Happy Thanksgiving to everyone. I hope you and your families have a lovely Holiday. This is the first year Lee Ann and I are celebrating Thanksgiving without any of our daughters. Two expecting babies, limiting travel, and our youngest in LA can’t get the time off. Headed to NYC for a very nice dinner that involves no prep or clean up.

Here is our annual holiday gift guide for those who have no time and no desire to go to a mall. (Feel free to share the link with friends, social media, etc, as it’s unlocked) And we are hosting a short Market Update webinar today at 10:30 am. The link I sent yesterday had an error, and this link should work fine. I’ll send the replay later. I will probably take off Friday unless there is some market-moving news.

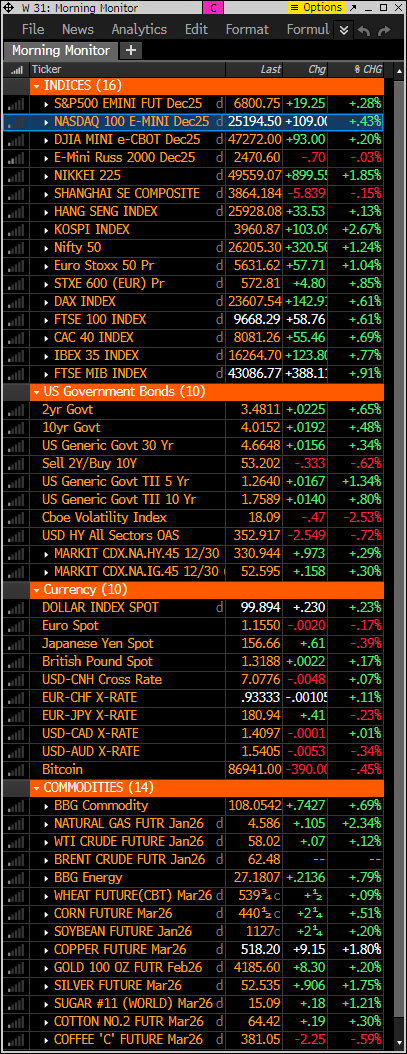

- S&P and Nasdaq futures up 0.3%-0.4% in Wednesday morning trading, off best premarket levels. Treasuries little changed to a touch weaker at front-end. Dollar index up 0.15%. Gold up 0.4%. Bitcoin down 0.5%. WTI crude is flat.

