Highlights and themes

- Powell’s speech at Jackson Hole reversed the recent Dollar increase with a bearish engulfing bar.

- I’ve been more interested in watching the TDST Setup Trend support/resistance levels vs the Sequential.

- Wouldn’t be surprised to see more sideways action in the coming weeks

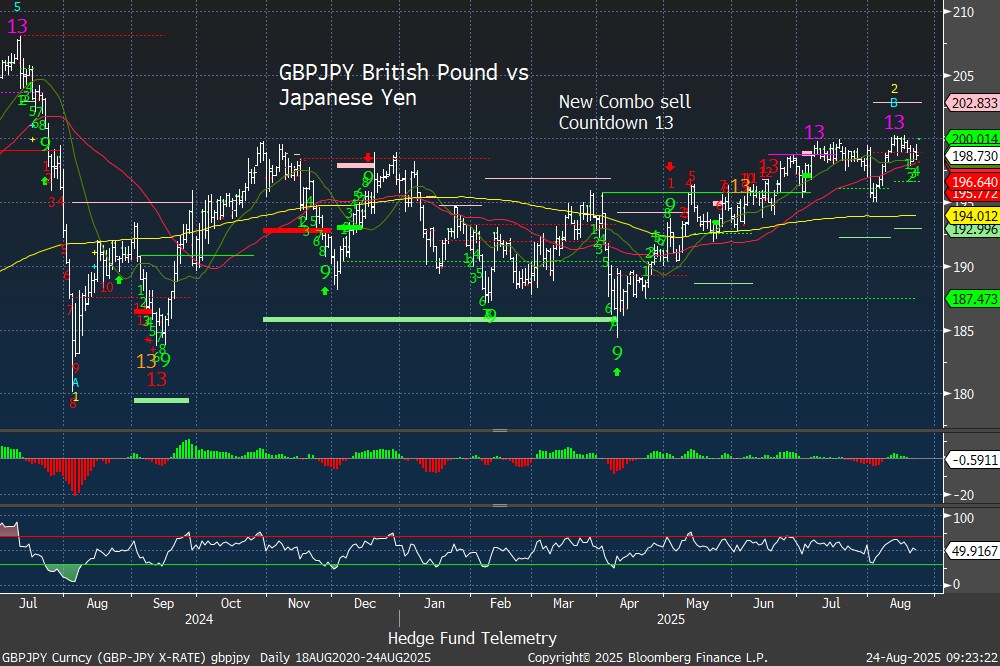

- Yen strength is also something to watch

- Crypto is mixed with Ethereum, moving to a new high while Bitcoin lags.

Comments on charts. If you have questions or would like more context, please email.

