I’ve discussed many of the risks associated that have been building in the markets, and one of the significant risks is overconfidence, which I covered yesterday. Another risk is the clear FOMO that has been evident for the last quarter. The Fear Of Missing Out is alive and well but there is also another deeper risk. It’s the lottery mentality. It’s not just the crypto bros but older investors who are worried about their jobs and retirements. Younger investors have more time to think in the long term. Still, the demographic of the older, retiring group is large, and with concerns about inflation, many, if not most, are falling behind in saving for a comfortable retirement. I got this from a wealth manager subscriber recently:

- Observation report: An 84-year-old woman stopped by my office. Wrote out a check to the custodian for her account and handed it to me, saying, “I just want to make a lot of money, fast. I see it happening on the news every day.”

She’s right that she has seen it happening on the news every day. The moves have been parabolic on many stocks. And she hasn’t seen things go down either, so her confidence has built up that the same fortune can happen to her. As I mentioned, the Najarian brothers pitch their options strategies daily on TV, accompanied by testimonials from baby boomers. All you have to do is get the free book on options trading, and you’re on your way!

The amount of speculation has been some of the highest I’ve ever seen in my career, and I was trading in the 90s tech bubble and through the Great Financial Crisis. Back in those days, there wasn’t social media to fuel the urge for a gambling mentality, nor was there the “democratization of markets” with shorter-term options and leveraged ETFs, giving people what they want. This was just announced today: According to its filing on October 14, Volatility Shares is planning to offer ETFs with magnified daily performance exposure: AMD 5x, AMZN 5x, COIN 5x, CRCL 5x, GOOGL 5x, MSTR 5x, NVDA 5x, PLTR 5x, TSLA 5x, Bitcoin 5x, Ether 5x, Solana 5x, XRP 5x

The term “democratization of markets” dates back to 1929, when brokers began offering credit or leverage of 10×1 to individuals for stock purchases. We’ve seen crypto alt-coins wipe people out recently, as they were highly leveraged. Crypto has always had a “Wild West” lottery mentality, lacking regulations, and with the Trump administration implementing loose regulations while endorsing and even promoting it.

There are signs of a lottery mentality as investors are not only hungry for quick gains but perhaps desperate for them. Lottery players know that the risk they are taking when they buy $20 ticket. As they say, “You never know…” The asymmetric risk-reward is appealing because winning the lottery is a life-changing dream, and blowing $20 isn’t going to change their life. The percentage of people playing tends to be lower-income individuals, and it accounts for a larger portion of their income. What is happening in the markets is that older people are taking more of their savings to gamble on higher-risk asymmetric rewards. People would prefer to buy a stock for $1 with the hope of it going to $10, or in some cases, now I hear the “10 bagger” is now touted as the “100 bagger” opportunity. Fundamentals? Doesn’t matter. If it’s going up, people will blindly put a lot more than the $20 lotto pick into these things. “You never know…”

Another troubling issue I see is crowding into things that have already moved up significantly. People would rather buy high and hope to sell at an even higher price. Again, the fundamentals don’t matter, nor do the technicals. I’ve seen people dismiss both just as they did back in the tech bubble. Most people appear on business TV to promote things that have already been successful, especially on social media. It’s not hard to find people today who tout crypto, or perhaps gold and AI stocks. Many analysts upgrade price targets to unrealistic levels after significant moves – for example, HSBC upgraded NVDA today with a $320 target, representing an increase in market capitalization of $3.5 trillion from today’s price. It crowds people into things that have moved up, as FOMO is a powerful psychological force. On the other hand, when stocks decline, the people who have been successful in shorting can lure others into ideas that have already been played out. I recall a commercial from Charles Schwab at the lows in 2018, highlighting how to short stocks.

