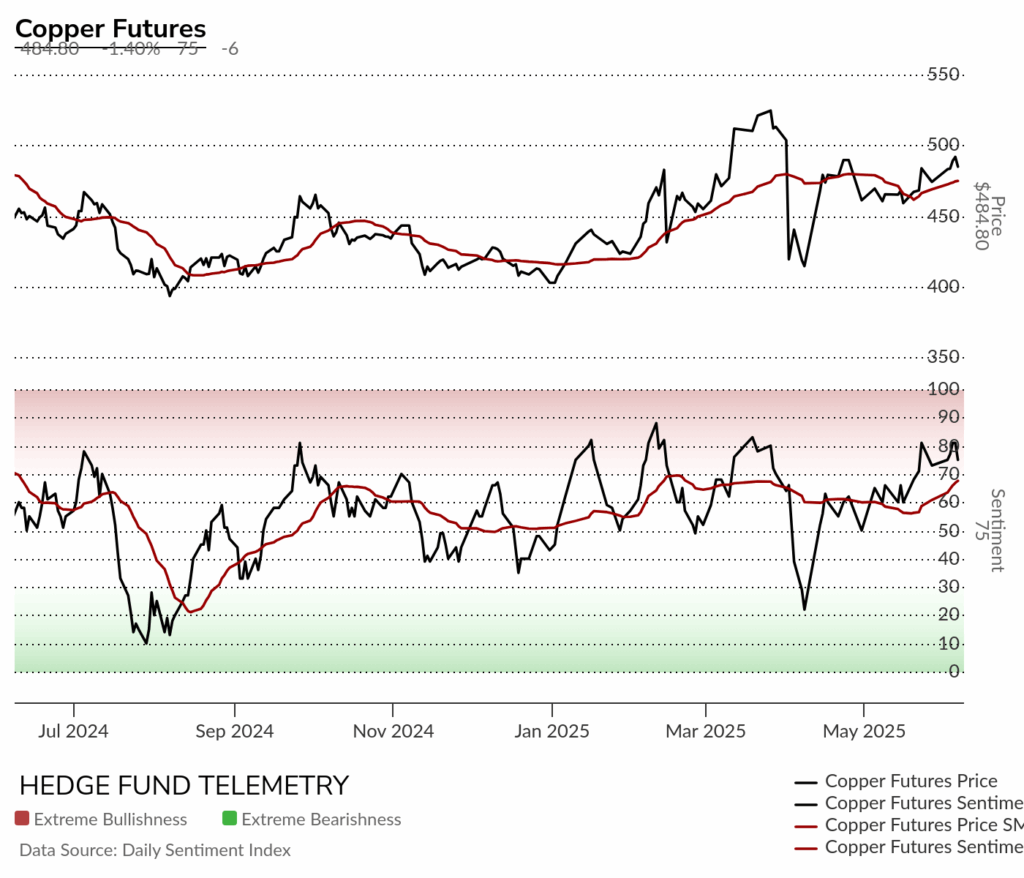

Copper futures daily still has the upside Sequential pending on day 6 of 13. Copper remains my favorite commodity for 2025

Copper futures bullish sentiment reversal after reaching extreme zone.

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Platinum daily with another spike higher

Platinum bullish sentiment hit a new high in sentiment in the extreme zone at 86%

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Palladium daily decent move last week and might continue higher

Palladium bullish sentiment has made higher lows with strong week

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains – some upside potential