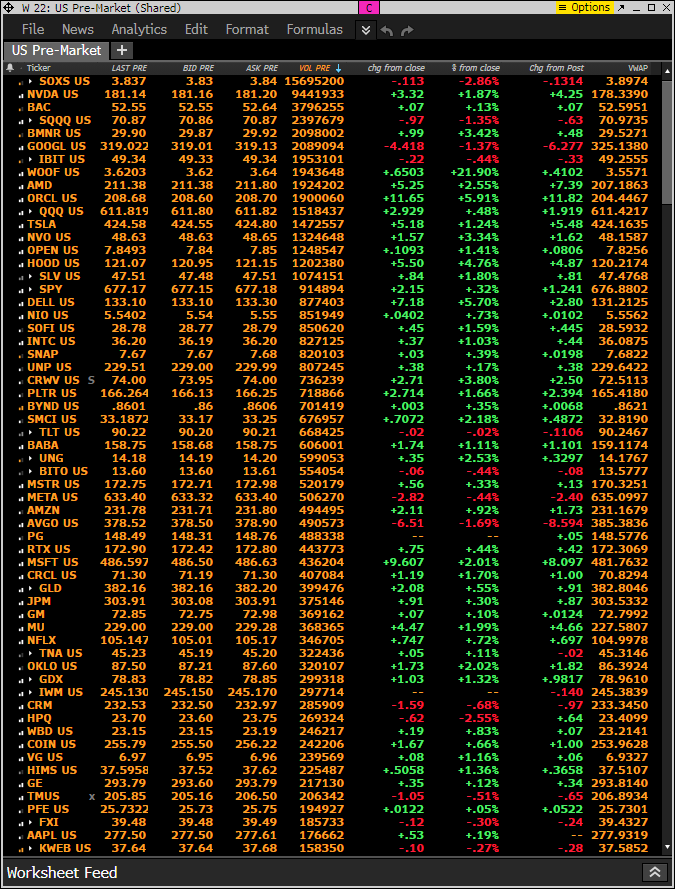

- Portfolio: The DE report was lackluster, but the guidance was cut significantly with 2026 revenues to drop and $1 billion below consensus estimates. It’s down 5% and I will continue to hold this short. DELL was fine and I will hold the long as it’s up 5%. WDAY wasn’t bad, but it wasn’t enough, and the stock is down 6%. It’s a chicken size 1% and I will hold to see if shorts cover this morning. If it breaks 215 I will sell.

- No big directional drivers in play and quiet from a headline perspective heading into the Thanksgiving holiday on Thursday in the US. US equity bounce has been the big story as of late with much of the focus on the ramp in December rate cut expectations following some dovish Fedspeak (and to a lesser extent, softer data). AI has also continued to dominate the headlines but the narrative has become more complicated and price action more mixed/choppy.

- Initial claims, continuing claims and September durable goods orders on the US economic calendar this morning. In addition, Fed Beige book out this afternoon. Also more bond supply with Treasury selling $44B of 7-year notes. Market closed for Thanksgiving holiday on Thursday and no data scheduled for Friday. Fed goes into a quiet period this weekend ahead of the December 10th FOMC decision. Probability of a December rate cut has pushed above 80% on the back of some dovish Fedspeak after falling below 30% at one point last week.

- DE guidance disappointed as management said 2026 the bottom of ag cycle. DELL a post-earnings gainer with takeaways noting momentum in AI servers, guidance raise and better margin performance despite higher AI sever mix. ADSK beat, highlighted outperformance in AECO, guided above and noted broadly stable macro. WDAY fiscal Q3 mostly better with cRPO growth acceleration but left FY guide unchanged and noted headwinds in higher ed and some concerns about more limited margin upside. ZS beat seemed to underwhelm, some scrutiny surrounding Red Canary contribution and bar high with stock up 60%+ ytd. HPQ fiscal Q4 ahead but Q1 and FY26 guide light, while company also announced plan to generate $1B of savings by FY28. NTNX down big on surprise miss and 3% cut to FY26 guide, though company focused on timing issues. NTAP fiscal Q2 ahead and raised FY guidance. AMBA pressured despite beat, better sales guidance and upbeat AI commentary, with some focus on slightly weaker GM guidance. URBN beat with UO comps ~3x consensus and Anthro and GMs also better. WOOF comps declined more than expected but GMs, EBITDA and EBITDA guide all better. Elon Musk tweets the Austin ‘robo taxi’ fleet will double this month. 30-60 cars? A few short of the promised 500 by the end of the year, along with safety drivers removed, which isn’t happening anytime soon. We are still awaiting the CA DMV case results, due out at any time after today.

- Key Upgrades/Downgrades: Autodesk upgraded to buy from hold at Deutsche Bank. APA Corp. initiated outperform at William Blair