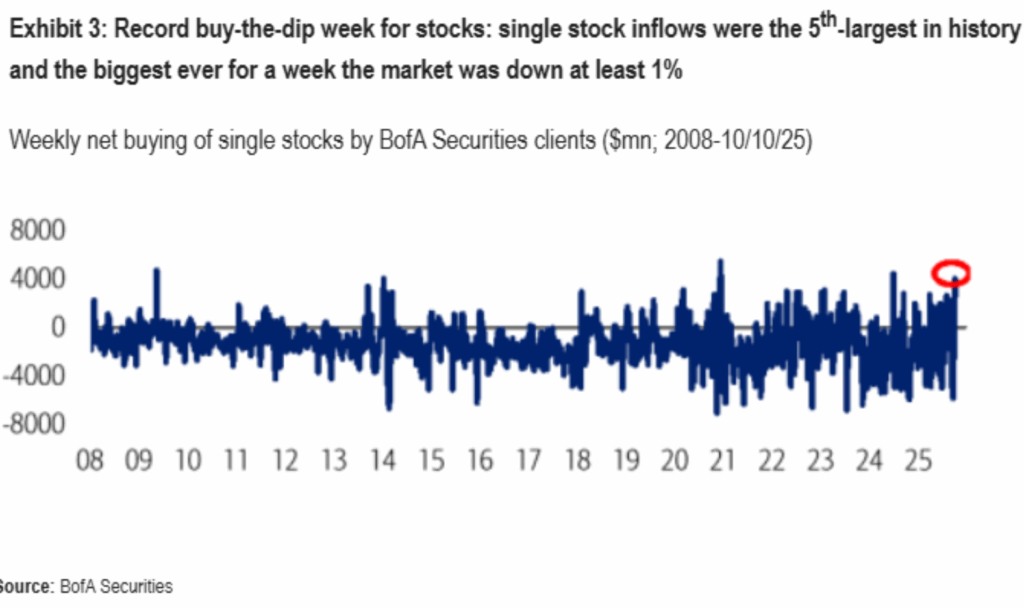

This came across my desk today. The large inflows were evident in 2021, but they turned into outflows. People at that time also had a lottery mentality, as call buying and inflows were strong. The risk arises when the market tops and the buy-the-dips strategy stops working; many trapped buyers will then start to give up. That phase is ahead.

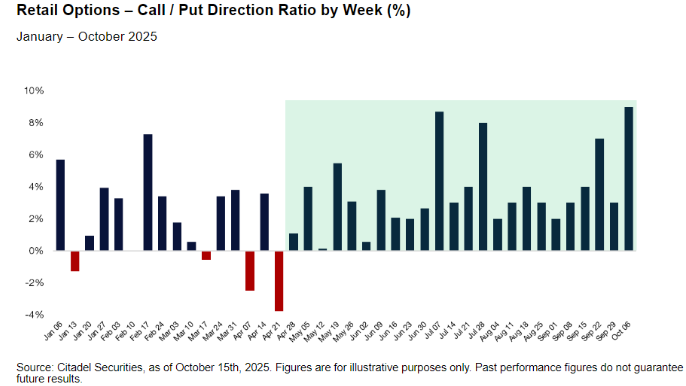

Scott Rubner, now at Citadel, posted this today on his note showing 24 weeks of retail buyers of calls, with the last week being the highest level. Note that when there is heavy put buying, as seen in April, it was the right time to start buying. This was one factor I saw back in April as a reason why it was right to shift long. I did not anticipate the continued trend and rabid call buying for 24 weeks! But this too shall end, and it’s just more evidence of lottery mentality.