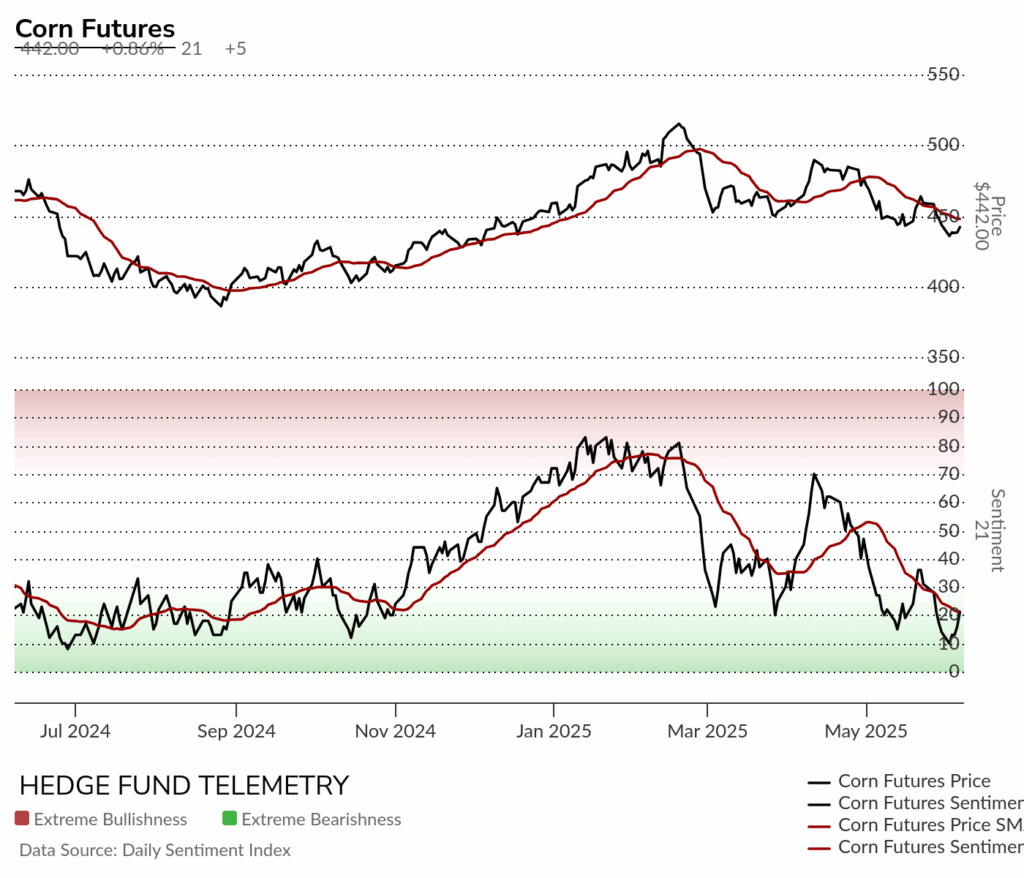

Corn futures daily still has a pending downside Sequential in progress with new Aggressive Sequential 13 (amber 13) which saw two times with decent inflection points.