market snapshot

economic reports today

premarket trading

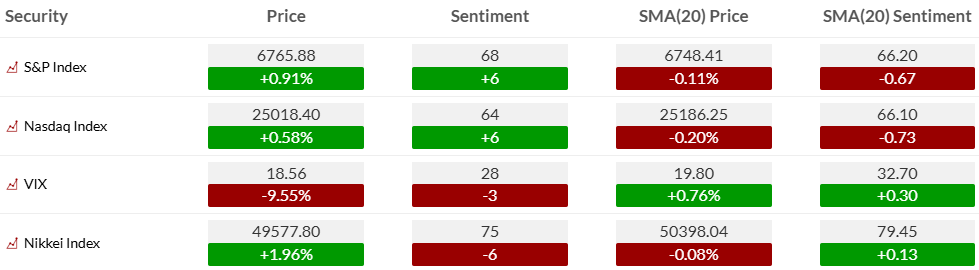

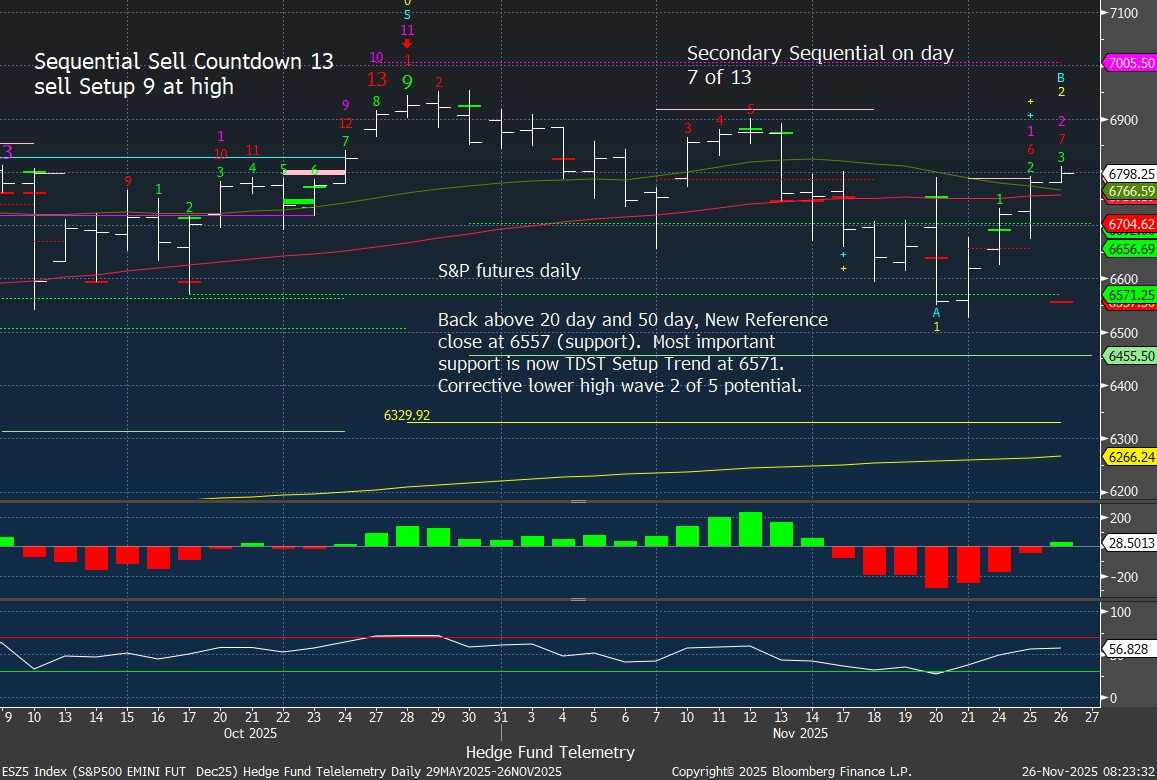

US MARKET SENTIMENT

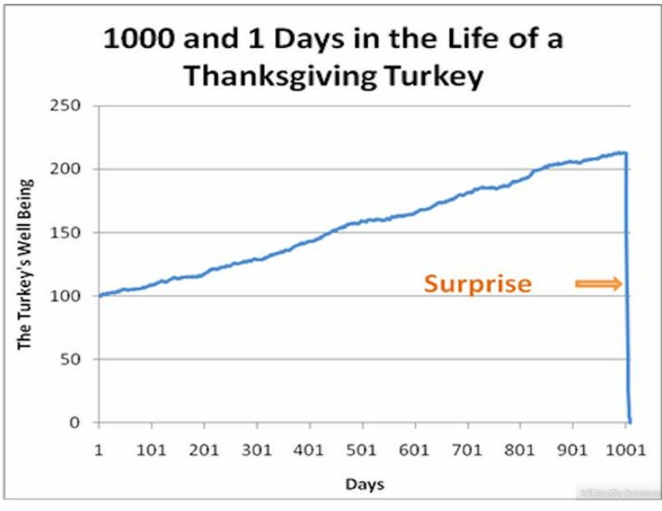

S&P and Nasdaq bullish sentiment bounced again after recently holding the 50% level. Back to the downward sloping 20 day moving average of bullish sentiment. I expected a bounce off 50% level in a mean reversion bounce. It’s very possible a lower high with sentiment will occur again.

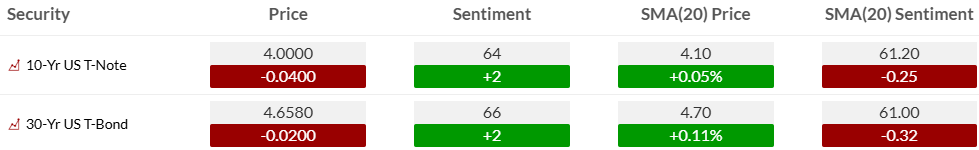

Bond bullish sentiment with small tick higher

Currency bullish sentiment with Bitcoin sentiment remaining under pressure

Commodity bullish sentiment with strong gold and silver sentiment moves back into the extreme zone

US MARKETS

S&P futures 60-minute tactical time frame in upside wave 5 of 5 with new Sequential and Combo sell Countdown 13s with elevated short term RSI