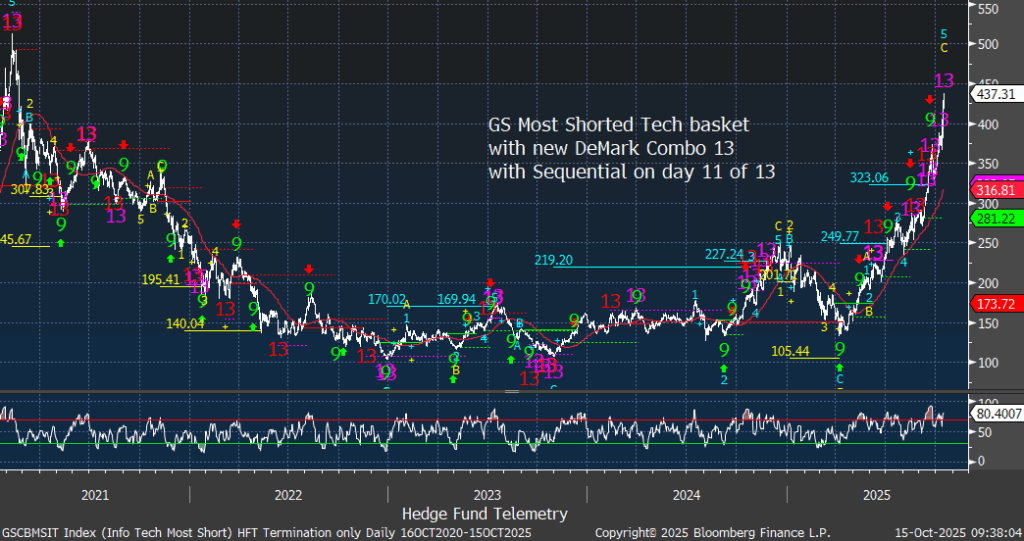

One input I like to use to gauge market sentiment is what the GS most shorted baskets are doing. At times when the shorts are making money with stocks going lower, they often stay too late at the Blackjack table, and their luck changes. When the short basket moves up, it indicates that investors are willing to buy perhaps higher-risk stocks that have a short thesis, such as overvaluation, lack of revenue, or being overbought. It’s also driven, obviously, by short covering buying, which adds to the squeeze. The GS most shorted basket was higher back in 2020, which was driven by the COVID-19 lockdown. Earnings are more normalized today, and I’d say that period was more of an anomaly.

GS Most Shorted Basket has both daily and weekly DeMark exhaustion sell signals. As a reminder, back in April, there were exhaustion buy signals.

Leading the charge has been the GS most shorted Technology basket. Up YTD nearly 100% vs the S&P tech sector up 20%. The daily has had several signals on the way up with short-lived dips. When I see this type of action, I’ll look at the weekly also in upside wave 5 of 5 with a new Sequential sell Countdown 13 following recent Combo 13’s. Some people have tried to tell me this is not a blow-off top or bubble… yet. I’d say those looking to buy now are in for a shocking surprise.

But, Tom, I want to make money! My job is to highlight the risks and rewards associated with the work I do and follow, combined with decades of experience, seeing the good, the bad, and the ugly. If you feel the need to speculate in the short term, despite the current backdrop, I won’t stop you, nor will I judge you. I’ve found over the years of doing this publicly with all sorts of investors that it’s best to stick to the process, and the returns will follow.