Corn futures bullish sentiment strong move off very oversold YTD lows

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

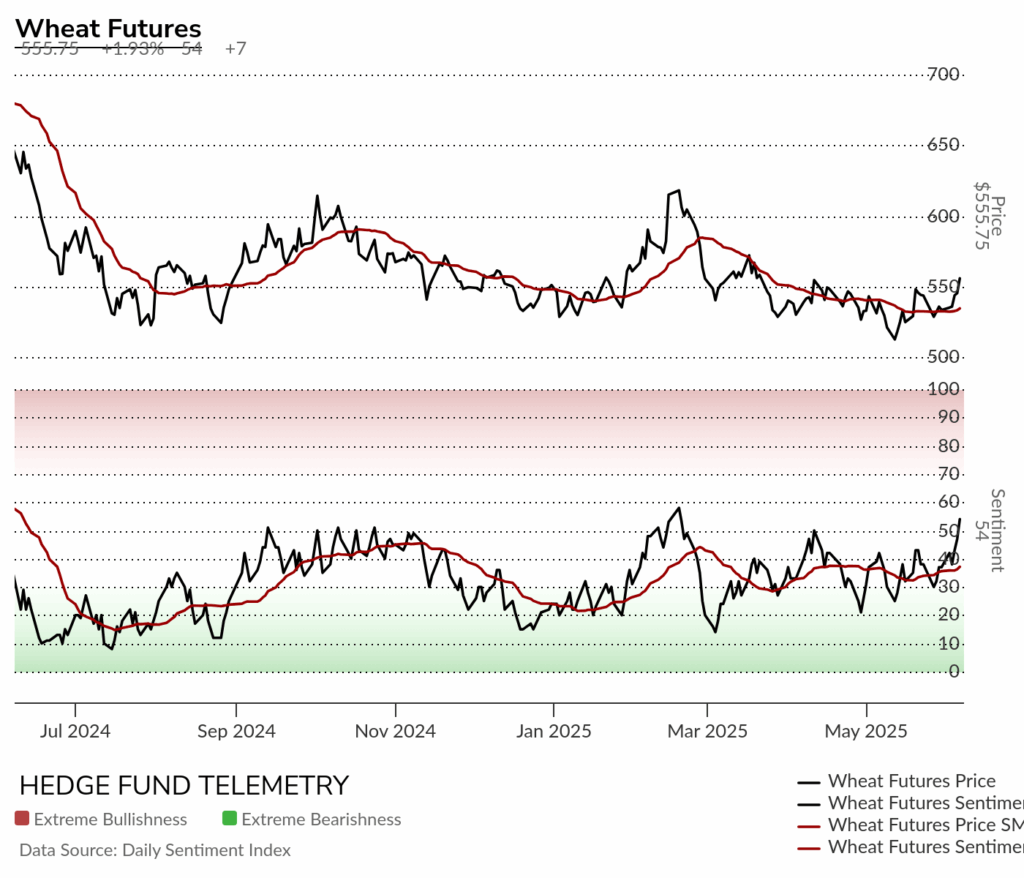

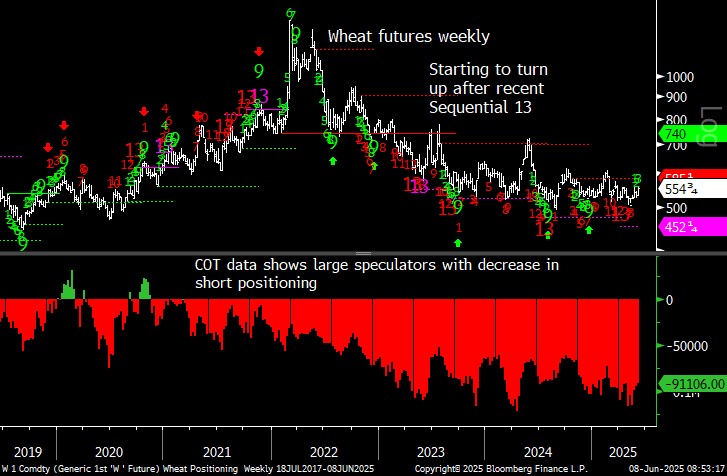

Wheat futures daily despite the pending Sequential Countdown this move looks decent for more upside.