Currency Sentiment Overview

Currency sentiment highlights

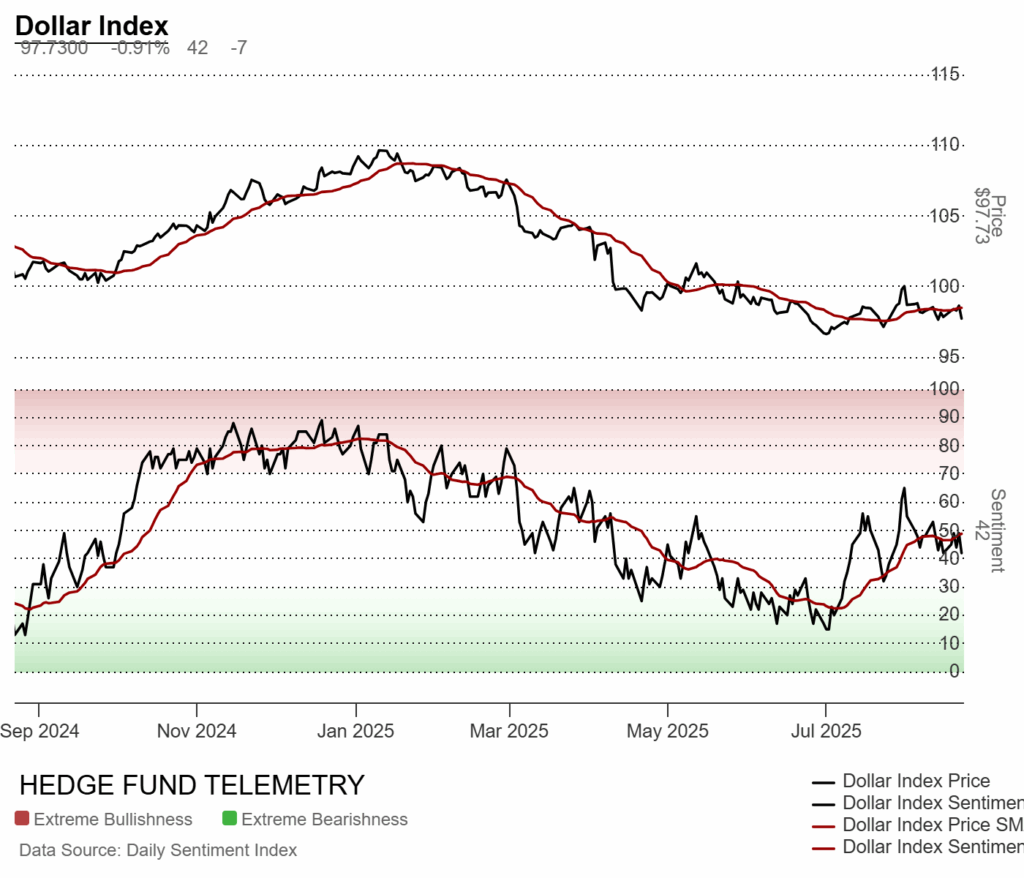

US Dollar Indexes

DXY US Dollar Index daily with Sequential left pending on day 11 of 13 with strong bearish engulfing drop on Friday. I continue to focus more on the TDST support and resistance levels – perhaps more than the Sequential. 96.85/99.49

DXY US Dollar Index weekly has the most bearish chart for the Dollar as there has been a downside Sequential pending with it now on week 9 of 13.

Bloomberg US Dollar Index daily still has the upside Sequential pending on day 10 of 13 with a strong drop on Frdiay giving back a week’s gain

US Dollar bullish sentiment has failed to lift and hold above the 50% midpoint level.

US Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Short lied bounce with downside Sequential on week 9 of 13