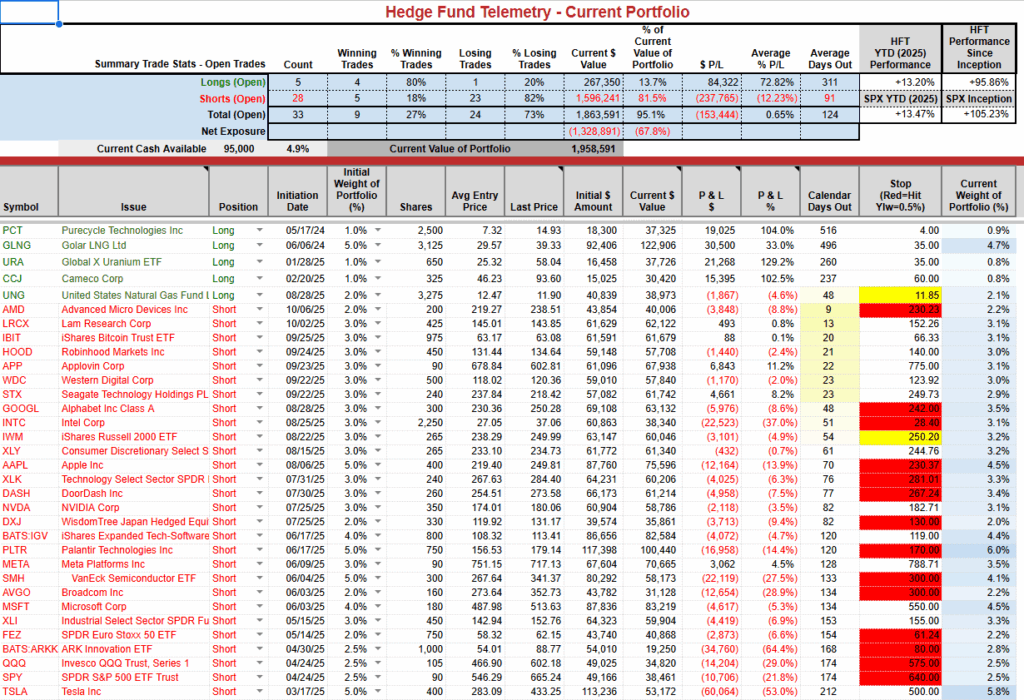

Current Portfolio Ideas: A little whippy with the PNL recently

Changes: Reit sell short on IBIT – see below. The short term SPY and QQQ momentum did confirm to buy however it has been very narrow and it might reverse with a small drop.

I look forward to adding more positions, especially on the long side; however, I will remain patient until the proper setup is in place.