Wheat futures bullish sentiment with strong move last week above 50% again

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

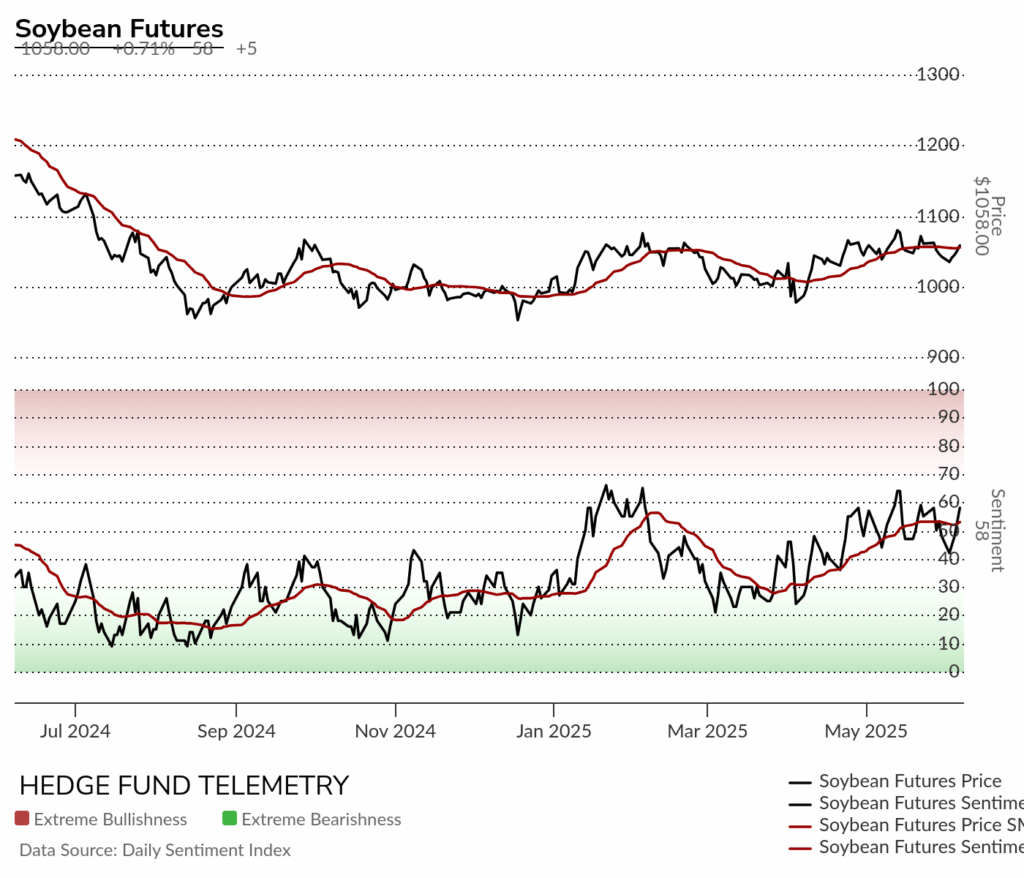

Soybean futures daily might make another attempt higher.

Soybean futures bullish sentiment reversed up late in the week

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

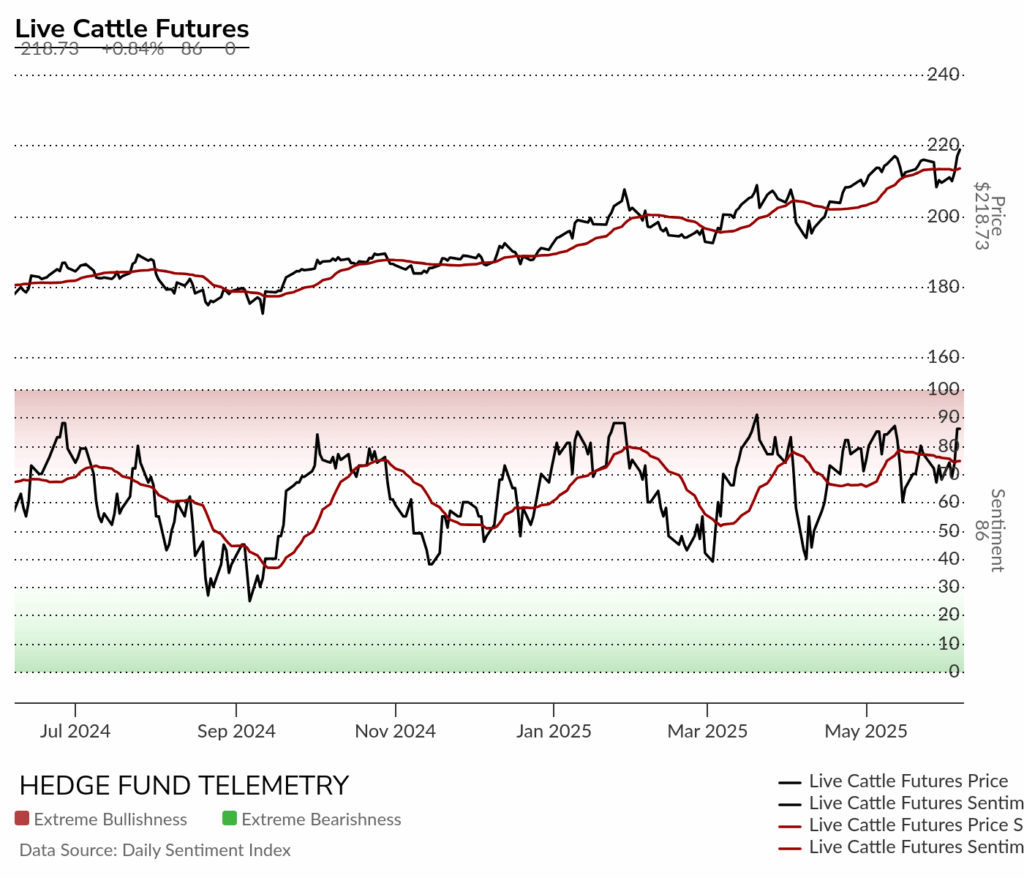

Livestock – more upside exhaustion

Live Cattle futures daily continued up last week with new Combo 13 (strict version)