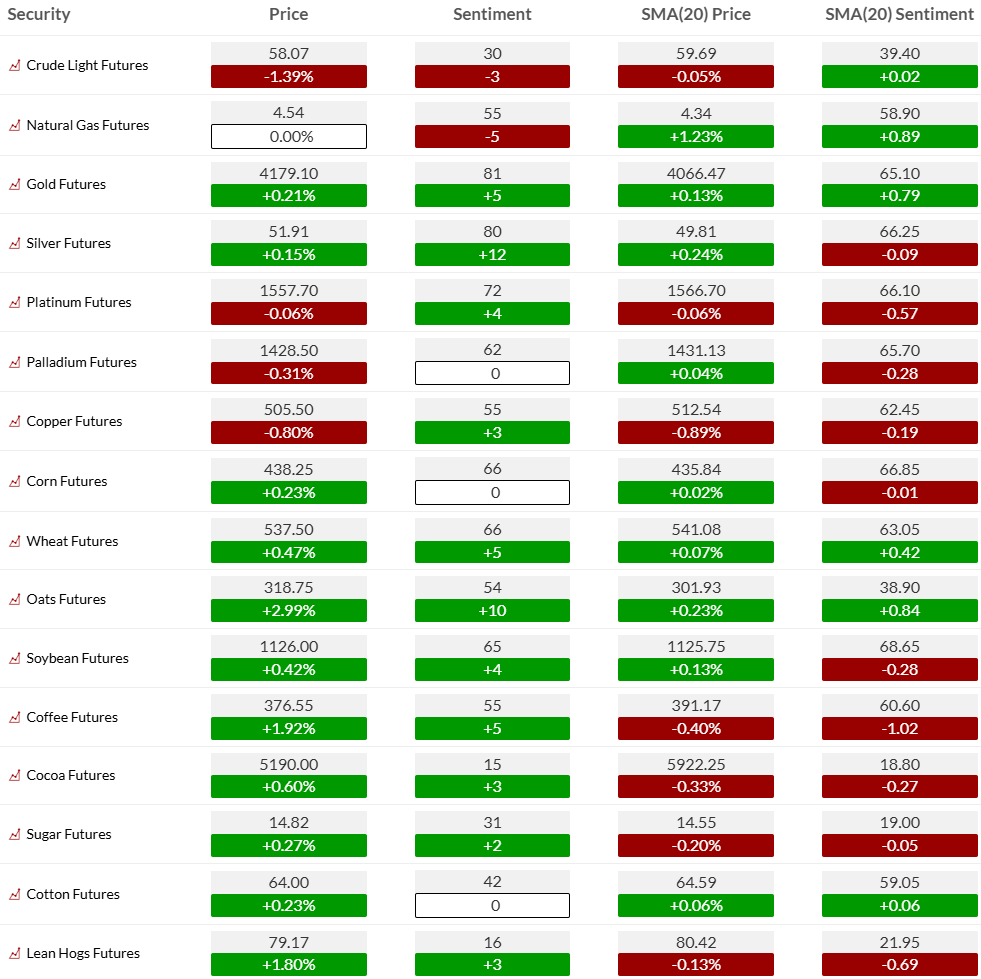

S&P futures daily with corrective lower high wave 2 of 5 now qualified. If this breaks down and closed below wave 1 (yellow 1) then wave 3 has a potential price objective of 6329. If rice makes a new closing high then the downside wave pattern will cancel. The secondary Sequential stretched from October is not a given since the TDST Setup Trend support is not far from here at 6571. A break below that level and qualifying the downside would cancel the secondary Sequential.

Nasdaq 100 60-minute tactical time frame in upside wave 5 of 5

Nasdaq 100 futures daily, also with a potential lower-high corrective wave 2 of 5. The TDST is not far from these levels and remains the most important level to watch.

Extra charts we’re watching

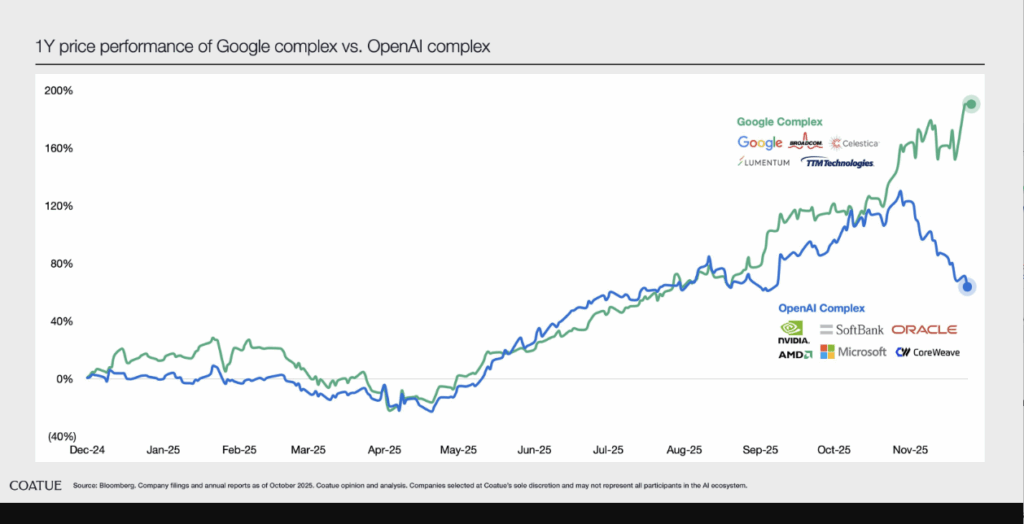

Interesting chart from Coatue hedge fund. The founder believes these dots will cross again.

US Dollar Index daily the 3 moving averages are converging and when that happens a more powerful move is possible.

US 10-Year Yield back to 4%

Bitcoin Daily remains at risk of moving lower lacking upside momentum. If this can bounce a corrective lower high wave 4 of 5 is possible. To qualify wave 4 a 13 day closing high is required.

DeMark Observations – Euro Stoxx 600