Major USD Crosses

EURUSD Euro / US Dollar remains in a range after strong bounce on Friday

Euro bullish sentiment back in the elevated zone at 75%

Euro Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

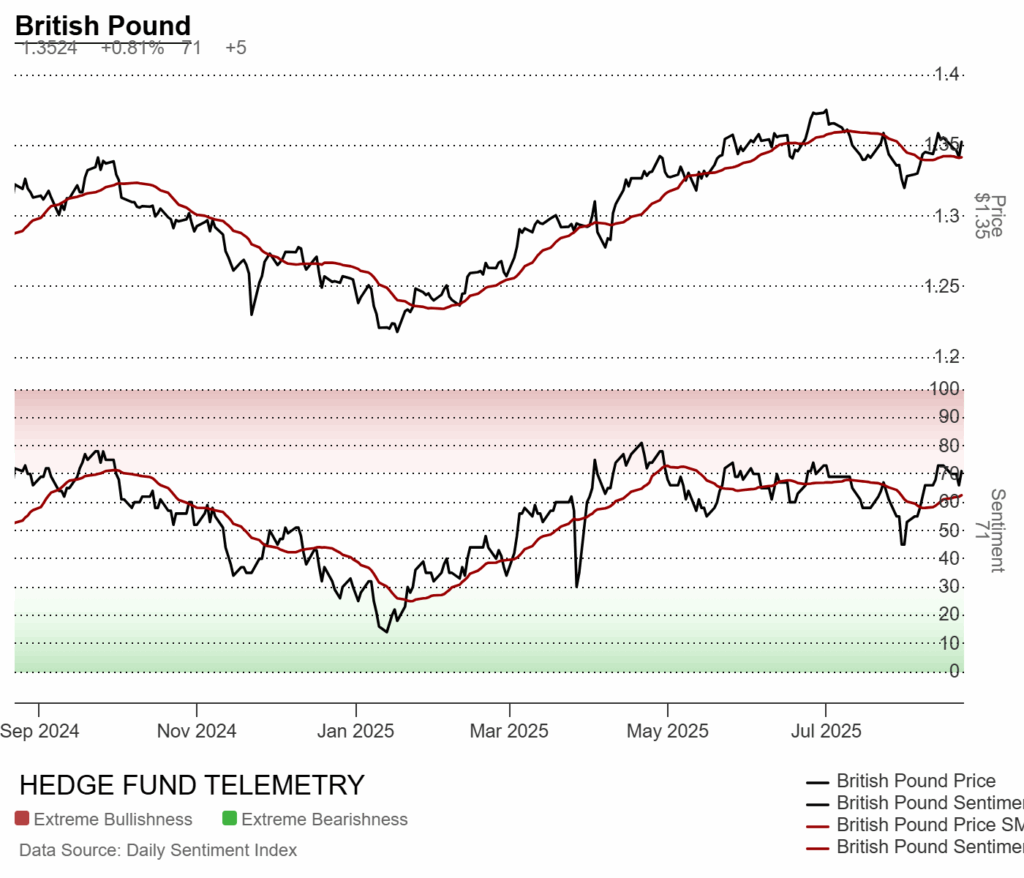

GBPUSD British Pound Sterling / US Dollar in a range between TDST support at 1.3272 and resistance at 1.3753

British Pound Sterling bullish sentiment steady

British Pound Sterling Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

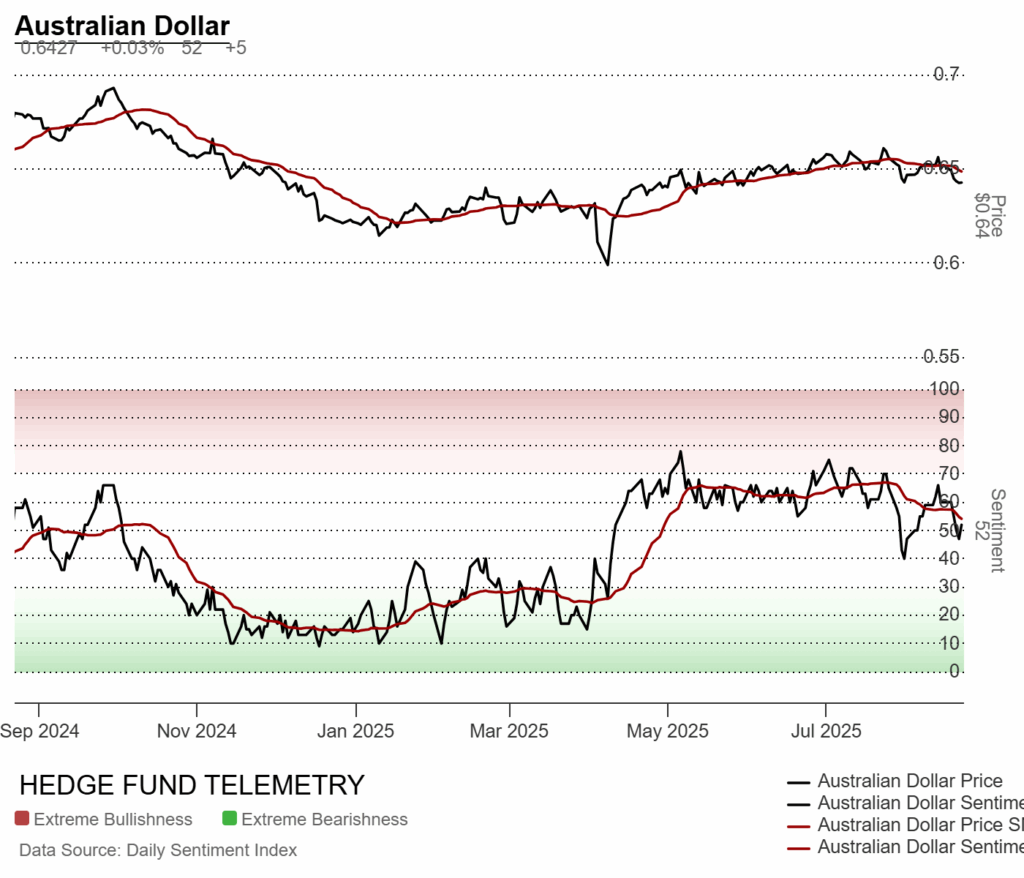

AUDUSD Australian Dollar / US Dollar with a bounce near the 200 day again

Australian Dollar bullish sentiment bounced on Friday

Australian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

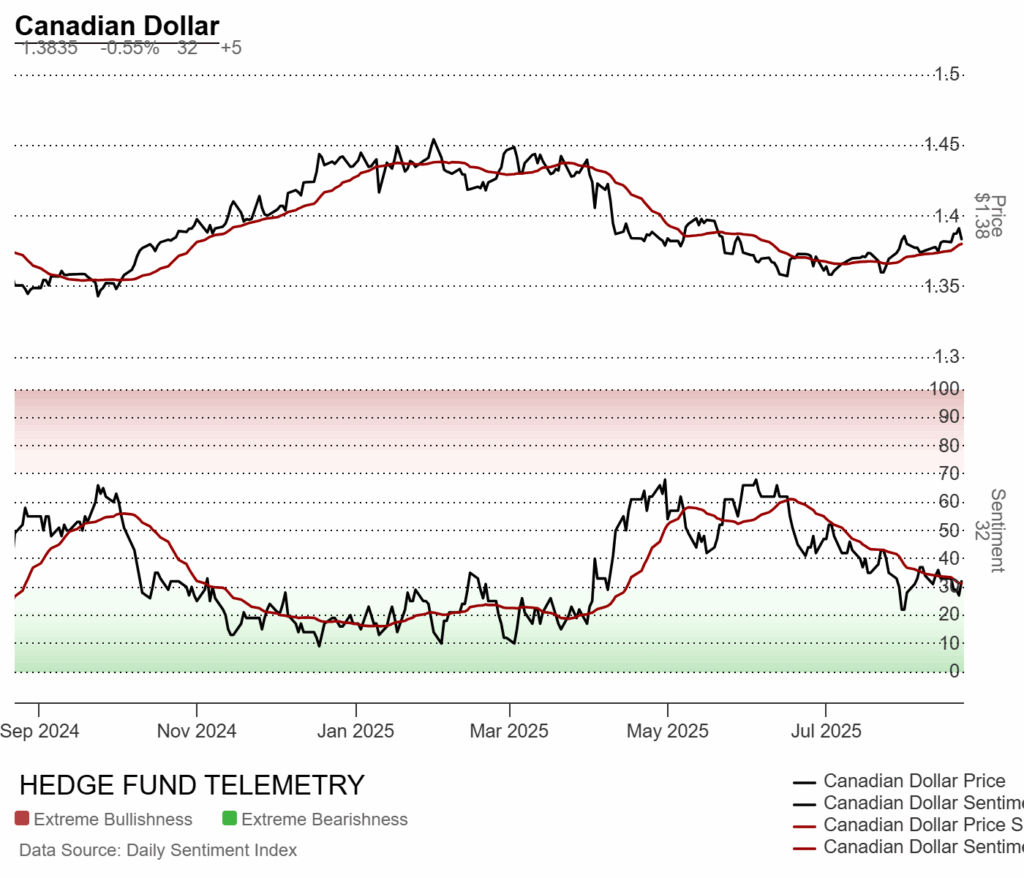

USDCAD US Dollar / Canadian Dollar with new Sequential sell Countdown 13 (potential reversal up for Canadian $)

Canadian Dollar bullish sentiment bounced but remains under pressure

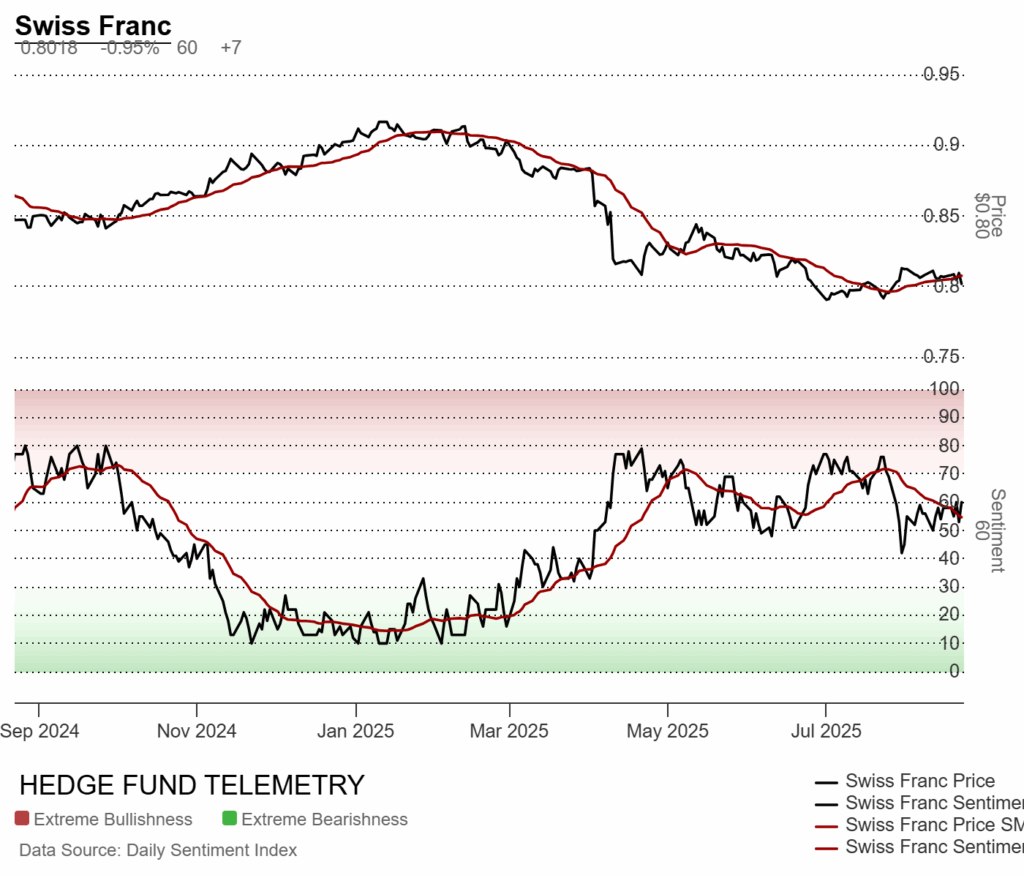

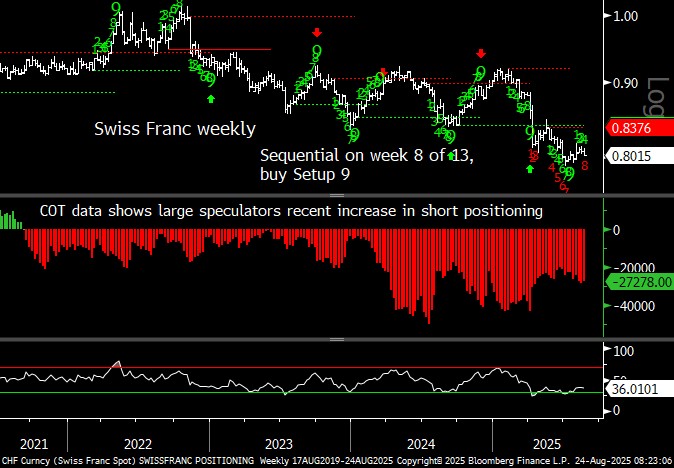

USDCHF US Dollar / Swiss Franc with downside Sequential on day 7 of 13 (stronger Swiss Franc)

Swiss Franc bullish sentiment steady with bounce on Friday

Swiss Franc Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDJPY Japanese Yen daily has been moving sideways for all of August. Upside Sequential in progress (weak yen) while Fridays move was lower (strong yen)

Japanese Yen bullish sentiment bounced strong on Friday.

Yen Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Crypto

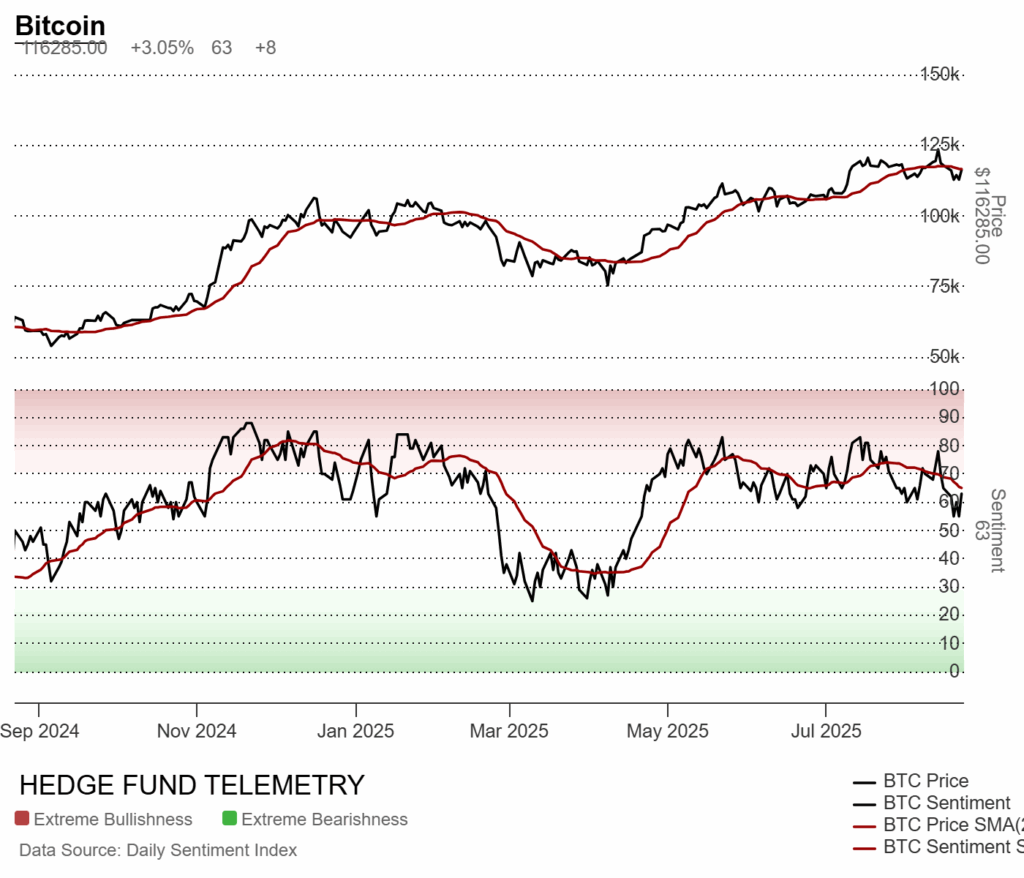

Bitcoin daily still has a pending Sequential late in the Countdown on day 11 of 13. Bounce on Friday seeing selling over the weekend.

Bitcoin bullish sentiment bounced moderately after making a new recent 4 month low this past week.

Ethereum backed off to the 20 day and bounced on Friday stalling over the weekend. Possible secondary Sequential starting?

Three major Yen crosses

Sideways action continues

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

USDBRL US Dollar / Brazilian Real bounced with recent Sequential buy Countdown 13 failing at the 50 day

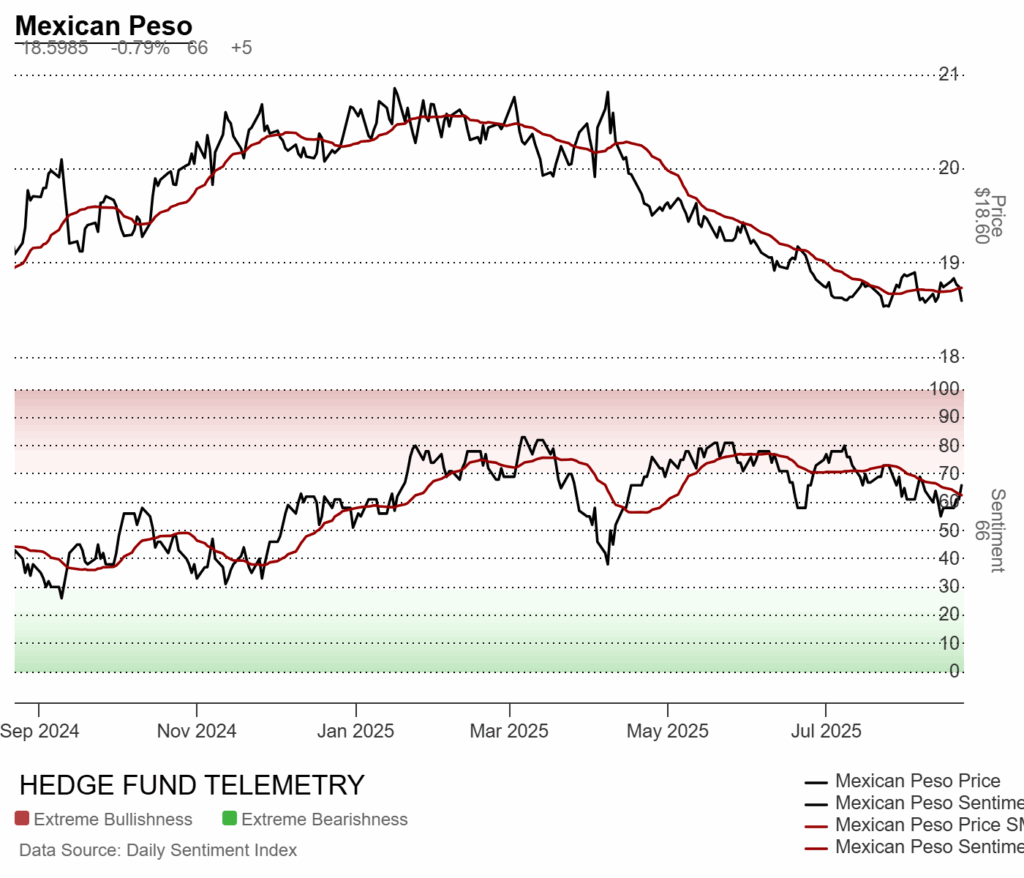

USDMXN US Dollar / Mexican Peso now with Sequential on day 11 of 13

Mexican Peso bullish sentiment remains steady

Mexican Peso Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

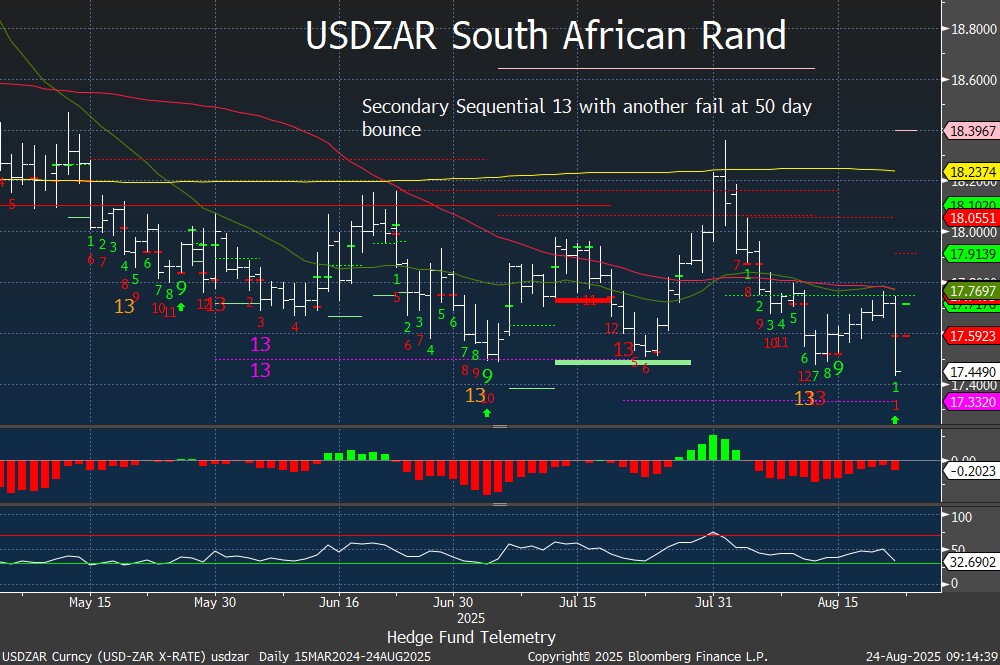

USDZAR US Dollar / South African Rand with a short lived bounce reversing it all on Friday.

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan) with Sequential on day 10 of 13 with Aggressive Sequential 13