Live Cattle futures bullish sentiment still in the extreme zone

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

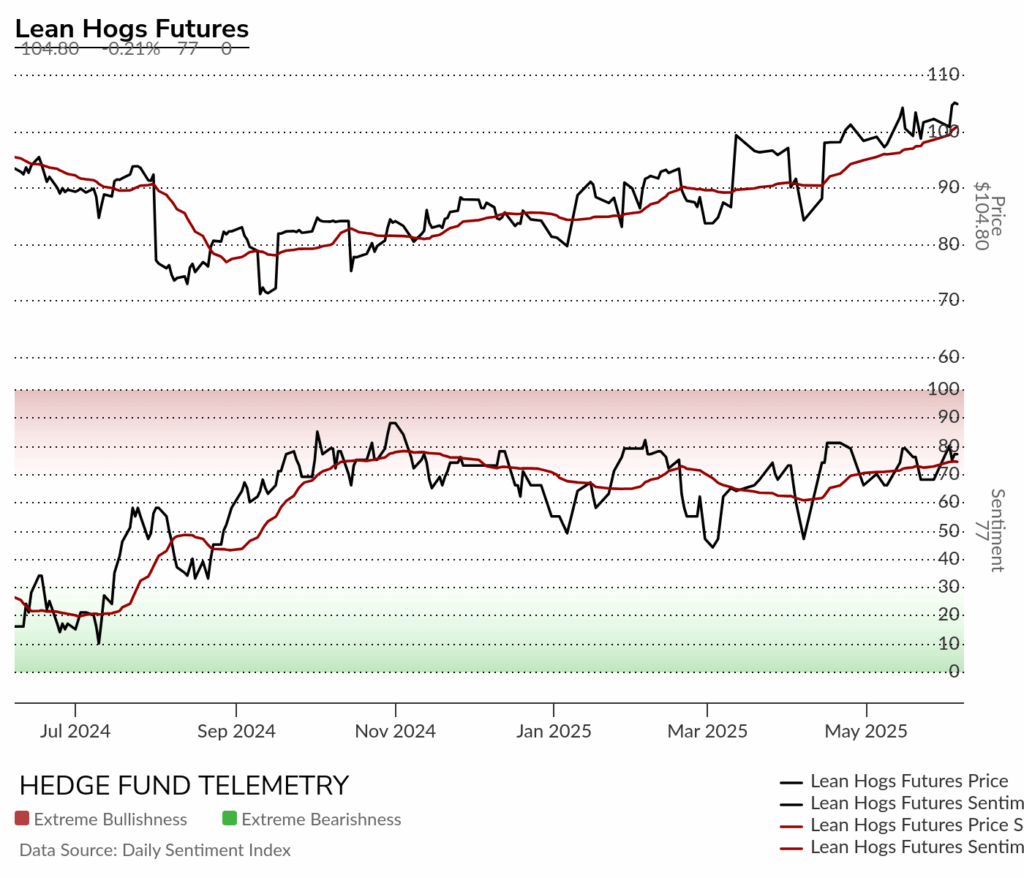

Lean Hogs futures daily with big move on Friday and Combo 13 (strict version)

Lean Hogs bullish sentiment elevated.