US INDEXES

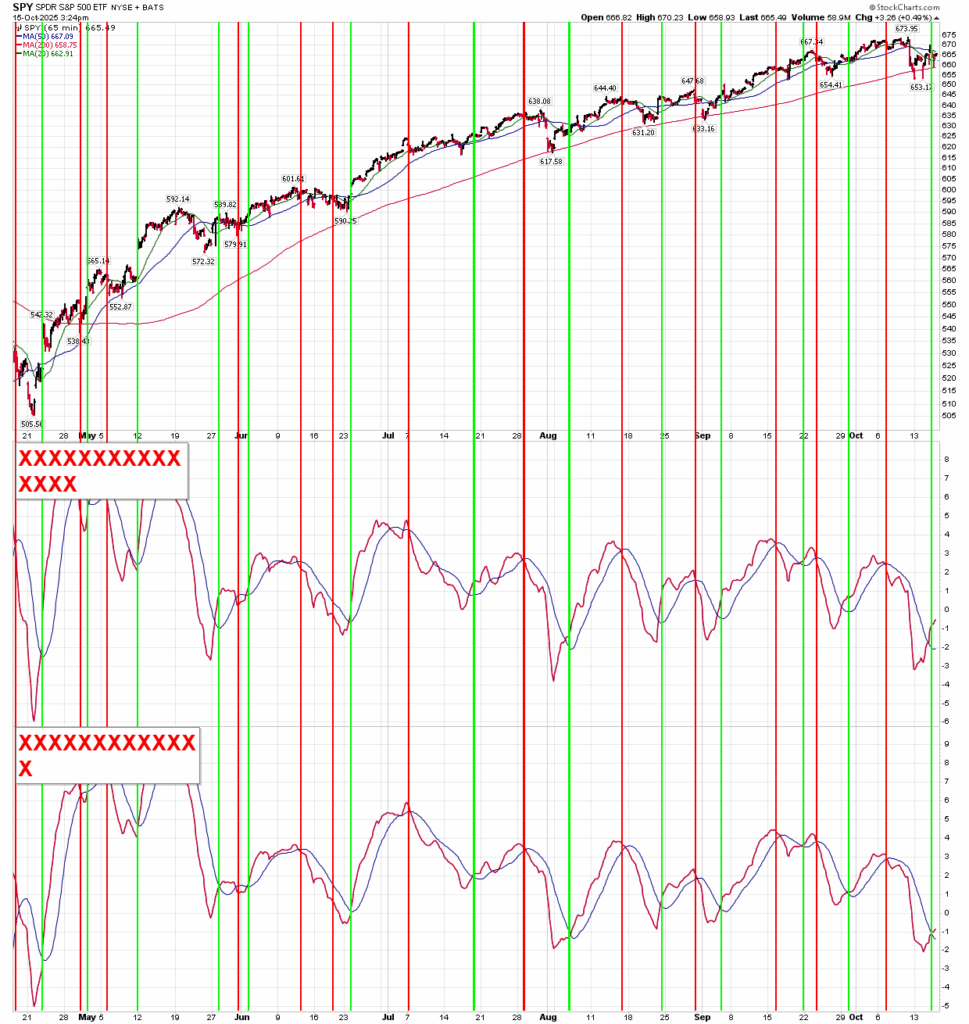

S&P futures 60-minute tactical time frame chopping around

S&P 500 Index daily trading below the open while still holding the recent lows and support levels

S&P weekly with DeMark Sequential and Combo sell Countdown 13’s and sell Setup 9. TDST Setup Trend support at 6238

Nasdaq 100 Index daily not making much progress recently

Nasdaq 100 weekly with Combo 13’s slightly breaking the recent trendline

Current Portfolio

As mentioned yesterday the short term SPY and QQQ momentum did confirm a buy however the choppy action might whip this back down

The IBIT Bitcoin ETF is nearing support again, and I remain short. It is still actionable, as I see a trapped long environment.

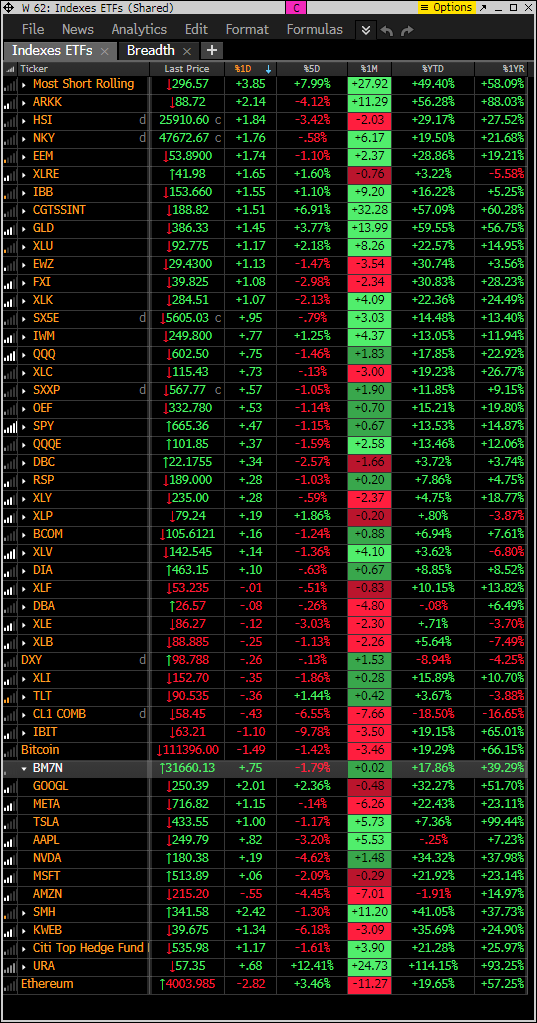

Hedge Fund Telemetry ETF Percentage Price Oscillator Monitor

The PPO monitor (percentage price oscillator) force ranks ETFs by percentage above/below the 50-day moving average. This monitor and others are offered to Hedge Fund Telemetry subscribers on Bloomberg. Mostly green today with notable weakness with financials XLF, KBE, KRE

Index ETF and select factor performance

ETF with today’s performance with 5-day, 1-month, and 1-year rolling performance YTD. GS Most Shorted basket leading along with the unprofitable tech ETF ARKK. The 5-day action has more down in the last 5 days

Goldman Sachs Most Shorted baskets vs. S&P Indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Mixed action with overall more squeezing

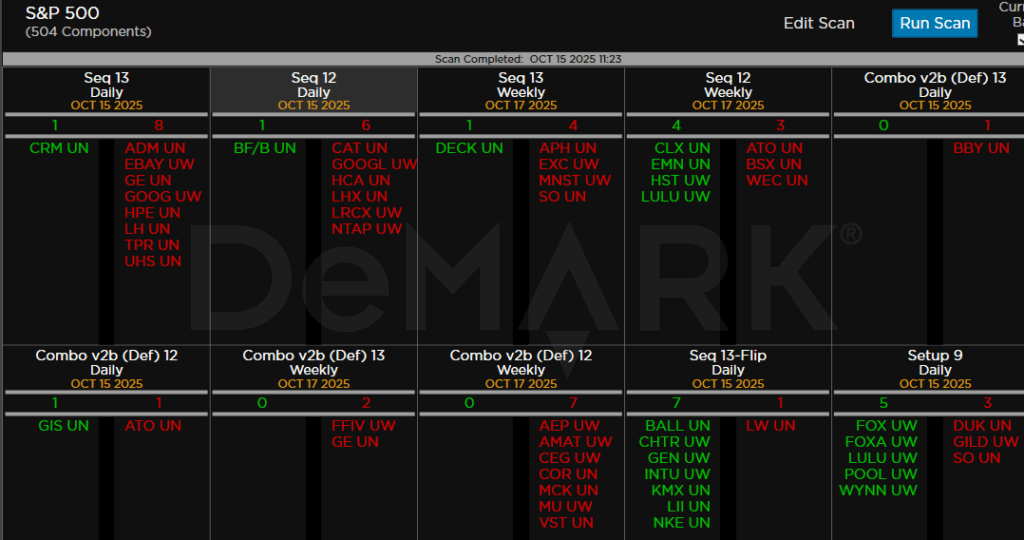

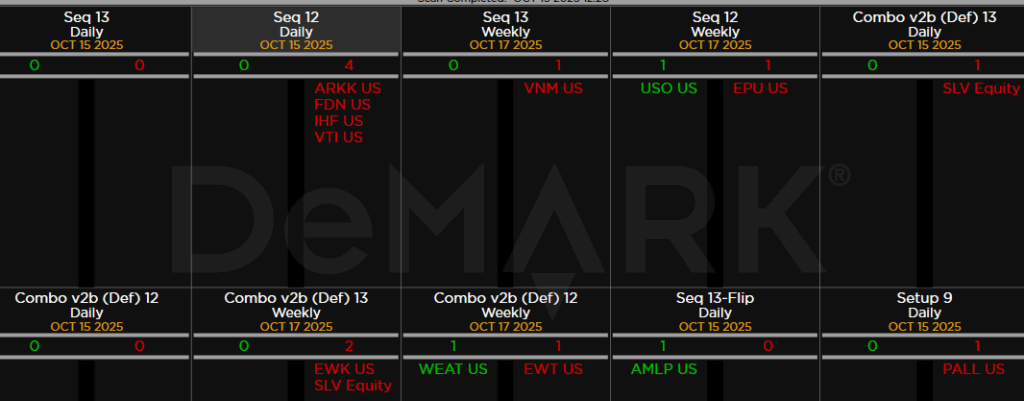

DeMark Observations

Within the S&P 500, the DeMark Sequential and Combo Countdown 13s and 12/13s on daily and weekly periods. Green = buy Setups/Countdowns, Red = sell Setups/Countdowns. Price flips are helpful to see reversals up (green) and down (red) for idea generation. The extra letters at the end of the symbols are just a Bloomberg thing. Worth noting: With the lift today more sell Countdown 13’s are developoing including EBAY, GE, GOOGL, HPE, CAT, LRCX, BBY

Major ETFs among a 160+ ETF universe. SLV Combo 13 daily. ARKK with Sequential on day 12 of 13

If you have any questions or comments, please email us. Data sources: Bloomberg, DeMark Analytics, Goldman Sachs, Street Account, Vital Knowledge, Daily Sentiment Index, and Erlanger Research