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

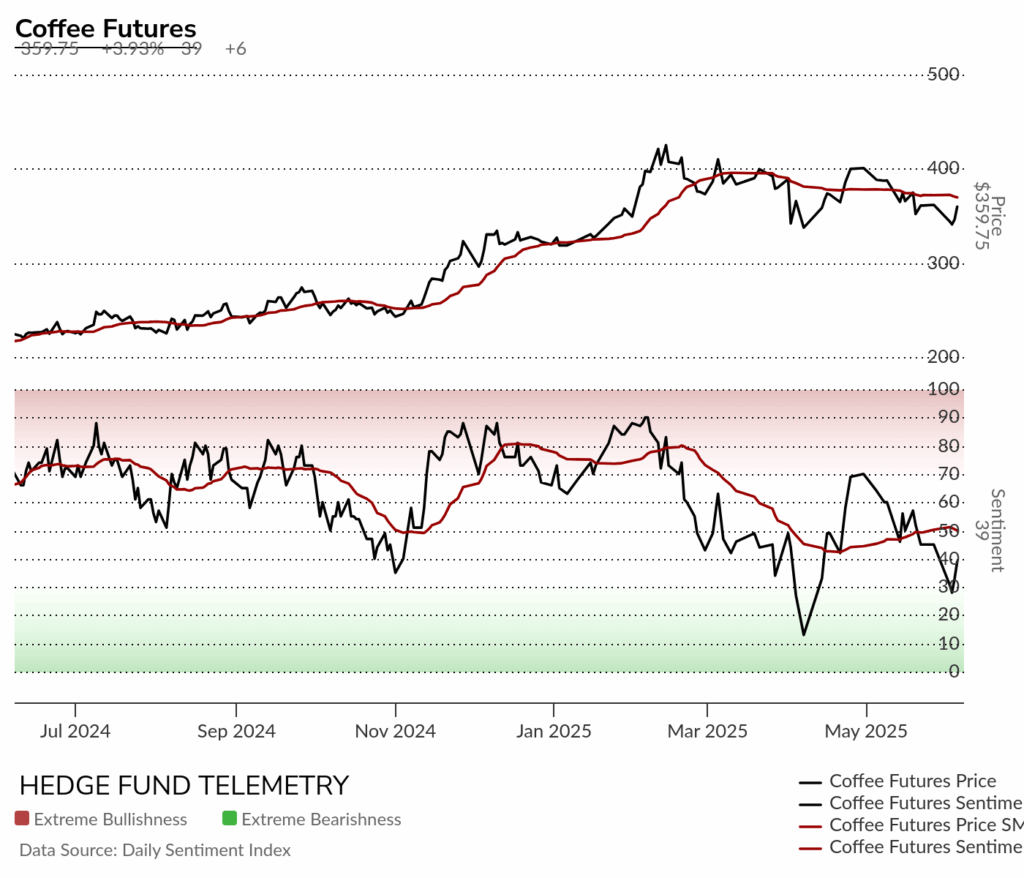

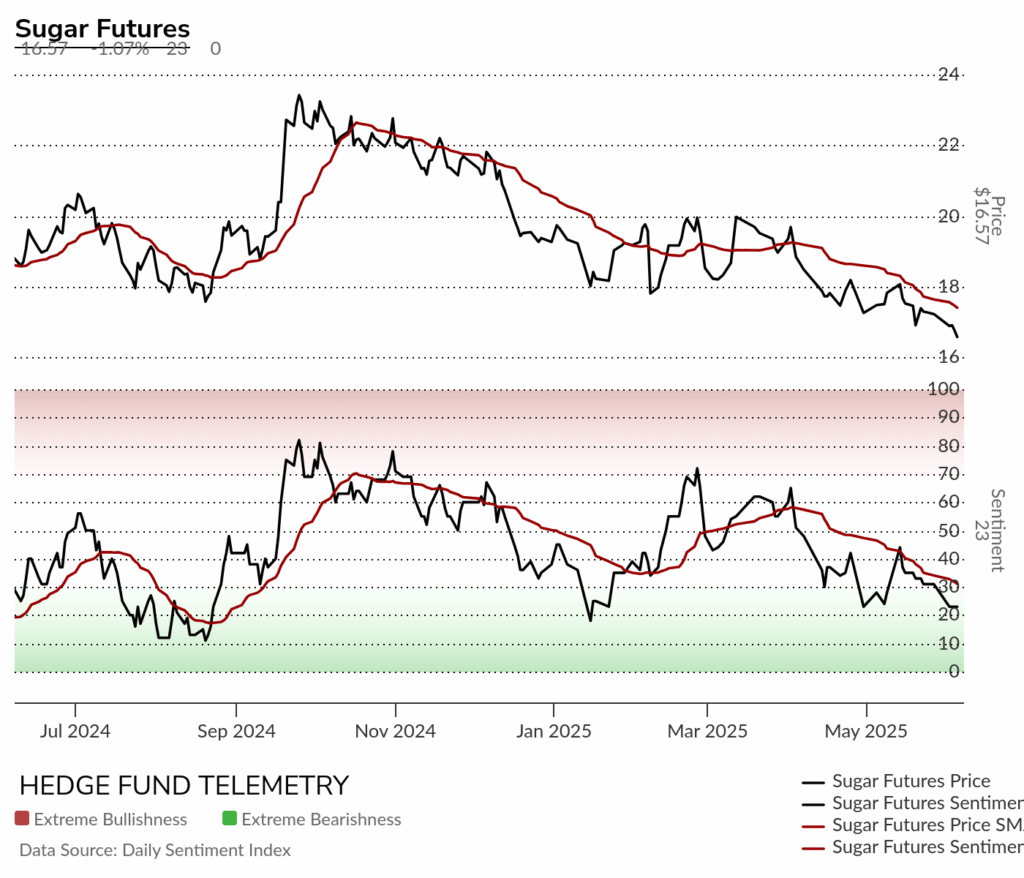

Softs mixed with some upside potential

Cotton futures daily has moved sideways after failing at 200 day.

Cotton futures bullish sentiment has been steady

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Coffee futures daily reversed off TDST support I’ve been mentioning and buy Setup 9. Nasty reversal down off Friday’s highs.

Coffee futures bullish sentiment might have made a higher low in sentiment

Sugar futures daily with new Sequential 13 this week but no turn yet. Made a slight lower low YTD on Friday

Sugar futures bullish sentiment remains under pressure

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

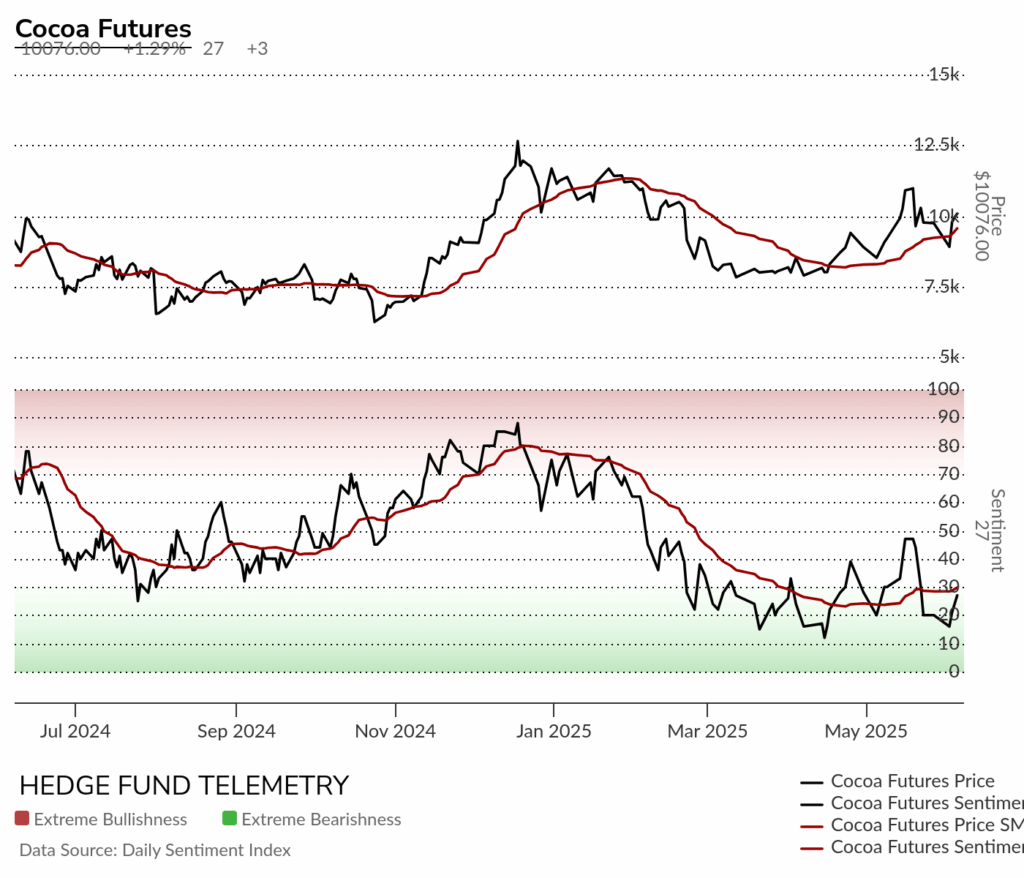

Cocoa futures daily might be on the cusp of making an upside move

Cocoa futures bullish sentiment has been oversold for 3 months

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators